The allure of a ‘tax haven’ traditionally conjures images of secluded islands with swaying palm trees, far removed from the complexities of national tax codes. However, a significant and increasingly attractive landscape for minimizing tax liabilities exists much closer to home: within the United States itself. For high-net-worth individuals and businesses, nine U.S. states have cemented their status as formidable tax havens, offering zero state income tax and powerful incentives for those seeking to reduce their overall tax burden.

Recent changes in state tax laws and ongoing trends have made these U.S. Tax Haven States more appealing than ever. These jurisdictions — Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming — provide a strategic advantage that allows entrepreneurs, investors, retirees, and corporations to protect and grow their assets more efficiently. This strategic environment allows for millions of dollars in potential savings each year for those with significant income or investment earnings, making careful planning and understanding of these policies paramount.

This in-depth article will navigate through these nine pivotal states, beginning with a closer look at what makes each of them a magnet for the wealthy. We will unpack their specific zero-income-tax policies, discuss their unique features, and highlight recent legislative updates that further solidify their positions. Understanding these state-level dynamics is crucial for anyone aiming to make informed financial decisions in an increasingly mobile and tax-conscious economy.

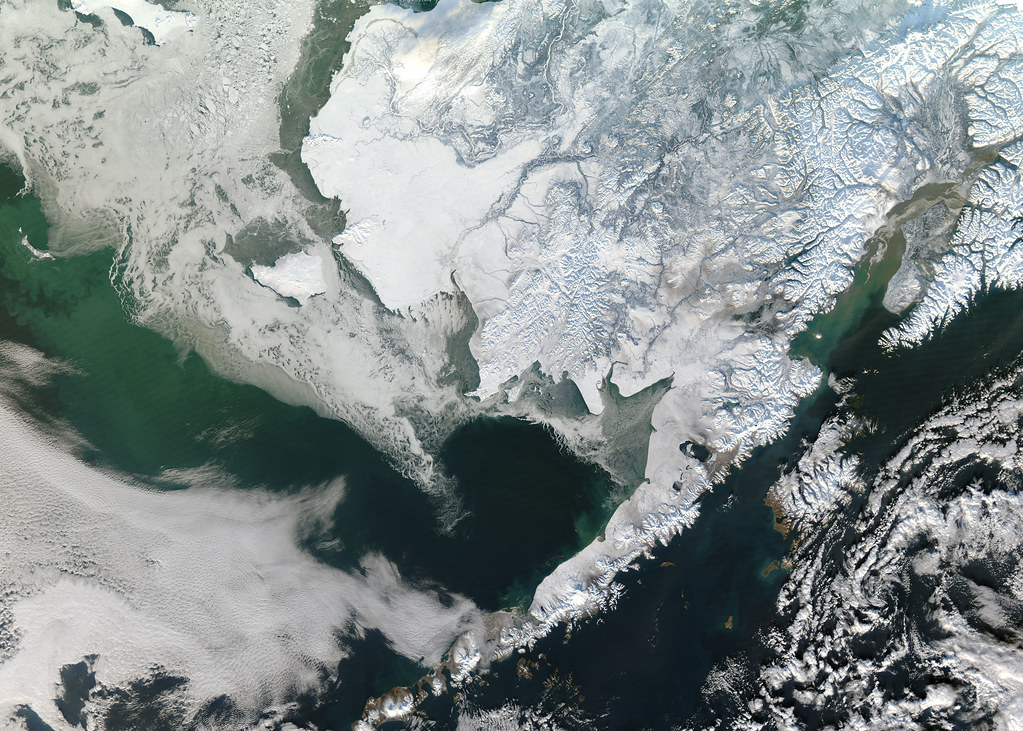

1. Alaska

Alaska stands out as a unique U.S. tax haven, distinguishing itself with a clear ‘No state income tax’ policy. This foundational benefit immediately positions it as an attractive option for individuals and businesses aiming to minimize their state-level tax obligations. Beyond the absence of an income tax, Alaska also offers an additional, often overlooked, advantage: ‘No state sales tax in most areas.’ This dual benefit means residents can enjoy significant savings not only on their earnings but also on their daily expenditures, making it a compelling choice for financial optimization.

A cornerstone of Alaska’s appeal is its distinctive Permanent Fund Dividend (PFD). This program, rooted in the state’s oil wealth, provides ‘Residents receive an annual payment from the state’s oil wealth.’ The PFD is a direct financial benefit to individuals who meet residency requirements, effectively distributing a portion of the state’s natural resource revenue back to its citizens. This annual payment can further enhance the financial attractiveness of establishing domicile in Alaska, offering a tangible return on residency.

The combination of zero state income tax, minimal sales tax, and the unique PFD program makes Alaska a powerful location for wealth preservation and growth. For high-net-worth individuals, the ability to retain more of their income and investments, coupled with an annual dividend, presents a robust financial incentive. Businesses, too, can benefit from the lack of a state income tax, which can lead to lower operating costs and potentially higher profitability for founders and key employees, especially those with flexible or virtual operations.

Read more about: Which US States Have the Highest and Lowest Gasoline Excise Taxes?

2. Florida

Florida has long been synonymous with sunshine, vibrant culture, and, increasingly, robust financial advantages for the wealthy. As one of the prominent U.S. Tax Haven States, it proudly maintains a policy of ‘No state income tax,’ a primary draw for countless individuals and corporations. This absence of state income taxation translates directly into substantial savings for those with significant earnings, allowing them to retain a larger portion of their wealth annually.

Beyond income tax relief, Florida also offers the significant benefit of ‘No estate tax.’ This particular feature is crucial for comprehensive estate planning, as it helps high-net-worth individuals ensure that their accumulated wealth can be passed down through generations without being diminished by state-level inheritance taxes. This makes Florida particularly popular among ‘retirees and wealthy individuals’ who are meticulously planning their financial legacies and seeking to maximize intergenerational wealth transfer.

Adding to its financial appeal, Florida has ‘enhanced asset protection laws,’ which provide strong legal frameworks designed to shield assets from potential liabilities, lawsuits, and creditors. These robust protections are a powerful draw for businesses and high-net-worth individuals who prioritize safeguarding their wealth. The combination of no state income tax, no estate tax, and comprehensive asset protection laws solidifies Florida’s position as a premier destination for those looking to protect and grow their financial portfolios, making it a pivotal choice in long-term financial strategies.

Read more about: From Pennies to Masterpieces: 14 Low-Budget Films That Rose to Timeless Classic Status

3. Nevada

Nevada, often recognized for its vibrant tourism and gaming industries, also stands out as a formidable U.S. tax haven, particularly for business and asset protection. The state boasts ‘No personal income tax,’ a significant advantage that directly benefits individuals and pass-through entities, allowing them to keep more of their earnings. This absence of personal income taxation is a core reason why Nevada has become a magnet for those seeking to reduce their overall tax burden.

The state’s ‘business-friendly regulations’ further enhance its appeal, creating an environment conducive to corporate growth and wealth management. Nevada is notably ‘popular for company incorporation, especially for asset protection trusts and LLCs.’ This favorable regulatory landscape, combined with the lack of personal income tax, makes it an ideal location for establishing various business structures designed to optimize financial outcomes and safeguard assets from potential claims or economic fluctuations.

One of Nevada’s most striking features lies within its progressive trust laws. The context explicitly notes that in Nevada, ‘a trust can remain untouched for 365 years.’ This extraordinary allowance for perpetual or near-perpetual trusts signifies a powerful tool for intergenerational wealth transfer, allowing assets to grow and benefit heirs for centuries without triggering tax events related to the dissolution of the trust. This makes Nevada an unparalleled stronghold for long-term wealth preservation, illustrating why it is considered one of the ‘Biggest Enablers’ in the national landscape of untaxed wealth, attracting elites who seek to stow away wealth without paying taxes across generations.

Read more about: Navigating Debt After Death in the US: What Every Family Needs to Know

4. New Hampshire

New Hampshire presents a distinctive approach to taxation within the U.S. tax haven landscape. It maintains ‘No tax on earned income,’ which is a significant draw for professionals, entrepreneurs, and anyone whose primary income derives from wages or business profits. This policy allows residents to retain 100% of their earned income at the state level, providing a substantial financial benefit compared to states with high progressive income tax rates.

A key update making New Hampshire even more attractive for investors is the ongoing phase-out of its ‘tax on dividends and interest.’ This tax ‘is being phased out and will be fully repealed by 2027,’ indicating a progressive move towards a more investment-friendly tax environment. For high-net-worth individuals whose income heavily relies on dividends and interest from investments, this repeal means significantly greater financial flexibility and increased after-tax returns on their portfolios, making the state an increasingly compelling choice for retirees and investors.

In addition to these income-related benefits, New Hampshire also boasts ‘No sales tax,’ which provides an everyday financial advantage for residents and businesses by reducing the cost of goods and services. However, it’s also worth noting that New Hampshire has been identified as a ‘Bad Actor’ in terms of trusts. This classification, along with Tennessee and Wyoming, highlights that these states also foster environments where substantial untaxed wealth, estimated at least ‘$800 billion stuffed in trusts,’ can flourish, reflecting a national ‘race to the bottom’ in terms of oversight and trust subservience.

Read more about: Unlocking Affordable Medications: A Comprehensive Guide to State-Specific Programs for Lowering Prescription Drug Costs

5. South Dakota

South Dakota has emerged as a particularly potent U.S. tax haven, not just for its ‘No state income tax’ policy, but predominantly for its pioneering and highly flexible trust laws. This combination creates an exceptionally favorable environment for wealth management and asset protection, attracting high-net-worth individuals from across the globe. The absence of state income tax ensures that personal earnings and profits are not diminished at the state level, providing immediate financial relief.

The state is widely recognized as a leader in ‘flexible trust laws,’ offering ‘strong protection for dynasty trusts and wealth management.’ Unlike many other jurisdictions, South Dakota has enacted legislation that allows trusts to endure for generations without mandatory dissolution. The context specifically states that in South Dakota, trusts ‘can exist indefinitely,’ with the exception of real estate in Delaware. This means there are essentially ‘no guardrails saying trusts have to be dissolved at some point and those assets sold off and taxed.’

This perpetual nature of trusts in South Dakota is a critical mechanism for ‘intergenerational inequality’ and wealth preservation, allowing assets to grow untaxed for extended periods. According to a report by the Institute for Policy Studies, South Dakota is identified as one of the ‘Biggest Enablers’ among U.S. states where untaxed wealth flourishes in trusts. Together with Nevada, Alaska, and Delaware, there is an ‘estimated $575 billion socked away in trusts’ within these states. This practice significantly impacts the broader tax landscape, with experts like Chuck Collins noting that ‘it’s costing the rest of us taxpayers billions and hundreds of billions of dollars in lost revenue’ due to these mechanisms.

Read more about: 10 Breathtaking Rail Trails Every Cyclist Should Ride Once

6. Tennessee

Tennessee achieved full income tax-free status in 2021 by completely phasing out its Hall Tax on dividends and interest. This makes it highly attractive for individuals whose wealth primarily stems from investments, offering significant benefits for financial planning and wealth preservation.

Retirees and investors particularly benefit, retaining more earnings and investment returns. This positions Tennessee as a strategic choice for optimizing portfolios and managing retirement finances effectively.

However, Tennessee compensates for no income tax with high sales taxes, a crucial consideration for residents. The Institute for Policy Studies also identifies Tennessee as a “Bad Actor” regarding trusts, where an estimated “$800 billion stuffed in trusts” flourishes, reflecting a national “race to the bottom” in oversight.

Read more about: Fading Glory: Reliving 15 Defunct Sports Leagues and Iconic Teams That Vanished from the U.S. Landscape

7. Texas

Texas offers the significant advantage of no state income tax, combined with a booming economy. This positions it as a prime destination for businesses and high-net-worth individuals, fostering both wealth creation and preservation.

Major corporations like Tesla and Oracle have relocated or expanded here, highlighting Texas’s appeal through supportive infrastructure and lower operating costs for entrepreneurs and key employees.

While personal income tax is absent, businesses are subject to a franchise tax on gross receipts as a state revenue mechanism. Texas is also classified as an “Emerging Enabler,” hosting over “$300 billion” in trusts, contributing to untaxed wealth accumulation.

Read more about: The Billion-Dollar Lesson: Why Jennifer Lopez’s Lack of a Prenup Underscores Its Critical Importance for Every Financial Future

8. Washington

Washington State attracts high-net-worth individuals and businesses with its no state income tax policy, particularly benefiting tech entrepreneurs and innovators. This allows maximized personal earnings and investment returns.

A unique feature is the Business and Occupation (B&O) tax, levied on businesses’ gross receipts. This taxes revenue rather than net profit, a key operational consideration for businesses operating within the state.

Despite no income tax, Washington compensates with “High sales taxes.” Residents save on income tax but incur increased costs on goods and services, a pattern common in U.S. tax haven states, requiring careful budget planning.

Read more about: Fading Glory: Reliving 15 Defunct Sports Leagues and Iconic Teams That Vanished from the U.S. Landscape

9. Wyoming

Wyoming, with zero state income tax and “Minimal corporate taxes,” is a strong contender for wealth preservation, especially for businesses seeking lean corporate structures and streamlined operations.

It is highly “Popular for LLC formation and estate planning,” reflecting favorable legal and tax frameworks for asset protection and wealth transfer, supporting efficient business operations and robust asset management.

Despite tax benefits, Wyoming uses alternative taxation. Residents should note “Higher property taxes in some areas,” which can offset income tax savings. Identified as a “Bad Actor” concerning trusts, Wyoming holds an estimated “$800 billion stuffed in trusts,” enabling substantial untaxed wealth through “indefinitely existing” trusts.

**Required Actions to Secure Tax Benefits**

Securing tax benefits in U.S. Tax Haven States demands deliberate action beyond mere property ownership. Establishing legal domicile, proving intent to make the new state your permanent home, is critical. High-tax states closely scrutinize these claims; improper execution can negate desired advantages.

Key steps include registering to vote, obtaining a new driver’s license or state ID, and changing all mailing addresses. Crucially, spending the majority of time physically in the new state and selling or renting your former primary residence are essential. These actions collectively build a strong case for permanent residency.

Business owners must review their structure, considering restructuring as a pass-through entity or relocating headquarters. Understanding state sourcing rules is vital; income from other states may still be taxed by those jurisdictions. Professional guidance is indispensable due to complex laws and strict enforcement, crucial for compliance and maximizing legitimate savings.

**Legal and Practical Considerations**

While the prospect of zero state income tax is appealing, individuals and businesses must grasp all legal and practical considerations. Benefits aren’t automatic; a nuanced awareness of tax implications and residency rules is vital. Demonstrating intent to make a state your permanent home is paramount for long-term planning.

Interstate income sourcing is a key factor: income generated from activities or properties in other states may still be taxed by those jurisdictions. Federal taxes still apply regardless of state residency; U.S. tax haven states only offer relief from state-level income taxation.

These states often compensate through other taxes: high sales taxes (Tennessee, Washington), franchise tax (Texas), or higher property taxes (Wyoming, Alaska). Tax benefits also differ for groups. U.S. citizens/permanent residents establishing domicile generally avoid state income tax; resident aliens (Substantial Presence Test/green card) benefit similarly; nonresident aliens are taxed only on U.S.-sourced income.

**The Role of Trusts in Wealth Preservation and Broader Implications**

U.S. tax haven states crucially involve trusts in wealth preservation, impacting tax planning and inequality. Chuck Collins states, “The US has become a tax haven” for global wealthy seeking to avoid tax responsibilities. A report highlights 13 U.S. states where untaxed wealth flourishes indefinitely within trusts, allowing assets to grow untaxed for centuries.

“Biggest Enablers” like South Dakota, Nevada, Alaska, and Delaware hold an estimated “$575 billion socked away in trusts.” Trusts in Nevada can exist for “365 years”; others “exist indefinitely,” effectively removing “guardrails” for asset taxation. This “race to the bottom” among states for less oversight has profound economic consequences.

“Bad Actors” (Tennessee, Wyoming, New Hampshire) collectively hold “$800 billion stuffed in trusts”; “Emerging Enablers” (Florida, Texas) host “$300 billion.” This unchecked untaxed wealth fuels “intergenerational inequality,” costing “taxpayers billions and hundreds of billions of dollars in lost revenue,” as Collins notes.

Federal estate/gift taxes collected only “$27 billion” last year (0.7% of all taxes), contrasting with “$5.626 trillion in trusts and estates” by 2021, implying trillions annually escape taxation. America’s richest often pay effective tax rates as low as “24 percent” by legally sheltering fortunes, significantly shaping individual wealth and the broader economy.

**Conclusion**

U.S. tax haven states present significant opportunities for high-net-worth individuals and businesses to optimize financial strategies. States like Tennessee, Texas, Washington, and Wyoming provide distinct advantages, from zero income tax to business-friendly environments, fostering savings and asset protection.

However, realizing these benefits demands meticulous planning. A thorough understanding of residency rules, interstate income sourcing, and each state’s unique tax structure is crucial. Informed decision-making regarding domicile significantly impacts long-term financial success in an increasingly mobile economy.

Read more about: Unlock Significant Savings: 12 Expert Strategies to Effectively Lower Your Property Taxes Before Year-End

The strategic use of trusts highlights potent wealth preservation, yet also raises critical questions about inequality and revenue. Consulting experienced tax and legal experts is paramount to navigate complexities, ensure compliance, and fully leverage America’s tax haven opportunities.