Buying a new or used car should be an exciting journey, filled with the promise of new adventures and reliable transportation. Yet, for many, this experience quickly turns into a confusing and frustrating gauntlet of unexpected costs. One moment you’re negotiating the vehicle’s price, and the next you’re staring at a breakdown of charges that seem to materialize from thin air, pushing your dream car further out of reach.

This isn’t just a minor inconvenience; it’s a widespread issue costing consumers billions. Around 7 out of 10 used-car sales, for instance, are riddled with hidden fees, contributing to an estimated $11.8 billion in hidden charges on 26 million used cars sold every year. These aren’t always legitimate costs; many are questionable at best, and outright avoidable at worst, designed purely to pad the dealership’s profit margins after you’ve already agreed to a sticker price.

But here’s the empowering truth: you don’t have to pay them. Understanding which fees are legitimate, which are excessive, and which are entirely illegitimate is your ultimate superpower in the car-buying process. By arming yourself with knowledge and a readiness to push back, you can protect your wallet and ensure you get the best deal possible. Let’s dive into the first seven sneaky fees you should always refuse to pay, or at least fiercely question, to save yourself hundreds, if not thousands, of dollars.

1. **Dealer Prep Fees**One of the most common—and often most infuriating—charges you’ll encounter is the dreaded “Dealer Prep Fee.” This fee, which might also appear under names like “Vehicle Prep Fee,” “Pre-Delivery Service Fee,” or “Reconditioning Fee,” supposedly covers the dealership’s cost to clean, inspect, and get your vehicle ready for pickup. It sounds reasonable on the surface, doesn’t it?

The reality, however, is far less justifiable. Most manufacturers already compensate dealerships for these exact services as part of their franchise agreements. This means that if you’re being charged for a dealer prep fee, you’re essentially being double-billed for a service that’s already accounted for. It’s a prime example of a “fake fee” that adds absolutely no value to your car, new or used.

These so-called services, like getting a car ready for sale, should inherently be included in the selling price of the vehicle. There are no ifs, ands, or buts about it. This fee exists solely to inflate the dealership’s profit. As a savvy buyer, you have every right to challenge it.

When you see this charge, politely but firmly ask for it to be removed from the contract. If the dealer claims it’s non-negotiable, consider it a red flag. You can then negotiate a lower vehicle price to offset the unwarranted charge or, if they remain stubborn, be prepared to walk away and find a dealership that respects your intelligence and your wallet.

Read more about: Your Ultimate Guide: 14 Critical Car Rental Mistakes Abroad (And How to Dodge Them!)

2. **Advertising Fees**Another fee that frequently pops up on vehicle sales contracts is the “Advertising Fee,” sometimes disguised as “regional advertising fees” or “marketing fees.” Dealerships will tell you this charge helps them offset their substantial advertising expenses, implying it’s a necessary cost passed directly to the consumer.

However, advertising is a fundamental operating cost for any business, including a car dealership. These expenses should already be factored into the overall pricing strategy and the sticker price of the car itself. Directly charging the customer for a dealership’s advertising budget is an unnecessary and questionable practice that you shouldn’t passively accept.

Some dealers might even try to tack on extra advertising charges beyond what might be passed along from the manufacturer. If these fees appear out of the blue in your contract, especially without prior mention, it’s a strong indication that you can successfully challenge them. Dealers should inform you of any advertising fees beforehand, not spring them on you at the last minute.

Your best course of action is to ask the salesperson for a clear explanation of this fee. Once you’ve heard their justification, calmly request its removal. If they are unwilling to remove it, use it as leverage to negotiate a corresponding reduction in the vehicle’s overall price. Remember, these are business overheads, not an additional cost you’re obligated to cover.

Read more about: Unpacking the Colossus: An In-Depth Look at Google’s Genesis, Growth, and Dominance in the Digital Economy

3. **VIN Etching Fee**Many dealerships offer “VIN Etching” as an anti-theft measure. This service involves inscribing your vehicle’s identification number onto the windows or other major car parts, ostensibly to deter thieves and aid in recovery if theft occurs. While the concept of deterring theft is appealing, the execution and pricing at the dealership are often predatory.

Dealerships frequently mark up the cost of VIN etching by an exorbitant amount—sometimes 500% to 1000% over its actual value. What might cost under $30 for a DIY kit or through certain insurance company programs can easily be presented as a $200 to $400, or even an average of $1,795, charge on your sales contract. This makes it a prime example of an “illegitimate fee” due to its deceptive pricing.

Even if you appreciate the security benefit, it’s crucial to understand that you have far more affordable alternatives. You can purchase DIY kits for a fraction of the cost, or in some cases, your insurance provider might offer it as part of a theft prevention program. There’s no need to line the dealership’s pockets with such an inflated charge.

Always ask if VIN etching is an optional service. If it has already been performed on the vehicle, which dealers often claim to justify the charge, negotiate for a substantial discount or compensation elsewhere in the deal. Do not pay thousands for something that adds little value at such a high price point when cheaper, equally effective options are readily available.

Read more about: The 14 Most Extraordinary & Expensive Movie Props That Vanished: Tales of Theft, Loss, and Star-Powered Souvenirs

4. **Paint and Fabric Protection**Picture this: a dealership representative enthusiastically pitches a “Paint and Fabric Protection” package, promising a magical coating that will shield your vehicle’s exterior from the elements and its interior from every spill and stain. They might emphasize the long-term care and pristine condition it will maintain, all for a few extra hundred or even thousands of dollars.

However, the reality is that modern vehicles are already manufactured with highly durable paint finishes and stain-resistant fabrics. The protective coatings applied by dealerships rarely provide enough additional benefit to justify their hefty price tag. Often, a simple wax job from a local detailer or a do-it-yourself application of a quality protectant would be far more cost-effective and equally, if not more, effective.

These “protection packages” are often one of the most egregious examples of overpriced dealer add-ons, designed to generate pure profit without delivering proportional value to the customer. The context notes an example where a $3,000 “protection package” could be applied with similar products for just a few hundred dollars elsewhere. It’s a clear instance of an “excessive fee” where the charge is unreasonably high for a minimal or unnecessary add-on.

Your strategy here is simple: decline this service outright. If you’re genuinely concerned about long-term care for your vehicle’s paint or interior, explore independent detailing shops or consider applying high-quality products yourself. Never feel pressured to pay thousands for something that adds little tangible value, especially when the vehicle’s inherent design already offers a good level of protection.

Read more about: 15 Defining Characteristics and Milestones of Jerry Mouse: An In-Depth Look at the Iconic Cartoon Hero’s Enduring Legacy

5. **Market Adjustment Fees**In times of high demand or low supply, particularly with popular new models or during periods of supply chain disruptions, some dealerships introduce a “Market Adjustment Fee.” This charge is an additional markup the dealership tacks on above the manufacturer’s suggested retail price (MSRP). It’s essentially a random price hike because, as the dealer might explain, “demand is high” and they have “leverage in their interactions with car shoppers.”

It’s crucial to understand that a market adjustment fee is not a manufacturer requirement; it is purely a profit-generating tactic for the dealership. While these fees may become common in competitive or tight markets, they are not set in stone and are absolutely negotiable. Paying a premium due to market adjustment doesn’t just hit your wallet upfront; it can also negatively impact your vehicle’s resale value down the road, as the original MSRP remains the official baseline.

This fee became particularly prevalent during recent market shifts, when “dealers have a lot of leverage in their interactions with car shoppers, and have felt even more empowered to lean into bait-and-switch pricing,” as noted by Pat Ryan, CEO of CoPilot. It’s a direct exploitation of market conditions, and you, as the buyer, have the power to push back against it.

Your best defense against a market adjustment fee is negotiation. Try to talk the price down or, if the dealership is unwilling to budge, expand your search. Look for the same model at other dealerships, perhaps in different regions where market conditions or dealer practices might be less aggressive. Never feel obligated to pay a premium that is purely for the dealer’s additional profit; your patience and willingness to shop around can save you significantly.

Read more about: Seriously Where Did They Go? A Deep Dive into 14 Iconic Car Gadgets That Vanished From Our Toolboxes

6. **Extended Warranties (Without Shopping Around)**An extended warranty, or service contract, is designed to provide coverage for repairs beyond the manufacturer’s standard warranty period. On the surface, this sounds like a smart move for long-term peace of mind, and for some buyers, it genuinely can be a beneficial investment. However, dealerships are notorious for overcharging for these contracts.

Often, extended warranties are presented late in the sales process, or even worse, subtly tacked onto your financing without a full and clear explanation of their terms, coverage, or cost. The dealership stands to make a significant profit from selling these contracts, which is why they push them so aggressively. You might find yourself paying hundreds, or even thousands, more than necessary if you don’t shop around.

The real power lies in comparing your options. Before you even step foot into the finance office, research third-party extended warranty providers. These companies often offer comparable, if not superior, coverage at a much more competitive price than what the dealership will quote. This pre-approval gives you a baseline for comparison and a strong negotiating position.

If you decide an extended warranty is right for you, treat its price just like you would the car itself: negotiate it. Do not simply accept the first number they offer. Make sure you meticulously understand what is covered, what isn’t, and the terms of the contract. Armed with external quotes, you can either secure a much better price from the dealer or confidently opt for a more affordable third-party option.

7. **Documentation Fees (Over a Certain Amount)**The documentation fee, often called a “doc fee,” is a charge for the dealership’s administrative costs in handling paperwork, processing your title, registration, and other forms. Unlike some other fees, doc fees generally straddle the line of legitimate and illegitimate, as they are indeed permitted in many states. However, the legitimacy ends when the amount becomes excessive.

The critical issue with doc fees is their wild variability. Some states cap these fees at a reasonable $100 or less, ensuring dealers can’t exploit them. For example, in California, doc fees are capped at $85. Yet, other states have no such regulations, allowing dealerships to charge upwards of $500, or even over $1,000 in places like Florida, creating a “wild west” scenario where dealers can charge almost anything they want for essentially the same service.

While you typically can’t get a doc fee entirely removed from a buyer’s order if it’s legitimate in your state, you absolutely can and should negotiate it. Dealers often respond by reducing the selling price of the vehicle by an equivalent amount, effectively neutralizing the impact of an inflated doc fee. It’s a game of numbers, and knowing the typical rates for your area gives you significant leverage.

Your best strategy is to research your state’s laws and typical doc fee ranges *before* you visit the dealership. If the fee presented to you is unusually high compared to state caps or local averages, challenge it. Ask for a price reduction elsewhere in the deal to balance it out. Don’t let an excessive doc fee become an easy profit center for the dealership when a little research can save you hundreds.

Alright, smart car shoppers, you’ve mastered the art of sidestepping those initial profit padders that dealerships love to spring on unsuspecting buyers. You’re already miles ahead, protecting your hard-earned cash from those ‘prep’ and ‘protection’ ploys. But the journey to a truly transparent car deal isn’t over yet. Just when you think you’re in the clear, dealers have a knack for introducing even more sneaky charges, often disguised as necessities or overlooked conveniences. In this next crucial phase of your car-buying adventure, we’re diving deeper. We’re going to unmask seven more of these elusive fees, equipping you with the advanced negotiation tactics you need to save not just hundreds, but potentially thousands more. Get ready to fortify your defenses and walk away with a deal that truly reflects the car’s value, not the dealer’s hidden agenda.

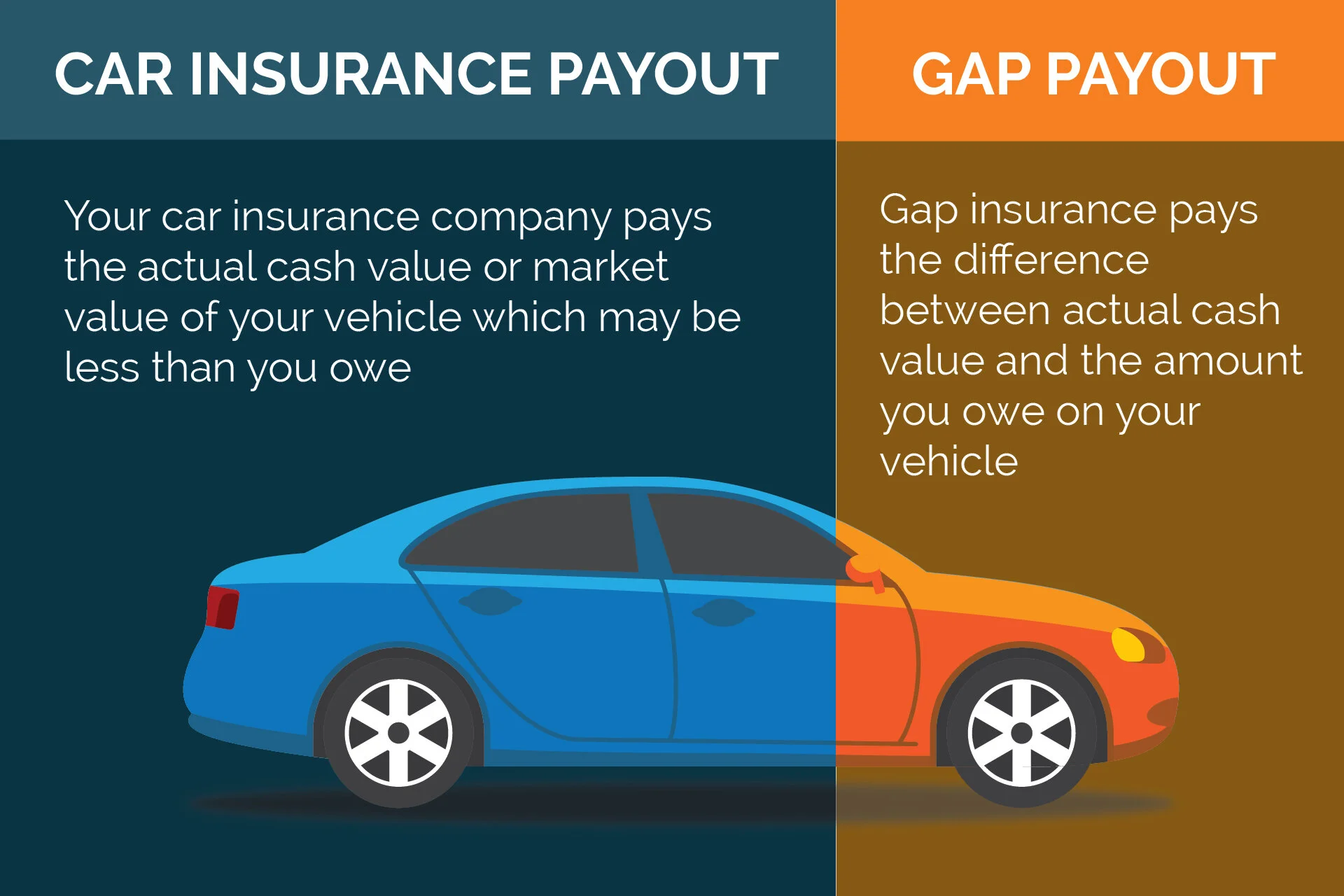

8. **GAP Insurance (From the Dealership)**Guaranteed Asset Protection, or GAP insurance, is often pitched as a crucial safeguard. It’s designed to cover the financial gap that can emerge if your vehicle is totaled or stolen, specifically the difference between what your car is worth and what you still owe on your loan. For many buyers, especially those with small down payments or long loan terms, this coverage can indeed be a smart financial move, offering peace of mind against unexpected losses.

However, the smart buyer knows that while GAP insurance itself can be valuable, buying it directly from the dealership is almost always a costly mistake. Dealerships notoriously mark up the price of GAP insurance significantly, sometimes charging hundreds more than necessary. This means you could be paying a substantial premium for coverage that’s available at a fraction of the cost elsewhere.

The savvy strategy here is to shop around before you even step foot into the dealership’s finance office. Make a quick call to your auto insurance provider, or even your primary lender, to compare quotes for GAP coverage. You’ll likely find that you can secure the same level of protection for a much lower cost, ensuring you get the coverage you need without padding the dealer’s profits. Don’t let convenience cost you extra.

9. **Dealer Add-Ons You Didn’t Ask For**Imagine this scenario: you’ve finally agreed on a price for your dream car, and you’re reviewing the final paperwork, only to spot a slew of charges for things you never requested. These are often extras like wheel locks, window tinting, nitrogen tire fills (more on that later!), door guards, or cargo nets that have already been installed on the vehicle. Dealerships often add these items after the car arrives on their lot, and many buyers are unaware that these “enhancements” are optional.

The core problem with these pre-installed dealer add-ons is that they are rarely worth what the dealership is charging for them. The markups can be astronomical, turning relatively inexpensive items into significant profit centers for the dealer. You might find yourself paying hundreds of dollars for accessories that offer minimal utility or could be purchased and installed independently for a fraction of the cost.

Your most effective defense against these unwanted add-ons is to scrutinize your buyer’s order carefully. Request a detailed breakdown of all installed extras and challenge anything you didn’t explicitly ask for. If the dealer insists they can’t be removed because they’re already on the car, use this as powerful leverage to negotiate a corresponding reduction in the vehicle’s total price. You have every right to refuse to pay for features you neither wanted nor requested.

Read more about: Timeless Engineering, Iconic Style: Unpacking the Most Significant Cars of the 1940s

10. **Nitrogen-Inflated Tires**Dealerships sometimes present nitrogen tire inflation as a premium service, promising a host of benefits from better fuel economy to extended tire life and more stable tire pressure. The idea is that nitrogen, being a larger molecule and less prone to temperature fluctuations, will seep out slower than regular air, providing consistent performance. It’s often bundled into a “protection package” or as a standalone add-on.

The reality, however, is that for the average driver, the benefits of nitrogen-inflated tires are minimal at best. While it’s true that nitrogen leaks slower, the practical advantages over standard air, which is already 78% nitrogen, are negligible for daily driving. Maintaining proper tire pressure through regular checks with a standard gauge is far more impactful for tire longevity and fuel efficiency than paying for nitrogen.

This falls squarely into the category of an “almost fake” fee. The context clearly states that “The benefits are minimal, and air inflation works just as well.” There’s little to no real value added to your car for the potentially significant cost. When this charge appears, politely but firmly decline the service. There’s simply no compelling reason to pay extra for something that provides such a negligible return on your investment.

Read more about: Why Your Dream Truck Is Costing You Thousands More: An In-Depth Guide to Unmasking Hidden Dealership Fees and Markups

11. **Pinstripes**Adding pinstripes is a classic dealership tactic for a cosmetic upsell. These decorative lines, often applied to the vehicle’s exterior, are presented as a way to enhance the car’s aesthetic appeal and make it stand out. Much like other dealer add-ons, pinstriping might already be on the car when you first see it, making it seem like a non-negotiable part of the package and therefore, the price.

The issue with dealership-applied pinstripes is their inflated cost. What is a relatively inexpensive customization when done by an independent detailer becomes a highly profitable add-on at the dealership. The markups can be substantial, adding hundreds of dollars to your final bill for a purely aesthetic feature that many buyers may not even want or appreciate.

Pinstriping is an entirely optional, cosmetic feature, and you should treat it as such. If you find this charge on your contract, firmly request its removal. If the dealership claims it’s already on the car and cannot be removed from the price, use this as a strong point of negotiation. Insist on a corresponding reduction in the vehicle’s selling price to offset this unnecessary charge. Don’t pay a premium for a personal styling choice that should be yours alone.

Read more about: Foose’s Blueprint: The 12 Most Insane Custom Cars That Define the Legendary Designer’s Vision

12. **Supplemental Anti-Theft Systems**Beyond basic VIN etching (which we discussed earlier), dealerships often offer more advanced “anti-theft measures” designed to deter thieves and aid in vehicle recovery. These can include supplemental alarm systems, advanced vehicle tracking units, or even specialized wheel locks, often bundled under names like “Safety and Security Package” or “Theft Recovery System.” Dealers highlight the peace of mind these systems supposedly provide in an era of increasing vehicle theft.

While personal safety and vehicle security are paramount, the costs associated with these dealer-installed anti-theft systems are frequently exorbitant. The context notes that a “Theft System” can average between $600 and $900, which is often a significant markup from the actual value or installation cost. You can often find comparable or even superior security solutions from independent specialists or aftermarket providers for a much lower price, giving you more control over the features and cost.

Your best approach is to decline these supplemental anti-theft systems from the dealership. As with other add-ons, “You can opt out of purchasing such products from your dealer.” If you genuinely desire enhanced security for your vehicle, research third-party options. Many specialized shops offer state-of-the-art alarm systems or GPS trackers at more competitive prices, ensuring you protect your investment without overpaying the dealership for an inflated add-on.

Read more about: Beyond the Factory Floor: Unpacking the Essential Insurance Policies for Your Custom Vehicle Upgrades

13. **CarFax Fee**A CarFax or AutoCheck report is an indispensable tool for anyone buying a used car. These reports provide a comprehensive history of the vehicle, detailing everything from accident records and service history to previous owners and odometer readings. A reputable dealer should provide this information transparently and readily, as it builds trust and helps the buyer make an informed decision about the vehicle’s condition and value.

Despite the importance of these reports, some dealerships attempt to charge a separate “CarFax fee” to the customer. The context is very clear on this: “If you’re engaging with a reputable dealer, there is no reason why you should have to pay for a CarFax or AutoCheck report.” These reports are a basic cost of doing business for a used car dealership and should be included as part of their service, not as an additional charge to the buyer.

If you see a CarFax fee listed on your buyer’s order, politely but firmly request its removal. A dealer who insists on charging for this essential transparency tool is using it as an easy profit center. Use this as leverage to negotiate a lower overall vehicle price or, if they remain stubborn, consider it a red flag and potentially take your business elsewhere. Access to a vehicle history report should be a given, not a hidden expense.

Read more about: The 15 Most Common Lies Car Salespeople Tell to Rush Your Purchase: A Consumer’s Guide

14. **Additional Destination Fees**Understanding destination fees can be a bit nuanced. A legitimate destination fee covers the cost for the manufacturer to transport a new vehicle from the factory to the dealership. This is a non-negotiable charge for all new cars, typically ranging from $1,000 to $3,000, and is always listed on the manufacturer’s window sticker. It’s a fee you’re generally expected to pay for a new vehicle.

The problem arises when dealerships introduce an “Additional Destination Fee” or attempt to apply a new car destination fee to a used vehicle. The context explicitly lists “Additional Destination Fee” under “Fake Fees to Avoid.” This signifies that any charge *beyond* the standard, manufacturer-set destination fee, or its application to a vehicle where such transport costs are no longer relevant, is an illegitimate attempt to inflate the profit.

Your strategy for this fee depends on the situation. For a new car, verify that the listed destination fee matches the manufacturer’s official charge; you can’t typically remove it, but you should ensure it’s not inflated. For any “additional” destination fees, or if you’re buying a used car and see this charge, firmly challenge it. As with other “fake fees,” these “add no value at all to your car.” Insist on its removal or use it to negotiate a significant reduction in the vehicle’s overall price. Do not pay thousands for something that is either already covered or entirely unwarranted.

Read more about: Unpacking the Colossus: An In-Depth Look at Google’s Genesis, Growth, and Dominance in the Digital Economy

Congratulations, car buyer, you’re now armed with an arsenal of knowledge to conquer the dealership landscape! We’ve peeled back the layers of deception, revealing the 14 most common and costly hidden fees that dealerships often try to sneak onto your bill. From initial ‘prep’ fees to overpriced add-ons and stealthy financing charges, you now know what to look for, what to question, and most importantly, when to refuse. Remember, buying a car is one of the most significant financial decisions many of us make, and you deserve transparency and fairness. Never feel rushed, never be afraid to ask for explanations, and always, always be prepared to walk away if a deal doesn’t feel right. Your confidence, your research, and your willingness to push back are your greatest assets. Go forth, negotiate like a pro, and drive away not just in a new car, but with the satisfaction of a truly smart deal. Happy driving!