The American financial landscape stands at a critical juncture, navigating the aftermath of recent significant bank collapses. In the wake of the failures of Silicon Valley Bank and Signature Bank, President Joe Biden’s administration has initiated a comprehensive push for heightened regulatory oversight.

This proactive stance aims to bolster the resilience of the nation’s banking system, with a clear focus on reversing what the White House identifies as regulatory rollbacks from the preceding administration. The proposals signal a determined effort to reshape the framework governing large regional financial institutions.

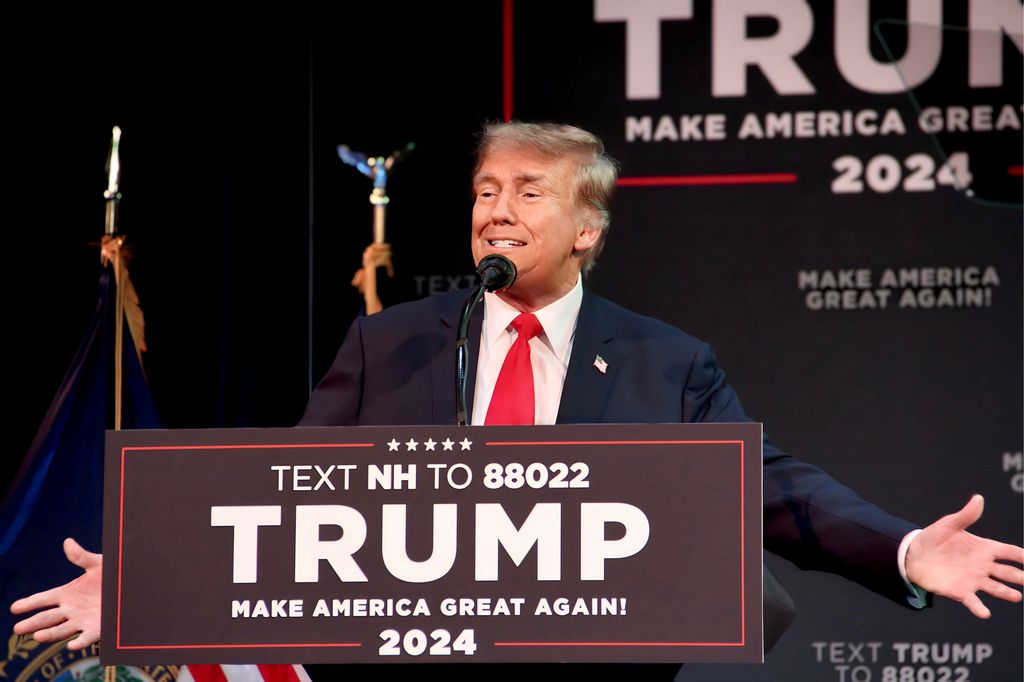

Central to the administration’s strategy is a belief that the weakening of common-sense bank safeguards contributed significantly to the recent turmoil. A White House official articulated this perspective, stating, “President Joe Biden ‘believes that the weakening of common-sense bank safeguards and supervision during the Trump administration for large regional banks should be reversed in order to strengthen the banking system and protect American jobs and small businesses.’

This assertion frames the current initiatives as a necessary corrective action to ensure future stability. The administration highlights that the Obama-Biden era established robust requirements, primarily through the Dodd-Frank Act, designed to mitigate the risk of banking crises.

However, these measures, according to the White House, were subsequently diminished. Unfortunately, the Trump administration and its regulators weakened many important common-sense requirements and (weakened) supervision for large regional banks like Silicon Valley Bank and Signature Bank, whose recent failure led to the risk of contagion throughout the banking system,” an official noted, drawing a direct link to the recent failures.

Independent financial experts, the administration points out, have also attributed the recent bank failures, in part, to these prior regulatory adjustments. This perspective underpins the urgency and necessity perceived by the White House in advocating for swift and decisive changes.

The proposed regulatory enhancements are multifaceted, targeting banks with assets ranging from $100 billion to $250 billion. A primary recommendation is the reinstatement of stringent liquidity requirements, ensuring that these institutions maintain sufficient cash reserves to meet their obligations even under stressed conditions.

Alongside liquidity, the administration advocates for enhanced liquidity stress testing, a critical tool for assessing a bank’s ability to withstand sudden market shocks. These tests, originally conceived under the Dodd-Frank Act, provide forward-looking insights into a bank’s financial vulnerabilities.

Furthermore, the White House is calling for the return of annual supervisory capital stress tests. These evaluations are essential for determining whether banks possess adequate capital buffers to absorb potential losses during economic downturns or periods of high interest rates.

Another key proposal involves mandating comprehensive resolution plans, often referred to as “living wills,” for midsize banks. These plans would detail how a bank could be wound down in an orderly fashion without causing systemic disruption to the broader financial system.

The aim is to prevent future scenarios where failing institutions might necessitate taxpayer-funded bailouts. Such proactive planning ensures that mechanisms are in place for managing distressed banks gracefully, minimizing broader contagion.

The president also seeks to implement strong capital requirements for banks, to be applied “at an appropriate time after a considerable transition period.” This phased approach acknowledges the need for banks to adapt to new requirements without undue immediate burden.

Beyond capital and liquidity, the administration emphasizes strengthening supervisory tools across the board. The goal is to ensure that regulatory oversight is sufficiently robust to allow banks to “withstand high interest rates and other stresses.”

Moreover, the White House intends to reduce the transition periods for applying these common-sense safeguards to growing banks once they exceed the $100 billion asset threshold. This measure aims to prevent regulatory arbitrage as banks expand.

An additional component of the president’s recommendations involves expanding long-term debt requirements for a broader range of banks. This provision seeks to enhance banks’ loss-absorbing capacity and promote financial stability through a diversified capital structure.

Crucially, the administration is committed to ensuring that community banks are not burdened with the costs of replenishing the Deposit Insurance Fund following the recent bank failures. This reflects a desire to protect smaller, localized institutions from the fallout of larger banks‘ missteps.

A significant aspect of these proposed reforms is their intended pathway to implementation. White House officials have repeatedly stressed that these actions can be accomplished under existing law, placing them within the purview of independent federal banking agencies.

This means that the changes would not require congressional action, theoretically allowing for quicker adoption. The administration has indicated that these recommendations build upon regulatory reforms already on its agenda, streamlining the process.

While the focus is on immediate regulatory adjustments, the White House also continues to engage with lawmakers on potential legislative reforms. These include measures that would facilitate the government’s ability to rescind bonuses and stock sale gains from executives whose actions directly contribute to bank failures.

The administration has additionally requested that Congress expand the Federal Deposit Insurance Corp.’s authority to impose fines on such executives. These legislative efforts signify a broader ambition to enhance accountability within the banking sector, extending beyond just institutional regulations.

Despite the White House’s optimism regarding the banking system’s stabilization, industry representatives have voiced strong skepticism and opposition. Greg Baer, President and CEO of the Bank Policy Institute, a nonpartisan policy group representing leading American banks, criticized the administration’s regulatory push.

Baer expressed concern that the proposed regulations, if implemented, would “impose meaningful costs on the U.S. economy going forward.” He also argued that the timing was premature, stating, “The Fed has barely begun its promised review. This has a strong feeling of ready, fire, aim.”

Similarly, Rob Nichols, President and CEO of the American Bankers Association, deemed the White House’s move “premature.” These industry leaders suggest that a comprehensive review of the recent failures should precede any sweeping regulatory changes.

In stark contrast, Better Markets, a nonpartisan organization dedicated to advocating for tougher banking regulations since the 2008 financial crisis, applauded the Biden administration’s efforts. Dennis M. Kelleher, the nonprofit’s co-founder, president, and CEO, dismissed industry criticisms as predictable.

Kelleher stated, “Yes, the bankers, their lobbyists, and allies are going to scream and make all sorts of baseless claims about how the sky will fall if they are properly regulated, as they always do and have been doing since the Great Crash of 1929.” He concluded that “Their claims are false and dangerous and must be rejected.

This sharp divergence of opinion underscores the enduring philosophical divide regarding financial regulation: the balance between fostering stability and minimizing perceived burdens on economic activity. The debate extends beyond immediate regulatory changes into the realm of legal challenges.

Indeed, financial industry powerhouses are not solely relying on lobbying Congress for reversals; they are actively pursuing legal avenues. This “belt-and-suspenders approach by the industry,” as described by Lucy Morris, a Hudson Cook LLP partner and former CFPB deputy enforcement director, aims for more certain and lasting outcomes.

The strategy is evident in reactions to rules from the Consumer Financial Protection Bureau (CFPB). When the CFPB finalized its $5 limit on overdraft fees in December, bank and credit union lobbying groups immediately filed lawsuits to block it.

Likewise, the agency’s final rule on January 7, barring medical debt from consumer credit reports, prompted immediate legal action from credit reporting companies and credit unions. Debt collectors followed suit shortly thereafter, demonstrating a coordinated legal defense.

While a Republican-controlled Congress could potentially use the Congressional Review Act (CRA) to cancel recently enacted rules, the path is not always clear. The CRA offers a fast-track process, but it requires simple majorities in both chambers and a presidential signature.

However, as Elliott Stein, a senior litigation analyst at Bloomberg Intelligence, points out, congressional floor time might be tied up with other priorities, such as immigration, tariffs, and tax cuts. Furthermore, some consumer-friendly regulations, like those from the CFPB, might possess “populist overtones” that make them politically difficult to target.

Adam Rust, the director of financial services at the Consumer Federation of America, suggests that the industry prefers to challenge these rules in court rather than through public debate. He posits, “They’d prefer to sweep this under the rug rather than give it a fair public hearing because they know those are popular issues. They resonate with people.”

Beyond the CRA, rescinding a regulation typically involves the formal notice-and-comment rulemaking process mandated by the Administrative Procedure Act (APA). This process, which includes justifying proposals, reviewing comments, and crafting a final rule, can take many months.

Agencies must also exercise increased caution in providing justifications for axing rules, particularly following last year’s US Supreme Court ruling in Loper Bright Enterprises Inc. v. Raimondo. This ruling eliminated long-standing judicial deference to federal regulators on unclear laws, demanding greater rigor in APA rulemaking.

Given these protracted administrative pathways, financial companies cannot afford to wait, especially due to time limits for filing lawsuits. Filing a lawsuit so as not to waive that right is definitely the prudent thing to do since one can never be sure what an administration’s priorities will be or whether Congress will expend time and capital going through the CRA,” Stein observed.

Some lawsuits even serve as strategic placeholders. For instance, a lawsuit filed last month by the Bank Policy Institute, the American Bankers Association, and the US Chamber of Commerce challenging the Federal Reserve’s stress tests for banks came just one day after the Fed announced plans to revise the stress test process.

Rob Nichols, the ABA President and CEO, explained the rationale: “We remain hopeful the Fed will address long-standing issues with the stress tests, but this litigation preserves our ability to seek legal remedies if the Fed falls short.” This highlights the industry’s intent to keep all options open.

A court decision overturning a rule offers a level of finality and precedent that a simple regulatory reversal by an agency cannot match, as Stein further elucidated. If an agency reverses a rule, a subsequent administration can attempt to reinstate it.

This dynamic was observed with shareholder proxy voting rules promulgated under the Trump administration and partially rolled back under Biden. However, if a court deems a particular rule to violate the law, an agency’s ability to reinstate that regulation becomes significantly more constrained.

Another avenue for the industry lies in the possibility of new agency leadership in a future administration choosing not to defend certain regulations challenged in court. For example, a future CFPB could simply allow a judge to eliminate rules on overdraft fees or medical debt without mounting a defense.

“This would be easier than going through another rulemaking process to unwind the rule,” according to Morris. This legal and political interplay creates a complex environment for regulatory evolution, where outcomes are shaped by judicial rulings as much as by legislative or executive actions.

The ongoing debate surrounding President Biden’s push for new banking regulations underscores the intricate balance required for financial stability. On one side, proponents argue for robust oversight as a bulwark against future crises, emphasizing the lessons learned from recent collapses and past economic downturns.

They contend that stronger safeguards are essential not only to protect the financial system itself but also to shield American jobs and small businesses from volatility. Their perspective stresses accountability and the proactive management of systemic risks.

On the other side, industry voices raise concerns about the potential for over-regulation, arguing that it could stifle economic growth, impose undue compliance costs, and hinder the essential functions of banking. They advocate for a more measured approach, emphasizing the need for thorough review before broad reforms are enacted.

The interplay between executive proposals, independent regulatory agencies, congressional deliberations, and strategic litigation creates a dynamic and often contentious landscape. The ultimate trajectory of these reforms will depend on the sustained political will of the administration, the independent decisions of financial regulators, and the outcomes of the vigorous legal challenges mounted by the financial industry.

As the banking sector navigates these pressures, the core objective remains elusive yet paramount: fostering a financial system that is both resilient in the face of adversity and sufficiently agile to support a vibrant economy. The unfolding chapters of this regulatory saga will undoubtedly shape the future of American finance for years to come.