For more than eight decades, Social Security has served as a cornerstone of financial stability for millions of retired workers across the United States. While the monthly benefit provided by this vital program may not lead to lavish wealth, it consistently proves to be a fundamental necessity for a vast majority of retirees, forming a crucial component of their income streams. Understanding its mechanisms and how to maximize one’s entitlement is paramount for securing a stable financial future.

Indeed, the reliance on Social Security benefits is not merely anecdotal; it is substantiated by comprehensive data. For each of the last 23 years, Gallup has conducted extensive surveys revealing that between 80% and 90% of retirees depend on their monthly Social Security check, in some capacity, to cover their essential expenses. This consistent level of dependence underscores the program’s critical role in preventing financial hardship among the elderly.

A separate, impactful analysis from the Center on Budget and Policy Priorities further illuminates Social Security’s importance. This research determined that the poverty rate for adults aged 65 and above would be nearly four times higher if Social Security did not exist, escalating from 10.2% (as of 2022) with Social Security to an estimated 38.7% without it. Therefore, optimizing one’s Social Security benefits is not just about additional income; it is vital to the financial well-being of most future retirees. To achieve this, a clear understanding of benefit calculation and the profound impact of claiming age is essential.

1. The Indispensable Role of Social Security in Retirement

Social Security’s enduring presence for over eighty years has solidified its status as a critical financial lifeline for retired workers throughout the nation. Far from being a luxury, the monthly benefits disbursed by this program are, for a vast majority of its beneficiaries, an absolute necessity in covering their daily living expenses.

The widespread reliance on these benefits is consistently highlighted by annual surveys. Gallup’s research over the past two decades has consistently shown that between 80% and 90% of retired workers utilize their monthly Social Security income to meet various financial obligations. This consistent data points to Social Security as an indispensable income source rather than a supplementary one for most retirees.

The societal impact of Social Security extends beyond individual reliance, playing a significant role in poverty reduction. An analysis by the Center on Budget and Policy Priorities revealed a stark reality: without Social Security, the poverty rate for adults aged 65 and above would skyrocket. It would increase from 10.2% in 2022 to an estimated 38.7%, illustrating the program’s profound effect on the economic security of older Americans.

Given this deep reliance and protective function, it becomes unequivocally clear that maximizing Social Security benefits is a critical objective for nearly all future retirees. A strategic approach to claiming these benefits can significantly enhance one’s financial stability and quality of life throughout retirement.

Read more about: Bye-Bye, Old-School! 12 Wedding Traditions Modern Couples Are Happily Ditching in 2025

2. The Four Core Components of Your Monthly Social Security Check

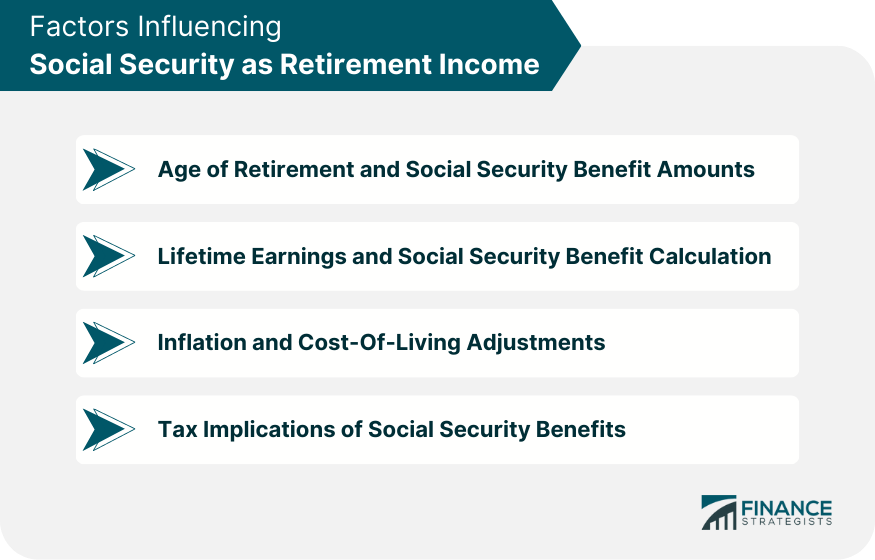

While Social Security benefits can sometimes present unexpected complexities, such as being taxable at both federal and, in nine states, local levels, the fundamental factors used by the Social Security Administration (SSA) to determine your monthly check are remarkably straightforward. Understanding these core components is the first step toward informed planning.

The SSA employs four distinct, yet interconnected, variables to calculate the amount of your monthly Social Security benefit. These factors create a personalized calculation based on an individual’s unique history and decisions. Recognizing each component’s role is crucial for comprehending the eventual payout.

These four pivotal components are: your work history, your earnings history, your full retirement age (FRA), and, perhaps most influentially, your claiming age. Each of these elements contributes significantly to the final sum you will receive each month, dictating the financial resources available to you in retirement.

By delving into each of these factors, individuals can gain a clearer perspective on how their past employment, income levels, and future decisions will directly translate into their Social Security benefits. This foundational knowledge empowers future retirees to make strategic choices regarding their retirement income.

Read more about: Beyond the Hue: Unpacking the Complex Layers of Donald Trump’s Public Persona and Enduring Impact

3. Understanding Your Work and Earnings History’s Impact on Benefits

Your work history and earnings history are inextricably linked when the SSA calculates your monthly Social Security benefit. The administration looks at your lifetime earnings, but with a specific methodology to ensure fairness and account for career progression over time. This careful assessment directly influences the size of your future checks.

Specifically, the SSA will identify your 35 highest-earning years. These earnings are then adjusted for inflation to reflect their equivalent value in today’s dollars, ensuring that earlier high-earning periods are given appropriate weight. This calculation method prioritizes periods of peak earning potential, rewarding sustained career success.

It is important to note that only earned income from employment or self-employment counts towards this calculation; investment income is explicitly excluded. Furthermore, a crucial aspect of this component is the requirement for at least 35 years of work history. Failing to meet this threshold can significantly reduce your eventual benefit.

For every year a worker falls short of the 35-year mark, the SSA factors a $0 into the average earnings calculation for that missing year. This can substantially “dampen” your Social Security benefit over the rest of your life, as noted by financial planner Christopher Stroup. Therefore, if you anticipate relying on Social Security to cover expenses during retirement, working for at least 35 years is a vital step to safeguard your income.

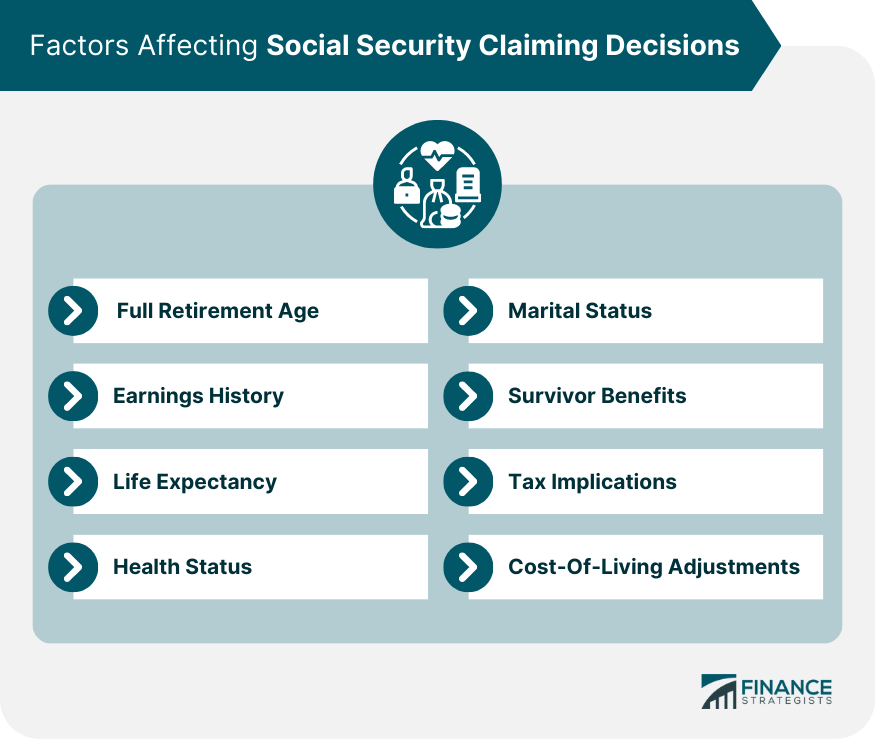

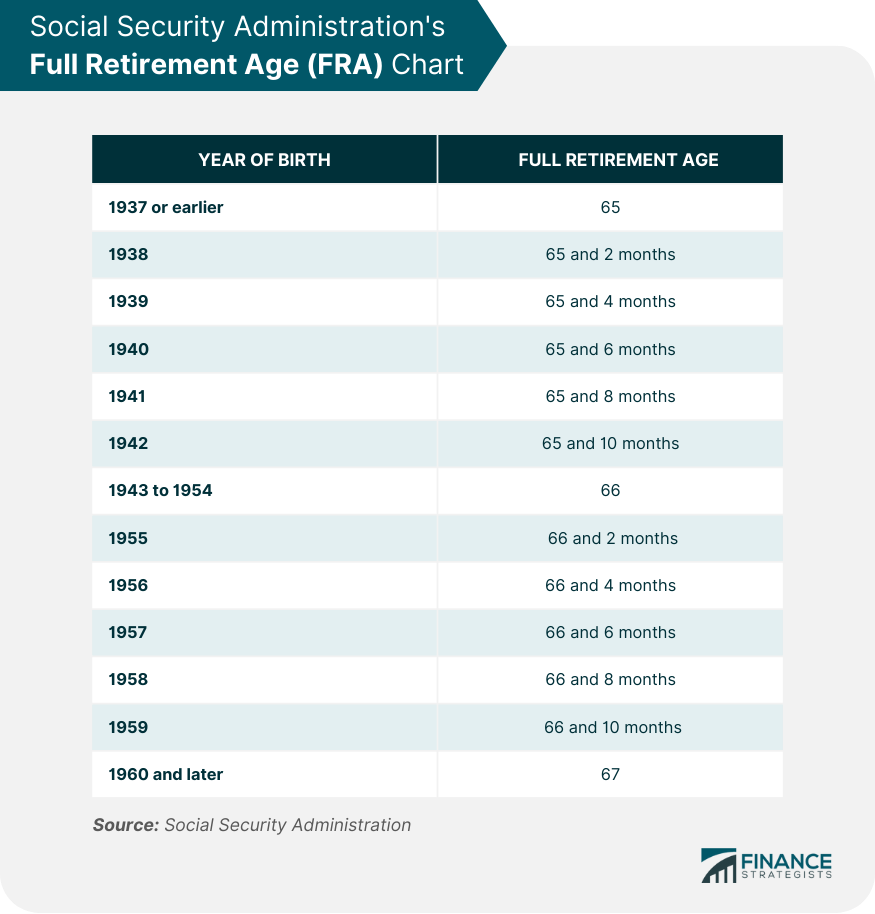

4. Decoding Your Full Retirement Age (FRA) by Birth Year

Among the four components that determine your Social Security benefit, your full retirement age, or FRA, stands out as the only factor over which you have no control. This age is not a choice but rather a fixed point determined solely by your year of birth, acting as a crucial benchmark for your benefits.

Your FRA represents the age at which you become eligible to receive 100% of your retired-worker benefit. Claiming benefits precisely at this age means you receive your primary insurance amount (PIA) without any reductions for early filing or additions for delayed claiming. It is the baseline from which all other claiming ages are measured.

The specific FRA varies across different birth cohorts. For individuals born between 1943 and 1954, the full retirement age is 66. This age then gradually increases for those born in subsequent years, specifically from 1955 to 1959, reflecting incremental adjustments to the Social Security system.

For anyone born in 1960 or later, the full retirement age is set at 67. This means that a significant portion of today’s workforce will reach their FRA at age 67. Understanding your specific FRA is fundamental, as it directly informs the financial consequences of claiming benefits earlier or later than this benchmark.

Read more about: Social Security at 90: Debunking 14 Stubborn Myths That Could Jeopardize Your Retirement

5. The Powerful Incentive: How Claiming Age Affects Your Payout

While your work history, earnings, and full retirement age lay the groundwork for your potential Social Security benefit, your claiming age introduces a dynamic element that can “wildly swing the monthly (and lifetime) payout pendulum.” This decision point offers a significant opportunity for individuals to influence their retirement income.

The Social Security system provides a clear financial incentive for patience: for every year a worker chooses to wait to collect their benefit, starting from age 62 and continuing until age 70, their monthly payout can increase by up to 8%. This annual increase, known as Delayed Retirement Credits, is a powerful mechanism for boosting one’s future income.

Conversely, choosing to claim benefits earlier than your full retirement age results in a permanent reduction to your monthly check. The specific percentage of reduction depends on how many months you claim prior to your FRA, with benefits being reduced by five-ninths of 1% for each month before your FRA, up to 36 months, and further reduced by five-twelfths of 1% per month for any additional months.

This interplay between early claiming reductions and delayed claiming credits creates a spectrum of potential monthly benefits. The attached table, which outlines percentages based on birth year and claiming age, vividly demonstrates how a carefully considered claiming age can translate into hundreds of additional dollars per month, significantly impacting financial security throughout retirement.

6. Claiming Benefits at Age 62: The Earliest Option’s Pros, Cons, and Average Check

Age 62 marks the earliest point at which an individual can begin collecting Social Security retirement benefits. The primary “lure of claiming benefits at age 62” is the immediate access to income, which can be particularly attractive for those facing job loss, health issues, caregiving demands, or other urgent financial needs.

Some individuals may also view early claiming as a strategy to “front-run any possible reduction” given the “possibility of sweeping Social Security benefit cuts by 2033.” This perception, whether accurate or not, can influence the decision to take benefits as soon as they become available, prioritizing immediate receipt over potential future increases.

However, claiming benefits at age 62 comes with a significant and permanent drawback: your monthly payout is reduced by 25% to 30% depending on your birth year and full retirement age. For instance, if your FRA is 67, claiming at 62 results in a 30% permanent reduction in payments. This substantial reduction can have long-lasting effects on your retirement budget.

Furthermore, early filers may be subject to other penalties, notably the retirement earnings test. This test allows the SSA to withhold some or all of your benefits if your income exceeds certain thresholds before you reach your FRA. Despite these reductions, early claiming can be a sensible choice for specific circumstances, such as those with “chronic health conditions that may lead to a shortened life expectancy,” as noted by finance professor Bob Wood.

In terms of actual payments, the average Social Security check for approximately 590,000 aged 62 retired-worker beneficiaries was $1,298.26 in December 2023. More recent data for December 2024 shows the average check at age 62 at $1,341.61. This figure is “significantly lower than the average check at FRA or later,” representing a 37.6% reduction compared to the average 70-year-old’s benefit of $2,148.12. For men at age 62, the average was $1,485.76, while for women, it was $1,207.03 in December 2024.

7. Navigating Age 65: Medicare Eligibility and Its Impact on Early Claims

Age 65 holds a unique significance in retirement planning, primarily because it marks an individual’s eligibility to enroll in Medicare, the federal health insurance program. This is the earliest age at which one can access Medicare benefits, with “no provisions or exceptions for those who retire before 65.” For many, access to health care is a considerable factor influencing retirement timing.

The importance of Medicare eligibility at age 65 has grown substantially due to the “decline of employer-provided health care in retirement,” as highlighted by a paper from the Center for Retirement Research. Employees who retire before age 65 often face the challenge of purchasing health insurance independently, without the subsidies typically associated with workplace plans, making Medicare a critical consideration.

While reaching age 65 provides access to essential health coverage, it is crucial to understand its implications for Social Security benefits. If age 65 is earlier than your full retirement age (FRA), claiming benefits at this point will still result in a permanently reduced monthly payment, similar to claiming at age 62, though the reduction will be less severe.

For instance, if your FRA is 67 and you opt to claim benefits at 65, which is 24 months early, your monthly benefit will be permanently reduced by approximately 13.3% (calculated as 24 months multiplied by five-ninths of 1% per month). This illustrates that even a mid-range early claim carries a substantial financial consequence on a lifelong basis.

Historically, age 65 was the full retirement age for retirees, but this changed after 2007. Now, for most individuals born after 1942, the FRA ranges from 66 to 67. Consequently, claiming benefits at 65 today means you are likely collecting before your FRA, leading to a reduced benefit compared to claiming at FRA or age 70.

The average check for a retired worker at age 65 was $1,611.00 in December 2024. When compared to the average check of a 70-year-old, which was $2,148.12, the difference is substantial, amounting to a 25% reduction, or $537.12 less per month. For men, the average benefit at 65 was $1,784.78, and for women, it was $1,452.55, further emphasizing the financial trade-offs of claiming at this age.

For most retirees, navigating Social Security benefits is one of the most significant financial decisions they will make, with the timing of their claim dramatically influencing their long-term financial stability. As we move beyond the foundational aspects and early claiming considerations, this second section delves into strategies for optimizing benefits at later ages, providing a comprehensive analysis of the financial implications and broader factors that should guide your personalized claiming decision.

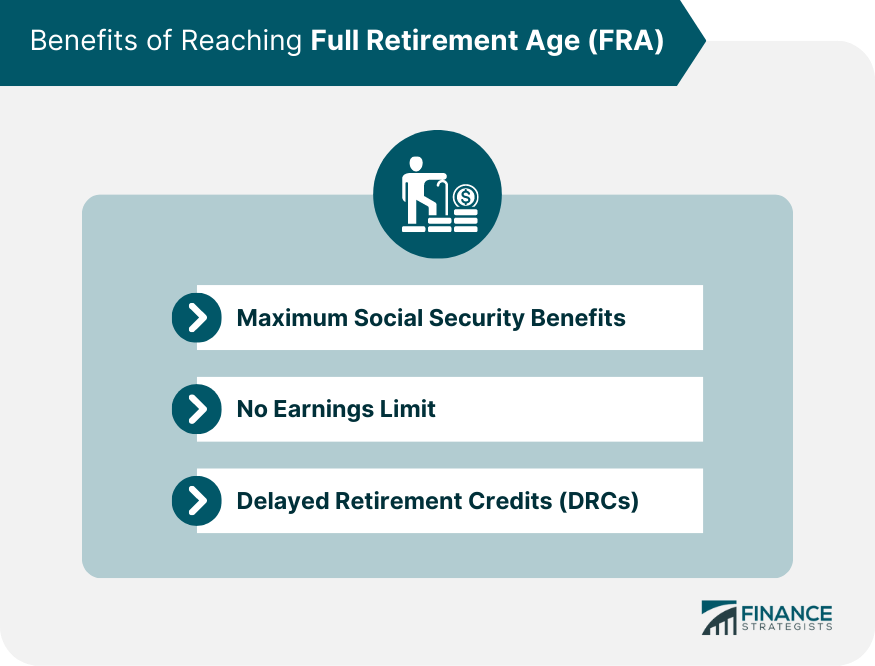

8. Claiming at Your Full Retirement Age (66/67): Securing 100% of Your Benefits

Your full retirement age (FRA) stands as a pivotal benchmark in Social Security planning, representing the age at which you become entitled to receive 100% of your retired-worker benefit. This age, determined solely by your birth year, ensures you collect your primary insurance amount (PIA) without any reductions for early filing or additions for delayed claiming. For those born between 1943 and 1954, the FRA is 66, while individuals born in 1960 or later have an FRA of 67.

Choosing to claim benefits precisely at your FRA offers a clear advantage: you avoid the permanent reductions associated with early claiming. The Social Security system, designed to reward a full career, ensures that your accumulated work and earnings history fully translate into your entitled benefit at this milestone. Furthermore, if you continue working past your FRA, your Social Security benefits will not be subject to reduction, regardless of your income levels.

Given that age 67 is the full retirement age for a significant portion of today’s workforce—anyone born in or after 1960—claiming at this age is poised to become the most popular choice. The average benefit for a retired worker at age 66 in December 2024 was $1,763.99, while at age 67, it stood at $1,929.73. This represents a substantial improvement over early claiming, as a 67-year-old collecting reduced benefits receives $215.24 less per month, an 11% reduction compared to their counterpart without a reduction.

While claiming at your FRA guarantees 100% of your earned benefit, it’s worth noting the “downside” often considered in hindsight: if you live well into your 80s or beyond, you might have, in essence, “left a lot of Social Security income on the table” by not delaying further. This highlights the ongoing trade-off between immediate receipt and long-term maximization, even at this seemingly ideal claiming age.

9. Maximizing Benefits at Age 70: Leveraging Delayed Retirement Credits

For those seeking to maximize their monthly Social Security income, delaying benefits until age 70 represents the ultimate strategy. The Social Security system provides a powerful financial incentive for this patience, known as Delayed Retirement Credits. For every year a worker waits to collect benefits, starting from age 62 and continuing until age 70, their monthly payout can grow by an impressive 8%.

These Delayed Retirement Credits accrue at a rate of two-thirds of 1% for each month you delay claiming past your full retirement age, culminating in an 8% increase for each full year. This mechanism guarantees that your monthly benefit at age 70 will be significantly higher—between 24% and 32% more than what you would have received at your FRA, depending on your birth year. It’s a compelling rate of return that few, if any, fixed investment vehicles can guarantee.

As investment advisor representative Krisstin Petersmarck aptly states, “By waiting up to age 70, retirees can lock in the biggest benefit checks available based on their work records.” She further emphasizes the long-term advantage, noting, “If longevity is a concern, having the larger Social Security benefit for your lifetime is a major plus.” This strategy provides a robust income stream that can better support an extended retirement.

While the financial advantages are clear, it is important to consider the trade-off. The primary “flip side” to claiming at age 70 is the inherent uncertainty of life expectancy. There’s no guarantee that an individual will live long enough to fully maximize their *lifetime* payout from Social Security, even if their monthly checks are at their highest possible value. This underscores the personal nature of the claiming decision, balancing guaranteed monthly growth against the unknown duration of that payout.

10. The Striking Difference: Average Social Security Benefits Across Key Claiming Ages (62, 67, 70 – SSA 2023/2024 data)

To truly appreciate the financial impact of your claiming age, it’s illustrative to compare the average monthly benefits at the three most popular milestones: ages 62, 67, and 70. Based on December 2024 data from the Social Security Administration, these figures reveal stark differences in potential retirement income. The average check for approximately 594,233 aged 62 retired-worker beneficiaries was $1,341.61.

Moving to age 67, which is the full retirement age for most of today’s workforce, the average benefit for nearly 3 million retirees climbed to $1,929.73. This represents a substantial increase over the earliest claiming age. This jump reflects the avoidance of permanent reductions and the benefit of receiving 100% of one’s primary insurance amount, showcasing the financial reward for waiting just a few years longer than the earliest possible claiming age.

However, the most significant difference is seen when comparing these figures to benefits at age 70. The average benefit for nearly 3.18 million retired-worker beneficiaries who claimed at age 70 reached $2,148.12. This figure dramatically outperforms the earlier claiming ages, being 37.6% more than the average check received by a 62-year-old, and $218.29 more per month than the average benefit at age 67.

Across the entire traditional claiming spectrum, from the earliest filers at age 62 to those who maximize their monthly benefit at age 70, the financial variance is profound. Beneficiaries at age 70 received, on average, 57% more than the earliest filers according to December 2023 data. This quantitative evidence unequivocally demonstrates that delayed claiming can translate into hundreds of additional dollars each month, significantly enhancing financial security throughout retirement.

This striking difference, for example, amounts to $537.12 less per month, or $6,445.44 annually, for a 65-year-old compared to a 70-year-old, underscoring the long-term financial consequences of an earlier claiming decision. These numbers are not just statistics; they represent tangible impacts on a retiree’s budget and lifestyle.

11. Examining Maximum Possible Benefits in 2025 at Different Claiming Ages

Beyond average benefits, it’s insightful to consider the maximum possible Social Security payouts to understand the full spectrum of financial potential. For the year 2025, the Social Security Administration has outlined the maximum benefits available at key claiming ages, providing a clear illustration of how delayed claiming can substantially increase an individual’s monthly income.

At age 62, the youngest possible retirement age, the maximum reduced benefit is projected to be $2,831 per month. This figure reflects the full early retirement reduction. By comparison, individuals who claim at their full retirement age (66 or 67, depending on birth year) can expect a maximum benefit of $4,018, as they receive 100% of their earned amount without reductions or delayed retirement credits.

The most significant increase in maximum benefits is realized by those who wait until age 70. At this age, when extra benefits from Delayed Retirement Credits stop accruing, the maximum possible benefit surges to $5,018 per month. This represents a substantial “bump” in income, highlighting the powerful financial leverage of patience in Social Security claiming.

Quantifying this difference, an individual claiming the maximum benefit at age 70 would receive $2,187 more per month than someone claiming the maximum reduced benefit at age 62. This translates to a staggering 45% loss for those who opt for the earliest claiming age. Even when compared to claiming at FRA, the age 62 maximum represents a 31% reduction, or $1,187 less monthly, underscoring the profound financial cost of early retirement.

Read more about: Driving the Distance: A Deep Dive into Electric Vehicle Lifespan, Reliability, and Future-Proofing for 200,000 Miles and Beyond

12. The Statistical Truth: Unpacking Optimal Claiming Ages for Lifetime Payouts

While individual circumstances always play a role, comprehensive statistical analyses consistently point to a “superior claiming age” for the majority of retirees looking to maximize their *lifetime* Social Security income. A landmark 2019 study by United Income, “The Retirement Solution Hiding in Plain Sight,” analyzed the claiming decisions of 20,000 retired workers using data from the University of Michigan’s Health and Retirement Study. Its goal was to identify claiming ages that optimize lifetime income collection.

The findings were startling: a mere 4% of the 20,000 retired workers studied had made an optimal claim. This indicates a significant disconnect between actual claiming behaviors and the decisions that would yield the most Social Security income over a lifetime. This gap is largely attributed to the inherent guesswork involved in claiming, as individuals cannot know their “expiration date” ahead of time, leading to variability in choices.

The study further revealed a “nearly perfect inversion” between actual and optimal claims. Despite 79% of the surveyed retirees initiating benefits between ages 62 and 64, only a meager 8% of these early claims ultimately proved optimal for maximizing lifetime payouts. This suggests that the immediate appeal of early income often overshadows the long-term financial benefits of delayed claiming.

Conversely, while only a small percentage of retired workers waited until age 70 to begin receiving their Social Security benefits, this claiming age would have been optimal for an astounding 57% of the individuals analyzed. This powerful statistical evidence strongly suggests that patience typically pays off handsomely for a majority of future retirees, underscoring the significant financial advantage of delayed claiming.

This conclusion is corroborated by a 2022 study from the National Bureau of Economic Research, which found that claiming at age 70 was the ideal choice for 91.6% of participants to maximize their lifetime benefit. Furthermore, 99.4% of older adults could optimize their benefits by waiting until after age 65. The right decision could lead to a median lifetime benefit increase of $158,069 for all households, reaching $225,944 for those aged 45 to 62. While there are legitimate reasons for early claiming, such as chronic health conditions that may shorten life expectancy, the statistical data overwhelmingly favors a strategy of delayed gratification for most.

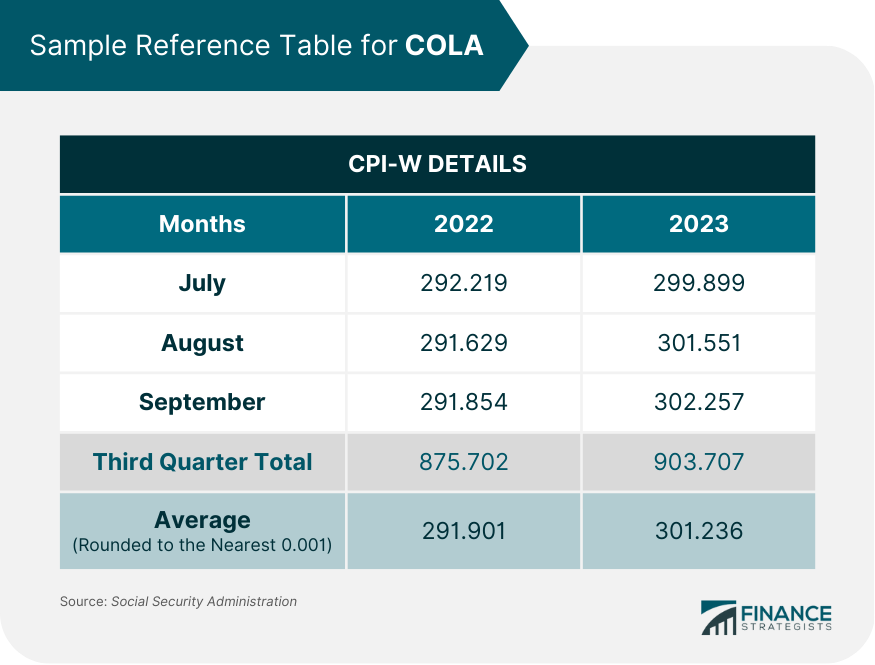

13. Cost-of-Living Adjustments (COLA): Protecting Your Purchasing Power in Retirement

Living on a fixed income during retirement presents a unique challenge: the erosion of purchasing power due to inflation. Recognizing this, the Social Security Administration (SSA) has, since 1975, implemented annual cost-of-living adjustments, or COLAs. These modifications are designed to help Social Security benefits keep pace with rising costs, protecting retirees’ financial stability against inflationary pressures.

The COLA is typically announced each October for the following year, based on changes in the Consumer Price Index, which tracks the costs of everyday necessities such as food, gas, and household items. For instance, the COLA for 2023 was set at 8.7% in October 2022, marking the highest adjustment in over 40 years. This meant a beneficiary receiving $1,000 in 2022 saw their monthly check rise to $1,087 in 2023.

While COLAs are crucial for maintaining financial equilibrium, it’s important to understand their basis. In September 2023, for example, the Senior Citizens League forecasted the COLA for 2024 to be 3.2%. These adjustments, while aiming to help retirees cover rising expenses, are calculated based on national averages. Consequently, the actual impact on an individual’s monthly budget can vary depending on personal spending habits, where they live, and other economic variables.

Crucially, the initial amount you receive from Social Security—whether you claimed early, at your full retirement age, or waited until age 70—becomes the fundamental basis for all your future cost-of-living adjustments. A higher initial benefit means that all subsequent COLAs, regardless of their percentage, will result in a larger absolute dollar increase. This compounding effect further underscores the long-term advantage of maximizing your initial benefit through delayed claiming, as it creates a higher foundation for all future inflation-driven increases.

14. Beyond the Numbers: The Broader Implications of Your Social Security Claiming Age (Spousal Benefits, COLA basis)

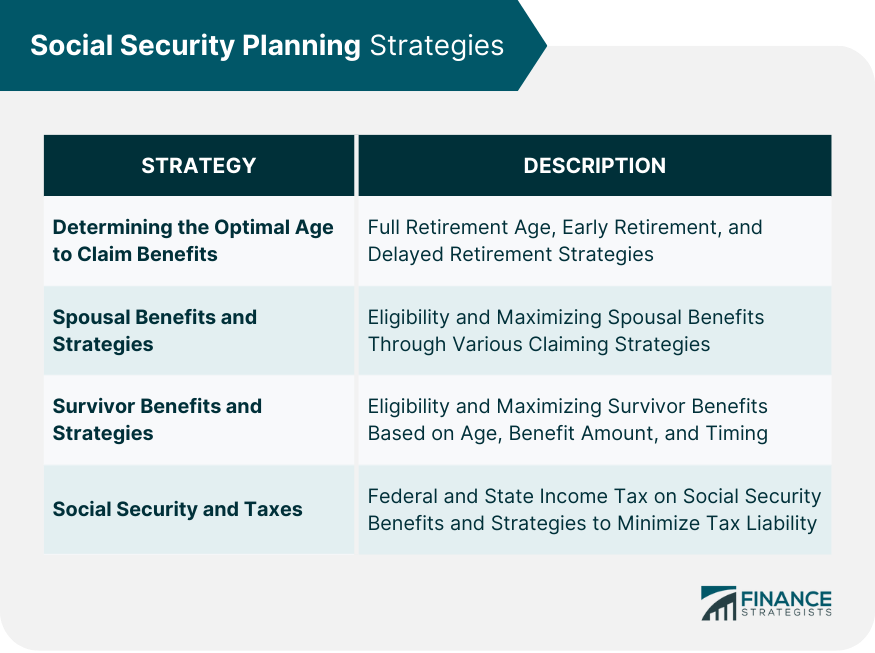

The decision of when to claim Social Security extends far beyond simply maximizing your individual monthly check; it carries broader implications that can affect your entire household’s financial well-being. One of the most significant considerations is the impact on spousal benefits. For married couples, the claiming age of one spouse can directly influence the benefits available to the other.

Spousal benefits are typically capped at 50% of the primary earner’s *full* retirement age benefit. If the higher-earning spouse claims benefits early, thereby permanently reducing their own check, this reduction can indirectly diminish the potential spousal benefit for their partner. Therefore, understanding how claiming early can affect your spousal benefits is paramount, as “half of a reduced benefit might not be enough to support your household.”

Furthermore, as previously discussed, the initial benefit amount you establish through your claiming age serves as the permanent basis for all future Cost-of-Living Adjustments (COLAs). A higher starting benefit, achieved through delayed claiming, means that every subsequent COLA will result in a larger dollar increase, compounding the financial advantage over the decades of retirement. This long-term effect can significantly enhance your purchasing power throughout your golden years.

Historically, age 65 was synchronized as both the full retirement age for Social Security and the eligibility age for Medicare, simplifying retirement planning. However, for anyone born after 1942, their full retirement age now ranges from 66 to 67 years old, creating a gap between Medicare eligibility and full Social Security benefits. This divergence requires careful planning, especially for those considering retirement before their FRA, to ensure continuous health coverage.

It is worth noting that while concerns about Social Security’s funding or external factors, such as “DOGE’s involvement,” have reportedly led to a rise in new claims across all age groups, most experts consistently advise against letting these issues dictate your claiming strategy. They emphasize that focusing on your age and individual circumstances remains the most critical factor for maximizing your monthly benefit and ensuring long-term financial stability.

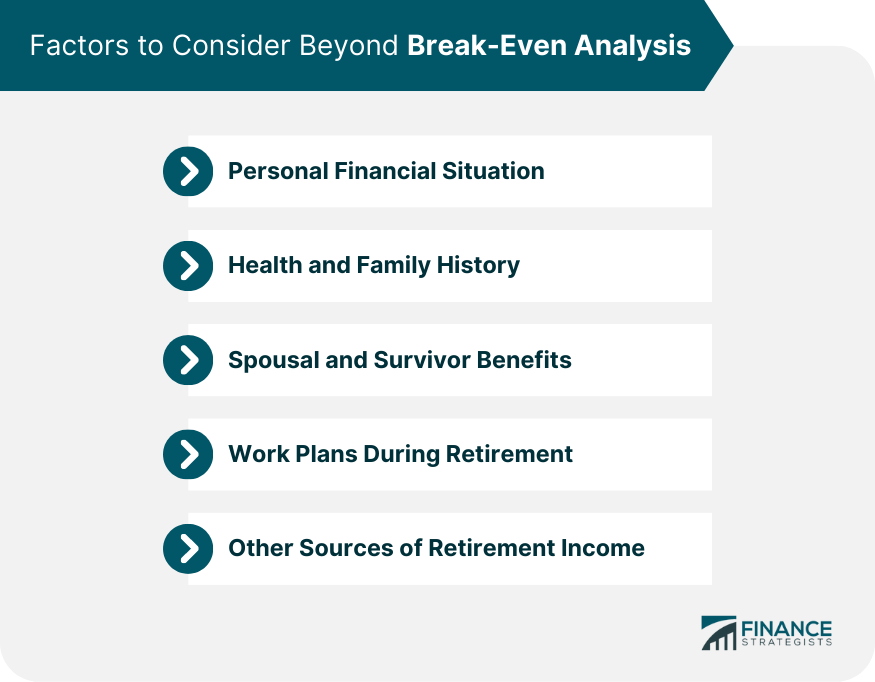

15. Tailoring Your Strategy: Why the ‘Best’ Claiming Age is a Personal Decision

After exploring the intricacies of Social Security benefits, from early reductions to the power of delayed retirement credits and statistical optimal ages, a crucial truth emerges: the “best” age to claim is ultimately a deeply personal decision. There is no one-size-fits-all blueprint, as every individual’s journey toward retirement is unique, shaped by a complex interplay of personal circumstances.

Key factors that must be carefully considered include your personal health and estimated life expectancy. For individuals with chronic health conditions that may lead to a shortened lifespan, claiming benefits at an earlier age, despite the reductions, can be a perfectly sensible and advantageous strategy. The goal is to maximize *personal* lifetime benefits, which isn’t always aligned with purely statistical averages.

Beyond health, your financial landscape—including other sources of retirement income, the accessibility of various retirement accounts, and your unique tax implications—plays a significant role. Married couples must also consider their marital status and how claiming decisions impact potential spousal and survivor benefits, as a coordinated strategy can yield greater overall household income.

Financial planner Christopher Stroup highlights the importance of understanding your earnings record and reviewing it for accuracy, as this, coupled with your age, forms one of the main determinants of your benefit size. Similarly, Krisstin Petersmarck stresses that “if longevity is a concern, having the larger Social Security benefit for your lifetime is a major plus,” reinforcing the notion that personal outlook on life expectancy heavily influences the choice.

Ultimately, whether you decide to claim early at 62, at your full retirement age, or delay until 70, the most critical element is making an informed decision. If you have “plenty of savings and want to retire and take benefits at 62, and you’re OK with making some financial sacrifices,” that strategy, as long as it’s a conscious choice with full awareness of its implications, is valid. The power lies in understanding the trade-offs and aligning your claiming age with your unique financial goals and life circumstances.

Making an informed Social Security claiming decision is one of the most impactful choices for your retirement future. The age you choose to begin receiving benefits will reverberate throughout your golden years, affecting not just your monthly income but also your lifetime financial security and potentially that of your loved ones. By diligently understanding the mechanisms, evaluating the average and maximum benefits at various ages, and critically assessing your personal situation, you empower yourself to navigate this vital program with confidence. Social Security remains a cornerstone of American retirement, and a well-thought-out claiming strategy is your key to unlocking its full potential for a comfortable and secure tomorrow. To gain more personalized insights, utilize resources like the Social Security Administration’s “Full Retirement and Age 62 Benefit By Year Of Birth” table or a reputable retirement calculator to estimate your future savings and benefit potential.