For years, a strong desire pushed me forward: I wanted to feel free, no longer tied down by society’s expectations. Escaping the rush of everyday life became essential to me. My goal was financial independence, and early retirement was a crucial part of that dream. This ambition grew stronger after I left my corporate job in 2015.

At that time, I was selling my time for money, working about twelve hours a day. Life felt stuck, going nowhere. The work itself brought me no true happiness — it was like being trapped inside a box. The system did not align with what I truly wanted.

Feeling unhappy sparked a strong urge for change. I started exploring different ways of living, reading many books about alternative lifestyles. Books like The 4-Hour Work Week opened new perspectives. I also discovered Mr. Money Mustache, who retired young and lived simply and freely. These ideas resonated deeply with me — a corporate warrior craving freedom. The thought of having complete control over my time sounded amazing. Doing what I wanted, without job limits, seemed like the ultimate goal and key to a meaningful life.

Pursuing Early Retirement: Achievements and Realities

I committed fully to this path, setting big goals to achieve financial independence. This journey required focus and discipline. Now, fast forward to 2025, it feels amazing to see those goals achieved. Many targets set years ago have been met.

Initially, I expected to reach financial independence faster — maybe five years earlier than 2020. But life has its own schedule, and delays do not truly matter. The main point is that I have arrived at the destination. We stand at the edge of the freedom we long sought.

Reaching this point raises important questions about what financial comfort really means. It is a very personal concept. I won’t share exact income numbers not because of hiding but because the numbers alone do not tell the full story.

Money’s significance varies depending on circumstances. What is enough for one person differs greatly for another. Where and how you live play a major role in shaping your financial comfort.

Lifestyle and Financial Situation

My wife and I live in Leeuwarden, Netherlands, where the cost of living is much lower compared to big cities like Amsterdam. This affordable living location greatly helps our financial comfort. We own an apartment where we currently reside, providing stability and control over major expenses.

We still have a mortgage, but the interest rate is very low, only 1.7%. Since 2017, we have been carefully paying it down. Originally, we bought the apartment for about $150,000. Its value has since increased by over $100,000, which adds a safety layer to our financial foundation.

Besides our home, much of our income is passive. It comes from books, courses, and rental properties. This passive income stream averages around $15,000 to $20,000 per year. This means earning money without selling my time — a core idea behind the FIRE (Financial Independence, Retire Early) movement that inspired me.

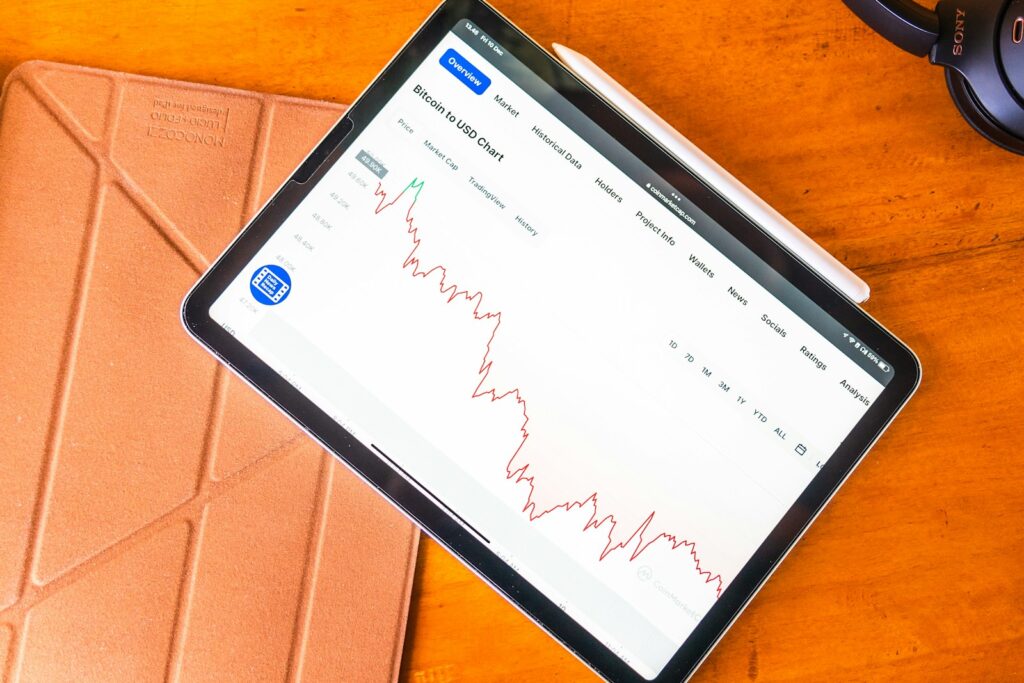

Additionally, I have liquid assets easily available. My stocks and cash combined reach seven figures. I actively manage this capital pool, with about 30% invested in trading stocks. This is not passive investing but requires active work. Since 2020, I have achieved an average annual return of around 30%, which is quite impressive.

Trading profits now feel like regular income, separate from my core retirement funds. Rather than spending these profits, I reinvest them to grow my wealth further. Staying actively engaged with the markets keeps me connected to the financial world and stimulates me intellectually.

Planning for the Future and Family

Our financial position allows us to plan for a bigger home, such as a million-dollar house, which now feels doable. The plan would involve selling some stocks for a down payment and taking a mortgage of about $600,000 to $700,000. The estimated monthly payment would be around $3,500, fitting comfortably within our financial picture.

Future expenses like children also seem manageable. We are fortunate to live in the Netherlands, a country that provides strong support for families, including affordable education and healthcare. This support reduces financial stress significantly compared to many other countries.

Personally, I also have no problem living with less if needed. If we have kids, priorities will naturally shift to meet their needs first. I am prepared to adjust my spending and habits to ensure our family’s comfort and safety. Being adaptable is part of the freedom money provides.

Unexpected Lessons from Early Retirement

Reaching financial comfort brought unexpected insights. The biggest lesson from trying early retirement is that I actually do not like having too much free time. This may sound strange given my original goal, but it’s a truth I discovered through experience.

Too much free time often means spending more money. Without work structure, it’s easy to fill hours with activities that cost money, which quickly adds up. For example, I traveled extensively in the past six months, and the expenses piled up fast.

More than money, the lack of structure made me feel restless. Open days grew tiresome quickly. When days are too empty, an uneasy feeling sets in. I do not have many hobbies to fill long hours, nor am I someone who enjoys big DIY projects or house cleaning.

Images of early retirement involving surfing or golfing all day just do not fit who I am. Realizing that these fun retiree activities don’t fulfill me deeply was a major revelation.

Finding Purpose in Work

What I understand more clearly now is that my true hobby is the work I do. Saying this aloud, I feel deeply grateful. It is a great fortune to find work you truly love.

Work that engages the mind brings purpose in a way rest or play cannot. For a long time, my goal was to be free — free from waiting on others and escaping the 9 to 5 grind. I wanted to opt out of the rat race entirely, where everyone seemed to be running in place.

I achieved that escape by reaching financial independence. But then the bigger question emerged: what do you actually do next? After money freedom, what truly comes next? This question moves the conversation from numbers to deeper meaning.

What is the purpose of life after your basic needs are met and security is secured? For most people, this is just an abstract idea — many never reach true financial freedom. But for those who do, it is a question that must be answered.

Life Beyond Money: The Importance of Being Useful

Life keeps moving forward regardless of money or freedom. We keep figuring things out, doing new things, growing as people. Having lots of money does not change this fundamental truth.

Warren Buffett understands this well. He says we are all the same, only he travels faster because he owns a private jet. Apart from that luxury, his daily routine is similar to anyone else’s: wake up, eat breakfast, go to work, eat lunch, repeat. Wealth does not change the core rhythm of life.

Many want to quit their jobs and travel the world endlessly, believing freedom and fun bring happiness. But with age, I have come to believe that true purpose lies in being useful.

Money gives safety and choice, but it does not give life meaning on its own. Buying things or traveling creates only temporary joy, which fades quickly. This leads to a constant chase for new pleasures that ultimately feel empty.

Being useful, on the other hand, provides lasting satisfaction. Helping others, solving problems, and creating value connect you to deeper fulfillment. This feeling endures and keeps you engaged.

Work, Balance, and the Reality of Freedom

When usefulness guides your life, your time and energy have meaning. You face new challenges, solve problems, build things, and share knowledge. This keeps you busy in a good way and prevents boredom.

Too much free time leads to restlessness. This realization makes you think about life’s true balance between work and rest. There is no single right mix; balance constantly shifts and requires ongoing adjustment.

This explains why your job and money matter greatly. If you hate your job, it feels like being trapped. Jobs that are rigid and inflexible crush your spirit and increase the desire to escape.

I work with many people who understand life is more than just job hours. Some careers demand nonstop focus and sacrifice, such as investment banking. Choosing those paths means understanding the cost involved.

Freedom is not only about working for yourself or having no money worries. You can feel free working for others if you do your best and take responsibility. Flexibility without commitment does not bring real freedom.

The right attitude unlocks happiness regardless of job status. Being useful and excellent at your work matters most, whether employed or self-employed. As long as you are fairly compensated for your value, the inner wish to contribute remains.

Embracing Work as a Lifelong Passion

This perspective makes me realize I do not want to stop working completely. Drifting through life doing only fun things is not fulfilling. Fun is best enjoyed after productive work has been accomplished.

Rest alone feels less rewarding without contrast. Rest is truly enjoyable when it follows meaningful effort.

This clarity became evident over the past few months. I took much rest as planned, including marriage and travel. Yet, I often found myself aimlessly filling time without real purpose.

Despite all the rest, I returned to work. I could not stop completely because I love what I do and want to remain useful.

Two main forces explain this: a deep love for my work and the drive to contribute meaningfully. These have stayed with me throughout.

Moving Forward with New Purpose

Now it is clear I do not want to stop writing or working. After reflection, my energy for these things returned strong. Just last week, I began new projects that excite me, including plans to relaunch a weekly newsletter.

If you follow me, expect regular new content starting soon.

Trying early retirement taught me valuable life lessons. The biggest is that life without meaningful work feels incomplete. Money and security alone do not change this fundamental truth.

Early retirement brought surprises. More free time meant spending more money and restlessness. Leisure activities, especially travel, quickly added expenses. Lack of routine affected money flow and well-being.

I discovered that my true hobby is work itself — a source of purpose and fulfillment. Financial freedom is only part of the story. The real meaning of life comes from being useful and engaged.

Freedom does not mean stopping work completely but finding balance and purpose in what you do. This journey transformed me from a corporate warrior to an early retiree and back — now with a deeper understanding of purpose beyond financial freedom.