The financial markets often offer narratives of dramatic shifts, but few can match the recent resurgence of Tesla Inc. (NASDAQ: TSLA) stock. After a challenging year marked by significant volatility and steep losses, the electric vehicle giant has executed a remarkable comeback, with its shares not only recouping their previous declines but turning positive for the year. This impressive turnaround was catalyzed by a singular, audacious move from its visionary CEO, Elon Musk: a personal investment of $1 billion into the company’s stock.

This substantial purchase, an unusual and powerful statement in the world of corporate finance, has been widely interpreted as a profound vote of confidence in Tesla’s future. It signals a renewed focus and commitment from Musk himself, amidst a period that saw the company navigating intense market competition, political headwinds, and shifts in consumer incentives. As we delve into the intricacies of this development, we will examine the multifaceted factors that contributed to Tesla’s rollercoaster year and how Musk’s recent actions have fundamentally reshaped its trajectory and market perception.

Our analysis will draw upon factual, data-driven insights, reflecting a Bloomberg-esque approach to understanding the complex interplay of executive action, market sentiment, and corporate strategy. This in-depth exploration will unpack the significance of this $1 billion investment, detailing the immediate market reactions and placing them within the broader context of Tesla’s tumultuous 2025, from its political entanglements to its evolving competitive landscape and the critical role of its ambitious technological pursuits.

1. **The $1 Billion Stock Purchase: A Rare CEO Move**Elon Musk’s decision to personally invest a staggering $1 billion into additional shares of Tesla marks an extraordinary event in corporate finance, immediately grabbing headlines and igniting market enthusiasm. This monumental purchase was executed on Friday, September 12, with regulatory filings on the subsequent Monday, September 15, confirming the transaction. Musk acquired approximately 2.57 million to 2.75 million $TSLA shares, with prices ranging between $372 and $397 each at the time the sale was executed, demonstrating a significant commitment at a substantial valuation.

What makes this move particularly remarkable is its nature: Musk opted for an outright purchase on the open market, rather than utilizing stock options, which typically allow executives to acquire shares at a fraction of their market price. As industry observers noted, this represents “a rare action – by Musk or any other CEO,” highlighting a direct and transparent investment of his personal capital. Such a direct infusion of funds, bypassing the more common and often less costly exercise of options, underscores the depth of his conviction in Tesla’s intrinsic value and future prospects.

The financial implications of this purchase were swift and dramatic. Upon the news breaking, shares of Tesla (TSLA) surged by 7% at the market open on Monday. While the stock did not fully sustain those initial premarket gains throughout the entire trading day, it still managed to close up nearly 4%. This robust performance was more than sufficient to eradicate Tesla’s remaining year-to-date losses, which at one point had seen the stock battered down 42% from its position at the end of 2024, completing an astonishing turnaround.

This was not Musk’s first foray into purchasing blocks of Tesla shares on the open market; however, most of his past acquisitions stemmed from exercising stock options received as part of his compensation. The recent $1 billion transaction stands out as his “largest insider stock purchase ever by value,” according to Verity data, and his first open-market buy since February 2020. This significant insider acquisition, representing an additional 2.6 million shares into his portfolio, albeit increasing his total stake by less than 1% to 12.8% of the company’s shares, was nonetheless a powerful statement.

Ultimately, the ability for Musk to inject $1 billion into Tesla’s stock largely as a symbolic gesture serves as another stark reminder of his immense personal wealth. For the planet’s richest person, this cost is indeed affordable. In a fascinating twist of market dynamics, the very rise in Tesla’s stock value on Monday, spurred by his purchase, added approximately $5.8 billion to his net worth, effectively more than covering the initial cost of his significant investment, illustrating his powerful influence on the company’s valuation.

2. **Musk’s “Vote of Confidence”: Signalling a Bullish Future**The impact of Elon Musk’s $1 billion stock purchase transcended mere financial transaction; it resonated deeply as a profound “vote of confidence” that swiftly recalibrated market sentiment surrounding Tesla. Industry analysts and market “bulls” were quick to interpret this unusual move as a definitive statement of Musk’s unwavering belief in the company’s trajectory, especially after what had been a notably tumultuous period for both the CEO and Tesla shareholders.

One of the more prominent voices in the tech analysis sector, Dan Ives, a tech analyst with Wedbush Securities and a fervent supporter of Tesla on Wall Street, articulated this sentiment clearly. Ives remarked, “It’s a huge vote of confidence from Musk and the bulls love seeing this.” He further elaborated that the purchase “sends a positive signal after a very tumultuous year for Musk and Tesla shareholders,” encapsulating the relief and renewed optimism pervading the investment community.

Similarly, Matt Britzman, a senior equity analyst at Hargreaves Lansdown, echoed this perspective, viewing the investment as “the clearest signal yet that (Musk is) slamming the accelerator on being all in again.” Britzman underscored that “the Tesla-Musk narrative looks firmly back on track after a shaky start to the year,” suggesting a powerful reset in the perception of Tesla’s leadership and its future direction. This analyst consensus highlights that the purchase was not just about capital, but about commitment.

This direct, substantial investment from the CEO himself provided an indispensable psychological boost to investors. In a market often driven by speculation and perceived stability, such a bold personal stake from the company’s helm acts as a powerful assurance. It implicitly suggests that Musk is putting his considerable chips on the table, betting heavily on the company’s capacity to overcome current challenges and realize its ambitious long-term goals, particularly those centered around autonomous technology and robotics.

Ultimately, the message sent by Musk’s purchase was unequivocal: despite the recent headwinds and criticisms, he remains deeply committed to Tesla’s success. This act serves as a foundational element in rebuilding and strengthening investor confidence, providing a tangible demonstration of his belief that the company is poised for significant future gains, transforming a period of doubt into one of renewed bullishness for its market outlook.

3. **Tesla’s Roller Coaster Year: From Steep Losses to Full Recovery**The year 2025 has been nothing short of a “roller coaster” for Tesla shares, characterized by dramatic swings that saw the company’s valuation plummet before an astonishing, and equally rapid, recovery. At its lowest point, Tesla’s stock was down by a significant 42% from its closing value at the end of 2024, reflecting considerable investor apprehension and a series of challenging operational and external factors that tested the company’s resilience.

However, the year began with a surge of optimism. Following the election, shares of Tesla nearly doubled, buoyed by investor expectations that Elon Musk’s then-close ties to President-elect Donald Trump would translate into favorable financial conditions for the company. This initial rally was particularly fueled by hopes surrounding Tesla’s ambitious plans to accelerate its focus on self-driving cars and the highly anticipated development of a fleet of robotaxis, positioning it as a leader in future transportation.

This period of euphoria, however, proved short-lived. After reaching a record high in mid-December, a turning point occurred, and shares began a sharp and sustained slide. This decline was triggered by a confluence of factors, which included a growing political backlash against Musk stemming from his active involvement in the Trump administration, increasing competitive pressures in the burgeoning EV market, and broader economic concerns that began to weigh heavily on investor sentiment.

The full extent of the market’s punitive response became evident as Tesla grappled with these challenges, pushing its stock to significant lows by March. The narrative, for a time, shifted from unbounded optimism to serious questions about the company’s immediate future and its ability to sustain growth amidst a more complex operational environment. Many market watchers believed the path to recovery would be long and arduous, if not entirely uncertain.

Yet, the market’s capacity for rapid shifts was once again demonstrated with Monday’s rally. Propelled by the news of Musk’s $1 billion stock purchase, the stock’s ascent was sufficient to completely wipe out the remaining losses for the year. This dramatic reversal not only brought Tesla shares back into positive territory but also restored a sense of equilibrium, showcasing the profound impact of executive action on market perception and confirming the stock’s propensity for both steep declines and equally impressive recoveries.

4. **The Shadow of Political Backlash: Impact on Sales**One of the significant factors contributing to Tesla’s tumultuous year and its initial stock slide was the unforeseen shadow cast by Elon Musk’s deep engagement with the Trump administration. As Musk became notably active in running the Department of Government Efficiency, the company found itself caught in a broader political crossfire. This involvement quickly led to “backlash from those who opposed Trump and his agenda,” an opposition that regrettably spilled over to affect the Tesla brand itself.

This political entanglement had tangible and immediate consequences for Tesla’s commercial performance. The company experienced what was described as its “largest sales drops in history in the first and second quarter,” directly correlating with the period of heightened political association and subsequent public discontent. Accompanying this decline in sales, “profits plunged along with it,” painting a stark picture of how external, non-automotive factors could profoundly impact a company’s financial health and market perception.

Beyond domestic political controversies, the billionaire’s early participation in Trump’s presidency also appeared to hurt the Tesla brand on an international scale. The context specifically highlighted that “electric vehicle sales plummeted in Europe” during this period. This global impact underscored the broad reach of Musk’s public persona and political activities, demonstrating that the brand’s perception was intrinsically linked to its CEO’s controversial engagements, affecting customer sentiment across key markets.

The narrative of political entanglement evolved further with a public “fallout between President Trump and CEO Elon Musk” that initially deepened the stock’s woes. However, a significant turning point came when Musk officially “left DC,” signaling a strategic pivot away from active political roles and back to a dedicated focus on his companies, particularly Tesla. This shift, coupled with his subsequent pausing of a proposal for a third political party in the US, began to alleviate some of the brand damage.

Indeed, the context explicitly states that “Tesla stock has made a full recovery since sinking to a March low in the aftermath of a public fallout between President Trump and Musk, which later cooled off.” This indicates that a distancing from the most divisive political associations was instrumental in allowing the brand to recover its footing and for its stock to begin its climb back, underscoring the critical importance of brand perception and political neutrality in a globally competitive market.

5. **Rising Competition in the EV Market: The BYD Challenge**Beyond the political turbulence, Tesla has also been navigating an increasingly formidable landscape of competition within the global electric vehicle (EV) market, a challenge that significantly contributed to its earlier stock struggles in 2025. The context points out that the company is “facing increased competition from the EV offerings of other automakers,” indicating a maturation of the industry and a proliferation of viable alternatives for consumers.

A particularly potent challenger has emerged from China: BYD. The Chinese automaker is explicitly “set to eclipse Tesla as the world’s largest maker of EVs despite its cars not being available in the US market.” This statistic is a powerful testament to BYD’s aggressive expansion and market penetration, especially within its massive home market and other international territories, showcasing a formidable rival that is rapidly gaining ground, even without a direct presence in Tesla’s crucial US market.

The impact of BYD’s ascendancy has not been abstract; it has translated into concrete shifts in market dynamics. The context confirms that “China’s BYD (BYDDY) has eaten into Tesla’s market share,” signifying a tangible loss of ground for the American EV pioneer. This market share erosion underscores the intensity of the competition and the growing preference among a segment of global consumers for alternative EV brands, particularly those that might offer different price points, features, or design philosophies.

This competitive pressure is a multifaceted challenge, demanding constant innovation and strategic adaptation from Tesla. It forces the company to not only differentiate its products through advanced technology, such as its self-driving capabilities and nascent robotics, but also to carefully consider its pricing strategies and market positioning across various geographies. The presence of a strong rival like BYD necessitates a sharpened focus on operational efficiencies and customer acquisition in an increasingly crowded arena.

Ultimately, the rise of competitors like BYD highlights a fundamental truth about the evolving EV industry: what was once a nascent market dominated by a few pioneering companies is now a fiercely contested space. Tesla’s ability to maintain its leadership hinges not just on its technological prowess but also on its capacity to respond effectively to these growing competitive threats, ensuring that its innovations and brand appeal continue to resonate with a diverse and expanding global customer base.

Read more about: Ford’s Bold Bet: How the $30,000 Electric Pickup and Universal EV Platform Could Reshape the Automotive Future for Mainstream Buyers

6. **The Impending End of EV Tax Credits: A Looming Headwind**As Tesla grapples with intensifying competition and the aftereffects of political entanglements, another significant financial headwind emerges on the horizon: the impending expiration of crucial consumer incentives. The context explicitly states that “Tesla and other automakers face the end of a $7,500 tax credit for US buyers of EVs at the end of this month,” referring to the current month in which the article is set, September. This imminent policy change represents a material shift in the purchasing landscape for electric vehicles in the United States.

While the immediate effect of this deadline is somewhat counterintuitive, it is clearly explained. The expectation is that this policy expiration will “lift third quarter Tesla sales.” This anticipated short-term boost is likely due to consumers accelerating their purchase decisions to take advantage of the credit before it vanishes, creating a temporary surge in demand. Savvy buyers will undoubtedly aim to complete their EV acquisitions within September to benefit from the significant $7,500 incentive, which makes a substantial difference in the overall cost of a vehicle.

However, the long-term outlook beyond the third quarter paints a less optimistic picture. The context warns that the “EV company is likely to see a sharp drop for rest of the year” once the tax credit is no longer available. This anticipated decline stems from the removal of a powerful financial incentive that has historically made EVs more attractive and accessible to a broader segment of the American population. Without this credit, the effective price of a Tesla vehicle increases, potentially deterring some prospective buyers.

The end of these incentives raises broader concerns across the industry, with the context noting that it “has also raised concern over the electric vehicle business.” This widespread apprehension reflects the understanding that government subsidies play a critical role in fostering nascent markets and encouraging consumer adoption of new technologies. Their withdrawal, even if anticipated, can create significant market disruption and necessitate strategic adjustments from automakers like Tesla.

In response to this looming challenge, Tesla’s strategy has increasingly leaned into its unique technological differentiators, such as its self-driving capabilities and the highly anticipated robotaxi fleet. These innovations are poised to become central to the company’s value proposition, helping to offset the diminished price advantage that the tax credits once provided. The ability to articulate and deliver on these advanced technologies will be crucial for sustaining demand and growth in a post-tax credit era, where fundamental product appeal and long-term value will matter even more.

7. **Musk’s Shift from Politics: A Return to Core Focus**A pivotal moment in Tesla’s recovery narrative, closely intertwined with the stabilization of its stock, has been Elon Musk’s discernible shift away from active political engagement and a renewed, concentrated focus on his core business endeavors. This transition followed a period where Musk had become deeply involved with the Trump administration, a role that, as previously discussed, contributed to a significant political backlash against the Tesla brand and its subsequent sales declines.

The context explicitly highlights that “Musk had a falling out with Trump as he left his role in the administration and returned to Tesla.” This departure from the political arena marked a crucial turning point, signaling a strategic retreat from the divisive public sphere. The implications for Tesla’s stock were immediate and positive; “Tesla shares have climbed off their lows from earlier this year,” directly correlating with Musk’s re-engagement with the company’s operational and strategic direction.

This renewed focus has been emphatically endorsed by Wall Street analysts and Tesla enthusiasts, who “stress that the future value of company is tied to its self-driving technology and robotaxi plans.” The emphasis here is on the technological innovation and future-oriented projects that define Tesla, rather than the political activities of its CEO. The market clearly prefers a Musk singularly dedicated to pioneering electric vehicles, AI, and robotics.

The recovery in Tesla’s stock performance since this pivot is striking. The context notes that “The stock is up more than 70% since Musk officially left DC and subsequently paused a proposal for a third political party in the US.” This substantial rebound underscores the market’s positive reception to his disengagement from political controversies and his apparent recommitment to leading Tesla’s technological advancements. It suggests that investors view a less politically entangled Musk as a more stable and effective leader for the company.

Ultimately, the board of Tesla has also recognized the imperative of keeping Musk concentrated on the company’s vision. In their proxy statement, the board underscored “the importance of keeping Musk focused on Tesla going forward,” particularly given his numerous other ventures, including SpaceX, xAI, and X. This collective push, coupled with his own actions, has repositioned Musk as the dedicated chief of Tesla, steering it through innovation and market leadership, thereby reinforcing investor confidence in its long-term potential.

8. **Musk’s Ambitious Pay Package: A Trillion-Dollar Vision**As Tesla successfully navigated its tumultuous year, a significant forward-looking strategy emerged: a new, ambitious pay package proposed for Elon Musk. This compensation scheme, unveiled by the board, has the potential to grant Musk additional stock options that “could be worth $1 trillion” if the company achieves a series of challenging sales and valuation milestones. This staggering figure underscores the scale of ambition embedded within Tesla’s future plans and the board’s commitment to motivating its visionary CEO.

The structure of this monumental pay package is meticulously tied to performance, designed to align Musk’s personal wealth with the company’s exponential growth. It stipulates that Musk will receive “no additional shares and no income from Tesla unless its stock increases by more than 50% to a market cap of $2 trillion.” At the time of this proposal, Tesla was valued at approximately $1.3 trillion, meaning a substantial leap in market capitalization is required for any payout. This high-stakes framework effectively transforms Musk’s compensation into a powerful incentive for driving unparalleled company performance.

News of the proposed pay package itself acted as a catalyst in the market, further boosting investor confidence in Tesla’s future. Following its unveiling, “shares of Tesla increased 13%,” demonstrating the immediate positive reception from investors who viewed the scheme as a clear signal of aggressive growth targets and Musk’s continued, highly incentivized leadership. This market reaction suggests that, despite the astronomical sum involved, many investors are willing to back a plan that aims for such transformative expansion.

9. **The Board’s Defense and Investor Pushback**The proposed trillion-dollar pay package for Elon Musk, while igniting market enthusiasm, also sparked considerable debate and drew both ardent defense from Tesla’s board and pointed criticism from various quarters. Robyn Denholm, Tesla’s board chair, publicly championed the compensation plan, emphasizing its strategic importance for the company’s future. In an interview with The New York Times, she articulated the board’s belief that “Mr. Musk could achieve world-changing technology if motivated by seemingly impossible goals,” highlighting the aspirational nature of the targets set.

The ambitious compensation scheme is predicated on Musk achieving an array of truly monumental corporate milestones. To unlock the full payout, he “must drive up Tesla’s valuation to $8.5 trillion, from about $1 trillion today; deploy one million autonomous taxis and one million robots, and increasing its profits more than 24-fold from last year.” These targets are not merely incremental but represent a multi-fold expansion of Tesla’s current operations and market footprint, pushing the boundaries of what is conventionally considered achievable for a public company.

Despite the board’s robust defense, some investors have voiced concerns, suggesting that such a package could “reward a chief executive for staying at a company that he has managed poorly” in certain respects. Furthermore, the sheer scale of the potential payout drew broader societal commentary on wealth disparity. Pope Leo XIV, in his first extensive interview as the American pontiff, specifically “cited massive CEO pay, specifically Musk and his proposed pay package, as a sign of the income inequality that he said is behind the polarization of society,” questioning the ethical implications of such vast individual compensation.

10. **Musk’s Quest for Control: The 25% Voting Stake**Beyond the financial incentives of his pay package, Elon Musk has openly articulated a critical condition for his continued, deep engagement with Tesla’s most ambitious technological endeavors: a significant increase in his voting control over the company. Musk has made it clear that he is “uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control,” stating his desire for a stake “enough to be influential, but not so much that I can’t be overturned.” This demand highlights his conviction that significant control is necessary to steer the company through its transformative AI and robotics roadmap effectively.

His current ownership stake, while substantial, falls short of this desired level. The context states that Musk purchased an additional 2.6 million shares through his recent $1 billion investment, bringing his total holdings to “413 million shares of Tesla,” which “represents 12.8% of the company’s shares” (or roughly 13% according to LSEG data). This means he needs to double his current voting power to reach his stated comfort level, presenting a significant challenge for the board and shareholders alike.

Musk has backed his demand with a clear and potent threat: “Unless that is the case, I would prefer to build products outside of Tesla.” This ultimatum signals that without the desired control, he might shift some of his crucial AI development efforts away from Tesla to his other ventures, such as xAI. This prospect poses a substantial risk to Tesla’s competitive edge in cutting-edge AI and robotics, emphasizing the strategic importance of addressing Musk’s demands for increased governance influence. The board, recognizing this, “spoke of the importance of keeping Musk focused on Tesla going forward” in its proxy statement.

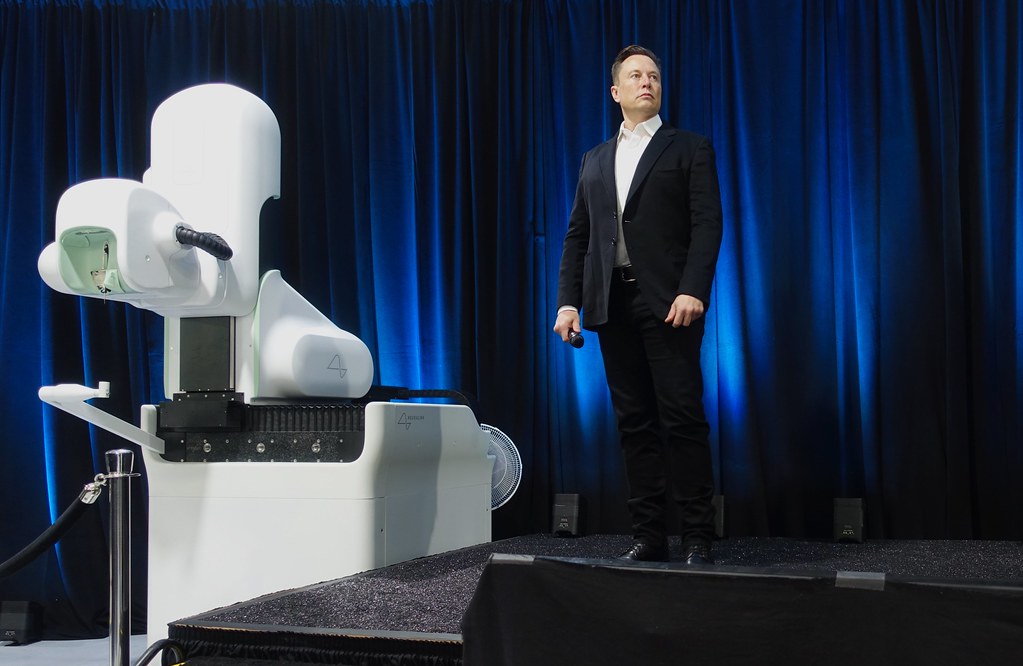

11. **The Robotaxi Revolution: Powering Tesla’s Future**Central to Tesla’s long-term valuation and Elon Musk’s vision is the ambitious robotaxi initiative, which many on Wall Street and within the company believe holds the key to its future value. Enthusiasts and analysts alike “stress that the future value of company is tied to its self-driving technology and robotaxi plans,” positioning autonomous transportation as a cornerstone of Tesla’s projected growth and market dominance. This focus underlines a strategic pivot towards capitalizing on advanced AI in mobility.

The rollout of this groundbreaking technology has already begun, albeit on a limited scale. Tesla’s highly anticipated robotaxis “launched for the first time in June in Austin, Texas,” marking a significant step from conceptualization to real-world deployment. These initial operations are not fully autonomous in the strictest sense; they “operate with technicians sitting inside who monitor the cars and can intervene if something goes wrong,” ensuring safety and gathering crucial data during the early stages of commercial service.

Looking ahead, Tesla has plans for broader testing and expansion of its robotaxi fleet, with the context indicating intentions “to start testing in Nevada soon.” This systematic, phased deployment strategy allows for continuous refinement of the autonomous technology and adaptation to various operating environments. The success and scaling of the robotaxi program are seen as fundamental to unlocking the ambitious market capitalization targets outlined in Musk’s compensation package, making it a critical barometer of Tesla’s future trajectory.

Read more about: Navigating the Future: 2025’s Top Self-Driving Cars and the Tech Powering Autonomous Innovation

12. **Optimus Humanoids: The Next Frontier of Value**Beyond revolutionizing transportation with robotaxis, Elon Musk has set his sights on an even more audacious frontier: humanoid robots, which he touts as the “next major catalyst for growth” for Tesla. This vision positions Tesla not merely as an electric vehicle company, but as a leader in advanced robotics and artificial intelligence, fundamentally reshaping its long-term identity and potential market value. The scope of this ambition extends far beyond automotive manufacturing, into the realm of general-purpose AI and robotics for everyday life.

Musk has repeatedly articulated his conviction that these humanoid robots, dubbed Optimus, will constitute a vast majority of Tesla’s ultimate valuation. He has boldly declared that Tesla “will eventually derive 80% of its value from robots,” a statement that dramatically reconfigures the traditional understanding of the company’s core business. These robots are envisioned as integral assistants, designed to “help humans with everyday tasks, from cooking dinner to walking the dog to babysitting,” thereby integrating seamlessly into the fabric of daily domestic and professional life.

The potential impact of Optimus is so profound in Musk’s view that he famously proclaimed, “Optimus is going to be the greatest product in the history of humanity,” during an appearance on the “All-In” podcast. While the company “has shown a robot,” the timeline for its commercial availability remains somewhat opaque, with the context noting that “it is not clear when that device will go on sale.” Nevertheless, this vision forms a cornerstone of Tesla’s long-term narrative, offering a glimpse into the company’s expansive aspirations in the field of artificial intelligence and robotics.

13. **Wall Street’s Divided Outlook: Analysts Weigh In**As Tesla charges forward with its ambitious strategies, the financial community remains a blend of fervent optimism and cautious skepticism, reflecting a divided outlook on Wall Street. The broader consensus shows a significant number of analysts betting on Tesla’s upside, with “27 Buy ratings on Tesla stock,” indicating a strong belief in its future growth. However, this bullish sentiment is tempered by “19 Hold, and 5 Sell” ratings, illustrating that a notable portion of analysts perceive existing risks or limited short-term upside, suggesting a complex landscape of expert opinions.

Among the prominent voices, Morgan Stanley analyst Adam Jonas has maintained an “Overweight recommendation on the stock and price target of $410 per share.” Jonas’s analysis delves into the transformative potential of Tesla’s ventures, particularly its humanoid robots. He offers a compelling, data-driven valuation, estimating that “converting just 1% of the US labor force to humanoid is worth approximately $320bn or $100 per Tesla share,” thereby providing a concrete financial model for the impact of Optimus on the company’s valuation.

Despite the long-term optimism from some quarters, the immediate outlook from a consensus perspective appears more guarded. According to Tipranks.com, the “consensus price target on Wall Street calling for about a 20% decline from here,” reflecting concerns about current market conditions, competition, and the ambitious nature of Tesla’s targets. However, this is often juxtaposed with “many are optimistic over the long term if Musk can pull off a transformation of the company to focus more on autonomous driving, artificial intelligence and robotics,” underscoring that Tesla remains a story of future potential.

14. **Societal Scrutiny and Future Vision: Beyond the Balance Sheet**Tesla’s trajectory, driven by Elon Musk’s grand ambitions in AI, robotics, and transformative technology, extends far beyond mere financial metrics, drawing significant societal scrutiny and ethical considerations. The proposed “trillion-dollar payday” for Musk, as previously discussed, elicited strong criticism from Pope Leo XIV, who not only questioned the scale of CEO compensation but also highlighted its role in exacerbating “income inequality” and the “polarization of society.” His stark warning, “If that is the only thing that has value anymore, then we’re in big trouble,” frames Tesla’s pursuit of immense wealth within a broader moral and societal context, challenging the singular focus on monetary valuation.

Furthermore, Musk’s ambitious expansion into artificial intelligence and his desire for greater control over Tesla are intrinsically linked to his other ventures. He has explicitly stated his intention to “shift some of his AI efforts away from Tesla to xAI without more control,” and indeed, the context notes that the “CEO wants shareholders to approve an investment by Tesla into his latest company, xAI.” This signifies an evolving ecosystem where Tesla’s technological advancements are intertwined with Musk’s broader AI ambitions, raising questions about resource allocation and shareholder alignment across his diverse portfolio.

Ultimately, Tesla’s story in 2025 is a complex tapestry of corporate resilience, visionary leadership, technological audacity, and profound societal implications. From the immediate impact of Musk’s personal investment to the far-reaching aspirations of robotaxis and humanoid robots, the company is positioning itself at the forefront of multiple transformative industries. As it navigates competitive pressures and seeks to realize its ambitious valuation targets, the world watches not just for its financial performance, but also for the broader influence of its innovations and the leadership of its outspoken chief on the future of technology and society. The interplay of these forces will undoubtedly define Tesla’s legacy in the years to come.