The United States stock market experienced a robust rally, surging to unprecedented records, driven by fresh economic data that suggested inflation was moderating more favorably than economists had projected. This wave of optimism swept across Wall Street, propelling major indexes to new peaks and igniting investor hopes for imminent interest rate reductions by the Federal Reserve.

On a pivotal Tuesday, the Standard & Poor’s 500 index climbed 1.1%, reaching an all-time high of 6,445.76 points, surpassing its previous record set just two weeks prior. Concurrently, the Dow Jones Industrial Average ascended by 483 points, or 1.1%, closing at 44,458.61, while the Nasdaq composite soared by 1.4%, achieving its own historical record at 21,681.90 points.

The driving force behind this impressive market ascent was the pervasive expectation that the more encouraging inflation report would provide the Federal Reserve with the necessary flexibility to implement interest rate cuts at its upcoming September meeting. Such a move, if realized, would likely invigorate investment prices and stimulate broader economic activity by reducing borrowing costs for American households and businesses looking to finance homes, vehicles, or equipment purchases.

Examining the underlying inflation figures, Tuesday’s report indicated that U.S. consumers faced overall prices for essentials like groceries and gasoline that were 2.7% higher in July compared to a year earlier. This rate remained consistent with June’s inflation figure and registered just below the 2.8% increase that economists had anticipated, offering a degree of market reassurance.

However, a deeper dive into the inflation data revealed a more nuanced picture, with some “discouraging undertones” that warrant close attention. An underlying measure of inflation, which many economists consider a more reliable predictor of future trends, reached its highest point since the beginning of the year. This observation was highlighted by Gary Schlossberg, a market strategist at Wells Fargo Investment Institute, and contributed to some fluctuations in Treasury yields within the bond market.

Core inflation, specifically, accelerated to 3.1%, marking its highest pace in six months. This surge is largely attributed to the impact of tariffs, which have pushed prices higher on various consumer goods, including apparel and furniture. Despite this, energy prices actually provided some relief, declining by 1.1% in July, with gasoline prices specifically dropping by 2.2%.

The Federal Reserve finds itself navigating a complex economic landscape, balancing its dual mandates of achieving a 2% inflation target while simultaneously maintaining a healthy job market. The central bank has expressed reservations about lowering rates too quickly, citing the potential for tariffs to exacerbate inflation and suggesting that further rate reductions could “give inflation more fuel, potentially adding oxygen to a growing fire.”

Fed officials have consistently articulated a preference for observing more incoming inflation data before making policy adjustments. Adding to the complexity, the most recent jobs report delivered a “stunner,” coming in considerably weaker than economists had foreseen. This combination of mixed signals underscores the intricate challenge facing the central bank.

Economists broadly caution that the path forward for Federal Reserve decisions may not be straightforward, anticipating “more twists and turns in upcoming data.” The inherent tension between aiding one of the Fed’s goals, such as stimulating the economy, often risks undermining the other, such as controlling inflation, making policy formulation particularly delicate.

Traders on Wall Street responded to the latest inflation report by significantly increasing their wagers on a September interest rate cut by the Federal Reserve, marking it as the first such reduction this year. Data from CME Group indicated that the probability of a September cut jumped to 94%, a notable increase from approximately 86% just a day prior.

The sentiment surrounding interest rates is not isolated to the United States. Other central banks globally have been proactive in reducing their own interest rates, with Australia, for example, implementing its third rate cut of the year on the same Tuesday. This global trend further informs market expectations for the Federal Reserve’s upcoming policy decisions.

President Donald Trump has been a vocal proponent of interest rate cuts to bolster the economy, frequently expressing his views forcefully and even, at times, personally criticizing the Fed’s chair. His administration’s actions, including signing an executive order to delay hefty tariffs on China by 90 days, are seen by some as an attempt to clear a path for a potential trade deal and avert a broader trade war, which could influence inflation dynamics.

On the corporate front, individual stock performances on Wall Street showcased varied responses to the prevailing market conditions. Intel’s stock experienced a notable rise of 5.6% following President Trump’s commendation of its CEO’s “amazing story,” a statement that came less than a week after the President had called for Lip-Bu Tan’s resignation. This illustrates the potential for executive comments to swiftly impact market valuations.

Critics within the financial community have begun to voice concerns that the broad U.S. stock market appears “expensive” after its significant surge from a low point in April. This perception places considerable pressure on companies to consistently deliver robust profit growth to justify current valuations and sustain the upward trajectory of the market.

In the global equity markets, indexes in China recorded modest gains following President Trump’s executive order to postpone tariffs. This anticipated move was perceived as potentially facilitating a resolution to the ongoing trade tensions between the United States and China. Japan’s Nikkei 225 jumped by 2.1%, while South Korea’s Kospi experienced a 0.5% decline, representing some of the more significant movements in international markets.

Bond market dynamics also reflected the shifting investor sentiment. The yield on the 10-year Treasury note saw a slight increase, rising to 4.28% from 4.27% late Monday. In contrast, the yield on the two-year Treasury, which is often considered a more direct indicator of Federal Reserve policy expectations, decreased to 3.73% from 3.76%, signaling a greater conviction in impending rate cuts.

Despite the prevailing optimism and the market’s rally on the back of rate cut hopes, the landscape quickly shifted as investors recalibrated their expectations. In a subsequent development, U.S. stocks experienced one of their most significant downturns of the year after the Federal Reserve provided clearer guidance, hinting at a potentially more restrained approach to interest rate reductions in the coming year.

The S&P 500 notably fell by 2.9%, nearing its largest single-day loss of the year recorded during the summer. This decline pushed the index further from its recently established all-time high. The Dow Jones Industrial Average similarly plummeted by 1,123 points, or 2.6%, and the Nasdaq composite sharply dropped by 3.6%, underscoring the market’s acute sensitivity to the Fed’s forward guidance.

At its first meeting of 2025, the Federal Reserve proceeded with a widely anticipated third interest rate cut of the year, reducing its main rate by a full percentage point since September to a range of 4.25% to 4.50%. However, the market’s reaction was largely driven by the central bank’s updated projections for the coming year.

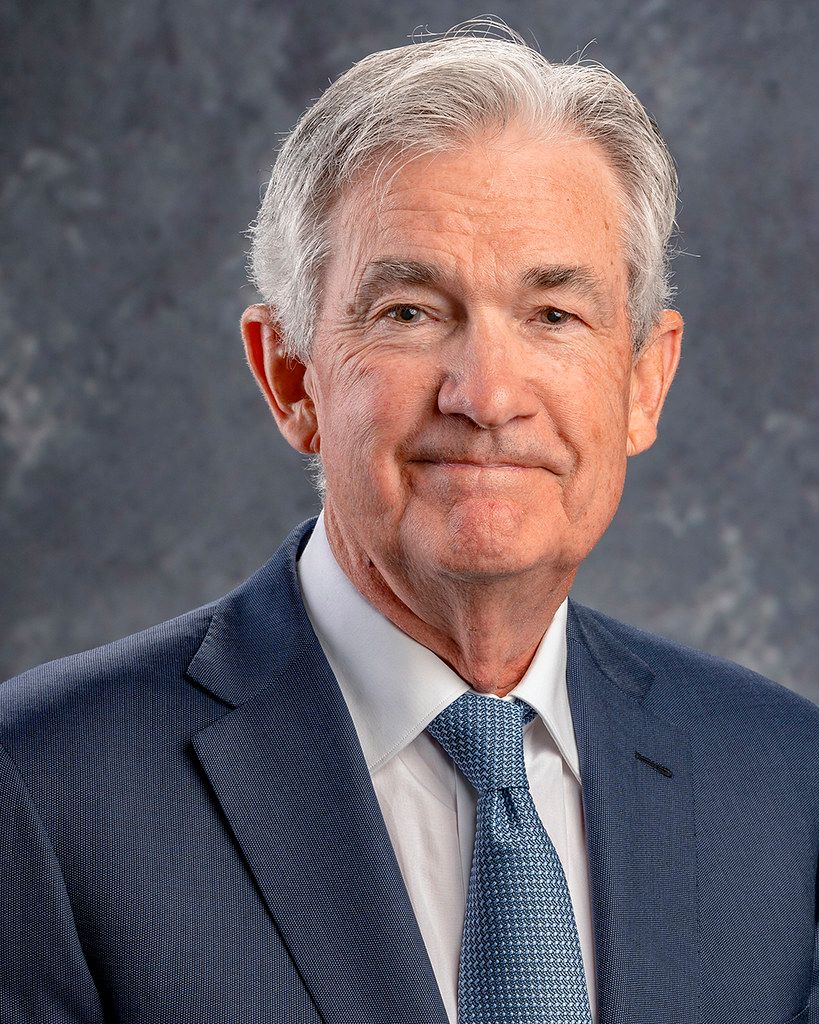

Fed officials’ projections indicated a median expectation of just two more rate cuts in 2025, totaling half a percentage point. This marked a significant reduction from the four cuts that had been anticipated just three months prior, effectively signaling a slowdown in the central bank’s easing cycle. Fed Chair Jerome Powell articulated this shift, stating, “We are in a new phase of the process.”

Powell elaborated that the decision to potentially slow the pace of rate cuts stemmed from observations of a generally well-performing job market and recent upticks in inflation readings. He also acknowledged the inherent “uncertainties” arising from a new administration entering the White House, particularly concerns that President-elect Trump’s policies, such as tariffs, could further fuel inflation and economic growth.

The cautious stance within the Fed was also evident in the vote. Cleveland Fed President Beth Hammack cast the lone dissenting vote against the recent rate cut, reflecting a minority view that the central bank should not have eased policy at that juncture. Such internal divergences highlight the ongoing debate and varying perspectives within the policymaking body.

This revised outlook from the Federal Reserve had a direct impact on the bond market, where reduced expectations for 2025 rate cuts led to a rise in Treasury yields. The yield on the 10-year Treasury climbed to 4.50% from 4.40%, a notable movement for the bond market. The two-year yield, which is particularly responsive to immediate Fed expectations, also increased, moving to 4.35% from 4.25%.

Companies perceived as highly susceptible to higher interest rates experienced some of the steepest declines. Small-cap stocks, for instance, which often rely on borrowing for growth, were particularly affected, with the Russell 2000 index tumbling by 4.4%. This segment of the market tends to feel more immediate pain when the cost of borrowing increases.

Among individual companies, General Mills shares dropped by 3.1%, despite the food giant reporting stronger profits than expected for its latest quarter. The company announced plans to boost investments in its brands to foster growth, a strategic decision that led to a downward revision of its profit forecast for the fiscal year, affecting investor sentiment.

Nvidia, a technology powerhouse whose remarkable performance had significantly contributed to Wall Street’s recent record rallies, saw its stock decline by 1.1%. This marked an extension of its weekslong downturn, with shares falling over 13% from their record high set the previous month and experiencing losses in nine out of the last ten trading days, signaling a deceleration in its previously rapid momentum.

In a contrasting performance, Jabil, an electronics manufacturing services company, provided a positive highlight, jumping by 7.3%. This surge followed its report of stronger-than-anticipated profits and revenues for the latest quarter. Furthermore, Jabil raised its revenue forecast for the full fiscal year, indicating robust business prospects that resonated favorably with investors.

Across international markets, London’s FTSE 100 showed a marginal gain of less than 0.1%, even as data revealed that inflation in the U.K. had accelerated to 2.6% in November, reaching its highest level in eight months. The Bank of England was also due to announce its own interest rate decision, adding to the global monetary policy watch.

In Japan, the Nikkei 225 index slipped by 0.7%, ahead of the Bank of Japan’s policy meeting. Notably, Nissan Motor Corp. experienced a substantial 23.7% jump after announcing discussions about closer collaboration with Honda Motor Co., though no definitive merger decision had been reached. Despite this, Honda Motor’s stock recorded a 3% loss, illustrating how corporate news can create divergent outcomes for related entities.

The recent shifts in U.S. stock markets, from rallying to record highs on rate cut hopes to subsequently tumbling on hints of fewer cuts, vividly illustrate the delicate balance and profound sensitivity to Federal Reserve policy. The intricate interplay of inflation data, job market performance, geopolitical influences, and corporate earnings continues to shape investor sentiment and drive market movements.

As the Federal Reserve navigates its path forward, investors worldwide will remain intently focused on upcoming economic data releases—particularly those pertaining to employment, manufacturing, and consumer spending—and the central bank’s official statements. Geopolitical developments, especially in trade negotiations and regulatory decisions impacting major technology firms, will also remain critical watchpoints.

The current market environment reflects a complex tapestry of cautious optimism intertwined with lingering uncertainties. While the prospect of monetary policy easing has previously fueled significant market gains, the central bank’s measured approach underscores the ongoing challenges in achieving its economic mandates. The unfolding scenario demands continuous vigilance and adaptable strategies from market participants seeking to navigate this dynamic financial landscape.

The trajectory of the U.S. stock market remains inextricably linked to the nuanced signals from the Federal Reserve and the broader economic data. The past week has served as a powerful reminder that even as records are set, the path ahead is fraught with variables that require sophisticated analysis and a keen understanding of both domestic and global economic currents.