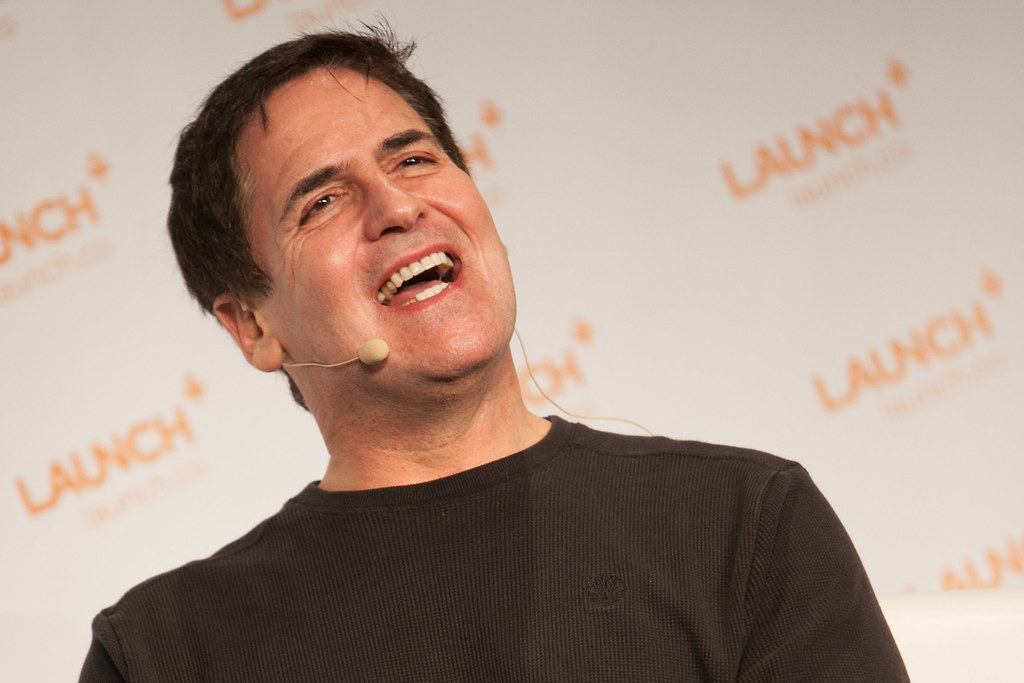

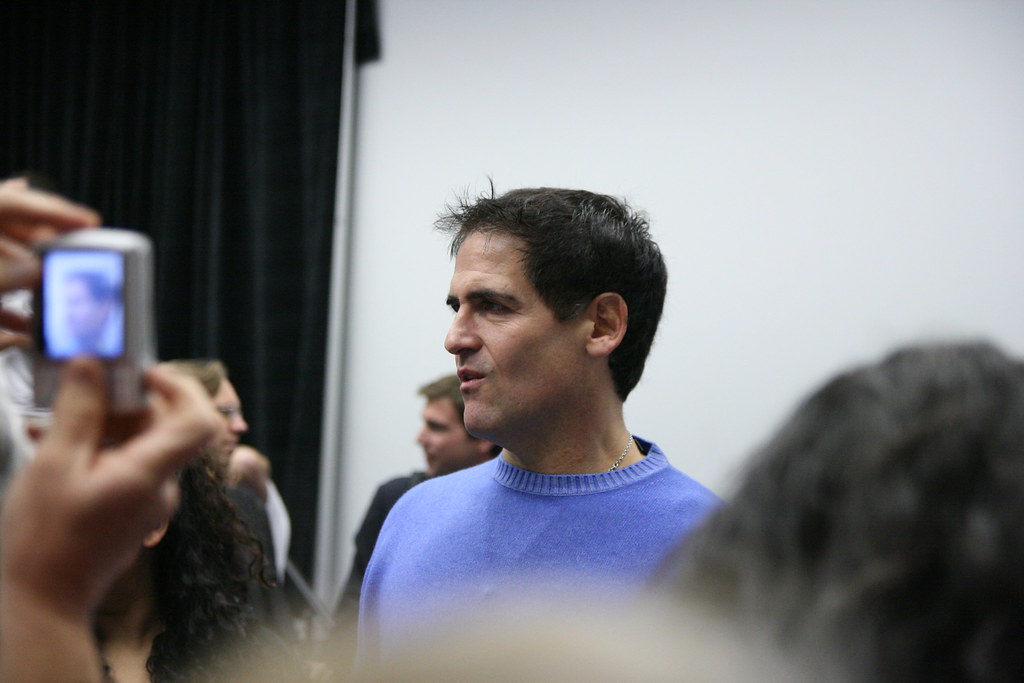

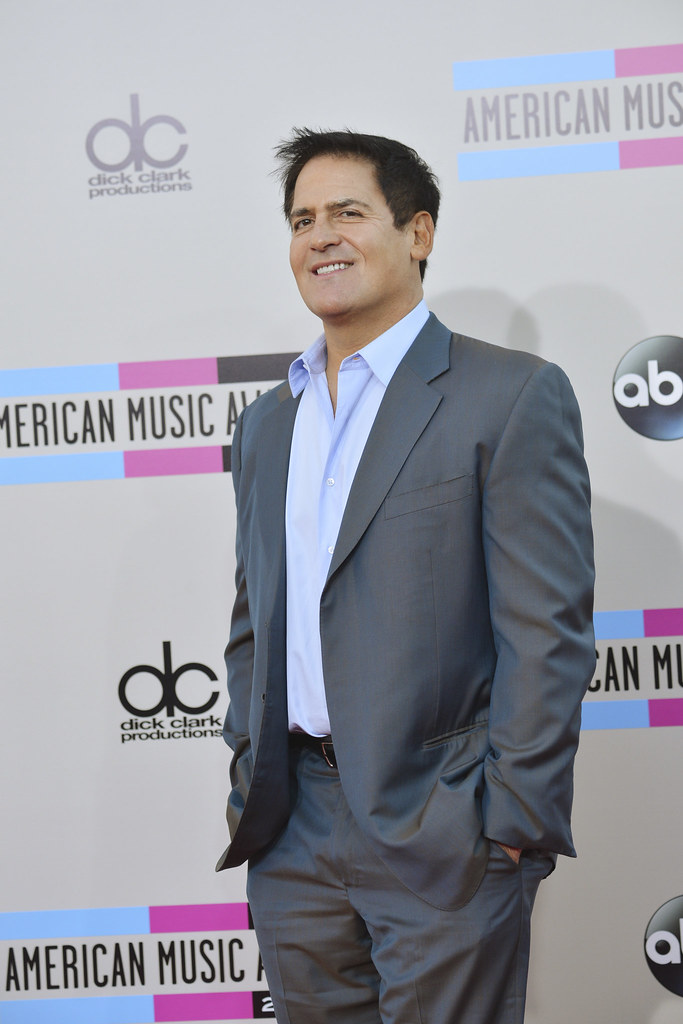

In an economic landscape saturated with fleeting trends and often misguided advice, the voice of a seasoned entrepreneur like Mark Cuban cuts through the noise with refreshing clarity. His insights, particularly for those who come into sudden wealth, challenge conventional wisdom and pinpoint common pitfalls that can quickly deplete fortunes. Cuban’s blunt warnings about certain “money pits” offer a crucial roadmap for anyone serious about building and preserving wealth, urging a strategic pivot towards more resilient and less glamorous investment avenues.

Indeed, the allure of flashy ventures can be incredibly powerful, especially for celebrities and athletes looking to parlay their fame into sustainable fortune. However, Cuban, with his extensive experience, has observed a recurring pattern of mismanaged earnings. His counsel serves as a powerful reminder that true financial success often lies not in chasing the limelight, but in understanding foundational economic principles like barriers to entry and the enduring value of professional guidance.

This in-depth exploration will dissect Mark Cuban’s astute observations and the actionable investment advice gleaned from his perspective and that of other financial experts. We’ll delve into his warnings against seductive, low-barrier businesses, the imperative of professional financial management, and then pivot to the often-overlooked yet profoundly profitable realms of “boring” industries and diversified real estate, revealing how these strategies can lay the groundwork for steady, inflation-hedged growth in any economic climate.

1. **Mark Cuban’s Warning: The ‘Death Trap’ of Flashy Ventures**Mark Cuban issues a stark warning against investing in what he calls “flashy ventures” — businesses like restaurants, clothing labels, liquor companies, or music. His experience has shown that these industries, while glamorous on the surface, often become significant money pits for investors, particularly for those with newfound wealth seeking to expand their influence or personal brand. Cuban minces no words, stating unequivocally: “Don’t invest in the restaurant, don’t invest in the clothing label, don’t invest in the liquor company … or music. That is the death!”

The core of Cuban’s caution lies in the concept of “barriers to entry.” These are factors, such as regulations, licensing requirements, advanced technology, or proprietary patents, that make it difficult for new competitors to enter a market. Industries with high barriers to entry typically protect existing businesses from excessive competition, allowing them to maintain pricing power and higher profitability. Conversely, the flashy ventures Cuban warns against — clothing, restaurants, liquor — are characterized by extremely low barriers to entry.

Launching a clothing line or opening a restaurant, for example, typically requires minimal investment or specialized expertise compared to, say, developing a complex software platform or establishing a utility company. This ease of entry means that anyone can jump in, leading to a flood of competition. The unfortunate consequence of such high competition is a race to the bottom in pricing, severely eroding profit margins and making it incredibly challenging for businesses to thrive. Indeed reports that the average profit margin for a full-service restaurant hovers at a mere 3% to 5%.

For investors, this translates into a high risk of capital loss and an uphill battle for any significant return on investment. The excitement and public appeal of these industries can mask their underlying financial fragility. Cuban’s advice serves as a critical reminder that a business’s perceived coolness or public visibility does not equate to sound investment potential; instead, investors and entrepreneurs should diligently scrutinize the competitive landscape and look for ventures protected by meaningful barriers to entry, backing only products that are truly exceptional and defensible.

2. **The Wisdom of Professional Investment Management**Beyond steering clear of specific types of businesses, Mark Cuban offers crucial guidance on the fundamental approach to managing significant wealth: hire a professional. His advice is unequivocal: “It cannot be your friend,” he asserts. “It’s got to be somebody who’s done it for big time people.” This distinction highlights the critical need for unbiased, expert-driven financial management, especially for those who suddenly come into substantial funds.

The rationale behind this advice is multifaceted. Friends, while well-intentioned, often lack the requisite experience, professional detachment, and fiduciary responsibility to manage complex investment portfolios. Personal relationships can cloud judgment, lead to conflicts of interest, or simply result in suboptimal decisions due to a lack of specialized knowledge. Managing wealth on a grand scale demands a level of expertise that typically comes from years of experience with high-net-worth individuals and a deep understanding of market dynamics, risk management, and long-term financial planning.

A professional advisor who has managed finances for “big time people” brings a proven track record, sophisticated strategies, and an objective perspective that is invaluable. These advisors are not swayed by personal sentiment or the emotional aspects of money; their focus remains solely on optimizing returns and safeguarding assets within a client’s specific financial goals and risk tolerance. Such professionals are equipped to navigate intricate tax implications, diversify across various asset classes, and identify opportunities that might be invisible to an untrained eye.

Platforms like Vanguard, for instance, exemplify the kind of professional guidance Cuban advocates. Their hybrid advisory system combines the personalized insights of professional advisors with automated portfolio management, ensuring investments are aligned with financial goals. As fiduciaries, Vanguard’s advisors operate without commissions, ensuring that their advice is solely in the client’s best interest. This unbiased, expert-driven approach to wealth management is a cornerstone of prudent financial stewardship, offering a tailored plan and consistent management that allows investors to achieve their objectives with confidence.

Read more about: The Unseen Architects of Excellence: Unveiling the Enduring Impact of ISO 9000 on Global Quality and Innovation

3. **Embracing the Unsung Heroes: “Boring” Businesses**In stark contrast to the flashy ventures Mark Cuban cautions against, lies the world of “boring” businesses — unglamorous industries that, despite their lack of broad appeal, often possess significant investment potential. This strategy aligns perfectly with the approach of legendary investor Warren Buffett, who has built an enormous fortune by consistently betting on such overlooked enterprises. These industries, by their very nature, can act as powerful barriers to entry, precisely because they fail to capture the imagination of the masses.

Few individuals dream of establishing waste disposal firms, pest control services, or utility companies. This inherent lack of “bragging rights” discourages widespread competition, allowing existing players to operate with stability and healthy margins. Cuban would likely concur that for those willing to forgo the spotlight, these seemingly mundane industries can be profoundly lucrative. Their essential nature often ensures steady demand, regardless of economic cycles, making them resilient pillars in any investment portfolio.

Warren Buffett’s current portfolio, as of Q3 2024, vividly illustrates this principle. It includes stalwarts like Chubb Limited, a major insurance company, and DaVita, a provider of kidney treatment services. These are not industries that generate headlines for their innovation or trendiness, but they offer indispensable services with consistent demand. Buffett’s success underscores a knack for identifying undervalued, overlooked opportunities where long-term profitability thrives due to the foundational necessity and often regulated nature of the services provided.

The enduring appeal of “boring” businesses lies in their predictable cash flows, often stable customer bases, and relative insulation from volatile market fads. These characteristics combine to create a compelling proposition for investors seeking consistent returns and a hedge against the speculative fluctuations common in more exciting, but ultimately riskier, sectors. The real value, as Cuban and Buffett teach, is often found not where everyone is looking, but in the quiet, essential corners of the economy.

4. **Strategic Insight from Research Platforms: Moby’s Edge**Navigating the landscape of “boring” but profitable industries, while appealing, can still present a challenge in terms of identifying specific opportunities. This is where specialized investment research platforms become invaluable tools for savvy investors. Moby, an investment research platform led by former hedge fund analysts, stands out as a prime example, providing expert guidance for those looking to tap into these undervalued sectors.

Moby is designed to demystify complex market data, breaking it down into simple, actionable insights. Their expert stock reports are backed by hundreds of hours of meticulous research, allowing investors to gain a deep understanding of potential investments without having to conduct extensive due diligence themselves. This level of comprehensive analysis is crucial when evaluating industries that may not receive as much mainstream media attention but hold significant promise.

What truly distinguishes Moby is its proven track record. Its stock picks have reportedly outperformed the S&P 500 by nearly 12% over the past four years, offering a rare edge to investors seeking to uncover opportunities in sectors that are often overlooked by the broader market. This performance metric underscores the platform’s ability to identify robust companies within these unglamorous yet highly profitable niches.

The context provides examples of industries where Moby can help investors thrive, citing logistics, utilities, energy, and enterprise software. These sectors are characterized by low competition and steady demand, making them ideal candidates for the “boring but profitable” investment thesis. By leveraging Moby’s insights, investors can confidently tap into opportunities where profitability is not just possible, but often a consistent reality, without needing to become industry-specific experts themselves. Furthermore, premium subscribers benefit from a 30-day money-back guarantee, underscoring Moby’s commitment to delivering value and making it a solid tool for making smarter, data-driven investment decisions.

5. **Real Estate: A Bedrock for Steady Income and Growth**While “boring” businesses offer one path to steady returns, real estate presents an equally compelling alternative for investors seeking long-term income generation and inflation-resistant growth. Its tangible nature and historical resilience make it a cornerstone of diversified portfolios, proving its worth through various economic cycles and periods of volatility. Unlike the ephemeral nature of some market trends, real estate remains a fundamental asset class with enduring value.

Real estate’s stability stems from its dual potential for both passive income and capital appreciation. Through residential properties, commercial developments, or highly specialized niches, property ownership can generate consistent rental income. Simultaneously, over the long term, real estate values tend to appreciate, providing a powerful hedge against inflation. This combination makes it particularly attractive for those looking to build wealth that can withstand economic fluctuations and grow steadily over time.

The appeal of real estate is universal, transcending the ultra-rich to become an accessible investment for many. Its foundational role in economies worldwide ensures a constant demand for space, whether for living, working, or commerce. This intrinsic demand, coupled with the finite nature of land, contributes to its long-term stability and growth potential, making it a reliable component of any robust investment strategy aimed at achieving financial independence.

Moreover, the evolution of investment platforms has significantly lowered the barriers to entry for real estate. What was once the exclusive domain of institutional investors or those with substantial capital is now increasingly accessible, allowing a broader spectrum of investors to participate in this resilient asset class. This democratization of real estate investment opportunities means that more individuals can benefit from its proven ability to generate income and grow wealth, making it an indispensable element in a strategy focused on steady, inflation-hedged gains.

6. **Accredited Access: Grocery-Anchored Retail with FNRP**Within the broad and resilient asset class of real estate, specialized niches offer particularly attractive opportunities for accredited investors. First National Realty Partners (FNRP) exemplifies this by focusing on grocery-anchored retail properties, a sector renowned for its resilience, even during periods of significant economic volatility. This specialization is a strategic move, capitalizing on the non-discretionary nature of essential goods and services.

Grocery-anchored retail centers house supermarkets like Kroger, Walmart, and Whole Foods – businesses that provide daily necessities. Regardless of economic downturns or shifts in consumer spending habits, people consistently need food and essential household items. This consistent demand translates into reliable foot traffic and, crucially, steady rental income for property owners. Such stability makes these properties a highly desirable asset for investors seeking dependable passive income and growth that is hedged against inflation.

FNRP provides accredited investors with expert guidance and a comprehensive management solution. From the initial due diligence to leasing, property management, and strategic efforts to enhance property value, FNRP handles every aspect of the investment process. This hands-off approach allows investors to gain exposure to a robust real estate sector without the operational burdens typically associated with direct property ownership. The personalized investor portal further streamlines the experience, providing transparent access to performance metrics and investment details.

By leasing to essential-needs brands, FNRP creates opportunities for consistent passive income streams and inflation-hedged growth. This focus on recession-resistant tenants ensures a higher degree of stability for the investment, making it a compelling option for those looking to secure their capital within a proven segment of the commercial real estate market. The strategy aligns with Cuban’s emphasis on finding durable businesses with inherent demand, translated into a tangible asset like real estate.

7. **Democratizing Home Equity: Homeshares for Accredited Investors**The vast and often exclusive $36 trillion U.S. home equity market has historically been the playground of institutional investors, largely inaccessible to individual accredited investors. However, new investing platforms are now making it possible to tap into this significant asset class, offering a unique avenue for diversification and steady returns. Homeshares stands out as one such platform, democratizing access to this traditionally elite investment opportunity.

Homeshares allows accredited investors to gain direct exposure to hundreds of owner-occupied homes across top U.S. cities. With a minimum investment of $25,000, investors can participate in the U.S. Home Equity Fund, effectively becoming part of a diversified portfolio of residential properties without the typical headaches of direct ownership. This means no property management, no tenant issues, and no maintenance responsibilities—a truly hands-off investment approach.

The appeal of investing in owner-occupied home equity lies in its inherent stability and growth potential. Residential real estate has consistently proven to be a resilient asset, and tapping into home equity allows investors to benefit from the appreciation of these properties across regional markets. This approach differs from traditional rental properties by focusing on the underlying equity value, reducing exposure to tenancy-related risks while still benefiting from housing market trends.

Homeshares touts impressive risk-adjusted internal returns ranging from 12% to 18%, presenting an effective and attractive means for accredited investors to participate in a historically robust market segment. This innovative method provides a crucial pathway for individuals to diversify their portfolios with a unique real estate asset, aligning with the principle of finding sound, often overlooked, opportunities for wealth creation that offer consistent returns and financial security.

8. **Accessible Real Estate for Every Investor: Arrived**While accredited investors access specialized real estate, property investment isn’t exclusive. Mark Cuban’s philosophy of accessible opportunities extends to innovative platforms democratizing real estate. These ensure individuals with modest capital can participate, aligning with diversified, inflation-hedged growth for a wider audience.

Arrived exemplifies this democratization, lowering traditional barriers to real estate. With a minimum investment of just $100, it makes market entry feasible for many. Arrived offers shares of SEC-qualified investments in curated rental homes and vacation rentals, each vetted for appreciation and consistent income, providing crucial due diligence.

The platform simplifies the entire investment journey, making it a hands-off experience. Backed by world-class investors like Jeff Bezos, Arrived provides a streamlined process, allowing integration into portfolios without direct ownership complexities. This user-friendly approach empowers both accredited and non-accredited investors to leverage real estate as an inflation-hedging asset, building wealth seamlessly without operational burdens.

9. **Diversifying with Alternative Assets: The Art Market through Masterworks**As investors seek robust avenues beyond conventional assets, alternative investments offer powerful diversification. Fine art, in particular, aligns with Mark Cuban’s advocacy for unique risk-return profiles. Historically, art has shown resilience during downturns and potential for strong returns, positioning it as an attractive, low-volatility option for astute investors.

Masterworks is democratizing this once-exclusive domain, making blue-chip art investments accessible. By fractionalizing ownership of iconic pieces from artists like Basquiat, the platform breaks financial barriers to high-value artworks. This model transforms museum-quality art into manageable investment opportunities, allowing individuals to own a share of culturally significant assets.

The platform’s strategy is bolstered by a compelling track record. Masterworks notes every one of its 23 art sales has yielded profits, a testament to its meticulous selection. This consistent performance underscores art’s capability as a wealth generator and reliable hedge against market volatility. Masterworks handles all aspects, from acquisition to sale, making art investing truly hands-off.

10. **The Timeless Hedge: Gold and the Gold IRA with Thor Metals**For centuries, gold has served as a steadfast store of value, proving its mettle during economic uncertainties. In line with Mark Cuban’s emphasis on foundational investments, gold remains a critical component of diversified portfolios, acting as a tangible hedge against inflation and a crucial stabilizer for turbulent markets. Its enduring appeal stems from inherent scarcity and universal recognition.

Modern investment strategies offer sophisticated ways to integrate gold beyond bullion ownership. A Gold IRA, for instance, provides investors a unique opportunity to directly hold physical precious metals within a retirement account. This approach diversifies holdings away from exclusive reliance on stocks and bonds, mitigating risks through tangible assets.

The strategic advantage of a Gold IRA, especially with Thor Metals, lies in its dual benefit structure. It merges gold’s protective qualities—as an inflation hedge and market stabilizer—with the tax advantages of traditional IRAs. This powerful combination makes it attractive for those seeking to shield and grow retirement funds against future economic uncertainties, preserving purchasing power.

11. **Mastering Personal Finance: Mark Cuban’s Call to “Live Like a Student”**Beyond investment vehicles, Mark Cuban’s wisdom extends to foundational personal finance principles critical for long-term wealth. One impactful piece of advice, especially for young professionals, is to “live like a student.” As Brandon Galici emphasizes, this is not about deprivation but a disciplined approach to spending and saving, establishing an unshakeable financial bedrock early in one’s career.

The trap of lifestyle creep—expenses expanding with income—is precisely what Cuban’s advice prevents. Galici highlights intentional purchasing decisions as paramount. This deliberate strategy helps individuals avoid increasing expenses proportionally with income, creating a vital margin for consistent saving and strategic investment, allowing financial resources to compound effectively.

Fundamentally, living like a student means consistently spending less than you earn. This habit is a primary engine for wealth creation, helping to circumvent high-interest credit card debt. By maintaining a surplus, individuals safeguard earnings and liberate valuable capital. This freed-up money can then be allocated towards investments, accelerating their path to financial independence.

12. **The Power of Preparedness: Saving Six Months’ Worth of Income**Mark Cuban’s financial tenets prioritize robust resilience, a cornerstone of which is his emphatic recommendation: save six months’ worth of income. Brandon Galici stresses this guidance transcends mere emergency preparedness; it cultivates financial flexibility and strategically positions one to seize future opportunities.

Such a significant cash cushion provides immediate, tangible protection against unforeseen financial shocks. It prevents reliance on high-interest credit cards or premature liquidation of long-term investments for unexpected expenses. This proactive measure ensures wealth-building plans remain intact, providing crucial stability amidst economic turbulence or personal setbacks.

Beyond protection, this buffer confers invaluable financial freedom. It offers a critical runway to pursue new opportunities—whether bridging a career transition, launching a side business, or investing in personal development without immediate income pressure. This liberty empowers individuals to make choices aligned with long-term aspirations. High-yield savings accounts ensure this emergency fund also actively contributes to wealth growth.

13. **Prioritizing Financial Health: Eliminating Personal Debt**Among Mark Cuban’s observations, his unequivocal emphasis on eliminating personal debt, especially high-interest liabilities, before significant investment, stands as a critical principle for sustainable wealth. Justin Godur affirms this direct counsel: “The best investment you can make is paying off your credit cards.” This advice is a strategic imperative that can significantly outperform many traditional market investments.

Cuban’s rationale is compelling: “Paying off a 19% credit card is a heck of a lot better than trying to make 19% in the stock market.” This highlights the immediate, guaranteed return from eradicating high-interest debt. Unlike volatile market investments, eliminating high-interest debt offers a risk-free “return” equivalent to that interest rate—often substantially higher than average market activities can reliably deliver.

Godur strongly advocates this strategy as it solidifies an individual’s financial foundation. By systematically reducing high-interest obligations, future income consumed by interest payments is freed up. This liberated capital can then be strategically reallocated towards productive, diversified investments, significantly accelerating wealth accumulation and forging a clearer path to financial independence.

14. **The Long-Term Play: Investing in S&P 500 Funds**For enduring wealth, Mark Cuban, echoing many experts, champions low-cost, diversified portfolios. Central to this is investing in S&P 500 index funds, a potent vehicle for long-term growth. Brandon Galici stresses these funds offer a straightforward way to participate in the broader market’s expansion without active management complexities or high fees.

S&P 500 index funds mirror the performance of the 500 largest U.S. publicly traded companies, providing broad market exposure at minimal cost. This inherent diversification across industries significantly reduces idiosyncratic risks of individual stock picking. It’s a pragmatic strategy aligned with not trying to “beat the market,” but consistently benefiting from the market’s robust, overall growth.

This approach has proven effective for countless investors over extended periods. Investing in the S&P 500 means acquiring a diversified stake in the American economy, a powerful engine of wealth creation. The passive nature of index fund investing translates to lower expense ratios, ensuring more capital remains invested and compounds, further enhancing long-term returns and accelerating wealth accumulation.

15. **Strategic Risk-Taking: Allocating up to 10% to High-Risk Investments**Even with emphasis on stable growth, Mark Cuban’s investment philosophy acknowledges the strategic role of calculated risk within a diversified portfolio. He advocates a balanced approach, recommending allocating up to 10% or less of a portfolio to high-risk investments. Brandon Galici commends this nuanced perspective, recognizing that while high-risk ventures offer potential for significantly higher returns, they are coupled with substantial losses.

Even with emphasis on stable growth, Mark Cuban’s investment philosophy acknowledges the strategic role of calculated risk within a diversified portfolio. He advocates a balanced approach, recommending allocating up to 10% or less of a portfolio to high-risk investments. Brandon Galici commends this nuanced perspective, recognizing that while high-risk ventures offer potential for significantly higher returns, they are coupled with substantial losses.

Limiting this allocation is paramount. Capping high-risk investments at 10% effectively manages exposure to potential downside, preventing speculative bets from jeopardizing overall financial security. This disciplined approach allows participation in innovative or rapidly growing sectors without placing the core, more conservative portfolio at undue risk, striking a crucial balance between ambition and prudence.

However, venturing into any high-risk investment necessitates an honest understanding of one’s personal risk tolerance. What is acceptable volatility for one investor may cause anxiety for another. It is crucial for individuals to assess their comfort level with potential losses before committing capital, ensuring decisions align with both financial capacity and psychological temperament.

**The Enduring Principles of Wealth Creation**

Mark Cuban’s comprehensive insights, powerfully reinforced by leading financial advisors, converge on a singular truth: sustainable wealth accumulation is less about chasing ephemeral fads and more about cultivating a disciplined, long-term financial mindset. His warnings against seductive “money pits” and advocacy for “boring” yet profitable businesses, coupled with diversified real estate and carefully selected alternative assets, offer a robust investment framework. Moreover, his essential personal finance wisdom—from living below your means and building emergency savings to aggressively eliminating high-interest debt and embracing broad market index funds—lays an unshakeable groundwork for achieving enduring financial independence. As Justin Godur eloquently summarizes, this philosophy forms the bedrock of prudent and strategic financial planning, empowering investors to navigate complex economic landscapes with unwavering confidence, consistently prioritizing long-term security over the fleeting allure of short-term gains, and ultimately, forging a legacy of true financial strength and lasting prosperity.