In the rarefied air of the automotive luxury market, the conventional wisdom often dictates that a truly exceptional experience comes with a price tag well north of $150,000. Yet, as the industry evolves at a blistering pace, a fascinating new dynamic is emerging, challenging these long-held assumptions. Our latest insights into the luxury-automobile market reveal a significant transformation, particularly within the segment typically priced from $80,000 to $149,000, which is rapidly gaining ground and offering features that once belonged exclusively to its ultra-premium counterparts.

This shift isn’t about finding a needle in a haystack; it’s about fundamental market forces reshaping what luxury means and how it’s delivered. While the mainstream automotive market largely stagnates, the luxury segments are set for robust growth, ranging from 8 to 14 percent annually through 2031, driven by an expanding demographic of high-net-worth individuals and significant technological advancements. This burgeoning environment fosters intense competition, especially in the entry-luxury tier, prompting manufacturers to imbue these vehicles with a level of sophistication and desirability that can indeed rival models commanding twice their price.

Through this in-depth exploration, we will dissect the pivotal trends and innovations detailed in our latest research that are empowering vehicles in the $80,000-and-above segment to redefine the luxury landscape. From the strategic influx of new market attackers and the pervasive march of electrification to the transformative power of direct-to-consumer models and hyper-personalization, these developments are collectively creating a compelling value proposition that demands attention. Prepare to discover how the lines between luxury tiers are blurring, offering an unprecedented opportunity for discerning buyers in 2025 and beyond.

1. **Explosive Growth in the Entry-Luxury Segment**The luxury car market, particularly its entry-level segment as defined by vehicles priced from $80,000 to $149,000, is currently a hotbed of activity, presenting a compelling narrative of growth and intensified competition. Our analysis highlights that this price band is poised for remarkable expansion, with expectations of growing by “more than 8 percent per year, exceeding three million units, more than double 2021 volumes” by 2031. This isn’t mere incremental growth; it’s a profound market reorientation that signifies an explosion of choice and value for consumers.

This significant surge in volume within the segment is not occurring in a vacuum. It is primarily fueled by what our research identifies as “rising competitive intensity due to the growing importance of new attackers.” These new entrants are not just adding numbers; they are bringing fresh perspectives, innovative technologies, and agile business models that challenge the established order. Their aggressive push into this segment is a clear indication that they see immense potential, and their strategies are geared towards capturing market share by offering compelling value propositions.

Furthermore, while new attackers are shaking things up, incumbent luxury manufacturers are far from stagnant. The report notes that “Incumbents will continue to dominate the market through timely product upgrades and new launches.” For instance, a “leading German OEM in the $80,000-to-$149,000 segment will likely launch up to five new products,” a testament to the fact that established players are keenly aware of the evolving competitive landscape and are responding with substantial investments in product development.

The sheer scale of this growth, doubling volumes in a decade, inherently translates to economies of scale and a wider array of options previously unheard of at this price point. As the market expands, consumers gain access to more sophisticated features, enhanced performance, and elevated luxury experiences, effectively raising the bar for what an $80,000-$149,000 vehicle can offer. This robust competition is precisely what allows these vehicles to begin to rival the perceived value and capabilities of models traditionally found in the $150,000+ segment.

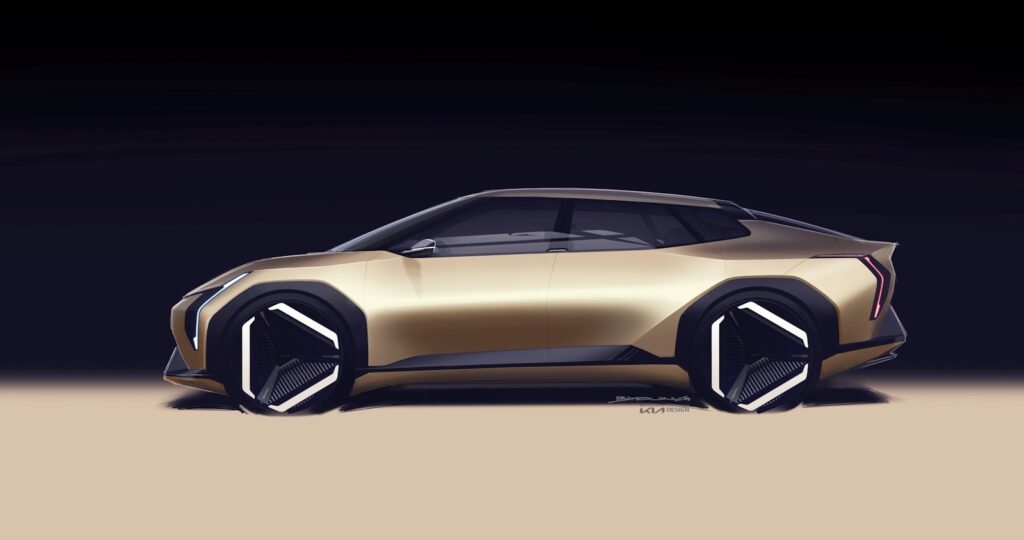

2. **The Electrification Imperative**The automotive landscape is unequivocally shifting towards electrification, and this transformation is particularly pronounced and strategic within the luxury segments. Our research, conducted under an “accelerated scenario,” projects that “battery-electric vehicles (BEVs) will be dominant across all luxury-segment tiers by 2031.” This isn’t just an environmental mandate; it’s a powerful differentiator that is redefining performance, luxury, and brand identity, especially for those vehicles seeking to punch above their traditional price class.

Affluent customers, critical to the luxury market’s growth, are increasingly open to embracing this electric future. The report highlights that “more than 70 percent of current owners of premium and luxury internal-combustion-engine (ICE) vehicles are willing to switch to EVs during their next vehicle purchase.” This willingness is driven by a confluence of factors, including growing awareness and valuation of sustainability, coupled with the inherent performance advantages that electric powertrains offer—instant torque, silent operation, and seamless acceleration. These attributes are becoming synonymous with modern luxury, and their integration into vehicles in the $80,000-$149,000 segment elevates their competitive standing.

Moreover, the strategic timing and depth of EV adoption vary across price bands, but the direction is clear. The $80,000-to-$149,000 price band is expected to achieve “65 to 75 percent electrification” by 2031, a substantial penetration rate that underscores the industry’s commitment to delivering advanced electric options at this level. This high rate of electrification means that entry-luxury buyers will not be settling for compromised technology but will instead be at the forefront of automotive innovation, accessing performance and features that are becoming benchmarks for the entire luxury sector, irrespective of price.

The influx of EV-focused disruptors plays a crucial role here, as they are not burdened by legacy combustion-engine issues. These new players, alongside mainstream luxury brands, are already offering advanced EV models. By introducing cutting-edge electric technology, often featuring superior connectivity and driver-assistance systems, vehicles in this foundational luxury segment are delivering an experience that often mirrors, or even surpasses, the technological prowess of more expensive, older-generation ICE luxury models, thus truly rivaling their capabilities.

Read more about: Buyer Beware: 12 Critical Reasons Why a Ford Might Not Be Your Best Investment

3. **SUV Redefining Luxury Mobility**The unwavering global popularity of Sports Utility Vehicles (SUVs), a trend that began in the early 2000s, is now profoundly shaping the luxury electric vehicle market, extending its influence across all luxury tiers. Our research clearly indicates that “SUVs will likely dominate the luxury-EV market,” a testament to their broad appeal driven by “perceived safety, convenience, styling, and practicality.” This dominance is migrating with significant force into the electrified space, profoundly impacting how luxury value is delivered and perceived, especially in segments around the $80,000 mark.

The shift is evident in manufacturer strategies. OEMs are rapidly electrifying and introducing SUVs not just in the traditional $80,000-to-$149,000 segment where they’ve long been popular, but also in higher luxury tiers that were once the exclusive domain of sports cars and limousines. For instance, in the $150,000-to-$299,000 and $300,000-to-$500,000 markets, “OEMs have announced close to ten new BEV SUVs across sports, coupe, and crossover categories through 2027,” signaling a strong pivot towards this body style.

As a direct consequence, the share of SUV sales within the luxury market is projected to “increase from less than 25 percent to 40 percent between 2021 and 2031.” This means that buyers in the entry-luxury segment will have access to a growing array of highly sophisticated, electrified SUVs that embody modern luxury: versatility, commanding presence, and advanced technology. The fact that leading luxury-car makers such as Aston Martin, Ferrari, and Lotus are introducing their own SUVs further legitimizes this trend and raises the bar for all segments, including those just above the $80,000 entry point.

The enduring appeal of SUVs, coupled with their increasing electrification, means that luxury vehicles in the $80,000-$149,000 range can now offer a compelling package that combines the practical benefits and desired styling of an SUV with the cutting-edge performance and sustainability of a BEV. This combination directly contributes to their ability to rival more expensive models by delivering a comprehensive, contemporary luxury experience that resonates deeply with discerning buyers who seek both opulence and utility.

Read more about: From Basic Repairs to Epic Builds: 14 Indispensable Tools for the Modern Man’s Garage Workshop

4. **New Value Streams and Monetization Models**The underlying economic structures of the automotive industry are undergoing a significant metamorphosis, particularly within the luxury segment, characterized by “value pools shifting.” This evolution is creating unprecedented opportunities for profitability and innovation, fundamentally altering how value is generated and distributed, and ultimately, how much luxury consumers receive for their investment. EV disruptors, in particular, are at the forefront, finding novel ways to monetize the entire life cycle of their vehicles.

These new business models extend far beyond the initial vehicle purchase. Strategies such as “only direct to consumer (DTC), EV- and battery-as-a-service, advanced driver-assistance systems (ADAS), and smart-connectivity features” are increasing profits by “more than 7 percent by 2026.” This holistic approach means that the initial price tag of a vehicle in the $80,000-$149,000 segment can unlock a continuous stream of value through subscriptions and services, offering a richness of ownership experience that was once the exclusive domain of ultra-luxury models.

Incumbent luxury players, while facing the challenge of adapting legacy systems, are also recognizing and embracing these new revenue streams. The report indicates they “should also benefit from the chance to offer software via over-the-air (OTA) updates going forward.” This capability allows vehicles to evolve and improve post-purchase, ensuring that a car bought today remains cutting-edge tomorrow, enhancing its long-term value and perceived sophistication. This digital upgrade path provides a dynamic ownership experience that contributes significantly to a vehicle’s competitive edge against more static, higher-priced alternatives.

Crucially, these shifting value pools are also influencing consumer preferences. Our research shows that “more than 70 percent of Chinese customers would prefer to access postpurchase upgrades through subscriptions or pay-per-use plans.” This demonstrates a clear appetite for flexible, evolving luxury that isn’t solely defined by the initial hardware. By embracing these innovative monetization strategies, vehicles in the entry-luxury segment can provide a feature set and ownership experience that rivals, and in some cases surpasses, the static offerings of older, more expensive luxury cars, delivering a more dynamic and personalized luxury proposition.

Read more about: The Dynasty Architect: Unveiling Kris Jenner’s Unexpected Rule and the Empire-Building Playbook Behind the Kardashian-Jenner Fortune

5. **China’s Pivotal Role in Innovation**China is rapidly emerging as a central force in the global luxury automotive market, not merely as a burgeoning consumer base, but as a crucial engine for innovation that is redefining the very essence of luxury. Our report emphasizes that “China will be a crucial part of the growth engine for the luxury-automobile market,” projecting it to be the fastest-growing market by 2031 with “14 percent annual growth,” increasing its global share to about 35 percent in the segment above $80,000. This explosive growth is backed by a rising number of high-net-worth individuals and ultra-high-net-worth individuals who possess distinct preferences that are shaping automotive development worldwide.

Chinese car buyers are fundamentally redefining what constitutes luxury, extending beyond traditional elements like craftsmanship and quality to embrace technology with unparalleled enthusiasm. A McKinsey survey revealed their “high interest in technology, especially when it comes to powertrain functions, digital interactions, connectivity, and ADAS features.” This contrasts with German and American consumers who prioritize styling and driving “feel.” This strong demand for integrated technology and “smartification” drives local OEMs to innovate heavily, pushing boundaries in areas that directly enhance the vehicle’s functional luxury.

Local champions in China are not just catching up; they are setting new benchmarks. Companies like NIO have become leaders in the EV SUV segment, driven by “a seamless technology-backed customer experience with and beyond the vehicle.” This focus on a holistic digital ecosystem, coupled with cutting-edge features, means that innovations pioneered in China are increasingly influencing global luxury vehicle design and feature sets. This environment forces all luxury manufacturers, including those targeting the $80,000-$149,000 segment, to integrate more advanced technology to remain competitive.

The relentless pursuit of technological superiority in China, driven by discerning consumers who expect “the latest ADAS and connectivity features [as] must-have elements of their EV deals,” directly translates into vehicles around the $80,000 price point offering a technological suite that could easily be found in vehicles twice their cost just a few years ago. This “smartification,” encompassing everything from advanced driver-assistance systems to sophisticated digital interactions, allows entry-luxury vehicles to deliver an intelligent, connected experience that genuinely rivals the offerings of more expensive models from global competitors.

Read more about: Beyond the Clouds: 14 Incredible Airplane Types Every Curious Traveler Should Know!

6. **The Demand for a Seamless Customer Journey**In today’s interconnected world, customer expectations for luxury cars are no longer solely shaped by the automotive industry itself. Instead, they are being “rapidly evolving, spurred by luxury brands beyond automotive,” setting a new, higher benchmark for what constitutes a truly premium experience. Consumers now benchmark their automotive interactions against their best experiences in other luxury sectors, demanding a seamless, integrated journey that prioritizes simplicity, omnichannel reach, customization, and diverse experiential touchpoints, irrespective of the vehicle’s price tier.

Automotive OEMs are keenly aware that to deliver a superlative experience, they must continuously align with these shifting customer needs. Our research in the China Consumer Survey highlights this imperative, indicating that “nearly 80 percent of luxury-car customers are looking for a seamless, omnichannel experience, with consistent interactions across departments.” This desire for frictionless, on-demand service is further underscored by the fact that “83 percent expect to engage immediately when contacting a company,” and “nearly 70 percent of customers want new channels and new ways to obtain existing products and services.”

This intense focus on the customer journey means that luxury vehicles, even those in the entry segment, are increasingly part of a broader ecosystem designed to surprise and delight users at every touchpoint. From initial research to post-purchase support, the emphasis is on creating a cohesive and personalized interaction. Companies are leveraging customer experience to build loyalty and drive sales, with one Chinese EV OEM generating “nearly three-quarters of its sales from existing-owner referrals,” far exceeding the industry average. This demonstrates the immense power of a superior customer experience.

Therefore, when considering vehicles around the $80,000 mark that rival their $150,000+ counterparts, it’s not just about the car itself. It’s about the entire ownership ecosystem. The integration of transparent pricing, efficient service, and responsive support—elements that consumers define as core to a positive experience—elevates the value proposition of these vehicles. By mirroring the seamlessness found in other luxury industries, entry-luxury cars are able to offer a comprehensive, high-end experience that enhances their competitive standing against traditionally more exclusive models.

Read more about: Beyond the Shiny Exteriors: Uncovering the Auto Industry’s Darkest Secrets and Corporate Scandals

7. **Deep Personalization as a Luxury Hallmark**The ability to personalize a luxury vehicle has transcended from a mere option to a fundamental expectation, rapidly becoming a key driver of purchase decisions and a crucial differentiator in the competitive luxury market. Our research clearly indicates that modern luxury car buyers, especially in emerging markets, place an extraordinary emphasis on bespoke experiences. This trend is particularly powerful in China, where “nearly 84 percent of respondents say that the ability to personalize their vehicle is important or very important.”

This demand for customization extends far beyond superficial aesthetic choices; it encompasses the entire purchasing and ownership journey. Chinese consumers, for instance, rank personalization ahead of a “lengthy list of other features that includes connectivity service, driving performance, high-end interior design, battery range capacity, and autonomous-driving features.” Furthermore, “nearly 60 percent of these consumers say that they want customized service throughout the buying process,” highlighting a desire for an individualized touch from start to finish.

Global OEMs are responding to this demand through various strategic approaches. Some are introducing “strong global brands with traditional local customization (for example, premium exterior paint or special interior features),” while others are “developing local bespoke specials that more deeply integrate unique features around connectivity, navigation, and infotainment.” An example of this is a “leading luxury-car manufacturer [that] recently introduced a series of bespoke models exclusive to China,” underscoring the importance of tailoring offerings to specific regional preferences.

For luxury cars in the $80,000-$149,000 segment, this focus on personalization is a game-changer. It allows manufacturers to create a unique connection with buyers, making their vehicles feel more exclusive and tailored, even at a relatively accessible luxury price point. By offering significant customization options and personalized service, these vehicles can deliver an individualistic luxury experience that challenges the perceived exclusivity of much higher-priced models, effectively closing the gap in desirability and perceived value.

The evolution of the luxury automotive market, particularly for vehicles poised to challenge the premium segment from a more accessible price point, hinges not just on technological advancements but also on how brands connect with their customers and manage their operations. As we continue our journey into the forces reshaping this dynamic sector, it becomes clear that a comprehensive strategy extending beyond the vehicle itself is essential for capturing and retaining discerning buyers. The next eight pivotal trends unveil the sophisticated brand-building, customer-centric strategies, and profitability measures that elevate these luxury vehicles, positioning them competitively against even the most exclusive offerings.

Read more about: Beyond the Mainstream: 15 Wild Classic Car Features Automakers Left in the Dust and Why You Won’t See Them Again

8. **Evolving Customer Expectations Beyond Automotive Benchmarks**In today’s interconnected world, the bar for luxury isn’t solely set by what’s happening within the automotive industry. Rather, customer expectations for luxury cars are being rapidly redefined and spurred by exceptional experiences offered by luxury brands in completely different sectors. Consumers now benchmark their interactions with car manufacturers against their very best experiences across all luxury domains, demanding a consistently high standard that prioritizes simplicity, omnichannel reach, customization, and diverse experiential touchpoints, regardless of the vehicle’s price.

This means that for a luxury vehicle, especially one in the $80,000-$149,000 segment aiming to rival its $150,000+ counterparts, the customer journey must be as meticulously crafted and seamless as the vehicle’s engineering. Automotive OEMs are acutely aware that a superlative experience necessitates continuous alignment with these ever-shifting customer needs. The focus has moved beyond the showroom to encompass every touchpoint, from initial research through post-purchase support, all designed to delight and engage.

Our research from the China Consumer Survey powerfully illustrates this imperative. Nearly 80 percent of luxury-car customers are actively seeking a seamless, omnichannel experience, characterized by consistent interactions across all departments. This desire for frictionless, on-demand service is further underscored by the fact that 83 percent expect immediate engagement when contacting a company, while close to 70 percent of customers are looking for new channels and innovative ways to access existing products and services. These demands push the boundaries of traditional automotive retail, compelling manufacturers to adapt and innovate to deliver a truly high-end experience.

Read more about: Beyond the Mainstream: 14 Unforgettable ’70s Classic Cars That Shaped Automotive History for Enthusiasts

9. **The Virtuous Cycle of Superior Customer Experience**When a luxury automotive brand truly masters the art of customer experience, it unlocks a powerful ‘virtuous cycle’ that delivers tangible benefits across the entire business. Industry leaders who prioritize this integrated approach consistently see significant improvements, transforming customer satisfaction into measurable gains in sales and operational efficiency. This isn’t just about making customers happy; it’s about building a sustainable, profitable model.

Our findings reveal compelling statistics that underscore the impact of this virtuous cycle. Companies that excel in customer experience have documented impressive 20 percent improvements in customer satisfaction. Crucially, this heightened satisfaction translates directly into commercial success, with observed increases of 10 to 15 percent in sales conversion performance. Moreover, the positive effects extend internally, fostering a more engaged workforce, with companies reporting 20 to 30 percent increases in employee engagement, often achieved in a labor-neutral or even beneficial manner.

The real-world success of this approach is exemplified by a leading Chinese EV OEM. This company has cultivated industry-leading customer satisfaction levels so effectively that it generates nearly three-quarters of its sales from existing-owner referrals. This figure dramatically surpasses the industry average of a mere 10 percent, showcasing the immense power of a superior customer experience to drive loyalty, organic growth, and an enthusiastic customer base. For luxury vehicles in the sub-$150,000 category, replicating such a customer-centric model is key to competing with more established, higher-priced brands.

10. **Adopting Best Practices from Other Luxury Industries**The automotive sector can significantly enhance its luxury proposition by looking beyond its own confines and learning from the successes of other established luxury industries. These non-automotive brands have often set benchmarks in areas such as social responsibility, brand consistency, and innovative customer engagement, offering valuable lessons that can be adapted to elevate the luxury car buying and ownership experience.

One significant area for learning is a strong commitment to social responsibility and sustainability, which is increasingly valued by affluent consumers. For instance, a prominent luxury fashion brand notably ended its use of animal furs in 2018 and ceased the practice of burning unsold new clothing, articulating that modern luxury demands socially and environmentally responsible behavior. Similarly, a global footwear and apparel company embarked on a net-zero carbon reduction campaign, cutting its CO2 emissions by millions of tons and pledging to power all its facilities with renewable energy. Such initiatives resonate deeply with today’s luxury buyers and can differentiate an automotive brand.

Another defining characteristic of leading luxury industry players is their global consistency, even while adapting to local nuances. While local offerings may reflect regional styles, these brands strive to maintain a globally recognizable identity. In the automotive context, this could translate into standardized brand treatments worldwide, complemented by local features such as special vehicle color schemes or region-specific connectivity options. Innovative engagement methods, such as a European fashion house’s use of a ‘brand bible’ for storytelling or a bespoke high-end fashion player’s integration of virtual and augmented reality into its buying experience, also provide inspiration for creating a compelling and immersive luxury journey for car buyers, directly impacting their perception of value.

11. **The Shift Towards Direct-to-Consumer (DTC) Sales Models**The traditional franchised-dealership model, long a cornerstone of automotive sales, is increasingly proving insufficient for the discerning luxury car buyer. Affluent consumers, conditioned by seamless and personalized luxury-goods experiences in other retail environments, now demand continual engagement and tailored interactions when shopping for luxury cars. This expectation for a highly controlled, end-to-end customer experience, which luxury OEMs find challenging to replicate through traditional channels, is driving a significant shift towards direct-to-consumer (DTC) sales models.

A primary struggle for luxury automotive OEMs within the traditional dealership framework lies in potential conflicts over data ownership and the inherent difficulties in building a truly seamless omnichannel experience. This often results in inconsistent customer engagement, failing to provide the personalized, exclusive treatment that luxury buyers expect. Research confirms this dissatisfaction, revealing that fewer than 2 percent of customers consider the dealer approach in market segments to be “ideal.” Furthermore, issues like price inconsistencies and the disliked practice of price haggling at dealerships undermine the premium customer experience and can harm residual values, which is particularly detrimental in the luxury automotive segment.

Consequently, the majority of luxury marques are actively exploring or progressing towards DTC or even outright retail ownership models, with only a handful content with the status quo. The move to DTC offers compelling advantages: it enables luxury OEMs to fully own the customer experience from end to end, facilitating complete personalization of the customer relationship and ensuring a truly seamless omnichannel journey. This strategic shift is vital for luxury vehicles in the $80,000-$149,000 segment to deliver an experience that rivals the bespoke offerings of more expensive models.

12. **Individualized Retailing and the Agency Model**As luxury OEMs transition towards direct-to-consumer models, they are exploring a spectrum of individualized retailing approaches, each designed to provide a more controlled and personalized customer experience. This shift represents a significant departure from traditional wholesale, allowing manufacturers to better align their sales and service with the elevated expectations of luxury buyers, thus enhancing the perceived value of their vehicles.

Among these emerging models, the ‘agency model’ is gaining traction, particularly among some European incumbent OEMs. In this setup, sales agents operate on commission under the strong control of the automaker, which dictates prices and makes point-of-sale investments. This provides the OEM with greater control over pricing consistency and brand presentation. Alternatively, ‘outright retail network ownership’ is favored by some EV specialists and niche incumbents, where permitted. These companies sell directly online or through their own physical stores, thereby owning the complete customer experience from configuration to delivery, often incorporating build-to-order approaches.

A more innovative strategy is the ‘ecosystem model,’ where the OEM divides distribution activities—such as vehicle configuration, test drives, sales, and delivery—into specific tasks and assigns different partners for each. This allows the OEM to avoid the substantial costs of owning and operating every task itself while maintaining overall coordination and control of the entire distribution system. Regardless of the chosen path, a common thread is the critical need for comprehensive data analysis to underpin and optimize these evolving go-to-market strategies, ensuring that every customer interaction adds to the luxury perception, even for models in the entry-luxury tier.

13. **Disruptors Lead the Way in DTC Implementation**Newer luxury OEMs, particularly EV specialists, have astutely identified superior customer experience as their core strategy to differentiate themselves from long-standing incumbents. These agile players have not just embraced but pioneered go-to-market approaches that perfectly align with the expectations of new customer groups, who are increasingly digitally savvy and demand frictionless interactions. Their innovation in this space sets a challenging benchmark for the entire luxury automotive market.

Consumer preferences clearly validate this approach. Our research indicates that half of all premium consumers would prefer to buy their next cars online, while 60 percent are interested in contactless sales and services. Critically, 40 percent of these discerning buyers find haggling over price at dealerships genuinely annoying—a sentiment that traditional models often fail to address. It is, therefore, no surprise that newer luxury-EV OEMs are innovating rapidly to meet these evolving customer needs, focusing on transparency and convenience.

A prime example is a well-known Chinese luxury-EV OEM that operates via a strict DTC model, utilizing special ‘spaces’ or ‘houses’ instead of traditional retailers. Consumers can order cars online as part of a unique, end-to-end user experience featuring multiple customer interactions. This company has built a comprehensive customer experience data system to deliver what it calls an ‘ultimate experience’ across all channels. Its omnichannel approach includes a service ecosystem that drives customer lifetime value with simple, transparent offers and pricing, allowing it to invest more in IT and less in brick-and-mortar stores. This customer-centered mindset, combined with innovative solutions like proposed battery-swapping features and frequent over-the-air (OTA) updates for product features, results in word-of-mouth referrals nearly ten times the industry average, demonstrating how entry-luxury vehicles can leverage advanced digital strategies to rival more expensive models.

14. **DTC’s Profound Impact on Profitability**Beyond enhancing the customer experience, the adoption of Direct-to-Consumer (DTC) models by luxury automotive OEMs is proving to be a significant driver of increased profitability. This strategic shift allows manufacturers to optimize their cost structures, gain greater control over pricing, and foster stronger customer loyalty, ultimately boosting their bottom line in ways that traditional wholesale models often cannot.

McKinsey’s analysis reveals compelling financial benefits associated with DTC. OEMs making this transition could see their return on sales increase by more than five percentage points. For instance, a leading EV specialist operating with a DTC go-to-market model spends approximately half as much in terms of cost of sales compared to an incumbent OEM utilizing traditional channels. This considerable cost advantage underscores the efficiency gains inherent in a streamlined, direct approach.

The profitability boost from DTC can be broken down into several key areas. Approximately two percentage points of the advantage stem from ‘volume effects,’ driven by increases in customer loyalty and higher sales conversion rates due to a more personalized and seamless journey. An additional three points come from ‘price effects,’ as direct sales enable central price steering and more effective incentive spending, reducing competition among brands and minimizing price haggling. Finally, one to two percentage points arise from ‘cost effects,’ achieved through network consolidation and facility-related savings. These combined benefits demonstrate how DTC empowers entry-luxury vehicles to achieve margins that were once exclusive to higher-priced segments.

15. **The Ultra-Profitability of the Luxury Segment**The luxury automotive segment stands apart in its ability to generate outsize profit margins, a stark contrast to the largely stagnant and low-margin mass market. This robust profitability is driven by a confluence of factors, including consistent demand from an increasing number of Ultra-High-Net-Worth Individuals (UHNWIs), particularly in rapidly expanding non-traditional markets like China and the Middle East. For luxury cars under $80,000 to rival models over $150,000, understanding this underlying profitability is key to their value proposition.

Examining the profit landscape, most automotive brands in the luxury segment have seen their EBIT margins increase significantly between 2016 and 2021, while mass-market brands remained stable at around 8 percent. While the $80,000-to-$149,000 price band maintained stable EBIT margins of about 10 percent during this period, the higher tiers saw dramatic gains. Major players in the $150,000-to-$299,000 and $300,000-to-$500,000 price bands observed average EBITs of 38 percent in 2021, a substantial leap from less than 20 percent in 2016. Even the most expensive luxury brands saw average EBITs rise from 20 to 35 percent.

Crucially, the segment above $500,000 maintained the strongest EBIT margins even during the pandemic, underscoring the resilience of ultra-luxury demand. Luxury EVs are expected to partake in this profitability, with projected EBIT margins of 21 to 25 percent through 2031, despite potential risks from currency shifts or supply chain disruptions. The relentless growth in the UHNWI population, projected to increase globally by 5 percent from 2021 to 2026, reaching over 700,000 people, fuels this sustained demand. China, notably, is expected to see the fastest growth among large UHNW clusters, significantly driving market expansion.

This deep dive into the luxury automotive landscape reveals a market in profound transformation, where innovation, customer-centric strategies, and agile business models are reshaping the very definition of luxury. For discerning buyers in 2025, the notion that exceptional quality and groundbreaking features are reserved exclusively for vehicles well over $150,000 is rapidly becoming outdated. The trends we’ve explored, from explosive growth and electrification to advanced personalization and direct-to-consumer sales, collectively empower a new generation of luxury cars in the $80,000-$149,000 segment to offer an experience that not only competes with but often surpasses their more expensive counterparts. The race to crack the code on satisfying the most individuals in this evolving luxury market promises a future brimming with unprecedented value and choice.