In the dynamic world of investing, where fortunes can be made with breathtaking speed, the flip side often gets less attention: the substantial destruction of shareholder wealth that can occur. While the market’s climb may be inflating many accounts, Americans are, in fact, more exposed than ever to the potential sting of a market slump, with direct and indirect stock holdings accounting for an all-time high of 45% of households’ financial assets in the second quarter, according to Federal Reserve data.

This record-high stock ownership, while enabling more people to benefit from Corporate America’s gains, especially long-term investors, also raises red flags. Jeffrey Roach, chief economist at LPL Financial, notes that because so many people now own and have so much of their money in stocks, the market has a much greater influence on the economy, for good or ill, than even a decade ago. This means the impact of a stock market melt-up or meltdown will be far more significant across the broader economy.

Indeed, a closer look at market performance reveals a stark reality: some stocks can dramatically erode investor savings. Amy Arnott, a portfolio strategist for Morningstar Research Services, highlighted the “stinkers” – the stocks that have destroyed the most shareholder wealth over the past decade. Her research, covering 2014 through 2023, identified 15 such companies that collectively wiped out an estimated $281.2 billion in shareholder wealth. These wealth destroyers are not monolithic; they represent a diverse set of industries, sectors, and underlying problems, often sharing common threads that savvy investors should recognize and understand. This article delves into 14 critical factors and notable stock examples that illustrate how savings can be undermined, providing crucial insights for a more resilient investment strategy.

1. **The Peril of Lacking an Economic Moat: Companies Without Sustainable Competitive Advantage**One of the most profound insights from Morningstar’s analysis of wealth-destroying stocks is the crucial role of an “economic moat,” or sustainable competitive advantage. Arnott noted that many companies that have destroyed significant shareholder wealth over the past decade simply lack this fundamental protection. A staggering ten of the 15 worst wealth destroyers on her list had no economic moat whatsoever, leaving them vulnerable to market pressures and competitive threats.

This absence of a durable competitive edge means these companies often struggle to defend their market share or pricing power against rivals. Without unique strengths like strong brand identity, proprietary technology, or cost advantages, they find it difficult to maintain profitability in the long run. Investors are often drawn to growth stories, but true, sustainable growth requires a mechanism to fend off competition, a factor often overlooked in the euphoria of a rising market.

For investors, identifying companies with strong economic moats is a cornerstone of prudent decision-making. Conversely, a lack thereof should serve as a significant red flag. Without this foundational advantage, companies are more susceptible to disruptive innovation, aggressive pricing from competitors, or shifting consumer preferences, any of which can lead to a rapid erosion of value and devastating losses for shareholders. This often translates into the “sudden drop” as market realities catch up to initial investor enthusiasm.

Understanding a company’s competitive landscape and its ability to maintain its position is paramount. When a business cannot sustain its advantage, its long-term viability becomes questionable, regardless of short-term market sentiment. The data strongly suggests that avoiding companies without an economic moat is a key defensive strategy for protecting one’s savings from unexpected downturns.

2. **Deteriorating Financial Fundamentals: The Warning Signs of Declining Revenue and Operating Income**

Beyond competitive positioning, the financial health of a company provides clear indicators of its trajectory. Amy Arnott’s research points to “deteriorating fundamentals” as another common factor among these value destroyers. Most of the companies on her list suffered from declining revenue and operating income over the past decade, a trend that investors eventually recognized and punished.

Declining revenue is an immediate red flag, signaling that a company is losing its ability to sell goods or services effectively. This could be due to a shrinking market, increased competition, or a failure to innovate and meet customer demands. Consistent drops in revenue indicate a business in distress, struggling to generate the top-line growth essential for long-term survival and shareholder returns.

Operating income, which measures a company’s profit after deducting operating expenses like wages and raw materials, is equally critical. A decline here suggests that even if sales are maintained, the company is becoming less efficient at turning those sales into actual profit from its core operations. This can stem from rising costs, poor management, or a lack of pricing power, all of which chip away at the company’s ability to generate cash and reinvest in its future.

When both revenue and operating income are in decline, it paints a picture of a company facing severe headwinds, both in terms of market demand and operational efficiency. Investors, observing these worsening metrics, inevitably bid down stock prices. For those looking to protect their savings, a diligent review of these fundamental financial statements is crucial, as they often provide the earliest warnings of a stock’s potential to become a wealth destroyer.

3. **The Red Flag of Declining Free Cash Flow: Why This Metric is Crucial for Long-Term Viability**

While declining revenue and operating income are clear warning signs, the analysis by Morningstar’s Amy Arnott further highlights the significance of free cash flow. In addition to other deteriorating fundamentals, three of the 15 worst wealth destroyers also reported declines in free cash flow over the past decade. This metric is a powerful indicator of a company’s financial health and its ability to generate actual cash for shareholders.

Free cash flow represents the cash a company generates after accounting for cash outflows to support its operations and maintain its capital assets. It’s the money left over that can be used for things like paying dividends, buying back shares, reducing debt, or investing in new growth opportunities. A consistent decline in this critical metric suggests that a company is struggling to produce enough liquid capital to sustain itself, let alone reward its investors or pursue expansion.

Companies with diminishing free cash flow are often in a precarious position. They might be forced to borrow heavily, sell assets, or cut back on vital investments, all of which can hinder future growth and profitability. This situation can lead to a downward spiral, where a lack of cash makes it harder to compete, further exacerbating declines in revenue and operating income.

For investors, a robust and growing free cash flow is a sign of financial strength and flexibility. Conversely, a shrinking free cash flow indicates a severe structural problem, making the company less attractive and significantly increasing its risk profile. Over time, such a trend invariably leads to a negative re-evaluation by the market, culminating in significant stock price declines that can devastate an investment portfolio. Monitoring free cash flow is an indispensable part of safeguarding one’s financial future.

4. **From Dominance to Downfall: Large-Cap Industry Leaders That Lost Their Way**It’s a common misconception that large, established companies are inherently safe investments. However, Morningstar’s research on wealth destroyers reveals a sobering truth: some of the 15 companies that wiped out the most shareholder wealth were, in fact, large-cap stocks that once dominated their industries. This illustrates that even market leaders are not immune to decline and can pose significant risks to investor savings.

The trajectory of these once-dominant firms often involves a failure to adapt to changing market conditions, technological disruptions, or evolving consumer preferences. What was once a source of strength – their sheer size and market presence – can become an anchor, making them slow to react and less agile than smaller, innovative competitors. Complacency can set in, leading to missed opportunities and a gradual erosion of their competitive edge.

When a large-cap leader begins to falter, the scale of wealth destruction can be immense due to its initially high market capitalization and widespread institutional and individual ownership. The impact of their decline reverberates across many portfolios, turning what were once considered ‘safe’ foundational holdings into significant liabilities. The sheer volume of shares outstanding means even a modest percentage drop can equate to billions in lost market value.

Investors must recognize that past performance and current market leadership are not guarantees of future success. Continuous scrutiny of a company’s ability to innovate, adapt, and maintain its competitive position, regardless of its size or historical dominance, is essential. The fall of a giant serves as a stark reminder that no stock is too big to fail, and diversification across truly independent assets remains a critical defense against such large-scale value destruction.

5. **Tesla (TSLA): A High-Flyer’s Q1 Tumble Illustrates Market Volatility**While Morningstar’s analysis focused on a decade of wealth destruction, recent market movements offer vivid examples of how even high-profile, influential stocks can experience sudden drops. Tesla (TSLA), for instance, serves as a stark reminder of this volatility, experiencing a significant decline in the first three months of the year, losing more than 35 percent through April 1st. This sharp downturn highlights how quickly investor sentiment can shift, even for companies that have previously enjoyed meteoric rises.

Tesla, whose chief executive, Elon Musk, has become a lightning rod for critics, saw its shares plummet. This substantial loss for a company that had buoyed the U.S. stock market over much of the previous couple of years underscores the inherent risks in highly concentrated, momentum-driven investments. Even amidst broader market rallies, specific companies can face significant headwinds that lead to pronounced individual stock performance issues.

The reasons behind such a steep drop can be multifaceted, ranging from company-specific news and performance concerns to broader macroeconomic trends or shifts in investor confidence. For many investors, particularly those heavily concentrated in such high-growth, high-volatility names, such a rapid decline can have a disproportionate impact on their savings, turning significant paper gains into equally significant realized losses in a short period.

This example emphasizes the importance of not equating past stellar performance with guaranteed future returns. The market is constantly re-evaluating companies, and even leaders in innovative fields can face periods of intense selling pressure. For investors, it reinforces the wisdom of a diversified approach rather than placing excessive bets on any single stock, no matter how compelling its story has been.

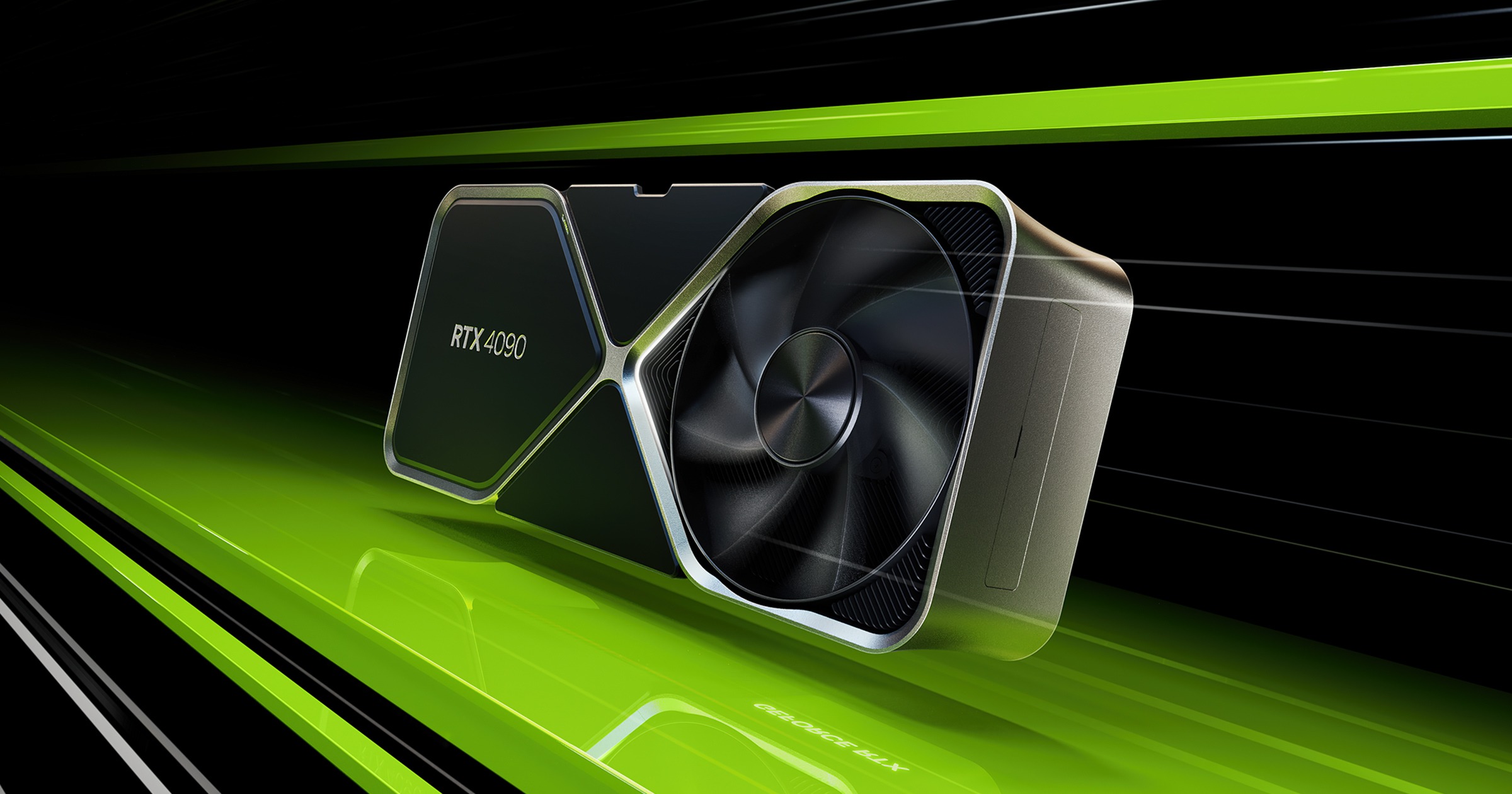

6. **Nvidia (NVDA): AI Darling’s Retreat Amid Broader Market Shifts**Another prominent example of a significant stock reversal in the first quarter comes from Nvidia (NVDA), a star of the artificial intelligence boom. Despite its central role in the surging interest in AI, Nvidia experienced a notable downturn, losing nearly 19 percent in the three months that ended on April 1st. This dip, while less severe than Tesla’s, still represents a substantial erosion of value for investors, particularly given its status as a market darling.

Nvidia’s performance highlights that even companies at the forefront of transformative technologies are not immune to market corrections or shifts in investor appetite. While the AI boom has fueled much of the market rally this year, lifting major indexes, the concentrated nature of these gains also presents vulnerabilities. When sentiment shifts or profit-taking occurs, even the most celebrated stocks can see significant retreats.

The context notes that the S&P 500 has become increasingly concentrated, with the Magnificent Seven tech stocks, including Nvidia, accounting for roughly 41% of the S&P 500’s gains this year and 34% of its market value. This concentration means that investors are highly exposed to the fate of a few enormous companies. When one of these giants experiences a pullback, its impact can be felt across many portfolios.

For investors who have benefited immensely from Nvidia’s previous surge, the first quarter’s performance serves as a reminder that market leadership can be fleeting, and even the most compelling growth stories face periods of correction. It underscores the importance of regularly re-evaluating positions and ensuring that portfolios are resilient enough to absorb such substantial, albeit not necessarily catastrophic, drops from high-performing assets.

7. **Stocks Affected by Global Trade Tensions and Tariff Policies**Beyond individual company fundamentals, macroeconomic factors, particularly government policies, can inflict widespread damage on stock valuations. The market’s recent mood has been significantly darkened by pessimism surrounding U.S. tariff policies, leading to painful declines across various sectors. This demonstrates how trade conflicts can directly translate into sudden drops in investor savings.

President Trump’s imposition of substantial tariffs on a wide range of countries, simply for running trade surpluses with the United States, startled the markets. Depending on how these tariffs are carried out, the effective U.S. tariff rate could surge to around 24%, the highest level in 125 years. Such protectionist measures evoke historical parallels, with a rush to raise tariffs in the 1930s exacerbating the Great Depression, illustrating the potential for grave global economic damage.

Economists overwhelmingly agree that the net effect of tariffs is destructive. A September survey by the University of Chicago of over 80 eminent economists revealed a 95% consensus that tariffs are substantially borne by consumers through price increases. The higher these effective tariffs climb, the greater the odds that the economy will slow, potentially falling into a recession, leading to layoffs, wage freezes, household distress, and shriveling stock portfolios.

Therefore, stocks deeply embedded in international supply chains or those reliant on global trade are particularly vulnerable to such policy shifts. The longer these trade disputes linger, the deeper the market is expected to fall, impacting everything from manufacturing to consumer goods. For investors, monitoring the geopolitical landscape and understanding how policy decisions, such as tariffs, can directly translate into market volatility and erode savings is a crucial component of risk management.

Read more about: U.S. Markets Ride Rate Cut Hopes to Record Highs, Yet Underlying Inflation and Fed Caution Signal Persistent Volatility Ahead

8. **Systemic Risk from Record-High Stock Ownership and Market Concentration**The current investment landscape presents a striking paradox: while markets have soared, Americans find themselves more exposed than ever to the potential for a severe market downturn. Federal Reserve data indicates that direct and indirect stock holdings now constitute an all-time high of 45% of households’ financial assets in the second quarter. This record level of exposure raises significant red flags, especially given an increasingly fragile labor market and persistent inflation.

Jeffrey Roach, chief economist at LPL Financial, underscores the profound implications of this widespread stock ownership. He argues that because so many individuals now hold a substantial portion of their wealth in stocks, the market exerts a far greater influence on the broader economy, for better or worse, than it did even a decade ago. This heightened interconnectedness means any significant market event will have much more widespread economic repercussions.

Further compounding this systemic vulnerability is the increasing concentration within benchmark indexes like the S&P 500. The “Magnificent Seven” tech stocks, for instance, have accounted for roughly 41% of the S&P 500’s gains this year and now represent 34% of its total market value. This concentration means investors are heavily exposed to the performance and fate of a relatively small number of enormous companies, amplifying systemic risk across portfolios.

History offers a cautionary tale, as noted by John Higgins, chief markets economist at Capital Economics, who points out that Americans’ stock ownership has surpassed late 1990s levels, just before the dot-com bubble burst. Rob Anderson, US sector strategist at Ned Davis Research, adds that record-high stock ownership levels historically correlate with an increased risk of downturns and below-average returns.

Read more about: America’s Housing Conundrum: A Deep Dive into the Systemic Roots of Unaffordability and the Fading Dream of Homeownership

9. **The “K-shaped Economy” and its Hidden Fragilities**Beneath the veneer of a buoyant stock market, concerns are mounting about the emergence of a “K-shaped economy,” where the wealthiest Americans accumulate wealth while lower-income segments struggle. This dichotomy arises because the stock market, primarily benefiting those with significant assets, is surging, whereas the job market, the main income source for most Americans, faces stagnation. This creates a distorted economic picture that masks underlying vulnerabilities.

Michael Green, chief strategist at Simplify Asset Management, highlights how this economic imbalance creates significant distortions in reported economic data. Those with substantial wealth invested in the stock market perceive themselves as doing exceptionally well, fueling their spending and contributing to a seemingly robust economic narrative. In contrast, individuals whose finances are primarily tied to employment feel much more constrained, experiencing a different and often harsher economic reality.

The spending habits of the affluent further illustrate this divergence. According to Mark Zandi, chief economist at Moody’s Analytics, the top 10% of earners accounted for over 49% of consumer spending in the second quarter, the highest share on record since 1989. This heavy reliance on the spending of a small segment of the population makes the overall economy highly susceptible to their financial sentiments and market performance.

Kevin Gordon, senior investment strategist at Charles Schwab, warns of the significant risk inherent in this concentration of economic influence. If a market slump were to spook wealthy Americans, their subsequent reduction in spending could profoundly weigh on household expenditures and impact broader economic psychology. This reveals a hidden fragility, where market performance can rapidly affect economic growth.

10. **Diminishing Public Investment Opportunities: The Decline of U.S. Public Companies**A critical structural issue impacting investors is the steady decline in the number of public companies in the U.S., a trend exacerbated by current and past government policies. Under the Biden-Harris administration, the Securities and Exchange Commission (SEC) has continued Obama-era policies that are progressively limiting the investing choices available to average Americans, including within their 401(k) or IRA retirement accounts. This shrinking universe of public firms directly impacts diversification potential.

The impact on initial public offerings (IPOs) has been particularly stark. In 2021, the U.S. saw 1,035 IPOs, including many Special Purpose Acquisition Company (SPAC) mergers. However, once the Biden-Harris SEC implemented its policies, U.S. IPOs plummeted dramatically to 181 in 2022 and further to just 154 last year. This rapid decline indicates companies are increasingly deterred from entering the public market, shutting off a vital avenue for investment.

The long-term erosion of public companies is also evident in broader market indices. The Wilshire 5000, established in 1974 with approximately 5,000 stocks, has now dwindled to fewer than 3,500 companies. While mergers have contributed to this reduction, the primary culprit is the dwindling supply of new companies going public via IPOs. This shrinking pool of available public investments forces increasing amounts of capital into a smaller number of stocks.

This crowding of retirement savings into fewer public companies has significant consequences. Steep market declines become particularly unsettling for older investors who witness their savings dwindle with less ability to spread risk. An increase in public companies is essential for retirement investors to diversify their investments more effectively.

11. **Regulatory Burdens: How SEC Policies Deter Public Listings**The unattractiveness and expense associated with being a public company in the U.S. largely stem from an accumulation of regulatory burdens and disclosure requirements. The Biden administration, through its SEC leadership, further contributed to this environment by asserting that SPACs, despite decades of prior approval as public entities, should be regulated like mutual funds. This sudden regulatory uncertainty effectively chilled the SPAC boom, which had previously offered a pathway to reverse the decline in public companies.

Building on Obama-era initiatives, the Dodd-Frank law imposed requirements for public companies to disclose information on “political hot topics.” These include the ratio of CEO pay to employee pay, the use of “conflict minerals,” or participation in “extractive resources” industries. While these issues may hold social significance, they often bear no direct relationship to a company’s ability to generate shareholder returns, yet they add substantial compliance costs and make public listing more complex.

A significant, often overlooked, consequence of these extensive disclosure mandates is the creation of a new revenue stream for trial lawyers. These legal professionals frequently file lawsuits against public companies alleging inaccuracies or omissions in such disclosures. Companies, often seeking to avoid the prohibitive costs of litigation, choose to settle these lawsuits, further increasing the overall expense and administrative burden of maintaining a public listing.

Furthermore, the Sarbanes-Oxley Act established the Public Company Accounting Oversight Board, which continuously introduces more stringent accounting requirements. To comply with this ever-expanding labyrinth of disclosure and accounting rules, a public company must maintain an expensive army of lawyers and accountants. Any perceived misstep can lead to debilitating “strike suits” or hostile Congressional hearings, making public life difficult for entrepreneurs.

12. **The Rise of Private Equity: An Alternative to Public Markets**In parallel with the increasing regulatory and financial burdens of going public, another structural shift has significantly altered the investment landscape: the exponential growth of private equity funds. These funds, substantially fueled by investments from pension plans for state and local government workers, offer a compelling alternative for promising private companies that wish to avoid the complexities and costs associated with an IPO and public listing.

This robust availability of private capital directly contributes to the dwindling supply of new companies entering the public market. Entrepreneurs, facing the choice between a cumbersome and expensive IPO process and a more streamlined path through private funding, increasingly opt for the latter. The allure of staying private allows companies to focus on growth without the intense scrutiny, quarterly reporting pressures, and regulatory compliance demands of public ownership.

The consequence of this trend for everyday Americans is a significant limitation on their investment choices. As innovative and high-growth companies choose to remain private, the opportunity for individual investors to participate in their early-stage success through traditional public markets diminishes. This leaves a smaller, potentially less dynamic pool of companies for 401(k) and IRA accounts.

Read more about: Revving Up Your Portfolio: 14 Once-Overlooked Vintage Cars Poised for Explosive Investment Growth

13. **Geopolitical and Trade Policy Risks: Tariffs as a Market Destabilizer**Beyond company-specific fundamentals and domestic regulatory shifts, broader geopolitical and trade policies represent significant systemic risks that can devastate investment portfolios. The recent mood in the U.S. stock market has been markedly darkened by pessimism surrounding U.S. tariff policies, leading to painful declines across diverse sectors. This illustrates how government decisions on international trade can directly translate into widespread erosion of investor savings.

President Trump’s imposition of substantial tariffs on a wide range of countries, justified by trade surpluses with the United States, sent shockwaves through global markets. Depending on their implementation and longevity, these tariffs could elevate the effective U.S. tariff rate to around 24%, a level not seen in 125 years. Such protectionist measures evoke grim historical parallels, notably the rush to raise tariffs in the 1930s, which exacerbated the Great Depression.

Economists are in overwhelming agreement regarding the destructive net effect of tariffs. A September survey by the University of Chicago, involving over 80 eminent economists, revealed a striking 95% consensus that tariffs are substantially borne by consumers through price increases. This means trade wars are not just about international relations; they directly impact domestic purchasing power and economic stability. The higher these effective tariffs climb, the greater the odds that the economy will slow, potentially tipping into a recession.

A recession, in turn, brings with it a cascade of negative economic outcomes: widespread layoffs, wage freezes, profound household distress, and, inevitably, shriveling stock portfolios. For investors, monitoring the geopolitical landscape and understanding the direct correlation between policy decisions like tariffs and market volatility is an an indispensable component of sound risk management.

14. **The Crucial Role of Diversification and Long-Term Strategy in Volatile Markets**In an environment fraught with systemic risks, policy headwinds, and market volatility, the wisdom of a well-diversified, long-term investment strategy becomes paramount for safeguarding savings. Quarterly numbers from Morningstar demonstrate that traditional, diversified investments, such as those commonly found in retirement accounts, outperformed big-name tech stocks like Tesla and Nvidia during periods of sharp declines, offering greater stability. This highlights the virtue of not putting all your eggs in one basket.

While diversified portfolios may not always capture the absolute highest returns in any given period—a single stock like Nvidia might surge spectacularly—their primary virtue lies in risk reduction and resilience. Academic research consistently suggests that broad investments in low-cost index funds, judiciously divided among different categories of global assets like stocks and bonds, represent a wise and effective approach for most investors. This strategy acknowledges the unpredictability of markets and the hazards of attempting to “time” them.

For investors, particularly those nearing retirement, having sufficient cash available for short-term needs is a foundational element of financial security. Holding Treasury bills or money market funds provides a liquid buffer, offering current yields of over 4% on short-term holdings. This strategic cash reserve offers peace of mind, enabling investors to weather stock market downturns without being forced to liquidate core portfolio assets at unfavorable prices.

Read more about: Why Your Investment Portfolio Needs Diversification: A Strategic Guide for Navigating Market Volatility

Furthermore, while high-quality bonds, whether taxable or municipal, offer greater dependability than stocks for those reliant on investments for day-to-day living, stocks retain their crucial role for long-term wealth creation. Despite their inherent volatility, diversified stock investments have historically been the most effective way to earn inflation-beating returns over decades. A balanced portfolio that includes diversified stock holdings, along with appropriate bond and cash allocations, remains the most prudent path forward amidst turbulent markets.

:max_bytes(150000):strip_icc():focal(784x348:786x350)/Dakota-Johnson-during-the-Splitsville-photocall-at-the-78th-annual-Cannes-Film-051925-tout-d0e14710da614ee09cb181d601713675.jpg)