Remember when Captain America, played by Chris Evans, challenged Iron Man, played by Robert Downey Jr., in the iconic 2012 Avengers movie, asserting, “Big man in a suit of armor. Take that off, what are you?” Tony Stark, ever the quick wit, instantly retorted, “Genius, billionaire, playboy, philanthropist.” While Stark’s self-assessment was undeniably accurate, it seems he omitted one crucial, rapidly evolving detail: “venture capitalist.” Indeed, the dynamic world of venture capital and innovative startups is no longer the exclusive domain of tech moguls and seasoned business tycoons; it has dramatically transformed into a formidable playground for some of the biggest names spanning Hollywood, music, and sports.

This paradigm shift sees A-list celebrities leveraging their immense wealth, unparalleled influence, and often keen business acumen to back groundbreaking startups, thereby actively shaping the future trajectories of diverse industries. From pioneering sustainable technologies to revolutionizing consumer goods and digital media, these influential figures are not merely lending their names; they are deeply engaged, often launching their own investment firms and driving strategic decisions that yield significant returns and foster innovation on a global scale. While we anticipate their eventual foray into burgeoning ecosystems like Central and Eastern Europe, their current investments are already making a profound worldwide impact.

In this in-depth exploration, we delve into the portfolios and philosophies of 14 prominent celebrities who have seamlessly transitioned into the role of astute startup investors. Our journey will highlight their venture capital firms, articulate their core investment focuses, and showcase their most notable portfolio companies. This carefully curated list, presented alphabetically to ensure editorial harmony, offers a compelling look at how star power is increasingly intertwined with financial foresight in the high-stakes arena of modern entrepreneurship.

1. **Ashton Kutcher**Ashton Kutcher, widely recognized for his memorable acting roles in television hits like “That ’70s Show” and “Two and a Half Men,” has carved out an equally, if not more, impactful career as a shrewd and visionary venture capitalist. He stands as the co-founder of two highly successful VC firms: A-Grade Investments, established in 2010 and based in Los Angeles, California, and Sound Ventures, co-founded with Guy Oseary in 2015 and headquartered in Beverly Hills, California. Effie Epstein later joined Sound Ventures as managing partner, further solidifying its leadership.

Together, A-Grade and Sound Ventures boast an impressive track record, having collectively made over 280 investments to date, with Sound Ventures alone managing more than $1 billion in assets, according to PitchBook. Kutcher’s investment strategy prominently features a keen focus on tech, consumer products, and digital media, consistently identifying and backing companies poised for disruptive growth. His prescience in the tech space is perhaps best encapsulated by his profound philosophy, as quoted from The Telegraph: “The companies that will ultimately do well are the companies that chase happiness. If you find a way to help people find love, or health or friendship, the dollar will chase that.”

Sound Ventures has also embraced thematic funds, notably launching an AI Growth Thematic fund last year. This fund has strategically invested in leading artificial intelligence companies such as Hugging Face, OpenAI, Anthropic, and World Labs, demonstrating Kutcher’s forward-thinking approach. During TechCrunch’s 2024 Disrupt event, Kutcher articulated his strategy of backing competitors in AI, expressing a belief that the nascent industry has ample room for multiple massive AI model companies to thrive.

His remarkable portfolio includes early and impactful stakes in now-household names such as Airbnb, the global accommodation marketplace; Uber, the multinational online transportation network company; Spotify, the digital music streaming service; and Shazam, the popular music recognition app. Additional notable investments span across Affirm, Airtable, and Duolingo. With a substantial net worth estimated at $200 million, Ashton Kutcher has solidified his position not just as a celebrated actor, but as one of the most prominent and respected figures in the startup ecosystem, whose strategic insights continue to shape technological landscapes.

Read more about: Unplugged and Unstoppable: Decoding How 15 A-List Stars Thrive Without Social Media

2. **Calvin “Snoop Dogg” Broadus**Calvin Broadus, universally known as Snoop Dogg, transcends his iconic status as a rapper and media personality to stand as a remarkably prolific angel investor and a pioneering venture capitalist. He is the founder of Casa Verde Capital, a micro-VC firm based in Los Angeles, California, which he launched in 2015. Under the leadership of managing partner Karan Wadhera, Casa Verde Capital distinguishes itself by its specialized focus on the rapidly expanding cannabis industry, making seed-stage, early-stage, and later-stage investments.

Casa Verde Capital has made over 40 investments to date, strategically supporting companies that are at the forefront of the cannabis sector. Notable portfolio investments for the firm include Dutchie, a leading cannabis e-commerce platform based in the U.S., Green Bits, also from the U.S., and Cansativa, a German company operating within the cannabis space. The firm’s success is further underscored by its closure of a $94 million Fund II in 2020, signaling strong investor confidence in its specialized approach and market expertise.

Beyond his institutional ventures, Snoop Dogg has also been a highly active angel investor. According to PitchBook, he has personally backed at least 26 companies. His diverse angel investment portfolio includes widely recognized names such as Cameo, the personalized video messaging service; Reddit, the social news aggregation and discussion platform; Klarna, the Swedish fintech company; and Robinhood, the commission-free trading platform. He also co-invested in the fintech MoonPay, often alongside other celebrities featured on this very list.

Snoop Dogg’s multifaceted career, which encompasses his roles as a rapper, singer, songwriter, producer, media personality, entrepreneur, and actor, has led to an impressive net worth of $160 million. His early and dedicated focus on the cannabis industry, coupled with his broad angel investments, demonstrates a keen eye for emerging markets and a strategic understanding of where cultural influence can translate into significant financial and business impact, cementing his legacy beyond entertainment.

3. **Jared Leto**Jared Leto, the esteemed actor and musician, brings a unique blend of artistic vision and entrepreneurial acumen to the world of startup investing, establishing himself as one of Silicon Valley’s more “silent investors.” Beyond his Oscar-winning performances and musical endeavors, Leto has proactively engaged in the tech ecosystem through numerous angel investments and by founding several of his own companies.

As an individual angel investor, Leto has made more than 50 investments, predominantly focusing on tech companies. His impressive portfolio showcases a knack for identifying groundbreaking platforms that have gone on to achieve significant market presence. Among his most notable portfolio investments are two giants of the sharing economy: Uber, the multinational ride-sharing service, and Airbnb, the popular online marketplace for lodging. He also backed Slack, the widely used business communication platform.

Leto’s entrepreneurial spirit extends to his own ventures, where he has founded companies that align with his interests in digital connectivity and creative expression. These include The Hive, a social media management company designed to help creators and brands navigate the digital landscape, and VyRT, a live-streaming service that aimed to offer unique virtual experiences and direct interaction between artists and their audiences. These initiatives underscore his hands-on approach to the tech world.

One of his most significant investment successes includes Nest, the home automation producer of programmable, self-learning, sensor-driven, Wi-Fi-enabled thermostats, smoke detectors, and other security systems. Nest was famously acquired by Google for a substantial $3.2 billion in cash, validating Leto’s early conviction in smart home technology. With an estimated financial standing of $90 million, Jared Leto continues to prove that his talents extend far beyond the stage and screen, making meaningful contributions to the growth and innovation of the tech industry through his strategic investments.

Read more about: 12 Hollywood Stars Who Completely Lost Themselves (And Their Looks!) For Groundbreaking Roles

4. **Justin Bieber**Justin Bieber, the Canadian pop sensation celebrated for his chart-topping music, has adeptly diversified his ventures beyond the recording studio, emerging as a notable player in the startup investment arena. Transitioning into the tech and digital media sectors, Bieber has amassed a portfolio that underscores his entrepreneurial ambition. As an angel investor, he has made at least eight investments to date, showcasing a strategic interest in the evolving digital landscape.

His involvement in the tech industry became particularly evident in 2013 when he notably invested in Shots Studios, a social networking app primarily focused on selfie-based content. The platform was designed with a specific aim to cultivate a safe and positive online environment for its young user base, fostering avenues for creativity and connection. Bieber’s significant involvement not only brought substantial media attention to the app but also played a crucial role in attracting users and contributing to its initial growth. Shots Studios continues its journey, adapting to the dynamic shifts within the social media sphere and exploring new opportunities for expansion.

Beyond his angel investments, Justin Bieber has also ventured into entrepreneurship as a co-founder of Drew House, a clothing and lifestyle brand that further extends his influence into consumer markets. His investment focus, as highlighted by his portfolio, includes tech companies and digital media, reflecting a keen awareness of sectors where his personal brand and audience resonance can create tangible value. Notable angel investments include TMRW Sports, Legacy, and Stamped, which was later acquired by Yahoo.

According to Celebrity Net Worth, Justin Bieber commands an impressive net worth of $300 million, a testament to his multifaceted success across both the entertainment and business realms. His strategic forays into tech and digital media underscore a broader trend of celebrities not just endorsing products, but actively participating in and shaping the companies that define our digital future, solidifying his status as a prominent figure in both pop culture and the startup world.

Read more about: Beyond the Buzz: 15 Highly Rated Movies That Ignited Unforgettable Controversies

5. **Justin Timberlake**Pop star and actor Justin Timberlake, a versatile entertainer whose career spans music, film, and fashion, has also established a formidable presence in the investment world. With a discerning eye for emerging opportunities, Timberlake has invested in more than 15 companies, expanding his influence across a diverse range of sectors, including food & beverages, recreational goods, and entertainment software.

Timberlake’s entrepreneurial drive is further evidenced by his role as a co-founder and co-owner of the Nexus Luxury Collection. This venture highlights his engagement in luxury hospitality and lifestyle experiences, showcasing a strategic interest in creating and curating high-end consumer offerings. His involvement in such diverse fields demonstrates a comprehensive approach to wealth management and business development that goes far beyond typical celebrity endorsements.

Among his notable portfolio investments are companies that resonate with modern consumer trends and entertainment technologies. These include The Ugly Company, a venture likely within the food and beverage sector; Superplastic, a prominent player in the animated character and digital collectibles space; and Sandbox VR, an immersive virtual reality experience provider. These investments reflect his understanding of contemporary consumer demands and his willingness to back innovative entertainment and lifestyle concepts.

Justin Timberlake, renowned globally for his roles as a singer, songwriter, actor, and record producer, boasts a substantial net worth estimated at $250 million, as reported by Celebrity Net Worth. This significant financial standing not only underscores his remarkable success in the entertainment industry but also solidifies his position as a multifaceted powerhouse in the investment realm. His consistent engagement in various business ventures marks him as an influential force shaping consumer experiences and technological advancements.

Read more about: Reality TV’s Reckoning: The Legal and Financial Disasters That Threaten Dynasties

6. **Katy Perry**Katy Perry, the internationally acclaimed pop star celebrated for her infectious melodies and vibrant stage presence, has also made a quiet yet impactful venture into the world of startup investments. Amassing a portfolio of eight endeavors to date, Perry demonstrates a clear and consistent focus primarily within the rapidly evolving food and beverage industry, often with an emphasis on sustainability and innovative food technologies.

Her investment strategy highlights a commitment to companies that are poised to disrupt traditional food production and consumption patterns. Among her most prominent investments are industry leaders such as Impossible Foods, a company at the forefront of developing plant-based meat substitutes, and Apeel Sciences, which utilizes plant-derived materials to create an invisible edible peel that helps fruits and vegetables last longer, thereby reducing food waste. These choices underscore her interest in environmentally conscious and health-forward ventures.

Katy Perry’s financial acumen reflects an impressive net worth of $330 million, as per Celebrity Net Worth. This substantial wealth enables her to strategically back companies that align with her values and offer significant growth potential. Her foray into the investment landscape adds a new dimension to her already illustrious career, showcasing an astute financial mind that extends well beyond the music industry, positioning her as a significant influencer in the consumer tech and food innovation sectors.

Her selective yet impactful investments suggest a thoughtful approach to leveraging her capital, not just for financial gain, but also for supporting companies that address global challenges related to food sustainability and healthy living. This strategic positioning solidifies her role as a discerning investor who is as passionate about innovation as she is about entertainment, making her a notable figure among Hollywood’s new class of venture capitalists.

Read more about: Taylor Swift’s Political Evolution: Unpacking Her Journey From Apolitical Silence to Influential Endorsement

7. **Kim Kardashian**Kim Kardashian, a global reality TV personality, entrepreneur, and fashion icon, has made a decisive move into the sophisticated world of private equity, significantly expanding her entrepreneurial empire. She is the co-founder of SKKY Partners, a private equity firm headquartered in Boston, Massachusetts, which she established in 2022. This venture marks a serious pivot into institutional investing, underscoring her ambition to become a formidable figure in finance.

SKKY Partners’ investment interests are broad yet strategically defined, encompassing a range of high-growth sectors. The firm focuses on consumer goods, digital technology, media, and luxury hospitality, reflecting Kardashian’s deep understanding and proven success in these areas through her own brands and public persona. While specific portfolio investments for SKKY Partners are not yet detailed in the provided context, the firm’s establishment signals a significant commitment to large-scale, strategic investing in industries where Kim Kardashian possesses extensive firsthand experience and market insight.

Her transition into private equity highlights a sophisticated evolution of her business strategy, moving beyond individual brand building to leveraging capital and expertise on an institutional level. According to Forbes, her net worth is an impressive $1.7 billion, a staggering figure that underscores her unparalleled success in business and entrepreneurship. This substantial financial standing provides SKKY Partners with a powerful foundation, enabling it to pursue ambitious investment opportunities and compete with established firms.

Kim Kardashian’s entry into private equity solidifies her status as a formidable figure not only in the entertainment and entrepreneurial spheres but also in the high-stakes world of finance. Her ability to translate celebrity influence into credible business ventures, backed by significant capital, positions her as a powerful force in shaping future market trends and supporting the next generation of innovative companies across consumer, digital, and luxury sectors. Her journey exemplifies the new archetype of the celebrity investor, one who is deeply embedded in the strategic and financial aspects of business growth.

Read more about: Taylor Swift’s Political Evolution: Unpacking Her Journey From Apolitical Silence to Influential Endorsement

8. **Leonardo DiCaprio**American actor and film producer Leonardo DiCaprio has seamlessly transitioned his dedication to global issues into a formidable presence within the startup investment world. With an impressive portfolio boasting over 20 investments, DiCaprio has carved out a unique niche by primarily focusing on tech startups that champion sustainable practices. His investment philosophy aligns with his well-known advocacy for environmental conservation, directing capital towards innovations that offer long-term ecological and economic benefits.

DiCaprio’s discerning eye for impact-driven ventures is evident in his notable portfolio investments. These include Casper, the popular mattress company, and Rubicon, a leading provider of sustainable waste and recycling solutions. He has also backed MindMaze, a Swiss neurotechnology company, demonstrating a breadth of interest that extends to health and advanced tech. His commitment to transforming food production is further evidenced by investments in Mosa Meat (Netherlands) and Aleph Farms (Israel), both pioneers in cultivated meat technologies.

These strategic investments highlight DiCaprio’s understanding that addressing global challenges like climate change and sustainable living requires innovative technological solutions. By backing companies that are at the forefront of these transitions, he is not merely investing for financial returns but also actively contributing to a more sustainable future. With an estimated net worth of $300 million, Leonardo DiCaprio’s influence as an investor reinforces his status as a visionary both on and off the screen, driving capital towards purposeful innovation.

Read more about: Prepare to Scream: The 12 Mind-Bending Movie Plot Twists That Still Leave Us Totally Speechless!

9. **Nasir “Nas” Jones**The hip-hop luminary Nasir “Nas” Jones has made a remarkably successful transition into the world of venture capital, establishing himself as a highly influential investor. He co-founded QueensBridge Venture Partners, a firm based in Los Angeles, California, in 2014. Under his leadership, QueensBridge Venture Partners has built a robust portfolio, having made over 130 investments across various industries, managing around $140 million in assets.

The firm’s investment focus spans across tech, consumer products, and digital media, reflecting Nas’s keen understanding of evolving market trends and cultural shifts. Among its notable portfolio investments are innovative companies such as Soma Water, a purveyor of sustainable filtration systems, Ring, the smart home security company, and Casper, the direct-to-consumer mattress brand. These investments underscore a strategy of backing companies that enhance daily living and embrace technological advancements.

Beyond his institutional endeavors with QueensBridge Venture Partners, Nas is also a prolific angel investor, having personally backed more than 50 companies, according to PitchBook. His diverse angel portfolio includes widely recognized platforms like SeatGeek, the ticket marketplace, Robinhood, the commission-free trading platform, and Coinbase, a leading cryptocurrency exchange. He has also invested in the fintech Mercury, demonstrating a broad and insightful engagement with the burgeoning digital economy, further cementing his legacy as a multifaceted force in both music and finance. With a formidable net worth estimated at $70 million, Nas continues to shape the investment landscape with strategic foresight.

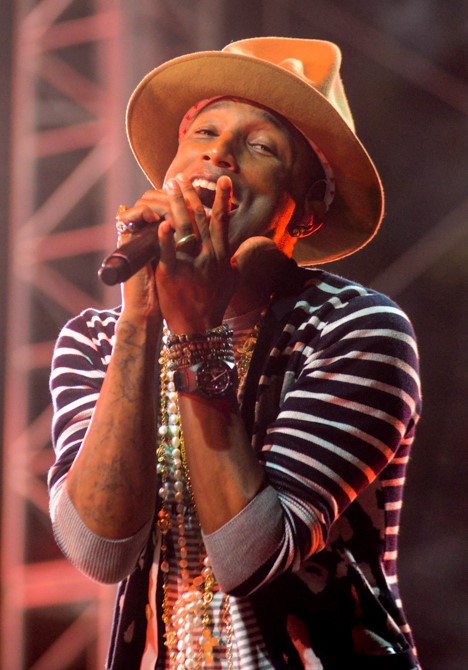

10. **Pharrell Williams**Pharrell Williams, the versatile American record producer, rapper, singer, songwriter, and fashion designer, has also made a significant mark in the investment world, with six notable investments under his belt. His entrepreneurial spirit extends to co-founding UJAM, an innovative company focusing on music technology, which aligns perfectly with his creative background.

As an individual angel investor, Williams has strategically directed his capital towards sectors that resonate with his vision for technological advancement and accessible education. His primary investment focus encompasses EdTech, electronics, and information services, reflecting a belief in the power of knowledge and technology to shape future generations. This targeted approach positions him as an investor keenly interested in societal and cultural impact.

Among his standout investments are Genius, the popular online music encyclopedia and knowledge platform, and ROLI (UK), a company renowned for its innovative musical instruments and software. He has also backed Boddle, an adaptive learning platform that uses AI and gamification to help K-6 students master math. With a substantial net worth estimated at $250 million, Pharrell Williams exemplifies how creativity and financial acumen can converge to support groundbreaking companies, pushing boundaries in both artistic and technological realms.

Read more about: A Melancholy Note: Reflecting on the Enduring Legacies of 15 Jazz Legends We Lost in 2024-2025

11. **Priyanka Chopra-Jonas**Actress Priyanka Chopra-Jonas has emerged as a savvy angel investor, carefully building a portfolio of eight strategic investments that reflect her diverse interests and global perspective. One of her most significant involvements is with the dating platform Bumble, which she not only invested in but also played a crucial advisory role in its launch in India back in 2018, leveraging her influence to connect with a vast market.

Chopra-Jonas’s investment focus is broad, encompassing Food & Beverages, Social/Platform Software, and Real Estate, showcasing a keen understanding of consumer trends and lifestyle brands. Her choices demonstrate a preference for companies that are either disrupting established industries or creating new avenues for social connection and personal well-being. This strategic diversity highlights a thoughtful approach to wealth management and impact.

Beyond Bumble, her notable portfolio investments include Perfect Moment (UK), a luxury athleisure brand, and Apartment List (US), a digital platform revolutionizing apartment rentals. Furthermore, she co-invested in the popular beverage brand Olipop, aligning with other celebrity investors such as Katy Perry. These investments underscore her commitment to backing innovative companies that cater to modern consumer demands and contribute to community and lifestyle improvements, solidifying her position as a discerning and influential investor.

Read more about: Priyanka & Nick: Inside Their Global Love Story, Family Adventures, and Baby Malti’s Joyful Journey

12. **Robert Downey Jr.**Robert Downey Jr., widely recognized for his iconic portrayal of Iron Man, has proven to be a real-life superhero in the venture capital world, particularly through his dedication to sustainable technologies. He founded FootPrint Coalition Ventures in 2021, a prominent investment fund based in Beverly Hills, California. The firm is specifically focused on backing companies that are developing innovative solutions for environmental challenges.

FootPrint Coalition Ventures has rapidly made over 20 investments, channeling capital into sectors critical for a sustainable future. Its investment focus includes Data & Analytics, Energy, Food & Agriculture, Homes & Building, and Mobility, all with an underlying emphasis on eco-friendly advancements. This strategic approach highlights Downey Jr.’s personal commitment to addressing climate change and promoting a greener economy.

Among the notable portfolio investments are RWDC Industries (US), which develops biodegradable polymers as alternatives to single-use plastics, Ynsect (France), a leader in insect farming for protein and fertilizer, and Albedo (US), a company focused on very high-resolution earth imaging. These investments not only aim for significant financial returns but also strive to create tangible positive impacts on the planet. Robert Downey Jr.’s journey as a venture capitalist underscores a powerful narrative: leveraging celebrity influence and substantial capital to drive meaningful change in the world of sustainable technology.

Read more about: The Surprising Twist: 14 Times Supporting Actors Totally Stole The Show (And Our Hearts!)

13. **Serena Williams**Tennis legend Serena Williams has transitioned her championship mindset from the court to the boardroom, establishing herself as a formidable force in the venture capital landscape. As the founder of Serena Ventures, launched in 2014, she has cultivated an investment philosophy centered on backing companies that embrace diverse leadership, individual empowerment, creativity, and opportunity. This ethos reflects her own trailblazing career and commitment to social impact.

Serena Ventures boasts an impressive track record, having made over 90 investments to date across a wide array of high-growth sectors. Her firm’s investment focus is notably diverse, including e-commerce, Fintech, Health, Sports & Wellness, Web3, Edtech, Enterprise, Social Tech, and Climate Tech. This comprehensive approach underscores her belief in supporting innovative businesses that are shaping the future across multiple industries.

Among her notable portfolio investments are MasterClass (US), the online education platform offering courses from experts; Billie (US), a leading women’s razor and body care brand focused on inclusivity; and Daily Harvest (US), a subscription service for healthy, organic, plant-based foods. These investments collectively illustrate Serena Williams’s strategic vision: to not only generate strong financial returns but also to foster a more equitable and innovative entrepreneurial ecosystem, particularly by uplifting underrepresented founders and diverse teams.

Read more about: Behind the Spotlight: 14 Stars We’ve Adored Who Committed Shameful Acts That Still Make Us Cringe

14. **Shawn “Jay-Z” Carter**Shawn “Jay-Z” Carter, an undisputed music mogul and one of the most successful rappers of all time, has also established himself as a highly astute investor and entrepreneur. His investment journey has evolved significantly, initially through Roc Nation, which he co-founded in 2008, and its venture arm, Arrive Opportunities Management. More recently, he co-founded MarcyPen Capital Partners, stemming from the merger of his Marcy Venture Partners with Pendulum Holding’s investment arm Pendulum Opportunities, which itself was founded in 2019.

MarcyPen Capital Partners, and its predecessors, have made over 50 investments, targeting a diverse range of high-growth sectors. The firm’s investment focus includes Consumer Products, Consumer Services, e-commerce, Micro-mobility, Robotics, Drones, Virtual Reality, Ephemeral Content, and Mobile Commerce. This broad scope demonstrates a forward-thinking approach to identifying and supporting companies that are at the cutting edge of consumer technology and digital innovation.

Among the notable portfolio investments from these ventures are Altro (US), a credit-building platform; Babylist (US), a popular baby registry service; and Rihanna’s Savage x Fenty (US), a groundbreaking lingerie brand. As an angel investor, Jay-Z has also made at least 27 investments, according to PitchBook, backing companies such as Oatly, the plant-based milk company; Flowhub, a cannabis retail software platform; Impossible Foods, a leader in plant-based meats; and the luggage company Away. His multifaceted investment strategy solidifies his position as a powerful figure in both the entertainment and financial worlds, consistently identifying and nurturing companies poised for significant market impact.

As this in-depth exploration concludes, it becomes undeniably clear that the landscape of startup investment has dramatically diversified, welcoming influential figures from the entertainment industry with open arms. These celebrated individuals are not merely celebrity endorsers; they are astute venture capitalists, leveraging their substantial wealth, strategic insights, and unparalleled platforms to drive innovation across critical sectors. From fostering sustainable technologies to championing health tech, e-commerce, and social platforms, these A-listers are actively shaping the future of business. Their collective impact underscores a powerful paradigm shift, where star power now directly fuels the engine of entrepreneurship, proving that true influence extends far beyond the red carpet and into the very fabric of our evolving global economy. The fusion of celebrity and capital is not just a passing trend; it is a defining characteristic of modern investment, promising continued disruption and groundbreaking advancements for years to come.