The Nasdaq Stock Market stands as a testament to innovation, a vibrant hub where groundbreaking ideas transform into global enterprises. For decades, it has been the launchpad for companies that have redefined industries, capturing the imaginations of investors and consumers alike. Its journey, marked by periods of explosive growth and challenging corrections, offers invaluable lessons about market dynamics and the enduring power of technological advancement.

One such pivotal period was the dot-com era of the late 1990s. This epoch saw unprecedented investor optimism and speculation, as the internet promised to reshape every facet of life and business. While the subsequent bursting of the dot-com bubble served as a cautionary tale, it also laid crucial groundwork, accelerating technological advancements and fostering a new generation of digital pioneers who would one day build the next wave of influential companies.

Today, the Nasdaq continues to host companies that are true “titans of growth,” driving forward the next wave of innovation. These firms, through their relentless pursuit of advancement and their profound impact on daily life, exemplify the dynamic spirit that has characterized the Nasdaq since its inception. Let’s delve into some of these remarkable companies, understanding their influence, and reflecting on the broader legacy of an exchange that constantly looks to the future.

1. **Apple Inc. (AAPL)**

Apple Inc. is undeniably one of the most recognizable and influential brands on the planet, a true titan listed on the Nasdaq. This multinational technology company has masterfully designed, developed, and marketed a suite of consumer electronics that have profoundly integrated into our daily lives. From the iconic iPhone that revolutionized mobile communication to the sleek iPad, powerful Mac computers, and innovative wearable devices like the Apple Watch and AirPods, Apple’s product lines consistently set industry benchmarks, embodying innovation and premium design.

Beyond its celebrated hardware, Apple is also a formidable force in the software industry, with its operating systems – macOS, iOS, iPadOS, watchOS, and tvOS – providing seamless user experiences across its diverse ecosystem. Furthermore, the company’s robust suite of online services, including the immensely popular App Store, Apple Music, Apple TV+, Apple Arcade, and iCloud, forms a significant part of its global appeal. This integrated digital environment deepens user loyalty and creates a powerful moat around its offerings.

With a market capitalization frequently exceeding an astonishing $3 trillion, Apple stands as one of the most valuable companies in the world. Its stock, traded under the ticker symbol AAPL, boasts a long history of strong performance, making it a perennial favorite for investors seeking exposure to the technology sector. The company’s ability to consistently innovate and capture consumer loyalty has been a cornerstone of its sustained growth and influence on the global economy.

However, even a company of Apple’s stature faces significant market dynamics and potential headwinds. Future performance is intrinsically linked to the success of its eagerly anticipated new product launches, which must continually excite a demanding global consumer base. Fierce competition from other technology giants like Samsung, Google, and Microsoft constantly challenges Apple to innovate and differentiate. Moreover, global economic conditions and an ever-evolving regulatory environment, particularly concerning antitrust and privacy laws, present a complex landscape that Apple must adeptly navigate.

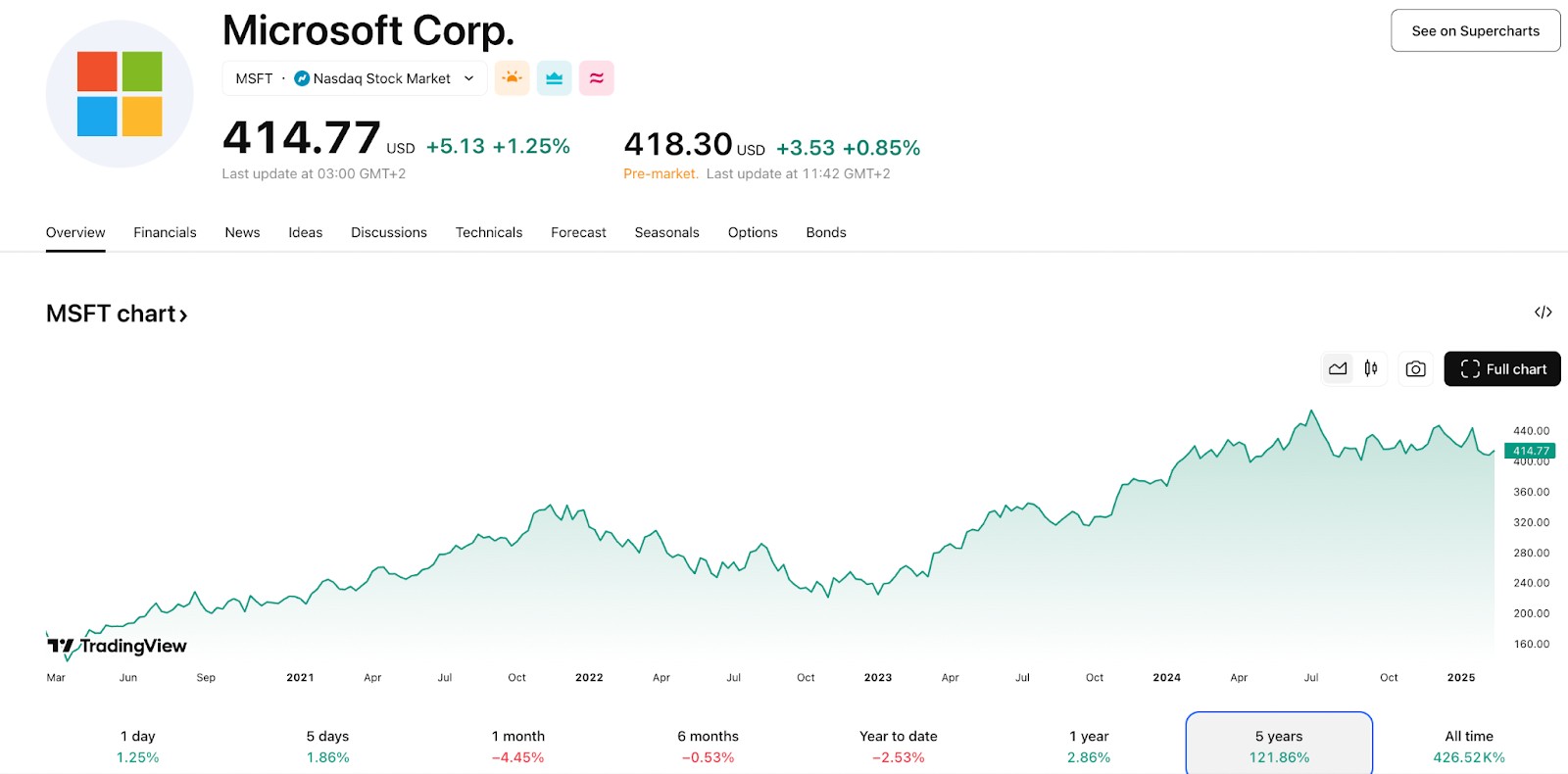

2. **Microsoft Corporation (MSFT)**

Microsoft Corporation stands as another undisputed tech titan, a company that has not merely adapted to the digital landscape but has consistently shaped it from its very foundations. With a market capitalization often exceeding $3 trillion, Microsoft’s pervasive influence spans across personal computing, enterprise solutions, and emerging technologies, cementing its status as one of the most impactful companies globally. Its journey on the Nasdaq reflects a narrative of strategic evolution and relentless innovation across decades.

At its core, Microsoft has built a formidable empire on foundational technologies. The Windows Operating System remains the undisputed backbone of personal computing, powering billions of devices worldwide. Complementing this, the ubiquitous Microsoft Office Suite, featuring indispensable productivity tools like Word, Excel, PowerPoint, and Outlook, is an essential daily companion for businesses and individuals, driving efficiency and collaboration across the globe.

In the modern era, Microsoft has aggressively expanded its horizons, particularly into the lucrative cloud computing space with Azure, which has emerged as a significant rival to Amazon Web Services. Its footprint in entertainment is also substantial with the Xbox gaming console, and it innovates in hardware with its line of Surface Devices. Microsoft’s enduring influence is driven by consistent investment in research, strong financial performance, strategic partnerships, and a proactive focus on emerging technologies like artificial intelligence, machine learning, and the metaverse.

From an investment perspective, Microsoft’s stock has historically delivered strong performance, propelled by its consistent growth. However, intense competition from other tech behemoths and the impact of economic downturns on technology spending are ever-present risks. Additionally, the ever-shifting regulatory landscape, particularly in areas like antitrust and data privacy, presents ongoing challenges. Despite these, Microsoft’s deep technological roots and strategic vision position it well for continued growth.

Read more about: Beyond the Obvious: Uncovering 14 Fascinating Secret Messages Hiding in Your Favorite Brand Logos

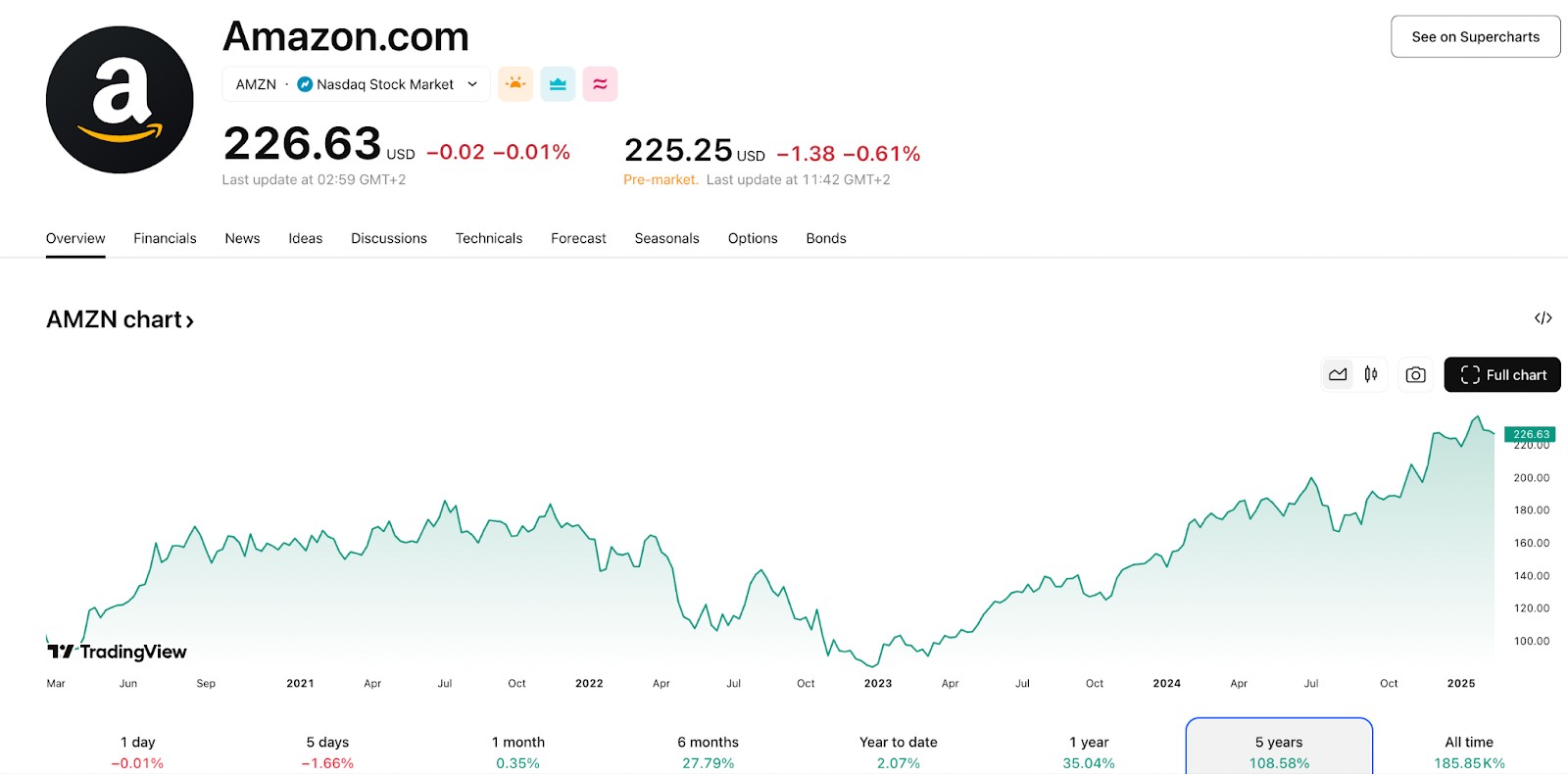

3. **Amazon.com, Inc. (AMZN)**

Amazon.com, Inc. stands as an absolute behemoth in the tech world, an undeniable force whose immense influence on the Nasdaq and the global economy cannot be overstated. From its humble beginnings, Amazon has relentlessly innovated and expanded, revolutionizing the way we shop, consume media, and utilize digital infrastructure. Its journey is a prime example of relentless diversification and market disruption, solidifying its place as a cornerstone of the modern digital economy.

Amazon’s initial and most visible impact was its complete transformation of online shopping, emerging as the dominant force in e-commerce. Its success is rooted in an extensive product selection, aggressively competitive pricing, and a highly efficient fulfillment network that set new industry standards. This relentless pursuit of customer convenience fundamentally disrupted traditional retail, forcing countless brick-and-mortar stores to adapt and innovate in the face of this digital tidal wave.

However, Amazon’s empire extends far beyond its retail origins. Amazon Web Services (AWS) has grown into a leading cloud computing platform, providing essential services like data storage, powerful databases, and scalable computing power to businesses worldwide. AWS is a profit engine and a critical piece of the global internet infrastructure. Furthermore, the Amazon Prime membership program offers a compelling bundle of benefits, deepening customer loyalty. Amazon also continually invests heavily in Artificial Intelligence (AI), driving innovation across its vast operations.

With a market capitalization often exceeding $2.3 trillion, Amazon consistently ranks among the world’s most valuable companies. Its ethos of constant innovation means it continuously diversifies and expands its offerings, pushing boundaries in every sector it touches. While Amazon is undoubtedly powerful, potential investors must consider factors like its valuation, intense competition from incumbent retailers and other tech giants, the impact of economic downturns on consumer spending, and the evolving regulatory environment, particularly regarding data privacy or antitrust laws.

4. **Alphabet Inc. (Google) (GOOGL)**

Alphabet Inc., widely recognized as the parent company of Google, stands as a quintessential digital titan, a technological behemoth that has profoundly shaped the modern digital age. Its omnipresent services and relentless pursuit of innovation have granted it an undeniable and massive influence on the Nasdaq and global markets alike. Alphabet’s journey is a narrative of transforming how the world accesses information, communicates, and navigates the digital realm.

At the heart of Alphabet’s dominion lies Google Search, which remains the world’s most popular search engine, serving as the primary gateway for billions to access vast amounts of information instantly. This foundational service underpins an even larger ecosystem, including Google Ads, a dominant digital advertising platform that consistently generates substantial revenue for the company. Beyond search and advertising, YouTube, the world’s largest video-sharing platform, captivates billions of users daily, redefining entertainment and information dissemination.

In the enterprise sector, Google Cloud is a rapidly growing cloud computing platform, intensely competing with established players like Amazon Web Services and Microsoft Azure. Alphabet’s commitment to innovation extends far beyond its core offerings, venturing into audacious and transformative projects through its “Other Ventures” segment, including Waymo (self-driving cars) and Verily (healthcare technology). The company’s advancements in artificial intelligence are also at the forefront of the industry.

The driving forces behind Alphabet’s pervasive influence are numerous: its relentless focus on innovation, unparalleled data dominance, truly global reach, and strong financial performance. This allows for continuous, significant investments in future growth, reinforcing its status as a leading innovator. Potential investors, however, must be mindful of the intense competition Alphabet faces from fellow tech giants like Amazon, Microsoft, and Meta Platforms, which constantly vie for market share and technological supremacy.

5. **NVIDIA Corporation (NVDA)**

NVIDIA Corporation has emerged as an indispensable titan in the technology sector, wielding profound influence on the Nasdaq and the broader digital infrastructure. Once primarily known for its graphics processing units (GPUs) that revolutionized gaming, NVIDIA has strategically expanded its reach. Today, its advanced chip technology is the very engine powering the explosive growth in artificial intelligence, professional visualization, and high-performance computing, transforming industries across the globe and making it a crucial enabler of modern technological advancement.

The company’s pioneering work in GPU design made them uniquely suited for parallel computing, ideal for accelerating demanding workloads in fields far beyond its initial gaming roots. This strategic foresight led it to become a crucial enabler of artificial intelligence and machine learning, with its GPUs being the preferred hardware for training sophisticated AI models, from natural language processing to computer vision. As AI continues its rapid expansion, NVIDIA’s foundational technology becomes ever more central to these advancements.

Furthermore, NVIDIA is a key player in professional markets, providing robust solutions for data centers and scientific research, and its system-on-a-chip units are integral to mobile computing and automotive markets, particularly in autonomous driving. With a market capitalization of approximately $3.39 trillion as of early December 2024, NVIDIA’s valuation reflects its pivotal role in these high-growth sectors. While its growth has been extraordinary, investors should consider market volatility, intense competition, and the cyclical nature of demand for advanced computing components. However, its deeply entrenched position in AI and high-performance computing makes it a compelling entity on the Nasdaq.

6. **Tesla, Inc. (TSLA)**

Tesla, Inc. represents a disruptive force that has fundamentally reshaped the automotive industry and invigorated the clean energy sector, earning its place as a formidable titan on the Nasdaq. More than just a car company, Tesla has pioneered the mass adoption of electric vehicles (EVs), showcasing that high performance, cutting-edge technology, and environmental responsibility can coalesce into a compelling consumer offering. Its very existence has catalyzed a global shift towards sustainable transportation, inspiring both established automakers and new entrants.

The company’s vision extends beyond electric cars to encompass a broader mission in clean energy, deeply involved in battery storage solutions, solar energy generation, and charging infrastructure. This holistic approach differentiates Tesla from traditional automakers, positioning it as a leader in the wider clean tech revolution and challenging established paradigms. Tesla’s influence is also profoundly felt in its approach to manufacturing and technology integration, embracing advanced robotics and software-defined vehicles, setting new standards for automotive production and over-the-air updates.

With an approximate market capitalization of $1.11 trillion as of early December 2024, Tesla’s valuation reflects investor confidence in its long-term growth potential and its leadership in rapidly expanding markets. Its strong brand, driven by a charismatic leader and passionate community, allows it to generate significant buzz. However, investing in Tesla also comes with notable considerations such as intense competition, regulatory scrutiny, supply chain complexities, and the inherent volatility of a growth stock. Despite these factors, Tesla’s pioneering spirit ensures its continued status as a closely watched and highly influential company on the Nasdaq.

Read more about: Tesla’s Strategic Price Adjustments and Their Profound Impact on the Used Car Market

7. **Meta Platforms, Inc. (META)**

Meta Platforms, Inc., formerly known as Facebook, represents an undeniable titan in the realm of social media and digital communication, wielding colossal influence across the Nasdaq and the global internet landscape. The company has built an unparalleled empire connecting billions of people worldwide through its flagship platforms. Its ambitious pivot towards the metaverse signifies a bold vision for the future of digital interaction, aiming to shape the next iteration of the internet itself.

At its core, Meta dominates the social media landscape with its powerful suite of applications: Facebook, Instagram, and WhatsApp. These platforms collectively serve as primary communication channels, content consumption hubs, and advertising avenues for a significant portion of the global population. Their ability to foster communities and facilitate commerce on an unprecedented scale makes Meta a central pillar of modern digital life, generating massive user engagement and data, and driving a colossal digital advertising engine that fuels its substantial revenue.

The company’s rebranding to Meta Platforms signaled a strategic and significant shift, committing substantial resources to the development of the metaverse, which aims to create immersive virtual experiences. With an approximate market capitalization of $1.45 trillion as of early December 2024, Meta’s valuation reflects its dominant position in existing markets and the perceived potential of its metaverse bet. However, investors must consider intense competition, significant regulatory scrutiny concerning data privacy and content moderation, and the substantial, speculative investment in the metaverse. Nevertheless, Meta’s existing reach and its bold future vision ensure its sustained importance as a Nasdaq titan.

8. **Netflix, Inc. (NFLX)**

Netflix, Inc. stands as a significant player on the Nasdaq, exemplifying the exchange’s diverse portfolio of influential companies that extend beyond traditional hardware and software giants. As an “Entertainment Streaming service provider,” Netflix has profoundly reshaped the entertainment industry, becoming a global phenomenon in digital content delivery. Its presence highlights Nasdaq’s role as a platform for firms redefining how consumers access and experience media, driving forward new paradigms in entertainment and showcasing innovation.

The company’s journey on the Nasdaq reflects the dynamic nature of growth stocks, especially those capitalizing on evolving consumer habits. Netflix leveraged the internet’s infrastructure to build a massive global subscriber base, demonstrating the power of digital-first business models. Its influence stems from continuous innovation within its sector, consistently offering content that attracts and retains millions of users worldwide, making it a key component of the modern digital economy.

Investing in such growth-oriented companies on the Nasdaq comes with specific considerations. While Netflix embodies the spirit of an “innovation hub,” its stock, like others in rapidly evolving sectors, can be subject to market volatility. Investors are drawn to its potential, but a long-term perspective is crucial, acknowledging the intensely competitive digital entertainment landscape and its continuous shifts.

9. **PayPal Holdings, Inc. (PYPL)**

PayPal Holdings, Inc. has carved out a pivotal role on the Nasdaq as a “Digital payment platform,” signifying the exchange’s broad reach into financial services that underpin the digital economy. This company has revolutionized how individuals and businesses conduct online transactions, making digital payments accessible, secure, and widely adopted. Its inclusion among Nasdaq’s titans underscores the critical importance of financial technology (fintech) in enabling and accelerating e-commerce and digital trade, a direct outgrowth of the internet’s development.

The rapid ascent of companies like PayPal is deeply intertwined with the Nasdaq’s history as an “innovation hub.” As the internet matured beyond the dot-com bubble, the need for reliable and efficient payment systems became paramount. PayPal filled this void, demonstrating how specialized digital services could achieve significant scale and influence. Its global presence and role in facilitating cross-border e-commerce illustrate its far-reaching economic impact, contributing to global economic growth facilitated by Nasdaq-listed entities.

For investors, PayPal represents an opportunity to gain exposure to the burgeoning digital payments sector, which continues to evolve. Potential investors must consider the intense competition within the fintech landscape and the ever-evolving regulatory environment. Nevertheless, its foundational role in the digital transaction ecosystem firmly establishes PayPal as an influential stock on the Nasdaq, embodying the exchange’s capacity to host companies driving essential digital infrastructure.

10. **Adobe Inc. (ADBE)**

Adobe Inc. holds its place among Nasdaq’s most influential stocks as a leading “Computer software company specializing in multimedia and creativity software.” Adobe’s suite of products has become indispensable tools for creative professionals and businesses worldwide, setting industry standards for digital content creation. Its sustained influence highlights the enduring power of specialized software development and its integral role in the digital transformation of industries, consistent with Nasdaq’s focus on technological advancement.

The company’s journey on the Nasdaq reflects a consistent trajectory of innovation and adaptation within the software sector. Adobe has successfully transitioned from traditional licensed software to a subscription-based cloud model, demonstrating a strategic evolution that mirrors broader industry shifts. This continuous innovation, a characteristic of Nasdaq-listed companies, has allowed Adobe to maintain market dominance and generate substantial revenue, making it a valuable component of the Nasdaq Composite Index with an approximate market capitalization of $200 billion.

Investment in Adobe, like other established tech titans, requires considering market dynamics and the competitive landscape. However, its deeply entrenched position in essential creative and business workflows, coupled with consistent investment in research and development, positions Adobe as a resilient and influential force on the Nasdaq. It exemplifies the exchange’s capacity to foster long-term technological leadership and contribute to overall market capitalization.

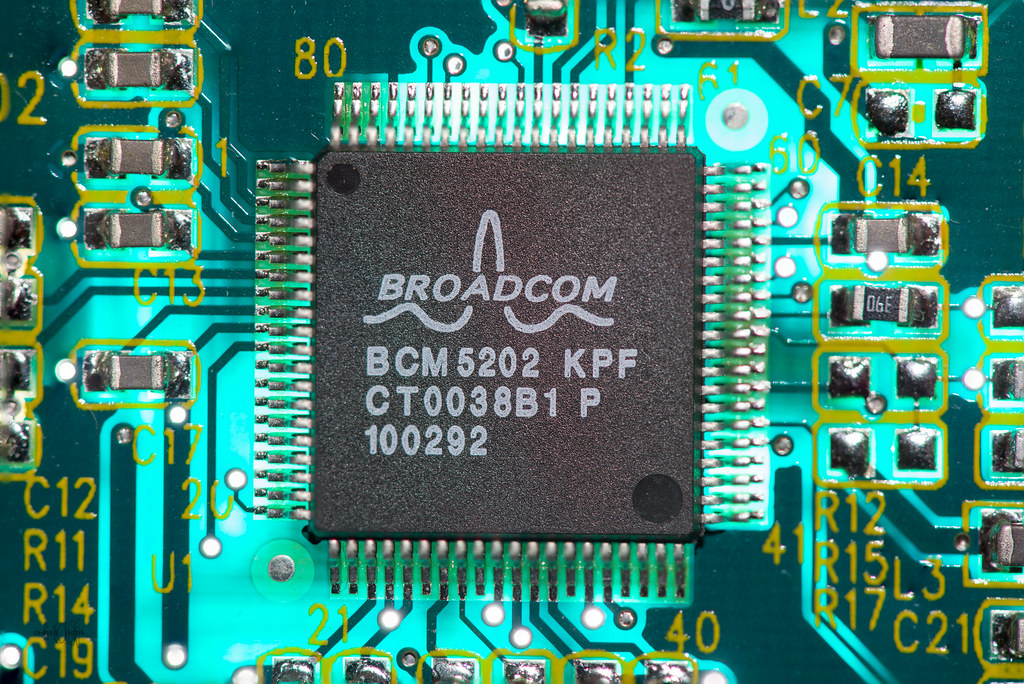

11. **Broadcom (AVGO)**

Broadcom, a significant holding on the Nasdaq Composite Index with an approximate market capitalization of $250 billion, stands as a critical player in the semiconductor and infrastructure software sectors. Its position underscores the vital role of foundational technology companies in powering the digital economy. These firms, though not always in the consumer spotlight, provide the essential components and systems that enable the broader technology landscape, from data centers to communication networks.

The Nasdaq, known for its “technological focus” and as an “innovation hub,” naturally hosts companies like Broadcom that drive advancements at the chip and infrastructure level. The relentless pace of technological progress, accelerated since the dot-com era, depends heavily on continuous innovation in semiconductor design and related software. Broadcom’s market presence reflects its contributions to these critical areas, ensuring the performance and efficiency of digital infrastructure that countless other Nasdaq titans rely upon.

Investing in companies like Broadcom offers exposure to the fundamental building blocks of technology. Their influence is often tied to cycles of technological upgrades and the pervasive demand for higher performance computing and networking. While market capitalization figures can fluctuate, Broadcom’s consistent listing among top Nasdaq holdings highlights the market’s recognition of its strategic importance. Such companies represent the backbone of the Nasdaq’s strength and the broader technology sector’s ongoing evolution.

12. **Texas Instruments (TXN)**

Texas Instruments, listed as a notable component of the Nasdaq Composite Index with an approximate market capitalization of $200 billion, further exemplifies the exchange’s deep roots in the semiconductor and electronics manufacturing industries. This company represents the core engineering and innovation that underpins a vast array of modern electronic devices, contributing to the technological advancements that have characterized the Nasdaq’s history since its founding. Its influence, while perhaps less visible, is pervasive and fundamental.

As a company deeply entrenched in the “semiconductors” sector, Texas Instruments plays a crucial role in the digital economy by producing analog and embedded processing chips. These components are essential for a multitude of applications, from industrial machinery to automotive systems and personal electronics. The Nasdaq’s commitment to technology and innovation has consistently provided a platform for such foundational companies, recognizing their indispensable contributions to global technological progress and economic growth.

The sustained presence of Texas Instruments on the Nasdaq, even after decades, speaks to the enduring demand for its specialized products and its ability to adapt and innovate within a highly competitive industry. Investors considering such a stock typically look at its role in long-term technological trends, its robust intellectual property, and its consistent financial performance. Texas Instruments remains a resilient and influential component of the Nasdaq’s diverse ecosystem, reinforcing the exchange’s broader market role.

13. **Visa (V)**

Visa, Inc. holds a significant position on the Nasdaq, appearing among the “Top 10 Companies by Market Capitalization” in some context listings. Its inclusion underscores the Nasdaq’s expanding scope beyond pure technology firms to include influential companies across various “growth sectors,” including financial services. Visa’s role as a global payments technology company is central to the modern economy, facilitating digital transactions on an immense scale.

The company’s influence on the Nasdaq reflects its pivotal function in the global financial infrastructure. By enabling electronic fund transfers worldwide, Visa supports the vast network of commerce that powers economies and connects consumers and businesses. Its presence aligns with the Nasdaq’s emphasis on innovation, as Visa continually adapts its technology to enhance security, efficiency, and accessibility of digital payments, making it a key enabler of “cross-border e-commerce and digital trade” post dot-com era.

Investing in a company like Visa offers exposure to the resilient and growing digital payments industry. While it operates in the “Financial Services” sector, its technological backbone and global network align perfectly with the innovative spirit of the Nasdaq. Consideration for investors would include intense competition in payment processing and the dynamic regulatory landscape. Nevertheless, Visa’s entrenched position makes it a truly influential stock, contributing to the overall health and stability of the global financial system that Nasdaq supports.

Read more about: Decoding the Lexus RX Engine: A MotorTrend Analysis of Lifespan, Common Issues, and the Intricacies of Replacement

14. **Qualcomm (QCOM)**

Qualcomm, Inc. is another prominent name on the Nasdaq, consistently listed among the “Top 10 Companies by Market Capitalization” within the provided context. Its inclusion firmly establishes it as an influential force, particularly within the “semiconductors” and telecommunications industries. Qualcomm’s core business revolves around developing and licensing intellectual property for wireless communication technologies, playing a foundational role in the mobile revolution that followed the dot-com era.

The company’s deep-seated influence stems from its pioneering work in mobile technology, particularly its contributions to 3G, 4G, and 5G cellular standards. These innovations have been instrumental in making mobile computing ubiquitous, enabling the smartphone era, and connecting billions globally. As a crucial enabler of “telecommunications” and “technological advancements,” Qualcomm embodies the Nasdaq’s mission to host companies that drive groundbreaking innovation and economic growth, reflecting its status as a technological powerhouse.

For investors, Qualcomm represents an opportunity to invest in a company that is at the forefront of wireless technology and its future evolution. The cyclical nature of the semiconductor industry, intense competition, and the complexities of intellectual property licensing are important investment considerations. Despite these factors, Qualcomm’s strategic importance in the global mobile ecosystem and its continuous investment in research and development solidifies its position as an influential Nasdaq titan, contributing significantly to the exchange’s diverse and dynamic offerings.

**Revisiting the Critical Lessons from the Dot-Com Bubble**

The dot-com era, a pivotal period for the Nasdaq, brought with it invaluable lessons that continue to shape investment strategies and market regulation. As the “dot-com bubble peaked” in March 2000, fueled by “investor optimism and speculation,” the market experienced a “rapid rise in stock prices.” However, the subsequent “burst of the bubble” led to a “sharp decline” in the Nasdaq, highlighting the dangers of “excessive speculation and irrational exuberance” and the importance of market caution.

A primary lesson learned was the critical importance of “rational valuation,” emphasizing the need to focus on “fundamental value” rather than solely on future potential. Many companies during that time had “little or no earnings” yet commanded exorbitant prices, a stark reminder that solid business models and profitability are paramount. The period also underscored the necessity of “risk management,” urging investors to implement robust practices to mitigate potential losses in highly volatile markets, ensuring informed decisions.

Furthermore, the dot-com bust highlighted the vital role of “regulatory oversight.” The context explicitly calls for “strengthening regulatory frameworks to prevent future bubbles,” ensuring a more stable and transparent market environment. For individual investors, the era powerfully demonstrated the value of a “long-term perspective,” advocating for a patient approach and avoiding the pursuit of “short-term gains” driven by market hype. These lessons, deeply ingrained in the Nasdaq’s history, serve as a perpetual reminder of market dynamics and the wisdom required for sound investment.

**Nasdaq’s Enduring Resilience**

Despite the dramatic challenges posed by the dot-com bubble’s collapse, the Nasdaq has showcased remarkable resilience, evolving and thriving in the decades since. The context clearly states that “Despite the challenges of the dot-com bust, the Nasdaq has continued to evolve and thrive.” This recovery and sustained growth have been driven by new waves of innovation, particularly “the rise of mobile technology and cloud computing” in the 2010s, reaffirming its role as a “leading global exchange” and a hub for continuous advancement.

The exchange’s inherent “commitment to technology and innovation” has been a cornerstone of its recovery and continued success. By providing a “platform for innovation and capital formation,” Nasdaq has consistently attracted “groundbreaking ideas” and companies that have “redefined industries.” This dynamic environment has allowed it to adapt to changing technological landscapes, fostering the emergence of new titans that drive global economic growth, embodying “the enduring power of technological advancement.”

The Nasdaq’s ability to bounce back from significant market corrections also reflects the fundamental strength of the technology sector itself. While speculative excesses can lead to bubbles, the underlying advancements in computing, internet infrastructure, and digital services are genuinely transformative. The exchange’s “diversification” beyond just internet pure-plays, now including “biotechnology and pharmaceuticals” and “other growth sectors,” has also contributed to its stability and broadened its appeal, showcasing a mature and robust market.

**Examining Nasdaq’s Broader Market Role**

Beyond its identity as a hub for technology stocks, the Nasdaq plays a multifaceted and crucial “role in the global financial landscape.” It is far more than just a trading venue; it functions as a comprehensive financial services leader that underpins significant economic activity worldwide. Nasdaq, Inc. is a “multinational financial services corporation that owns and operates multiple stock exchanges, market data products, and technology solutions.”

One of its key roles is “Facilitating Trading,” providing an “electronic platform for buying and selling stocks, bonds, and other securities,” making markets more efficient and accessible. Equally important is its function as a “Listing Companies” venue, offering a platform for firms, especially technology-focused ones, to “list their shares and raise capital,” thereby fueling business expansion and job creation. This capital formation is vital for fostering innovation and economic development globally.

Furthermore, Nasdaq acts as a critical “Market Data Provider,” offering “real-time market data, including stock quotes, trading volumes, and market indices,” which are indispensable for informed investment decisions worldwide. It is also an active “Technology Innovator,” continually “developing innovative trading technologies” and market infrastructure, driving efficiency across the financial system. Finally, through its “Creating Indices” function, it provides a “barometer of global economic health, particularly in the technology sector,” guiding investors and analysts globally. By fulfilling these diverse roles, Nasdaq significantly contributes to the “efficient functioning of the global financial markets” and the overall stability of the global financial system.

**A Forward Look: Nasdaq’s Enduring Legacy of Growth and Innovation**

As we’ve journeyed through the titans that define the Nasdaq, from established giants of computing to innovators in streaming and digital payments, it’s clear this exchange is more than a marketplace. It’s a living testament to human ingenuity and economic evolution, continually reinforcing its status as a “technological powerhouse driving innovation.” Nasdaq attracts companies that not only push boundaries but also reshape our daily lives.

The lessons from the dot-com era stand as a powerful reminder of market cycles, yet the Nasdaq’s “enduring resilience” demonstrates the fundamental strength of genuine technological advancement. It remains a vibrant ecosystem where groundbreaking ideas find capital and grow into global forces. For investors, understanding its characteristics—from inherent volatility to the necessity of a long-term perspective—is key to navigating its dynamic landscape effectively.

Ultimately, the Nasdaq’s broader market role extends far beyond stock listings; it fosters an environment of innovation, provides essential financial services, and acts as a pulse for the global technology sector. It’s a place where the future is being built, one influential company at a time, reminding us that with careful consideration and a forward-looking mindset, the opportunities it presents are as vast as the digital frontier itself.