Turning 62 is a significant milestone for many Americans, as it marks the earliest age you can begin claiming Social Security retirement benefits. While the prospect of receiving this income can be appealing, it’s crucial to understand that an informed decision is paramount. Rushing into claiming without a clear strategy or full understanding of the rules can lead to financial repercussions that last a lifetime.

Indeed, Social Security serves as a vital financial lifeline for millions of seniors, but a single misstep on the path to claiming benefits can permanently reduce that crucial income stream. Research highlights a widespread lack of basic knowledge, with nearly half (49%) of Social Security beneficiaries admitting they don’t know how to maximize their benefits, according to a 2024 survey from Nationwide Financial. Another 33% were unsure of their full retirement age or whether to claim benefits early or delay them.

With over 72 million Americans slated to collect Social Security benefits this year, the importance of making the right decisions cannot be overstated. This guide, drawing on expert analysis and official guidelines, is designed to empower you with the knowledge to navigate the complexities of Social Security and avoid some of the most common, and costly, mistakes people make when considering filing for benefits at age 62.

1. **Claiming Benefits Too Early Without an Informed Decision**

One of the most frequently made and financially impactful mistakes is claiming Social Security benefits at age 62 without fully understanding the consequences. While this is the earliest age you can start receiving payments, doing so will result in a permanently reduced monthly benefit. This reduction can be as much as 25% to 30%, depending on your full retirement age, and it’s a lifelong reduction, not a temporary one that increases later.

The context explicitly states that for those born in 1960 or later, filing at 62 means accepting a benefit that is permanently reduced by 30% compared to their full retirement age benefit. If your full retirement age benefit is $2,000, claiming at 62 could mean accepting $600 less per month – for life. It’s not necessarily a bad idea to sign up for benefits early if financial circumstances demand it, but the critical error lies in doing so without knowing precisely what reduction you’ll face and how it will impact your overall retirement income.

Before making any decision, it is essential to create an account on the Social Security Administration’s (SSA) website at SocialSecurity.gov. Here, you can access your most recent earnings statement, which provides an estimate of your benefits at different claiming ages. Without this crucial information, you cannot make an informed choice about whether it pays to file early, on time, or later. Taking benefits without first seeing how much money you’re actually entitled to is like signing a blank check for your retirement future.

Read more about: 15 Unbeatable Secrets Top Real Estate Agents Swear By to Sell Homes Faster and for More

2. **Miscalculating Your Full Retirement Age (FRA)**

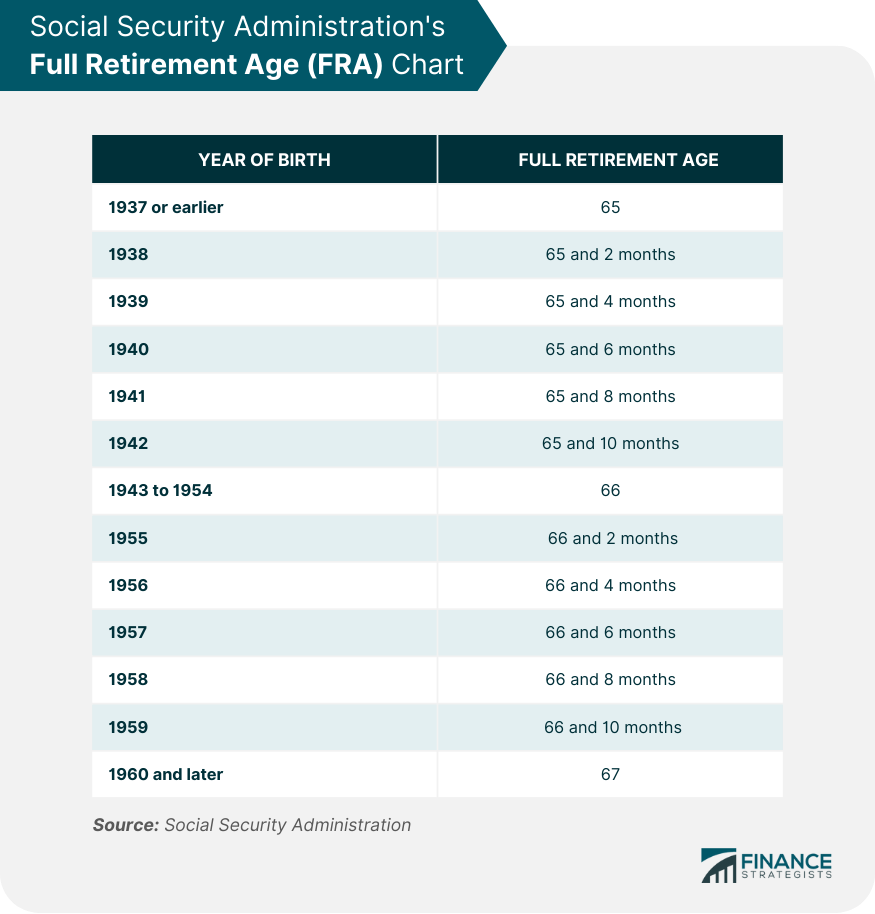

Another fundamental error often committed by those nearing retirement is miscalculating or simply not knowing their Full Retirement Age (FRA). Your FRA, also known as normal retirement age, is the age at which you are entitled to 100% of your earned Social Security benefits. Claiming benefits before your FRA permanently reduces your monthly payment, while delaying benefits until age 70 increases it.

The FRA varies based on your birth year. For beneficiaries born between 1943 and 1954, FRA is 66. It then gradually increases, reaching 67 for anyone born in 1960 or later. For instance, if you were born in 1957, your FRA is 66 and 6 months; if born in 1959, it’s 66 and 10 months. Not knowing your specific FRA can lead to claiming at the wrong time and receiving less than you could or should.

An interesting detail highlighted in the context is that if you were born on the first day of a month, the SSA uses the previous month to determine your FRA. For example, if your birthday is March 1st, the SSA considers you to have been born in February, which can subtly shift your FRA calculation. This nuance underscores the importance of understanding the precise rules rather than making assumptions, as an error here can have lasting financial consequences.

Read more about: Unlock Your Retirement Potential: Avoiding the Social Security Mistakes That Can Cost You 30% For Life

3. **Not Checking Your Social Security Statement/Earnings Record**

Trusting without verifying is a dangerous game when it comes to your Social Security benefits. Many people neglect to review their earnings history for errors that could potentially reduce their future benefits. The Social Security Administration bases your benefits on your average wages, adjusted for inflation, during your 35 highest-paid years on the job. If your earnings record is incorrect, your benefit calculation will be too.

Experts strongly advise that you create a My Social Security account at SocialSecurity.gov if you haven’t already. This online portal allows you to see your complete earnings record and get an estimate of your benefits. It’s crucial to give that earnings statement a good look once a year, comparing it against your own records or pay stubs. If it doesn’t match what you believe you’ve earned, you must fill out the appropriate form to request a correction.

Furthermore, neglecting your Social Security statement extends beyond just verifying earnings; it’s also a vital step in protecting yourself from fraud. Thieves may attempt to steal your identity to claim benefits. By regularly reviewing your documents and keeping track of the numbers, you can better protect your personal information and ensure that your benefits are correctly calculated and disbursed to you, and not someone else.

4. **Forgetting to Factor in Your Life Expectancy**

When to begin receiving Social Security benefits is a deeply personal decision, heavily influenced by individual circumstances, including your health and projected longevity. A common oversight is failing to adequately factor in your life expectancy, which can lead to claiming benefits too early and missing out on higher benefits later in life.

While delaying benefits as long as possible (up to age 70) will maximize your monthly payments, this strategy may not be optimal for everyone. If you experience an unexpected health emergency or genuinely do not expect to live a long life, claiming benefits earlier might be a more sensible choice. The goal is to maximize your total lifetime benefits, not just your monthly payment.

Conversely, if you anticipate living a long and healthy life, delaying benefits can significantly increase your total payout over time, making it a powerful strategy. Resources like LongevityIllustrator.org can help you learn your personal life expectancy and the odds of making it to certain ages. Evaluating your health and longevity near retirement age is a worthwhile exercise that can inform a crucial part of your claiming strategy.

Read more about: Unlock Your Retirement Potential: Avoiding the Social Security Mistakes That Can Cost You 30% For Life

5. **Not Assessing Your Savings to See if Waiting Pays**

Many individuals focus solely on Social Security as their primary retirement income without fully evaluating their overall financial picture. A significant mistake is failing to assess your personal savings and other income sources before deciding when to claim Social Security. The more money you bring into retirement from other sources, the less reliant you might be on Social Security, offering greater flexibility in delaying your claim.

Understanding how much income your savings will provide is critical. This isn’t just about looking up your IRA balance; it means understanding the monthly income your nest egg can realistically generate. For example, if you expect monthly expenses of $5,000 in retirement and have a $900,000 nest egg, using a popular 4% rule could provide $3,000 a month from savings. If your full retirement age Social Security benefit is $2,000, that covers your $5,000 needs, allowing you to delay Social Security if desired.

Before you can make an informed decision about when to take benefits, you need a clear picture of your total retirement income landscape. This holistic view, integrating Social Security with pensions, 401(k)s, investment portfolios, and other savings, allows you to determine if delaying Social Security payments for a larger monthly check later is a viable and beneficial strategy for your unique situation.

Read more about: Stop the Drain: 14 Critical Retirement Pitfalls That Turn Savings into Costly Money Pits After Age 60

6. **Misunderstanding the Earnings Limit if Working Before FRA**

For those who decide to claim Social Security benefits before their Full Retirement Age (FRA) but continue to work, a common and often costly mistake is misunderstanding the earnings limit. The Social Security Administration imposes a limit on how much you can earn while collecting benefits before your FRA. If your earnings exceed this limit, your benefits will be temporarily reduced.

As an example, the context mentions that in 2025, earning over $23,400 will reduce your benefits by $1 for every $2 earned above the limit. This means that for every two dollars you earn above the threshold, you lose one dollar of your Social Security payment. Many people are unaware of this limit, leading to unexpected reductions in their expected monthly income from Social Security.

While these reductions are not permanent and your benefits will be recalculated at FRA to compensate for the amounts withheld, it can still create an immediate financial strain. If you plan to work and anticipate earning more than the earnings limit before reaching your FRA, it’s often advisable to delay claiming benefits. This avoids the temporary benefit reduction and allows your monthly payment to grow, ensuring you receive the full amount you’re entitled to without penalty.

Read more about: The 12 Worst Financial Mistakes Professional Athletes Make After Retirement

7. **Claiming Early Due to Fear of Social Security Running Out**

A significant number of Americans, particularly younger generations, worry about the future solvency of the Social Security program. This fear can unfortunately drive some individuals to claim benefits early, even if it’s not in their best financial interest, under the mistaken belief that the program is on the verge of bankruptcy and they might not receive anything if they wait.

It is true that Social Security faces financial challenges, and discussions about potential benefit cuts are on the table. However, it is fundamentally incorrect to believe that Social Security is about to go bankrupt and run out of money completely. The program is primarily funded by payroll taxes. As long as people are working and paying into the system, Social Security cannot go bankrupt. It will always have a revenue stream.

While a financial shortfall is anticipated in the coming years, potentially leading to benefit reductions, this is vastly different from the program disappearing entirely. Claiming benefits early solely out of fear, rather than a sound financial strategy, is a costly mistake. It locks in a permanently reduced benefit based on a misconception, potentially forfeiting thousands of dollars over a retiree’s lifetime that could have been gained by waiting.

Turning 62 might open the door to Social Security, but the journey to maximizing your benefits is filled with complex decisions that extend beyond individual choices. As we delve deeper, it becomes clear that a strategic, holistic approach, especially for couples and those with unique entitlements, is crucial for securing a robust financial future.

Read more about: Spilling the Tea: 11 Famous Kids Who Publicly Called Out Their Own Parents for *That* Behavior

8. **Not Coordinating with Your Spouse**

For married couples, the decision of when to claim Social Security benefits transforms from a personal choice into a joint financial strategy. A significant mistake is failing to coordinate with your spouse on a claiming strategy, potentially leaving thousands of dollars in lifetime benefits on the table. While it might seem straightforward for a single earner to delay benefits for a larger payout, for two-earner households, the optimal path is far more intricate.

In scenarios where both spouses have earned benefits, it’s often more advantageous for the lower-earning spouse to claim benefits earlier or on time, providing immediate income to the household. Simultaneously, the higher-earning spouse can delay their claim, allowing their larger benefit to grow significantly until age 70. This synchronized approach aims to maximize the combined lifetime income for the couple, leveraging the growth of the larger benefit while still bringing in some Social Security funds.

Furthermore, if there is a significant disparity between a couple’s lifetime incomes, the lower-earning spouse may be eligible for a spousal benefit that could exceed their own earned retirement benefit. The timing of one spouse’s claim can directly affect the other’s potential spousal benefits, making joint discussion absolutely essential. Rushing to claim without understanding these interdependencies can lead to suboptimal outcomes for both partners.

The decisions made now also profoundly impact the surviving spouse. If the higher earner delays their benefits, the resulting larger monthly payment also translates into a larger survivor benefit for their spouse should they pass away first. This long-term consideration is often overlooked but is paramount for the financial security of the surviving partner.

Navigating these intricate options can be overwhelming, and even financial professionals often rely on specialized software to pinpoint the best claiming date for couples. Resources like online calculators are available, but for many, a consultation with a financial adviser can provide tailored guidance to ensure that both partners’ benefits are optimized as part of a comprehensive retirement plan.

Read more about: Navigating Your Social Security Retirement Benefits: A Comprehensive Guide to the New Retirement Age and Beyond

9. **Being Unaware of Specialized Spousal and Divorced Spousal Benefits**

Many individuals unknowingly bypass valuable Social Security entitlements, particularly those related to spousal and divorced spousal benefits. These specialized benefits can serve as a critical safety net, especially for individuals who had lower lifetime earnings or spent time out of the workforce, such as stay-at-home parents. The mistake lies in assuming eligibility is limited to one’s own work record without exploring all available avenues.

For current spouses, if one partner has a substantially higher work history, the other may be entitled to spousal benefits. These benefits can amount to up to 50% of the higher-earning spouse’s Full Retirement Age (FRA) benefit. The timing of the higher earner’s claim can significantly influence the amount the lower-earning spouse receives, underscoring the importance of a coordinated claiming strategy, as discussed earlier.

A powerful, yet often overlooked, entitlement is the divorced spousal benefit. If you were married for at least 10 years and are currently unmarried, you could be eligible to claim benefits based on your ex-spouse’s earnings record. Crucially, this does not affect your ex-spouse’s benefits, nor does it matter if they have remarried. Both a current and a former spouse can draw on the same person’s record, providing a vital source of income for many.

This benefit can be a tremendous boon, particularly for those who were stay-at-home spouses and have limited or no Social Security benefits from their own work history. Understanding these rules means ensuring you claim the highest possible benefit you are entitled to, whether it’s based on your own record or that of a current or former spouse.

Read more about: The Biggest Mistakes Americans Make When Claiming Social Security: 12 Pitfalls to Avoid for a Secure Retirement

10. **Forgetting About Survivor Benefits**

The loss of a spouse is an emotionally devastating event, and in the midst of grief, many individuals overlook crucial financial lifelines like Social Security survivor benefits. This oversight can be a costly mistake, as survivor benefits can significantly bolster the financial stability of a widowed individual or family. These benefits are designed to support those who were financially dependent on the deceased worker.

Eligibility for survivor benefits extends beyond just current widows or widowers. Divorced widows or widowers who remarry after age 60 can also collect these benefits. For those who qualify, these benefits can begin as early as age 60, or even 50 if the individual is disabled. This provides a critical income stream during a challenging transition period.

A key aspect of survivor benefits is that a widow(er) can receive either their own retirement benefit or up to 100 percent of their deceased spouse’s benefit amount, whichever is larger. This flexibility ensures that the surviving spouse receives the maximum possible income. The decision to claim survivor benefits, and when, requires careful consideration to optimize the payout.

Beyond spouses, Social Security also provides survivor benefits to young or disabled children of the deceased worker, as well as financially dependent parents. However, it’s important to note that the total benefits payable on a single deceased person’s record are subject to a family benefit maximum. Understanding these maximums and the various eligible parties is essential for ensuring all entitled family members receive the support they need.

Read more about: The Great Blinker Blackout: Are You Contributing to the 750 Billion Signal Failures Annually?

11. **Not Understanding the Tax Implications of Social Security Benefits**

Many retirees are caught off guard by the fact that their Social Security benefits can be subject to federal income tax, leading to a significant and unexpected reduction in their net income. This often-overlooked pitfall can derail a carefully planned retirement budget, making it a critical mistake not to understand these tax implications. The degree to which your benefits are taxed depends on your “combined income.”

Your combined income includes your adjusted gross income, any tax-exempt interest (like from municipal bonds), and half of your Social Security benefits. If this combined income exceeds certain thresholds, a portion of your Social Security benefits becomes taxable. For example, if your combined income is between $25,000 and $34,000 for an individual, up to 50% of your benefits may be taxed. For combined incomes above $34,000, up to 85% of your benefits could be taxable. These thresholds are higher for married couples filing jointly.

To mitigate this impact, retirees can proactively strategize their withdrawals from various retirement accounts. Drawing from Roth IRAs or annuities, which are typically tax-free in retirement, can help reduce your taxable income and, consequently, the amount of Social Security benefits subject to taxation. This approach helps keep your combined income below the federal thresholds, preserving more of your Social Security payments.

Another effective strategy involves utilizing tax-free investments, such as municipal bonds, or executing Roth conversions in lower-income years before retirement. These financial maneuvers can help manage your taxable income throughout retirement, ensuring that a larger portion of your hard-earned Social Security benefits remains yours. This fix is particularly relevant for retirees with higher income sources who wish to minimize their tax liability.

Read more about: Beyond the Hype: Experts Debunk 15 Pervasive Myths About Self-Driving Cars, Unpacking the Future of Autonomous Mobility

12. **Overlooking Delayed Retirement Credits**

While claiming Social Security benefits early results in a permanent reduction, the converse, delaying your claim past your Full Retirement Age (FRA), offers a powerful incentive known as Delayed Retirement Credits. A common mistake is overlooking these significant credits, which can substantially boost your monthly payout, transforming a modest benefit into a much more robust income stream.

For every year you delay claiming benefits beyond your FRA, up until age 70, your monthly benefit increases by 8%. This 8% annual boost is a guaranteed return on your decision to wait, making it one of the most reliable ways to increase your retirement income. There is no incentive to delay claiming after age 70, as benefits stop accruing these credits at that point.

This strategy is particularly beneficial for individuals who anticipate a long and healthy lifespan. By maximizing your monthly payments through delayed retirement credits, you can ensure a higher lifetime payout, especially if you live well into your 80s or 90s. Resources like LongevityIllustrator.org can help assess your personal life expectancy and the odds of reaching certain ages, providing valuable context for this claiming decision.

If you are healthy and have sufficient alternative income sources, such as pensions, 401(k)s, or investment portfolios, delaying your Social Security claim becomes a highly attractive option. You can use these other resources to cover your expenses during the waiting period, allowing your Social Security benefit to grow. This intentional waiting period is a strategic move to optimize your long-term financial security, rather than just avoiding an early penalty.

Read more about: The $1,907 Social Security Shift: 9 Overlooked Strategies for Retirees to Maximize Benefits

13. **Assuming Social Security Covers All Retirement Needs**

A dangerous and widespread misconception among Americans is that Social Security benefits alone will be sufficient to cover all their retirement expenses. This fundamental misunderstanding of Social Security’s role in retirement planning can lead to a significant financial shortfall, forcing retirees to make difficult choices later in life. It’s a critical mistake to view Social Security as a comprehensive retirement solution.

The reality, as highlighted by expert analysis, is that Social Security replaces only about 40% of pre-retirement income for average earners. For higher earners, this percentage is even lower. This means that a substantial portion of your pre-retirement income needs to come from other sources to maintain your desired lifestyle in retirement. Relying solely on Social Security can leave a gaping hole in your budget.

To avoid this pitfall, it is absolutely essential to supplement your Social Security benefits with other forms of retirement savings and income streams. This includes drawing from 401(k)s, IRAs, investment portfolios, pensions, and even considering annuities or life insurance. A diversified approach ensures that you have multiple income streams to meet your monthly expenses and unexpected costs.

Before making any claiming decisions, you must take a holistic view of your financial landscape. This involves understanding how much monthly income your entire nest egg—not just your Social Security—can realistically generate. Utilizing retirement income calculators can help you determine if your combined resources will be enough to cover your anticipated expenses, providing a clear picture of whether you need to ramp up other savings to avoid relying too heavily on Social Security.

Read more about: Guard Your Golden Years: 14 Unexpected Expenses That Could Derail Your Retirement Budget

14. **Failing to Verify Benefits Received (Avoiding Clawbacks)**

While checking your earnings record (as discussed in Section 1, Item 3) is crucial before claiming, a distinct and equally critical mistake is failing to continuously verify the accuracy of the Social Security benefits you *receive*. The Social Security Administration (SSA) is not infallible, and errors can occur, leading to overpayments that they may later seek to “claw back.” This can be a devastating financial blow if you’ve already spent the money.

The context reveals a stark warning: the SSA is actively trying to “claw back” an astonishing $8.6 billion in benefits it believes it overpaid. These overpayments can stem from various reasons, such as individuals receiving benefits despite having pensions that disqualify them, or failing to pass the earnings test for those working before their Full Retirement Age. The onus is often on the beneficiary to ensure they are not receiving more than they are entitled to.

The financial and emotional toll of having to repay money that you have already spent can be immense, often far worse than simply not receiving it in the first place. Imagine having your monthly income abruptly reduced or receiving a demand for a lump sum repayment years into your retirement. This unexpected financial burden can severely impact your stability and peace of mind.

Experts strongly advise a regular “sanity test” for your benefits once they start rolling in. This means comparing the amount you receive against what you believe you are owed and being vigilant for any discrepancies. Maintaining careful records of all communications and statements from the SSA can provide crucial documentation if an issue arises.

Proactive verification of your received benefits is a vital safeguard against unforeseen financial demands from the SSA. By staying informed and scrutinizing your payments, you protect your hard-earned retirement income from unexpected and potentially severe reductions, ensuring that your financial security remains intact.

Avoiding these common, yet often overlooked, Social Security mistakes is not merely about navigating bureaucratic hurdles; it’s about safeguarding your peace of mind and securing the financial future you’ve diligently planned for. The complexities of Social Security demand a proactive and informed approach, transforming what might seem like minor details into pivotal decisions for your retirement. By taking the time to understand spousal benefits, survivor entitlements, tax implications, delayed retirement credits, and the critical need for comprehensive financial planning, you can move confidently toward a retirement where your Social Security benefits truly work for you, not against you. The journey to a secure retirement is an ongoing process of learning and adaptation, and with the right knowledge, you are empowered to make the best decisions for yourself and your loved ones. This isn’t just about avoiding pitfalls; it’s about building a foundation for enduring prosperity in your golden years.