Indian Prime Minister Narendra Modi is navigating a delicate geopolitical landscape, skillfully balancing robust partnerships with both US President Donald Trump and Russian leader Vladimir Putin. This intricate equilibrium has recently been tested, as Western nations, having imposed sanctions on Moscow, observe with growing dismay India’s continued purchases of discounted Russian oil. The situation has intensified, pushing the long – standing friendly ties between Trump and Modi, two prominent nationalist leaders, to an unprecedented inflection point.

Recent developments underscore this mounting tension. On a recent Wednesday, President Trump unveiled significant and wide – ranging tariffs targeting India, a key trading partner of the United States. These measures include a 25% tariff that was set to take effect on Thursday, along with an additional 25% tariff scheduled for later this month. The latter imposition serves as a direct punitive response to India’s ongoing imports of Russian oil and gas, indicating a clear escalation in the trade dispute.

These combined penalties would effectively raise the total tariff on goods originating from the world’s fifth – largest economy to a substantial 50%. Such a rate places India among the nations facing the highest import duties from the United States. Earlier in the week, Trump had already issued a direct threat of these new tariffs, explicitly linking India’s oil purchases to aiding Russia in its military actions in Ukraine.

Through social media, President Trump articulated his frustration, stating, “India is not only buying massive amounts of Russian oil, but it is also, for much of the oil purchased, selling it on the open market for big profits. It doesn’t care how many people in Ukraine are being killed by the Russian war machine.” This public condemnation underscores the depth of American concern and the perceived role of Indian commerce in the ongoing conflict.

However, for Prime Minister Modi and the Indian government, the situation is far from straightforward. While numerous countries have eagerly pursued trade agreements with the Trump administration, India has adopted a posture of defiant resistance. It has vociferously argued that it is being unfairly singled out, labeling the American measures as “unjustified” and “unreasonable.”

Indian officials have pointed to a perceived double – standard, noting that the United States and European nations continue to engage in trade with Russia for various other products, including essential fertilizers and chemicals. This perspective highlights India’s position that its actions are not unique in the global trade landscape with Russia.

India’s substantial reliance on Russian crude oil is a foundational element of its economic strategy, essential for sustaining its rapidly expanding economy and supporting its immense population, which now exceeds 1.4 billion people. As the world’s most populous nation, India is also the third – largest global consumer of oil, and according to projections cited by Reuters, it is projected to surpass China in this position by 2030.

The nation’s transformation into a formidable economic superpower has significantly improved the livelihoods of millions of households. This societal uplift has, in turn, fueled a surge in the acquisition of personal vehicles such as cars and motorcycles, directly driving up the demand for gasoline and other petroleum products across the country.

According to Muyu Xu, a senior oil analyst at Kpler, a trade intelligence firm, Russian crude oil constituted a significant 36% of India’s overall imports during the first six months of the current year, cementing Moscow’s position as India’s primary supplier. Other data indicates that Russian oil accounts for over 30% or nearly a third of India’s total oil imports, with India purchasing Russian oil worth more than US $47 billion in 2024.

A critical factor in India’s continued reliance on Russian oil is the substantial discount at which it is acquired. Amitabh Singh, an associate professor at Jawaharlal Nehru University’s Centre for Russian and Central Asian Studies, highlighted that these favorable terms “otherwise would not have been given by the traditional oil and gas suppliers.” He characterized India’s ongoing purchases as “a purely economic or commercial decision,” a stance consistently maintained by Indian authorities, despite attracting considerable criticism and anger from Ukraine and its international allies.

While India has actively sought to diversify its crude oil sources over recent years, a complete cessation of Russian oil imports would create a significant void that would be exceptionally challenging to fill. India’s domestic oil production is insufficient to meet its vast needs, importing approximately 80% of its total oil requirements.

Read more about: Pennsylvania: A Tapestry of American History, From Founding Principles to Contemporary Dynamics

Analysts note that while OPEC, the coalition of major oil producers, may possess some spare capacity, it would be difficult to request it to pump an additional 3.4 million barrels overnight, referring to Russia’s daily seaborne exports, as noted by Xu in July. This logistical challenge underscores the impracticality of a rapid shift in supply.

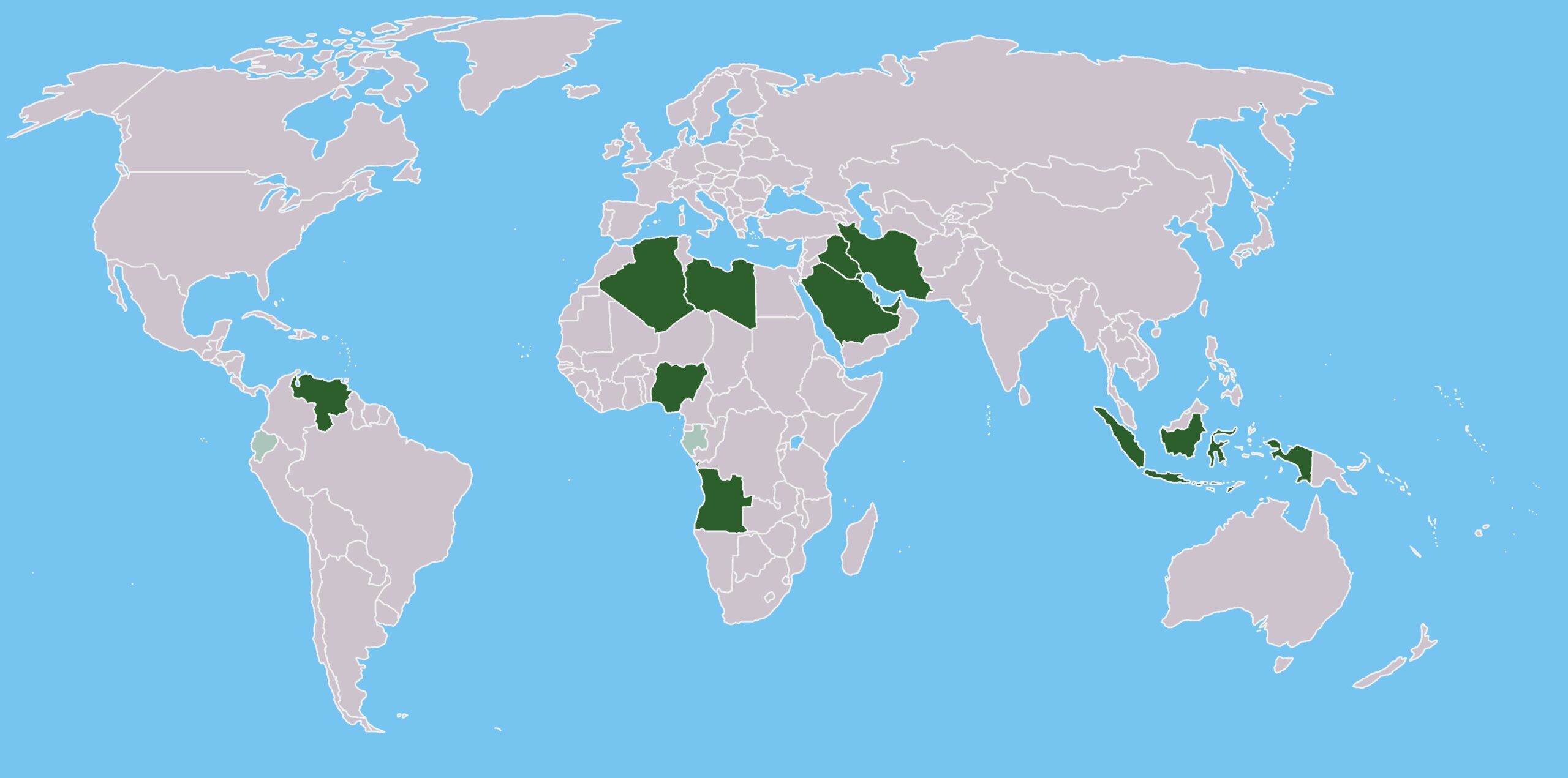

Furthermore, India’s options have been constrained by previous US policy decisions. Notably, India was compelled to cease oil purchases from Iran and Venezuela following the Trump administration’s imposition of sanctions and threats of tariffs against countries engaging in trade with those nations. Before these sanctions, India had been one of Iran’s largest clients, importing up to 480,000 barrels per day, according to Reuters.

Singh aptly summarized India’s predicament, stating, “We have our hands tied behind our backs. There is very limited space in which the Indian oil economy or market can operate.” For the foreseeable future, he added, it remains unlikely that Delhi will concede to Trump’s demands. Modi’s administration is expected to continue engaging in trade discussions with the US while concurrently exploring the “traditional route” of Middle Eastern oil to gradually reduce its dependence on Russian crude, a process that “cannot be done overnight.”

India asserts that its continued purchases of Russian oil contribute to global oil price stability. The nation argues that by not competing with Western countries for Middle Eastern oil, it effectively helps to keep international crude prices lower. Singh remarked that during the Biden administration, as the Ukraine – Russia conflict began, “everyone knew that India was buying oil from Russia,” and Western nations tolerated it “because they knew that if India were not buying oil from Russia, then inflation would go up.”

Should India be compelled to procure oil from alternative sources at a higher cost, American consumers would likely experience the repercussions in the form of increased prices. A notable aspect of this trade is that some of the Russian crude oil imported by India is subsequently refined and exported to other countries, including Europe, the US, and the UK. This practice exploits a loophole wherein sanctions on Moscow do not extend to products refined outside Russia.

This “loophole” has proven mutually beneficial, bolstering India’s economy and supplying recipient nations. In 2023, India exported a remarkable $86.28 billion in refined oil products, cementing its position as the world’s second – largest exporter of petroleum products, according to the National Bureau of Asian Research (NBR). The Centre for Research on Energy and Clean Air (CREA), an independent organization, has urged G7 nations to close this loophole, arguing that it would discourage third countries, like India, from importing Russian crude.

Beyond the immediate economic considerations, India and Russia share a historic partnership spanning decades, making a swift disengagement particularly challenging. During the Cold War, India officially maintained a non – aligned stance. However, it gravitated towards the Soviet Union in the 1970s when the United States commenced providing military and financial assistance to Pakistan, India’s historical rival. This period marked the beginning of Russia’s role as a major arms supplier to India.

Read more about: Donald J. Trump: A Comprehensive Profile of the 45th and 47th U.S. President, Businessman, and Media Personality

In recent years, India has incrementally drawn closer to Washington, increasing its arms procurements from the United States and its allies, including France and Israel. Nevertheless, India continues to be the primary recipient of Russian arms, as confirmed by SIPRI. Furthermore, Prime Minister Modi has maintained a visible friendship with President Putin, notably paying a controversial visit to Moscow last year, during which the Russian president personally greeted him with a hug and drove him around.

Historically, both Donald Trump and Narendra Modi have publicly celebrated their mutual admiration. During a 2019 rally, Trump famously declared that India had “never had a better friend as President than President Donald Trump.” It was widely anticipated that this personal rapport would persist if Trump secured a second term in the White House.

However, the relationship has demonstrably soured during this period. India has expressed displeasure with Trump’s assertions of brokering a ceasefire in the latest India – Pakistan conflict, a claim India rejects, insisting that its military prowess forced Pakistan’s hand. Modi also faces mounting domestic pressure not to concede to the White House’s demands.

Trump, for his part, has voiced increasing frustration over his unfulfilled promise to end the Ukraine – Russia war on his first day in office. In an irate social media post last week, he declared, “I don’t care what India does with Russia. They can let their dead economies go down together, for all I care.” This sentiment reflects a significant departure from previous rhetoric, indicating a deeper rift.

Further complicating matters, Trump hosted Pakistani army chief Asim Munir at the White House and signed a trade deal that offered Pakistan a preferential tariff rate, including an agreement to explore its oil reserves, suggesting that Pakistan might one day sell oil to India. This, alongside Trump’s repeated insistence on having mediated the India – Pakistan ceasefire, deeply irritates Delhi, which considers the Kashmir dispute an internal affair and rejects third – party mediation.

The broader economic ties between India and the United States are substantial, with bilateral trade exceeding $150 billion. While certain Indian exports to the US, such as pharmaceuticals and electronics, remain exempt from the new tariffs, other vital industries are set to suffer significant setbacks. Exports of gemstones, seafood, and textiles, among others, are expected to be severely affected.

Anupam Manur, a professor of economics at The Takshashila Institution, a Bengaluru – based think tank, estimates that the 50% tariff could impact tens of thousands of workers and potentially reduce India’s earnings by billions. This comes at a critical juncture when India is desperately seeking to create more jobs for its burgeoning workforce, exacerbating the economic challenge.

India’s historical assertiveness regarding its energy security, coupled with its long – standing relationship with Russia, explains its defiance against Western pressure. However, Indian analysts note that this public assertiveness has not always prevented India from acceding to US demands in the past. Manur points to Trump’s first presidential term in 2019, when India, despite initial statements prioritizing energy security, gradually ceased oil imports from Iran following US sanctions.

Data from the Helsinki – based Centre for Research on Energy and Clean Air suggests a potential shift, as some Indian state – owned refineries reportedly ceased procuring from Russia in early July, coinciding with Trump’s warnings of “secondary tariffs”. This indicates that despite strong public statements, underlying adjustments may be taking place.

Since the 1990s, America’s bipartisan foreign policy has consistently aimed to foster closer ties with India, viewing it as a crucial economic and political bulwark against the rising influence of China. During his first term in office, President Trump actively embraced Modi as a key ally, with both leaders participating in reciprocal rallies in their respective countries, cultivating a seemingly strong personal relationship.

Yet, the current trajectory suggests an unraveling of this once – cultivated relationship between the two leaders and nations. Despite five rounds of trade talks since February, a significant point of contention persists: U.S. officials seek access to India’s agriculture and dairy sectors for American products. This demand is politically contentious in India, where the agriculture sector employs over 45% of the workforce, making concessions exceedingly difficult for any Indian prime minister.

Indian analysts suggest that Trump’s current frustrations also stem from Modi’s perceived lack of acknowledgment of Trump’s role in the May ceasefire between India and Pakistan. While Pakistan has profusely thanked Trump and even offered to nominate him for a Nobel Peace Prize, India insists that its military prowess secured the ceasefire. Milan Vaishnav, director of the South Asia Program at the Carnegie Endowment for International Peace, suggests that Trump may simply be seeking a “thank you”.

Read more about: Trump’s Escalating Tariff Threat on India: A Geopolitical and Economic Reckoning Over Russian Oil Purchases

On a recent Friday, Prime Minister Modi shared on the social – media platform X that he had had a “very good and detailed conversation with my friend President Putin,” expressing gratitude for updates on the Ukraine war. Modi also reaffirmed his commitment to “further deepen the India – Russia Special and Privileged Strategic Partnership” and anticipated hosting President Putin in India later this year, clearly signaling a continued alignment with Moscow amid tariff threats.

Despite the current acrimony, it is technically and legally feasible for India to reduce its reliance on Russian oil. Prior to the war in Ukraine, Russia accounted for less than 1% of India’s oil imports. The subsequent opportunity to purchase Russian crude at a significant discount, estimated to have saved Indian companies $13 billion over two years, prompted a rapid increase in imports. This transition from minimal to substantial reliance, reaching around two million barrels per day by May 2023, demonstrates the industry’s capacity for swift adaptation.

Furthermore, modern refineries, such as those operated by Reliance Industries and Nayara Energy in Gujarat, are technologically advanced. Duttatreya Das, an analyst at Ember and a former official with India’s national oil and gas company, stated that such facilities are “interoperable with different grades of crude” and can switch intake “almost instantaneously.” This refutes claims that reconfiguring facilities for Middle Eastern grades would be a major constraint.

Cancelling existing contracts with Russian suppliers and shippers could be justified by Indian buyers through “force majeure,” citing Trump’s trade war as grounds for backing out of the agreements. While securing new contracts for India’s massive oil consumption—around 5 million barrels a day—would be tricky, buyers could likely line up sufficient non – Russian oil within approximately a year. However, this would inevitably mean forfeiting the significant wartime profits currently enjoyed.

It is important to note that while Indian companies have profited from discounted Russian oil, the benefit to Indian consumers has been less pronounced, with pump prices rising gradually since the Covid – 19 pandemic. The Indian government carefully manages prices through fuel taxes and fees, using the savings from cheaper crude to protect the value of the Indian currency and bolster the bottom line of companies like Reliance. However, the overall direct economic benefit to India’s $4 trillion economy has been relatively modest, making Trump’s tariffs a potent threat to its growth.

The United States has long regarded India as a pivotal counterweight to China’s influence in the Indo – Pacific region, a strategic view that has historically garnered bipartisan support in Washington. Concurrently, Moscow, albeit sometimes reluctantly, tolerated India’s cultivation of closer ties with Washington and other Western nations. However, President Trump’s current confrontational approach directly challenges this established diplomatic norm.

Despite the apparent discord, the fundamental strength of the India – US relationship is often underscored by the enduring cooperation across various sectors. The two nations collaborate extensively in space technology, information technology, education, and defense. The recent joint launch of a satellite, for instance, symbolizes the resilience of strategic cooperation even amid escalating trade disputes.

As President Trump continues his “transactional and commercial” approach to foreign policy, employing potentially alienating tactics against a close partner such as India, the future of this critical relationship remains in flux. While a considerable degree of trust is embedded in the partnership, which has been painstakingly built over two decades, what is currently at stake could potentially be recovered. Yet, given the profound nature of the present malaise, a complete restoration may necessitate a substantial and protracted period of diplomatic effort.

Read more about: Donald J. Trump: A Comprehensive Profile of the 45th and 47th U.S. President, Businessman, and Media Personality

India’s measured yet resolute response to Trump’s rhetoric signals its determination to safeguard its sovereignty and economic interests. As the geopolitical chess – pieces shift, the world observes closely to see how this crucial relationship, which is vital for global stability and economic balance, will ultimately evolve amid the escalating tensions.