In today’s automotive landscape, the decision of whether to invest in an extended warranty for your vehicle has become more complex and, frankly, more critical than ever. Recent insights from the J.D. Power 2024 U.S. Vehicle Dependability Study paint a concerning picture, indicating a decline in vehicle dependability across the board. The study reveals that nearly two-thirds of car brands have experienced an increase in problems reported by owners during the first three years of ownership. This trend underscores a pivotal shift, making the choice about extended coverage a significant consideration for any car owner.

For many consumers, the term ‘extended warranty’ conjures images of peace of mind and protection against the dreaded unexpected repair bill. However, like many financial products related to vehicle ownership, these plans are often shrouded in confusion, can be surprisingly expensive, and, in some cases, may prove entirely unnecessary. Our goal here is to cut through the jargon and the sales pressure, providing you with a data-driven, objective, and consumer-focused analysis that empowers you to make an informed decision.

This in-depth guide is designed to equip you with the knowledge needed to navigate the often-murky waters of extended car warranties. We will dissect what these contracts truly entail, how they function, their potential benefits and significant drawbacks, and critically, what they actually cover. By exploring these foundational elements, you’ll be better prepared to weigh the pros and cons against your personal circumstances and determine if such an investment aligns with your needs.

1. **The Current State of Vehicle Dependability: Setting the Stage**The landscape of vehicle dependability has undeniably shifted, making the discussion around extended warranties more relevant than ever. The J.D. Power 2024 U.S. Vehicle Dependability Study has brought to light a significant concern for car owners and prospective buyers: vehicle dependability has declined. This isn’t just an anecdotal observation; it’s a finding supported by extensive research.

According to the study, a substantial majority of car brands—nearly two-thirds, to be precise—have witnessed an increase in reported problems from owners within the crucial first three years of ownership. This trend signifies that modern vehicles, despite technological advancements, are not necessarily becoming more robust over time. For consumers, this directly translates into a heightened risk of encountering issues earlier in their vehicle’s life cycle.

This decline in reliability means that the traditional assumption that a relatively new car will be trouble-free for many years might no longer hold true for all brands and models. It places a greater emphasis on understanding potential risks and considering strategies to mitigate the financial impact of unexpected repairs. The decision of whether to purchase an extended warranty, therefore, moves from a ‘nice-to-have’ to a more pressing ‘should-I-consider-this?’ question for many.

2. **Understanding Extended Car Warranties: More Than Just a “Warranty”**Often colloquially referred to as an ‘extended warranty,’ these plans are, in fact, officially known as vehicle service contracts. This distinction is crucial because, unlike the warranties included with new vehicles, these plans are not warranties as defined by federal law and do not come with the same consumer protections. They are optional plans that you purchase separately, designed to cover specific repair costs once the car’s original manufacturer’s warranty has lapsed.

These service contracts can be acquired from various sources, each with its own advantages and disadvantages. You might be offered one by the vehicle manufacturer when purchasing a new car, by a dealership when buying a new or used vehicle, or through independent third-party providers. Understanding that these are purchased contracts, rather than an inherent guarantee, is the first step in demystifying them.

Fundamentally, an extended warranty acts as a financial safety net. It’s intended to shield you from the potentially hefty repair bills that can arise as a car ages and its original factory coverage expires. It’s a promise from the provider to pay for certain repairs as outlined in the contract, offering a form of protection against the financial strain of unexpected mechanical or electrical failures down the line.

Read more about: Protecting Your Purchase: A Consumer Report on Top Car Warranties and Key Manufacturer Recall Trends

3. **How Extended Warranties Function: Navigating the Claim Process**Understanding the operational mechanics of an extended warranty is paramount to avoiding future frustrations. When a component covered by your service contract fails, the process typically begins with you filing a claim with the warranty provider. This initiates a review, where the provider either approves or denies the claim based on the terms and conditions outlined in your contract.

If the claim receives approval, the provider will then cover the repair costs according to the specifics of your agreement. This often means they will pay the repair shop directly. However, it’s vital to be aware that in some instances, you might be required to pay the bill upfront and then seek reimbursement from the warranty provider, which can impact your immediate finances.

The specifics of how a warranty works, including where you can get repairs done, can vary widely among providers. Some contracts mandate the use of specific repair shops within their pre-approved network, limiting your flexibility. Others offer more freedom in choosing your repair facility. Additionally, many plans involve deductibles—a fee you pay per claim or per visit—or even impose limits on the number of claims you can make. Thoroughly reading the fine print and understanding these operational nuances beforehand is essential to prevent unwelcome surprises when you most need the coverage.

4. **The Clear Advantages: When Peace of Mind Has a Price**While extended warranties are certainly not suitable for every car owner, they do present several compelling advantages that can make them a worthwhile investment for certain buyers. One of the most frequently cited benefits is the profound peace of mind they offer. Knowing that you’re protected against the significant financial burden of unexpected and costly repairs allows you to enjoy your vehicle without the constant apprehension of potential breakdowns or the financial strain they could impose.

Another significant advantage is the financial security provided, especially when facing major, high-cost fixes. Critical components such as engine or transmission replacements can easily run into thousands of dollars. With an extended warranty in place, these unexpected and substantial expenses are typically covered, safeguarding your savings and preventing a sudden drain on your financial resources. This can be particularly reassuring if a large, unplanned repair bill would severely strain your budget.

For drivers who accumulate high mileage rapidly, extended warranties can be particularly appealing. These plans provide coverage that extends beyond the mileage limits of a typical new-car warranty, ensuring protection for vehicles that are driven extensively. This is a crucial consideration for those whose daily routines or travel habits mean their cars will quickly exceed standard factory warranty mileage thresholds.

Furthermore, many extended warranties enhance their value by including additional perks that offer practical support during car troubles. These often encompass roadside assistance, towing services, and even rental car reimbursement. Such supplementary benefits can be incredibly valuable, minimizing the inconvenience of a breakdown and providing crucial support when you need it most. These extras can be especially beneficial if you frequently travel or reside in areas where immediate access to such services might otherwise be challenging.

Read more about: The Road Ahead: Ranking 12 Convertibles Built to Endure 180,000 Kilometers of Open-Air Thrills

5. **The Hidden Costs and Common Pitfalls: Unpacking the Downsides**Despite their advertised benefits, extended car warranties come with a notable array of downsides that potential buyers must carefully consider. A significant concern is the presence of limited coverage and cleverly worded loopholes within many contracts. It’s a common misconception that an extended warranty will cover every conceivable repair; however, wear-and-tear items, routine maintenance (such as oil changes and tire rotations), and certain specific parts are frequently excluded. Some warranties also feature strict terms or “quirky rules” that can complicate or even prevent the filing of a successful claim, leaving consumers feeling misled.

Another substantial drawback is the considerable upfront cost associated with these plans. Extended warranties can be remarkably expensive, often adding thousands of dollars to the overall cost of your car purchase. If, as many people experience, you never need to utilize the warranty, that money effectively vanishes. This can lead to significant frustration, as those funds could have been saved, invested, or allocated to other pressing financial needs, making the purchase feel like a regrettable expense.

Unfortunately, the industry is not immune to less-than-reputable players. Some warranty providers have a history of unethical or dishonest practices, which can make dealing with them incredibly frustrating for consumers. Reports of denied claims, delayed payments, or outright unresponsiveness are not uncommon. Selecting a provider known for its integrity and prompt service is crucial to minimize these risks, but identifying such providers requires diligent research and a cautious approach.

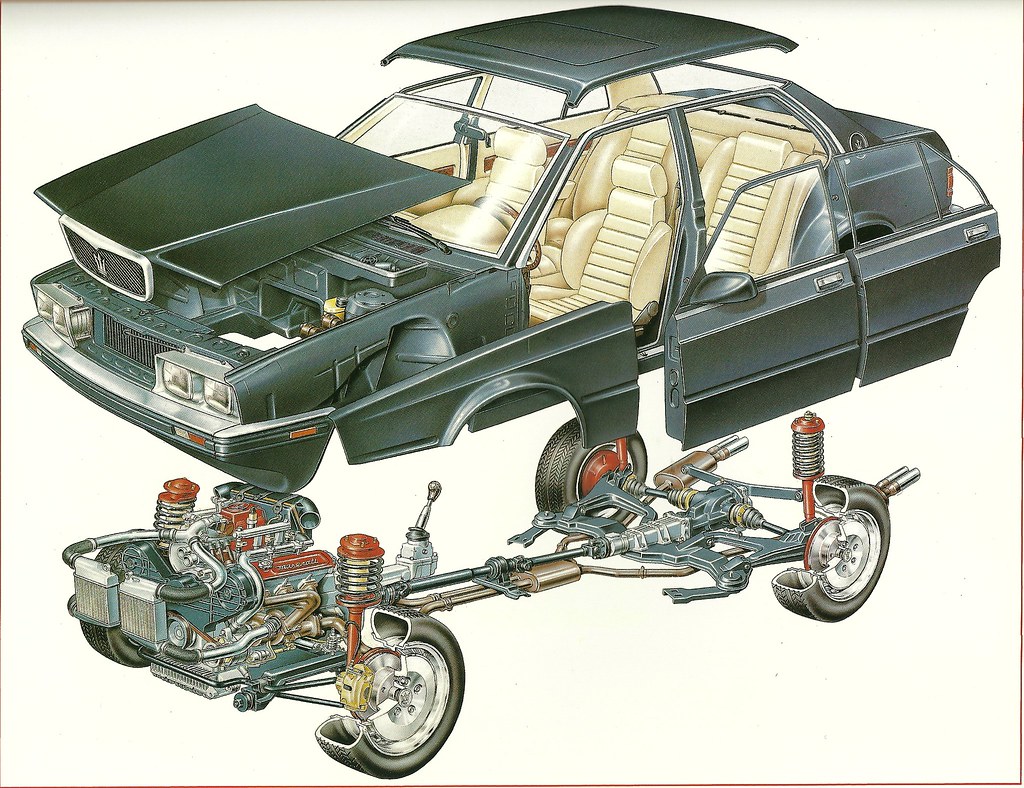

6. **The Reality of Coverage: What’s Truly Protected (and What Isn’t)**One of the most critical aspects of an extended warranty—and often the source of consumer disappointment—is understanding precisely what it covers and, perhaps more importantly, what it explicitly excludes. In general, extended warranties are designed to protect major vehicle components, acting as a financial safety net for the most expensive potential repairs. This typically includes the engine, transmission, and other core drivetrain components that are vital for the car’s operation.

However, it is equally important to acknowledge the common exclusions. Routine maintenance items, such as oil changes, tire replacements, and brake pad replacements, are almost universally not covered. These are considered normal operating expenses and are the owner’s responsibility. Similarly, problems arising from normal wear and tear are often excluded, although it’s worth noting that some comprehensive warranties might cover specific wear-down parts at an additional cost, requiring careful scrutiny of the contract details.

Warranty providers usually offer tiered coverage options, designed to match various budgets and needs. A basic powertrain plan, for instance, focuses solely on the major vehicle components directly involved in propulsion—the engine, transmission, and drivetrain. At the other end of the spectrum are “bumper-to-bumper” plans, also known as exclusionary plans. These provide the most extensive coverage, often protecting nearly all car parts, with only a short, specific list of excluded items.

Beyond these core tiers, various plans may include coverage for other essential systems. This can encompass heating and air conditioning, steering, braking, suspension, and the vehicle’s electrical and fuel systems. Some warranties further enhance their appeal by offering add-ons like roadside assistance or rental car reimbursement. Regardless of the tier or the additional features, the golden rule remains: you must meticulously read the fine print of the warranty contract before purchasing to clearly understand all inclusions and exclusions. This diligence is the only way to ensure you are not caught off guard by a repair bill you mistakenly believed would be covered.

7. **Factors to Consider: Personalizing Your Warranty Decision**Before making any decision about an extended warranty, it is crucial to recognize that the optimal choice hinges significantly on your individual circumstances and the specifics of your vehicle. A one-size-fits-all approach simply doesn’t apply here. Your journey to an informed decision should begin with a thorough assessment of factors unique to your situation.

A vital first step involves consulting the J.D. Power predicted reliability score for the car you are considering, information readily available in new car rankings. Models from brands with a strong reputation for durability and low maintenance costs may very well make an extended warranty an unnecessary expense. Conversely, for vehicles with less robust reliability ratings, such coverage could prove to be a remarkably wise investment, mitigating potential future financial strain.

Next, carefully consider the vehicle’s age and mileage, as these are significant indicators of potential repair needs. Older cars or those that have accumulated substantial mileage are inherently more prone to breakdowns and the need for repairs. It’s also important to note that many warranty providers impose restrictions, often excluding vehicles that exceed a certain age or mileage threshold from coverage, so always verify these limitations upfront.

Your driving habits also play a pivotal role in this assessment. If your routine involves frequent long trips, consistently heavy vehicle usage, or driving in harsh environmental conditions, these factors undeniably accelerate wear and tear on components. In such scenarios, an extended warranty can become a considerably more beneficial safeguard. However, if you are an occasional driver who primarily uses the car for short, infrequent excursions, the added value and necessity of extended coverage might significantly diminish.

Crucially, take an honest look at your personal financial situation and your capacity to comfortably handle unexpected repair costs. If a major, unforeseen repair bill would severely strain your finances or deplete your savings, an extended warranty could truly provide essential protection and invaluable peace of mind. On the other hand, if you possess the financial cushion and are comfortable covering potential repairs out of pocket or via a credit card, you might find it more prudent to assume the risk and save the cost of the warranty itself.

Furthermore, diligent research into the car’s history and overall condition is indispensable. As a ‘nerdy tip’ suggests, always request to see maintenance records, obtain a comprehensive vehicle history report, and, ideally, secure a professional used car inspection. A vehicle that has been meticulously cared for, with a clear history of regular maintenance, may very well be an expense you don’t ultimately need.

Finally, the status of a certified pre-owned (CPO) vehicle can dramatically influence your decision. CPO cars typically undergo rigorous inspections and must meet elevated quality standards, often accompanied by a manufacturer-backed warranty that extends the original factory coverage’s time and mileage limits. Always verify precisely what a CPO warranty covers and for how long before committing to any additional, potentially redundant, coverage.

8. **Types of Car Warranties: Navigating Your Options**Understanding the various categories of car warranties is fundamental to making an informed decision, as not all coverage is created equal. In general, car warranties are designed to pay for specific repairs resulting from mechanical or electrical failures on a vehicle, but the scope and source of that protection can differ significantly. Generally, there are three primary types of warranty coverage available to consumers.

First, there’s the **factory warranty**, often referred to as leftover coverage. If the used car you are considering is only a few years old, it may still benefit from some of its original manufacturer’s warranty. A key advantage here is that this existing coverage may transfer directly to you with the car purchase, providing you with valuable protection for a certain period without requiring any additional upfront cost.

Another option you might encounter is a **dealer warranty**. Some used car dealerships, as part of their sales package, will include short-term warranties at no additional cost. These warranties are typically more basic in nature, usually covering only fundamental repairs for a limited duration, often ranging from just 30 to 90 days after the vehicle’s purchase. While offering a brief safety net, their scope and duration are quite restricted.

Finally, and the main subject of our detailed exploration, is the **extended warranty**, officially known as an auto service contract. This distinct type of coverage is an optional contract that you purchase separately. It is specifically designed to activate and provide protection for your vehicle after any factory warranty has fully expired. Importantly, extended warranties are available for both used and new cars, offering a customizable layer of protection tailored to various needs and budgets.

Read more about: The 12 Most Boring Crossovers in the Market Right Now: What Critics and Performance Specs Reveal for Enthusiasts.

9. **When an Extended Warranty Might Be Worth It (or Not)**Making the call on an extended warranty can feel like a gamble, but by carefully weighing specific circumstances, you can assess whether it truly offers a benefit or if it could simply be a considerable investment with little direct return. The ultimate value hinges on a comprehensive evaluation of your vehicle’s profile and your personal financial readiness.

For some car owners, particularly those who don’t drive extensively, own a relatively new car (only a few years old) that’s still in excellent condition, or possess a vehicle from a brand renowned for its reliability, an extended warranty may very well be an unnecessary expense. The same often holds true for certified pre-owned cars, which typically come with their own manufacturer-backed warranties, providing sufficient coverage for a substantial period.

Conversely, an extended warranty becomes a much more compelling consideration under different conditions. If you frequently find yourself on the road, accumulating significant mileage, or if the car is an older model or not in optimal mechanical shape, the likelihood of needing repairs increases substantially. Moreover, if the prospect of affording sudden, potentially high-cost repairs out of pocket would create a significant financial burden, a warranty could provide crucial peace of mind and protection.

Your long-term ownership plans also weigh heavily on this decision. If you intend to keep your used car for several years, you are naturally more likely to utilize extended warranty coverage as the vehicle ages and components begin to wear. However, if your plan is to maintain ownership for only a short period, the initial expense of a service contract, coupled with the potential hassle of cancelling it later, might not justify the investment. Always double-check for any remaining manufacturer’s warranty to avoid paying for redundant coverage.

10. **Exploring Smart Alternatives to Extended Warranties**For consumers who remain uncertain about committing to an extended warranty, it’s empowering to know that several practical and financially sound alternatives exist. These options can offer a valuable degree of peace of mind regarding potential car repairs without the complexities and often high upfront costs associated with service contracts.

One of the most frequently recommended strategies is to establish and consistently fund a dedicated savings account specifically earmarked for car repairs and maintenance. By building this financial cushion over time, you create your own ‘self-insurance’ fund. This approach allows you to cover unexpected bills directly when they arise, often eliminating the need to deal with the specific limitations, deductibles, and claim procedures of external warranty providers.

Another incredibly effective preventative measure is to diligently adhere to a regular service schedule for your vehicle. Consistent, preventive maintenance—including oil changes, tire rotations, and timely inspections as recommended by the manufacturer—can significantly reduce the likelihood of major mechanical failures and expensive repairs occurring down the line. Staying proactive with maintenance is often the best defense against unexpected breakdowns.

For those seeking a structured layer of protection without a large, one-time upfront cost, mechanical breakdown insurance (MBI) presents a compelling choice. Offered by reputable organizations like AAA and certain insurance companies, MBI functions much like an extended warranty, but you typically pay for it as a component of your monthly insurance premiums. This coverage often boasts more clear-cut terms and can be a streamlined way to protect yourself; however, it is always crucial to compare policies and thoroughly understand what is covered before committing to such a plan.

Read more about: Consumer Alert: The 14 Costly Dealer Add-Ons to Avoid at the Car Dealership

11. **Key Tips for Purchasing an Extended Warranty Wisely**If, after careful consideration, you decide that an extended warranty is indeed the right choice for your specific needs and financial situation, approaching the purchase strategically is absolutely paramount. Keeping several key tips in mind will ensure you make the most informed decision and secure the best possible value, potentially saving you from future frustration and unnecessary expense.

First and foremost, **conduct thorough research**. Not all warranty providers offer the same level of service, reliability, or coverage, making it essential to read customer reviews and meticulously compare different coverage plans. Opting for a reputable company, one known for its fairness, prompt service, and clear communication, can save you significant headaches in the long run. Most importantly, always thoroughly read the fine print of the contract before signing, paying exceptional attention to precisely what is covered, what is explicitly not, any deductibles you’ll be responsible for, and the exact procedures for filing a claim. Do not hesitate to ask questions about anything that remains unclear or seems ambiguous.

Next, remember that **negotiation is often possible**. Dealers frequently incorporate substantial markups on warranty prices, presenting a clear opportunity for you to save money. Don’t be afraid to haggle; shop around and obtain quotes from other independent providers, then use these as leverage to negotiate down the price. The initial offer from a dealer is rarely the final one, and a little astute haggling can frequently lead to considerable savings on the overall cost of the warranty.

It’s also critical to understand **waiting periods** and **maintenance requirements**. Many used-car warranties do not cover preexisting conditions, and you may encounter a waiting period, typically ranging from 30 to 90 days or a certain number of miles, before any repairs are actually covered under the plan. Furthermore, your warranty contract may stipulate strict adherence to all recommended maintenance, such as routine oil changes; failure to prove this compliance could potentially void your contract. Therefore, diligently maintaining detailed receipts for all repair work and maintenance is an excellent practice to safeguard your coverage.

Read more about: Beyond the Badge: Why a ‘Bargain’ Used Luxury Car Can Lead to Unexpected Financial Headaches and Repair Nightmares

12. **Making the Final Decision: Is It Worth It?**Ultimately, the pivotal decision of whether an extended car warranty is truly “worth it” is a deeply personal and subjective one. It requires carefully balancing the potential financial protection it offers against the considerable upfront investment and an honest assessment of the likelihood you will actually need and utilize the coverage. The goal is to avoid an expense that offers little to no direct benefit for your specific circumstances.

It is essential to recognize that an extended car warranty can add thousands of dollars to the purchase of a car. While this cost may seem less daunting if it’s rolled into your monthly loan payments, it still represents a significant financial commitment. Consumer data often indicates that many individuals who purchase an extended car warranty never actually use it, or if they do, the cost of the repair needed is frequently less than the total expense of the warranty itself. This scenario can leave car owners feeling frustrated, viewing their initial investment as a financial loss.

For those purchasing a vehicle with a well-established track record of reliability, it often makes more robust financial sense to bypass the extended warranty altogether. Instead, consider taking the money you would have allocated to the warranty and dedicating it to a specialized savings account. This ‘self-insurance’ approach ensures those funds are readily available for any unexpected repairs, and, crucially, if those repairs never materialize, you retain the entire sum for other financial goals or investments.

Read more about: 10 Baffling Cases: When Famous Writers Mysteriously Vanished Mid-Story

While the promise of peace of mind offered by an extended warranty can be incredibly compelling, it is absolutely crucial to approach this decision with an informed, data-driven perspective. Arm yourself with thorough research about your specific vehicle, honestly evaluate your driving habits, and realistically assess your personal financial readiness. Diligently doing your homework, remaining vigilant against auto warranty scams, and committing to work exclusively with reputable companies are indispensable steps to ensure that any protection you choose genuinely serves your best interests and delivers true, tangible value for your investment.