The prospect of retirement, for many, conjures images of leisure, travel, and the freedom from daily professional obligations. Yet, beneath this appealing vision often lies a significant financial reality that can catch even the most diligent planners off guard: the escalating cost of healthcare. This concern has become increasingly prominent as a cornerstone of retirement planning, with recent data painting a clear, albeit challenging, picture of the financial commitment required.

Indeed, the latest figures underscore the magnitude of this challenge. Fidelity Investments’ 24th annual Retiree Health Care Cost Estimate, released in July 2025, reveals a startling projection: a 65-year-old retiring in 2025 can anticipate spending an average of $172,500 in health care and medical expenses throughout retirement. This figure represents a more than 4% increase over 2024 and continues a general upward trend from Fidelity’s inaugural estimate of $80,000 in 2002. It serves as a stark reminder that while the dream of retirement is universal, the financial preparedness for its realities is often less so, particularly when it comes to medical outlays.

Understanding and proactively addressing these substantial costs is not merely prudent; it is essential for safeguarding financial well-being in later years. This in-depth article will navigate the intricate landscape of retirement finances, commencing with an exploration of why many Americans consistently underestimate their future healthcare needs, moving through the foundational elements of retirement income and spending, and then meticulously detailing the various facets of healthcare expenses that retirees face, from pre-Medicare costs to the relentless pressures of medical inflation. Our aim is to provide clarity, insight, and practical information to empower pre-retirees and current retirees alike in securing a more predictable and financially robust future.

1. **The Alarming Underestimation of Retirement Healthcare Costs**One of the most persistent and concerning trends in retirement planning is the widespread underestimation of future healthcare expenses. This gap between expectation and reality can derail even well-intentioned financial strategies, leaving retirees vulnerable to unforeseen outlays. The $172,500 average projected by Fidelity for a 65-year-old retiring in 2025, while substantial, often falls outside the scope of many individuals’ foresight.

This is not a new phenomenon; Fidelity’s estimate has climbed significantly from its initial $80,000 projection in 2002, demonstrating a consistent upward trajectory. A Jackson study further highlights this disconnect, finding that nearly two-thirds of pre-retiree investors significantly underestimate their expected health care retirement costs, responding that they anticipate expenses substantially below the retirement average of $8,600 a year per person. This underscores a critical need for greater awareness and education, as 1-in-5 Americans, according to recent Fidelity research, say they have never considered health care needs during retirement—a figure that rises to one-in-four among Gen X.

The implications of this underestimation are profound. When the average American couple estimates the total cost of healthcare in retirement to be a mere $41,000, while the actuality for an average 65-year-old couple retiring in 2022 was closer to $315,000, the magnitude of the planning shortfall becomes clear. Such a significant discrepancy necessitates a re-evaluation of retirement savings strategies, emphasizing the crucial importance of accurate forecasting and dedicated allocation for medical expenses to ensure financial stability throughout one’s golden years.

2. **Beyond the 80% Rule: Defining Your Personal “Good” Retirement Income**The ubiquitous “80% of pre-retirement income” rule of thumb has long served as a baseline for retirement planning. While offering a convenient starting point for workers, financial experts are quick to point out its limitations. As Ashley Weeks, vice president of wealth strategies for TD Wealth, aptly puts it, “That’s a pretty broad stroke,” acknowledging that a single percentage may not capture the nuances of individual financial needs.

Indeed, the concept of a “good” retirement income is highly individualized. Joe Conroy, a financial advisor, highlights this variability, stating, “You can have a great retirement on $5,000 a month, and you can have a great retirement on $50,000 a month.” This sentiment is echoed by Christopher Abts, a financial advisor, who notes that most retirees already possess a keen understanding of their needs because their retirement budget often mirrors their working-life spending habits, as “No one wants to retire to a lower lifestyle.”

Beyond personal lifestyle, factors such as geographic location significantly influence what constitutes sufficient income. Nick Hughes, a certified financial planner, remarks, “It’s going to vary based on where you are in the country,” emphasizing regional cost of living differences. Moreover, spending patterns evolve throughout retirement: newly retired individuals may spend more on travel and hobbies, mid-retirement often sees reduced spending as a slower pace sets in, and costs may rise again towards the end of retirement due to increased healthcare and potential long-term care needs. These dynamic elements underscore why a personalized approach, often with professional guidance, is paramount to defining and securing an adequate retirement income.

3. **Deconstructing Retiree Spending Habits: A Look at the Averages**While personal financial situations vary widely, examining national averages provides a valuable benchmark for retirement planning. The Bureau of Labor Statistics, through its consumer expenditure surveys, offers insights into how older Americans allocate their funds. In 2023, the most recent year for which data is available, U.S. households led by someone 65 or older reported an average annual expenditure of $64,326.

However, this average can be somewhat misleading, as it includes both high and low spenders. A closer look reveals that the majority of retiree households spend significantly less. The 2022 Spending in Retirement Survey by the Employee Benefit Research Institute, which polled nearly 2,000 American retirees between the ages of 62 and 75, found that a vast majority—68%—spend less than $4,000 per month, translating to under $48,000 per year. The breakdown indicates that 15% spend less than $1,000 monthly, 33% spend between $1,000 and $1,999, and 20% spend between $2,000 and $2,999, demonstrating a broad distribution of expenditure levels.

Housing consistently emerges as the largest expense category for retirees. In 2023, housing costs—encompassing mortgage payments, rent, property taxes, insurance, maintenance, and repair—averaged $21,445 annually, or approximately $1,787 per month. This figure alone accounts for over 36% of retirees’ total annual expenditures. While some work-related expenses like commuting and lunches may diminish, core costs such as housing and utilities often remain, with new expenses for travel, hobbies, and entertainment frequently added, making a comprehensive budget essential for navigating retirement’s financial landscape.

4. **The Pillars of Retirement Income: Social Security, Investments, and More**Once a retiree has a clear understanding of their projected expenses, the next crucial step is identifying the reliable sources from which that income will originate. Financial advisor Joe Conroy articulates this task plainly: “Our job is to figure out how to get $5,000 in the bank at the start of each month.” According to Ashley Weeks, retirees commonly draw from five primary financial categories to meet their needs.

These foundational “buckets” include Social Security, a well-managed investment portfolio, annuities, income from part-time employment, and, for a diminishing number, traditional pensions. Beyond these, individuals may also generate income through rental properties or by tapping into their home equity via a reverse mortgage. Among these, Social Security stands out as a critical component, representing almost a third of the income received by people older than age 65, with nearly 90% of individuals in this age group receiving benefits, according to the Social Security Administration.

While pervasive, the average monthly Social Security benefit for retired workers in December 2024 was $1,975, equating to an annual income of $23,700. This amount, for most households, is insufficient to sustain a comfortable retirement on its own, highlighting the necessity of diversified income streams. Furthermore, relying indefinitely on part-time work for supplemental income may not be a sustainable long-term strategy. As Weeks cautions, “Most folks just assume ‘I can use part-time work as a stop-gap,’” but realistically, “At some point, we all won’t physically be able to go to work.” This emphasizes the paramount importance of saving for retirement during working years through accounts like 401(k)s and IRAs, which can provide essential supplementary income even after full cessation of employment.

Read more about: Your Essential Roadmap to Financial Control: 14 Practical Budgeting Strategies for Savvy Spenders

5. **The Critical Bridge: Healthcare Costs Before Medicare Eligibility (Ages 62-65)**For those contemplating retirement before the age of 65, a significant financial consideration emerges: bridging the gap for healthcare coverage until Medicare eligibility kicks in. Retiring early means foregoing employer-sponsored health insurance, which can lead to substantial out-of-pocket costs if not properly planned for. This interim period demands careful strategizing to ensure continuous and affordable medical coverage.

One common option is Consolidated Omnibus Budget Reconciliation Act (COBRA) coverage, which allows individuals to continue their previous employer’s health insurance for up to 18 months. However, COBRA can be quite expensive, as the individual typically bears the full cost, including the employer’s previous contribution. A more widely accessible alternative is to purchase a plan on the health insurance marketplace, HealthCare.gov, often referred to as Obamacare or the Affordable Care Act (ACA). The marketplace guarantees coverage, even with preexisting conditions, and offers potential government subsidies for premiums depending on income, location, and the selected plan type.

Without subsidies, premiums for an individual insurance policy on the ACA Marketplace for someone aged 62 to 65 typically run between $800 and $1,200 a month. A third option, if applicable, is to obtain insurance coverage through a spouse’s plan if they are still actively employed. Quantifying these specific “finite” expenses during this pre-Medicare phase is crucial. By determining the additional monthly cost compared to anticipated Medicare premiums—for instance, an extra $600 per month—retirees can structure their investments to provide this short-term income. This proactive approach helps to demystify the “health insurance boogeyman” and prevents unnecessary delays in retirement due to fear of the unknown, transforming a perceived hurdle into a manageable financial calculation.

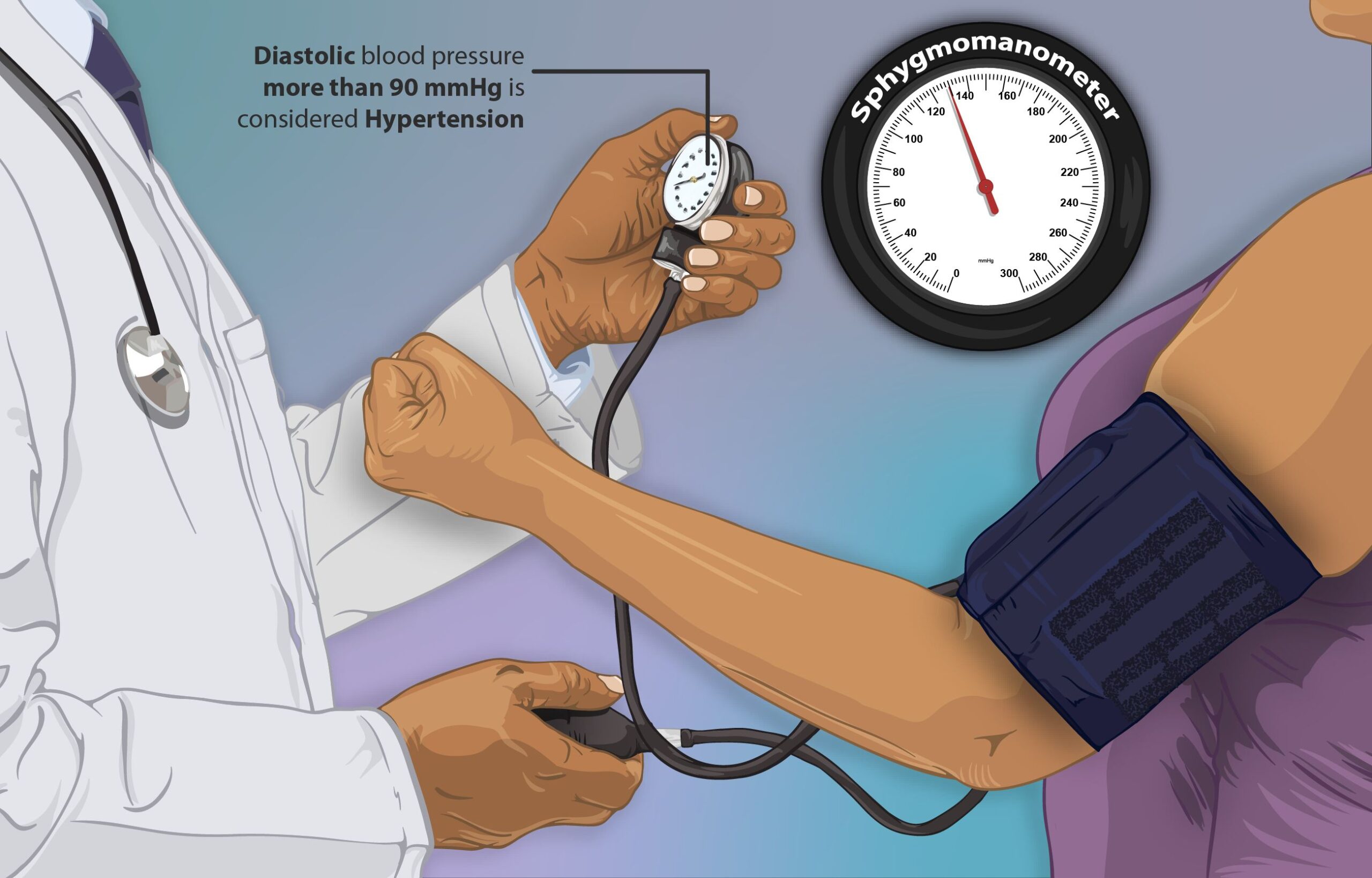

6. **Categorizing Retirement Health Expenses: Premiums, Deductibles, and More**To effectively plan for healthcare in retirement, it is essential to disaggregate the various components that contribute to the overall cost. These expenses can be broadly divided into five common categories, each representing a distinct financial obligation. Understanding these distinctions is fundamental to creating a realistic retirement budget and avoiding unforeseen financial strains.

Firstly, **Premiums** represent the monthly cost paid for the selected health insurance coverage. This could include payments for private insurance before Medicare, or for Medicare Parts B and D, as well as Medicare Advantage or Medicare Supplement plans. These recurring fees are a baseline expenditure that must be factored into every retirement month. Secondly, **Deductibles** are the amounts paid upfront for certain services before the insurance coverage begins to kick in. This means that a retiree will need to pay the full cost of specific medical services or prescriptions out of pocket until they reach their plan’s annual deductible threshold.

Thirdly, **Cost-sharing or Copays** refer to the portion of costs paid for doctor’s visits, medical procedures, lab tests, and prescriptions, even after the deductible has been met. This is a shared expense between the insurer and the insured for ongoing medical services. Fourthly, **Out-of-pocket costs** encompass expenses for doctor’s visits, medical procedures, lab tests, and prescriptions that are not covered by insurance at all, or those incurred before meeting a deductible or after reaching coverage limits. Finally, and significantly, **Long-term care expenses** cover costs associated with assisted living, nursing home care, and home health aides. Critically, these substantial costs are generally not covered by Medicare, representing a separate and often considerable financial planning challenge that demands dedicated consideration beyond standard medical insurance budgets.

Read more about: Mastering Your Retirement Budget: Real-World Insights from a 65-Year-Old Retiree’s Monthly Spending Plan

7. **The Inflation Challenge: Why Healthcare Costs Continue to Rise Faster**One of the most insidious challenges to retirement healthcare planning is the persistent reality that medical costs tend to rise at a rate significantly higher than general inflation. This accelerated increase means that over a 25- to 30-year retirement, healthcare spending is likely to grow more rapidly than many other expense categories, potentially eroding savings and budget projections if not properly accounted for. This dynamic makes long-term forecasting particularly complex and crucial.

Furthermore, the timing of retirement itself plays a significant role in determining healthcare expenditures. A study from Milliman indicates that the earlier an individual retires before Medicare eligibility at age 65, the more their healthcare costs will increase. Conversely, deferring retirement beyond age 65 can lead to a decrease in overall costs, as employer-sponsored benefits may continue to cover a significant portion of expenses. This suggests a strategic benefit to aligning retirement timing with healthcare coverage transitions.

Longevity also compounds the inflation effect. Living even five years longer than one’s targeted life expectancy can increase healthcare spending by a remarkable 42%, underscoring the financial implications of extended lifespans. To proactively address this, a potential rule of thumb for budgeting is to use an annual medical cost baseline—such as the $8,600 average (excluding long-term care) in 2025—and then incrementally add 5% each year to account for both general and healthcare-specific inflation. While individual costs will inevitably vary, particularly for those with chronic or life-threatening conditions, building in this inflationary buffer helps retirees remain in the reasonable vicinity of their actual expenses, ensuring a more resilient financial plan against the rising tide of medical costs.

8. **The Complexities of Medicare Coverage Options**For Americans nearing or entering retirement, navigating Medicare is a pivotal, yet often perplexing, financial decision. Eligibility for Medicare begins at age 65, marking a significant transition from employer-sponsored or marketplace health plans. However, the system itself presents a labyrinth of choices, with individuals needing to decide between Original Medicare, supplemented by Medicare Part D for prescriptions and potentially a Medicare Supplement (Medigap) plan, or opting for a consolidated Medicare Advantage plan. Each pathway carries distinct implications for premiums, out-of-pocket costs, and covered services, even as Fidelity’s estimate assumes enrollment in Original Medicare, highlighting that substantial out-of-pocket expenses remain.

Medicare premiums themselves are not static. While the monthly premium for Medicare Part B was $170.10 in 2022, these costs can escalate considerably for individuals with higher incomes, potentially reaching up to $560.50 per month based on their modified adjusted gross income (MAGI). A noteworthy, albeit often overlooked, aspect of these income-related premiums is their two-year lag. A substantial increase in income in a given year, perhaps from realizing a large capital gain or converting traditional IRA funds to a Roth account, will not impact Medicare premiums until two years later. This delayed effect requires astute tax planning to anticipate and mitigate future premium increases.

The challenge of selecting appropriate Medicare coverage is widely acknowledged, with data showing 55% of Americans anticipate difficulty enrolling and half expecting confusion when choosing a plan. This complexity highlights the need for informed guidance to ensure retirees select coverage that best aligns with their health needs and financial objectives. Resources like Fidelity Medicare Services offer crucial impartial education and support from licensed insurance agents, helping individuals make these intricate decisions with greater clarity and confidence, ultimately contributing to a more predictable retirement healthcare future.

Read more about: Navigating Retirement at 61: Is Your $1.65 Million Nest Egg Enough for Financial Freedom?

9. **Strategic Benefits of Health Savings Accounts (HSAs)**In the quest to manage escalating retirement healthcare costs, Health Savings Accounts (HSAs) have emerged as a powerfully advantageous financial tool, often described as a critical component of the retirement readiness equation. HSAs offer a unique “triple-tax advantage”: contributions are made pre-tax, withdrawals for qualified medical expenses are tax-free, and investment growth within the account is also tax-free. This potent combination of benefits allows savings to compound significantly over time, making HSAs particularly attractive for long-term healthcare savings. Fidelity research consistently demonstrates that individuals utilizing HSAs report feeling more prepared to cover healthcare expenses during retirement.

Despite these evident advantages, a notable knowledge gap persists regarding the full potential of HSAs. While adoption rates are increasing—Fidelity HSAs, for instance, saw 43% growth in total assets and a 23% increase in accounts in 2024—many Americans are not fully leveraging them. Recent Fidelity research shows only 23% of Americans contribute to an HSA for retirement healthcare costs, and just 3-in-10 invest their HSA assets, leaving significant growth potential untapped.

This deficit is particularly pronounced among pre-retirees, as only 15% of people aged 55-64 have an HSA. Among those who do, more than half (52%) are unaware that an HSA can function as a retirement savings vehicle. This highlights a critical need for enhanced education on how to effectively use HSAs, not just for immediate expenses, but as a robust, tax-advantaged savings and investment tool designed to mitigate the financial burden of healthcare in later life.

Read more about: Mastering Your Money: An In-Depth Guide to Personal Budgeting for Financial Control and Future Security

10. **Tackling Long-Term Care Expenses**While planning for immediate and ongoing medical costs is paramount, retirees must also confront the distinct and often substantial challenge of long-term care expenses. This category of costs, encompassing assisted living, nursing home care, and home health aides, is critically important because, unlike other medical services, it is generally not covered by Medicare. This leaves individuals and families directly responsible for potentially massive outlays, transforming long-term care into a significant financial planning hurdle that demands dedicated consideration beyond standard medical insurance budgets.

The prospect of requiring long-term care often looms as a “boogeyman” in retirees’ minds. However, data can help demystify this concern: the average stay in a long-term care facility is actually one year or less. While the average annual cost for a private nursing room was a considerable $108,405 in 2021, for the average person, these expenses may not be as financially ruinous compared to other cumulative healthcare expenditures over a lifetime. This perspective suggests that while serious, long-term care shouldn’t necessarily be the “horror” many people perceive it to be.

Nevertheless, averages can be misleading, and individual circumstances vary widely. It is crucial to approach long-term care planning probabilistically, considering one’s personal and family health history, and lifestyle factors. For instance, individuals with chronic conditions may face a higher likelihood of needing extended care. In such cases, the cost of purchasing a long-term care insurance policy can be prohibitive, as insurers are typically selective. A comprehensive strategy integrates personal risk assessment, potential insurance solutions, and an honest evaluation of family resources.

Read more about: Decoding Your Wealth: What the Average 60-Something American Has in Net Worth and How You Compare

11. **Converting Savings into Sustainable Cash Flow**The accumulation of retirement savings represents a lifetime of diligent effort. However, converting that nest egg into a sustainable cash flow to cover monthly expenses throughout retirement is complex, involving managing withdrawals, anticipating market fluctuations, and navigating taxation. Financial advisor Joe Conroy’s insight, “Our job is to figure out how to get $5,000 in the bank at the start of each month,” perfectly encapsulates this challenge.

One widely referenced guideline is the “4% rule of thumb,” suggesting retirees can safely withdraw 4% of savings annually. For a $1 million nest egg, this yields $40,000 annually. However, financial experts caution against its uncritical application, as certified financial planner Nick Hughes points out, “The problem is that the 4% rule doesn’t really account for taxes,” a significant limitation.

Indeed, the tax implications of withdrawals are profound. Christopher Abts, a financial advisor, emphasizes, “How you take income in retirement will absolutely have an impact on the taxes you pay.” Many retirees hold wealth in traditional 401(k)s and IRAs, where withdrawals are subject to income tax. Furthermore, at age 73, Required Minimum Distributions (RMDs) become mandatory, irrespective of income needs, potentially inflating taxable income and leading to high tax bills.

To mitigate this, proactive planning is essential. Converting money from traditional to Roth accounts during working years or early retirement, though requiring taxes paid at conversion, allows for entirely tax-free withdrawals in retirement. This strategy offers greater tax flexibility and predictability, enabling retirees to manage income streams more efficiently and potentially avoid higher tax brackets, particularly when combined with careful management of RMDs and other taxable income sources.

Read more about: Mastering Your Retirement Budget: Real-World Insights from a 65-Year-Old Retiree’s Monthly Spending Plan

12. **The Profound Impact of Tax Planning on Retirement Finances**Effective tax planning is a continuous, strategic imperative that profoundly influences the long-term sustainability of retirement finances. Beyond direct taxes on withdrawals, intricate tax considerations impact eligibility for healthcare subsidies and Medicare premiums. Proactively managing one’s tax situation in retirement is essential for optimizing cash flow and preserving wealth.

One critical aspect involves recognizing how income levels affect government assistance. Healthcare subsidies through the Affordable Care Act (ACA) marketplace are income-dependent, as are Medicare premiums, particularly for Part B and Part D, via income-related monthly adjustment amounts (IRMAA). Lower incomes can yield substantial premium savings, while higher modified adjusted gross income (MAGI) can lead to significantly increased Medicare costs, eroding a carefully constructed retirement budget.

This interplay necessitates careful consideration when drawing income from investments. Realizing a large capital gain or executing a substantial Roth conversion in a given year can have cascading effects. While immediate tax implications are often factored in—like federal capital gains, net investment income, and state income tax—retirees frequently overlook the delayed impact on Medicare premiums. An income spike in one year can trigger higher Medicare premiums two years later, an unforeseen consequence.

Therefore, integrating tax planning into the broader retirement strategy is non-negotiable. This holistic approach should involve a financial advisor and a Certified Public Accountant (CPA). Such collaboration ensures all financial decisions—from investment withdrawals to asset allocation—are made with a clear understanding of their tax consequences and their ripple effect on healthcare costs. Strategically managing income realization and distribution allows retirees to minimize tax burdens and healthcare outlays, securing a more robust financial future.

Read more about: Decoding Your Wealth: What the Average 60-Something American Has in Net Worth and How You Compare

13. **Actionable Steps for Securing a Financially Sound Retirement Healthcare Future**Armed with a deeper understanding of retirement healthcare costs, proactive engagement is the most effective defense against financial surprises. Concrete steps can be taken now to prepare, transforming uncertainty into manageable financial calculations and bolstering confidence for the golden years.

Firstly, clarity on potential health insurance premiums is paramount. For early retirees, estimating COBRA or HealthCare.gov costs, and understanding subsidies, is crucial for short-term fund allocation. Once Medicare eligible, consulting an experienced Medicare advisor is essential to understand costs and benefits of various Medicare Supplement or Medicare Advantage plans, which profoundly shape ongoing premium outlays.

Secondly, quantify all projected healthcare expenses and assess if current assets are sufficient. Integrate baseline averages, like the $8,600 (excluding long-term care) for 2025 with an annual 5% inflation buffer, alongside personalized estimates. If a shortfall is revealed, seeking guidance from a financial advisor is crucial. A professional can help structure investments for necessary income and close funding gaps, ensuring financial components work cohesively.

Finally, integrate tax planning into every facet. Recognizing healthcare subsidies and Medicare premiums are income-sensitive empowers informed decisions on drawing investment income. Strategically timing Roth conversions or managing taxable withdrawals can minimize tax burdens and premium surcharges. Aligning investment vehicles with income needs—safer options for immediate expenses—provides peace of mind that all financial elements are optimized for a stable, predictable retirement.

Read more about: Your Essential Roadmap to Financial Control: 14 Practical Budgeting Strategies for Savvy Spenders

14. **A Final Word: Securing a Financially Sound Retirement Healthcare Future**As this in-depth exploration concludes, the overarching message remains clear: healthcare expenses represent one of the most significant and often underestimated financial factors in retirement planning. Understanding the alarming underestimation of costs, defining personalized income needs, dissecting spending habits, identifying income pillars, navigating pre-Medicare hurdles, categorizing expenses, and confronting inflation, ultimately leads to a profound realization: preparedness is paramount. The initial sticker shock of a $172,500 average for retirement healthcare can, with diligent planning, be transformed from a daunting unknown into a manageable financial reality.

By proactively embracing the complexities of Medicare coverage, strategically leveraging powerful tools like Health Savings Accounts, thoughtfully confronting the potential for long-term care expenses, and mastering the art of converting savings into sustainable, tax-efficient cash flow, retirees can gain considerable control over their financial destinies. The profound impact of meticulous tax planning, influencing everything from subsidies to Medicare premiums, underscores the interconnectedness of all financial decisions in retirement. It is this integrated approach, moving beyond simplistic rules of thumb and embracing personalized, professional guidance, that truly empowers individuals.

Ultimately, the goal is not merely to amass savings, but to create a realistic and resilient financial blueprint that anticipates, rather than reacts to, the inevitable costs of healthcare in later life. By understanding what these costs are likely to be and diligently factoring them into a comprehensive retirement expense budget, individuals are far more likely to avoid unexpected, budget-busting expenses. This foresight cultivates not just financial stability, but also the invaluable peace of mind necessary to truly enjoy the well-deserved leisure and freedom of retirement, secure in the knowledge that their healthcare future is robustly provisioned. The time for planning is now.