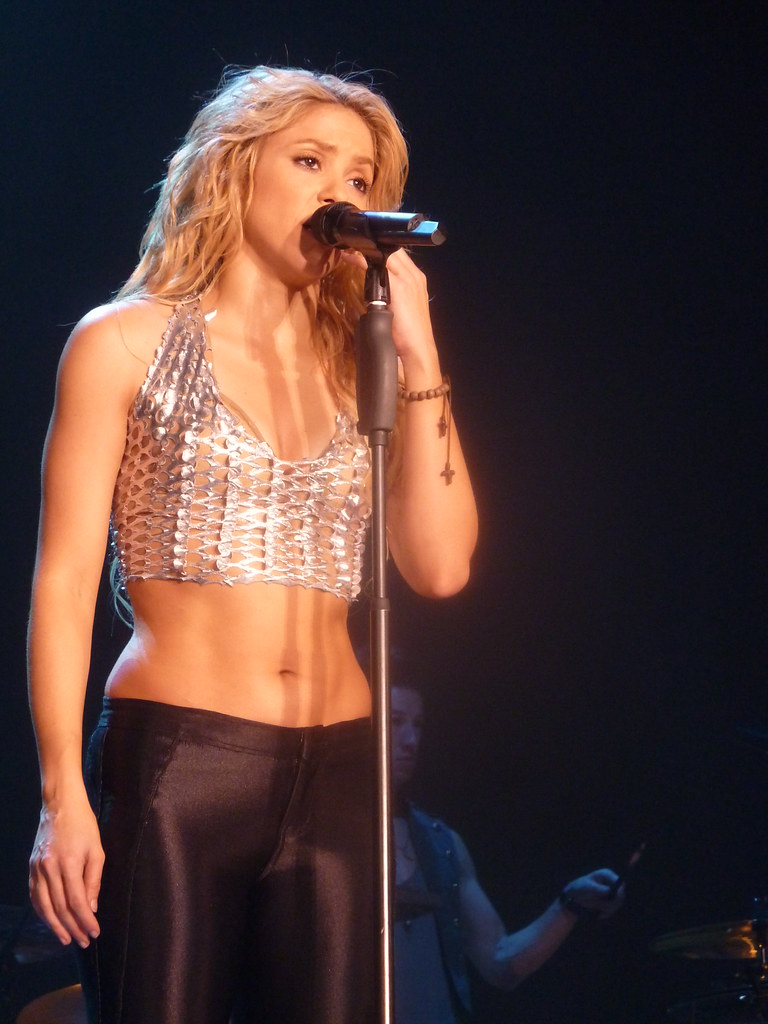

Well, talk about unexpected headlines! The incredible Shakira, a global superstar and someone we all know from her dynamic performances and even her time coaching on *The Voice*, is currently navigating some serious legal waters. The news hitting the wires is that the renowned singer has been ordered to stand trial in Spain amidst allegations of tax fraud. It’s a significant development, and certainly puts a different kind of spotlight on the versatile artist.

We’re talking about a situation where Shakira could potentially face up to eight years in jail if found guilty. Prosecutors in Spain have accused her of failing to pay taxes between 2012 and 2014. These are substantial claims, and they highlight the complexities that international figures can encounter when it comes to financial matters across different jurisdictions.

The core of the allegations, which first surfaced back in 2021, centers on accusations that Shakira used shell companies. Authorities allege she did this to conceal control of assets and that she registered her name on forms only in countries considered tax havens. It’s a picture painted by the prosecution claiming a deliberate effort to avoid tax obligations.

The alleged amount of evaded tax is quite hefty, coming in at €14.5 million, which translates to £13 million. Six prosecutors were reportedly involved in convincing a Spanish court to bring the singer to trial. It underscores the seriousness with which the Spanish authorities are pursuing this case against such a high-profile figure.

Naturally, Shakira has a very different perspective on these allegations. She has firmly called all accusations against her “false.” She maintains that she has already paid everything that she owed to the government. It’s her stance that these charges are unfounded, and she’s pushing back against the prosecution’s claims.

Her defense rests on her claim that between 2012 and 2014, her fiscal residence was actually in the Bahamas. According to her, this meant she was exempt from having to pay Spanish income tax during that period. She also stated that she was only in Spain “sporadically” throughout those years.

However, the prosecutors have a counterargument. They contend that, contrary to her claims, she was actually living in Barcelona for more than six months of the year during that timeframe. This is a critical point of contention, as spending more than half the year in Spain would typically establish tax residency there.

Despite the weight of these legal challenges and the potential for a significant prison sentence of up to eight years, Shakira has continued to deny all allegations of tax fraud. It’s a tough position to be in, balancing a demanding global career with a complex legal battle.

And speaking of that career, it’s truly remarkable! Shakira made her recording debut at the young age of 13, a testament to her early talent and drive. She burst onto the international scene and found massive fame with her fifth album, *Laundry Service*, released in 2001. That album gave us unforgettable hits like “Whenever, Wherever” and “Underneath Your Clothes,” songs that still get people moving today.

Her influence stretches far beyond just album sales. Remember the 2010 official World Cup song? That was her! “Waka Waka (This Time for Africa)” became an anthem for the global football spectacle. She also showcased another side of her talent by serving as a coach on two seasons of *The Voice* in the US, sharing her expertise and personality with aspiring singers. And who could forget her electrifying performance alongside Jennifer Lopez at the Super Bowl halftime show? She truly is a multi-faceted entertainer.

Even with the legal issues looming, Shakira’s professional life hasn’t slowed down. She’s currently in the midst of her *Las Mujeres Ya No Lloran* World Tour, which just kicked off recently on February 11 in Rio de Janeiro, Brazil. This tour is set to run into June of this year, with concerts scheduled across North and South America, including a planned stop in her home country of Colombia after her dates in Peru.

The tour is in support of her latest album, also titled *Las Mujeres Ya No Lloran*, which translates to *Women No Longer Cry*. This album, released in 2024, marked her 12th studio effort and her first in seven years following 2017’s *El Dorado*. It’s clear she poured a lot into this project, and it’s resonating with audiences.

Adding to the album’s success, it recently earned her a Grammy for Best Latin Pop Album. That’s a significant achievement and highlights her enduring impact on the music industry. The album itself is deeply personal, reportedly inspired by her breakup with her longtime partner, Gerard Piqué, and features popular tracks like “Te Felicito,” “TQG,” and “Shakira: Bzrp Music Sessions, Vol. 53.”

Of course, life on the road can have its challenges. Just recently, Shakira had to cancel a concert in Lima, Peru, on a Sunday night. Reports indicated she was hospitalized due to an abdominal issue and wasn’t cleared by doctors to perform. It was a temporary setback for the energetic performer.

She kept her fans updated, announcing the cancellation on Instagram stories with messages in both Spanish and English. She shared her regret and sadness about not being able to perform the show that night. She expressed hope that she would recover in time for her planned performance the following night in the same city.

Her team was actively working behind the scenes to figure out a new date for the canceled show. On Monday, she took to Instagram again, sharing a message of gratitude to her fans. She told them, “Thank you all for your loving messages. You give me so much strength!! I love you with all my heart.” It shows the connection she has with her audience, supporting her through both health issues and, presumably, the stress of her legal situation.

Interestingly, Shakira isn’t the only high-profile figure to face scrutiny from Spanish tax authorities regarding income and residency. The context of her case brings to mind several prominent individuals from the world of football, many of whom have also navigated allegations related to tax evasion, often linked to image rights income.

Take, for example, former Real Madrid coach Carlo Ancelotti. He was recently sentenced to one year in prison and ordered to pay a hefty fine after being found guilty of tax fraud. The charges stemmed from his alleged failure to pay over a million euros (US$1.1 million) in Spanish taxes specifically related to his image rights. It’s a recurring theme in these cases.

Ancelotti, a hugely successful figure as both a player and manager for teams like AC Milan, Chelsea, Paris Saint-Germain, and Bayern Munich, was acquitted on similar charges for the 2015 tax year. This was because he had moved to London mid-year after his first stint with Real Madrid, meaning he likely didn’t meet Spain’s residency requirement for that specific year.

Despite prosecutors originally seeking nearly five years in prison across two counts of tax evasion for Ancelotti, he received a one-year sentence. This shorter sentence is notable because, in Spain, individuals who receive a light prison sentence, typically two years or less, do not usually serve time unless the offense is violent or they are habitual offenders. This suggests he will likely only serve probation.

In addition to the prison sentence, Ancelotti was required to pay a fine of €386,361, which is roughly US$452,973. Ancelotti acknowledged receiving six million euros (approximately US$6.7 million) from Real but claimed he didn’t pay close attention to the deal’s specifics. He reportedly stated, “For coaches [image rights] don’t mean the same as they do for players because they don’t sell shirts.”

However, the context points out that this isn’t entirely accurate, mentioning managers like Jürgen Klopp appearing in ads for trivago and José Mourinho appearing in ads for Topps sports cards and Turkish Airlines. These examples highlight that coaches *can* indeed generate significant outside revenue, often tied to their image rights.

Another huge name in Spanish tax cases is none other than Lionel Messi, arguably the most famous soccer player in the world. While playing for FC Barcelona, he was charged with tax evasion in 2013. Authorities alleged that his father used a series of shell companies located in tax havens to shield royalties and licensing income, again related to those valuable image rights, from Spanish tax.

Allegations claimed income from lucrative contracts was funneled offshore through an elaborate maze of entities to help Messi and his father avoid paying income tax in Spain, dating back as far as 2005. Despite maintaining his innocence throughout the proceedings, Messi took steps to address the issue shortly after the charges became public, making a “corrective payment” of five million euros (US$6.57 million) to clear his tax debt.

In 2015, Spanish tax authorities ordered Messi to stand trial. At trial, he famously testified about his lack of involvement in managing his finances, stating, “I was playing football. I had no idea about anything.” He further explained, “I trusted my dad and my lawyers,” even claiming he didn’t read the documents he signed. The court, however, was not convinced by this defense.

In 2016, both Messi and his father, Jorge Messi, were found guilty of tax fraud and sentenced to 21 months in prison. Messi appealed the case to the Spanish Supreme Court, but his appeal was rejected, confirming his conviction on the tax fraud charges. Like Ancelotti, it’s understood Messi did not serve actual prison time due to the sentence length being under two years.

Messi’s career, like Shakira’s, has continued to flourish despite these legal challenges. He recently received the Presidential Medal of Freedom and is credited with significantly amping up enthusiasm for soccer in the United States, especially with the World Cup heading there. He now plays for MLS’ Inter Miami and landed at number 5 on Forbes’ list of The World’s 10 Highest-Paid Athletes in 2025, with estimated total earnings of $175 million.

Yet another FC Barcelona player, Javier Mascherano, also faced tax issues. In 2015, during a hearing that reportedly lasted less than ten minutes, Mascherano admitted to failing to pay taxes on his earnings for 2011 and 2012. His case, too, involved assigning image rights to companies located in tax havens, a recurring pattern.

Before entering his plea, Mascherano had not admitted any wrongdoing, but he did settle an outstanding tax bill. He paid 1.5 million euros (then US$1.69 million) in taxes plus 200,000 euros (US$225,860) in interest. Following his guilty plea, he was fined 815,000 euros (US$880,078) and sentenced to 12 months in prison (four months for 2011 and eight months for 2012). Notably, like the others, he did not serve any prison time.

Several other soccer stars have also been named in tax allegations in Spain, showing a broader effort by authorities. This list includes Alexis Sanchez and Neymar da Silva Santos Júnior, known simply as Neymar, both formerly with FC Barcelona. Cristiano Ronaldo, formerly of Real Madrid, was also accused of tax evasion.

Ronaldo, who has since moved to Saudi Arabia to play for Al Nassr, topped Forbes’ list of The World’s 10 Highest-Paid Athletes in 2025 with an estimated total earnings of $275 million. There was even some speculation that he had initially appeared immune to tax allegations while at Real Madrid, leading some to wonder if there was a conspiracy specifically targeting FC Barcelona players.

However, suspicions against Ronaldo were raised after the “Football Leaks” disclosures, which were similar to the Panama Papers but focused on soccer finances. These leaks suggested that Ronaldo had underreported his income. Ultimately, Ronaldo reached a deal with prosecutors and, like others with shorter sentences, served no jail time.

It’s worth noting that not everyone targeted has been found guilty. Former Real Madrid player Xabi Alonso is cited as one of the few soccer figures to be acquitted of tax evasion charges. The former midfielder was initially accused of failing to declare income related to his image rights in 2015 but successfully navigated the legal challenge.

.jpg/440px-Jos%C3%A9_Mourinho_2020_(cropped).jpg)

And managers haven’t been exempt either. Before Ancelotti’s recent sentencing, José Mourinho proved that coaches could also face tax fraud charges. Mourinho was accused of underpaying taxes during his time managing Real Madrid from 2011 to 2012. He was sentenced to prison, though he did not serve any time, and was also fined. And the income he was accused of not reporting? Yes, you guessed it – it was for his image rights.

So, while Shakira’s case as a global music icon and former *The Voice* coach brings a different flavor, she finds herself part of a larger trend where Spanish authorities are diligently pursuing alleged tax irregularities among high-earning, high-profile individuals, particularly those generating income from sources like image rights.

As Shakira continues her dynamic world tour, bringing her incredible music and energy to fans across the globe, the legal proceedings in Spain represent a significant challenge she must face. Despite the serious nature of the allegations and the potential sentence, her defense remains strong, asserting her innocence and compliance. The trial will ultimately determine the outcome, but for now, the world watches to see how this complex intersection of international fame, finances, and law will unfold for the superstar.