In our fast-paced digital world, it’s easy to overlook some of the most basic security practices, especially when it comes to something as mundane as our wallets. We’ve all seen the classic sitcom moment—Jerry Seinfeld’s friend George Costanza with a wallet so overstuffed it practically serves as a filing cabinet, only to explode in a comical shower of receipts and forgotten essentials. While the scenario on screen is played for laughs, the real-world implications of a bulging, unprotected wallet are anything but humorous.

Today, identity theft isn’t just a concern; it’s an epidemic. Jon Clay, vice president of threat intelligence for Trend Micro, a global cybersecurity firm, notes that thieves could take more than just the cash in your wallet; they could profit significantly from your stolen information. Consider the man in suburban Chicago who left his wallet at a grocery store’s self-checkout. Even after he canceled his bank cards, the thief exploited his driver’s license to withdraw a staggering $15,000 from his bank account. This isn’t an isolated incident; reports to the Federal Trade Commission (FTC) indicate that a record $12.5 billion was stolen through scams and fraud last year, a 25 percent increase from the previous year, with credit card fraud being the most prevalent type.

As Amy Nofziger, director of victim support for the AARP Fraud Watch Network, aptly states, “We all think we are being careful, but it takes one second for a criminal to steal our wallet or purse.” The good news? You have the power to make your wallet leaner and, to cybercriminals, meaner. Many of the informational items we once felt compelled to carry can now be accessed securely on our smartphones, through digital wallets that safely store credit, debit, and prepaid cards. For the physical wallet, however, a strategic cleanse is paramount. Let’s dive into the core vulnerabilities and the high-risk documents you absolutely must remove.

1. **Your Social Security Card**

There is perhaps no single item in your wallet more dangerous to your financial well-being than your Social Security card. It’s the absolute worst item to carry around in your purse or wallet, according to ID-theft experts. Your nine-digit Social Security number (SSN) is quite literally the master key to your identity, and once thieves possess it, they can wreak havoc on your finances by opening new lines of credit, obtaining credit cards, or engaging in various other forms of financial chicanery in your name. The protection of your full Social Security number is paramount, and losing it provides a fast track to identity theft.

While there might be rare, specific occasions when you need your Social Security number for identification purposes—such as closing on a real estate loan or filing for benefits—these instances are few and far between. In such cases, the recommendation is clear: retrieve your card for the immediate necessity and then immediately stow it back in a secure location at home. It should never be part of your daily carry, nor should any piece of paper with your Social Security number be casually kept in your wallet.

Moreover, it’s crucial to check other forms of identification you might possess. States have, commendably, stopped displaying SSNs on newly issued driver’s licenses, state ID cards, and motor vehicle registrations. However, if you happen to still have an older photo ID that lists your Social Security number, it is strongly advised to request a new ID without delay. Even if there’s an additional fee involved, this proactive step is an invaluable investment in protecting your identity and safeguarding against future fraud. Do not hesitate to make this change.

Read more about: 13 Essential Life Hacks for US Online Casino Players in 2025: Maximize Your Wins & Experience

2. **A Password Cheat Sheet**

Let’s be honest: many of us are guilty of keeping a password cheat sheet somewhere, whether it’s a physical note or a digital one. The reason is simple and understandable: the average American uses at least seven different passwords to access everything from ATM cards to credit card accounts, and ideally, these should be unique combinations of numbers, letters, and symbols, changed regularly. Remembering them all is a monumental task. However, carrying these sensitive details, especially PIN numbers for ATM cards or login credentials for online banking and investment accounts, on a scrap of paper in your wallet is a recipe for financial disaster.

If your wallet falls into the wrong hands, these jotted-down passwords provide criminals with a direct portal to your most sensitive financial and personal accounts. This immediate access can lead to rapid and devastating financial losses. The convenience of having them on hand is dwarfed by the immense security risk they present. It’s an open invitation for thieves to bypass your security measures entirely.

Fortunately, there are far superior alternatives for managing your myriad passwords. For physical backups, the safest place is a locked box within your home, not your wallet. Even better, explore the robust capabilities of digital password managers. Services like LastPass offer basic free versions with options to upgrade for more features and storage, securely encrypting and organizing all your login credentials. Furthermore, always enable two-factor authentication on any account that supports it; this adds an extra layer of security by requiring a code sent to your smartphone or email after entering your password, significantly thwarting unauthorized access attempts. This small “hassle” is more than worth the peace of mind and financial protection it offers.

Read more about: Beyond the Desktop: Essential Guides to Screen Mirroring and Mastering GNU Screen

3. **Spare House or Car Keys**

Imagine the scenario: your wallet is lost or stolen, and within it, a spare house key rests alongside your driver’s license, which prominently displays your home address. This isn’t just an inconvenience; it’s a treasure map for thieves, inviting them directly into your home. The combination of your physical address and a means of entry creates an alarming vulnerability, putting your property and family at significant risk. Burglars are always on the lookout for such opportunities, and this seemingly innocent inclusion in your wallet transforms it into a powerful tool for them.

Even if, by some stroke of luck, your home isn’t immediately robbed after you lose a spare key, the psychological impact alone is substantial. Most individuals will spend upwards of $100 or more to pay a locksmith to change their locks, purely for the peace of mind that their home is once again secure. This cost and disruption are entirely avoidable. While hiding a key under a doormat or a decorative rock may seem like a clever solution, thieves are well aware of these common spots and actively check them, making them equally unsafe.

The best and most secure approach is to entrust your spare keys to a trusted relative or friend who lives nearby. While it might take a little longer to retrieve your backup key if you ever find yourself locked out, this minor inconvenience pales in comparison to the potential security breach of your home. Alternatively, consider investing in smart digital locks, such as Google’s Nest x Yale Smart Lock, or more affordable options from companies like Phillips and Kwikset. These modern solutions offer keyless entry and enhanced security, eliminating the need for physical spare keys altogether.

Read more about: Linda Ronstadt’s ‘Prisoner in Disguise’ at 50: An Emotional Look Back at a Superstar’s Defining Era

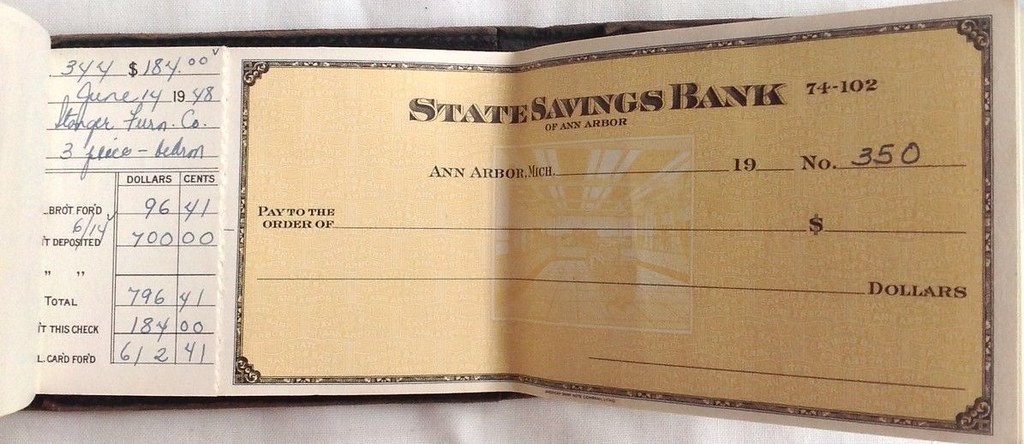

4. **Blank Checks**

In an era of digital transactions, fewer people write checks than in decades past, but some still carry blank checks “just in case” of an emergency. This age-old advice is, unfortunately, no longer good advice; it’s a significant security risk. Blank checks are direct conduits for financial fraud. In the wrong hands, a stolen blank check can be quickly filled out and used to drain money directly from your bank account, causing immediate and substantial financial loss. This is a vulnerability that provides criminals with direct access to your funds without any immediate authorization from you.

Even if a stolen check isn’t used directly to withdraw funds, it still contains highly sensitive information that can be exploited. Every blank check features your bank account and routing numbers, which are prime targets for electronic withdrawals from your account. Armed with these numbers, a skilled thief can set up unauthorized direct debits or transfers, effectively siphoning money from your account over time without ever needing to forge a signature. This type of electronic theft can be harder to trace and may go unnoticed for a period.

To exacerbate the risk, blank checks often have your home address, and sometimes even your telephone number, printed on them. Some individuals, mistakenly believing it offers an extra layer of identification, even add their Social Security numbers—a strict no-no that amplifies the danger exponentially. The better option, unequivocally, is to only carry the specific check or checks you anticipate needing immediately. Leave your checkbook securely at home, bringing only the precise number of checks required for your planned transactions. This simple adjustment significantly reduces your exposure to direct financial theft.

Read more about: From Hollywood Hills to Real Estate Empires: 12 Celebrities Who Mastered Property Investment

5. **Your Passport or Passport Card**

A passport or passport card, as a government-issued photo ID, is an incredibly valuable document—not just for you, but for identity thieves. Experts warn that if it falls into the wrong hands, it becomes a powerful weapon against your finances and personal security. Nikki Junker, a victim adviser at the Identity Theft Resource Center, emphasizes that thieves “would love to get (hold of) this” because it can be used for a wide array of fraudulent activities, including traveling in your name, opening new bank accounts, or even obtaining a new copy of your Social Security card. Its comprehensive nature makes it a cornerstone for establishing a new, fraudulent identity.

You might think, “Who carries their passport in their wallet?” However, the market includes specialized passport wallets with slots designed for cash, credit cards, and the passport itself. Moreover, passport cards, which are roughly the same size as a driver’s license, are particularly insidious; they are helpful for frequent border crossers but are also easy to slip into a regular wallet and then forget they are there, increasing their vulnerability to theft alongside your other daily items. This convenience can quickly turn into a major security risk if not managed carefully.

When traveling domestically within the U.S., the recommendation is to carry only your driver’s license or another commonly accepted personal ID. Your passport book and wallet-sized passport card should remain in a secure place at home, ideally within a fire-proof safe. For international travel, where a passport is indispensable, experts advise carrying a photocopy of your passport and leaving the original safely secured in your hotel safe. Some travelers even use an additional external lock, like the Milockie Hotel Safe Lock, for added peace of mind, ensuring that the most powerful form of identification remains under your vigilant protection.

Read more about: Future-Proofing Your Career by 2030: 12 Essential Strategies for Professionals in an AI-Driven World

6. **Multiple Unnecessary Credit Cards**

While carrying credit cards is generally a good financial practice—those who regularly use cards often have higher credit scores—there’s a significant difference between carrying *a* card and carrying *multiple* cards. Your bulging wallet could be significantly slimmed down, and your financial risk dramatically reduced, by simply carrying fewer credit cards. The logic is straightforward: if your wallet is lost or stolen, the more credit cards it contains, the greater the number of accounts you’ll have to cancel, dispute fraudulent charges for, and eventually replace. This process is not only time-consuming and stressful but also increases the window of opportunity for thieves to exploit your stolen cards.

Experts generally recommend a minimalist approach: carry one primary rewards credit card for your everyday purchases. This allows you to earn benefits while keeping your spending consolidated. Additionally, it’s wise to carry one backup card for unplanned purchases or genuine emergencies. This two-card strategy provides sufficient financial flexibility without exposing an excessive number of accounts to potential theft. It’s about optimizing functionality while minimizing vulnerability.

Crucially, and as a vital safety measure often overlooked, you should maintain a separate, secure list of all the cancellation phone numbers or websites for your credit cards. These numbers are typically printed on the back of each card, which is entirely unhelpful if the card itself is stolen. Keep this list at home, perhaps with photocopies of the front and back of all your cards. This proactive step ensures that in the unfortunate event of a lost or stolen wallet, you can immediately contact the necessary institutions and mitigate financial damage swiftly, without scrambling to find contact information in a crisis.

Read more about: Home Refinancing 101: Your Essential Guide to Knowing When to Refinance — And When to Hold Off for Bigger Savings

7. **Your Birth Certificate**

While your birth certificate, if stolen on its own, might not immediately provide a thief with direct access to your bank account or allow them to open credit in your name, it is a foundational document that forms a critical part of your identity. Security experts warn that if a birth certificate falls into the wrong hands, especially in conjunction with other types of fraudulent IDs or personal information, thieves can use it as a powerful building block to construct a more comprehensive false identity. This makes it a high-value target in the broader scheme of identity fraud, even if its immediate utility to a thief is less obvious than, say, a credit card or Social Security card.

There are rare occasions when you might be required to carry all of your most sensitive documents simultaneously. A prime example is during a mortgage closing, where you might need to present your birth certificate, Social Security card, and passport all at once. In such circumstances, vigilance is paramount. These documents should never leave your sight, and the moment the transaction is complete, they should be taken straight home to a secure location, preferably a fire-proof safe. The excitement of celebrating a new home purchase or sale should not overshadow the importance of immediately re-securing these vital papers.

Furthermore, it is never a good idea to leave your birth certificate, or any other critical personal document, unattended in your car. Vehicles, even when locked, are vulnerable to break-ins, and leaving such documents inside only increases the risk of them being stolen. Think of your birth certificate as a cornerstone of your existence; it verifies who you are. As such, it deserves the highest level of security and should be kept safely at home, retrieved only for specific, necessary circumstances, and returned promptly thereafter. Protecting this document helps secure the very fabric of your identity.

Having diligently purged your wallet of the most obvious threats, you’re already leaps and bounds ahead in the fight against identity theft. But the battle isn’t over yet! It’s time to delve deeper, moving past the high-profile targets to uncover the more subtle, yet equally dangerous, items lurking in your billfold. These often-overlooked culprits can still provide crafty criminals with enough fragmented data to piece together your identity, making you vulnerable. This next phase empowers you with smarter habits, transforming your wallet into a fortress against every conceivable risk. Let’s ensure your personal security is comprehensive, leaving no stone unturned.

Read more about: Your Tires Are Lying to You: Unmasking the Hidden Hazards of Worn and Aged Rubber for Safer Driving

8. **A Stack of Old Receipts**

You might dismiss those crumpled receipts as harmless clutter, but ID-thieves see them differently. While businesses are restricted from printing more than the last five digits of your credit card on paper receipts, skilled criminals can leverage this information. Combined with merchant details and your full name (often also printed), these fragments can be used to launch sophisticated phishing attacks.

These seemingly innocuous slips provide building blocks for thieves to reconstruct partial credit card information. They can then attempt to “phish” for the remaining numbers, or target you with scams, posing as legitimate entities to trick you into revealing sensitive data. It highlights how small pieces of information, when aggregated, create significant vulnerability.

The solution is simple: remove receipts from your wallet daily. Make it a habit to shred them immediately, especially if they contain any identifiable purchase information. If you need to retain them for returns or budgeting, ask for a digital receipt. Most retailers now offer this convenient and secure option, delivering it straight to your email.

For printed receipts you must keep, consider making them digital. Apps like Shoeboxed allow you to create and categorize digital copies, storing them securely in the cloud. This declutters your wallet and centralizes your records, accessible when needed without physical risk.

Read more about: Unveiling the Unseen: Why a Pristine 1979 Ford Bronco Ranger XLT Represents Peak Collectibility

9. **Your Old Medicare Card (with SSN)**

Many retirees still carry an old Medicare card, a relic that prominently displayed their Social Security number. This is a critical security oversight. Identity theft experts specifically highlight this as a significant risk, advising older adults to remove any Medicare cards still carrying their SSN.

Thankfully, Medicare has proactively enhanced security. They’ve stopped issuing cards with Social Security numbers, replacing them with new, wallet-sized paper cards featuring a unique, non-SSN number. This change greatly reduces identity fraud risk if your card is lost or stolen.

Therefore, ensure you carry only your *new* Medicare card. If you find an old card with your Social Security number, remove it from your wallet immediately and shred it thoroughly. Replacing it with the new, more secure version is a simple yet powerful step in safeguarding your identity.

10. **Multiple Gift Cards**

It’s tempting to hold onto gift cards “just in case” you visit a specific retailer or restaurant. However, carrying multiple gift cards in your wallet is akin to carrying loose cash. Identity theft experts advise against this, as they represent easily convertible value that thieves covet.

The fundamental issue is that gift cards are not personalized; retailers typically don’t ask for ID. If your wallet goes missing, anyone who finds it can instantly use those gift cards, no questions asked. They are as good as cash in a thief’s hands, making your lost wallet even more appealing.

This untraceable nature makes them a prime target. Minimizing the number of gift cards in your wallet reduces the immediate financial loss you could incur from theft. Think about it: that Home Depot gift card, even with a “To Dad” message, can be spent by anyone.

The smarter strategy is to keep gift cards securely at home until you have a confirmed plan to use them. Many retailers also allow online redemption, offering a secure method without physical carriage. This protects your funds and keeps your wallet lean.

Read more about: Foose’s Blueprint: The 12 Most Insane Custom Cars That Define the Legendary Designer’s Vision

11. **Any Document Containing Your Full Social Security Number (Beyond the Card)**

We know your Social Security card is dangerous. But the threat extends further. You must rigorously check your wallet for *any* other document or scrap of paper inadvertently containing your full Social Security number. This includes old pay stubs, health insurance forms, or carelessly jotted notes.

Identity theft experts consistently emphasize that protecting your full Social Security number is non-negotiable. Any piece of paper with this nine-digit identifier provides a fast track for criminals to exploit your identity. Thieves constantly seek opportunities, and even a partial SSN can be leveraged to fish for the rest or validate other stolen information.

Once a thief obtains your full SSN from any source, they can quickly embark on extensive financial chicanery. This could involve opening new credit lines, obtaining additional credit cards, or applying for loans in your name. Such fraud can severely damage your credit and lead to a lengthy, frustrating recovery.

Conduct a thorough purge of your wallet, scrutinizing every item. If you find any document, no matter how insignificant, displaying your full Social Security number, remove it immediately. Shred it securely. This master key to your identity must remain locked away at home, far from prying eyes.

12. **Outdated Photo IDs with SSNs**

While states have commendably stopped displaying Social Security numbers on newly issued driver’s licenses and state ID cards, a lingering vulnerability persists. If you carry an older photo identification card that lists your Social Security number, you’re unwittingly providing identity thieves with another potent weapon.

This specific type of ID, often an expired or older version, presents a direct security gap. Despite its outdated status, the information on it—particularly your SSN—remains valid and highly valuable to criminals. They can leverage this official-looking document, combined with other stolen details, to solidify a fraudulent identity or access your existing accounts.

Security experts are unequivocal: if you possess old photo IDs listing your Social Security number, prioritize requesting a new ID without delay. This proactive step is crucial, even if it incurs an additional fee. Consider it a small but vital investment in securing your personal information and protecting yourself from potential fraud.

Don’t wait for your current ID to naturally expire if it displays your SSN. Eliminate this potential security risk now. Contact your local Department of Motor Vehicles or equivalent authority to obtain a new card adhering to modern privacy standards, ensuring your Social Security number is removed from your daily carry.

Read more about: Chic Hair Transformations: Celebrity Stylists’s Advices to Refresh Your Look This Summer

13. **Single-Store Credit Cards You Rarely Use**

Beyond paring down general credit cards, let’s get more specific. Many of us hold single-store credit cards—perhaps for a department store from years ago, or a specialty boutique visited annually. While these offer specific perks, carrying them daily, especially if rarely used, adds unnecessary bulk and risk to your wallet.

The principle is simple: every additional credit card in your wallet represents another account to cancel and monitor if stolen. Even a card for a rarely frequented store provides a pathway for thieves to make unauthorized purchases. This adds to the stress and complexity of a theft incident.

Experts recommend a strategic cleanse. Evaluate each store-specific credit card. If cards offer limited daily utility or are only for infrequent purchases, they don’t belong in your everyday wallet. Their minimal convenience does not outweigh the increased exposure to financial fraud.

Instead, keep these less-used cards in a secure location at home, such as a locked drawer or safe. Retrieve them only when you plan to shop at that specific store. This simple adjustment helps maintain a minimalist and secure wallet, carrying only essential financial tools.

14. **Unnecessary Loyalty Cards**

In our pursuit of rewards and discounts, we accumulate numerous loyalty cards, club memberships, or coffee shop punch cards. While seemingly harmless, they contribute to wallet clutter and potential risk, especially those that might be linked to personal data or simply take up space.

Consider the “coffee shop punch cards that you’ll likely never fill up,” as mentioned by security experts. These cards, and similar loyalty programs, often offer minimal daily utility for the space they occupy. Furthermore, some loyalty programs might be linked to personal details like your name, email, or phone number.

While the immediate threat isn’t as direct as a Social Security card, these cards can provide additional pieces of information. Combined with other stolen data, they help thieves construct a more complete picture of your identity. Even confirming your name and shopping habits offers a puzzle piece for a determined fraudster.

The smart approach is selectivity. Keep only loyalty cards for stores you frequent, where benefits genuinely outweigh the risk. For others, particularly those rarely used or where a phone number suffices at checkout, leave them at home. Many programs also offer digital versions via smartphone apps, eliminating physical card carriage.

Read more about: Travel Hacking for Beginners: Your Actionable Guide to Earning a Free Domestic Flight in 6 Months

15. **Your Full Home Address (if easily accessible/not on standard ID)**

We’ve highlighted the peril of combining a spare key with an ID showing your home address. However, the risk extends beyond your driver’s license. Carrying separate notes, business cards, or other documents prominently displaying your full home address creates another vulnerability, especially if easily accessible.

While a driver’s license legitimately contains your address, the problem arises when additional, non-essential items in your wallet also broadcast this critical detail. Imagine a lost wallet with a business card showing your home address, a shopping list for delivery, or a discarded envelope.

When these items combine with other identifying information—or worse, a spare house key—you inadvertently create a clear roadmap for potential burglars or stalkers. Security experts emphasize that such a combination transforms a lost wallet from a financial inconvenience into a direct threat to your physical property and safety.

To minimize this risk, be diligent about non-ID documents you carry. Purge business cards or personal notes displaying your full home address if not absolutely necessary. If you need to write an address for an errand, use a partial address or only essential details. Limit how readily available your complete home address is to anyone who gains access to your wallet.

Congratulations! You’ve navigated the crucial steps of decluttering your wallet, transforming it from a potential data goldmine for thieves into a lean, secure personal safeguard. Remember, in this era of escalating identity theft, vigilance isn’t just a suggestion; it’s your most powerful defense. Jon Clay, vice president of threat intelligence for Trend Micro, reminds us that thieves profit significantly from stolen information, far beyond mere cash.

The good news is you’re now equipped with actionable strategies to combat this threat. From meticulously managing your Social Security number and passwords to reconsidering every receipt and loyalty card, each step makes you a tougher target. As Amy Nofziger of the AARP Fraud Watch Network notes, “We all think we are being careful, but it takes one second for a criminal to steal our wallet or purse.” Your proactive efforts in embracing a minimalist, security-first approach are your shield.

Embrace modern alternatives that enhance both convenience and security. Digital wallets, offered by giants like Apple, Samsung, and Google, safely store your credit, debit, and prepaid cards on your smartphone, rendering physical card theft less impactful. By cultivating these smart habits and maintaining a vigilant eye, you’re not just protecting your finances; you’re safeguarding your peace of mind and the very fabric of your identity against the ever-evolving tactics of identity thieves. Make your wallet leaner, meaner, and most importantly, impenetrable.