In the bustling landscape of quick-service dining, innovation is the ultimate currency, and Chipotle Mexican Grill has proven to be a master of strategic evolution. This deep dive into Chipotle’s game-changing Chipotlanes reveals not just a new way to pick up your favorite burrito, but a complete transformation of the brand’s accessibility and growth strategy. It’s truly fascinating to witness how a company tackles challenges head-on, delivering solutions that genuinely resonate with its customers.

Rewinding to 2018, Chipotle was at a pivotal juncture. Despite commendable increases in same-store sales and transactions, a glaring problem emerged: customer frustration over a perceived scarcity of restaurants. Diners felt that their only recourse for a Chipotle fix was to physically enter a restaurant, a bottleneck in an increasingly convenience-driven world. This insight became the catalyst for a profound shift in thinking.

Tabassum Zalotrawala, Chipotle’s chief development officer, articulated the company’s clear vision during this period. She emphasized a dual focus: first, on enhancing Chipotle’s visibility and relevance, and second, on broadening access and convenience. The goal was to empower people to “Chipotle when, where and how they want,” a mantra that perfectly encapsulated their strategic ambitions. Central to this transformation was the ingenious application of technology and innovation to fuel digital growth.

From this strategic imperative, a brilliant solution emerged: the mobile order pickup window, affectionately christened the Chipotlane. This innovative channel harnessed Chipotle’s robust app and online ordering capabilities, offering customers a seamless experience. Imagine bypassing the traditional drive-thru queues, eliminating the need to wait behind another car, and foregoing the speaker box interaction entirely – a truly modern approach to fast-casual dining.

One of the most compelling aspects of the Chipotlane experience is its remarkable efficiency. According to Zalotrawala, transactions at a Chipotlane typically take less than 30 seconds. This astounding speed stands in stark contrast to traditional drive-thrus, where, for instance, Taco Bell, despite boasting the fastest drive-thru time in 2022 according to a QSR Magazine report, averages 221 seconds. Even Chick-fil-A, known for its efficiency, recorded a speed of service time of 325 seconds among the quickest brands.

The potential of the Chipotlane concept became undeniably clear by 2019. Zalotrawala enthusiastically noted that the “sales margins and returns are far higher in restaurants that had a Chipotlane versus non-Chipotlane.” This early success laid the groundwork for an ambitious expansion, proving that this digital-centric approach was not just a convenience, but a powerful business accelerator.

Chipotle’s commitment to this model has been nothing short of aggressive. In November 2022, the company celebrated a significant milestone, opening its 500th Chipotlane. The future pipeline is overwhelmingly Chipotlane-focused, with impressive targets for new restaurant openings. In 2022, Chipotle aimed to open between 235 and 250 new restaurants, with a remarkable 80% of those featuring a Chipotlane. The momentum continues into 2023, with targets set for 255 to 285 restaurant openings, and again, 80% of these new locations are slated to include the popular pickup lanes.

This strategic channel has proven to be a powerful engine of growth, contributing roughly 15% higher sales compared to traditional Chipotle restaurants. This substantial impact has, in turn, instigated a significant reevaluation and shift in Chipotle’s real estate, construction, and labor strategies. Zalotrawala passionately declared, “Our priority for development will always be the Chipotlane.” Her determination underscores the company’s unwavering commitment to integrating this innovative pickup window wherever and whenever possible.

The journey to integrate Chipotlanes across its expanding footprint was not without its hurdles. One of the initial challenges involved a necessary shift in approach, even necessitating the revision of some pending leases to convert buildings to accommodate a pickup window with a vehicular lane. This was a monumental undertaking, especially when considering the scale. As Zalotrawala put it, “It’s one thing if you’re building 10 restaurants a year to make that change, but imagine implementing those changes into over 200 restaurants that are opening that year.”

Retrofitting existing sites that were already approved posed a distinct set of difficulties. Construction plans required redrawing, and the permitting processes had to be completely redone. This intricate task demanded extensive coordination across various departments, including the operations services team, which focuses on equipment innovation, and the field operations team, vital for real-world testing and feedback. It was a complex dance of logistics and design.

The integration of Chipotlanes fundamentally reshaped the very fabric of Chipotle’s restaurants. Zalotrawala candidly stated, “Adding the Chipotlane pretty much required a redesign of our restaurant, both dining and kitchen … and that was a pretty mammoth task for us.” This comprehensive overhaul extended to the digital makelines, which needed to be exact replicas of the frontline, ensuring consistency with full pans holding both cold and hot wells. Crucially, staff also needed to replicate their frontline operational methods for the digital orders.

Another critical learning curve involved optimizing labor for these new digital-centric operations. The operations team in the field, alongside the operation services team, meticulously crunched numbers to determine the precise number of employees required for the digital makeline and the associated costs. Given that Chipotlanes typically contribute about $1 million to restaurants annually, it was imperative to have the right staffing in place to ensure efficient, speedy, and accurate service, directly impacting profitability.

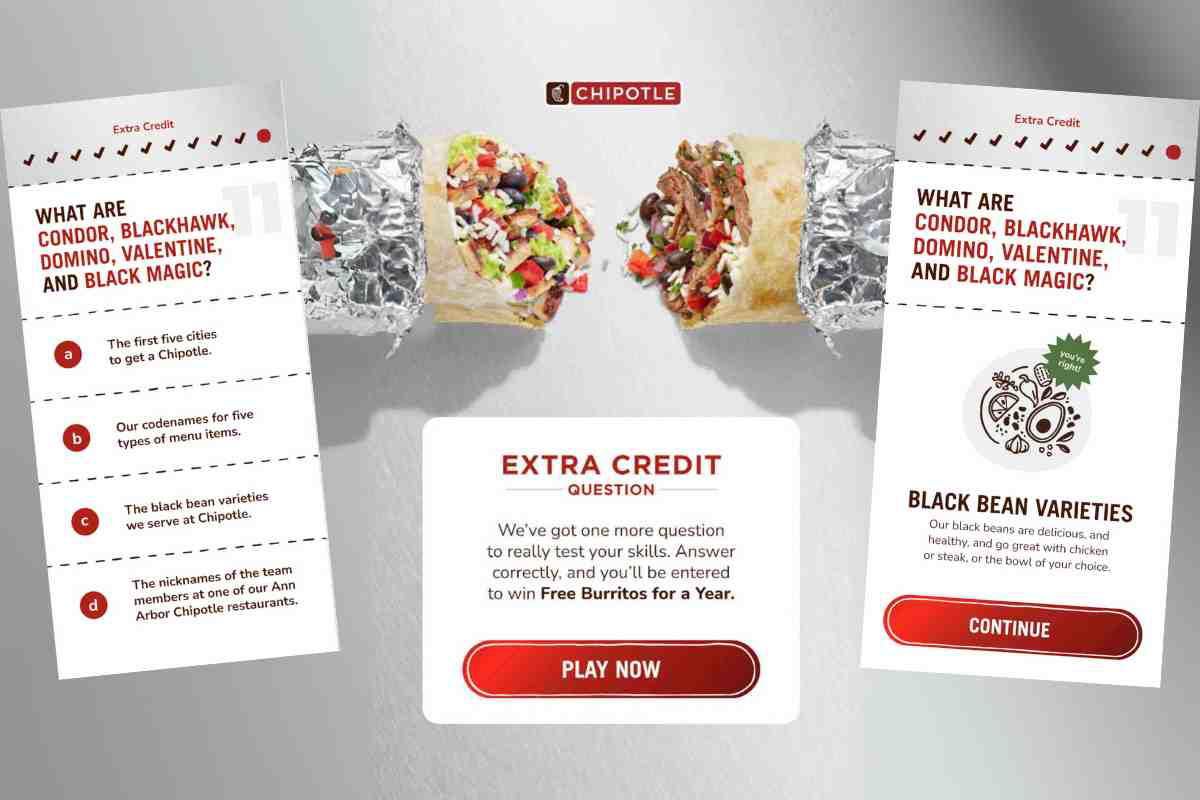

Furthermore, Chipotle quickly recognized the need to educate and acclimate consumers to the new pickup windows. In the initial months, many customers, unfamiliar with the concept, would drive up to the window attempting to place an order. This necessitated staff proactively informing guests that the window was exclusively for mobile order collection, a crucial step in streamlining the experience and reducing customer confusion, which was identified as one of the biggest challenges at the outset.

Beyond new builds, Chipotle embarked on a strategic mission to streamline conversions and remodels of existing locations. Prior to the Chipotlane era, the company primarily sought end-cap or freestanding locations, not necessarily real estate that could easily accommodate a drive-thru window. With the strategic shift, Chipotle needed to clearly communicate its interest in potential sites to developers and landlords, including buildings with existing drive-thrus, such as former banks or defunct restaurants.

Chipotle has successfully executed numerous bank conversions, leveraging the inherent advantage of these structures which often already possess a pickup window or the foundational ability to add one. Zalotrawala highlighted the efficacy of this approach, stating, “Between conversions and being clear about what we’re looking for in terms of the development strategy with our landlords and with our developers, we’ve been able to accelerate this pipeline very quickly.” This adaptability has been key to their rapid expansion.

An ongoing process involves a comprehensive analysis of Chipotle’s entire portfolio of restaurants to identify which ones are physically capable of accommodating a Chipotlane. This meticulous review considers various factors, including the remaining duration of a lease; if a lease is set to expire in less than five years, the location is typically not considered a suitable candidate. The company also scrutinizes a restaurant’s sales and comparable performance to ascertain if there’s ample space on the site for a vehicular lane.

Securing permits from local authorities and approval from landlords for conversions are additional, vital considerations. Naturally, the total investment costs for such modifications are also factored into the decision-making process. Chipotle’s strategic foresight extends to minimizing disruption during remodels, having developed enhanced methods to significantly reduce closure times. Initially, the first few remodel projects resulted in restaurants being closed for three to six days.

Read more about: Beyond the Jar: Unlocking Culinary Magic with Homemade Sauces

However, through rapid innovation and strong partnerships with general contractors, vendors, operations partners, and facility partners, the team ingeniously reconfigured construction schedules and modified restaurant hours to completely avoid full closures. Remarkably, every remodel undertaken by Chipotle in 2021 achieved zero closure time. While maintaining operations during construction does extend the overall timeframe, Chipotle is still able to complete these complex remodels efficiently, typically within a week or two, showcasing impressive operational agility.

Despite overcoming numerous internal challenges in developing Chipotlanes, one persistent external hurdle remains: the permitting process. This has become an increasingly “onerous process, Chipotlane or no Chipotlane,” as Zalotrawala explained. What once took roughly 60 to 90 days for a permit now stretches to 180 days. Consequently, a development timeline that was typically 12 to 18 months has now easily extended to 18 to 24 months, making it a rare occurrence to approve real estate and open a store within 12 months.

Even before the COVID-19 pandemic, permitting was a lengthy affair, likely due to the heavy workload for prospective developers during a bustling period of development. The pandemic further complicated matters; while many restaurant companies paused development, the subsequent surge in projects has added to the volume of permits cities are processing, creating ongoing backlogs. Chipotle is actively engaged in addressing this by fostering dialogues with city officials.

To gain municipal buy-in for Chipotlanes, the company engages in numerous conversations, demonstrating that these pickup lanes do not create the extensive 20- to 30-car stacks characteristic of traditional drive-thrus. Chipotlanes avoid the back-and-forth conversations at speaker boxes and payment processing at the window, eliminating traditional delays. Zalotrawala proudly asserted, “That’s what differentiates us from QSR, because we have none of that.”

Chipotle bolsters its case by providing compelling videos and images to city officials, effectively illustrating how Chipotlanes compare to traditional drive-thrus. These visuals showcase the specific appearance of a Chipotlane and highlight its numerous benefits, such as attracting more visitors to a shopping center without exacerbating general traffic congestion. This proactive educational approach helps smooth the path for new developments.

Looking ahead, the future of Chipotle is unmistakably bright and replete with Chipotlanes. With an ambitious goal of reaching 7,000 restaurants in North America and an annual growth rate of 8% to 10% in units, the opportunities for building new Chipotlanes are vast. Chipotle is also strategically expanding its presence into smaller towns across the U.S. These small-town restaurants are proving to be remarkably successful, often yielding comparable margins and returns to the company average.

CEO Brian Niccol noted during an October earnings call that an opening day in a small town in Texas even set a new company record, highlighting the untapped potential in these markets. Furthermore, CFO Jack Hartung pointed out that compared to urban restaurants where rent is typically higher, small-town restaurants require less initial investment, making them attractive growth vehicles.

While Chipotlanes are a fantastic solution for many areas, dense urban environments present unique challenges due to space constraints. In these regions, the next significant question has been how to enhance Chipotle’s accessibility, convenience, and visibility for its urban guests. The company’s ingenious solution for foot traffic is the digital pickup window, a concept they successfully tested near Wrigleyville in Chicago, which saw high user adoption. Zalotrawala emphasized that this has been “another enabler for the Chipotlane strategy,” allowing for the design of a walk-up window in urban areas instead of a vehicular one.

Chipotle’s spirit of innovation extends beyond just walk-up windows. The company is actively experimenting with alternative formats, such as the Digital Kitchen it opened outside West Point in Highland Falls, New York. This unique concept offers pickup- and delivery-only service, intentionally designed without a dining room or a full-service line, catering specifically to off-premise needs. Another significant step in this direction was the opening of Chipotle’s first Chipotlane Digital Kitchen at the end of 2021.

This innovative prototype, which recently opened in Cuyahoga Falls, Ohio, features no dining room or front line, allowing guests to pick up digital orders exclusively through a drive-up or walk-up window. It integrates the best features of a Chipotlane with an all-digital unit, and even includes a small outdoor patio for on-site dining. Chipotle strategically tests these new formats in established markets where current restaurant density might be lower, allowing a smaller format store with a Chipotlane to service more customers effectively.

Digital sales remain a core focus for the brand, a testament to their foresight and adaptability. In October, CEO Brian Niccol reported year-to-date digital sales nearing $2.7 billion, almost matching the impressive $2.8 billion achieved in 2020 when indoor dining was widely restricted due to the pandemic. To further optimize the convenience of online and app ordering, Chipotle has even reconfigured 12 existing restaurants to include a digital order pickup lane, further boosting digital sales. The company is also relentlessly improving digital-order throughput times, with Niccol stating that the time from digital order to pickup was less than 10 minutes, down from 12 minutes earlier in the year.

The strategic investment in dedicated digital makelines, operating as a “restaurant within a restaurant,” has been foundational to this success. From the outset, Chipotle ensured these secondary makelines were exact replicas of the frontline, featuring the same size and pans. This foresight meant they were primed to scale quickly when the demand surged, especially during the pandemic. Zalotrawala starkly highlighted the importance of this separation, noting the “horrible” experience that would result if digital orders were fulfilled on the front line in front of in-person guests.

Read more about: Perfecting the Craft: A Practical Guide to Building a Passionate Food Career

Chipotle’s directive is clear: digital orders are never fulfilled on the front line, even during slow periods. This maintains a distinct mindset and culture for separating the two businesses, ensuring optimal efficiency and guest experience for both. The company is also introducing four new pieces of kitchen equipment by 2025, including produce slicers, dual-sided planchas for chicken and steak, three-pan rice cookers, and dual-vat fryers, all designed to simplify order fulfillment, enhance worker experience, and speed up food preparation.

This meticulous attention to operational detail positions Chipotle for continued strong growth momentum, with an unwavering focus on the “total guest experience.” As CEO Scott Boatwright articulated, “everything we do is in service of our guests or those who serve our guests.” This includes a commitment to improving the experience for their restaurant teams, knowing that “When we improve the experience for our restaurant teams, it ladders to a better guest experience.” Digital sales accounted for 35% of sales in 2024, emphasizing the critical role of these innovations.

The metrics supporting the Chipotlane strategy are compelling. Chipotlanes continue to open with sales 20% higher than traditional formats and operate with 200 basis-points higher restaurant-level margin. This incremental profit comfortably offsets the $75,000–$100,000 cost of a Chipotlane, yielding a cash-on-cash return of at least 500 basis points above standard locations. Over the trailing 12 months, Chipotlanes drove about a 15% higher overall digital sales mix, underscoring their strategic importance in meeting evolving consumer preferences.

Analysts predict that by 2025, there could be 1,000 Chipotlane locations through new builds alone, representing about 30% of domestic units. The potential for “several hundred” retrofits also exists, given that approximately 80% of Chipotle’s existing stores are free-standing or end-cap sites. This expansion could also enable the brand to broaden its menu offerings, with the digital, order-ahead setup providing ample time for food preparation and eliminating typical throughput concerns.

Read more about: McDonald’s Global Reach: Navigating Expansion, Structure, and Market Forces

Imagine the possibilities: digital-centric menu launches, like Chipotle’s successful quesadilla that now appears in about 10% of transactions, and even potential late-night hours with drive-thru only service or a breakfast test. The Chipotlane has indeed triggered a significant and positive turn for the brand’s prospects, especially in a sector where the pandemic highlighted the importance of off-premises channels. As Zalotrawala, with her extensive experience in the fast-food drive-thru sector, wisely observed, traditional drive-thru’s relentless pursuit of speed often leads to rushing and order inaccuracy, compromising the guest experience.

Chipotle’s philosophy is to empower customers to customize their orders at their leisure, whether at home or in their cars, and then grant crew members the necessary time to meticulously prepare the order, just as they would for an in-person customer. This dedication to quality and experience, even at scale, differentiates the Chipotlane. During uncertain times, Chipotlanes served as the “ultimate, touchless experience for our guests during the pandemic,” enabling continued access to beloved food in the safest way possible, which resulted in higher overall digital sales and sales at Chipotlanes compared to non-Chipotlanes.

Chipotle’s evolution was not merely a reaction to the pandemic; it was a well-laid strategy already in motion. The unfortunate closures during the pandemic, however, inadvertently “opened up a treasure trove of real estate for Chipotle,” particularly former quick-serve sites with existing drive-thrus ripe for conversion. While temporary pressures like supply chain tightness, construction slowdowns, and labor shortages exist, Zalotrawala views these as transient challenges, confident in the healthy pipeline of new developments across the nation.

Driving through smaller towns, Zalotrawala is consistently amazed by the sheer scale of the opportunity awaiting Chipotle. Reaching 6,000 units would more than double the chain’s current footprint, yet it would still represent fewer domestic restaurants than many other major quick-service brands. The continued evolution of Chipotle’s restaurant design, including digital-only stores and Chipotlane-only constructs without dining rooms, further expands this conversation.

These innovative models allow Chipotle to rethink trade areas once thought saturated and explore entirely new ones. This ability to pivot to digital or on-site propositions was a proactive, pre-pandemic strategy that prepared them for the future. The enduring commitment, as Zalotrawala aptly puts it, is to ensure that “every new restaurant we add to our pipeline has this convenient channel where guests can Chipotle a different way.” This dedication to accessibility, efficiency, and a truly seamless experience firmly positions Chipotle as a leader in the next generation of fast-casual dining, delighting burrito lovers everywhere.