When tablet computers first emerged into the digital landscape around 2010, they were hailed as a potential paradigm shift, bridging the gap between smartphones and personal computers. Their promise was immense: a lightweight, touch-enabled device offering a more immersive experience than a phone, yet more portable than a laptop. For a time, this vision held true, with tablet ownership growing steadily and establishing a significant presence in American households. This era of rapid adoption set expectations high for the segment’s future trajectory.

However, the narrative has undeniably begun to shift. Recent data and industry reports paint a picture of a market that, after its initial boom, is now ‘losing steam.’ A comprehensive survey of over 269,000 U.S. adults by CivicScience reveals a critical turning point: tablet ownership, having peaked at a robust 56% at the start of 2017, has since declined to 54% and appears to be on a clear downward trajectory. This trend is not merely anecdotal; it is echoed by market leaders like Apple, Samsung, and Amazon, all of whom have reported drops in tablet sales, signaling a broader industry-wide contraction.

The reasons behind this apparent recalibration of the tablet’s place in the American digital ecosystem are multifaceted and intricate. It is not a singular phenomenon but rather a complex interplay of economic pressures, the rapid evolution of alternative devices, changing consumer behaviors, and even generational preferences. Understanding these underlying currents is crucial to grasping why tablets, once seen as the next big thing, are experiencing a decline in new purchases, and what their enduring role, if any, might be in our increasingly interconnected lives. We delve into these factors to unravel the story of the modern tablet.

1. **The Plateau and Decline of Tablet Ownership** The journey of tablet ownership in the United States has been a dynamic one, characterized by an initial surge followed by a distinct period of stagnation and decline. According to CivicScience’s extensive survey, which tracked U.S. adults since 2015, tablet ownership demonstrated consistent growth, reaching its zenith at the dawn of 2017. At this point, a significant 56% of adults in the nation proudly owned a tablet, a testament to the device’s widespread appeal and perceived utility during its earlier years. This figure represented the pinnacle of its market penetration.

Yet, this peak was not a harbinger of continued expansion. The survey vividly illustrates a subsequent downturn, with ownership figures dropping to 54% of U.S. adults. This retreat from its high-water mark suggests a market correction, indicating that the initial wave of early adopters and general consumers has largely been exhausted, and new buyers are not materializing at the same rate. The trajectory, as observed, is unmistakably downward, challenging the earlier projections of sustained growth.

This observable dip in consumer adoption is not an isolated statistical anomaly. It aligns precisely with the financial reports from the industry’s heaviest hitters. Apple, a pioneer and perennial leader in the tablet space, has consistently reported drops in iPad sales. Similar trends are visible with other major manufacturers, including Samsung and Amazon, indicating a synchronized reduction in market demand across the board. The collective decline among these prominent players underscores a fundamental shift in the broader consumer electronics landscape, where the tablet’s once unassailable position is now being re-evaluated.

2. **The Cost Conundrum: Is a Tablet Worth the Investment?** In an increasingly competitive and cost-conscious consumer market, the financial outlay required for a new device inevitably plays a pivotal role in purchase decisions. For tablets, this economic consideration has emerged as a significant ‘prohibitive factor driving down tablet ownership,’ as astute analysts have begun to point out. The simple reality is that tablets represent an added cost, and consumers are rigorously weighing whether that investment yields sufficient unique value compared to other digital tools already at their disposal.

Indeed, the survey data strongly supports a correlation between income levels and tablet ownership, underscoring the economic sensitivity of this market segment. Among individuals earning $50,000 or less per year, only 46% reported owning a tablet. This contrasts sharply with the demographic making between $100,000 and $150,000 annually, where tablet ownership surged to an impressive 65%. Such a disparity highlights that for many, a tablet remains a discretionary purchase, one that becomes more accessible as disposable income increases.

This economic logic leads to a crucial question for the price-conscious consumer: “is it worth investing in a tablet when you could purchase a large-screen smartphone (a ‘phablet’) or a laptop with a touchscreen interface and greater computing power?” The perceived value proposition has undoubtedly been eroded by the evolution of these alternative devices. When a smartphone offers expansive screen real estate and a laptop provides superior processing capability and full operating system functionality, the tablet’s middle-ground position becomes financially precarious, particularly for those managing tight budgets.

3. **The Device Convergence Challenge: Phablets and Touchscreen Laptops** The landscape of personal computing has undergone a radical transformation, driven by relentless innovation and the convergence of functionalities across different device categories. This evolution has presented a formidable challenge to the tablet market, as other devices have incrementally absorbed and even surpassed many of the core utilities once unique to tablets. The “rise in smartphone growth” is a prime example, with an estimated 77% of U.S. adults now owning a smartphone. These aren’t the compact phones of yesteryear; modern smartphones often feature ‘phablet’-sized screens, offering a visually engaging experience that rivals smaller tablets for media consumption and web browsing.

Simultaneously, the laptop market has not stood still. Manufacturers have increasingly incorporated touchscreens, convertible designs, and lightweight form factors into their offerings. These “newer laptops with touchscreens” are, in essence, ‘more powerful tablets with more utility,’ providing the flexibility of a tablet mode while retaining the robust processing power, comprehensive software ecosystem, and physical keyboard that traditional laptops are known for. This blurring of lines means that consumers seeking either portability or productivity often find more comprehensive solutions in either a premium smartphone or a versatile laptop.

The consequence of this widespread device convergence is that the tablet finds itself awkwardly positioned ‘in the middle of the road, falling short of user’s needs either way.’ If a user desires ultimate portability and constant connectivity, the smartphone excels. If the requirement is for intensive productivity, advanced software, or superior processing, a modern laptop is the clear winner. The tablet’s once distinct niche for casual content consumption and light productivity has been significantly encroached upon by these highly capable alternatives, making it harder for consumers to justify a dedicated purchase.

4. **Generational Divide: Why Younger Users Are Less Engaged** A truly revealing aspect of the tablet market’s shifting fortunes lies in the generational attitudes towards these devices. Surprisingly, “young people may play a significant role in the declining tablet market,” indicating a fundamental divergence in preferences among different age cohorts. When examining overall tablet ownership rates across all age groups, a clear hierarchy emerges: ‘Gen Xers appear to have the highest rates of tablet ownership, followed by Baby Boomers, then Millennials, and finally, Gen Z.’ This ordering suggests a declining enthusiasm for tablets as one moves down the age spectrum towards younger demographics.

Delving deeper, the data specifically highlights a significant slide in ownership among Millennials (ages 18-34). Their ownership rate “has slid significantly since 2017 and is today closer to what it was in 2015, at the start of the survey.” This is a stark contrast to Baby Boomer ownership, which has ‘stayed static since 2017,’ implying that older generations, having adopted tablets, continue to use them, while younger generations are either abandoning them or simply not entering the market as new buyers. This generational retreat signifies a challenge for future market viability.

Even concerted marketing efforts aimed at younger demographics have struggled to gain traction. ‘Apple’s efforts to promote the iPad Pro as a device that could rival laptops, particularly for young people… may not resonate with that audience.’ Despite a slight increase in iPad favorability ratings in 2018, Millennials notably ‘remain the most unfavorable of all age groups to the leading tablet,’ even though Apple’s device commands the largest market share. This sentiment is further cemented by broader studies indicating that ‘while almost 55% of Millennials own a tablet, only a third of Gen Zers own tablets.’ Looking ahead, the trend is projected to continue its downward trajectory, with ‘Gen Alpha expected to own even fewer tablets, with their Gen Z parents not having value for tablets.’ This generational shift in digital preference represents a fundamental headwind for the tablet market.

5. **The Longevity Factor: When Devices Don’t Break, They Don’t Get Replaced** Another subtle yet significant contributor to the slowdown in tablet purchases stems from their inherent durability and typical usage patterns. Unlike smartphones, which are often subjected to daily, rigorous handling in a multitude of environments, tablets tend to lead a comparatively sheltered life. “For whatever reason, people tend not to bring their tablet out” into the bustling world as frequently as their phones. This difference in mobility and exposure inherently translates to ‘less wear and tear on the device,’ extending its functional lifespan far beyond that of its pocket-sized counterparts.

Consider the typical scenario: a tablet is frequently ‘gently cradled in one’s lap with one’s feet up’ in the comfort of a home or office. This protective usage contrasts sharply with a smartphone that is ‘brought literally everywhere,’ exposed to the elements, jostled in bags, dropped on pavements, and constantly handled throughout the day. The result is a device that simply lasts longer, enduring years of use without demanding an immediate replacement due to physical degradation or diminished performance.

It is this profound ‘difference in usage that gives the tablet its relative longevity.’ Because tablets are not typically subjected to the same level of environmental stress and physical impact, they ‘prevent tablets from being bought and replaced out of necessity.’ Consumers are simply not compelled to upgrade a device that continues to perform its intended functions perfectly well, even years after its initial purchase. This extended lifespan, while a testament to product quality, paradoxically slows down the sales cycle for new units.

6. **The Upgrade Apathy: Lack of Innovation and Consumer Pressure** Beyond their physical resilience, tablets face another formidable challenge in the form of consumer apathy towards upgrades. The very concept of regular device replacement, so deeply ingrained in the smartphone market, simply ‘is not associated with tablets.’ Smartphone manufacturers and carriers have cultivated a culture of frequent turnover, driven by incentives like ‘free upgrades with a contract renewal’ and the constant unveiling of new models by giants like Samsung and Apple. This perpetual cycle ensures that consumers feel a consistent impetus to replace their phones on a regular basis, often every one to two years.

This robust upgrade ecosystem for smartphones finds no parallel in the tablet world. A key reason for this lack of pressure is the perceived incremental nature of technological advancements in tablets. Over recent years, ‘there just isn’t the motivation to upgrade, largely because there aren’t many groundbreaking changes made to them.’ While processors might get faster or screens marginally better, these improvements often aren’t compelling enough for the average consumer to justify spending hundreds of dollars on a new device, especially when their existing tablet still perfectly executes its primary functions.

From a purely pragmatic, or ‘frugal,’ perspective, the question becomes straightforward: ‘why would someone spend money to replace something that still serves them perfectly well?’ If an older tablet efficiently handles web browsing, video streaming, and casual gaming—its most common uses—the allure of a newer model with only marginal enhancements significantly diminishes. This absence of compelling innovation or external pressure to upgrade creates a stagnant demand for new tablet purchases, contributing to the overall market slowdown.

7. **Awkward in the Middle: The Form Factor Dilemma** The physical dimensions and design, or ‘Awkward Dimensions,’ of tablets represent a persistent challenge in a market increasingly defined by convenience and specialized functionality. Tablets were initially envisioned to strike a perfect balance between the pocketability of a phone and the screen size of a laptop. However, as both smartphones and laptops have evolved, this middle ground has become increasingly precarious, leaving the tablet in a difficult position where it ‘falls short of user’s needs either way.’

Modern ‘smartphone displays have become large enough to effectively take the place of a tablet’ for many common tasks. With screens pushing seven inches and beyond, watching videos, browsing the web, and engaging with social media on a smartphone has become a highly comfortable and immersive experience. The advantage of being able to carry this powerful, large-screen device in a pocket or small bag far outweighs the marginally larger screen of a tablet for many consumers, especially when considering the added bulk.

Conversely, the rapid advancement of ‘convertible touchscreen laptops’ has also eroded the tablet’s upper boundary. These devices ‘are essentially a more powerful tablet with more utility,’ offering the full capabilities of a desktop operating system, superior processing power, and a comprehensive range of ports, while still providing a touch interface and the flexibility to transform into a tablet-like mode. For tasks requiring actual productivity, typing, or running specialized software, these versatile laptops offer a far more robust solution than a tablet.

This continuous evolution of both smaller and larger devices means that ‘the tablet in the middle of the road’ struggles to carve out a distinct, indispensable niche. It is often either too large to be truly portable like a phone or not powerful and versatile enough to replace a laptop for serious work. These ‘reasons like these have led to tablets falling in popularity when compared to smartphones and laptops,’ solidifying their position as a potentially superfluous device for a growing segment of the population.

8. **Erosion of Global Market Share: A Shrinking Footprint**The trajectory of tablet adoption is not merely a domestic narrative; it reflects a significant global recalibration of consumer priorities and market dynamics. Understanding ‘global market share,’ which quantifies the percentage of a given market a product commands, is crucial to fully appreciate the challenges tablets face. In this broader context, the picture for tablets appears increasingly stark, signaling a pervasive shift in consumer preference away from these devices on an international scale.

Over the last seven years, tablets have experienced a dramatic contraction in their global presence, ‘losing over 50% of the market.’ This substantial decline means that less than half the number of people who purchased tablets in 2017 are doing so today. Such a steep drop is a clear indicator that the tablet’s once-promising position as a ubiquitous computing device has been significantly diminished, with consumers actively opting for alternatives.

The implications of this market erosion are profound. Currently, tablets command a meager ‘about 2.4% of the global market,’ a figure dwarfed by other personal computing categories. To put this in sharper relief, ‘mobile phones have a 56.45% share of the market,’ illustrating a stark contrast in consumer appeal and essential utility. This disparity underscores that, worldwide, the preference for smartphones over tablets is overwhelmingly clear.

9. **Stagnation in Growth and Generational Disconnect**Directly linked to the erosion of global market share is the widespread stagnation in growth that has afflicted the tablet segment. The market has demonstrably ‘haven’t experienced any growth since 2017, when their market share peaked,’ marking a sustained period of flatlining demand. This lack of dynamism is not confined to specific regions; it is a global phenomenon, with ‘US tablet ownership’ notably showing no increase since 2019, signifying a mature market that has reached its saturation point for many.

This trend of stagnation extends across international borders, indicating that ‘tablets are going stagnate in both the US and abroad.’ This broad-based lack of expansion suggests that the initial wave of adoption has crested, and manufacturers are struggling to find new compelling reasons for consumers to integrate tablets into their digital lives. The market is not just declining in absolute terms, but it is also failing to attract new users at a rate that could sustain growth.

Compounding this challenge is the generational disconnect, a factor previously observed in the U.S. but also manifesting on a global scale. Studies reveal a stark difference in ownership rates: ‘while almost 55% of Millennials own a tablet, only a third of Gen Zers own tablets.’ This trend is projected to intensify, with ‘Gen Alpha expected to own even fewer tablets, with their Gen Z parents not having value for tablets.’ This generational shift in digital preference represents a fundamental headwind for the tablet market, signaling a long-term decline in relevance among future generations of consumers.

Read more about: From Dominance to Decline: Why These 12 Iconic Car Brands Are Fading Fast in Today’s Volatile Market

10. **The Digital Multi-tasker’s Companion: A Unique Niche**Despite the broader market contractions and generational shifts, tablets have undeniably carved out a distinct utility for a specific segment of the population: the digital multi-tasker. While they may no longer serve as a primary computing device for many, tablets maintain a nuanced appeal for those deeply immersed in the digital ecosystem. This demographic finds unique value in the tablet’s form factor and capabilities, often integrating it seamlessly into a multi-device workflow.

Survey results illuminate the characteristics of these engaged users. Individuals who are ‘Netflix users, streaming-video watchers, heavy social media users, people who shop more online than in stores, and iPhone owners may all be more inclined to own and purchase tablets.’ These findings suggest that tablets resonate particularly with avid digital consumers who leverage multiple platforms and services throughout their day, seeking an optimal screen experience for various types of content consumption.

Indeed, tablet owners are notably ‘more likely to report being addicted to their digital devices than those who don’t own tablets and to more frequently use multiple digital devices at once.’ A compelling ‘nearly half of tablet owners surveyed (48%) say they regularly use multiple devices at the same time,’ a significant contrast to the 34% of non-owners. This data clearly points to tablets appealing to those who orchestrate a symphony of screens in their daily routines.

Ultimately, these insights affirm that ‘tablets appeal to digital multi-taskers, which further suggests that tablets serve unique purposes for this large swath of owners rather than function as a primary digital source.’ For this crucial segment, the tablet acts as an indispensable companion, augmenting their digital interactions and providing a dedicated screen for specific tasks that neither a smartphone nor a laptop can fulfill as elegantly.

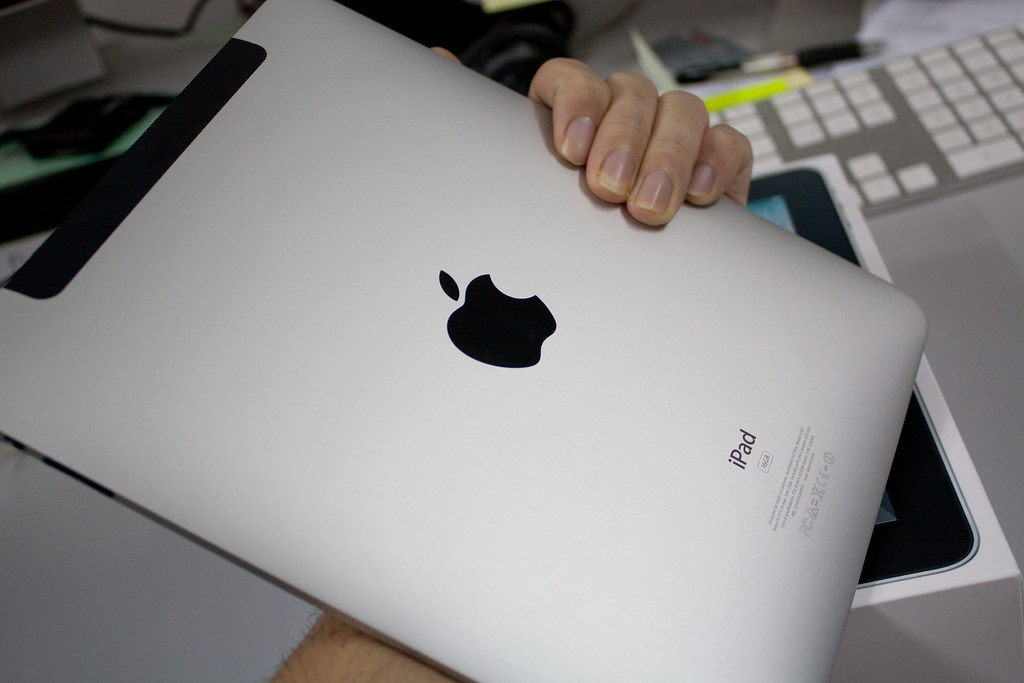

11. **The Premium Tablet Exception: A Surprising Resurgence**Amidst the overarching narrative of market stagnation and decline, a fascinating counter-trend has emerged, suggesting a surprising resurgence in specific segments of the tablet market, particularly at the premium end. Recent industry reports contradict the broader sentiment, indicating that ‘demand for tablets has grown over the last few years.’ This unexpected uptick points to a nuanced market where not all tablets are created equal, and high-end devices are finding renewed favor.

Market researcher IDC provides concrete evidence of this vitality, reporting that ‘Worldwide tablet shipments recorded year-over-year growth of 22.1% in 2024 (2Q24), totaling 34.4 million units.’ This substantial growth figure signals a healthy appetite for new devices in certain categories, challenging the notion of a universally contracting market. This resurgence appears to be driven by significant innovation and strategic positioning by market leaders.

Leading this charge is Apple’s iPad, which emerged as ‘the best-selling tablet last quarter, selling 12.3 million units, giving it a 35.8% market share.’ Not far behind, Samsung captured a respectable ‘20.1% market share’ with 6.9 million units sold. Apple’s financial reports further underscore this success, with the iPad segment bringing in a robust ‘$7.009 billion’ in the last quarter, a significant increase from ‘$5.791 billion in the same quarter in 2023.’

A substantial part of this impressive iPad growth can be attributed to Apple’s strategic launch of the M4 iPad Pro, a device ‘which Apple Intelligence now powers.’ This particular model holds a notable distinction as ‘the first product Apple has released with its new high-speed M4 processor,’ signaling a technological leap designed to elevate the tablet experience. This investment in advanced processing power and intelligent features appears to be resonating strongly with consumers, driving a premium segment growth that defies the broader market’s struggles.

12. **The iPad Pro: A New Standard for Professional Productivity**The success of devices like the M4 iPad Pro offers compelling insight into a shifting perception of tablets, particularly their growing utility in professional environments. Reviews from users and experts alike highlight that this new generation of tablets is not merely for casual consumption but is increasingly positioned as a serious productivity tool. Ryan Christoffel, a 9TO5 Mac reviewer, shared his three months of experience with the new iPad, confirming ‘why this new M4 iPad Pro is a hit’ for its enhanced capabilities.

For many, the premium tablet, especially with cellular connectivity, has transformed into a viable primary computer for work on the go. The flexibility of a wireless 5G connection combined with the ability to run essential applications means that tasks such as writing, research, and accessing various tools can be performed efficiently. The increasing availability of ‘web-based’ versions of major apps further solidifies the iPad’s role, minimizing compatibility issues and streamlining workflows for mobile professionals.

Even within a fixed office environment, these advanced tablets are proving their worth as an “indispensable sidekick.” One user, for example, integrates an iPad into an ‘advanced home office’ setup, leveraging it to augment their workflow alongside a main computer. The device becomes a dedicated screen for tasks that, while possible on a main PC, are often more efficiently handled on the versatile tablet, such as quick searches, checking news sources, and managing communications, thereby making work ‘more efficient.’

The utility of such a setup is echoed by professionals in various fields. A MacRumors forum user, Outlawarth, described using a 12.9-inch iPad extensively for a middle management finance role. This included ‘note-taking, reading, and signing of documents, MS Teams meetings, Email, and Remote Desktop in a Windows environment.’ They even utilized the iPad ‘as a secondary screen when referencing a document while working on the laptop,’ underscoring its multifaceted contributions to a demanding professional workflow.

This evidence strongly suggests that while general consumer tablet sales may be declining, the integration of tablets, particularly high-performance models, into business and professional settings is a significant growth area. The evolving capabilities of these devices are allowing them to become highly mobile and versatile personal computers, proving indispensable not just for entertainment but for serious work.

Read more about: Awe Dropping Expectations: Everything You Need to Know About Apple’s September 9th iPhone 17 Launch

13. **Tablets’ Enduring Niche: Education and Enterprise Solutions**Beyond individual professional users, the tablet market is also finding sustained relevance and even growth within institutional sectors, specifically education and enterprise. This strategic focus highlights a future where tablets, rather than being mass-market consumer devices, solidify their position as purpose-built tools for specific organizational needs. Apple, recognizing this potential, ‘has prioritized education as a target for a more affordable iPad version,’ fostering widespread adoption in learning environments.

Across the nation, ‘many schools… have already adopted tablets for learning,’ leveraging their interactive nature and portable design to enhance educational experiences. Similarly, in the commercial sphere, ‘businesses use tablets for POS systems,’ demonstrating their utility in operational contexts that benefit from a dedicated, portable interface for transactions and inventory management. These applications underscore the tablet’s distinct value proposition in environments where specialized functionality and robust yet intuitive design are paramount.

The implications of these dedicated use cases are significant for the tablet’s long-term viability. While questions remain about their endurance for ‘personal use,’ especially among digitally native generations, their firmly established roles in education and business provide a stable foundation. These sectors demand reliability, specific functionalities, and often benefit from the tablet’s unique blend of portability and screen real estate, ensuring continued demand irrespective of broader consumer trends.

Therefore, even as the consumer tablet market navigates complexities, the evolving landscape suggests a future where tablets refine their identity, moving beyond a general-purpose entertainment device to become indispensable tools in specialized domains. The insights gained from how different people, and indeed different institutions, leverage tablets are critical for manufacturers to maintain product viability. This adaptability ensures that tablets will continue to carve out essential roles, demonstrating their enduring capacity to meet specific needs in an increasingly diversified digital world.

The story of why Americans are buying fewer tablets than before is multifaceted, encompassing economic pressures, device convergence, and generational shifts. Yet, it is also a narrative of resilience and adaptation, where premium devices and specialized applications in education and business are charting a new, focused path forward for these versatile digital companions. The tablet’s journey is far from over; it is simply evolving into a more specialized and indispensable role within our ever-expanding digital ecosystem.