Car insurance is an essential, often mandatory, part of vehicle ownership, providing a crucial safety net against the unexpected. Yet, for many drivers, the cost of this protection remains a mystery, varying wildly not just from person to person but, perhaps most dramatically, from state to state. Understanding these disparities is key to becoming a more informed consumer and potentially finding more budget-friendly policies. The national average cost for full coverage car insurance stands at $2,126 per year, but this figure masks a complex tapestry of state-specific influences that can see premiums soar or dip significantly.

From the bustling highways of California to the tranquil roads of Vermont, the price tag attached to auto insurance coverage reflects a myriad of local conditions and regulatory frameworks. What might seem like an arbitrary difference in cost is, in fact, a calculated response by insurers to the unique risk profiles presented by each state. These risks encompass everything from the frequency of natural disasters to the very laws governing how claims are processed after an accident, creating a dynamic environment where no two states are exactly alike when it comes to car insurance.

As savvy drivers, dissecting these factors is not just an academic exercise; it’s a practical step towards making better financial decisions. By shedding light on the fundamental reasons behind state-to-state variations, we can better appreciate why Louisiana drivers face some of the highest costs while those in Vermont enjoy the lowest. This comprehensive look at the foundational pillars of car insurance costs will empower you with knowledge to navigate the market more effectively, regardless of where your journey takes you.

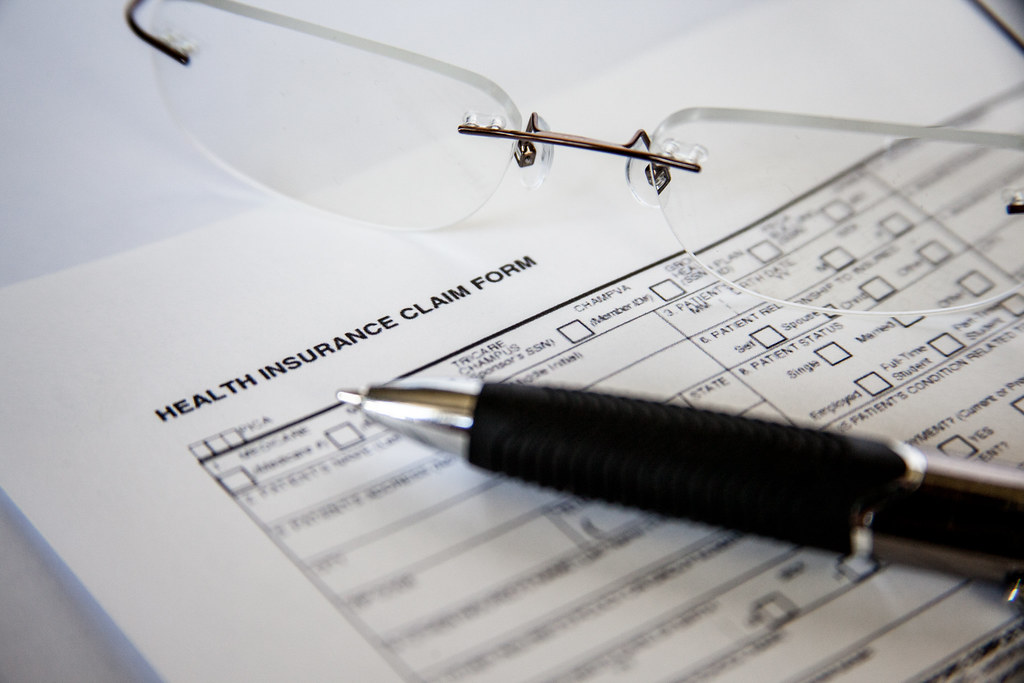

1. **State Minimum Coverage Requirements**Each state has its own specific set of car insurance laws and requirements, and these mandates fundamentally influence the cost of policies. Some states, for instance, demand only liability coverage, which covers damages you might cause to others. Other states extend these requirements significantly, mandating additional coverages like personal injury protection (PIP) or uninsured/underinsured motorist (UM/UIM) coverage.

These additional requirements directly translate to higher premiums. For example, as Lauren McKenzie, an insurance broker at A Plus Insurance, notes, “South Carolina requires drivers to have uninsured/underinsured motorist bodily injury protection and property damage as a minimum requirement on their auto insurance policy, whereas many states offer that coverage but don’t require it.” This additional layer of protection, while beneficial for drivers, comes with an associated price that increases the total premium for everyone in the state.

Furthermore, coverage limits can also change, impacting costs. California, for instance, increased its minimum car insurance coverage limits as of January 1, 2025. Drivers there must now carry a minimum of 30/60/15 coverage, which means $30,000 for bodily injury liability per person, $60,000 per accident in bodily injury liability, and $15,000 in property damage liability coverage. Such increases in minimum requirements naturally push up the base cost of insurance, affecting all drivers within the state.

Read more about: Consumer Alert: 13 Essential Safeguards Against the Hidden Dangers of Buying a Car Sight Unseen Online

2. **Regional Risk Factors (Theft, Vandalism, Accidents)**The specific geographic location, right down to the ZIP code, plays a significant role in determining car insurance rates due to varying levels of risk. Insurers assess the likelihood of claims by analyzing data related to car theft, vandalism, and the frequency of collisions within a particular area. A region with higher rates of such incidents will inevitably face higher insurance costs for its residents.

This principle means that even within a state, your specific city or neighborhood can drastically alter your premium. As Mark Friedlander, director of corporate communications for the Insurance Information Institute, explains, “Insurers determine rates by the city you live in and even your specific ZIP code. Traffic volume, accident frequency and severity, as well as theft and vandalism data, vary in every city throughout every state.” Therefore, a high crime rate or frequent accidents in your vicinity directly contributes to elevated car insurance prices.

Living in an area prone to such risks effectively increases the statistical probability that an insurer will have to pay out a claim. To offset this heightened risk, insurance companies adjust premiums accordingly. It’s a direct reflection of local safety and traffic conditions, making it one of the most granular factors influencing your individual and statewide car insurance costs.

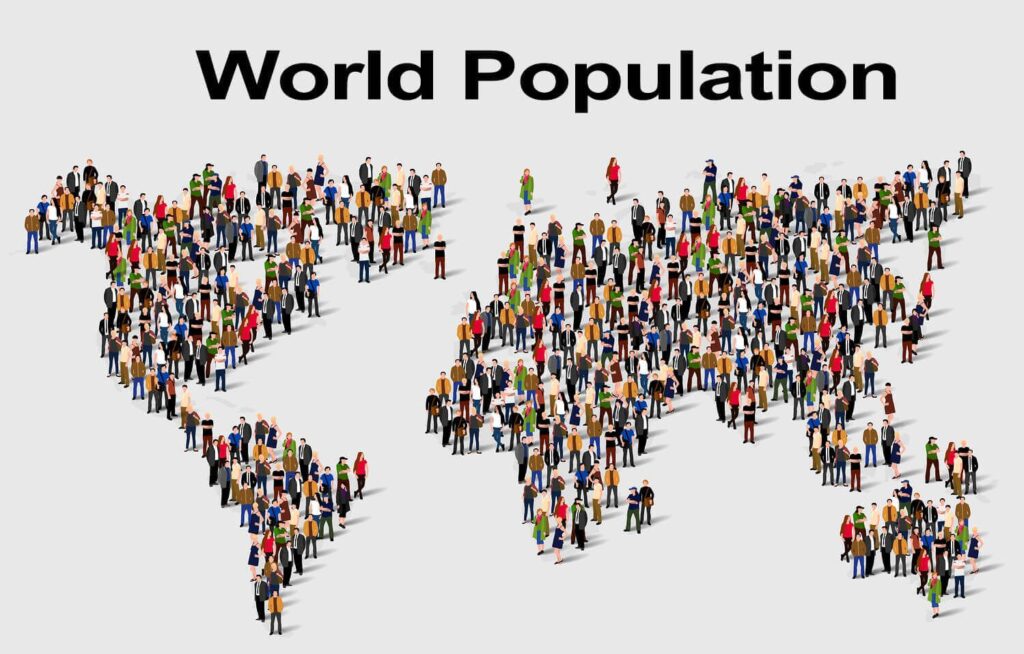

3. **Impact of Population Density and Urbanization**Population density is another crucial factor that heavily influences car insurance rates, creating a clear disparity between urban and rural areas. Densely populated states and major metropolitan areas generally experience higher rates of car accidents and claims due to increased traffic volume and congestion. This heightened activity on the roads leads to a greater frequency of incidents, driving up insurance costs for everyone in those areas.

Consider the states with high population density, such as New Jersey (ranking second in the U.S. Census), Delaware (eighth), New York (ninth), Florida (10th), and California (13th). These states also tend to appear on lists of the most expensive states for car insurance. The sheer number of vehicles and drivers in close proximity increases the statistical likelihood of collisions, making insurance more costly.

Conversely, drivers in more sparsely populated states like Idaho and North Dakota typically pay less for coverage. With fewer cars on the road and less congestion, the chances of accidents are reduced, leading to fewer claims and, consequently, lower premiums. This demonstrates a clear correlation: where you live, and how many people and cars are around you, profoundly shapes your car insurance bill.

Read more about: Decoding the USA: An Engineering Perspective on America’s Foundational Systems

4. **“No-Fault” vs. “Tort” State Laws**The legal framework that governs accident claims in a state—specifically whether it operates under “no-fault” or “tort” laws—has a significant impact on car insurance rates. Most states fall into one of these two categories, and the distinction fundamentally alters how insurance payouts are handled after an accident. This difference can lead to substantial variations in overall costs for drivers.

No-fault states generally experience higher car insurance rates. In these states, after an accident, each party typically files a claim with their own car insurance to cover medical expenses, regardless of who caused the crash. Drivers in no-fault states are usually required to carry Personal Injury Protection (PIP) coverage to help cover these medical costs, which adds to the premium. The system limits the ability to sue the other driver, except in cases of severe injury or significant damage, but often leads to higher instances of fraud, further pushing up costs.

Conversely, tort states, also known as at-fault states, place responsibility for covering damages and injuries on the driver found to be at fault in an accident. In this system, the at-fault driver’s insurance company pays for the damages and medical costs of others involved in the accident. This allows the injured party to sue the at-fault driver for compensation beyond what insurance covers. While the specifics vary, the direct accountability in tort states can sometimes lead to different pricing dynamics compared to the broader coverage requirements in no-fault systems. Florida, Michigan, and New York are examples of no-fault states often cited as having higher rates due to these laws and associated fraud.

5. **State Litigiousness and Lawsuit Frequency**Beyond the specific framework of no-fault or tort laws, the general legal climate and the propensity for lawsuits within a state can significantly inflate car insurance costs. States known for being highly litigious tend to see higher average premiums, as claims dealt with in court can result in larger settlements and drive up expenses for all drivers in that state.

Louisiana stands out as a prime example of a litigious state, consistently showing a higher-than-average number of car insurance lawsuits. New York is also frequently identified as highly litigious. When claims escalate to court proceedings, the potential for significant payouts increases, and insurance companies factor this risk into the rates they charge across the board. This is a direct consequence of the legal environment in which they operate.

These increased costs are not limited to the individuals directly involved in lawsuits. Instead, they are distributed among all insured drivers in the state, as insurers adjust their pricing strategies to maintain profitability and cover the higher financial risks. Therefore, a state’s legal culture can be a powerful, if indirect, driver of car insurance premiums.

6. **Prevalence of Uninsured Motorists**One often-overlooked factor that significantly impacts car insurance rates is the percentage of uninsured drivers on a state’s roads. When a substantial portion of drivers operates without insurance, it creates a heightened risk for everyone else, as there’s a greater chance that damages from an accident will not be covered by the at-fault party’s policy. This burden ultimately shifts to insured drivers.

Florida, for instance, is cited as having one of the highest uninsured motorist rates in the United States, at 20.4%. This high percentage contributes significantly to the state’s elevated insurance premiums. When a state has many uninsured drivers, insurance companies face a higher likelihood of paying out claims for incidents where the other party lacks coverage, often through the uninsured/underinsured motorist (UM/UIM) coverage that many drivers carry or are required to have.

To compensate for this added risk and the potential costs associated with it, insurers must charge higher rates to all policyholders. This ensures that funds are available to cover incidents involving uninsured drivers, making the prevalence of uninsured motorists a collective financial challenge that impacts the cost of insurance for every compliant driver.

Read more about: New York’s War on ‘Ghost Cars’ Marks 100 Operations: Unveiling Strategies, Successes, and Public Safety Wins Against Toll Evaders

7. **Severity of Local Weather Events**Natural disasters and severe weather events pose a substantial risk to vehicles and, consequently, have a pronounced effect on car insurance rates. States that are particularly prone to extreme weather patterns often see higher premiums due to the increased frequency and severity of claims related to weather damage. This is a tangible factor directly linked to geographic location and climate.

Florida and Louisiana are prime examples, as they are especially vulnerable to hurricanes. These powerful storms can cause widespread and substantial damage to cars, leading to a surge in insurance claims in a short period. The sheer volume and cost of these payouts force insurance companies to reassess their risk models and adjust their rates upward to cover future potential losses.

According to Geoff Cudd, a consumer advocate, states with milder weather and more rural areas often enjoy cheaper car insurance rates because there’s “less chance of accidents and weather-related claims.” This highlights the direct correlation between a state’s susceptibility to severe weather and the premiums its drivers must pay. It’s a powerful reminder that Mother Nature, in her fury, can have a very real impact on your wallet.

Navigating the complexities of car insurance requires a deep understanding of not just the foundational state-level factors, but also the dynamic influences that constantly reshape rates and the proactive strategies consumers can employ. This second section delves into these evolving trends, broader economic impacts, and practical steps drivers can take to effectively manage their insurance expenses, including a closer look at vehicle-specific considerations like transmission type. By understanding these additional layers, drivers can move beyond merely reacting to premium changes and instead strategically influence their financial outcomes.

Read more about: The Silent Saboteurs: Why Your Semi-Trailers Are Leaking Days Before They Hit the Road

8. **Overall Vehicle Repair and Medical Expense Costs**One of the most direct forces pushing car insurance rates upward is the escalating cost of repairing vehicles and providing medical care after accidents. These expenses are fundamental components of an insurer’s payout calculations, meaning that states or regions with higher average repair and medical costs will inevitably see higher premiums. It’s a clear economic principle: as the cost of covering claims rises, so too does the price of the policy.

Modern vehicles, while safer and more efficient, are also significantly more complex to repair. Advanced sensors, sophisticated computer systems, and specialized materials mean that even a minor fender-bender can necessitate expensive parts and highly skilled labor. This technological advancement, coupled with general inflation in parts and labor, means that the average cost of fixing a damaged car continues to climb, directly impacting insurers’ financial outlays.

Similarly, the cost of medical care varies considerably across different states and even within regions. In areas where healthcare services, emergency treatments, and rehabilitation are more expensive, the personal injury protection (PIP) or bodily injury liability portions of car insurance claims will naturally be higher. Insurers must factor these regional medical cost disparities into their pricing models, leading to higher premiums for drivers in states with elevated healthcare expenses.

Ultimately, these combined factors create a challenging environment for both insurers and policyholders. As long as the trajectory of vehicle repair complexity and medical care inflation continues upward, it will exert consistent pressure on car insurance rates, requiring consumers to be ever more diligent in seeking out value.

Read more about: The Unexpected Urban Conundrum: Why Owning a Car in the City Can Become a Significant Liability

9. **Market Competition Among Insurers**The level of market competition within a state’s insurance industry is a powerful, yet often underestimated, determinant of car insurance rates. A state with a vibrant and competitive landscape, where numerous national and regional insurance companies actively vie for customers, typically presents more favorable pricing opportunities for drivers. This dynamic ensures that insurers are incentivized to keep their rates competitive and offer compelling deals.

In states where many insurance providers are battling for market share, the pressure to attract and retain customers drives down premiums. Companies are more likely to offer a wider array of discounts, promotional rates, and flexible policy options, all designed to make their offerings stand out. This intense competition empowers consumers, providing them with more choices and leverage to negotiate for better terms.

Conversely, states with fewer insurance carriers or less aggressive competition may find their residents facing higher average premiums. Without the constant push to outdo rivals, insurers in these markets have less incentive to lower rates or introduce new savings opportunities. This can lead to a less dynamic pricing environment, where the consumer’s ability to shop for the best deal is somewhat curtailed.

Therefore, active comparison shopping becomes an even more critical strategy in any state, regardless of its overall competitiveness. The context highlights that “It’s great if your state has a competitive auto insurance market where many national and regional car insurance companies are competing for your businesses. You can shop around for the best car insurance at the most budget-friendly price.” This underscores the consumer’s role in leveraging market forces to their advantage.

Read more about: The 15 Most Expensive Cars to Insure Right Now: Essential Insights for Savvy Budget Planners from Brokers and Claim Records

10. **Recent Trends in Rate Increases**Car insurance rates are not static; they are subject to ongoing fluctuations influenced by broader economic and industry-specific trends. In recent years, the trajectory has been distinctly upward, impacting a significant majority of states across the nation. Understanding this overall trend and its drivers is crucial for anticipating future costs and making informed financial decisions.

According to S&P Global, there has been a notable acceleration in rate increases since 2018. The data reveals a substantial shift, with “In 2023, 43 states and the District of Columbia saw an effective rate change exceeding 10%, resulting in a nationwide effective increase of 14.0% for the year.” This represents a significant jump compared to 2022, when only 26 states experienced double-digit increases, leading to a national average increase of 11.4%.

These increases were not uniform across all states. Some experienced particularly sharp spikes, while others saw more moderate adjustments. “Nevada recorded the highest effective rate increase in 2023 at 28.3%, followed by Minnesota at 19.8% and Washington at 19.7%.” In contrast, states like “Hawaii (3.8%), North Carolina (4.3%), and Colorado (4.5%)” experienced the lowest average effective increases, demonstrating regional variations even within a national trend.

Experts attribute these rising rates to a confluence of factors. Mark Friedlander, director of corporate communications for the Insurance Information Institute, explains, “With more drivers on the road, higher inflation and replacement part costs continuing to escalate, this loss trend in the insurance industry is expected to continue, leading to rate increases from national and regional insurers.” These systemic pressures indicate that the upward trend in car insurance costs is likely to persist in the near future.

Read more about: Understanding the Forces Behind Soaring Fuel Costs: An In-Depth Analysis of Key Drivers and Regional Impacts Across the U.S.

11. **Emerging Pricing Factors (Telematics, Credit Scores, Gender)**The landscape of car insurance pricing is continually evolving, with insurers exploring and adopting new methods to assess risk and calculate premiums. Beyond traditional factors like driving history and vehicle type, emerging data-driven approaches and shifts in regulatory policy are beginning to redefine how rates are determined, introducing both opportunities and potential complexities for consumers.

One significant innovation is the rise of telematics programs. These technologies, which often involve in-car devices or smartphone apps, monitor actual driving behavior, collecting data on factors such as speed, braking, mileage, and even the time of day a vehicle is driven. As Scott Distasio, a Florida-based civil trial lawyer, notes, “One emerging trend is the adoption of telematics programs, allowing insurers to base premiums on actual driving behavior.” While offering the potential for more personalized and potentially lower rates for safe drivers, these programs also raise valid concerns about data privacy, as Distasio cautions.

Another factor that has historically influenced premiums in some states is the use of credit-based insurance scores. Insurers have utilized these scores as a predictive tool for a driver’s likelihood of filing claims. However, this practice is facing increasing scrutiny, with “some states are considering prohibiting the use of credit-based insurance scores that could dramatically change how premiums are calculated.” Such legislative changes could significantly alter how a driver’s financial history impacts their insurance costs.

Furthermore, the industry is seeing a crackdown on gender-based pricing in certain regions. Andrew Lokenauth, founder of Be Fluent In Finance, highlights, “Some states are cracking down on gender-based pricing.” This movement aims to eliminate pricing disparities based solely on gender, which could lead to a recalibration of rates for both male and female drivers, ensuring a more equitable approach to premium calculation. These evolving factors underscore the dynamic nature of insurance pricing and the ongoing quest for more precise risk assessment.

12. **Driver Behavior and Record**While many factors influencing car insurance rates are external, such as state laws or weather patterns, a driver’s personal behavior and their historical driving record remain among the most potent determinants of their individual premium. This is an area where policyholders have direct and significant control, with safe driving habits translating into tangible financial benefits.

Insurers rely heavily on a driver’s record as a primary indicator of future risk. A clean driving history, free from accidents, speeding tickets, or other moving violations, signals to an insurance company that the individual is a responsible and low-risk policyholder. This favorable risk profile typically translates directly into lower insurance premiums, rewarding consistent adherence to traffic laws and cautious driving practices.

Conversely, a history of multiple claims, traffic citations, or serious violations like DUIs will significantly increase insurance costs. Each incident on a driving record serves as evidence of heightened risk, prompting insurers to adjust premiums upwards to compensate for the greater likelihood of future payouts. These surcharges can be substantial and remain on a driver’s record for several years, reinforcing the financial consequences of risky behavior.

The power of a good driving record as a money-saving tool cannot be overstated. As Scott Distasio advises, “Simple actions like regularly checking credit reports, enrolling in defensive driving courses or leveraging multi-policy discounts can yield significant savings.” He further notes that “Maintaining a clean driving record… could help you keep your costs low for your state.” This underscores that responsible driving is not only about safety but also about prudent financial management.

Read more about: The Affordable New Truck That Is Outselling the Ford F-150: Market Dynamics and Unprecedented Value

13. **Vehicle Characteristics Beyond Location (including transmission type)**Beyond the geographical and demographic factors, the specific characteristics of the vehicle itself play a substantial role in determining insurance premiums. These attributes encompass everything from the car’s make, model, and age to its safety features, engine size, and surprisingly, even its transmission type. Insurers assess these details to gauge the potential cost of repairs, the likelihood of theft, and the overall risk associated with the vehicle.

Focusing on the transmission, an often-overlooked detail, can reveal subtle impacts on insurance rates. Mark Romero, in an article discussing transmission types, notes, “Cars with manual transmissions generally are faster than those with automatic transmissions. They are also less complex in equipment and less expensive to maintain.” This insight provides a direct connection to insurance costs: vehicles that are “less complex in equipment and less expensive to maintain” present a lower financial risk to insurers in the event of a collision or mechanical issue.

The lower complexity of manual transmissions implies that potential repairs might be less costly and require less specialized diagnostic equipment compared to the intricate electronic and hydraulic systems found in many automatic transmissions. This reduced repair cost directly benefits insurers, allowing them to offer more favorable rates for vehicles equipped with manual gearboxes. While the debate over which transmission is “better” often comes down to personal preference or driving experience, this maintenance cost difference holds a practical financial implication for insurance.

Furthermore, while not explicitly stated as an insurance factor in the context, the “less common” nature of manual transmissions could potentially influence theft rates. If fewer manual cars are on the road, they might be less frequently targeted by thieves looking for easily disposable parts or vehicles, though this remains an inference. The primary, tangible advantage from an insurance perspective stems from their inherent simplicity and lower maintenance expense, which translates into a reduced financial burden for claims related to damage or upkeep.

14. **Strategic Comparison Shopping and Discount Utilization**While many elements influencing car insurance rates may seem beyond an individual’s control, drivers possess significant power to mitigate costs through strategic comparison shopping and diligent utilization of available discounts. This proactive approach is arguably the most effective tool in a consumer’s arsenal for securing the most budget-friendly policy. It transforms the often-daunting task of insurance selection into an opportunity for substantial savings.

The consensus among experts is clear: consistent comparison shopping is paramount. James Brau, Joel C. Peterson Professor of Finance at Brigham Young University, advises, “To find the best car insurance rates in your state, start by comparing quotes from multiple insurers online, using comparison websites to review coverage options and discounts.” This sentiment is echoed by John Crist, founder of Prestizia Insurance, who emphatically states, “Don’t hesitate to shop around and compare quotes from different insurers — prices can vary significantly for the same level of coverage.”

This diligent practice should not be a one-time event but an ongoing process. The recommendation is to “comparison shop for quotes around renewal time—at least annually, but every six months if you really want to save.” Market conditions, insurer algorithms, and even your personal circumstances can change rapidly, meaning a policy that was competitive six months ago might no longer be the best value today. Regularly re-evaluating options ensures you’re always aligned with the most current and favorable rates.

Beyond comparing base quotes, actively seeking and applying for discounts is another crucial strategy. Scott Distasio points out that “Simple actions like regularly checking credit reports, enrolling in defensive driving courses or leveraging multi-policy discounts can yield significant savings.” This includes practical steps such as “insuring multiple vehicles through a single insurance company and bundling your policies.” Many insurers offer a myriad of discounts for everything from good student status to vehicle safety features, and inquiring about every possible saving opportunity can collectively shave a considerable amount off your premium.

Read more about: The Strategic Ascent of Dining Subscriptions: A New Era for Consumer Loyalty and Restaurant Economics

In essence, while the labyrinthine world of car insurance is shaped by numerous external forces, the informed consumer is not without agency. By understanding these influences, staying abreast of market trends, and most importantly, dedicating time to comparing options and claiming eligible discounts, drivers can navigate the complexities to secure a policy that offers both essential protection and exceptional value, regardless of their state or vehicle choice. This diligent approach ensures that you are not merely a passive recipient of insurance rates but an active participant in shaping your own financial future on the road.