A Hall of Famer’s Financial Wake-Up Call

When people hear the name Charles Barkley, they usually think of a Hall of Fame basketball player, a charismatic television analyst, and a man known for his blunt honesty. What is less discussed is his transformation from what he once called a financial “idiot” into a disciplined money manager. His journey carries lessons not only for professional athletes but also for anyone learning to navigate the challenges of personal finance.

Barkley has never hidden his missteps. In a conversation with Shannon Sharpe on the Club Shay Shay podcast, he admitted, “I first was an idiot when I got my money.” His example of buying “three or four cars” illustrates how easy it is to fall into the trap of overspending when sudden wealth becomes available. These early splurges, while glamorous at the time, became the foundation of his financial learning curve.

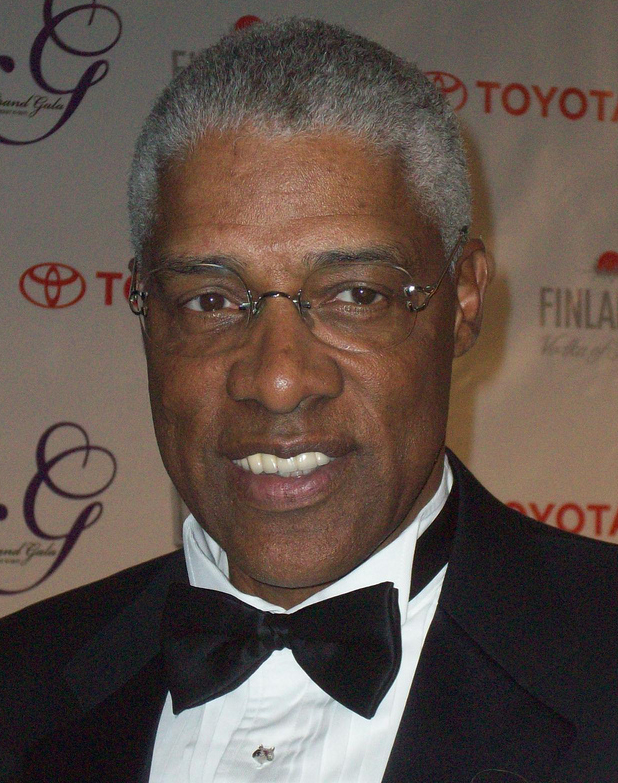

Dr. J’s Timeless Advice

The turning point came through the wisdom of Julius Erving, better known as Dr. J. He asked Barkley a simple but powerful question: “How many of those cars can you drive at the same time?” The question underscored the irrationality of Barkley’s spending. Erving continued, “‘Why you got four? This money got to last you the rest of your life.’”

This conversation left a lasting impression. Barkley began to see wealth not as a tool for displays of status but as a finite resource requiring careful stewardship. The lesson extended beyond cars. By pointing out that choosing a $70,000 car over a $300,000 Bentley would leave an extra $200,000 to grow through investments, Dr. J highlighted the importance of compounding and long-term thinking.

America’s Costly Love Affair with Cars

Barkley’s early obsession with cars mirrors a broader cultural reality. According to the International Organization of Motor Vehicle Manufacturers, the United States had 860 cars per 1,000 people in 2020, far outpacing Canada’s 707 or Germany’s 627. Car ownership is deeply embedded in American life, with the U.S. Census Bureau reporting in 2022 that 59.1% of households had at least two vehicles.

This cultural preference comes at a steep cost. Experian data from 2024 showed that the average new auto loan was $40,927, with monthly payments averaging $734 at an interest rate of 6.84%. Many households face the burden of $1,000 car payments, creating financial stress that limits opportunities to save for retirement, education, or home ownership.

Choosing Simplicity and Function Over Flash

Dr. J’s advice to “not waste your money on cars” has become central to Barkley’s financial philosophy. He eventually abandoned the idea that recognition required a flashy vehicle. In fact, he now drives a Kia, saying simply that a car’s role is to “get me from A to B.” His choice reflects confidence rooted in who he is, rather than in what he drives.

This shift in perspective offers practical guidance for others: choosing affordable vehicles, exploring shared transportation, or simply resisting the temptation to overspend on status symbols. Each decision frees up money to save or invest, creating long-term security rather than short-term gratification.

The Hidden Trap of Supporting Others

Beyond cars, Barkley confronted another financial pitfall common among those with sudden wealth: supporting family and friends. He described this as a kind of “survivor’s remorse” that can spiral into unsustainable obligations. Providing ongoing financial support often strains both finances and relationships.

A defining moment came during the 1996 Olympics when Barkley overheard Janet Hill, the mother of teammate Grant Hill, explain why she still worked despite her son’s wealth. She told Barkley, “Do not start taking care of your family and friends. They never gonna stop, and it’s gonna ruin all your relationships.” She added, “When you start giving people money, they never gonna ask for money [just] one time. No matter what you do for them, the first time you tell them no, they hate you.” Barkley later admitted this was a painful but transformative lesson.

The Weight of Community Expectations

Barkley’s struggle reflects a broader cultural challenge for athletes, particularly from marginalized communities. As wealth manager Humble Lukanga explained, “There’s a pressure that comes with being the African-American success story. You are some community’s pride and joy.” The sense of obligation to give back financially can be overwhelming, even when it threatens personal stability.

While community support is vital, Barkley’s experience illustrates that financial resilience requires boundaries. The best way to provide lasting value is to secure one’s own financial foundation rather than depleting it through endless handouts.

Why So Many Athletes Struggle After Retirement

The financial troubles Barkley describes are widespread in professional sports. A 2009 Sports Illustrated report estimated that 60 percent of NBA players face bankruptcy or serious financial stress within two years of retirement. Despite average NBA salaries exceeding $10 million in recent seasons, overspending and a lack of financial literacy often lead to ruin.

Notable examples such as Allen Iverson and Latrell Sprewell highlight how quickly fortunes can evaporate. Barkley’s candid warnings to younger athletes draw from his own missteps, urging them to think about what their finances will look like at age 55, not just during their peak earning years.

Building for the Long Term

Barkley’s financial journey reflects a mindset shift from immediate gratification to sustainability. His advice is direct: “When you waste money on cars, you’re really just trying to impress other people.” His focus is now on how much remains when the playing days are over.

He advocates for saving and investing, underscoring the importance of strategic growth. Examples such as Shaquille O’Neal, who expanded his wealth through business ventures and franchising, show how athletes can secure long-term financial stability. Barkley himself has built significant wealth through his post-retirement media career, further proving the value of smart financial planning.

Barkley’s financial transformation is more than a story about money. It is about self-awareness, mentorship, and the discipline to prioritize inner peace over external approval. His “Kia philosophy” represents not just practical car ownership but a broader philosophy: confidence without extravagance and freedom through financial security.

His candid reflections carry universal lessons. True wealth is not measured by cars, houses, or other possessions, but by the freedom and stability that come from sound financial choices. Barkley’s willingness to share his mistakes and growth makes him a relatable figure whose story can inspire anyone seeking financial resilience and peace of mind.