The automotive retail landscape is undergoing a profound and irreversible metamorphosis, driven by the relentless march of digital technologies and shifting consumer expectations. Today’s car buying has become a complex maze of over 400 digital touchpoints, leading customers through a journey that starts with excitement but often concludes with a disappointing “emotional drop-off problem.” This fragmentation, coupled with generic listings that prioritize specifications over inspiration, has created a critical imperative for change within dealerships. The future demands a fundamental reimagining of how vehicles are presented, experienced, and ultimately acquired.

This transformation extends beyond mere online presence; it signals a comprehensive overhaul of the entire retail ecosystem. While digital juggernauts like Amazon Autos and Carvana have perfected direct-to-consumer sales, they often lack the personal touch and local expertise that have historically defined dealership success. The real battle, as astutely observed by Yossi J. Levi, known as the Car Dealership Guy, isn’t fought on aesthetics but on the “seamlessness of the customer journey.” Adaptation is not merely an option for dealerships; it is an imperative for thriving in this new digital age.

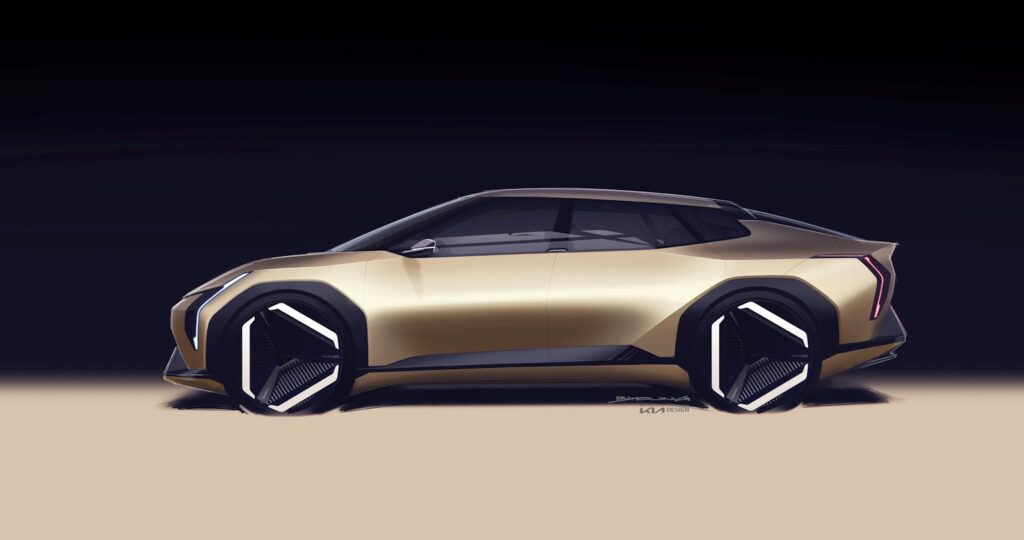

As we look towards 2035, dealerships stand at a pivotal juncture, poised for a renaissance rooted in innovation and a customer-centric approach. The traditional showroom model, once a bastion of high-pressure sales, is giving way to dynamic, technology-enabled environments that blend virtual exploration with physical experiences. This article will delve into seven crucial ways these pioneering shifts are redefining engagement, operations, and the very essence of automotive retail, focusing on the digital experience at its core.

1. **The Rise of Cinematic Storytelling**At the heart of future automotive retail lies the power of narrative. Dealerships have historically struggled with fragmented marketing pipelines, where the emphasis often falls on speed over a compelling story. This results in generic listings that highlight specs and price but fail to capture the emotion inherent in a vehicle purchase. Research from Harvard Business School underscores this challenge, revealing that “95 percent of purchase decisions are driven by emotion, not logic.” When this emotional connection is lost, engagement wanes, trust erodes, and conversion rates inevitably suffer.

Artificial intelligence is emerging as a critical “revival engine” for emotion in this context. By automating video production, AI can deliver high-quality, cinematic content for every single car in stock, a feat impossible for any human team to achieve at scale. These aren’t merely digital spec sheets; they are visual narratives designed to imbue each car with personality, context, and credibility, effectively stopping the scroll in a world of shrinking attention spans.

Sales teams, freed from the laborious task of video editing or image uploading, can redirect their energy towards genuine selling and relationship building. The effectiveness of this approach has been powerfully demonstrated. When Renault UK launched its Renew used car brand, it automated the creation of branded videos across its entire used stock. In just one month, over 1500 videos were generated and updated.

This initiative drove more than 34,000 views and accumulated 212 hours of watch time. The tangible business outcomes were equally impressive, including “a 20.5 percent increase in used vehicle enquiries,” “a 29.5 percent jump in transactions,” and a remarkable doubling of conversion rates. The future of car sales is unequivocally cinematic, transforming dealer staff into something akin to Hollywood producers, captivating audiences from the first click to the final closing scene.

Read more about: The 14 Most Extraordinary & Expensive Movie Props That Vanished: Tales of Theft, Loss, and Star-Powered Souvenirs

2. **Hybrid Purchase Pathways**The traditional car-buying process, often characterized by prolonged showroom visits and extensive negotiation, is undergoing a profound transformation. Digital technologies are permeating every facet of modern life, pushing the automotive retail landscape towards hybrid purchase pathways. These pathways seamlessly blend virtual exploration with crucial physical experiences, reflecting a deeper reimagining of consumer relationships with automobiles.

Online research now forms the bedrock of the car buyer’s journey. According to research by CSM International, “nearly 78 percent of car buyers now begin their journey online,” meticulously researching vehicles, comparing prices, and even configuring their desired models long before setting foot in a dealership. This shift has dramatically expanded the pre-dealership research phase. A comprehensive study noted that today’s car buyers spend “an average of 14 hours researching online” before contacting a dealership, a stark contrast to just four hours a decade ago.

Yet, despite the rise of digital tools, the physical showroom remains an indispensable component of the purchase journey. Consumers continue to highly value in-person experiences, particularly for test drives and for making final purchase decisions. The evolving reality is not a binary choice between digital and physical channels, but rather a “sophisticated integration of both realms.” This creates new imperatives for dealers and manufacturers alike, demanding a cohesive strategy that transcends traditional silos.

For forward-thinking dealerships, the challenge lies in orchestrating these digital and physical interactions into a coherent whole. This integrated approach must respect the consumer’s preferred pace and individual path through the purchasing journey, marking a significant departure from the traditional model where dealerships dictated the flow of information and the rhythm of the sales process. The most successful dealers are those who master this intricate dance between online discovery and tangible engagement.

Read more about: Score a Steal: 14 Electric Vehicles Waiting for Astute Buyers to Drive Home Unbeatable Deals

3. **Data-Driven Personalization**The convergence of digital and physical experiences within automotive retail unlocks unprecedented opportunities for personalization. Every online interaction—from website visits and configurator choices to video views—generates a rich tapestry of data. When properly analyzed, this data provides “rich insights into consumer preferences” that can inform and tailor every aspect of the customer journey, both online and in-person.

Leading dealerships are leveraging this wealth of data to craft highly individualized experiences. Research indicates a significant competitive advantage for those who effectively implement data-driven personalization strategies. Dealerships in the top quartile for data utilization have reported “23 percent higher conversion rates and 17 percent stronger customer satisfaction scores” compared to their less sophisticated peers.

Effective personalization extends far beyond simply recalling a customer’s name or vehicle preferences. It involves creating dynamic digital experiences that adapt in real-time to revealed interests, ensuring that physical showrooms are prepared with vehicles matching online explorations, and equipping sales staff with critical insights to seamlessly continue conversations initiated in digital spaces. Some advanced dealers are even experimenting with predictive analytics, anticipating customer needs based on behavioral patterns to offer proactive service that feels genuinely attentive rather than intrusive.

However, as privacy concerns increasingly shape the regulatory landscape, dealerships must meticulously balance personalization with respect for customer boundaries. Transparency in data collection and utilization is paramount. The goal is to use insights to enhance and enrich the consumer experience, building trust and loyalty, rather than to manipulate or pressure. This thoughtful application of data ensures that personalization serves the customer’s best interest.

Read more about: The Definitive Guide: 12 Top Insulated Water Bottles Engineered to Keep Ice Frozen for Over 17 Hours in Direct Sunlight

4. **The Transformed Showroom**As digital platforms assume an increasingly central role in the consumer journey, the physical dealership is undergoing a profound metamorphosis. The traditional showroom, historically designed as a static product display bolstered by high-pressure sales tactics, is evolving into something far more dynamic. It is transforming into a “brand experience center,” a space where consumers can immerse themselves in vehicles and brand values in a manner that is more engaging, consultative, and less overtly transactional.

This shift reflects a fundamental rethinking of the showroom’s purpose, particularly in an era where product information is readily available online. CSM International’s product research team has documented several innovative approaches to this reinvention. Some manufacturers are exploring urban micro-showrooms that showcase a select few vehicles, augmented by sophisticated digital interfaces that allow for comprehensive exploration of the entire product range.

Other progressive dealerships are creating destination showrooms that integrate amenities such as cafés, children’s play areas, and spaces for community events. This strategy positions them as lifestyle hubs rather than mere points of transaction, fostering deeper connections with their local communities. In these evolving spaces, physical venues serve new functions: they are sites for product validation, sensory engagement, and crucial relationship building, rather than primary sources of information.

This necessitates not only architectural reconfiguration but also a fundamental retraining of sales personnel. Staff must transition from being simple information providers to becoming “experience facilitators.” Their new role involves guiding customers seamlessly between digital and physical touchpoints. The dealership of the future is less a sales funnel and more a dynamic environment where digital research is validated through physical interaction, questions are expertly answered, and the emotional aspects of car purchasing are vividly brought to life.

Read more about: Seriously, Where Did They Go? The Fascinating Vanishing Act of 14 Legendary Auto Brands

5. **Revolutionizing the F&I Office**Perhaps no aspect of car buying has proven more resistant to digital transformation than the financing and paperwork phase, often referred to as the notorious “F&I office” experience. This final hurdle in the traditional purchase journey, burdened by lengthy waits and complex documentation, has long been a significant pain point for consumers, frequently undermining satisfaction with the entire vehicle acquisition process.

Innovative dealerships are now pioneering a revolution in this area through advanced digital tools and streamlined procedures. A comprehensive analysis of purchase friction points conducted by CSM International found compelling evidence of this transformation. Dealerships that have successfully implemented fully digital financing solutions reported reducing average transaction time by “67 percent,” while simultaneously boosting customer satisfaction scores for this phase by an impressive “47 percent.”

These dramatic improvements are a direct result of several key innovations. Online pre-qualification tools now provide consumers with accurate financing options before they even visit the dealership, demystifying a historically opaque process. Digital contracting platforms eliminate redundant data entry and excessive paper handling, accelerating the transaction. Furthermore, transparent pricing models are significantly reducing the often-dreaded negotiation phase, fostering greater trust.

Forward-thinking dealers are even exploring the integration of biometric authentication methods, which promise to further streamline documentation while simultaneously enhancing security. This financing revolution extends beyond mere efficiency, touching upon fundamental questions of transparency and trust. By making pricing and financing options more accessible and comprehensible, progressive dealerships are actively addressing long-standing consumer frustrations with perceived opacity in automotive transactions, building relationships based on trust rather than purely transactional interactions.

6. **Evolving Sales Roles**The transformation of automotive retail is deeply intertwined with broader shifts in consumer psychology and behavior. Modern car buyers, especially younger demographics, approach major purchases with distinct expectations and values compared to previous generations. They are notably more information-driven, often skeptical of traditional sales tactics, and increasingly prioritize the overall experience over mere ownership.

These evolving attitudes necessitate entirely new approaches to automotive retail, approaches that honor consumer autonomy while still providing meaningful guidance. An extensive consumer behavior analysis by CSM International’s customer research division revealed a significant trend: “65 percent of consumers under 40 report feeling anxious about traditional dealership experiences,” citing concerns about pressure tactics and information asymmetry. However, these same consumers express a strong desire for expert guidance during their purchase journey, indicating that the issue lies not with personal assistance itself, but with how that assistance is framed and delivered.

In response, the most successful dealerships are proactively adopting more consultative approaches. Sales staff are being repositioned as product experts and trusted purchase advisors, rather than merely closers focused on immediate sales outcomes. This strategic shift aligns seamlessly with broader trends in retail psychology, where consumers increasingly expect personalization without intrusion, expertise delivered without undue pressure, and efficiency without sacrificing thoroughness. It’s about providing value through informed advice.

Dealerships demonstrating the strongest performance in customer satisfaction are those that have embraced this consultative model. They are training staff to accurately recognize where each customer is in their journey, enabling them to provide appropriate and tailored support without attempting to artificially accelerate the process. This approach, while requiring greater patience and subtlety than traditional sales methods, yields significantly stronger long-term relationships and fosters higher levels of customer loyalty.

Read more about: 14 Unlikely Automotive Heroes: The Cars That Shocked Everyone and Redefined Success

7. **Embracing the Mobility Ecosystem**As the fundamental relationship between consumers and automobiles continues to evolve, progressive dealerships are expanding their operational paradigms far beyond traditional vehicle sales. They are actively redefining their role within a broader “mobility ecosystem.” This strategic expansion involves exploring diverse offerings such as subscription models, comprehensive used vehicle programs, a wider array of mobility services, and even automotive lifestyle products.

This forward-thinking approach creates multiple touchpoints throughout the entire customer relationship lifecycle, acknowledging that modern consumers may engage with automotive brands in various ways before, during, and after conventional purchase events. CSM International’s automotive research division has meticulously documented how leading dealership groups are successfully transforming into comprehensive mobility providers. They are offering flexible access programs designed to bridge the gap between rental services and traditional ownership, appealing particularly to urban consumers and younger demographics who highly value access and flexibility over outright ownership.

Some truly innovative dealers are even developing integrated mobility hubs. These advanced centers combine vehicle sales with essential charging infrastructure, comprehensive service facilities, and dedicated spaces for mobility-related events and educational initiatives. By positioning themselves as holistic mobility providers rather than merely vehicle sellers, these dealerships are not only creating robust new revenue streams but also forging deeper, more multifaceted relationships with their customer base. This shift is critical for long-term viability.

This significant evolution demands not only new business models but also a re-evaluation of traditional metrics for success. Customer lifetime value and the breadth of engagement are rapidly becoming as crucial as traditional indicators like units sold or profit per transaction. The dealerships most successfully navigating this transition are those that view themselves not as endpoints in a linear purchase journey, but as ongoing, adaptive partners in each customer’s evolving mobility story, continually meeting their diverse transportation needs.” , “_words_section1”: “1947

The initial transformations in automotive retail, while profound, are merely the prelude to an even more integrated and technologically advanced future. As dealerships continue their journey towards 2035, the focus intensifies on strategic operational changes and the sophisticated application of AI and data. These aren’t just incremental updates; they represent a fundamental re-architecture of how dealerships operate, engage with customers, and position themselves within a rapidly evolving mobility landscape.

This next phase is characterized by a deeper embrace of automation, predictive intelligence, and an acute understanding of the nuanced global and local factors influencing consumer behavior. It’s about leveraging cutting-edge tools to optimize every facet of the business, from marketing outreach to the final vehicle delivery, ensuring that every touchpoint is not only efficient but also deeply resonant with the modern buyer. This requires not just technological adoption but also a cultural shift within the industry, prioritizing adaptability and continuous innovation.

Read more about: Avoid These 10 Power Tool Purchasing Pitfalls: Keep Your Toolkit Productive, Not a Money Pit

8. **Consolidated Marketing for a Unified Customer Experience**For years, automotive marketing has been a fragmented battleground, characterized by keyword wars, paid search ads, and a myriad of third-party listing sites. This disparate approach often prioritizes sheer speed in lead generation over the cultivation of a cohesive, compelling brand narrative. The consequence? A disjointed customer experience and significant marketing spend that often fails to translate into meaningful engagement or conversions.

The shift towards 2035 demands an end to this fragmentation. Dealerships are beginning to understand that the true competitive edge lies in consolidating these scattered tech stacks into unified platforms. This integration streamlines the customer journey, ensuring that every digital interaction flows seamlessly into the next, creating a consistent and trustworthy experience. It’s about building a single, comprehensive view of the customer, allowing for more targeted and effective communication.

The success story of Toyota of Tampa Bay provides a powerful testament to this approach. By adopting an integrated system, the dealership witnessed a significant surge in customer engagement, proving that a streamlined experience is indeed the linchpin for fostering deeper connections. As David Boice, CEO of Team Velocity, astutely noted, this unified approach isn’t just about efficiency; it’s about fundamentally enhancing how customers interact with the brand, moving away from high-cost, manual execution towards automated systems that maximize every marketing dollar.

The future of dealership marketing is therefore blended and highly automated, leveraging technology to create a holistic narrative rather than a series of disconnected pitches. This strategic consolidation not only optimizes operational costs but also lays the groundwork for more sophisticated AI-driven insights, ensuring that marketing efforts are not just seen, but felt and acted upon throughout the buyer’s journey.

9. **AI-Driven Predictions and Proactive Service**The integration of artificial intelligence and predictive analytics is rapidly transforming from an aspirational concept into a fundamental operational necessity for dealerships. This advanced application of AI transcends basic automation, enabling dealerships to anticipate customer needs, personalize experiences on an unprecedented scale, and proactively address potential issues before they arise. This capability is nothing short of revolutionary, fundamentally redefining the relationship between dealer and customer.

AI’s ability to process vast datasets of customer behavior, vehicle performance, and market trends allows for highly accurate predictions. This means interactions can be transformed from mundane, reactive responses into personalized, forward-thinking engagements. Consider the implications for aftersales services, an area where dealers consistently predict significant AI potential. Predictive maintenance, for example, can alert customers to potential issues with their vehicles based on usage patterns, transforming service from a necessary chore into a proactive partnership for vehicle longevity.

Ford Motor Company has already demonstrated the tangible benefits of AI-powered logistics, which have boosted service experiences and delivered substantial ROI. This showcases how strategic AI implementation can lead to both enhanced customer satisfaction and improved profitability. Furthermore, the most sophisticated dealers are leveraging predictive analytics to anticipate customer interests and buying signals, allowing them to offer tailored product recommendations or financing options that feel genuinely attentive rather than intrusive.

However, the power of AI-driven predictions comes with a crucial caveat: the delicate balance between personalized service and privacy. Lynne Hudson of Morgan Auto Group rightly highlights the thin line between helpfulness and intrusiveness. Transparency in data usage and a strong ethical framework for AI deployment will be paramount to building and maintaining customer trust as these technologies become more pervasive.

Read more about: Beyond Gold: Unveiling the Next Generation of Wealth-Building Opportunities in High-Growth Sectors and Alternative Investments

10. **Adapting to New Consumer Psychology: The Rise of the Consultative Advisor**The fundamental shifts in consumer psychology and behavior represent a profound challenge and opportunity for automotive retail. Today’s car buyers, particularly younger demographics, approach major purchases with vastly different expectations than previous generations. They are information-driven, often skeptical of traditional sales tactics, and increasingly prioritize a seamless, transparent experience over mere vehicle ownership. This evolving mindset necessitates a complete overhaul of how dealerships engage with their clientele.

Traditional dealership experiences, often associated with high-pressure sales and information asymmetry, can generate significant anxiety for modern consumers. Research by CSM International’s customer research division reveals that a striking “65 percent of consumers under 40 report feeling anxious about traditional dealership experiences.” Yet, crucially, these same individuals express a strong desire for expert guidance throughout their purchase journey. This indicates that the problem isn’t with personal assistance itself, but rather with how that assistance is framed and delivered.

In response, leading dealerships are moving away from the ‘closer’ mentality and embracing a more consultative approach. Sales staff are being repositioned as product experts and trusted purchase advisors, focusing on providing value through informed advice rather than aggressive sales pitches. This strategic shift aligns perfectly with broader trends in retail psychology, where consumers expect personalization without intrusion, expertise without undue pressure, and efficiency without sacrificing thoroughness. It’s about empowering the customer, not overwhelming them.

Dealerships demonstrating the highest levels of customer satisfaction are those that have successfully adopted this consultative model. They invest in training staff to accurately gauge where each customer is in their unique journey, enabling them to provide tailored support without attempting to artificially accelerate the process. This patient, nuanced approach builds stronger, long-term relationships and fosters greater customer loyalty, proving that understanding and adapting to new consumer psychology is a cornerstone of future success.

11. **Hybrid BDC Models: Optimizing Lead Conversion and Resource Allocation**The traditional Business Development Center (BDC) model, while essential, has often been plagued by inefficiencies that lead to significant waste in advertising spend and missed conversion opportunities. Dealers globally invest substantial sums in generating leads—NADA reported $4.8 billion in the first half of 2025, equating to approximately $722 per new unit sold. Yet, a disheartening “43.2% of sales leads are mishandled on average,” a statistic that includes missed calls, leads failing to reach the CRM, and inconsistent follow-up. This problem is exacerbated by staffing shortages and high turnover, preventing teams from effectively nurturing every lead.

The solution emerging as a powerful fix is the adoption of a hybrid in-house/outsourced BDC model, strategically supported by artificial intelligence. This innovative approach allows in-house representatives to concentrate on high-value tasks, such as building robust customer relationships, confirming appointments, and diligently working hot leads that require immediate human connection. This allocation ensures that internal resources are focused where they can have the greatest impact and build the most trust.

Simultaneously, outsourced teams step in to manage the sheer volume of tasks that in-house staff simply cannot cover. This includes handling after-hours calls, providing essential overflow support during peak connection times—often between 6-8 PM—and initiating outreach on colder leads. Complementing both human teams, AI handles the repetitive, yet critical, grunt work: automating email sequences, ensuring timely text follow-ups, and intelligently scoring leads to prioritize efforts.

The results from dealerships adopting this hybrid model are compelling. GMC Mount Vernon, for instance, saw its appointment set rate jump from 17% to an impressive 42%, while response times plummeted to under 45 seconds. This dramatic improvement showcases the model’s effectiveness in maximizing lead conversion, reducing ad waste, and ensuring that every customer interaction is handled promptly and professionally, ultimately driving significant sales growth.

12. **AI Search Optimization: Ensuring Discoverability in the New Digital Frontier**The landscape of online search is undergoing a seismic shift, with a growing number of consumers turning to generative AI platforms like ChatGPT, Perplexity, and Microsoft Copilot for vehicle research, bypassing traditional Google searches. This evolution presents a critical challenge for dealerships: if their inventory isn’t discoverable on these emerging AI platforms, they effectively cease to exist for a significant segment of potential customers. The rules of digital visibility are being rewritten, and adaptation is imperative.

Unlike conventional SEO, which primarily optimizes for keyword algorithms, AI search prioritizes conversational queries and draws directly from real-time data found on dealer websites to provide direct, comprehensive answers. As Dustin Schuler from Bud Clary Auto Group observed, there’s a crucial distinction between what’s visible on a web page and what AI crawlers are capable of interpreting. Many third-party tools, scripts, and embedded images, which might be crucial for displaying vehicle information, are often overlooked by these advanced crawlers.

To navigate this new digital frontier, forward-thinking dealerships are swiftly adjusting their strategies. They are proactively uploading comprehensive inventory feeds to platforms like Google Merchant Center and OpenAI’s schema, ensuring their vehicle data is accessible to AI. Furthermore, they are thoughtfully rewriting FAQ pages in full, natural sentences that anticipate and directly answer conversational queries, mirroring how consumers interact with AI. Leveraging tools like Chrome extensions to audit what AI crawlers can actually see is also becoming a standard practice.

These adaptive measures are yielding significant results. Schuler reported that his group was “about 13% ahead of last month… in terms of total volume,” attributing this growth directly to their AI search optimization efforts. This demonstrates that by understanding and proactively engaging with the mechanics of AI-driven search, dealerships can ensure their digital presence remains strong, capturing a new wave of information-seeking buyers.

13. **The ‘Order-to-Delivery’ Paradigm: A Leaner, More Personalized Future**The traditional model of dealerships overflowing with inventory is giving way to a leaner, more efficient “order-to-delivery” paradigm, particularly for new vehicles. This significant shift sees dealerships holding minimal to no inventory, with cars instead being made-to-order, meticulously configured to a consumer’s exact specifications, and delivered months later. This transformation is driven by a confluence of factors, including evolving consumer behavior and external pressures like global supply chain disruptions.

The impact of events like the pandemic and the ensuing chip shortage accelerated this transition, forcing dealerships to operate with empty lots. Consumers responded by embracing pre-ordering, a behavior that has shown no signs of reversing. Ford CEO Jim Farley highlighted this dramatic shift, stating that “A third of our sales are order-to-delivery now. It used to be less than 5%.” This underscores a fundamental change in customer expectation and operational capability within the industry.

In this new path-to-purchase model, the role of the dealership transforms. They evolve beyond mere points of sale to become crucial delivery mechanisms for custom-ordered vehicles. Furthermore, they expand their value proposition by taking on enhanced post-purchase sales and services, such as vehicle upfitting—customizing a car with additional features or accessories—and comprehensive maintenance programs. This ensures that dealerships remain central to the customer’s mobility journey, even if their function shifts.

For OEMs, this evolution necessitates a seamless integration of their organizations across all tiers and channels, ensuring that the customer experience from configuration to delivery is smooth and consistent. The order-to-delivery model fosters a more personalized acquisition process, reduces dealer holding costs, and ultimately creates a more sustainable and customer-centric approach to vehicle sales, proving that less inventory can indeed lead to more tailored satisfaction.

14. **Global-Local Relevance: Tailoring Strategies for Diverse Markets**While digital transformation is a consistent global trend in automotive retail, its practical application demands a nuanced understanding of regional variations. Different cultural attitudes, regulatory environments, and market structures mean that strategies that flourish in one part of the world may require significant adaptation to succeed elsewhere. This global-local relevance is paramount for manufacturers and dealer groups operating across diverse international markets.

Research conducted by CSM International’s global automotive research team across 27 markets vividly illustrates these contrasts in consumer preferences. In Northern European markets, for example, consumers exhibit a strong preference for highly structured, low-pressure retail environments, often characterized by fixed pricing and minimal negotiation. A striking “over 70 percent of Norwegian consumers expressing comfort with primarily digital purchase processes” highlights this regional disposition towards digital-first transactions.

Conversely, in many Mediterranean and Middle Eastern markets, the personal relationship between the dealer and customer remains critically important. Here, “63 percent of consumers in these regions indicating that trust in their sales representative is more important than price or product features.” This emphasizes the enduring value of human connection and relationship building. Asian markets, meanwhile, present another unique pattern, combining exceptionally high digital engagement throughout the journey with a strong emphasis on in-person consultation for final decisions, demonstrating a hybrid preference.

These variations underscore that while universal elements like transparency and seamless information flow are always valued, the specific implementation of retail strategies must be meticulously tailored to local contexts. Successful global players are those who adeptly balance these universal elements with specific cultural adaptations, ensuring that their customer experience is both globally consistent in quality and locally relevant in its approach. This delicate equilibrium is one of the most significant strategic challenges and opportunities in contemporary automotive retail.

The future of car dealerships, as we hurtle towards 2035, is not one of obsolescence but of profound redefinition. It is a future where the physical showroom becomes an immersive brand experience, where data isn’t just collected but intelligently leveraged for hyper-personalization, and where AI transforms every operational facet from marketing to customer service. The human element, far from being diminished, is elevated, shifting from transactional sales to consultative advisory roles, fostering genuine trust and deeper relationships. Dealerships that embrace this metamorphosis—becoming agile, customer-centric hubs within a broader mobility ecosystem—will not merely survive; they will thrive, offering a richer, more integrated, and emotionally resonant experience for every car buyer. The road ahead is paved with innovation, and for those willing to adapt, the journey promises a renaissance of success.