Buying a new or used vehicle is an exciting milestone for many, a significant investment that promises freedom and functionality. Yet, for all the gleaming chrome and enticing test drives, the journey from browsing to buying can often feel fraught with uncertainty. It’s a landscape where seasoned professionals, the car salespeople, often hold a distinct advantage over even the most diligent amateur buyer.

While it’s important to acknowledge that many car dealers operate with integrity, earning their reputation through honest business practices, the industry also has its share of less scrupulous operators. These dealerships and individual salespeople employ a range of tactics designed to confuse, mislead, or simply pressure buyers into deals that are less favorable than they appear. Understanding these common pitfalls isn’t about fostering cynicism; it’s about empowering you with the knowledge to walk into any showroom with confidence and secure a truly fair deal.

We’re here to strip away the mystique and illuminate the most frequently encountered dealership deceptions. Drawing on expert insights and insider perspectives, we’ll equip you with the factual information and proactive strategies needed to spot red flags, navigate complex negotiations, and ultimately drive away with a vehicle and a financing plan that truly suits your budget and needs. Let’s dive into the first seven essential tactics you need to recognize and master.

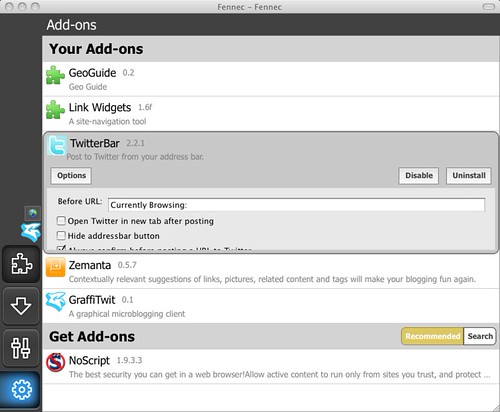

1. **Credit Score Deception**

One of the most insidious ways a dealership can disadvantage a less-informed buyer begins with your credit score. Some dealers may attempt to convince you that your creditworthiness is significantly worse than it actually is. This tactic aims to lower your expectations, making you believe you don’t qualify for the most competitive interest rates available.

Accepting a higher interest rate than you truly qualify for can lead to substantial financial repercussions. Over the typical lifespan of an auto loan, these seemingly small percentage points accumulate into hundreds, if not thousands, of dollars in unnecessary interest payments. It’s a silent drain on your finances, quietly padding the dealer’s profits at your expense.

To circumvent this common deception, proactive preparation is your most potent weapon. Before stepping onto a dealership lot, check your own credit score and research average auto loan rates for your profile. Arrive with a pre-approval from an independent lender already in hand; this provides a concrete benchmark and strengthens your negotiating position. As the context advises, “The fix to this is always to get preapproval from your own lender first so you know you walked away with the best deal possible.”

Read more about: Cybersecurity Experts Warn: Unpacking the New Wave of Incredibly Real Text Phishing Scams and How to Stay Safe

2. **The Three-Part Negotiation Trap**

Many car buyers mistakenly perceive the purchase of a vehicle as a single, unified transaction. This perspective is a common misconception, one that experienced car dealers adeptly leverage to their advantage. In reality, buying a car involves at least three distinct financial components that can become intertwined to obscure the true cost and potential savings.

These three integral transactions are: the price of the new car, the value of any vehicle you’re trading in, and the terms of your financing agreement. Each element represents a distinct opportunity for the dealership to profit, and consequently, each is an independent avenue where you can achieve significant savings. Blurring these together makes it incredibly difficult to discern where you’re truly gaining or losing ground.

The key to unlocking the best possible overall deal is to treat each of these three components as entirely separate negotiations. Initiate discussions for the new car’s price first, aiming for the lowest possible cost. Once that is settled, move on to negotiating the trade-in value of your current vehicle. Finally, address the financing, ideally with pre-approved rates from outside lenders already secured.

By segmenting the negotiations, you prevent the dealer from inflating one figure to compensate for a “good” deal on another. The given information clearly states, “Many people view buying a car as one transaction. It’s not, and dealers know this. It’s really three transactions rolled into one: the new car price, the trade-in value and the financing.” By taking the initiative to negotiate each separately, you maintain control and transparency.

3. **Monthly Payment Illusion**

A highly effective tactic dealerships use to draw in customers is highlighting an attractive, seemingly low monthly payment. This approach skillfully shifts the buyer’s focus away from the more critical figure: the total price of the vehicle. While a low monthly outlay can make an expensive car feel surprisingly affordable, it often masks the true financial commitment and potential long-term costs.

The illusion of affordability created by a low monthly payment can lead buyers to consider vehicles ultimately beyond their comfortable budget. Moreover, achieving these low payments frequently necessitates stretching the loan term to an excessive length, often 60 months or more. Such extended terms carry a heavy financial penalty, incurring substantially more interest over the loan’s lifetime.

Beyond increased interest, longer loan terms introduce another significant risk: becoming “upside down” on your car loan. This means you owe more on the vehicle than its actual market value. The context cautions that “low payments can lead to terms of 60 months or more. Such long terms cost more in interest and put you at risk of an upside down car loan.” This precarious situation can cause considerable financial strain if the car is totaled or traded in prematurely.

To combat this illusion, it is paramount to “Focus on the total amount you pay rather than the monthly payment.” Never answer the question, “How much can you pay each month?” Instead, firmly state, “I can afford to pay X dollars for the car,” referring to the total price you are willing to spend. This strategy keeps the focus squarely on the vehicle’s full cost, ensuring you remain within your financial means.

Read more about: 13 Expert Secrets to Negotiate the Lowest Price on Your Next Car Lease Agreement

4. **MSRP vs. Invoice Price Game**

When you walk onto a car lot, one of the most prominent figures you’ll encounter is the Manufacturer’s Suggested Retail Price, or MSRP. Often called the sticker price, the MSRP is exactly what its name implies: a suggestion from the manufacturer about what the dealer *should* sell the car for. While it’s a useful benchmark, focusing solely on the MSRP can leave you at a disadvantage.

A more critical piece of information, and one dealers are less eager to share, is the invoice price. This figure represents what the dealership actually paid the manufacturer for the vehicle. Understanding the invoice price is invaluable because it reveals the dealer’s markup—the difference between their cost and the MSRP. Armed with this knowledge, you gain a clear perspective on the dealer’s profit margin and significant leverage in your negotiation.

Knowing the invoice price empowers you to engage in more informed discussions about the “out-the-door (OTD) price,” which includes taxes and all applicable fees. Without this insight, you’re negotiating in the dark, unable to effectively gauge how much room there is for the price to move. The provided context highlights this: “It’s good to know, but ask for the invoice price instead. The invoice price is what the dealer paid for the vehicle, and knowing the invoice price helps you understand the dealer’s markup.”

Utilize reputable online resources like Kelley Blue Book and Edmunds to research what similar models are selling for, alongside knowing the invoice price. Do not hesitate to ask for the numbers you need to make an informed decision. If the initial selling price seems high, consider timing your purchase around holidays or year-end sales, when dealers are often more motivated.

Read more about: Car Salesman’s “Shady” Play Exposed: Your Guide to Uncovering the Dealer’s True Cost Without the Invoice

5. **Yo-Yo Financing & Spot Delivery Risks**

Imagine the excitement: you’ve found the perfect car, signed the papers, and are driving it home. But then, a few days later, you get a call from the dealership informing you that your financing fell through. You now need to sign a new contract, usually at a much higher interest rate. This is the essence of “yo-yo financing,” also known as a “spot delivery” scam, a tactic that turns joy into significant financial distress.

Spot delivery allows you to take possession of a vehicle before the financing is fully finalized. While some reputable dealers might use it as a courtesy during off-hours, it opens the door for less ethical practices. The yo-yo scam specifically preys on the buyer’s emotional attachment to the new car. You’re initially “qualified” at an appealing rate, driven off the lot, then later told those terms are no longer available, leaving you with the choice of a much more expensive loan or returning the car.

The Federal Trade Commission (FTC) considers the yo-yo scam illegal, yet it persists. This tactic leverages the psychological hurdle of returning a car you’ve already started to see as your own, pressuring you to accept new, unfavorable terms. The context explicitly details this: “The deal goes through, the paperwork is signed, the buyer goes home with the car and gets used to seeing it in their driveway. Then they get a call from the dealer saying that the financing wasn’t approved after all and that the buyer has to come back and sign a new deal at a higher interest rate or forfeit the car and their down payment.”

To safeguard yourself, always “Know in advance what kind of interest rate you qualify for by prequalifying with other lenders.” Confirm your financing approval *before* you leave the showroom. Crucially, ensure all signed contracts include every detail of your loan, including exact repayment terms, and never drive off the lot without fully finalized paperwork. If the dealer insists on spot delivery and you suspect foul play, it’s safer to politely refuse and wait until all financing is definitively secured.

Read more about: Don’t Get Skinned: 14 Used Car Traps and Questionable Models Savvy Buyers Should Steer Clear Of for Reliability and Real Deals

6. **Unnecessary Add-ons & Services**

Beyond the core price, dealerships often attempt to boost profits by pushing a myriad of additional products and services. While some “add-ons” might sound beneficial, many are either unnecessary, overpriced, or can be obtained more affordably elsewhere. Understanding which ones to scrutinize is key to preventing hundreds, or thousands, of dollars in extra, avoidable costs.

Common examples include Gap Insurance, Credit Life Insurance, Extended Warranties, VIN etching, paint sealants, rustproofing, and fabric protection. Gap insurance, covering the difference between car value and loan balance if totaled, is frequently cheaper through your own insurer or included in comprehensive coverage. Credit life insurance, which pays off your loan if you die, is rarely a wise financial decision for most.

Extended warranties are another frequent target for upselling. Consumer Reports suggests they rarely justify the expense, often costing more than actual repair bills and coming with high deductibles. For leased vehicles, an extended warranty is almost entirely redundant, as the car is typically covered by a bumper-to-bumper warranty for the entire lease term. As the context notes, “If you’re leasing rather than buying a car, don’t allow yourself to be talked into an extended warranty under any circumstance.”

Similarly, products like VIN etching, paint sealants, and rustproofing are often sold at inflated prices. Modern vehicles are manufactured with durable finishes and materials, largely negating the need for these expensive dealer applications. If you believe VIN etching is beneficial, it’s significantly cheaper to get it done at an independent auto shop or with a DIY kit. Always question every add-on, compare prices, and “Don’t automatically agree to the insurance offered” or any other service without thorough consideration.

Read more about: 13 Expert Secrets to Negotiate the Lowest Price on Your Next Car Lease Agreement

7. **Deceptive 0% Interest Offers**

The allure of a 0% interest financing offer is undeniable—who wouldn’t want to borrow money for free? These promotions are powerful marketing tools, but they often come with stringent qualifications and hidden trade-offs that can make them less advantageous than they appear. While seemingly incredible, a 0% APR deal may not always be the optimal financial choice for every buyer.

Typically, these highly attractive offers are reserved for buyers with impeccable credit scores, often above 720. Furthermore, they usually apply to shorter loan terms, commonly 24 or 36 months. While a shorter term means less time paying, it also translates into significantly larger monthly payments, even for moderately priced vehicles. This can strain budgets, making a seemingly “free” loan feel restrictive and challenging to manage.

Perhaps the most crucial aspect is whether accepting a 0% interest offer means forfeiting other valuable incentives, such as cash rebates or dealer discounts. The context provides a clear example: “For instance, say you’re looking at a $20,000 car and will get $4,000 for your trade-in. You can choose between 0 percent financing or 3.49 percent with a $2,000 rebate. The term of the loan is 36 months. At the loan’s end, you’ll come out ahead by more than $1,200 if you take the rebate and the 3.49 percent financing.” This illustrates how a higher interest rate, offset by a substantial rebate, can result in a lower total cost.

To determine the truly best option for your specific situation, it’s imperative to “Use a rebate vs. low-interest calculator to compare the total cost of the loan financed both ways.” Don’t assume 0% is automatically the superior choice. A comprehensive calculation, factoring in all available incentives and your budget constraints, will reveal whether the low APR or a rebate with standard financing offers greater overall savings. Informed comparison is your key to making the smart financial decision.

Navigating the complexities of car purchasing requires a keen eye and a solid understanding of the tactics that can quickly turn an exciting acquisition into a financial headache. As we’ve seen, the initial stages of a deal are ripe with opportunities for misdirection. Now, let’s peel back the curtain further and explore additional, equally potent ploys that dealerships might use, ensuring you’re fully equipped to secure a transparent and advantageous vehicle purchase.

Read more about: Beyond the Buzzwords: Unmasking 14 ‘Healthy’ Foods Secretly Sabotaging Your Diet

8. **The Loan Roll-Over Burden**

It can be incredibly tempting to trade in your current vehicle for a newer, more desirable model, even if you haven’t quite paid off the existing loan. Some buyers, driven by this desire, choose to roll the remaining balance of their old car loan into the financing for their new purchase or lease. This immediate gratification, however, often comes at a steep, hidden cost, setting the stage for significant financial strain down the road.

This practice is inherently risky and can quickly lead to a precarious financial situation where you owe substantially more on your new vehicle than its actual market worth. This is famously known as being “upside down” on your car loan. Should the unforeseen happen – perhaps your car is totaled in an accident, or you decide to trade it in prematurely – you could be faced with writing a sizable check to cover the outstanding balance, a responsibility many are unprepared for.

The most prudent approach is to avoid rolling over an old car loan into a new one whenever possible. Instead, concentrate on securing the best possible price for your existing vehicle, either through a trade-in with careful negotiation or by selling it privately. If these options aren’t feasible or don’t yield sufficient funds to clear the prior debt, it’s often more financially sound to stick with your current car. Unless a new vehicle is an absolute necessity, there’s little reason to hasten a purchase before your old loan is fully settled.

Read more about: 12 Dealership Tactics You Must Master Before Your Next Car Negotiation

9. **Excessively Long Loan Terms**

In today’s automotive market, loan terms that stretch to 60, 72, or even an astonishing 84 months are becoming increasingly commonplace. While the appeal of these extended terms is undeniable – primarily, the promise of significantly lower monthly payments – embracing such a lengthy commitment can inadvertently create a host of financial complications that outweigh the initial convenience. This seemingly simple adjustment can fundamentally alter the long-term cost of your vehicle.

The primary disadvantage of these prolonged financing agreements lies in the cumulative interest paid over the life of the loan. While each individual monthly payment may be smaller, you are paying interest for a much longer duration, resulting in a substantially higher total cost for the vehicle overall. Furthermore, these extended terms significantly increase your risk of falling “upside-down” on your loan, where the depreciating value of your car quickly falls below the amount you still owe, creating a precarious financial position.

To strike a healthy balance between manageable monthly payments and fiscal responsibility, it is generally recommended to aim for a loan term of no more than 60 months. If adhering to this timeframe pushes your monthly payments beyond your budget, it’s a clear signal to reassess your purchase. Consider trimming any non-essential add-ons or, more critically, explore more affordable vehicle models that better align with a sensible financing structure.

Read more about: Your Ultimate Guide to Navigating the Used Car Market: Avoid Rip-Offs and Drive Away with Confidence

10. **The Balloon Payment Surprise**

Though they have largely fallen out of favor in mainstream auto financing, some dealerships might still present balloon payment options as a means to offer enticingly low monthly payments at the outset of a loan. While this structure can appear convenient and lighten the immediate financial burden, it conceals a significant financial hurdle that awaits borrowers at the very end of their loan term, often catching them off guard.

The core issue with a balloon payment loan is the requirement for a much larger, lump-sum payment at the loan’s conclusion. While the initial installments are designed to be manageable, many borrowers find themselves struggling to meet this substantial final payment. This can lead to a frustrating cycle: after years of dutiful payments, you might be forced to roll that final balloon payment into a brand-new loan, essentially extending your debt further and incurring additional interest.

For the vast majority of borrowers, opting for a traditional installment loan with consistent, equal payments throughout the term is a far safer and more predictable financial choice. It’s difficult to forecast your financial circumstances years into the future, making the inherent risk of a large, looming balloon payment an unnecessary gamble. Choosing a standard repayment schedule provides stability and prevents unforeseen financial stress down the road.

Read more about: Don’t Get Caught Off Guard! 13 Unexpected Things Your Car Insurance Probably Won’t Cover

11. **Bait-and-Switch & Misrepresentation**

The classic “bait and switch” is a deceptive maneuver so egregious that the Federal Trade Commission has explicitly deemed it illegal under its recently implemented CARS Rule. This tactic typically involves a dealership promoting an attractive deal on a specific vehicle to lure a customer onto the lot, only to then claim that the advertised car is suddenly “unavailable” or “just sold.” The salesperson then artfully pivots, attempting to steer the buyer towards a different, often more expensive, vehicle.

Beyond the direct bait-and-switch, misrepresentation takes many forms, including the “misleading car photo” ploy. Here, online advertisements feature fully loaded models with appealing styling and features, but the advertised price actually corresponds to a much lower trim level. When the buyer arrives, they find the “bells and whistles” from the photo missing, and the desired features come with a significantly higher price tag, costing thousands more. Another variant includes “dealer added options” – unrequested extras like sunroofs or spoilers suddenly appearing on the advertised car, inflating its price.

Adding to these tactics is the subtle “see dealer for details” scheme. This involves ads for cars with an enticing price but sparse information, instead directing potential customers to come into the dealership to learn more. While not as overtly deceptive as other ploys, its purpose is clear: to get you in front of a salesperson, where in-person persuasion and the visual appeal of the car can make closing a deal significantly easier.

Empowering yourself against these forms of misrepresentation requires vigilance. Be firm about the specific vehicle you intend to purchase and its exact specifications. If the deal promised online isn’t honored or the car presented doesn’t match the advertisement, be prepared to walk away. Always verify all details and pricing before committing, and do not hesitate to research new information or seek out another dealership if you feel misled.

Read more about: FTC Cracks Down on ‘Junk Fees’: What It Means for Your Wallet

12. **Hidden Fees & Fine Print Traps**

After meticulously negotiating the price of a vehicle, many buyers are still unpleasantly surprised when the final paperwork presents a total cost that is significantly higher than what was initially quoted. This discrepancy is often a result of dealerships cleverly hiding extra fees and expenses, hoping that buyers, eager to finalize the deal, will overlook these additions and accept the inflated final number. Thankfully, the CARS Rule now mandates transparent disclosure of all costs upfront.

Beyond the overall total, watch out for various “nonsense fees” that sneak into contracts. These can include ambiguous charges such as advertising fees, loan payment fees, and market adjustment fees, all of which are frequently already factored into the car’s initial price. Such fees are designed purely to pad the dealer’s profits and should be contested. Reputable dealers will be upfront and transparent about all charges, and any pushback on correcting discrepancies should be a major red flag.

Another insidious trap is the “small-print smokescreen” found in advertisements. Car ads are often riddled with minuscule disclaimers, stipulations, and conditions that effectively render attractive offers moot for many buyers. These tiny fonts often reveal that 0% financing is only for those with impeccable credit, or that large down payments are required, or that the offer is strictly contingent on financing through the dealership’s preferred lender.

To effectively combat these traps, a meticulous review of the entire contract is paramount before signing. Demand clear explanations for every charge and ensure all terms are mutually understood and agreed upon. Keep a copy of all signed documents for your records. If you detect any incorrect charges or feel a lack of transparency, do not hesitate to walk away from the deal; a truly honest dealer will rectify issues without complaint.

Read more about: Unmasking the Hidden Costs: Your Expert Guide to Avoiding Surprise Rental Fees for Homes and Cars

13. **Payment Method Pressure**

The manner in which you intend to pay for your vehicle can surprisingly become a leverage point for dealerships seeking to maximize their profits. Salespeople often inquire about your payment method early in the discussion, sometimes even before negotiating the final price of the car. This seemingly innocuous question is strategic: dealers frequently earn a substantial portion of their income from financing agreements, and knowing your payment preference allows them to adjust their pricing strategy accordingly.

Should you indicate that you’re paying with cash or using third-party financing, some dealerships might subtly increase the vehicle’s price. This adjustment is a direct attempt to offset the revenue they will miss out on from not financing your loan through their partners. Conversely, if you express interest in dealership financing, they might offer a seemingly better deal on the car itself, knowing they can recoup or even exceed that discount by marking up the interest rate on your loan.

This “marking up the interest rate” tactic involves the dealer pocketing the difference between the actual loan rate approved by their partner bank (e.g., 5%) and a higher rate they quote to you (e.g., 7%). Similarly, in lease agreements, dealers can inflate the “money factor” (MF) – a decimal number used to calculate the APR of your lease – thereby increasing your monthly payments. Knowing your pre-approved interest rate from an external lender is critical, as is calculating the true APR from the money factor (multiply MF by 2,400) to ensure you’re getting a fair deal.

The strategy here is clear: negotiate the full price of the car first, completely separate from any discussions about how you intend to pay. Once the vehicle’s price is firmly established, then, and only then, introduce your payment method. Always arrive with pre-approval from your own lender to provide a benchmark, and politely decline to reveal your outside financing terms until the car’s price is locked in.

Read more about: 13 Expert Secrets to Negotiate the Lowest Price on Your Next Car Lease Agreement

14. **Odometer Tampering & Vehicle History Concealment**

For buyers in the used car market, mileage is a critical factor influencing both price and perceived reliability. Vehicles with lower mileage command higher prices, while those with more miles typically offer greater savings. This inherent valuation system, however, can be exploited by unscrupulous dealerships through the illicit practice of odometer tampering, a deceitful act that aims to artificially reduce a car’s displayed mileage and, consequently, inflate its value.

The dangers of purchasing a vehicle with a rolled-back odometer extend far beyond simply overpaying. Such cars may have accumulated significantly more wear and tear than indicated, requiring unforeseen and expensive maintenance, or even major component replacements like an engine, in the near future. These hidden costs can quickly negate any perceived savings and burden the new owner with substantial, unexpected financial outlays. The National Highway Traffic Safety Administration reports a staggering 450,000 cars with fake odometer readings are sold annually, leading to over $1 billion in repair costs.

Protecting yourself requires a multi-pronged approach. Always scrutinize the vehicle’s condition: inspect tire wear, which should generally align with the reported mileage, and look for any signs of tampering around the dashboard. Crucially, request to see the car’s title, comparing the mileage listed on it with the odometer reading. Additionally, obtaining a comprehensive vehicle history report, such as those from CarFax or AutoCheck, is non-negotiable, as it can often reveal discrepancies in mileage reporting over the vehicle’s lifetime.

15. **The Four-Square Negotiation Trick**

Among the most notorious and widely disliked tactics in the automotive sales world is the “four-square tactic.” Even many reputable dealers openly despise this method, as it heavily contributes to the negative stereotype of the “sleazy car dealer.” Despite its widespread condemnation, this confusing strategy has persisted for decades, serving as a powerful tool for some dealerships to bewilder and ultimately overcharge unsuspecting customers.

The technique involves a salesperson physically drawing four squares on a piece of paper, each representing a distinct element of the car deal: the vehicle price, the trade-in value, the down payment, and the monthly payments. The dealer then strategically shuffles and manipulates numbers between these boxes, making it appear as though they are offering a fantastic deal in one area, while simultaneously making up the difference – or more – in another. This creates a smokescreen, making it incredibly difficult for a buyer to track the true cost, compare offers, and discern where genuine savings might be achieved.

If, during your negotiation, a dealer pulls out a piece of paper and begins illustrating your deal using the four-square method, consider it a flashing red light. This tactic is a clear signal of an attempt to confuse and manipulate, rather than facilitate an honest transaction. Your most effective response in such a scenario is simple: politely but firmly walk away from the table. There are plenty of dealerships that operate with transparency, and you deserve a straightforward and honest negotiation process.

Read more about: Steer Clear of the Sales Pitfalls: 14 Dealer Tactics to Master Before Buying Your Next Car

The journey to purchasing a new vehicle, while exciting, doesn’t have to be a minefield of deceptions and high-pressure tactics. By arming yourself with this comprehensive knowledge of common dealership ploys, you transform from a susceptible buyer into a formidable negotiator. Understanding these schemes isn’t about fostering distrust, but rather about cultivating the confidence to spot red flags, ask the right questions, and maintain control over one of life’s significant financial decisions. Remember, the power is always in your hands as an informed consumer. Your preparation and willingness to walk away from an unfavorable deal are your strongest assets, ensuring you drive away with not just a great car, but also a great deal and peace of mind.