The relentless march of inflation has become a defining characteristic of our current economic landscape, impacting every corner of daily life. From the supermarket to the gas station, consumers are feeling the pinch as prices for basic essentials, rent, and utility bills continue to climb. This surge in costs means that even with no changes to your lifestyle, your spending amount will inevitably be higher, putting a noticeable strain on budgets and raising concerns about the eroding value of savings.

While we await inflation to stabilize at the Federal Reserve’s 2% target, individual action can significantly mitigate its impact. This isn’t just about weathering the storm; it’s about proactively implementing smart, actionable strategies to protect your financial health, preserve purchasing power, and even find opportunities for growth. Understanding where to cut back, how to optimize resources, and when to rethink spending habits can transform anxiety into empowerment.

This in-depth guide, presented in the straightforward, practical style of Business Insider, is designed to equip you with 15 savvy ways to fight price inflation on everyday purchases. We’ll delve into concrete steps you can take right now, offering practical advice and insights to help you navigate these challenging economic times and emerge stronger. By focusing on these proven methods, you can gain better control over your finances and ensure your hard-earned money works harder for you.

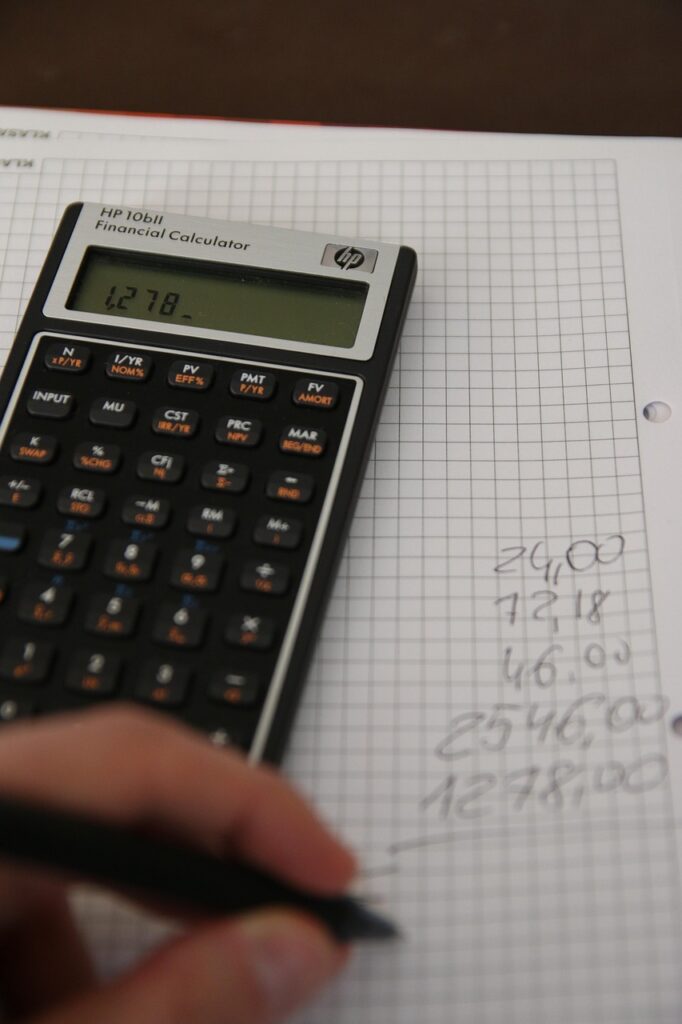

1. **Budgeting for Savings First & Tracking Your Spending**In an inflationary environment, establishing a robust budget and meticulously tracking your spending are essential defenses. Many individuals find that despite a comfortable salary, money for savings evaporates. The solution, as Sam Lewis, founder of SJL Financial, suggests, is to “put that savings first, [then] you can find a way to live within the bounds you set for yourself.” This involves figuring out how much you can comfortably save from each paycheck and allocating it to savings from the outset.

A common and effective budgeting framework is the 50/30/20 rule: 50% of income to needs, 30% to wants, and 20% to savings. While saving 20% might not be immediately realistic for everyone, making regular saving a consistent habit is crucial. Actively seek ways to cut down on other expenses and channel those savings into a high-yield savings account at the beginning of each month, consciously avoiding tapping into it for daily expenditures.

Furthermore, effective budgeting goes hand-in-hand with diligent spending tracking. Reviewing bank and credit card statements illuminates where your money is going and identifies areas ripe for reduction. This critical analysis helps determine how much you can realistically save. Fortunately, various budgeting apps streamline this process, helping you stay on track, analyze income and spending, and ultimately save both time and money. Budgeting is about intentional allocation, not deprivation.

Read more about: Beyond the Dream: Unmasking the 16 Worst Financial Pitfalls of Your Side Hustle Journey

2. **Prioritizing and Paying Down High-Interest Debt**One of the most impactful ways to safeguard your finances against inflation’s bite is to strategically tackle high-interest debt. As inflation rises, central banks often increase interest rates, making borrowing more expensive and amplifying the cost of existing debt. For most consumers, this translates directly to credit cards, where debt can escalate rapidly. As Jay Zigmont, CFP and founder of Childfree Wealth, advises, “If you have any credit card or other personal debt, you will most likely get a better return by paying down the debt than putting the money in savings.”

The primary focus should be on variable rate loans, especially credit card debt. When interest rates climb quickly, minimum payments might barely cover the interest, leaving little for the principal balance. This creates a cycle where debt becomes increasingly expensive. By making payments exceeding the minimum, you accelerate debt repayment, saving significant amounts on interest charges in the long run.

For credit card balances, consider options like a balance transfer credit card. These often offer an introductory period of no interest charges, sometimes for a year or more, providing a crucial window to pay down debt without additional interest. This “avalanche debt repayment method,” as Erika Kullberg highlights, involves making extra payments on the highest interest debt first. Once paid, roll those freed-up funds into the next highest interest payment, snowballing your way to becoming debt-free faster.

Read more about: Beyond the Buzz: 15 Common Financial Mistakes People Make After a Raise (and How to Avoid Them)

3. **Smart Strategies to Drastically Cut Energy Bills**The soaring costs of utilities like electricity and water can significantly erode your potential savings, especially during high inflation. However, with conscious lifestyle adjustments and practical changes around the house, you can substantially cut down on energy consumption, particularly in hotter months when cooling costs typically rise. This not only protects your wallet but also helps reduce overall resource consumption.

The U.S. Department of Energy offers numerous tips for reducing utility bills. A prime example is managing your thermostat: save up to 10% on heating and cooling by adjusting it seven to ten degrees Fahrenheit for eight hours a day. This means turning it down in fall/winter or up in spring/summer when you’re away or asleep. Insulating your water tank, if accessible, can save 7% to 16% annually on water heating costs. These seemingly small changes add up.

Beyond these adjustments, daily habits yield substantial savings. Run your dishwasher only when full and scrape dishes instead of hand washing. In the kitchen, use smaller appliances like microwaves for small meals, as they generate less heat, cutting cooling costs. In the laundry room, switching from hot water to warm water can halve energy use per load. Furthermore, unplugging electronics when not in use or employing advanced power strips prevents “phantom load,” potentially adding 10% to your monthly electric bill. Finally, upgrading to energy-efficient LED lightbulbs can save up to $80 in electricity over a bulb’s lifetime, a clear win.

Read more about: Beyond the Battery: 12 Smart Ways to Slash Your Car’s Emissions (No EV Needed!)

4. **Mastering Strategic Grocery Shopping to Combat Rising Food Costs**With inflation making basic food essentials more expensive, mastering strategic grocery shopping is a necessity. The goal is to maximize your budget and minimize waste. A crucial first step is to comparison shop *before* you leave home. Prices for identical products can vary significantly between retailers, so utilizing supermarket comparison spreadsheets or apps ensures you get the most value for your grocery budget. This habit of comparing prices, as Sam Lewis points out, will show an impact “over time… in your savings.”

Once in the planning phase, meal preparation and minimizing food waste become paramount. Planning out meals and creating grocery lists based on that plan drastically reduces impulse purchases and ensures you buy only what you need, making you less likely to waste money on items that look good but never get eaten. Actively using tips to reduce food waste, from proper storage to understanding expiration dates, prevents your hard-earned cash from ending up in the trash.

Furthermore, savvy shoppers should always “shop your pantry” before heading to the store. Taking inventory of existing canned goods, pasta, frozen items, and even toiletries prevents mistakenly buying duplicates and helps you use up what you already have, shortening your grocery list and reducing overall spending. Embracing “pantry challenges” can be effective. When it comes to product selection, consistently choosing store brands over name brands is a straightforward way to save, as generics are often significantly cheaper with comparable quality. Buying in bulk, while a larger upfront cost, typically offers a lower price per item. Finally, consider dietary adjustments: cutting back on expensive meats and incorporating cheaper alternatives like beans and lentils, or opting for in-season, local, or frozen produce, can significantly impact your grocery bill, helping you fight “shrinkflation.”

Read more about: Unlock Your Pantry’s Potential: 15 Simple Steps to Start Your Food Preservation Hobby

5. **Boosting Your Income: The Power of Side Gigs and Negotiating Raises**While cutting costs is essential, increasing your income provides another powerful lever against inflation. Completely eliminating all non-essential purchases can be challenging, but offsetting these costs by earning more offers a viable solution. As Sam Lewis wisely suggests, “If you are in a cautionary mode about spending and saving, but you still want something that’s unnecessary — you can do that once you earn enough money from a side gig.” The gig economy has made it easier than ever to pick up extra work.

Many avenues exist for generating supplementary income that aligns with your interests. Opportunities range from house-sitting, babysitting, or dog-walking, to online activities such as filling out paid surveys (e.g., Survey Junkie) or reselling clothes on platforms like Depop or Poshmark. For those with a knack for teaching, programs like VIPKid allow you to teach English to children in other countries, often without needing another language. The key is to find “side hustles or gig work that aligns with your interests,” enabling you to both earn more and develop new skills.

Beyond side gigs, evaluating your primary employment for opportunities to increase your base salary is critical. If you’ve been contemplating asking for a raise, now is an opportune moment. A successful negotiation means an immediate boost to your take-home pay, which can then be strategically directed towards paying down debt or bolstering your emergency fund. This also serves as an excellent chance to showcase your achievements and contributions, potentially paving the way for broader career advancement and the realization of long-term financial goals.

6. **Maximizing Your Savings: High-Yield Accounts and Certificates**Protecting the value of your savings from the corrosive effects of inflation requires strategic placement. The “where” you keep your money significantly influences its worth over time. High-yield savings accounts (HYSAs) are a popular and effective option for storing cash because they typically offer significantly higher interest rates than traditional savings accounts. This means your money earns dividends, gradually increasing your balance and serving as a direct countermeasure to inflation’s tendency to devalue currency.

For funds you won’t need immediate access to, Certificates of Deposit (CDs) offer another powerful tool. CDs allow you to deposit money for a fixed term—typically three months to five years—and in return, they often provide even higher interest rates than HYSAs. While this means locking up your money for a specified period, the increased earning potential can be a wise choice for longer-term savings goals. The context explicitly mentions that “keeping your money in savings and share certificate accounts is a wise place to start in protecting yourself from inflation.”

Both HYSAs and CDs represent a crucial step in ensuring your savings gain value rather than losing it. The longer cash sits uninvested in low-interest accounts, the more its purchasing power diminishes due to inflation. By actively choosing accounts that offer competitive interest rates, you give your money the best chance to grow at a rate that beats or at least significantly offsets inflation, helping you maintain financial preparedness and achieve your savings goals.

Read more about: Stop Inflation From Eroding Your Savings: Top High-Yield Accounts to Boost Your Money Now

7. **Cultivating Mindful Spending Habits and Avoiding Impulse Buys**In an era of rising prices, cultivating mindful spending habits is paramount to preserving your budget and protecting your financial well-being. This involves a conscious shift from reactive spending to intentional purchasing. As Erika Kullberg recommends, everyone can benefit from “pausing before buying and really thinking critically about every purchase you make.” This simple act of reflection can often be the barrier between an unnecessary impulse purchase and a preserved chunk of your savings.

A key technique for mindful shopping is to ask yourself a few illuminating questions before opening your wallet: “Do I need this or just want it?”, “Can this purchase wait?”, “Why do I feel an urge to buy it?”, and “What could that money go to instead?” Taking this moment to pause and interrogate your purchasing motivations is often enough to deter an impulsive decision. This practice helps differentiate between true needs and fleeting wants, aligning spending with actual financial priorities.

Further reinforcing mindful spending, consider implementing a “24-hour rule” for any nonessential items. As Robert Glatter, M.D., suggests, “For any nonessential item, I wait a day before buying. Items can remain in my cart as I reconsider if I truly need them.” This cooling-off period provides perspective and reduces buyer’s remorse. Moreover, challenging yourself to spend less, such as undertaking a “spending freeze” for a weekend or a week, can dramatically heighten your awareness of where your money goes and reveal unexpected areas to cut back. By consciously adopting these habits, you transform into an active manager of your finances, making every dollar count.

Navigating the complexities of inflation demands a multifaceted approach, extending beyond the foundational financial strategies we’ve already covered. The next set of tips delves into more advanced tactics and crucial lifestyle adjustments, focusing on often-overlooked avenues for savings that can significantly bolster your financial resilience. From strategically leveraging rewards to making smart choices about where and how you live and move, these insights provide actionable steps to preserve your purchasing power.

This section will also explore the power of community, the benefits of embracing reusable goods, and even how to make your health and wellness journey more budget-friendly. By implementing these advanced strategies, you can not only mitigate the impact of rising costs but also build a more robust and sustainable financial future. It’s about thinking differently, adapting creatively, and making every dollar count in today’s economic environment.

Read more about: Unveiling the Unexpectedly Frugal Habits of Hollywood’s Richest Celebrities

8. **Leveraging Rewards Programs for Every Purchase**Even with meticulous budgeting and conscious spending, certain expenses are unavoidable in a high-inflation environment. Rather than simply accepting these costs, smart consumers can transform everyday spending into savings opportunities by strategically utilizing credit card rewards programs. This approach allows you to earn value back on purchases that you would make anyway, effectively reducing the net cost of goods and services.

The context explicitly states that choosing a credit card that offers rewards can help you “make the most of the extra costs.” However, the critical caveat is to always “pay off your full balance each month” to avoid owing interest that would negate any benefits. This discipline ensures that you’re truly gaining from the rewards, whether they come in the form of cashback, points, or travel perks, rather than falling into a debt trap.

For instance, with certain cards like UNFCU Azure and Elite, you accumulate reward points with every dollar spent. These points aren’t just theoretical; they can be redeemed for tangible benefits such as cash, airfare, or hotel stays. This strategy means that even as prices rise, you’re extracting additional value from each transaction, helping to cushion your budget against inflationary pressures and making your money work harder for you.

Read more about: Fuel Your Savings: The 13 Best Free Apps for Finding the Cheapest Gas Prices Today

9. **Strategic Investing for Inflation Protection**While high-yield savings accounts and CDs offer a degree of protection, truly beating inflation over the long term often requires a more proactive investment strategy. The goal is to ensure your assets grow at a rate that outpaces the erosion of purchasing power. This involves diversifying your portfolio and considering specific assets designed to perform well when prices are on the rise.

Christopher Stroup, CFP and owner of Silicon Beach Financial, recommends investing in Treasury Inflation-Protected Securities (TIPS). These government bonds are specifically “designed to help protect your purchasing power by increasing in value as inflation rises.” This makes them a direct hedge against inflationary impacts, ensuring your principal adjusts to maintain its real value.

Beyond TIPS, diversification across equities is crucial. Historically, “equities have outpaced inflation over time,” according to Stroup. Investing in stocks, particularly those of “companies with strong pricing power,” can help your portfolio grow robustly. Real estate also presents a solid long-term hedge, as “property values and rental income often rise with inflation,” offering another avenue to combat the devaluing effects of currency depreciation.

Read more about: 12 Essential Steps: Maximize Your Luxury Sedan’s Resale Value for a Top Return

10. **Reducing Transportation Costs Strategically**The cost of getting from point A to point B has become a significant budget strain, largely due to fluctuating gas prices. Even if gas prices temporarily dip, finding ways to permanently reduce transportation expenses remains a vital strategy for combating inflation. This isn’t just about saving at the pump; it encompasses a broader look at how you manage your vehicle-related finances.

One of the most straightforward ways to keep more money in your pocket is by joining fuel reward programs offered by retailers like Kroger and Costco. It’s essential to ensure these are free rewards programs, not credit cards, to avoid accumulating debt. Additionally, cash-back apps such as Upside can put “extra cash in your pocket every time you head to the pump,” as the context highlights, turning routine fill-ups into small savings opportunities.

Beyond rewards, smart planning and technology can help. Apps like GasBuddy or Waze allow you to “track the cheapest gas prices in your area,” eliminating the need to drive around looking for deals and saving both fuel and time. Furthermore, simple habits like consolidating errands into a single trip or carpooling can significantly reduce your overall fuel consumption and wear and tear on your vehicle, freeing up funds for other inflationary pressures.

Read more about: Echoes of Industry: Unearthing 12 American Factories That Shaped Blue-Collar Towns, Now Rarely Hiring

11. **Optimizing Housing Expenses for Affordability**The rising cost of housing, whether rent or mortgage, has become one of the most substantial impacts of inflation, with median home listing prices increasing by 42% and typical apartment rents by 22% since 2020. Making housing more affordable requires a proactive approach, especially as these costs eat into a significant portion of household budgets. It demands exploring options that might initially seem challenging but yield substantial long-term savings.

For renters, considering a longer lease, such as 16 or 18 months, can be a game-changer. Landlords may be willing to offer a lower monthly price or lock in your rate, protecting you from future rent increases. As the context suggests, “it never hurts to ask and brush up on those negotiating skills.” This direct negotiation can provide stability and savings in an unpredictable market.

Another significant, albeit perhaps less appealing, strategy is to consider a roommate. While it involves sharing space, “those same people can cut your housing costs in half.” For substantial savings like that, the trade-off of minor inconveniences might be well worth it. Additionally, if certain cities experience higher inflation than others, moving to a more affordable area, even if it’s 15 miles outside of town, could result in cheaper rent and ease financial strain, despite the logistical challenges of moving.

Read more about: Unlock Your Home’s Hidden Wealth: Simple, Tax-Free Strategies to Convert Equity into Income

12. **Embracing Reusable Products for Long-Term Savings**In a world where single-use items are ubiquitous, consciously shifting towards reusable products is not only an environmentally sound decision but also a powerful money-saving strategy against inflation. While the upfront cost of reusable items might be higher than their disposable counterparts, their longevity and repeated utility lead to significant savings over time. It’s an investment that pays dividends in your budget.

The core principle is simple: “Which is better: Buying something for $5 that you use once and throw away, or purchasing something similar for $10 but that you can reuse over and over again?” The answer, as the context points out, is clear. Reusable products “last much longer,” making them “usually a better deal” despite the initial higher price tag. This perspective helps in reframing spending from short-term fixes to long-term value.

Think about items like coffee cups, water bottles, shopping bags, and even cleaning cloths. While a disposable option seems cheaper in the moment, the cumulative cost of constantly replacing them quickly surpasses the cost of a durable, reusable alternative. By making the conscious choice to invest in items that serve you repeatedly, you effectively reduce the frequency of purchases, thus insulating your budget from the relentless march of inflationary price increases on disposables.

Read more about: Unlock Your Pantry’s Potential: 15 Simple Steps to Start Your Food Preservation Hobby

13. **Utilizing Community Sharing and Free Resources**Beyond individual spending habits, a powerful, often overlooked avenue for combating inflation lies within your local community. Engaging with shared resources and leveraging free initiatives can significantly reduce the need for new purchases, fostering both financial savings and stronger community ties. This approach encourages a shift from ownership to access, particularly for items used infrequently.

Consider items like expensive tools or specialized equipment, such as a stand mixer or a leaf blower, which you might only use occasionally. “Splitting the cost of something you’ll use only occasionally is a better deal than paying full price for something that’ll end up collecting dust most of the time.” Sharing these items with neighbors or friends saves everyone money and reduces individual consumption.

Furthermore, “Buy-Nothing Groups” on platforms like Facebook offer a direct way to bypass store prices altogether. These groups are founded on principles of donation rather than trading or bartering, allowing you to acquire needed items for free. This fosters a culture of generosity and sustainability, demonstrating that a significant amount of “stuff” can be obtained without incurring new costs, a particularly impactful strategy when inflation makes every purchase more expensive.

Read more about: Unlock Your Creative Potential: The 12 Essential Free Tools for High-Quality Content Creation in 2025

14. **Smart Strategies Against Shrinkflation**Inflation isn’t always about outright price increases; sometimes, companies employ a more subtle tactic known as “shrinkflation.” This occurs when the size or quantity of a product is reduced while its price remains the same, effectively increasing the cost per unit without an obvious hike in the sticker price. Beating shrinkflation requires vigilance and a willingness to adjust your shopping habits.

The key to combating shrinkflation is simply “paying more attention while shopping.” This means looking beyond the advertised price and actively checking product weights, sizes, and quantities. A smaller package at the same price is a hidden price increase, and savvy shoppers must be aware of these changes to make informed decisions and ensure they are getting the most value for their money.

Being willing to “change up your habits to become a savvy shopper” is also essential. This might involve switching to a different brand if your usual one has shrunk, or opting for store brands that often offer better value per unit. By actively comparing unit prices and remaining flexible in your brand choices, you can effectively resist companies’ attempts to pass on increased production costs through reduced product size, keeping more of your hard-earned cash in your pocket.

Read more about: Don’t Get Fooled: 13 Supermarket ‘Deals’ You Might Want to Skip for Better Quality & Savings

15. **Health-Conscious Savings and Lifestyle Adjustments**Maintaining health and well-being can seem expensive, but experts reveal numerous ways to prioritize your health without sacrificing your financial stability, even during inflationary times. This involves smart choices about fitness, nutrition, and everyday habits that cumulatively contribute to significant savings while enhancing your quality of life.

Fitness doesn’t require an expensive gym membership. Michael Fredericson, M.D., codirector of the Stanford Center on Longevity, advocates for “setting up a home gym with TRX, a Bosu ball, dumbbells, a pullup bar, and a punching bag” and utilizing “fitness apps to help organize my workouts.” This significantly cuts down on monthly fees. For medications, Keith Roach, M.D., an internal-medicine specialist, suggests using “online sites like goodrx.com” where coupon prices can be lower than insurance copays.

Dietary habits also offer substantial saving opportunities. Dan Giordano, P.T., C.S.C.S., recommends “buying more whole-food options and less luxury snacks” and trying “to cook all meals—every day.” This not only saves money but fosters quality family time. Chris Winter, M.D., highlights the savings from making coffee at home; a $750 espresso machine and basic supplies can save “more than $1,900 in coffee savings the first year” compared to daily Starbucks lattes.

Finally, social and leisure activities can be reframed for savings. Avi Klein, L.C.S.W., notes drinking “way less alcohol” and instead opting for walks with friends, which are “100 times healthier” and free. P. Murali Doraiswamy, M.D., even considers vacationing in places like Mexico “where the dollar goes further.” These lifestyle adjustments demonstrate that well-being and financial prudence can go hand-in-hand, proving that inflation doesn’t have to cut into your healthy habits.

The journey to financial resilience in an inflationary economy is a continuous one, demanding a blend of vigilance, ingenuity, and disciplined action. From the foundational strategies of budgeting and debt management to these advanced tactics involving strategic investing, community engagement, and lifestyle optimizations, the power to mitigate inflation’s bite lies firmly in your hands. By consistently applying these 15 savvy tips, you’re not just weathering the storm; you’re building a stronger, more stable financial future, one smart decision at a time. The goal is not merely to survive, but to thrive, ensuring your hard-earned money works as hard as you do.”

Read more about: Retirement Planning Perils: 14 Common (and Costly) Mistakes Every Pre-Retiree Needs to Avoid

,”_words_section2″: “1948