When it comes to money, there is something undeniably comforting about seeing a healthy checking account balance. You might instinctively think, “More is better, right?” This feeling of security is deeply ingrained, providing a sense of control and preparedness for life’s unexpected twists. Yet, while a well-padded account might feel safe, this seemingly conservative approach could actually be hindering your financial future in significant ways.

Your checking account should be viewed as a dynamic financial tool, not a static storage unit for idle wealth. It is perfectly sensible to have enough money readily available to cover your monthly bills and handle day-to-day spending. However, if you find yourself sitting on a substantially large balance that far exceeds these immediate needs, you are almost certainly leaving money on the table and missing out on crucial opportunities for growth and long-term financial health.

This is not about shaming anyone for being financially prudent; it is about empowering you with the knowledge to make your money work harder for you. To help you identify if your checking account is perhaps a little too comfortable, we have identified 11 clear signs that indicate you might be keeping too much cash parked in a low-interest account. Understanding these signs is the first step toward optimizing your finances and unlocking your money’s true potential.

1. **You’re Missing Out on Easy Interest Earnings** One of the most immediate and impactful ways in which an overstuffed checking account costs you is through lost interest earnings. Be honest: when was the last time you actually examined your checking account’s interest rate? For most traditional checking accounts, the typical rate is surprisingly low, often less than 1.00%, and in many cases, it is likely less than 0.05% or even 0.01%. This implies that your money is virtually doing nothing to grow on its own.

Contrast this with high-yield savings accounts (HYSAs), which are currently offering impressive annual percentage yields (APYs) of 4.00% or more, with some top contenders reaching around 5%. The difference is stark and substantial. To put this into clear perspective, if you have $10,000 sitting idly in a checking account earning a paltry 0.01% interest, that money would only earn you a meager $1 per year.

However, if you were to move that exact same $10,000 into a high-yield savings account earning 4.5% APY, you could be looking at approximately $450 in interest within that same year, without lifting a finger. This is money that you don’t have to actively work for; it’s simply growing on its own, providing a risk-free return that your checking account cannot match. Keeping only what you need for monthly bills and a small cushion in checking, and moving the rest to a HYSA, ensures your money can actively work for you.

Read more about: Your Costco Insider Guide: 18 Smart Buys That Seriously Pay Off

2. **Your Money Isn’t Growing the Way It Could** Beyond merely earning a bit more interest in a high-yield savings account, your money has the potential for significantly greater growth if it is strategically invested. Over the long term, historical data clearly demonstrates this power. For instance, the S&P 500, which consists of the 500 largest publicly traded companies in the U.S., has yielded an impressive average annual return of approximately 10% since its inception in 1957. This long-term growth potential stands in stark contrast to the stagnant returns of a checking account.

Consider a scenario where you have an extra $20,000 simply sitting in your checking account, earning minimal interest. By leaving it there, you are potentially missing out on thousands of dollars in compounding growth that could be working assiduously for your future. This is not merely about abstract numbers; it is about real money that could fund significant life goals, such as a down payment on a house, a comfortable retirement, or even that dream vacation you have always envisioned for the future.

To illustrate the profound difference, imagine $20,000 parked in a checking account earning 0.01% interest; after 10 years, your balance would barely budge, reaching just $20,20.01. Now, envision that same $20,000 invested in an account earning a 10% annual return; at the end of that decade, you’d have a whopping $51,874.85. The winner in this comparison is undeniably clear, highlighting the substantial opportunity cost of not investing excess cash once your emergency fund is securely established.

Read more about: The Unpaid Overtime Betrayal: How One Employee Waited Six Years to Deliver the Ultimate Revenge on a Greedy Company

3. **You’re Tempted to Spend It** Let us be realistic about human nature: when you observe a large, healthy figure in your checking account, it generates an undeniable psychological temptation to spend it. It is exceedingly easy to rationalize various extravagant expenditures and impulse purchases when your balance appears substantial and gives you a false sense of unlimited spending capacity. However, that surplus cash, which seems so readily accessible, could actually be far more effectively employed elsewhere, contributing to your long-term financial well-being rather than providing immediate gratification.

Recall the last time you made an impulse purchase, something you had not truly planned for. Would you have expended that money as freely if it had been held in a dedicated savings account or, even more restrictively, an investment account? The answer, for most individuals, is probably not. The immediate availability of checking account funds often lowers our defenses against unnecessary expenses, diverting money from more strategic applications.

As financial expert Scott Cole sagely suggests, regarding a checking account solely as “a conduit through which money comes in and quickly goes out” is crucial for proper management. He cautions that “when we keep too much in our checking, it entices us to spend excessively for our present needs and wants at the expense of our longer-term needs and wants.” A straightforward yet potent solution is to establish automatic transfers to your savings and investment accounts, ensuring that the money leaves your checking account before you even have an opportunity to see it and be tempted. This ‘out of sight, out of temptation’ strategy can significantly curb impulsive spending tendencies.

Read more about: From Terrible to Terrifying: 21 Movies Guaranteed to Ruin Your Night

4. **You’re Losing Purchasing Power to Inflation** One of the most insidious ways in which an overstuffed checking account incurs costs for you is through the silent, constant erosion caused by inflation. While observing a large balance might engender a sense of security, money lying idle in a low-interest checking account is quietly losing value over time. Ironically, your “safe” strategy could be diminishing your actual purchasing power, which implies that every dollar held in that account will enable you to purchase less in the future than it does today.

To put this into perspective, consider that inflation was lingering above 3% as of early 2025, according to data from the Bureau of Labor Statistics. If your checking account is earning a negligible 0.01% interest, a $10,000 balance will yield a mere $1 after a year. During that same period, however, the real value of your $10,000 has diminished by over $300 due to inflation. This significant loss means you’re effectively going backward financially, even if your nominal balance remains the same.

Money that is not growing at a rate at least equivalent to inflation is, in essence, undergoing depreciation. While checking accounts offer essential liquidity for day-to-day transactions, they are simply not structured to preserve or enhance wealth in an inflationary environment. To safeguard your spending power, it is imperative to transfer excess funds into accounts that offer competitive interest rates or investment opportunities that can assist your money in keeping pace with, or even surpassing, the rising cost of living.

Read more about: Used Ford F-150 Prices Soar 30% Post-Pandemic: What Buyers Need to Know

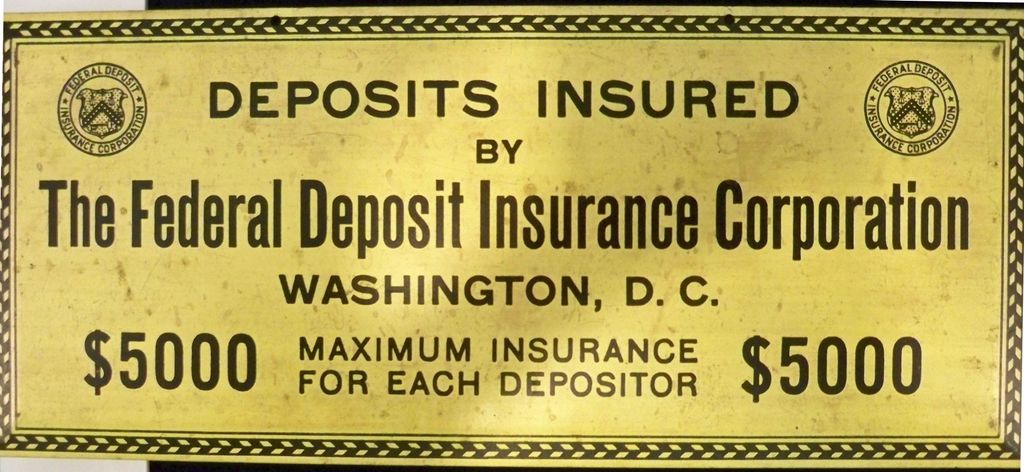

5. **You’re Exceeding FDIC Insurance Limits** For many individuals, the perceived security of a bank account constitutes a primary reason for maintaining substantial sums in checking accounts. It is indeed true that checking accounts are insured by the Federal Deposit Insurance Corporation (FDIC), yet only up to a specific limit. The FDIC’s benchmark for checking account insurance is set at $250,000 per depositor, per insured bank. While this threshold encompasses the vast majority of individual account balances, it represents a critical consideration if your checking account balance consistently remains above this amount.

Should your checking account balance surpass this $250,000 limit, the surplus funds will become uninsured and, as a consequence, will be at risk in the rare event of a bank failure. This implies that any amount exceeding the insured limit is not safeguarded by the FDIC and may be lost. Although bank failures are infrequent, financial prudence necessitates protecting your assets against all foreseeable risks, regardless of how remote they may appear.

To effectively safeguard your assets and ensure that all your funds remain insured, it is a judicious strategy to distribute your money across multiple accounts or even multiple banks. This approach enables you to guarantee that the balance in each individual account or the cumulative balance at a single institution remains comfortably within the $250,000 insured limit. Any deviation from this meticulous distribution means you are engaging in a potentially losing endeavor, leaving a portion of your hard – earned money unnecessarily exposed.

6. **Your Emergency Fund Isn’t Optimized** It is commendable to establish a substantial emergency fund, ideally encompassing three to six months’ worth of living expenses. This serves as a cornerstone of financial security, offering a crucial safety net in the event of unexpected job loss, medical emergencies, or substantial home repairs. However, merely possessing the funds is insufficient; the location where you store them is of paramount importance for their effectiveness and potential for growth.

Many individuals make the error of maintaining their entire emergency fund in a standard checking account, under the belief that immediate accessibility is of utmost significance. While access is indeed crucial, traditional checking accounts yield virtually no interest, which implies that your emergency savings are gradually losing value to inflation over time. A far more strategic approach involves storing these funds in a high – yield savings account (HYSA) or a money market account. These alternatives provide liquidity — you can typically access your funds within one or two days — while simultaneously generating significantly higher interest rates. For example, HYSAs currently offer annual percentage yields (APYs) of 4% or higher, enabling your emergency fund to grow rather than stagnate.

The objective is to achieve a balance: retain an adequate amount in your checking account for immediate, day – to – day requirements, perhaps sufficient to cover one to two months’ expenses along with a small buffer. Any sum beyond that, particularly your dedicated emergency savings, should be earning interest in a more productive account. This ensures that your safety net is not only available when needed but is also actively engaged in preserving and enhancing its purchasing power. As financial experts recommend, once your emergency fund is securely in place, surplus cash can be more effectively utilized elsewhere.

7. **You’re Neglecting Tax-Advantaged Accounts** A significant indicator that you may be retaining an excessive amount of money in your checking account is the situation where you consistently fail to maximize contributions to various tax – advantaged accounts. These accounts, such as Individual Retirement Accounts (IRAs), 401(k) plans, and Health Savings Accounts (HSAs), are specifically devised by the government to encourage long – term savings by providing substantial tax benefits, which can significantly enhance your wealth accumulation over time. Disregarding them implies forgoing substantial financial advantages.

For retirement savings, not making contributions to an IRA or a 401(k) plan when you have surplus cash in your checking account represents a missed opportunity for compound growth and tax deductions or deferrals. If your employer offers a matching 401(k) contribution, failing to contribute enough to obtain that match is tantamount to rejecting free money. As the S&P 500 has historically yielded an average annual return of 10% since 1957, these long – term investment vehicles offer far greater growth potential than any checking account. Funds in these accounts, while typically subject to penalties for early withdrawal, are of crucial importance for future well – being and are not intended for immediate access.

Beyond retirement, Health Savings Accounts (HSAs) offer a unique triple – tax advantage: tax – deductible contributions, tax – free growth, and tax – free withdrawals for qualified medical expenses. For those with high – deductible health care plans, an HSA can function as an excellent vehicle for health savings and even supplementary retirement savings. If you have cash lying idle in your checking account, reallocating some of it to these powerful accounts can provide immediate tax benefits and long – term financial security, which a checking account simply cannot offer.

8. **You Have High, Unallocated Balances Over Time** It can be reassuring to observe a consistently high balance in your checking account, which provides a sense of security and preparedness for any expense. However, if this high balance is not designated for a specific, near-term objective—such as a down payment on a house, a major renovation, or a substantial upcoming bill—it serves as a clear indicator that your funds are not being employed efficiently. Cash that merely remains in the checking account without a purpose constitutes idle money, potentially obstructing your overall financial advancement.

When your checking account regularly maintains a significantly higher amount than your immediate requirements—for instance, more than two months’ worth of living expenses—you are, in essence, opting for safety over growth. This excessive liquidity, while imparting a sense of comfort, incurs a high opportunity cost. It represents money that could be invested in higher-yield alternatives, such as diversified investment portfolios, or utilized for paying off high-interest debt, which can offer a guaranteed return by eliminating costly interest payments. As financial expert Scott Cole states, retaining an excessive amount in the checking account “invites the temptation to overspend for our present needs and desires at the expense of our longer-term needs and desires.”

Instead of allowing these funds to accumulate, evaluate your balance on a regular basis. If you discover that you have a considerable surplus beyond your short-term needs and emergency fund, it is time to allocate it in a targeted manner. Whether it is for long-term investments, specific savings goals, or debt reduction, actively directing your money ensures that it is working diligently for your financial future, rather than merely providing a false sense of security in a low-yield account. Having a plan for every dollar is crucial to maximizing its potential.

9. **You’re Paying Unnecessary Fees** While it may appear counterintuitive, maintaining an excessively high balance in your checking account can, under certain circumstances, lead to your incurring unnecessary fees. This issue is not always direct, such as a fee for having an excessive amount of money. Instead, it often presents itself through inefficient cash – flow management and a lack of optimization in your banking relationships. It is a sign that you may not be managing your funds strategically.

Some banks design their accounts with specific thresholds or requirements. For example, you might be retaining a substantial sum in your checking account to avoid a monthly maintenance fee, when that same money could be generating significantly higher returns elsewhere. Alternatively, you might be incurring overdraft fees, ATM usage fees, or other charges because, despite having a large overall balance, your day – to – day spending is not tracked efficiently or funds are not transferred precisely when required from your savings account. These fees, although seemingly minor, can gradually erode your wealth over time and indicate that your cash is not flowing optimally.

If you discover that you are constantly encountering and expressing dissatisfaction about excessive fees, it serves as a strong indication for a financial audit. Examine your bank statements, comprehend the fee structure of your checking account, and assess whether transferring some of your excess cash to a high – yield savings account or an investment account would completely eliminate these fees or at least offset them with higher earnings. The objective is to ensure that your money is working in your favor, rather than imposing costs on you, through prudent account management and strategic fund allocation.

Read more about: 14 Red Flags: How to Spot and Avoid Car Dealership Scams

10. **You’re Not Meeting Minimum Balance Requirements Elsewhere** Another clear indication that you are maintaining an excessive amount of money in your checking account is that, as a consequence, you are unable to meet the minimum balance requirements in other, higher – yield financial products. Numerous savings accounts, certificates of deposit (CDs), and even certain brokerage accounts offer significantly more favorable interest rates, reduced fees, or premium features provided that you maintain a specific minimum balance. By concentrating all your surplus funds in a low – interest checking account, you are forgoing these benefits.

Consider certificates of deposit (CDs): these accounts can secure higher interest rates, often surpassing 5% depending on the term length, in return for leaving your money untouched for a predetermined period. Many CDs necessitate a minimum deposit, perhaps 500or1,000. If you have thousands of dollars sitting in your checking account, you could readily meet these minimums, diversify your savings, and earn a substantially higher return. Similarly, some high – yield savings accounts may offer tiered interest rates, where larger balances are eligible for better annual percentage yields (APYs).

By deliberately allocating funds to meet these minimums, you can optimize your financial advantages across various accounts. It pertains to strategic distribution rather than passive accumulation. This approach guarantees that every dollar serves a purpose and is positioned where it can yield the greatest benefit, whether through higher interest earnings, waived fees, or access to more advanced financial tools. Do not allow your checking account to become a financial black hole that hinders your other valuable accounts from performing optimally.

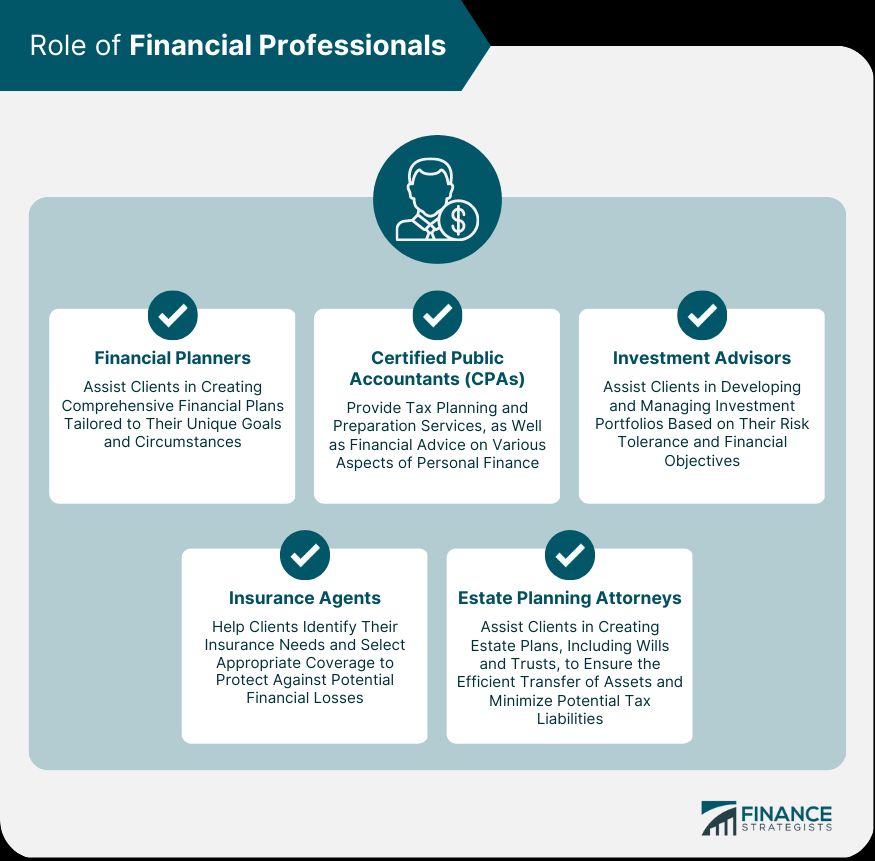

11. **You Lack a Comprehensive Financial Plan** Perhaps the most all – encompassing sign that you are maintaining an excessive amount of money in your checking account is the fundamental lack of a comprehensive financial plan. Without a well – defined roadmap for your financial resources, it is easy for funds to accumulate passively in the most accessible account, rather than being deliberately directed towards specific short – term needs and long – term objectives. A well – structured financial plan guarantees that every dollar has a designated role, maximizing its potential for growth and security.

A robust financial plan extends beyond merely paying bills; it includes budgeting, saving for emergencies, investing for retirement, planning for major purchases, and managing debt. If you discover that you are unable to clearly explain where your money is being allocated beyond immediate expenses, or if your savings and investment accounts remain stagnant while your checking balance swells significantly, it serves as a strong indication that you are lacking this crucial framework. This absence of direction can result in missed opportunities, inefficient cash allocation, and a reduced ability to achieve your financial goals.

Empower indicates that “nearly one – third of Americans state that they feel safer and more in control when they have extra cash on hand, even if it means forgoing higher returns elsewhere.” This sense of security is natural, but it should not come at the cost of progress. Consulting with a financial expert or simply taking the time to formulate your own plan can assist you in understanding how much to keep in liquid form, where to save for growth, and how to make your money work more effectively. Automating transfers to savings and investment accounts in accordance with this plan can alleviate the mental barrier and place you firmly on the path to financial optimization.

Read more about: Syndrome K: The Incredible Fictitious Disease That Saved Jews From the Nazis

Ultimately, your checking account serves as an indispensable financial instrument, specifically designed for uninterrupted transactions and instant access to funds. It represents the robust and reliable mainstay of your daily financial operations. However, it was never intended to constitute the entire financial repository. If you identify any of these eleven signs within your own financial practices, it does not constitute a criticism of your prudence; rather, it is an invitation to enable your money to achieve greater outcomes. By strategically reallocating surplus funds, you are not merely manipulating figures on a screen; you are converting idle cash into a dynamic driving force for your future wealth, ensuring that every dollar is positioned for a specific purpose and has the potential for growth. It is high time to let your money commence working for you, constructing the financial future you envision, one judicious decision at a time.