The journey to a new set of wheels often brings with it a fundamental question that can significantly shape your financial landscape: Should you lease or buy? It’s an age-old dilemma for drivers looking to get behind the wheel, and as many financial experts will attest, the answer isn’t always as straightforward as it seems. Given that a car or lease payment typically represents your second most expensive outlay after housing, making an informed decision is paramount to your overall financial well-being.

At its core, the distinction lies in control and ownership. Leasing a car is akin to a long-term rental, where you pay monthly to drive a vehicle for a predetermined period and mileage, eventually returning it to the leasing company. In contrast, buying a car, usually through a traditional loan, means your payments contribute towards building equity, culminating in full ownership once the loan is repaid. The difference boils down to paying for the car’s depreciation during your usage versus paying to build equity and eventually own the asset outright.

Ultimately, the choice between leasing and buying hinges on a careful assessment of your personal needs, driving habits, and financial priorities. There’s no one-size-fits-all answer, but by dissecting the key factors that influence this decision, you can empower yourself to make the smartest financial move for your unique situation. Let’s delve into the crucial elements that will guide you through this significant automotive crossroads.

1. **Mileage Habits: How Far Do You Drive?**One of the most critical factors to consider when weighing leasing against buying is your typical annual mileage. Leasing agreements are designed with specific mileage limits, often ranging from 12,000 to 15,000 miles per year. For a standard three-year lease, this translates to an allowance of anywhere from 30,000 to 45,000 miles over the term. Exceeding these predetermined limits can lead to substantial financial penalties at the end of your lease, with charges typically ranging from 12 to 50 cents per additional mile.

To illustrate the impact, consider if you were to go over your mileage limit by 2,000 miles, facing a 30-cent penalty per mile. This seemingly small oversight would result in an additional $600 owed when you return the vehicle. Joseph Yoon, Edmunds’ consumer insights analyst, highlights this, stating, “Sometimes it can be thousands of dollars you have to pay at the end of the lease.” While there are often options to purchase extra miles upfront or even during the lease term, for high-mileage drivers, buying a car almost invariably proves to be the more practical and cost-effective choice.

Yoon emphasizes that leasing is an excellent option “if you’re the type of person that typically drives less than 15,000 miles a year and you’re the type of person that’s kind of addicted to the new car smell.” Conversely, he advises against leasing for those who live in areas requiring extensive driving. “If you live in a semirural area, where the nearest grocery store is 50 miles away, then it’s not really practical for you to be leasing,” Yoon points out, underscoring that geographical location and daily routines play a significant role in making this determination.

Read more about: The Ultimate Automotive Showdown: Hybrid, Electric, and Gas Cars Face-Off on Costs, Range, and Practicality – Who Wins Your Drive?

2. **Vehicle Condition and Maintenance: Wear and Tear Considerations**The condition in which you return a leased vehicle is another crucial consideration that can have significant financial implications. When a lease ends, the car undergoes an inspection to determine if there is damage beyond what is considered “normal wear and tear” by the leasing company. This could include issues like significant upholstery damage, large dents, cracked windshields, or extremely worn tires. Should the inspector deem the damage excessive, you will be responsible for hefty repair fees.

While a financed car could also sustain similar damage, the key difference lies in control: as the owner, you decide what to repair, when, and at what cost. This flexibility is absent with a leased vehicle, where the leasing company sets the standards and charges. The good news for lessees is that newer leased vehicles often benefit from warranty protection that typically covers the first three years or 36,000 miles, potentially shielding you from unexpected major repair bills.

However, it’s important to remember that warranties don’t cover everything, and routine maintenance costs, such as oil changes and tire rotations, are still your responsibility. While some lease agreements might include certain maintenance coverages, making repairs on a newer leased car, especially one with premium parts, can still be costly. For a purchased car, while you are responsible for all maintenance and repairs, you gain the freedom to manage these costs as you see fit, without the oversight of a leasing company dictating what constitutes acceptable wear.

Read more about: Demystifying Engine Bay Cleanliness: An In-Depth Look at the Core Principles of a ‘Clean’ Engine

3. **Monthly Payment Comfort: What Can You Afford?**One of the most commonly cited advantages of leasing is the potential for lower monthly payments compared to financing a car purchase. Data from Experian’s State of the Automotive Finance Market report for the second quarter of 2025 illustrates this point clearly, showing an average lease payment for a new car at $612, significantly lower than the average monthly loan payment for a new car, which stands at $749.

This difference arises from how payments are calculated. When you lease, your monthly payment primarily covers the vehicle’s depreciation during the lease term, along with taxes and finance charges, rather than the car’s full purchase price. This makes a new, perhaps even more luxurious, vehicle more accessible on a month-to-month basis. Bankrate’s example further highlights this, calculating a new Toyota Camry lease at around $538 per month, while purchasing the same car with a loan would result in monthly payments of $861.

Despite the immediate appeal of lower monthly outlays, it’s crucial to consider the long-term financial picture. While leasing offers short-term savings, a strategy of perpetually leasing new cars means you’re continuously paying for the steep depreciation that vehicles experience, especially in their first few years. This cycle prevents you from ever building equity in a vehicle. Consequently, as the context states, if you are always leasing a newer car, “you can end up paying more than if you bought a car with a loan” over the years, as you never reach a point of ownership free from monthly payments.

4. **The Goal of Ownership: Equity vs. Perpetual Payments**The fundamental difference between leasing and buying lies in the concept of ownership and equity. When you buy a car with a loan, each monthly payment brings you closer to outright ownership. Your payments go towards building equity in the vehicle, and once the loan is fully repaid, the car is unequivocally yours. This means you can continue driving it without any further monthly payments, transforming a recurring expense into a paid-off asset.

Conversely, with a lease, you never truly own the vehicle. At the end of the lease term, you simply return the car to the dealership. This can lead to a feeling of “Did I just throw money away?”, as Joseph Yoon articulates. If you choose to continuously lease, you will perpetually face monthly payments, never achieving the financial freedom that comes with a paid-off vehicle. The distinction is clear: buying builds equity, offering the potential for future financial flexibility, while leasing provides temporary usage without an ownership stake.

Owning a vehicle can provide several advantages. It allows you to save money for other significant purchases, such as a home, or to use the vehicle’s value as a trade-in for your next car. Furthermore, in times of financial hardship, a owned car can be sold for extra cash, providing a crucial safety net. While it is possible to buy a leased car at the end of the term by paying its estimated residual value, this decision should be carefully evaluated, as it may not be financially advantageous if the car’s actual market value has fallen below that residual figure.

5. **Upfront Costs: Down Payments and Initial Fees**The initial financial outlay is another significant differentiator between leasing and buying a car. When financing an auto purchase, making a down payment is generally recommended. NerdWallet, for instance, suggests putting down 20% of a new car’s purchase price and 10% for used vehicles, if feasible. For a new car priced at $35,000, this would mean an initial payment of $7,000. While opting out of a down payment is possible, it typically leads to higher monthly payments and a greater total interest paid over the loan’s duration, and lenders may even require a down payment if a borrower has had credit challenges.

Leasing, on the other hand, often requires a lower initial cash commitment, or even no down payment at all, particularly for borrowers with good credit. This makes leasing an attractive option if you prefer not to tie up a large sum of money upfront. The ability to start a lease with $0 down while still enjoying lower monthly payments than a purchase is a commonly cited advantage. However, some auto experts advise against making a substantial down payment on a lease, as that money is unlikely to be recovered if the leased vehicle is stolen or totaled in an accident.

Beyond down payments, both options involve various fees. Lease agreements, however, often come with an array of additional costs at signing, including taxes, title fees, licensing fees, dealer documentation fees, and prep charges, along with potential acquisition or drive-off fees. These various charges can quickly accumulate to thousands of dollars, making it essential to scrutinize all initial costs associated with a lease to understand the true upfront financial commitment.

Read more about: Navigating a Total Loss: Your Comprehensive Consumer Guide to Car Accidents and Insurance Settlements

6. **Deals, Incentives, and Tax Credits: Maximizing Savings**When navigating the decision between leasing and buying, it’s wise to explore the range of deals and incentives offered by car dealers and manufacturers. Both purchasing and leasing can benefit from special promotions, such as cash rebates, low-rate financing, and attractive lease deals. Many auto manufacturer websites allow you to search for these offers in your local area by simply entering your zip code, providing a clear comparison of potential savings for each option.

However, caution is advised, especially with leasing specials that boast very low monthly payments. These attractive offers can sometimes be predicated on an inflated residual value for the car. While this might not pose an immediate problem if you intend to return the vehicle at the end of the lease, it could become an issue if you later decide to buy the car, as its actual market value might be less than the predetermined residual value.

A significant factor, particularly for environmentally conscious drivers, is the federal electric vehicle tax credit. This incentive, offering up to $7,500, applies to the purchase of certain new electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs). However, strict conditions apply to both the buyer and the vehicle, meaning many EVs may not qualify for purchasers. Interestingly, these restrictions typically don’t apply when leasing an EV. The transaction is treated as a commercial sale for the leasing company, allowing them to receive the tax credit, which is often then partially or fully passed on to the lessee. This unique aspect can make leasing an EV a financially savvy choice that might not be available if you were to buy the same model.

7. **The Lure of the New: Driving the Latest Models**For many drivers, the appeal of consistently driving a brand-new car, equipped with the latest design, cutting-edge technology, and advanced safety features, is a powerful draw. Leasing caters directly to this preference. With typical lease terms often set at 36 months, lessees frequently find themselves looking for a new vehicle much sooner than those who purchase. This rapid turnover means you’re almost always behind the wheel of a current model, benefiting from continuous innovations in comfort, technology, and driver aids that emerge each year.

Joseph Yoon notes that leasing is a great option for those “addicted to the new car smell,” and indeed, it allows access to vehicles that might otherwise be financially out of reach if purchased. Moreover, the constant cycle of new vehicles ensures that you are typically covered by the manufacturer’s warranty, which usually lasts for the first three years or 36,000 miles. This coverage significantly reduces the likelihood of encountering costly repair bills that often accompany older, higher-mileage vehicles, offering a ‘trouble-free driving’ experience.

However, this desire for perpetual newness comes with constraints. While leasing offers the perceived freedom to choose a new ride sooner, terminating a lease early can be prohibitively expensive, with fees potentially amounting to the total remaining payments on the lease. In contrast, car buyers have the flexibility to sell or trade in their vehicles at any time without incurring such penalties, using the proceeds to cover any outstanding loan balance or contribute towards their next purchase. Ultimately, if driving the newest model is a top priority, and your financial situation is stable, leasing provides an unparalleled pathway to this automotive refresh cycle.

Navigating the complexities of car acquisition extends beyond initial costs and immediate desires; it demands a thorough understanding of long-term financial implications and intricate contractual details. As we delve deeper into this crucial decision, we uncover additional layers of consideration that will ultimately solidify whether leasing or buying aligns best with your unique financial journey and lifestyle.

Read more about: Urgent Ford Recall: Over 355,000 F-Series Trucks Face Dashboard Blackout Risk – What Owners Need to Know Now

8. **Geographic Suitability: Urban vs. Rural Driving**The environment in which you typically drive plays a surprisingly significant role in determining the financial viability of leasing versus buying. Different geographical locations and daily routines can drastically alter the practicality of each option, particularly when mileage restrictions are factored into the equation. For example, if you reside in a densely populated metropolitan area, your driving habits might naturally align with the parameters of a lease.

Joseph Yoon, Edmunds’ consumer insights analyst, highlights that larger metropolitan areas tend to be more suitable for leasing. In such locales, regular destinations are often closer and more convenient, making it easier to stay within the typical 12,000 to 15,000 miles per year limit imposed by most lease agreements. This enables drivers in urban settings to enjoy the benefits of leasing, such as lower monthly payments and access to newer vehicles, without the constant worry of incurring mileage penalties.

Conversely, a semi-rural or rural lifestyle can quickly negate the advantages of leasing. Yoon directly addresses this, stating, “If you live in a semirural area, where the nearest grocery store is 50 miles away, then it’s not really practical for you to be leasing.” The frequent long drives inherent to such areas would almost certainly push you beyond mileage limits, leading to substantial financial penalties at the end of the lease. For these drivers, the unrestricted mileage of an owned vehicle makes buying a far more sensible and cost-effective choice.

Considering your typical driving radius and the necessity of long-distance trips is therefore paramount. A mismatch between your driving habits and a lease agreement’s mileage limits can turn an otherwise attractive option into a costly regret, underscoring the importance of assessing your everyday commute and weekend adventures when making this pivotal decision.

9. **Flexibility and Customization: Your Car, Your Rules?**For many car enthusiasts and practical drivers alike, the ability to personalize their vehicle or use it without strict limitations is a significant factor. This aspect of control, or lack thereof, stands as a stark contrast between buying and leasing, impacting everything from aesthetic modifications to how you use the car on a daily basis.

When you buy a car, it becomes your property, granting you the ultimate freedom to do as you please. As the context clearly states, if you’re buying, “you can do whatever you want with the car, including modifying it, something you can’t do with a lease.” This means you have the liberty to customize your vehicle to your heart’s content, whether it’s adding aftermarket parts, upgrading the sound system, or even changing the paint job to suit your personal style, without needing permission or worrying about penalties.

Leasing, on the other hand, operates under a different set of rules. Since you don’t own the vehicle, modifying it is generally prohibited. The expectation is that you return the car in nearly the same condition it was in when new, meaning significant alterations are a definite no-go. While there might be a couple of exceptions, such as professional window tinting that can be removed without damage, any permanent changes could lead to hefty charges for “excess wear and tear” at the end of the lease term.

This distinction extends beyond mere aesthetics; it touches upon the overall stress of maintenance. Owners don’t face penalties for everyday dents, dings, or interior stains, while lessees must meticulously care for the vehicle to avoid charges from the dealership. If the thought of constant vigilance over your car’s pristine condition, or the desire to make it truly your own, is important to you, buying offers an undeniable advantage in terms of unbridled flexibility and control.

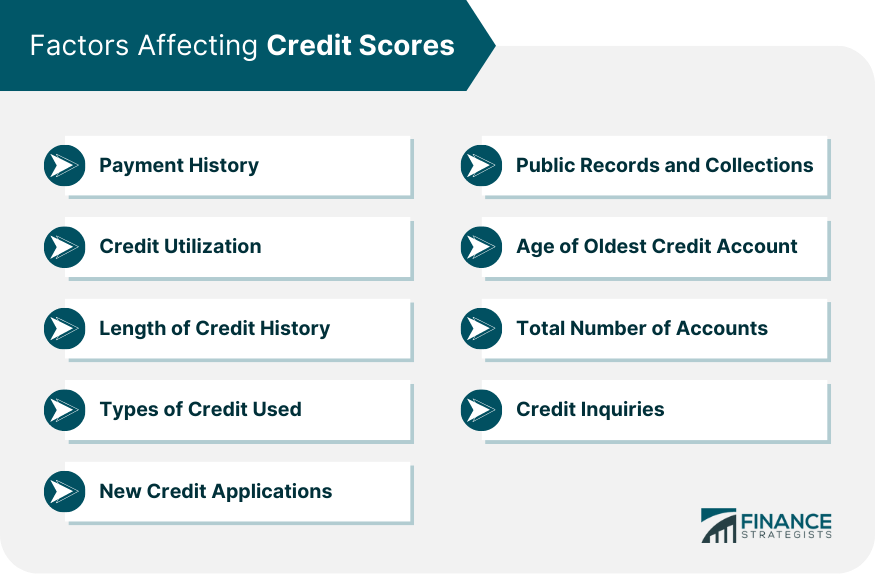

10. **Credit Score’s Crucial Role: Impact on Payments**Your creditworthiness is a foundational element that significantly influences the terms and overall cost of both car loans and leases. Lenders and leasing companies assess your credit score to gauge your financial reliability, and this assessment directly translates into the rates and payments you’ll be offered. A strong credit score can unlock more favorable terms, while a lower score can lead to higher costs or even impact your eligibility for certain options.

Your creditworthiness is a foundational element that significantly influences the terms and overall cost of both car loans and leases. Lenders and leasing companies assess your credit score to gauge your financial reliability, and this assessment directly translates into the rates and payments you’ll be offered. A strong credit score can unlock more favorable terms, while a lower score can lead to higher costs or even impact your eligibility for certain options.

According to Experian’s State of the Auto Finance Market report for the second quarter of 2025, there’s a clear correlation between credit scores and average monthly payments. For super-prime borrowers, those with scores between 781 and 850, the average lease payment was $616. In contrast, subprime borrowers, with scores ranging from 501 to 600, faced a slightly higher average lease payment of $620. This relatively small difference in lease payments across credit tiers is often noted as a characteristic of leasing that can make it accessible to a wider range of borrowers.

The impact is more pronounced when it comes to auto loans. The same report shows that super-prime borrowers paid an average of $728 per month for new car loans, while subprime borrowers saw that figure rise to $777. For used auto loans, super-prime borrowers paid $525, compared to $547 for subprime borrowers. These differences underscore how a higher credit score can translate into tangible savings over the life of a loan, significantly reducing your total cost of ownership.

It’s important to recognize that the vast majority of financing — 84.89 percent of loans and leases — is extended to borrowers with credit scores of 600 or higher. This emphasizes that while options exist for those with lower scores, improving your credit can directly lead to better rates and more affordable monthly payments, empowering you to make the most financially advantageous decision for your car acquisition, regardless of whether you choose to lease or buy.

11. **Long-Term Repair Costs: Beyond the Warranty Shield**While modern vehicles are generally more reliable than those of past generations, the specter of costly repairs remains a significant long-term financial consideration, particularly for car buyers. The initial years of vehicle ownership or a lease term typically offer a buffer against these expenses, but the situation shifts dramatically as a car ages.

One of the often-cited benefits of leasing a new car is the “trouble-free driving” experience it provides. Since leases often last only a couple of years, lessees are typically in a relatively new vehicle that is still covered by the manufacturer’s warranty. This protection, which usually extends for the first three years or 36,000 miles, shields drivers from the financial burden of unexpected major repairs. As a result, lessees generally avoid the inconveniences and costs associated with breakdowns that frequently plague older, higher-mileage cars.

However, for those who choose to buy and keep their vehicle for many years, the financial landscape changes considerably once the warranty expires. Although routine maintenance like oil changes and tire rotations are always the owner’s responsibility, major repair bills become a distinct possibility for an older car with more miles. The context points out that while cars are more reliable, “the cost of repairs has skyrocketed so an older car with more miles may come with some costly repair bills you wouldn’t encounter with a lease.”

Joseph Yoon underscores this point, indicating that for car buyers, even after the loan is paid off and you’re free from a monthly car note, “an older car with more miles may come with some costly repair bills you wouldn’t encounter with a lease.” Therefore, if your plan is to drive a vehicle until its wheels fall off, you must factor in a budget for these eventual repair costs, a financial commitment lessees typically bypass. This consideration highlights a crucial long-term financial difference between the two options.

Read more about: Consumer Alert: 12 Common Mechanic Rip-Offs You Need to Know to Ensure Honest Auto Service

12. **The Enduring Weight of Depreciation on Ownership**Depreciation is an unavoidable reality of car ownership, yet its financial impact is experienced differently depending on whether you lease or buy. While both options involve paying for depreciation, the long-term consequences, especially for buyers, can significantly affect overall financial outcomes and future flexibility. Understanding how this loss of value plays out over time is vital for an informed decision.

When you lease a car, your monthly payment is calculated primarily to cover the vehicle’s depreciation during the lease term, along with taxes and finance charges. You are essentially paying for the portion of the car’s value that it loses while you are driving it. At the end of the lease, you return the vehicle, and the depreciation burden, in terms of resale value, shifts back to the leasing company. This means you don’t directly bear the risk of market fluctuations that might cause the car to depreciate more than initially estimated.

However, for car buyers, depreciation eats directly into the value of their asset. A car is considered a depreciating asset, and this loss of value can be substantial, particularly in the early years. The context notes that “a car can lose as much as 20% of its value after just one year of ownership due to depreciation,” and about half of its value within the first five years. This means that if you need to sell or trade in your car relatively soon after purchase, you might find its market value significantly lower than your outstanding loan balance, potentially leaving you “upside-down” on your loan.

While building equity in a purchased car is a key benefit, the reality of depreciation means that this equity might grow slower than anticipated, especially if the car loses value rapidly. This limits your return on investment and can reduce the amount of trade-in value you can apply to a future purchase. Ultimately, while lessees pay for depreciation as a usage fee, buyers own the asset and therefore absorb the full, long-term financial impact of its declining value, making strategic timing for selling or trading in crucial.

Read more about: Minivans That Ace Safety and Family Life: Your Top Choices and What to Avoid

13. **Navigating Lease Terminology: Key Concepts You Need to Know**Stepping into the world of car leasing introduces a unique vocabulary, and understanding these specific terms is crucial for deciphering your lease agreement and ensuring you’re making a financially sound decision. Without this knowledge, the contract can seem opaque, and you might inadvertently agree to terms that aren’t in your best interest.

One of the primary terms you’ll encounter is “Capitalized cost,” often referred to simply as “cap cost.” This represents the vehicle’s agreed-upon value at the very beginning of the lease. Essentially, it’s the starting price of the car from which depreciation will be calculated. Any negotiations you make on the car’s purchase price effectively lower the capitalized cost, which in turn can lead to lower monthly payments.

Another critical concept is “Residual Value.” This term refers to the vehicle’s estimated value at the end of the lease term. Leasing companies project this figure, and cars with slower depreciation rates tend to have higher residual values, which directly results in lower monthly payments for the lessee. It’s the difference between the capitalized cost and the residual value that largely determines the amount you’ll pay for the car’s usage over the lease period.

Leasing companies do not use a traditional interest rate in their contracts. Instead, they employ a number called the “money factor.” To easily translate this into an interest rate you can understand, simply multiply the money factor by 2,400. For instance, a money factor of 0.0033 translates to an interest rate of 7.92%. Finally, be aware of the “Acquisition fee,” a charge by leasing companies to facilitate the lease arrangement, which can typically range from $500 to $1,000 or more, often increasing with the expense of the vehicle. These terms, along with taxes, title, and licensing fees, comprise the total financial picture of a lease agreement.

14. **Understanding Auto Loan Terminology: Principal, Interest, and Term**Just as leasing has its own specialized language, so too does financing a car purchase with an auto loan. Grasping these fundamental terms is essential for comprehending how your payments are structured, how much you’ll pay over time, and ultimately, when you’ll achieve full ownership of your vehicle. This transparency empowers you to compare loan offers effectively.

When you buy a car through financing, your monthly payments are typically composed of two main components: “principal” and “interest.” The principal is the original amount of money you borrowed to purchase the vehicle. Each payment you make reduces this principal balance, bringing you closer to outright ownership. The interest, on the other hand, is the charge levied by the lender for the privilege of borrowing their money. This is usually expressed as an Annual Percentage Rate (APR) and significantly impacts the total cost of your loan.

The “term” of an auto loan refers to its length, or the period over which you agree to repay the loan. Loan terms can vary widely, from as short as a couple of years to as long as seven or eight years. While longer terms might offer lower monthly payments, they often result in paying significantly more in total interest over the life of the loan. Experts generally advise buyers to avoid car loans that exceed five years, as longer terms can expose you to higher interest costs and potential “upside-down” scenarios where you owe more than the car is worth.

It’s worth noting the trend towards extended loan terms, with Edmunds reporting that “84-month loans hit an all-time high in Q1 2025, making up 19.8% of new-vehicle financing.” While this can make expensive cars more accessible on a monthly basis, it’s a decision that requires careful consideration of the long-term financial implications. Understanding these core terms allows you to dissect any loan offer and ensure it aligns with your financial capacity and long-term goals for vehicle ownership.

**Charting Your Course: The Road Ahead**

Read more about: Decoding Car Dealer Pricing: An In-Depth Guide for Consumers to Navigate Buying and Selling

Ultimately, the journey to a new vehicle, whether through leasing or buying, is a significant financial undertaking that demands careful navigation. It’s clear there’s no single right answer; instead, the smartest move for your finances is deeply personal, shaped by your individual driving habits, financial stability, and long-term aspirations. You’ve now explored the immediate practicalities, delved into the intricacies of depreciation and repair costs, and demystified the specialized language of both options. You’ve considered how geographic location impacts practicality, and the undeniable influence of your credit score on your bottom line. Armed with these comprehensive insights, you are no longer just a driver seeking a car, but a financially savvy consumer ready to make an empowered decision. By meticulously balancing your desire for the latest automotive innovations against the enduring benefits of ownership, you can confidently steer your finances toward the option that truly puts you in the driver’s seat of your financial future. This isn’t just about choosing a car; it’s about choosing the right financial path for your life on the open road.