Navigating Medicare can often feel like deciphering a complex puzzle, especially when it comes to understanding premiums and costs. For seniors, having clear, reliable information is not just helpful, it’s essential for managing budgets and ensuring access to vital healthcare services. We understand that changes to healthcare costs can significantly impact your financial planning and overall well-being, which is why staying informed is your best defense. This in-depth guide is designed to cut through the jargon and provide you with all the crucial details about Medicare Part B premiums for 2025, presented in a straightforward and accessible manner.

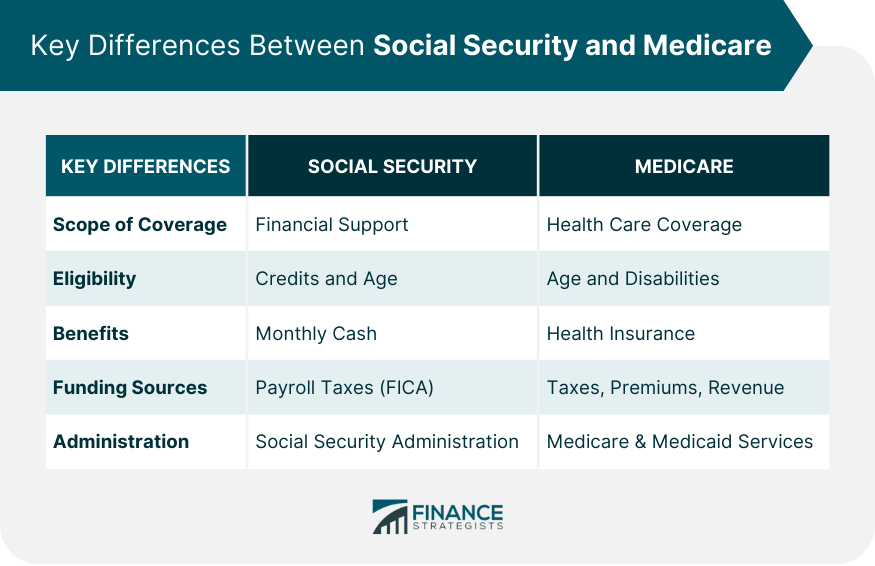

Medicare, generally designed for individuals aged 65 or older, also offers coverage to those with specific disabilities, End-Stage Renal Disease, or ALS. It comprises four main parts: Part A for Hospital Insurance, Part B for Medical Insurance, Part C for Medicare Advantage Plans, and Part D for Drug Coverage. While Part A often comes without a premium for many, Part B operates differently, consistently requiring a monthly premium payment from most beneficiaries, regardless of whether services are used.

The Centers for Medicare & Medicaid Services (CMS) recently released the updated 2025 figures for Part A and Part B premiums, deductibles, and coinsurance amounts, as well as the Part D income-related monthly adjustment amounts. These annual adjustments are critical for every Medicare beneficiary to understand, particularly those on fixed incomes. Our aim here is to walk you through these changes, focusing specifically on Part B, so you can confidently plan your healthcare expenses and make informed decisions for the year ahead. Let’s delve into the specifics.

1. Understanding Medicare Part B and Its Coverage

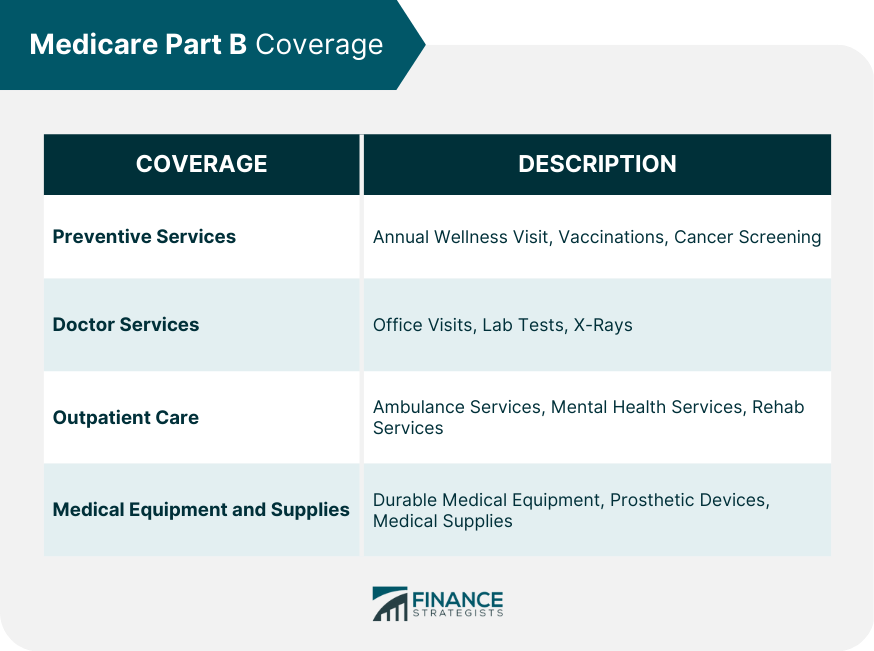

Medicare Part B is your essential “medical insurance,” covering a wide array of outpatient services and supplies that are not typically handled by Part A, which focuses on inpatient hospital care. This includes critical services like physician visits, outpatient hospital care, and various diagnostic tests. It’s designed to ensure you receive necessary medical care outside of an inpatient facility, forming a cornerstone of your overall healthcare coverage. Understanding what Part B encompasses is fundamental to appreciating its value and preparing for its associated costs.

Specifically, Part B extends to services such as durable medical equipment, which can include items like wheelchairs or oxygen equipment, and certain home health services. It also covers a variety of other medical and health services that are explicitly not covered by Medicare Part A. This broad scope ensures that many common medical needs, from routine check-ups to more specialized outpatient treatments, fall under Part B’s umbrella. Knowing these details helps beneficiaries anticipate their coverage and potential out-of-pocket expenses.

The continuous determination of Part B premium, deductible, and coinsurance rates is mandated by provisions of the Social Security Act, highlighting its integral role in the federal healthcare system. This means the structure and costs are subject to regular review and adjustment, making annual updates, like those for 2025, particularly significant. For seniors, grasping the breadth of Part B’s coverage is the first step in effectively managing their healthcare journey and finances. It truly forms the backbone of outpatient medical support.

Read more about: Your Essential Guide to Mandatory Minimum Car Insurance: Navigating State-Specific Requirements Across the U.S. in 2025

2. The Standard Medicare Part B Premium for 2025

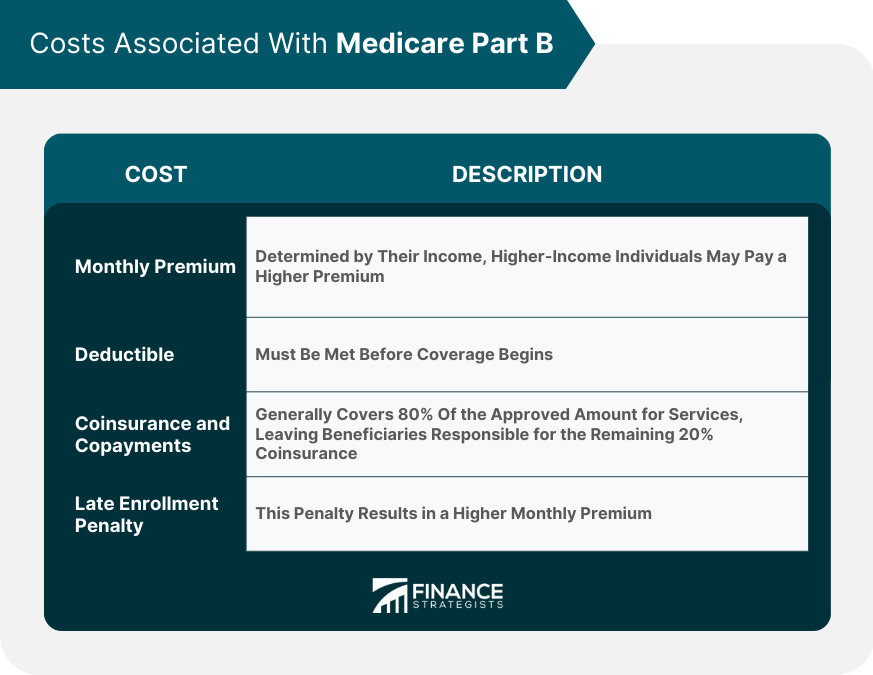

For the majority of Medicare beneficiaries, the standard monthly premium for Part B in 2025 has been officially set at $185.00. This figure represents an increase of $10.30 from the 2024 standard premium of $174.70. While a monthly increase of just over ten dollars might seem modest at first glance, it accumulates to an additional $123.60 over the course of a year. This adjustment is an important consideration for anyone managing a household budget, especially those living on fixed incomes.

Many individuals receiving Social Security, Railroad Retirement Board, or Civil Service Retirement benefits will find their Part B premium automatically deducted from their monthly checks. This convenient method means that most people don’t receive a direct bill from Medicare for this cost. However, for those who do not receive these payments, a bill will be sent directly from Medicare, requiring them to make payments directly to the agency. Understanding this deduction process is key to reconciling your monthly benefit statements.

This automatic deduction means that the increase directly reduces your monthly take-home income from Social Security. For retirees meticulously planning their finances, even these seemingly small adjustments in healthcare costs can create a noticeable difference, particularly when combined with the general rising expenses of daily living. It underscores the importance of being aware of these changes and adjusting personal budgets accordingly to maintain financial stability throughout the year.

Read more about: Your Essential Guide to Mandatory Minimum Car Insurance: Navigating State-Specific Requirements Across the U.S. in 2025

3. The 2025 Medicare Part B Annual Deductible

In addition to the monthly premium, beneficiaries also need to be aware of the annual deductible for Medicare Part B. For 2025, this deductible will be $257, which marks an increase of $17 from the 2024 annual deductible of $240. This deductible is the amount you must pay out-of-pocket for Part B-covered services before Medicare begins to cover its share of the costs. It’s an initial financial responsibility that beneficiaries incur each calendar year.

Once you have met this $257 annual deductible, Medicare typically starts paying 80% of the Medicare-approved amount for most covered outpatient services. This leaves you responsible for the remaining 20%, known as coinsurance, unless you have supplemental coverage like a Medigap plan or a Medicare Advantage plan that helps cover these costs. Understanding this cost-sharing structure is vital for predicting your potential out-of-pocket expenses for doctor visits, lab tests, and durable medical equipment.

The increase in the deductible means that you will need to spend slightly more of your own money before Medicare’s coverage kicks in for 2025. This adjustment, alongside the premium increase, highlights the growing financial responsibility placed upon seniors for their healthcare. Planning ahead, perhaps by reviewing existing supplemental insurance or budgeting for these initial costs, becomes even more essential for effectively managing healthcare expenses in retirement. It’s all part of staying on top of your Medicare game.

Read more about: Unmasking the Truth: 10 Costly Retirement Lies You Need to Stop Believing for a Secure Future

4. Why Medicare Part B Premiums and Deductibles Increased in 2025

The adjustments to Medicare Part B premiums and deductibles are not arbitrary; they are the result of several interconnected factors influencing the national healthcare landscape. These annual changes are determined according to specific provisions of the Social Security Act, ensuring a structured approach to funding Medicare services. Understanding the root causes of these increases can provide clarity and help beneficiaries contextualize their rising costs, rather than just seeing them as simple price hikes.

One of the primary drivers behind the 2025 increase is the projected price changes and assumed utilization increases, which are consistent with historical experience. More broadly, several key factors contribute to this trend. Rising healthcare spending, particularly for outpatient services, diagnostic tests, and home health care, continuously pushes program costs upwards. As medical technology advances and treatment options expand, the overall expense of delivering care grows, necessitating corresponding adjustments in premiums.

Moreover, broader inflation adjustments play a significant role, as premiums must reflect the general increase in costs across medical services and equipment. The economic climate affects everything from the cost of medications to the operational expenses of clinics, and Medicare premiums naturally absorb these inflationary pressures. Additionally, utilization growth, meaning more beneficiaries are using outpatient services at higher rates, further drives up overall program spending, necessitating more funds to cover the collective healthcare needs of the senior population.

Finally, the annual deductible often rises in tandem with the premiums, serving to shift a slightly larger portion of initial costs to beneficiaries. This synchronized increase ensures that the program can manage its financial obligations while still providing comprehensive coverage. Though individually these increases might seem small, their combined effect emphasizes the continuous need for beneficiaries to stay informed and financially prepared for evolving healthcare expenses. It’s a complex system, but understanding these reasons helps to demystify the changes.

Read more about: Unmasking the Truth: 10 Costly Retirement Lies You Need to Stop Believing for a Secure Future

5. What is the Income-Related Monthly Adjustment Amount (IRMAA)?

Beyond the standard Part B premium, some beneficiaries will pay an additional amount each month based on their income. This additional charge is known as the Income-Related Monthly Adjustment Amount, or IRMAA. It represents a surcharge added to the basic Part B premium, affecting roughly 8% of people with Medicare Part B. Since 2007, a beneficiary’s Part B monthly premium has been based on their income, ensuring that those with higher earnings contribute more towards their healthcare costs.

The IRMAA surcharge is calculated on a sliding scale, featuring five distinct income brackets. These brackets establish the different levels of additional premiums that high-income beneficiaries must pay. It’s crucial to understand that these figures are not static; they change annually, typically adjusting with inflation to reflect current economic conditions. This ensures that the IRMAA system remains relevant and responsive to broader financial trends.

A key characteristic of IRMAA calculations is the “two-year lag time.” This means that your IRMAA liability for 2025 is determined by the modified adjusted gross income (MAGI) reported on your 2023 tax returns. The Social Security Administration (SSA) is responsible for determining who pays an IRMAA based on this income data. So, if you’re wondering about your 2025 premium, you’ll need to look back at your income from two years prior. This lag is an important consideration for financial planning.

It’s also important to note that IRMAA is considered a “cliff” surcharge. That means if your modified adjusted gross income exceeds a threshold by even a dollar, you could move into a higher income bracket and thus be subject to significantly higher premiums. This characteristic makes careful income planning and awareness of your MAGI particularly important for beneficiaries nearing these income thresholds. Understanding IRMAA is paramount for accurately estimating your overall Medicare Part B costs.

6. 2025 IRMAA Brackets for Full Part B Coverage: Single and Joint Filers

For those beneficiaries with higher incomes, the Part B premium isn’t just the standard $185.00; it includes an additional Income-Related Monthly Adjustment Amount (IRMAA). The Social Security Administration uses your modified adjusted gross income (MAGI) from two years prior, meaning your 2023 tax returns, to determine which income bracket you fall into for 2025. This ensures a fair assessment based on your financial capacity. The following table provides a clear breakdown for individual and joint tax filers:

| Beneficiaries who file individual tax returns with modified adjusted gross income: | Beneficiaries who file joint tax returns with modified adjusted gross income: | Income-Related Monthly Adjustment Amount | Total Monthly Premium Amount |

| :——————————————————————————- | :————————————————————————– | :————————————— | :————————— |

| Less than or equal to $106,000 | Less than or equal to $212,000 | $0.00 | $185.00 |

| Greater than $106,000 and less than or equal to $133,000 | Greater than $212,000 and less than or equal to $266,000 | $74.00 | $259.00 |

| Greater than $133,000 and less than or equal to $167,000 | Greater than $266,000 and less than or equal to $334,000 | $185.00 | $370.00 |

| Greater than $167,000 and less than or equal to $200,000 | Greater than $334,000 and less than or equal to $400,000 | $295.90 | $480.90 |

| Greater than $200,000 and less than $500,000 | Greater than $400,000 and less than $750,000 | $406.90 | $591.90 |

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | $443.90 | $628.90 |

As you can see from the table, the “Total Monthly Premium Amount” includes both the standard Part B premium of $185.00 and the corresponding Income-Related Monthly Adjustment Amount. For instance, an individual filer with a 2023 MAGI between $106,001 and $133,000 will pay a total monthly premium of $259.00 in 2025, which includes the standard premium plus a $74.00 IRMAA surcharge. These surcharges are automatically added to your monthly premium bill.

These income thresholds are critical benchmarks for seniors to be aware of, as even moving slightly into a higher bracket can result in a significant increase in your total monthly Part B premium. Approximately 8% of all Medicare beneficiaries are impacted by these income-related adjustments, making it important to review your income situation carefully. This comprehensive table should help you identify where you stand and what to anticipate for your 2025 Part B costs.

7. 2025 IRMAA Brackets for Full Part B Coverage: Married Filing Separately

For Medicare enrollees who are married and lived with their spouse at any time during the taxable year, but choose to file separate tax returns, the IRMAA calculations present a distinct set of brackets. It’s important to understand these specific thresholds, as the income adjustments for this group can be steeper compared to married couples who file jointly. This separate category acknowledges different financial reporting structures and adjusts premiums accordingly to ensure fairness within the system.

The 2025 Part B total premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are outlined as follows:

| Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses with modified adjusted gross income: | Income-Related Monthly Adjustment Amount | Total Monthly Premium Amount |

| :——————————————————————————————————————————————————————————- | :————————————— | :————————— |

| Less than or equal to $106,000 | $0.00 | $185.00 |

| Greater than $106,000 and less than $394,000 | $406.90 | $591.90 |

| Greater than or equal to $394,000 | $443.90 | $628.90 |

As demonstrated by this table, the jump in the income-related monthly adjustment amount for those filing separately is substantial once the modified adjusted gross income exceeds $106,000. For instance, an individual in this filing category with a MAGI between $106,000 and $394,000 will face a significant IRMAA of $406.90, bringing their total monthly Part B premium to $591.90. This reflects a specific policy approach to this filing status.

These distinct IRMAA amounts underscore the need for married beneficiaries who file separately to pay close attention to their individual modified adjusted gross income. Careful tax planning and an understanding of these specific thresholds can help avoid unexpected increases in Medicare Part B premiums. Being well-informed about these specific rules is crucial for accurate financial forecasting and budget management.

8. Specialized Part B Premiums for Immunosuppressive Drug Coverage

Medicare Part B’s coverage extends to specialized needs, including a unique provision for immunosuppressive drugs. This specific coverage is available to individuals whose full Medicare benefits, particularly related to kidney transplants, have ended after 36 months. For these beneficiaries, if they do not possess other forms of insurance, Medicare offers a pathway to continue receiving vital immunosuppressive drug coverage by paying a dedicated premium. It’s a critical safety net for those managing the long-term health needs associated with organ transplantation.

For 2025, the standard monthly premium for this specialized immunosuppressive drug coverage is set at $110.40. This premium ensures that beneficiaries can maintain access to necessary medications without being subject to the full spectrum of standard Part B medical insurance. This targeted approach highlights Medicare’s commitment to supporting individuals with ongoing, life-sustaining medical requirements, ensuring continuity of care that is often essential for their well-being.

Just like with full Part B coverage, beneficiaries with higher incomes who only have immunosuppressive drug coverage are also subject to Income-Related Monthly Adjustment Amounts (IRMAA). The Social Security Administration evaluates your modified adjusted gross income (MAGI) from two years prior to determine these additional charges. This ensures that those with greater financial capacity contribute a larger share towards their specialized coverage, aligning with the broader principle of income-based adjustments across Medicare.

The 2025 IRMAA brackets for high-income beneficiaries with only immunosuppressive drug coverage are distinct, whether you file as an individual, jointly, or married filing separately. For instance, an individual filer with a 2023 MAGI between $106,001 and $133,000 will pay an IRMAA of $73.60, making their total monthly premium $184.00. Similarly, those married filing separately with a MAGI between $106,001 and $394,000 will see an IRMAA of $404.90, leading to a total premium of $515.30. These figures are crucial for beneficiaries to review carefully to understand their precise financial obligations.

9. The Direct Impact of Part B Premium Deductions on Social Security Benefits

For a significant number of Medicare beneficiaries, the payment of their Part B premium is a seamless, almost invisible process. This is because, for most individuals receiving Social Security, Railroad Retirement Board, or Civil Service Retirement benefits, their monthly Part B premium is automatically deducted from their benefit checks. This convenient method means that you typically won’t receive a separate bill from Medicare for this cost, simplifying your financial management.

However, this convenience also means that any increase in the Part B premium directly reduces the take-home amount of your monthly Social Security income. For 2025, with the standard Part B premium set at $185.00, this figure is automatically subtracted. This direct reduction is particularly impactful for retirees who depend on these benefits as their primary source of income, necessitating a careful review of their overall budget.

To illustrate this, consider a retiree who received $1,800 in monthly Social Security benefits in 2024. After the 2024 Part B premium of $174.70 was deducted, they were left with $1,625.30. In 2025, with the new deduction of $185.00, this amount would reduce to $1,615.00, effectively about $10 less each month. While this might seem like a small amount, over the course of a year, it adds up to a notable difference for those on fixed incomes.

While Social Security’s annual cost-of-living adjustments (COLAs) are designed to help offset the impact of inflation and rising Medicare premiums, it’s important to recognize that the benefit increase may not always fully cover these added costs. For some beneficiaries, the increase in their Social Security check may be entirely or largely absorbed by the higher Part B premium. This makes it even more vital for seniors to be aware of these deductions and adjust their financial planning accordingly.

Read more about: Navigate Your Financial Future: 10 Critical Social Security Changes Coming in 2026 That Impact Everyone

10. Vital Options for Low-Income Beneficiaries

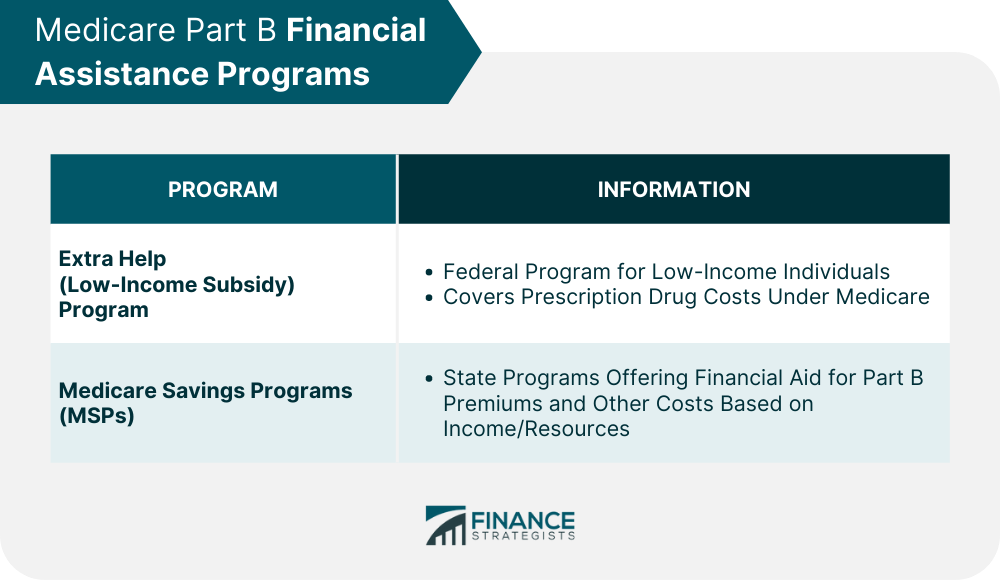

Navigating Medicare costs can be particularly challenging for seniors with limited incomes. The good news is that there are vital programs specifically designed to assist eligible beneficiaries with these expenses, potentially reducing or even eliminating their Medicare Part B premiums. These support systems are crucial for ensuring that financial constraints do not become a barrier to accessing necessary healthcare services.

One of the most impactful options available are Medicare Savings Programs (MSPs). These are state-run programs that can help low-income seniors pay for their Medicare Part B premiums. Depending on your income and resources, an MSP could cover your entire Part B premium, providing significant financial relief. It’s an invaluable resource for many who are struggling to keep up with rising healthcare costs, and eligibility rules vary by state, so it’s always worth investigating.

Beyond Part B premiums, many low-income beneficiaries also qualify for “Extra Help,” a Medicare program that assists with prescription drug costs. While Extra Help directly targets Part D expenses, by reducing what you pay for medications, it can free up funds that can then be allocated to cover Part B premiums or other essential living expenses. It’s a holistic approach to financial relief, recognizing that all healthcare costs are interconnected within a household budget.

Furthermore, it’s worth exploring other state assistance programs. Many states offer additional forms of aid or resources tailored to the needs of their senior residents, which might include help with medical bills, transportation, or other critical services. If the updated 2025 premiums and deductibles feel overwhelming, reaching out to your state’s Medicaid office or local Area Agency on Aging can open doors to relief. These programs are designed to support you, and understanding your eligibility is the first step toward securing that support.

Read more about: A New Era for Retiree Taxes: Examining the Legislative Proposals Reshaping Social Security Benefits

11. Actionable Strategies for MAGI Planning to Mitigate IRMAA

Understanding that your Income-Related Monthly Adjustment Amount (IRMAA) for 2025 is determined by your Modified Adjusted Gross Income (MAGI) from 2023 presents a unique opportunity for proactive financial planning. Because of this two-year lag, past financial decisions directly impact your current Medicare Part B premiums. This insight empowers you to strategically manage your income in the present to potentially mitigate future IRMAA liabilities.

A key aspect of MAGI planning involves being mindful of one-time spikes in income that can inadvertently push you into a higher IRMAA bracket. For instance, if you experienced a significant income event in 2023, such as selling a property, receiving a large bonus, or converting a traditional IRA to a Roth IRA, this could lead to higher premiums in 2025. Recognizing this connection allows for more deliberate timing of such events in the future.

Strategically, maintaining your MAGI below the critical IRMAA thresholds can significantly help in avoiding higher premiums in subsequent years. This might involve several prudent financial maneuvers. Maximizing contributions to pre-tax retirement accounts, like traditional IRAs or 401(k)s, can reduce your adjusted gross income. Spreading out withdrawals from retirement accounts over multiple years, rather than taking a large lump sum, can also keep your annual income lower.

Moreover, a well-timed Roth IRA conversion can serve as a powerful tool in your IRMAA planning arsenal. While a conversion itself increases your MAGI in the year it occurs, future distributions from Roth accounts are typically tax-free and, crucially, do not count towards your MAGI. This means that by carefully timing a conversion, you can avoid triggering IRMAA both during the conversion year (if managed well) and when you eventually take distributions, providing long-term benefits for your Medicare costs.

Read more about: Beyond the Average: A Comprehensive Guide to Understanding and Planning for the $172,500 Healthcare Costs Facing Retirees

12. The Practicalities of Paying Your Medicare Part B Premiums

Understanding how to effectively pay your Medicare Part B premiums is just as important as knowing the amounts. While many beneficiaries have their standard Part B premiums automatically deducted from Social Security benefits, those who don’t, or who owe an Income-Related Monthly Adjustment Amount (IRMAA), need to be familiar with the payment process. It’s crucial to manage these payments promptly to avoid any disruptions in coverage or additional charges.

If you are subject to an IRMAA for Part B, this surcharge is automatically integrated into your monthly premium bill. However, it’s vital to note that Part D IRMAA surcharges are handled differently; these must be paid directly to Medicare, not to your specific Part D plan or employer. This distinction means you might receive separate bills for your Part B and Part D IRMAA components, even if your Part D plan premiums are handled by a third party.

Medicare bills, including those for premiums and IRMAA, are consistently due on the 25th of each month. In most instances, the premium you’re billed for is due in the same month you receive the statement. Should a payment be missed or arrive late, your subsequent bill will reflect a past due amount, highlighting the importance of timely remittance. Establishing a consistent payment method can help you stay on track and ensure continuous coverage.

To make paying your Part B premium as convenient as possible, Medicare offers several methods. You can pay online through your secure Medicare account using a credit card, debit card, or funds from your checking or savings account; this is often the fastest way. Alternatively, you can sign up for Medicare Easy Pay, a free service that automatically deducts payments from your bank account monthly, though it can take six to eight weeks to initiate. Mailing your payment with a check, money order, or credit/debit card, alongside the payment coupon, is another option, as is utilizing your bank’s online bill payment service.

13. Understanding and Appealing IRMAA Due to Life-Changing Events

Discovering you owe an Income-Related Monthly Adjustment Amount (IRMAA) can be concerning, especially if your financial situation has significantly changed since the income year used for calculation. The good news is that Medicare understands that life happens, and there’s a structured appeal process in place allowing you to request a redetermination, particularly in the event of specific life-changing circumstances. This appeals process offers a crucial avenue for fairness and adjustment.

If the Social Security Administration (SSA) determines you are liable for an IRMAA, they will send you an “initial determination” notice. This important document will not only inform you of the surcharge but also provide instructions on how to request a new initial determination. This request allows you to present evidence that your financial situation has undergone a qualifying life-changing event, which might warrant a reduction or waiver of your IRMAA.

Qualifying life-changing events are specific situations that dramatically alter your modified adjusted gross income (MAGI) and include instances such as marriage, divorce or annulment, death of a spouse, work stoppage or reduction, loss of income-producing property, loss of employer-subsidized health insurance, or receiving a settlement payment from an employer. If you can demonstrate to Social Security that one of these events has impacted your income, they may reduce or even waive your premiums, providing significant relief.

Should your initial request for redetermination be denied, you still have additional levels of appeal. These include appealing to the Office of Medicare Hearings and Appeals, followed by the Medicare Appeals Council, and finally, if necessary, the federal district court where you reside. While the latter stages might necessitate legal assistance, the system is designed to provide multiple opportunities for beneficiaries to present their case and ensure their Medicare premiums accurately reflect their current financial reality.

14. The Crucial ‘Hold-Harmless’ Rule and Its Applicability

Among the intricate rules governing Medicare Part B premiums, the “hold-harmless” provision stands out as a critical safeguard for certain beneficiaries, particularly those with lower Social Security benefits. This rule is designed to prevent an increase in your Part B premium from reducing your monthly Social Security benefit check below its current level. It’s a protection mechanism to ensure that your net Social Security income does not decrease year-over-year due to Medicare premium adjustments.

The hold-harmless rule primarily protects individuals whose Part B premiums are automatically deducted from their Social Security checks, and whose Social Security cost-of-living adjustment (COLA) is not large enough to cover the entire increase in the Part B premium. For example, if the Part B premium increases by $21.50 and the COLA is 2.7 percent, only eligible recipients with a monthly Social Security benefit of $796.29 or less would be fully protected. This is because $21.50 represents 2.7 percent of $796.29, meaning their entire COLA could be consumed by the premium increase, but their benefit wouldn’t drop further.

However, it’s important to understand that the hold-harmless provision does not apply to everyone. As experts like Schwarz note, you will not be protected if you are new to Medicare in the coming year (e.g., 2026), receive a quarterly bill for Part B rather than having premiums deducted monthly, pay a higher Part B premium due to your income (IRMAA), or are enrolled in a Medicare Savings Program (MSP). These categories of beneficiaries are typically not covered by this specific safeguard, meaning their premiums could increase regardless of their Social Security COLA.

While the hold-harmless rule offers a vital protection, its application and impact can be complex and sometimes lead to unexpected outcomes for those it doesn’t cover. Historically, there have been instances where premium projections were significantly higher than actual amounts, demonstrating the dynamic nature of Medicare funding. In 2016, for example, legislative action was required to prevent a substantial premium increase for beneficiaries not protected by the rule, highlighting the importance of policy interventions to balance program needs with beneficiary affordability. This provision underscores the ongoing efforts to balance affordability with the financial sustainability of the Medicare program.

Staying informed about these nuances of Medicare Part B premiums for 2025 is an essential part of effective financial and healthcare planning for seniors. From understanding the standard premium and deductible to recognizing the impact of IRMAA, exploring assistance programs, and appreciating the hold-harmless rule, each piece of information helps you navigate your healthcare journey with greater confidence. We encourage you to use this knowledge to make the most informed decisions for your health and financial well-being, ensuring you continue to thrive in your retirement years.