Everyone recognizes names like Kim Kardashian, Ashton Kutcher, or Rafael Nadal. However, what often remains behind the scenes is a lesser-known — yet increasingly relevant — facet of these celebrities: their profound engagement in the world of private equity and hedge funds. These aren’t mere endorsements; these are strategic, often deeply personal, ventures that leverage their unique influence, vast networks, and astute business acumen to shape industries and accumulate significant wealth.

Indeed, the intersection of business and entertainment has become more seamless than ever, with celebrity investors emerging as powerful influencers in the financial world. They are proving that fame, when paired with strategic investment decisions, can yield substantial financial returns and foster meaningful innovation. The era of simply lending a name to a product is evolving into one where stars are actively creating, owning, and expanding their businesses, driving market trends and establishing formidable financial legacies.

This article takes an in-depth look into the strategies, major investments, and unparalleled business skills of 14 leading celebrity investors. From founding their own private equity firms and venture capital funds to making shrewd deals in technology, real estate, and media, these individuals illustrate how linking investments with personal brands and interests can lead to major wealth and lasting influence, marking a significant shift from mere celebrity to astute business leader in the modern financial landscape.

1. **Kim Kardashian: The Private Equity Powerhouse**One of the most notable initiatives in the celebrity investment sphere comes from Kim Kardashian, who has transitioned from reality television star to a formidable private equity firm founder. Her journey into this high-stakes world was driven by firsthand experience, having successfully navigated the sale of stakes in her own brands, KKW Beauty and SKIMS, which were jointly valued at over $5 billion. This direct engagement provided her with invaluable insights into the mechanics of private market transactions and the potential for scaling iconic brands.

In 2022, Kardashian co-launched SKKY Partners with Jay Sammons, a former senior executive at Carlyle, signaling her serious commitment to the financial sector. She identified private equity as a powerful platform to significantly scale established, iconic brands. The fund’s ambitious goal is to acquire both minority and controlling stakes in high-growth companies that demonstrate clear leadership within their respective markets, aiming to nurture them towards even greater success. This strategy is a testament to her vision for identifying untapped potential in consumer-facing businesses.

Kardashian’s investment philosophy for SKKY Partners is deeply aligned with her personal brand and entrepreneurial journey. In her own words, she expressed her excitement to “invest… leveraging my experience in building and scaling global businesses and partnering with innovative companies to help them grow.” This proactive approach sees her applying the lessons learned from her own billion-dollar ventures to a broader portfolio. SKKY’s current investments reflect this clear and coherent alignment, focusing on aspirational consumer products, including luxury skincare brand 111SKIN and TRUFF, which specializes in gourmet truffle-based products. These choices highlight a sophisticated understanding of consumer trends and market positioning, mirroring the success she achieved with Skims, which alone achieved a valuation of $4 billion in 2023, and her strategic $200 million sale of a 20% stake in KKW Beauty in 2020.

Read more about: Kim Kardashian’s True ‘Secrets’ for Shaping Her Billion-Dollar Image (and What It Means for Your Wellness Journey)

.jpg/640px-Ashton_Kutcher_-_2023_-_P060603-652701_(cropped).jpg)

2. **Ashton Kutcher: The Tech Visionary in Venture Capital**Ashton Kutcher, widely recognized for his roles in Hollywood comedies, has quietly built an equally strong and perhaps even more impactful reputation as a shrewd tech investor. Far from the glitz of the silver screen, Kutcher has demonstrated a remarkable ability to identify and back nascent technology companies with groundbreaking potential. His strategic foresight has positioned him as a key player in the venture capital landscape, proving that a keen eye for innovation can translate into substantial financial success.

In 2015, Kutcher solidified his presence in the investment world by co-founding Sound Ventures with entrepreneur Guy Oseary. This venture capital fund operates on the principle of investing in startups or early-stage companies that exhibit high growth potential. The fund’s objective extends beyond mere capital injection; it aims to increase the value of these companies by providing essential infrastructure and strategic support necessary for their robust development. This hands-on approach reflects a deep understanding of what it takes for a young company to thrive in a competitive market.

Sound Ventures has an impressive track record of backing major industry players during their formative stages. The fund anticipated the monumental success of platforms such as Uber, Spotify, Robinhood, and Airbnb, investing in them early on. Today, Sound Ventures continues to demonstrate its adaptability and forward-thinking approach by increasingly focusing on the rapidly evolving field of artificial intelligence. This includes a dedicated investment fund specifically geared towards this booming technology sector, with none other than OpenAI featuring prominently among its portfolio companies, underscoring Kutcher’s commitment to staying at the forefront of technological advancement and investment opportunity.

Read more about: Money Moves: What We Can Learn from Celebrity Financial Wins and Woes

3. **Will Smith: Quietly Cultivating Tech through Dreamers VC**While his acting career has long placed him in the global spotlight, Will Smith has carved out a more reserved but equally impactful profile in the investment world. Eschewing the more public-facing ventures, Smith has chosen a strategic path into financing tech companies with strong potential, demonstrating a nuanced understanding of long-term growth and innovation. His investment approach highlights a preference for backing transformative technologies that promise to reshape various aspects of modern life, aligning with a quiet ambition for significant influence.

Smith’s primary vehicle for these ventures is Dreamers VC, a firm he co-founded with Japanese footballer Keisuke Honda. This partnership itself is noteworthy, bringing together diverse backgrounds to identify and nurture cutting-edge companies. Through Dreamers VC, Smith is actively involved in the intricate process of identifying and financing technology enterprises that are poised for substantial disruption and expansion. This meticulous involvement underscores a commitment that goes beyond simply providing capital, leaning into the ethos of a strategic partner.

Dreamers VC’s portfolio offers a fascinating glimpse into Smith’s forward-thinking investment philosophy. It notably includes names like Oura, a company at the forefront of wearable wellness technology, emphasizing his interest in health and personal data innovation. Perhaps even more significantly, the portfolio also features Neuralink and The Boring Company, both ambitious ventures led by the iconic innovator Elon Musk. These investments not only showcase a willingness to engage with high-risk, high-reward opportunities but also indicate a profound belief in the transformative power of groundbreaking scientific and engineering endeavors, positioning Smith as a discerning patron of the future.

4. **Rafael Nadal: The Ace of Real Estate Investing**From dominating clay courts to strategically investing in tangible assets, Rafael Nadal has demonstrated that his disciplined approach extends far beyond professional tennis. While his athletic achievements are legendary, Nadal has made a significant — though less publicized — foray into private markets, establishing himself as a shrewd investor with a clear and coherent strategy focused on stability and long-term value. His transition showcases a meticulous dedication to building enduring wealth through carefully considered financial moves, reflecting the same focus he brings to his sport.

Nadal’s primary investment vehicle is Mabel Capital, a firm he co-owns, through which he has established an investment strategy focused primarily on premium real estate. This focus on tangible assets, particularly in the high-value property sector, is a hallmark of a conservative yet highly effective wealth management approach. Rather than chasing fleeting trends, Nadal has chosen a sector known for its stability and potential for consistent appreciation, allowing him to leverage his significant earnings into robust, long-term assets. This measured strategy underscores a deep understanding of market fundamentals and a preference for predictable returns.

Through Mabel Capital, Nadal manages a significant portion of his substantial wealth within a professional, long-term structure. This indicates a commitment to sophisticated financial planning and a recognition of the importance of expert oversight in managing complex assets. His approach is not merely transactional; it is holistic, designed to preserve and grow capital over decades, rather than months or years. By channeling his resources into carefully selected premium real estate, Nadal exemplifies how even the most high-profile athletes can build a durable financial legacy, leveraging the same strategic thinking that defines their legendary careers into the world of investment.

5. **Pau Gasol: Investing in the Spanish Startup Ecosystem**Pau Gasol, another Spanish sporting icon, has seamlessly transitioned his strategic prowess from the basketball court to the investment arena. Recognizing the burgeoning opportunities within the startup landscape, Gasol has channeled his entrepreneurial spirit into venture capital, particularly focusing on sectors where his expertise and influence can provide significant added value. His investment vehicle, Gasol16 Ventures, represents a thoughtful and targeted approach to supporting innovation and growth, especially within his home country.

Gasol16 Ventures is explicitly structured as a VC investment vehicle, signaling its dedication to funding early-stage companies with high growth potential. The firm distinguishes itself through its specialization, focusing on three key areas: sports, health, and strategic advisory. This specialization is a clear reflection of Gasol’s personal background and professional networks, allowing him to offer more than just capital. His insights as a world-class athlete in health and sports provide invaluable mentorship and strategic guidance to the startups within his portfolio, enhancing their chances of success.

Furthermore, Gasol16 Ventures places a particular emphasis on the Spanish startup ecosystem. This localized focus not only contributes to the economic development of his home nation but also allows for a deeper understanding of regional market dynamics and a more hands-on approach to nurturing local talent. By concentrating on sports, health, and strategic advisory within Spain, Gasol is building a robust portfolio that benefits from both his personal brand and a well-defined market niche, demonstrating how celebrity status can be effectively leveraged to foster innovation and create economic impact in specific, targeted sectors.

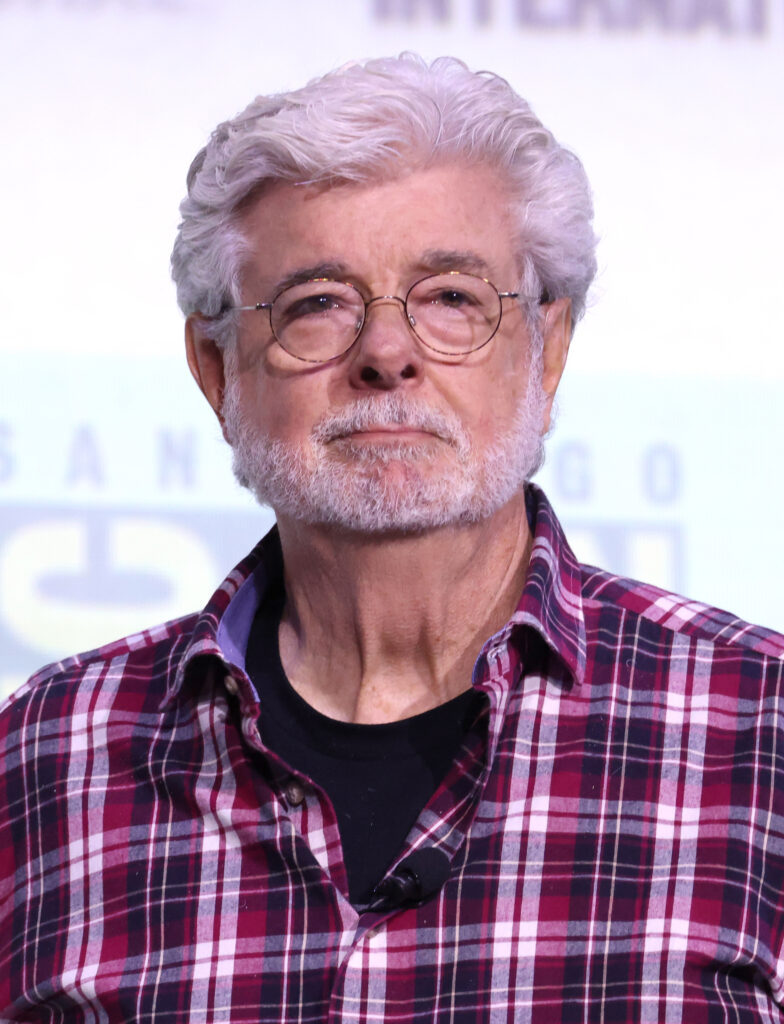

6. **George Lucas: The Architect of a Billion-Dollar Creative Empire**George Lucas, the visionary filmmaker behind the iconic Star Wars saga, stands at the pinnacle of celebrity investors, his net worth of $5.5 billion a testament to unparalleled creative genius coupled with extraordinary business acumen. His financial empire is not merely a byproduct of blockbuster films but the result of meticulously structured deals and a profound understanding of intellectual property rights. Lucas’s journey exemplifies how artistic vision can be translated into a lasting and monumental financial legacy, fundamentally reshaping the entertainment industry’s business model.

The cornerstone of Lucas’s immense fortune is deeply rooted in the success of Lucasfilm. The pivotal moment arrived in 2012 when he made the strategic decision to sell his production company to Disney for an astounding sum of over $4 billion in a combination of cash and stock. This transaction was not just a sale; it was a masterstroke that monetized decades of groundbreaking work and meticulous brand building. It secured his financial future while ensuring the continued legacy of his beloved franchises under one of the world’s largest entertainment conglomerates.

Beyond the revolutionary act of filmmaking, Lucas demonstrated formidable business acumen through his forward-thinking investments in technology and production facilities. These ventures laid the groundwork for future innovations in cinema and contributed significantly to his immense wealth, proving his vision extended beyond storytelling to the very infrastructure of media creation. However, perhaps his most savvy decision, the one that truly catapulted him into the billionaire bracket, was retaining the licensing and merchandising rights to Star Wars. This move created an enduring revenue stream that continuously generated substantial income, showcasing his strategic thinking and pioneering approach to monetizing intellectual property long before it became a standard industry practice, defining a new era for creators and their control over their creations.

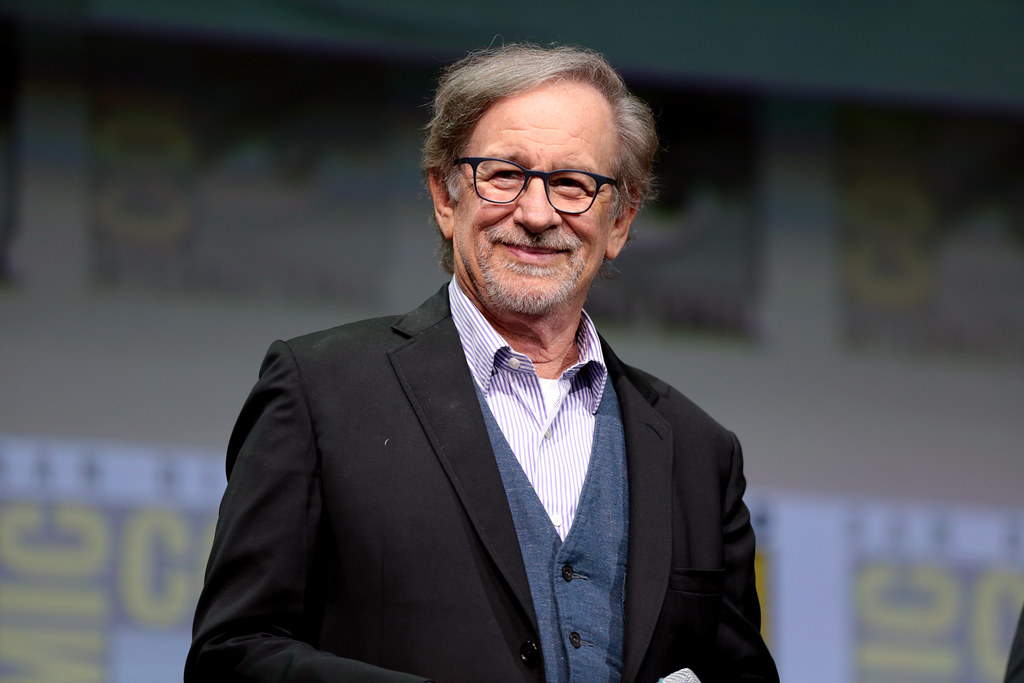

7. **Steven Spielberg: The Maverick Director and Master Dealmaker**Steven Spielberg, a name universally synonymous with blockbuster cinema, has not only defined generations of filmmaking but has also amassed a colossal net worth of $4.8 billion through innovative deals and sustained, strategic investments. His financial prowess is as legendary as his cinematic achievements, positioning him as a trailblazer among celebrity investors. Spielberg became the first director to ever land on the Forbes billionaires list in 1994, a testament to his extraordinary ability to leverage his creative genius into an enduring financial empire that continues to grow.

Spielberg’s unique path to wealth was forged through a series of unprecedented negotiations that fundamentally altered how directors could benefit from their work. He famously secured lucrative percentages of gross sales for his films, a departure from traditional fixed fees. This visionary approach allowed him to directly share in the immense commercial success of his iconic hits, including the terrifying sensation of “Jaws,” the awe-inspiring spectacle of “Jurassic Park,” and the poignant historical drama of “Schindler’s List.” These deals showcased his calculated moves to maximize returns, ensuring his participation in the long-term profitability of his creative endeavors, a model that few filmmakers before him had achieved.

His strategic acumen extended far beyond the immediate success of his films. Spielberg’s long-term vision for diversifying income sources is evident in his continued revenue streams from theme park royalties. This consistent influx of capital, stemming from the enduring popularity of attractions based on his films, highlights a profound understanding of how to build and maintain multi-faceted financial assets. By meticulously negotiating these long-term agreements, Spielberg not only capitalized on his immediate successes but also created a self-sustaining financial ecosystem that continues to generate wealth, solidifying his status as a true titan of both entertainment and investment, demonstrating a masterclass in combining artistic passion with astute business strategy.” , “_words_section1”: “1942

Continuing our exploration into the financial sagacity of global icons, we now turn our attention to seven additional titans who have redefined wealth creation, demonstrating mastery across diverse markets from sports and media to fashion and consumer goods. Their strategic acquisitions, intellectual property leverage, and broad diversification strategies have firmly cemented their status as influential business leaders and billionaire investors, showcasing a powerful evolution from mere celebrity to formidable financial powerhouse.

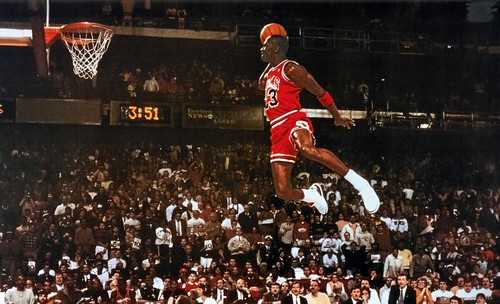

8. **Michael Jordan: The Billionaire Blueprint in Sports and Beyond**Michael Jordan, an undisputed basketball legend, transitioned his unparalleled athletic career into becoming the first billionaire athlete in 2015. His remarkable wealth is a masterclass in strategic brand building and investment, showcasing a profound understanding of how to leverage global recognition far beyond the court. This journey exemplifies a shift from sports icon to astute business magnate.

The cornerstone of Jordan’s financial empire is his enduring partnership with Nike’s Jordan Brand, which began in 1984. This collaboration evolved into a distinct, globally impactful entity, ensuring a consistent and massive revenue stream that solidified its place as one of the most successful athlete-led brands in history. Its cultural resonance and commercial success remain unparalleled.

Further demonstrating his strategic foresight, Jordan acquired the Charlotte Hornets in 2010 for $175 million, a bold move into sports ownership. His patience and acumen were profoundly rewarded when he sold the team in 2023 for an astonishing $3 billion. This transaction not only significantly boosted his net worth but also underscored his ability to identify undervalued assets and steer them to immense profitability, cementing his legacy as a brilliant investor.

9. **Oprah Winfrey: Media Mogul and Diversified Investor**Oprah Winfrey’s ascent from media pioneer to one of the world’s most influential billionaire investors is a remarkable narrative of strategic vision and relentless enterprise. Achieving the distinction of being the first black female billionaire in 2003, her financial success is deeply rooted in her groundbreaking media work and consistently astute investment strategies across various sectors.

The foundation of Winfrey’s immense fortune was built upon her pioneering “The Oprah Winfrey Show,” which she masterfully transformed into a syndicated empire. Her strategic decision to gain ownership and control over her content allowed her to build a media production powerhouse that continues to generate substantial returns. This early move into media ownership served as a powerful template for many who followed.

Her diversified investment approach is evident in her extensive real estate holdings across the United States, providing stable asset appreciation and a significant pillar of her wealth. Additionally, her strategic stake in WeightWatchers, despite her recent departure from its board, illustrated a willingness to invest in brands aligned with personal values and societal impact. Oprah’s influence and financial acumen continue to shape industries and inspire new generations of entrepreneurs.

10. **Jay-Z: Hip-Hop’s First Billionaire and Investment Innovator**Shawn Carter, globally renowned as Jay-Z, has masterfully transformed his iconic status in hip-hop into a sprawling, diversified investment portfolio, earning him the distinction of being the genre’s first billionaire. His business empire showcases a visionary approach, seamlessly blending cultural relevance with sophisticated financial strategy across music, entertainment, and luxury consumer goods.

Jay-Z’s genius is particularly evident in his lucrative ventures into luxury beverages. The strategic sale of his acclaimed champagne brand, Armand de Brignac, to LVMH, and a majority stake in his D’Usse cognac label to Bacardi, collectively added hundreds of millions to his fortune. These deals were meticulously orchestrated exits designed to maximize value and affirm his reputation as a shrewd negotiator in the high-stakes world of luxury branding.

Beyond high-profile consumer brands, Jay-Z’s holdings extend into dynamic tech and financial services sectors. He holds significant stakes in giants like Uber, demonstrating an early recognition of disruptive innovation, and financial services firms such as Block. These investments highlight a well-rounded approach that balances brand-aligned ventures with strategic placements in burgeoning technology and finance landscapes, continuously expanding his influence and wealth through astute market moves.

11. **Peter Jackson: From Middle-earth to Billionaire Investor**Peter Jackson, the visionary director globally celebrated for bringing “The Lord of the Rings” and “The Hobbit” to cinematic life, has achieved billionaire status through exceptionally strategic business decisions alongside his artistic triumphs. His journey exemplifies the potent combination of profound creative talent with a precise understanding of investment and critical market timing.

A significant catalyst for Jackson’s financial ascent was his pioneering visual effects company, Weta Digital. This enterprise became a beacon of innovation in entertainment technology, renowned for its groundbreaking contributions to cinema. Jackson’s foresight in nurturing this technological powerhouse proved incredibly valuable, transforming a creative endeavor into a major, highly sought-after asset.

In 2021, Jackson executed a pivotal deal, selling significant assets of Weta Digital to Unity Software for a staggering sum close to $1 billion in cash and stock. This transaction was a masterstroke, illustrating his expertise in recognizing opportune moments to divest from a highly successful venture at its peak valuation. This move solidified his place among leading celebrity investors, demonstrating a unique ability to translate creative innovation into immense financial success and long-term wealth.

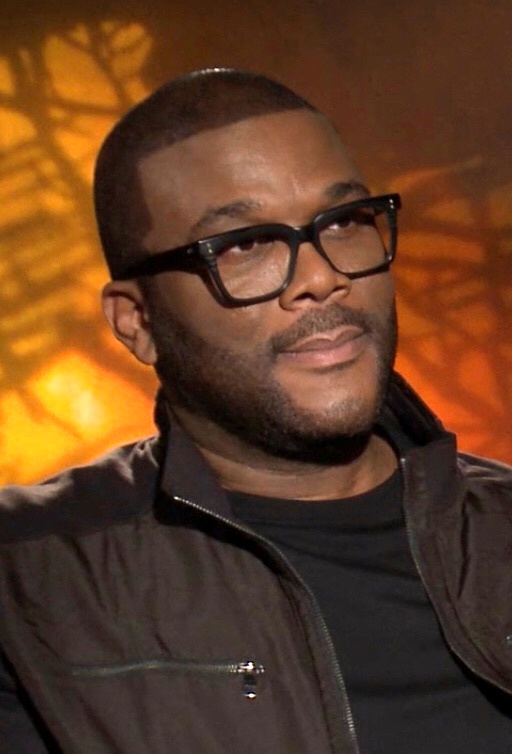

12. **Tyler Perry: The Independent Empire Builder**Tyler Perry stands as a towering figure in entertainment, not just for his prolific output as a creator and actor, but profoundly for his unwavering commitment to maintaining control over his vast production empire. His steadfast ownership of intellectual property and production facilities has been the bedrock of his journey into the billionaire club, setting a powerful precedent for financial independence in Hollywood.

Perry’s unparalleled success stems from a vertically integrated model, enabling him to create, produce, and distribute his content with minimal external interference. This comprehensive control extends to his magnificent Atlanta-based Tyler Perry Studios, among the largest and most advanced production facilities in the U.S. This strategic asset not only houses his extensive productions but also generates substantial revenue by hosting other major industry projects.

This level of ownership and operational self-sufficiency has been instrumental in securing Perry’s financial independence and propelling him to billionaire status. By foregoing traditional studio deals that often dilute creative and financial control, he has built an autonomous entity that maximizes profit margins and artistic freedom. His model demonstrates how strategic self-reliance can lead to enduring wealth and a singular force reshaping industry norms.

13. **Rihanna: The Fenty Billionaire in Beauty and Fashion**Rihanna, the global music superstar, has definitively transcended her celebrated career in entertainment to become an iconic business mogul. She has built a robust investment portfolio anchored by two billion-dollar ventures: Fenty Beauty and Savage X Fenty, exemplifying a modern celebrity’s ability to leverage unparalleled brand influence into highly profitable, disruptive business endeavors across the consumer market.

Her groundbreaking foray into cosmetics began with Fenty Beauty in 2017, a strategic partnership with luxury goods powerhouse LVMH. This venture instantly disrupted the beauty industry with its unprecedented emphasis on inclusivity, offering an expansive range of foundation shades for a diverse global audience. Fenty Beauty’s innovative approach and immediate commercial success quickly established it as a billion-dollar brand, showcasing Rihanna’s keen eye for market gaps and consumer demand.

Following this triumph, Rihanna expanded her entrepreneurial reach with Savage X Fenty, a lingerie brand that similarly challenged industry norms through its inclusive sizing and diverse marketing. This venture rapidly ascended to a billion-dollar valuation, further cementing her status as a visionary businesswoman capable of transforming industries through authenticity and a consumer-first approach. Her investments prove that an authentic connection with her audience can be channeled into extraordinary financial and cultural influence.

Read more about: 11 Former Movie Stars Who Mastered Simple Career Moves to Achieve Billionaire Status

14. **Tiger Woods: The Enduring Legacy of an Athlete-Investor**Tiger Woods, a name synonymous with golf greatness, has not only dominated the greens for decades but has also seamlessly transitioned into the exclusive ranks of athlete billionaires. While his financial ascent was significantly bolstered by an illustrious career with earnings surpassing $1.7 billion largely from endorsements, it is increasingly defined by astute strategic business decisions extending far beyond traditional sponsorships.

The bedrock of Woods’ early wealth accumulation was his extensive and long-standing partnership with Nike, a collaboration that became a cornerstone of his brand and financial success for decades. This symbiotic relationship demonstrated the immense power of aligning a global sports icon with a leading athletic brand, creating an enduring legacy that resonated worldwide.

However, Woods’ entrepreneurial spirit truly shone as he ventured into independent business initiatives. After concluding his foundational deal with Nike, he strategically launched his own clothing line, Sun Day Red, a proactive move to maintain and grow his financial empire. His investments in the sports and lifestyle sectors underscore a comprehensive strategy to sustain and grow wealth through diversified business activities, showcasing a profound ability to evolve his wealth generation strategies over a multi-decade career.

**The Evolving Landscape of Celebrity Investment**

The celebrity investment landscape in 2024 is unequivocally dynamic, characterized by a profound shift from mere endorsement to active, strategic engagement. The individuals highlighted in this comprehensive article – from tech visionaries and real estate moguls to media giants and fashion disruptors – bring more than just their capital to the table; they contribute their vast networks, unparalleled influence, and acute business acumen to every venture they undertake. These influential figures are not merely passive investors; they are active shapers of industries, driving innovation and influencing public opinion with every strategic move.

By diversifying their portfolios across burgeoning sectors such as technology, media, sports, and consumer products, these leading celebrity investors are setting a new benchmark for wealth creation and societal impact. Their commitment to building formidable financial legacies through thoughtful, often personally aligned, investments illustrates a powerful synergy between fame and fortune. As these titans continue to broaden their portfolios and back projects that resonate with their visions, they illuminate a path for future generations of celebrities to engage in meaningful and financially impactful ventures, proving that influence, when strategically applied, can indeed translate into extraordinary economic leadership.