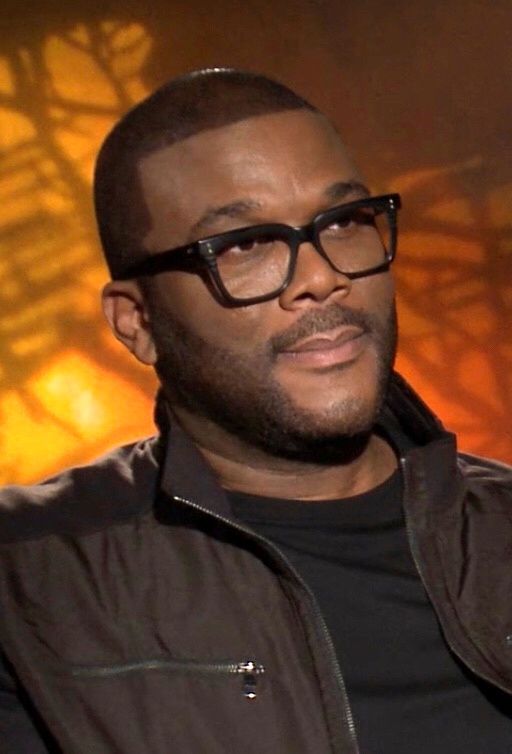

Tyler Perry’s Blueprint for Financial Independence

In the world of wealth management and family relationships, financial support among relatives often stirs debate. Media mogul and billionaire Tyler Perry has shared a direct and thought-provoking perspective, championing self-reliance over dependency. With a net worth of $1.4 billion, according to Forbes, Perry credits his success to business acumen and full ownership of his creative content. His approach to family finances reflects clear boundaries designed to promote dignity and productivity.

During the “Den of Kings” YouTube series with host Kirk Franklin and guests Derrick Hayes and Jay “Jeezy” Jenkins, Perry explained his refusal to serve as “welfare” for loved ones. This belief is rooted not in stinginess, but in a conviction that success earned through effort is more empowering than unearned assistance.

Tough Love in Practice

Perry shared a story about his aunt, who often asked for money. Initially, he agreed to help, saying, “She said she wanted a job. She would always call asking for money. I said, ‘OK,’ I would send her the money.” Seeking a more sustainable solution, Perry offered her a job instead, telling her, “I want to help you build this thing, not be welfare to you. So, let me give you a job.”

However, she repeatedly failed to show up for work. Perry’s response was firm: “OK, well you gotta go. You want me to hand you the money, but you don’t want to work for it. See, that doesn’t work for me.” This decision underscored his expectation of accountability in exchange for support.

A Broader Family Policy

Following the death of his mother in 2009, Perry confronted a long-standing pattern of financial dependence within his family. For years, many relatives had relied on him—often at his mother’s request—for regular financial assistance. Recognizing that this ongoing support was creating a cycle of dependency, he decided to implement a clear and decisive change.

Perry sent out formal letters to the family members in question, giving them a 60-day deadline to secure gainful employment. His message was direct: “I’m not going to keep supporting you like that.” This was not a withdrawal of love or care, but a strategic move intended to push them toward self-sufficiency. By setting a specific timeline and expectation, he removed any ambiguity about the need for personal responsibility.

The results were surprisingly encouraging. “They all got jobs,” Perry recalled, noting that although these roles were not high-paying, they represented an important shift in attitude and lifestyle. Employment provided his relatives with structure, purpose, and the opportunity to take pride in their own accomplishments. “That’s the same thing I would want someone to do for me,” he explained, underlining his belief that real support sometimes means challenging people to rise to their own potential rather than shielding them from it.

Passing on the Lesson to the Next Generation

Perry applies the same philosophy to raising his 10-year-old son, Aman. “There are certain things that he wants. He has to do chores and work for it,” he said, stressing the importance of avoiding dependency. “I don’t believe in just giving us things that are just going to handicap us. That is the worst thing you can do.”

On “The Sherri Shepherd Show” in December 2024, Perry revealed that Aman’s Christmas gifts are usually “books and Legos.” He also recalled that when Aman once complained about flying commercial, he and Aman’s mother, Gelila Bekele, decided he would continue flying coach. “So he understands, I worked, he did not. So when he works, he can learn that lesson. He’s not gonna be one of those ridiculously spoiled rich kids… He ain’t got no money.”

The Broader Context of Family Financial Support

The challenge Perry describes is far from unique; it cuts across income brackets, cultures, and even age groups. Financial reliance on relatives is often born from good intentions, such as helping someone through a difficult time, but it can easily evolve into a long-term dependency that strains both parties. According to SoLo’s 2025 Cash Poor Report, 43 percent of people borrowed money from friends or family in the past year, underscoring how widespread personal lending has become as a form of informal financial safety net.

The trend is particularly visible among younger generations. Bank of America research reveals that 46 percent of Gen Z Americans aged 18 to 27 currently depend on family for financial assistance. Rising living costs, student loan debt, and a competitive job market have all contributed to this reliance. However, these arrangements are not without risk. A survey by CreditCards.com found that 42 percent of such personal loans are never repaid, which can transform an act of generosity into a source of tension. More concerning, one in four lenders said the loan negatively impacted their relationship with the borrower, showing that the emotional cost can be as significant as the financial one.

These statistics illustrate why clear boundaries—like those Perry enforces—are critical. Without them, the act of helping can erode trust, foster resentment, and in some cases, destabilize the very relationships it was meant to support.

Protecting the Vision

From a business perspective, Perry believes boundaries protect long-term goals. He told Derrick Hayes, “If you’re trying to build a business to carry everybody in your family through, that’s one thing. But you’ve got to watch [out] for the family members that come putting holes in the boat when you’re trying to get across the sea.”

He advises, “Sometimes you build a boat by yourself, [and say] ‘y’all all wait over here on the shore. Stay here. I’m building this boat. I’m going to go over and build this and then I’m going to come back and see who’s worthy.’” This metaphor highlights his belief that contribution and effort matter more than expectation.

Practical Advice for Giving

Perry’s philosophy highlights the importance of intentionality when offering financial support, and experts emphasize the need for careful self-assessment before extending help. Wendy De La Rosa of the Wharton School told NPR, “Ask yourself: Am I really in a position to be gifting money right now?” This reflection ensures that the act of giving does not compromise the giver’s own financial stability or create unintended burdens.

When deciding to provide assistance, framing it as a gift rather than a loan can help preserve relationships by reducing the expectation of repayment. Gifts carry a sense of generosity, while loans can introduce pressure, resentment, or feelings of obligation. For situations involving significant amounts of money, documenting the arrangement in writing provides clarity for both parties, outlining responsibilities, timelines, and expectations. This formality can prevent misunderstandings and ensure that both sides are aligned.

Givers should also be aware of potential tax implications associated with large gifts. For instance, in the United States, gifting more than $19,000 per person per year can trigger federal gift tax for the giver, with higher thresholds for married couples and lifetime limits also applying. By understanding these rules in advance, individuals can plan their support thoughtfully and avoid unexpected financial or legal consequences. Adopting these practical measures ensures that generosity empowers rather than burdens both the giver and the recipient.

Building Independence and Pride

Perry’s rise from modest beginnings to building a media empire, including his “Madea” franchise grossing over $660 million, reflects relentless work and vision. His approach to family finances is about more than money; it is about fostering independence, self-respect, and empowerment. His message is clear: generosity is valuable, but the greatest gift is equipping others to build their own lives and navigate their own paths.