For decades, we have been informed that “money can’t buy you happiness,” a comforting maxim often repeated but perhaps not entirely accurate. While it is certainly not the sole determinant of joy, a recent study conducted by Cambridge University sheds light on a crucial nuance: money can indeed purchase happiness, at least up to a certain point. This breakpoint arises when financial hardships cease to be a significant, everyday concern in people’s lives. Below this threshold, an increase in money clearly correlates with an increase in happiness.

Typically, this amount is frequently cited as around $50,000 a year. However, interestingly, with improved financial management, the necessary income level can actually be lower. The core insight here is not about accumulating immense wealth, but about achieving financial stability where money is no longer a constant source of stress. It is about transforming your relationship with money, ensuring that it serves you rather than becoming a persistent burden.

This comprehensive guide is intended to equip you with the habits necessary to manage your money properly, enabling it to last longer and work more effectively for you. While we cannot magically increase your income, cultivating better saving and spending habits can significantly extend your existing funds. As your daily spending patterns change, so will your overall financial situation. With discipline and deliberate action, you can seamlessly incorporate these powerful money – related habits into your routine, laying the groundwork for a profoundly positive impact on your financial future. To truly commence, understanding your current financial situation is crucial; tools that provide a free credit score and report are an excellent starting point for this baseline assessment.

1. **Minimize Credit Card Debt** Debt is not inherently detrimental; it facilitates significant life – altering purchases such as a home, enabling us to enjoy years of habitation, or a vehicle, which might otherwise be unaffordable if paid for upfront. These can be regarded as beneficial debts, as they facilitate major investments that enhance the quality of life. However, certain categories of debt can rapidly escalate into substantial issues. Surveys disclose that a considerable proportion of American households—38.1%, precisely—are burdened with credit card debt, with the median individual debt standing at approximately $5,700.

Credit card debt is particularly pernicious because it is generally incurred not for large, appreciating assets like real estate or automobiles, but often for non – essential items that could frequently be dispensed with. This type of debt depletes your resources through exorbitant interest rates, making it difficult to accumulate savings or attain financial tranquility. Actively striving to eliminate this debt while simultaneously building up your savings will undoubtedly remove significant stressors and sources of unhappiness from your life.

Therefore, one of the most crucial financial habits you can cultivate is to rigorously reduce credit card debt. By keeping this “optional” debt as low as possible, you substantially decrease your ongoing expenses, create more space for savings, and liberate yourself from the constant anxiety of failing to meet persistent debt obligations. If you currently find yourself with a high credit card balance, consider services such as Payoff, which can consolidate your debts into a single, manageable monthly payment and may even enhance your credit score in the process. Learning to formulate financial SMART goals can offer a structured approach to clearing these debts more rapidly, providing a clear path to financial freedom.

Read more about: Mastering Your Retirement Budget: Real-World Insights from a 65-Year-Old Retiree’s Monthly Spending Plan

2. **Track Expenses** The notion of tracking every individual expense can be overwhelming, perhaps even slightly intrusive, as it necessitates 100% honesty about the actual destination of your money each day. Despite this initial discomfort, it is arguably the most crucial financial habit you can cultivate. It demands unwavering diligence and absolute candor with yourself regarding every dollar expended.

The practice entails a straightforward yet potent routine: each evening, meticulously record every purchase made by you and your family throughout the day. This implies diligently retaining all receipts, carefully scrutinizing credit card statements, and making notes to ensure that you can review each expenditure with clarity. After compiling this daily list, provide a detailed account of each purchase, noting its description and exact cost. For an even more profound understanding, you may also append a brief note explaining the rationale behind the purchase. For example, if you purchased a bottle of water on your way home, you might contemplate whether waiting 10 minutes to drink water at home would have been a more financially judicious choice.

Consistency is of utmost importance with this habit, as small, overlooked purchases can rapidly accumulate and distort your spending profile. Once you have recorded all your daily purchases, utilize a notebook or a spreadsheet program to analyze this data. This analytical step is where the genuine power of expense tracking resides, enabling you to clearly discern patterns and areas where you can substantially enhance your spending habits. For added convenience, a multitude of free apps and printable budget trackers are available, rendering the process of diligently tracking your expenses more accessible than ever before. This clarity represents the first stride towards taking control of your financial destiny.

Read more about: The Software Guru Behind a Viral Retirement Calculator Reveals Her ‘Boring’ Secrets to Financial Independence

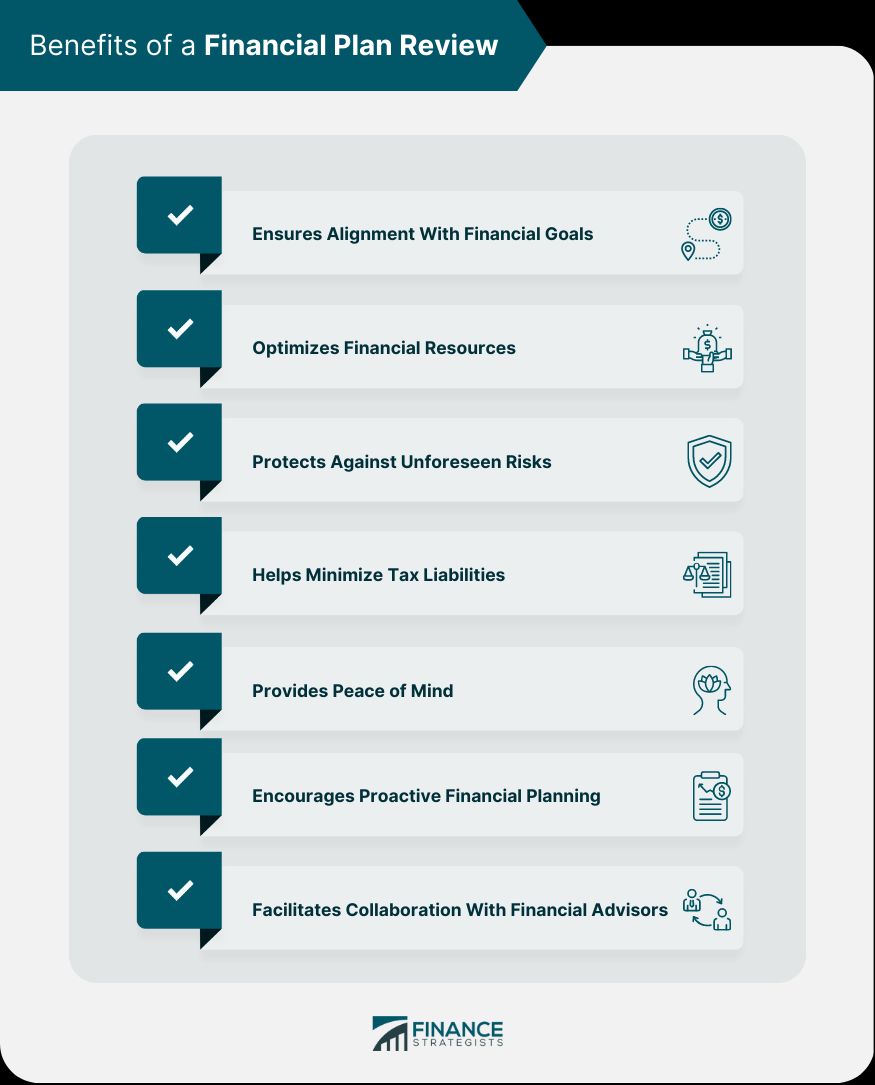

3. **Review Your Finances on a Regular Basis** In the pursuit of establishing solid money habits, the principle that “what gets measured gets managed” functions as a potent reminder. The most efficacious approach to retaining control over your finances and optimizing their flow is to consistently assess your financial status, ideally on a daily basis. To initiate this pivotal habit, commence by selecting a financial tool that aligns with your preferences, such as Mint or Personal Capital, which can offer a comprehensive view of your financial landscape. The subsequent step is to seamlessly integrate all your bank accounts into the chosen platform.

This all-encompassing integration ought to encompass all your credit cards, checking accounts, investment portfolios, and even personal assets like your car or home. Once consolidated, make it a daily routine to log into your account and thoroughly review your finances. This daily check-in serves several crucial purposes: it aids you in ensuring that every recorded purchase is legitimate, thereby protecting you against erroneous charges or fraudulent activities.

Furthermore, this consistent review enables you to examine the overall picture of your spending patterns. By observing the direction of your money flow, you can identify specific areas that are suitable for spending reduction or even complete elimination. Comprehending your spending habits also directly informs the amount of money you genuinely require in an emergency fund. For instance, do you have sufficient savings to comfortably support yourself for six months without income? It is also imperative to take your credit card debt into account in this context, ensuring that you can continue making payments even if your income stream undergoes a temporary interruption. Additionally, this regular supervision encourages you to evaluate the efficacy of your savings: are you earning adequate interest? Perhaps your funds are stagnating in a low-interest savings account and could be transferred to an alternative that generates better returns, significantly enhancing your financial situation over time.

Read more about: Unlock Your Financial Potential: A Comprehensive Guide to Budgeting Methods That Actually Work

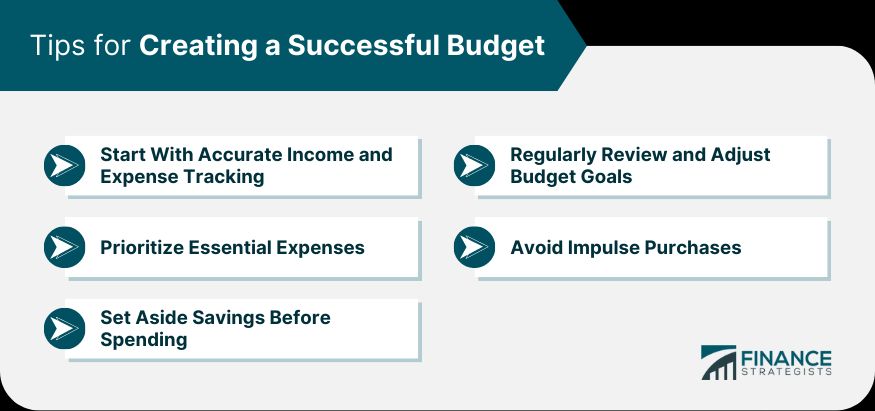

4. **Make and Review your Budget** Creating a budget constitutes an indispensable step towards achieving financial control. However, its true efficacy does not merely reside in its formulation, but rather in the unwavering discipline required to adhere to it firmly. This habit elevates financial management to a level beyond mere expense tracking, necessitating that you engage in critical thinking regarding every dollar expended and actively seek opportunities to economize on your outgoing cash. It transforms passive observation into proactive decision – making.

Initiate the process by integrating a daily budget check – up into your routine. This swift review functions as a constant reminder of the amount of money you have allocated for spending in each category, thereby assisting in keeping your impulses in check throughout the day. Subsequently, allocate a more substantial block of time—approximately 30 minutes each week—for a more extensive and comprehensive budget review. This weekly session should entail stepping back to gain a broader perspective on your spending, evaluating whether you have been adhering to your financial plan, and making adjustments as necessary.

Tools such as Excel and Mint are of inestimable value for organizing this financial information, offering a clear reference point for tracking your spending patterns. For those in search of a more specialized budgeting solution centered on allocation, “You Need a Budget” provides a dedicated framework. When you are in the process of reviewing or refining your budget, several tips can enhance its effectiveness: always maintain a realistic view of your income, making conservative estimates. Learn to make a sharp distinction between your “needs” and your “wants,” prioritizing essential expenses. Anticipate that your expenses may be slightly higher than initially projected and incorporate a buffer. Crucially, preserve flexibility by including a “miscellaneous” category to accommodate unexpected costs. Whenever feasible, use cash, as it engenders a more tangible sense of spending. If you deviate from your plan, the crucial aspect is to return to the right track as promptly as possible. Finally, regularly search for subscriptions that you no longer utilize; services like Truebill can automate the process of identifying and canceling unwanted subscriptions, thereby contributing to reducing your overall bills and even obtaining refunds on fees and outages.

Read more about: Unlocking Automotive Immortality: The 15 Most Durable Cars Proven to Conquer a Quarter-Million Miles and Beyond

5. **Review Your Billing Statements** It is remarkably easy to overlook the subtle fluctuations in your monthly bills, such as your internet or cell – phone statement, which may vary by a few dollars from time to time. Often, these slight increases result from numerous small charges and obscure fees that are surreptitiously added onto your monthly statements. These seemingly insignificant additions, when accumulated over time, can quietly inflate your expenses without your even realizing it.

Taking the proactive measure each month to scrutinize your bills line by line meticulously can reveal significant opportunities for reduction. This detailed examination enables you to identify and potentially eliminate many of these extraneous charges. For instance, are you still being billed for that premium sports package on your cable bill, even though it is currently the off – season or you no longer watch it? It is crucial to ensure that you are truly utilizing every service for which you are being charged.

As you review, highlight any charges whose purpose is not immediately apparent or for which you cannot ascertain a valid reason. If you find that you are paying a few extra dollars each month for a line item that simply does not make sense, do not hesitate to contact the company and dispute the charge. Furthermore, if you believe any of your bills are excessively high, reach out to the company and attempt to negotiate. You may not be receiving the most competitive offer they provide, or you could be unwittingly paying for services you no longer require or actively use. The ultimate objective is to reduce your bills to the absolute minimum, ensuring that you are only paying for what you genuinely utilize. Few financial habits are as effective as simply keeping a vigilant watch on all your expenses.

Read more about: A Disquieting Turn: Unpacking the Authoritarian Trajectory of the Trump Administrations

6. **Negotiate Your Bills** Actively negotiating your bills constitutes a potent strategy for substantially reducing your monthly expenditures and, consequently, your debt. This enables you to release valuable capital, which can then be strategically invested in long-term opportunities, thereby expediting your path to financial growth. The good news is that most companies are eager to retain their existing customers, often more so than acquiring new ones, primarily because the cost of customer acquisition can be rather high.

This willingness to compromise indicates that they are frequently inclined to collaborate with you to lower your monthly bill to a more reasonable and manageable amount. By dedicating time and energy to proactively contact each of your service providers—whether it be for cable, internet, phone, or even insurance—and firmly yet politely requesting their best possible deal or even a direct price reduction, you can achieve substantial monthly savings. It is crucial to acknowledge that different companies and industries may necessitate tailored approaches to negotiation, so conducting a bit of research into their typical policies can be advantageous.

A notable area where individuals often attain considerable success in negotiation is with medical bills. Medical debt, surprisingly, accounts for over one – third of all unpaid debts in the U.S., underscoring its pervasive nature. There are even professionals whose specific job is to scrutinize medical bills for errors and negotiate down balances on behalf of patients. Regardless of the type of bill, always ensure that you carry out thorough research and maintain clear and meticulous records. This factual support will significantly bolster your argument when you are attempting to negotiate. While the process of contacting every company with which you do business may seem time – consuming, the compounded financial results are almost invariably well worth the effort. For those with limited time, innovative services such as the Trim app can intervene to negotiate on your behalf, helping to lower cable, internet, phone, and medical bills, and even assisting in the cancellation of unwanted subscriptions, making this powerful habit more accessible.

Read more about: Navigating the Automotive Landscape: Your Essential Guide to the Best and Worst Cars for Your Money

7. **Use Coupons for Necessities** Embracing better money habits does not solely entail implementing drastic cuts or entirely avoiding spending. In fact, for certain products, spending is simply unavoidable, irrespective of cost. Items such as toilet paper and toothpaste, for instance, are non – negotiable necessities that will invariably end up in your grocery cart every few weeks. This is precisely where the strategic utilization of coupons becomes incredibly advantageous, enabling you to save money on purchases you must make in any case.

The crux lies in actively seeking out coupons for these essential household items. You can frequently find them in your daily newspaper or by visiting various online couponing websites. Once you identify a valuable coupon, make it a habit to clip or print it and keep it easily accessible in your wallet. This ensures that you have it at your disposal exactly when you need to make that necessary purchase, transforming a routine expense into a minor triumph for your budget.

Consistently practicing a money habit like couponing will generate impressive returns over time, demonstrating that the more effort you invest, the greater your potential for savings. To truly optimize your couponing endeavors, consider the following valuable tips: Allocate time to researching and learning about couponing hacks online; several websites specialize in disclosing strategies for doubling up coupons or even obtaining free items, thereby substantially enhancing your savings. Subscribing to multiple different local weekend papers can also keep you abreast of the best deals in your immediate vicinity. Crucially, resist the urge to engage in impulse buying; just because you possess a coupon for an item does not imply that you should purchase it, especially if it is something you would not normally buy. Purchasing items that you do not truly need, regardless of the discount, still constitutes a waste of money. Furthermore, to genuinely save, you will often need to relinquish brand loyalty. While you might have a preference for a specific brand of paper towels, if another brand offers a consistent coupon, flexibility in your choice can result in significant savings. Finally, explore cash – back apps like Rakuten, which provide a percentage rebate on everyday purchases, but always ensure that these tools are not prompting you to buy things outside of your normal routine. Remember, the objective is saving, not spending to earn a few dollars in return.

Read more about: Maximize Your Savings Effortlessly: The Insider’s Guide to Stop & Shop’s Digital Coupon Revolution

8. **Conserve Your Utilities** It may be straightforward to exit a room and neglect to turn off the light. However, making the effort to switch off your lights and appliances when they are not in use in your home, office, or apartment can contribute to saving you a substantial sum of money on your monthly utility bill. Developing the habit of turning off your electronic devices is simple and beneficial to the environment.

There are several additional measures you can take each day to capitalize on this and maximize the effectiveness of your efforts. Ensure that you turn off all the lights whenever you depart from a room. Switch off your electronic devices when you are not utilizing them; although many electronic devices will automatically enter a “standby” mode if not used for a specific period of time, this still consumes some electricity. If the weather outside is pleasant, open your windows and employ fans throughout the house to circulate the air and cool down during the summertime. This will assist you in saving money by only utilizing the air – conditioning on extremely hot days.

Open your blinds and shades during the winter to allow sunlight in and warm up your home, thereby preventing you from spending extra money on heating. When you cook, match the size of your pot to that of your burner; using a small pot on a large burner expends additional energy. Additionally, utilize the smallest pot or appliance that meets your needs; for heating a single chicken breast, use a small convection oven or pan instead of preheating your entire oven. Wash your clothes in cold water to achieve the same results as with warm water, saving approximately 40 cents per laundry load. If you are going out of town, turn off the water heater—it only takes an hour to reheat the water, which will save a significant amount of energy while you are away. Finally, do not leave your electronic devices on the charger once they are fully charged, as this wastes energy and may damage your batteries.

Read more about: Mastering Your Retirement Budget: Real-World Insights from a 65-Year-Old Retiree’s Monthly Spending Plan

9. **Pack a Meal, Snack, and Coffee** Purchasing a snack may appear to be inexpensive, yet expending money on these minor items on a daily basis truly accumulates. Prepare your meals at home and pack a snack and coffee each morning instead of spending funds to acquire these items while on the move. This will also assist you in making healthier dietary selections, as you will not be constrained by oversized portions at a restaurant or deli. Author David Bach refers to this as “the latte factor,” which implies that a straightforward approach to saving money is to eliminate those small, recurring purchases that sum up to a considerable amount of cash.

To concretely implement this habit, invest in a high-quality coffee mug that is easy to grasp before leaving the house and will not spill; a one-time purchase of a quality mug will rapidly recoup its cost if you cease spending money on coffee at coffee shops every day. For snacks, purchase food items in bulk at the grocery store and portion them out every Sunday so that they will last you throughout the week. Additionally, consider planning your dinners for the week so that you can rely on having leftovers to take to work for lunch.

To ensure that you do not forget your snack or lunch at home in the morning, a clever trick is to place your keys in the refrigerator on top of the items you intend to bring with you, so that you will have to notice them before leaving the house. If you also wish to incorporate some “health” into your snack and food packs, you may consider using simple portion control containers for your “on the go” eating. This simple discipline of planning and preparing meals at home, coupled with packing your own snacks and coffee, fundamentally alters your daily spending patterns, directly resulting in significant financial savings.

Read more about: Fuel Your Day: 12 Deliciously Healthy Sandwiches and Wraps for Work and School

10. **Buy for Value** Recall that you will never cherish an item as much as when you first lay eyes on it in the store. This implies that if you try something on and deem it merely acceptable, you are unlikely to return home and end up liking it any more than you did initially. Opting for quality over quantity when making purchases is the optimal approach to shield yourself from experiencing buyer’s remorse. If you solely purchase high – quality items, each time you reflect on the things you have bought, you will not regret having spent money on something you do not adore.

To advance this concept further, you can regard all your purchases as investments. If you are aware that you will use an item frequently or that you will retain it for an extended period, then it is reasonable to invest some funds in it and select the best, most durable option. This can encompass clothes, electronics, food, furniture, and appliances, and you can also apply this rationale to items that you would typically consider as investments, such as your home and car. Conversely, if you need to acquire something that you know you will use only once, such as a plain white T – shirt for a volunteering event, go ahead and purchase something inexpensive that you can discard after use.

This habit may take some time to master, but you should endeavor to think meticulously about the long – term repercussions of each item you purchase. If you consistently opt for the cheapest option while shopping, it is likely to break or be defective, which will necessitate a second purchase of the same item. You do not wish to waste money on a cheap item only to spend more to replace it; the superior option is to buy durable items that will endure, so you do not need to repurchase the item after only a few months. If you are uncertain about how to determine which items will offer you the best value for your money, purchase access to the Consumer Reports website, which is recognized as the best resource for testing products and providing them with reviews and rankings based on a wide range of factors. In this way, you will also avoid wasting money on the most expensive item, mistakenly believing that the price is correlated with the quality, as often, the best value can be found somewhere in the middle.

Read more about: Unlocking Automotive Immortality: The 15 Most Durable Cars Proven to Conquer a Quarter-Million Miles and Beyond

11. **Comparison Shop for a Major Purchase** Before making a significant purchase, conducting in – depth research by comparing prices across different websites is an indispensable step. The more costly the purchase is, the more crucial it is to allocate time to investigate your options, as such diligence will not only enable you to save money but also assist you in making a well – informed decision regarding the acquisition of the item.

To commence comparison shopping effectively, select the item you intend to purchase and examine its listings on at least three distinct retail websites. It is of utmost importance to remember to take the time to consult Consumer Reports to ascertain what other purchasers have to say about the item. Search for the various features, details, availability, and prices of the item from these sources to objectively ascertain which website provides the most favorable deal. This approach is not merely applicable to physical purchases; you should also invest some time in comparison shopping for items such as vacations, insurance rates, and credit card points programs.

Be cautious, for as your financial situation improves and you have more disposable cash, it is common to experience what is termed ‘lifestyle creep’—where, owing to an enhanced financial situation, you start to spend more money on non – essential items and make more purchases than when you had less money and were more frugal. Keep in mind: having extra money does not imply buying more; rather, it offers you the opportunity to save more. Always remember to review the item’s negative ratings to understand what people did not like about it. If you discern a pattern in negative ratings, ensure that you take their opinions into serious consideration before making the purchase, as this will aid you in obtaining an accurate perception of what it will be like to own this product. For those who aspire to be truly thorough, creating a spreadsheet to list and compare the key features of the items you deem most significant can be extremely advantageous, and tools like the Honey browser extension can automatically identify savings online. Ultimately, dedicating time to conduct research can result in substantial savings in the long run.

Read more about: I’m a Mechanic: Some Cars Experts Would Never Buy (and Why You Should Avoid Them Too)

12. **Avoid Emotional Spending** Many contemporary sales techniques center on inducing individuals to purchase items they neither need nor desire but perceive as indispensable at the present moment. This explains why chocolates and candies are frequently positioned adjacent to the checkout counter in grocery stores; these sales strategies appeal to your emotions, prompting you to think, “I require chocolate,” even though chocolate might have been the last thing on your mind until you encountered it in the checkout line. Emotional spending also stems from numerous sales pitches and often constitutes a substantial addition to the final costs.

Take the iPhone as an illustration. Most tech – literate individuals will inform you that while the iPhone is of a decent standard, there are nearly always superior tech – related options available that also come at a lower cost than the current model. All the advertisements and your friends’ purchasing of the iPhone may persuade you that acquiring one is the optimal choice. However, if you had taken the time to deliberate thoroughly, you might have determined that you did not need a new mobile device at all or, at the very least, could have spent less money on a brand that offers comparable functionality.

This habit necessitates a sharp sense of self – awareness to discern when emotions, rather than actual needs or rational deliberation, are dictating a purchase decision. By identifying these triggers—whether they be ingenious marketing tactics, peer influence, or transient desires—individuals can make more rational and budget – conscious choices. This proactive approach to spending averts unnecessary financial depletion, redirecting funds toward genuine necessities or savings objectives, ultimately enhancing your financial stability and well – being.

Read more about: The Software Guru Behind a Viral Retirement Calculator Reveals Her ‘Boring’ Secrets to Financial Independence

13. **Plan Your Meals** Without prior planning, individuals frequently resort to fast food or make impulse purchases, which constitute poor financial decisions that also adversely affect their physical health. If one does not take the time to consider how to nourish their body throughout the day, they are likely to wait until the last moment and make a swift stop for a burger and fries. When one feels hungry, it is effortless to purchase whatever is readily available; more often than not, it is unhealthy.

One can break this cycle by allocating time every Sunday to plan meals for the remainder of the week. Each Sunday, review the weekly schedule and determine the number of meals to be consumed at home and the number to be eaten out. Subsequently, strategically identify opportunities to overlap meals, such as having leftovers from the previous night’s dinner for lunch or purchasing a single ingredient for use in two different dishes. Research the required ingredients and shop for the most cost-effective options to prepare healthy and affordable meals at home.

Numerous resources are available to assist in mastering meal planning, with one of the finest being a website named Emeals. This platform provides valuable ideas for special dietary requirements, comprehensive meal plans, convenient grocery shopping lists, and a user-friendly interface for ordering groceries directly from local supermarkets. This habit ensures disciplined eating, leads to significant savings by avoiding last-minute, costly, and often unhealthy food choices, and has a profound impact on both financial health and physical well-being. It is a simple, actionable step that yields substantial benefits.

Read more about: Gavin Newsom: Unpacking a Decades-Long Political Ascent Defined by Principled Confrontation and Unyielding Conviction

This comprehensive approach, which extends from meticulous tracking and strategic negotiation to mindful consumption and long-term planning, constitutes the cornerstone of financial resilience. By consistently incorporating these practical money – management habits into your daily routine, you can transform money from a source of stress into a potent tool that serves your well – being. It is not about deprivation; rather, it is about intentionality—making every dollar work more effectively and intelligently for you, thereby paving the way for sustained financial freedom and a life in which happiness is not merely a transient emotion but a consistent reality.