The unfortunate reality of vehicle ownership is that accidents happen. Whether it’s a devastating weather event like a wildfire or hurricane, or a collision with another driver, the outcome can sometimes be a “totaled” car. This often-dreaded term signals a complex process involving insurance companies, valuations, and critical decisions for the vehicle owner. Understanding this process thoroughly is key to navigating the aftermath effectively and ensuring you receive fair compensation.

When an insurance company declares a car a total loss, it means the cost to repair the damage exceeds the vehicle’s book value at the time of the incident, or it would still be unsafe to drive even after repairs. This declaration triggers a series of steps and considerations, from filing a claim to understanding your settlement options. For many consumers, this can feel like navigating a maze of unfamiliar terms and procedures, often during a stressful time.

This comprehensive guide aims to demystify the total loss process, providing clear, actionable advice to empower you, the consumer. We’ll delve into how insurers determine a total loss, the types of coverage that protect you, the immediate actions you should take, and specific considerations when another party is at fault. Our goal is to equip you with the knowledge to confidently manage your claim and make informed decisions about your totaled vehicle.

1. **What “Totaled Car” Really Means**

The term “totaled car” is frequently used, but its precise meaning from an insurance perspective is crucial for vehicle owners to grasp. An insurance company “totals” a car when the cost to repair the damage exceeds the vehicle’s book value at the time of the crash. This determination isn’t arbitrary; it’s a function of basic math and the regulations in your particular state, ensuring a standardized approach to assessing vehicle viability after an incident.

Beyond the purely financial aspect, insurers may also declare a car a total loss if they consider it would still be unsafe to drive even after all the needed repairs are made. This is a critical safety consideration, as some damage can compromise the structural integrity or essential systems of a vehicle. Complete restoration to a safe operating condition might be impractical or impossible. Insurers prioritize public safety by preventing potentially dangerous vehicles from returning to the road.

If the insurer totals your car, it will pay you the vehicle’s actual cash value, or ACV. The actual cash value is essentially how much the car was worth just before the loss occurred. It’s important to understand that ACV includes a reduction in value for depreciation, factoring in wear and tear, mileage, and previous accidents. Therefore, the ACV will almost always be less than what you originally paid for the vehicle, even if it’s relatively new. This depreciation is a standard part of vehicle valuation in total loss claims.

Recent data underscores the prevalence of total loss claims. LexisNexis Risk Solutions’ latest Auto Insurance Trends report shows that total loss claims accounted for 27% of collision claims in 2022, a rise from 24% in 2021. This trend highlights the increasing likelihood that a vehicle owner might encounter a total loss scenario, making an understanding of these concepts more vital than ever for today’s drivers.

Read more about: Your Blueprint to Bargain: Smart Negotiation Strategies for Thousands in Savings on Your Next Car and Dealer-Installed Upgrades

2. **Understanding When Your Car Is Declared a Total Loss**

The decision to declare a car a total loss involves specific criteria set by both state regulations and individual insurance company policies. Each state establishes its own threshold for declaring vehicles a total loss, typically expressed as a percentage of the vehicle’s actual cash value (ACV). However, insurance carriers retain the right to use a lower threshold than the state mandates. This can result in a car being totaled even if repair costs are less than the state’s minimum percentage.

This discretion by insurers is a pragmatic response to repair complexities. For example, Alabama’s state threshold for totaling a car is 75% or greater of its ACV. A $10,000 vehicle must be declared a total loss if damage costs $7,500 or more. Yet, if an insurer’s internal threshold is 60% of the ACV, that same vehicle would be totaled when repair costs reach $6,000, even if below the state’s 75% mark.

Josh Damico, vice president of insurance operations at Jerry, explains the reasoning: “The reason that some carriers [use a lower threshold] is because when you’re adjusting a vehicle, and you’re looking at it after a loss, it’s still together. And all you can see, for the most part, is the exterior of the vehicle and the undercarriage.” He notes that when a body shop disassembles the vehicle, “they typically find more damage.”

This often-unforeseen additional damage, documented in “supplements” to the insurance company, factors into the insurer’s initial total loss calculation. Damico adds, “Some carriers have an idea of what supplements are going to look like on a damaged vehicle. They consider this upfront when determining when they will declare a vehicle a total loss.” This proactive approach helps insurers manage financial risk, especially given fluctuating costs of vehicle parts and labor, which can inflate repair expenses and insurance rates.

Read more about: Navigating the Electric Frontier: Your Essential Guide to 2025 Auto Insurance for EV Owners

3. **Key Insurance Coverages for Total Loss Situations**

The type of insurance coverage that comes into play if your car is totaled depends directly on the specific circumstances of the loss. Understanding these coverages is fundamental to knowing your financial protection. Four primary types of auto insurance are relevant when a vehicle is declared a total loss, each addressing different scenarios to ensure comprehensive protection.

**Collision coverage** is your safeguard if you are involved in a crash with another car or an immovable object, such as a fence or a lamppost. This coverage is designed to pay for the damage to your own vehicle, regardless of who is at fault. It’s a crucial component for any driver who wants their vehicle repaired or replaced after an impact.

**Comprehensive coverage** steps in for damage that is not crash-related. This broad coverage protects against a wide array of incidents, including those caused by severe weather events like hurricanes and floods, vandalism, theft, and even animal-related damage. It provides peace of mind for situations beyond typical road accidents, acknowledging that a total loss can stem from numerous non-collision circumstances.

If another driver is at fault for an accident that totals your vehicle, their **property damage liability coverage** should cover the damage to your car, assuming they are insured. This is why gathering the other driver’s insurance information is a critical step immediately following an accident where you are not at fault. This coverage ensures that the responsible party’s insurance pays for the damage they caused to your property.

Finally, **uninsured/underinsured motorist property damage liability** is vital coverage designed to protect you if you are involved in an accident where the at-fault driver is not adequately insured or has no insurance at all. Without this coverage, if an uninsured driver totals your car, you would bear the financial burden of repairs or replacement yourself. While collision and comprehensive coverage are often optional unless required by a lender, opting out of them or uninsured/underinsured motorist coverage leaves significant financial exposure.

Read more about: Your Essential Guide to Car Insurance: What First-Time Drivers Need to Know to Drive Smart and Save

4. **The Role of GAP Insurance in Total Loss Scenarios**

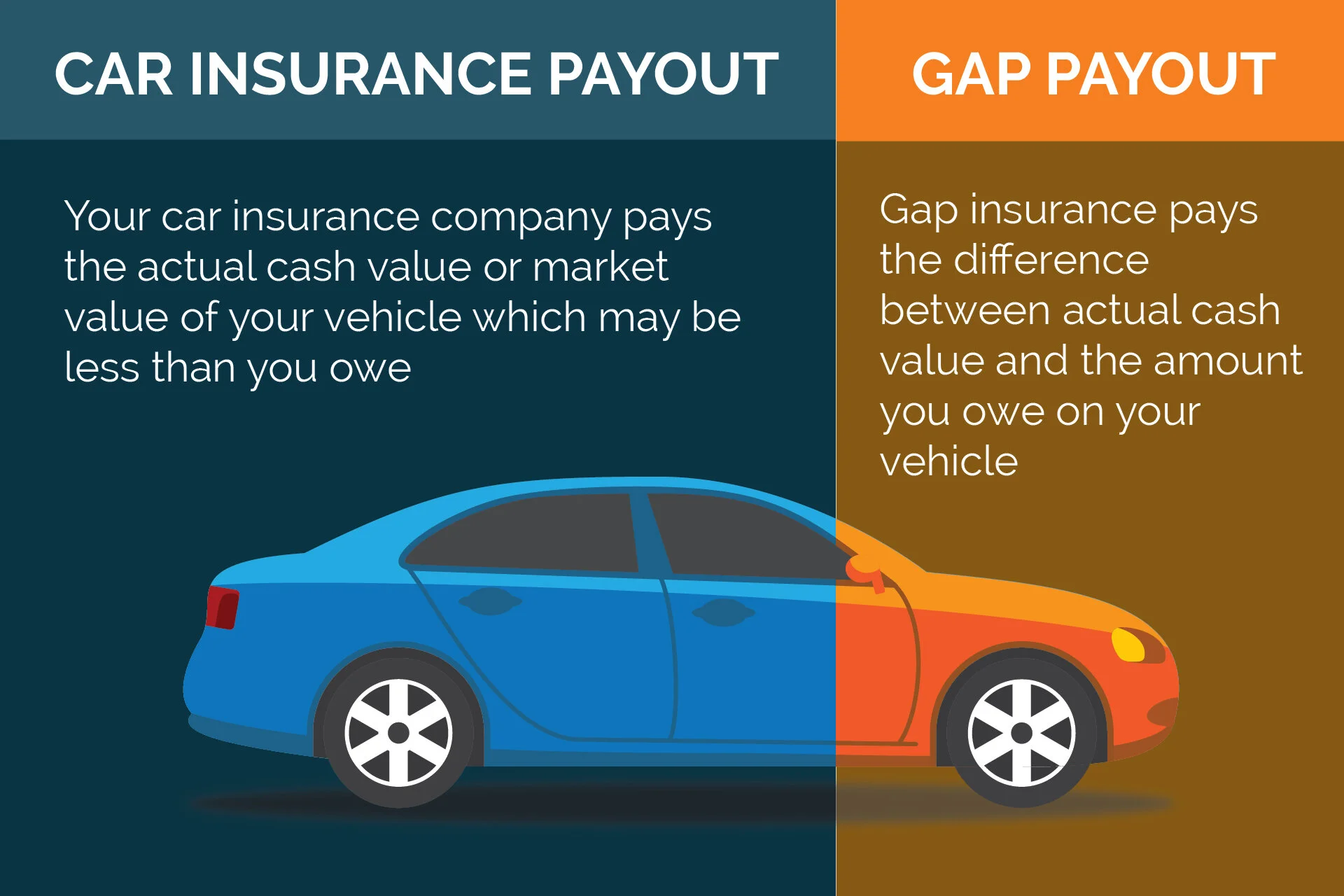

For many drivers, especially those who have recently purchased a vehicle with a loan or lease, the concept of actual cash value (ACV) can present a significant financial vulnerability in the event of a total loss. Vehicles depreciate rapidly from the moment they are driven off the lot. This quick depreciation means that the ACV of your car at the time of an accident might be considerably less than the outstanding balance on your loan or lease agreement.

This creates a gap between what your standard insurance policy will pay (the ACV) and what you still owe to your lender or leasing company. Without additional protection, you would be personally responsible for making up this difference, even though your car is no longer usable. This scenario can be particularly harsh if you made a small or no down payment when acquiring the vehicle, as the initial loan balance would be higher relative to the car’s depreciated value.

This is precisely where Guaranteed Asset Protection, or GAP, coverage becomes an invaluable asset. GAP insurance is specifically designed to cover this financial shortfall. It pays the difference between the amount you still owe on your loan or lease and the actual cash value that your primary insurance company pays out for a total loss. In many policies, GAP coverage even extends to cover your collision or comprehensive deductible, further alleviating your financial burden.

Many lenders or leasing companies often require collision and comprehensive coverage if you have a loan or lease on your vehicle. While GAP insurance is typically optional, its relatively inexpensive cost often makes it a wise investment, particularly for new vehicles or those with substantial financing. As the context states, “We think GAP insurance makes sense and is worth the extra cost,” highlighting its practical value in protecting consumers from unexpected financial liabilities after a total loss.

Read more about: Decoding EV Insurance Costs: A Consumer’s Guide to Top Providers and Savings Strategies

5. **How Insurers Calculate a Total Loss: Methods and Valuation**

When a car is damaged to the point where it might be a total loss, the insurance company undertakes a careful calculation to determine its actual cash value (ACV) immediately before the loss occurred. It then estimates the repair costs. This crucial assessment dictates whether your vehicle will be repaired or declared totaled. Most insurers don’t handle this valuation internally; instead, they often collaborate with third-party vendors who specialize in aggregating extensive vehicle data to accurately ascertain the ACV.

Following this initial valuation, the insurance company dispatches an adjuster to thoroughly inspect the damage to your vehicle and generate an estimate for the necessary repairs. The comparison between this estimated repair cost and the vehicle’s ACV, measured against specific thresholds, determines the total loss declaration. If the damage estimate surpasses the threshold established by either state law or the insurance company’s internal policies, the vehicle is officially deemed a total loss. Subsequently, the carrier will reimburse you for the calculated ACV of the vehicle.

The method an insurance carrier employs to calculate a total loss can vary depending on the state where you reside. The context identifies two primary methods: the Fair Market Value Total Loss Formula and the Total Loss Formula. Some states legally bind insurance companies to use one of these specific approaches, providing a clear framework for total loss determinations within their jurisdiction. These differing formulas highlight the importance of understanding your state’s particular regulations in addition to your insurance policy.

For example, the **Fair Market Value Total Loss Formula** involves the state setting a fixed percentage of the car’s fair market value (FMV) as the total loss threshold. The FMV is essentially the book value of your car right before the incident, as monitored by entities like Kelley Blue Book. If estimated repairs exceed this percentage of the FMV, the car is totaled. States like Alabama use a 75% threshold, Oklahoma 60%, and Colorado 100%. Alternatively, in states utilizing the **Total Loss Formula**, the calculation subtracts the car’s salvage value (what the insurer could sell the wrecked car for to a junk or salvage yard) from its fair market value. If estimated repairs exceed this difference, the vehicle is totaled. Both methods aim to provide a consistent and objective basis for these critical insurance decisions.

6. **Immediate Steps After Your Car is Totaled**

Discovering your car has been totaled can be distressing, but taking the correct immediate steps can streamline the claims process and protect your interests. The process can often take time, sometimes a month or more, due to the need to assess the claim, inspect, and evaluate the vehicle, especially with today’s higher car and parts prices. Being prepared and proactive is essential to navigating this unfortunate circumstance.

The very first action is to **file a claim** with your insurer, just as you would for a minor fender bender. Your insurance company can guide you through the initial options, even if you believe you are not at fault or are only partially at fault. This formal notification starts the official process and ensures your incident is recorded. Concurrently, it’s vital to **keep meticulous records** of all communications. This includes saving email correspondence with the insurance provider and adjuster, and making detailed notations of dates and times of all phone calls. Gathering your maintenance records and, if available, the original car window sticker, can also prove useful to demonstrate proof of upgrades or careful upkeep, potentially aiding in valuation.

Next, you must allow for an **assessment of the damage**. The insurance company will send an adjuster to visually inspect your vehicle’s damage and estimate repair costs. If a police report suggests you are at fault, it is particularly helpful to **gather necessary evidence** yourself, such as photos and videos of the damage to all involved vehicles, road conditions, and any objects involved. As trial attorney Ted Spaulding advises, “A not-at-fault driver should immediately take video and pictures of the vehicle, as it is, at the scene of the accident. Nowadays, everyone has a smartphone, and video is a great tool to show the damage in the immediate aftermath of an accident.” This evidence can be critical in demonstrating your level of fault, or lack thereof.

It is also imperative to **know your car’s fair market value (FMV)**. Before the adjuster provides an offer, research your car’s value using resources like Kelley Blue Book, or by checking prices for comparable vehicles currently selling in your area. This independent research provides a strong foundation for any negotiations you might undertake. Finally, if you have a loan or lease on the totaled vehicle, you must **contact your lender**. Your vehicle secures your financing, so inform the financing company about the damage and, crucially, continue making your payments. Stopping payments could negatively impact your credit, making it harder to finance a new vehicle. The insurance company will pay the lender or leasing company directly when the claim is settled.

Read more about: Unmasking the Markup: Your Essential Guide to Spotting and Avoiding Hidden Car Dealer Fees

7. **Navigating a Total Loss Claim When You’re Not at Fault**

When an accident that totals your car is caused by someone else, specific steps are critical to protect your rights and advocate for fair compensation. Your immediate actions in the aftermath of the incident are particularly important to establish the facts and ensure a smooth claims process. Prioritizing safety is paramount, so always “check for injuries and call 911 to report the accident,” as emphasized in the context. If police respond to the scene, make sure to obtain a copy of their report later, as it provides an official record of the event.

Documentation is your strongest ally in a not-at-fault claim. “Take photos of the accident scene, including all involved vehicles, road conditions and your injuries.” This visual evidence captures the immediate reality of the crash. Crucially, “gather contact and insurance information from other drivers,” and if there are witnesses, “ask for their contact information in case their testimony is needed later.” These details are fundamental for establishing liability and initiating the claim with the responsible party’s insurer.

Even if you initially feel unhurt, “seek medical assistance” promptly. Allan Siegel, partner at Chaikin, Sherman, Cammarata & Siegel, advises, “You should address your injuries promptly. Waiting too long can give the insurance company a reason to question the severity of your injuries.” He further stresses the importance of following through with recommended care, noting that “Getting medical care not only helps you recover but also provides the proof you’ll need when asking for fair compensation.” This applies not only to personal injury claims but also validates the overall impact of the accident.

Although you weren’t at fault, it’s important to “notify your insurance provider as soon as possible.” They can offer guidance through the claims process and may intervene if the other driver’s insurance proves uncooperative. The primary claim for your vehicle’s damage will be a “property damage claim… filed with the at-fault driver’s insurance” to recover the value of your totaled car. Ensure you provide all supporting documentation, such as damage photos and the police report. Finally, your car needs a professional “damage assessment” from a mechanic at a repair shop, who will provide a report to the insurance claims adjuster to determine if your car is totaled. While the insurance company might suggest a shop, “drivers have the right to get their own estimate from a trusted repair place,” according to Ted Spaulding.

Read more about: Consumer Alert: 12 Common Mechanic Rip-Offs You Need to Know to Ensure Honest Auto Service

8. **Can You Keep a Totaled Vehicle? Understanding Your Options**

After your vehicle has been declared a total loss, a common question arises: is it possible to keep your car instead of handing it over to the insurance company? The answer largely depends on the laws in your specific state, as regulations can vary significantly. The initial and most practical step in exploring this possibility is to directly communicate your desire to retain the vehicle with your insurance carrier. As Josh Damico, vice president of insurance operations at Jerry, advises, “The best way to start this process is to talk to your carrier about purchasing the totaled vehicle back.”

Should your state’s laws permit you to keep the vehicle and your insurer agrees, a specific sequence of actions will be required before you can legally operate it again. Once a car is deemed a total loss, it typically cannot be driven immediately on public roads. It “has to be repaired, pass inspection, and ultimately you’ll be given a rebuilt or a salvaged title for the vehicle,” Damico explains. This means you would be responsible for all necessary repairs, ensuring they meet safety and operational standards. Afterward, you must provide proof of a successful inspection and the new title to your local Department of Motor Vehicles (DMV) to properly register the car for road use.

Financially, deciding to keep a totaled car alters your insurance settlement. The insurance company generally remains indifferent about whether you keep the car, as their payout amount remains consistent. The company will start with the vehicle’s fair market value (FMV) at the time of the loss. From this amount, they will deduct what they would have recouped by selling the wrecked car to a salvage yard, known as the salvage value. Additionally, any applicable deductible due will be subtracted. You would then receive the remaining balance of the settlement along with possession of your car.

While keeping a totaled car might seem appealing, it comes with a mix of potential advantages and notable disadvantages. On the positive side, if an older car with a low market value is totaled primarily due to cosmetic damage, you might find that it requires minimal or no repairs to be roadworthy, making it a cost-effective option. Alternatively, the car could serve as a valuable source for parts for another restoration or repair project you might be undertaking, or its components could be sold for supplementary income.

However, the downsides often outweigh the benefits. There is a significant risk that the actual repair costs could escalate far beyond the initial estimate once work begins and hidden damages are uncovered. Once repaired, the vehicle must pass a rigorous state inspection to ensure it is safe to drive. Crucially, retaining the car means it will be issued a salvage or rebuilt title, which explicitly identifies it as having been a total loss. This branded title inherently complicates efforts to insure the vehicle and significantly diminishes its resale value, making future disposition much tougher. The general advice from experts like Damico is often to let the insurance company total it and walk away, as “at least 90% of the time, you will be better off.”

9. **What to Expect from Your Total Loss Insurance Settlement**

When your car is declared a total loss, understanding the financial aspects of your insurance settlement is paramount. Typically, the insurance company will reimburse you for the vehicle’s Actual Cash Value (ACV) as it stood immediately before the incident occurred. It’s crucial to recognize that the ACV inherently accounts for depreciation, meaning factors like normal wear and tear, accumulated mileage, and any prior accidents are considered. As a result, the reimbursement amount you receive will almost invariably be less than what you originally paid for the car, even if it was a relatively recent purchase.

The process of determining this ACV involves a comprehensive assessment. An insurance adjuster will thoroughly examine the damage to your vehicle and meticulously price out all necessary repairs. The car’s value is established based on its fair market value just prior to the damage. If these estimated repair costs surpass the car’s fair market value—or the specific threshold set by state law or the insurer’s internal policies—the adjuster will then formally declare it a total loss and issue an official notice to that effect. This structured evaluation ensures that the settlement reflects the vehicle’s true depreciated worth.

For some policyholders, especially those with newer vehicles, there are specific coverages that can mitigate the financial impact of depreciation. If your insurance policy includes “new car replacement coverage” or similar endorsements, it might provide sufficient funds to purchase a brand-new version of your old car. However, these specialized coverages often come with an increased premium and typically apply only when the vehicle is relatively new, usually within its first one or two years of ownership. Additionally, Guaranteed Asset Protection (GAP) insurance, as previously discussed, is specifically designed to cover the difference between your car’s ACV payout and the outstanding balance on your loan or lease, preventing you from being upside down on your financing.

The timeline for receiving your insurance check after a total loss settlement can vary. While most insurance companies aim to issue payment within a few days of finalizing the actual cash value amount, the overall process can take longer. Some insurers might process payments within a short timeframe of just a few days, while others may take up to 30 days. It’s worth noting that certain states have regulations that impose limits on how long insurance companies have to process claims, which can help ensure that policyholders receive their payouts more promptly. Being prepared for a potential wait and maintaining consistent communication with your adjuster can help manage expectations.

Read more about: Protecting Your Peace of Mind: AARP’s Essential Guide for Older Adults to Spot and Prevent Financial Scams

10. **Strategies for Negotiating a Fair Total Loss Settlement**

Receiving a settlement offer for a totaled car can often feel underwhelming, leading many policyholders to wonder if they have to accept the initial amount. It is a critical consumer right to understand that you are not obligated to accept the insurance company’s first payout offer. If you genuinely believe that the insurer’s assessment of your car’s actual cash value (ACV) is unjustly low, you possess the right to dispute the offer and actively negotiate for a more equitable payout. This negotiation process requires preparation and a clear strategy to present your case effectively.

To build a strong counteroffer, securing an independent valuation is often the most impactful first step. You can obtain a professional appraisal of your vehicle’s value from an independent expert, which provides an objective assessment of its worth before the accident. Simultaneously, diligently gather documents that support your car’s book value at the time of the crash. Resources like Kelley Blue Book are invaluable for this, offering widely recognized valuations. Furthermore, conduct thorough research on prices for comparable vehicles currently selling in your local market. This comprehensive data will form the backbone of your argument, demonstrating that your vehicle was worth more than the insurer’s initial offer.

Once you have compiled this compelling evidence, formally submit your counteroffer along with all supporting background documents to the insurance company. If, despite your efforts, the insurance company remains unyielding and refuses to budge on their offer, there are additional avenues you can pursue. A practical next step is to file a formal complaint with the department in your state that regulates insurance companies. This action can sometimes prompt insurers to re-evaluate their stance, as they are beholden to state oversight. As a last resort, if all else fails and you feel your rights are being disregarded, you have the option to hire an attorney specializing in insurance claims and file a lawsuit against the insurer.

It is entirely natural to develop an emotional attachment to your vehicle and consequently feel that its worth is greater than the financial figures presented by an insurer. However, in the realm of insurance claims, objective data is paramount. As the context emphasizes, “numbers don’t lie.” While your personal sentiment is valid, for the insurance company to seriously consider your counteroffer, you must provide concrete, verifiable evidence. Your assessment must clearly articulate and substantiate precisely why your car’s value surpasses the amount the insurer is offering, moving beyond subjective feelings to present a fact-based argument.

Read more about: Your Blueprint to Bargain: Smart Negotiation Strategies for Thousands in Savings on Your Next Car and Dealer-Installed Upgrades

11. **Who Receives the Insurance Check When a Car is Totaled?**

When an insurance company declares your car a total loss and issues a settlement, a common question arises regarding the recipient of the insurance check. The destination of this payment is not always straightforward and depends entirely on the financial ownership status of your vehicle—specifically, whether you own the car outright, have an outstanding loan, or are currently leasing it. Understanding these distinctions is crucial for anticipating how your settlement funds will be disbursed and what steps you might need to take.

If you are fortunate enough to own your car outright, meaning there is no outstanding loan or lease attached to the vehicle, the process is quite simple. In this scenario, the insurance company will issue the settlement check directly to you. This provides you with the immediate funds to use as you deem fit, whether for a down payment on a new vehicle or for other purposes. This direct payment system underscores the straightforward nature of ownership when no third-party financial institution is involved.

However, the situation becomes more nuanced if you have financed the purchase of your car and an outstanding loan exists. In such cases, the insurance check will most likely be sent directly to your lender, as they hold the primary financial interest in the vehicle. Alternatively, the check may be issued to both you and the lender jointly. If this occurs, you will typically need to endorse the check yourself and then forward it to your lender. The lender will then apply the funds to pay off the remaining balance of your loan and will subsequently send you any surplus amount that remains after the loan has been fully satisfied.

Similarly, if you are leasing your vehicle, the insurance payout for a total loss will not come directly to you. The leasing company is the legal owner of the vehicle, and therefore, the insurance funds are disbursed to them. As with a financed vehicle, the check will either be sent directly to the leasing company, or it may be a joint check requiring your endorsement before being sent to the leasing company. The leasing company will then apply the funds to settle the lease agreement, and any remaining balance that might be due to you, or any shortfall you might still owe, will be addressed according to your lease contract.

12. **Maximizing Your Compensation for a Totaled Car**

Securing the highest possible payout for your totaled vehicle requires a proactive approach focused on clearly communicating its true value to your insurer. The goal is to ensure the insurance company comprehensively understands all the factors that contribute to your car’s worth, moving beyond standard book values to account for its unique attributes and market position. This effort can significantly impact the final settlement amount you receive, potentially providing you with greater financial leverage for your next vehicle purchase.

One of the most effective strategies to substantiate your car’s value is to gather written quotes from local car dealerships. These professionals are intimately familiar with the used-car market and can provide an expert assessment of what a vehicle of your specific make, model, and year, in its pre-accident condition, would realistically command on the open market. These written valuations serve as compelling evidence, offering real-world market data that can be difficult for an insurer to dismiss. They reflect what a “willing buyer and a willing seller” would agree upon, given reasonable knowledge of the relevant facts.

Beyond general market value, it is essential to meticulously remind your insurer about any special features, custom parts, or significant upgrades your vehicle possessed. These additions, which may not be fully captured in standard valuation guides, can substantially boost your car’s overall appeal and, consequently, its fair market value. Examples include aftermarket navigation systems, premium sound installations, high-quality wheel upgrades, or any recent, major mechanical replacements that enhance its condition. Providing documentation, such as receipts for these enhancements, can further strengthen your claim.

Timing is key when presenting this crucial information. It is advisable to compile and present all your supporting documentation, including dealer quotes and details of upgrades, either before the insurance adjuster conducts their initial assessment or immediately upon receiving a settlement amount that you feel is insufficient. By proactively equipping your insurer with this detailed evidence, you are not only demonstrating your preparedness but also providing them with the necessary data points to make a more accurate and, ideally, higher valuation of your totaled vehicle from the outset.

Read more about: The Road to 100,000+ Miles: Essential Lessons from Long-Term Single-Car Ownership

13. **The Significant Implications of a Salvage or Rebuilt Title**

When a car is declared a total loss, the future of its title undergoes a significant transformation, carrying substantial implications for its ownership, insurability, and resale value. Typically, once the insurance company has settled the claim, the title of the totaled vehicle is transferred to them. The insurer then has the option to sell the vehicle for its salvage value. If the car is beyond repair or no longer drivable, it may be dismantled and its parts sold. However, if the vehicle is still drivable or reparable, its title is often branded as “salvage,” a permanent mark indicating its total loss history.

Should you decide to keep your totaled car, as discussed previously, a similar change will occur to its title. Regardless of whether you plan to repair it or not, the vehicle will be issued a salvage title. This distinct branding immediately complicates the process of obtaining future insurance coverage. As Josh Damico explains, “Some insurance companies only insure salvaged or rebuilt-titled vehicles for liability only.” This is primarily because “it’s difficult to assess the current condition of the vehicle” after a total loss, making comprehensive or collision coverage a much higher risk for insurers. Consequently, your coverage options will be severely limited, offering only minimal protection.

If you opt to repair a totaled vehicle that you have retained and intend to drive it on public roads, you will need to navigate a specific pathway to achieve legal roadworthiness. The repairs must be completed to a safe and functional standard, and the car must then successfully pass a rigorous state inspection. Following this, you will need to apply for a rebuilt title. This type of title identifies the car as having originally been a total loss but subsequently repaired and inspected to meet safety standards. The process ensures that vehicles with a history of severe damage are thoroughly vetted before returning to the road.

The long-term repercussions of a salvage or rebuilt title are considerable. Beyond the challenges of securing adequate insurance, the vehicle’s resale value will be significantly diminished. Buyers are often wary of cars with such titles due to concerns about hidden damages, safety, and potential difficulties with future insurance. As the context notes, “A salvage or rebuilt title will make insuring and eventually disposing of the vehicle tougher.” Even if the damage was purely cosmetic, the branded title remains, impacting its market perception and liquidity. Understanding these implications is vital before making the decision to keep a totaled car.

Read more about: The Ultimate 12-Step Guide to Inspecting a Used Heavy-Duty Truck for Frame Damage

Navigating the aftermath of a totaled car can feel overwhelming, a complex journey filled with unfamiliar terms and critical decisions. However, armed with the comprehensive knowledge presented throughout this guide, you, the consumer, are now better equipped to face this challenge. From understanding how an insurer determines a total loss to confidently negotiating your settlement and exploring options for your vehicle’s future, preparedness is your greatest asset. As the experts suggest, knowing what’s involved, how to file your claim, and conducting thorough research ensures you are ready for this unfortunate circumstance and can successfully navigate the entire process, securing the best possible outcome for your situation.