Thinking about what happens to our finances after we pass away isn’t exactly a cheerful topic, but it’s an incredibly important one. For many, the idea of leaving behind a financial mess or burdening loved ones with debt is a significant concern. It’s a common misconception that all debt simply vanishes into thin air upon death, or, conversely, that surviving family members automatically inherit every bill. The truth, as often is the case with financial matters, is more nuanced and depends heavily on several factors, including the type of debt, state laws, and whether certain protections are in place.

The emotional toll of losing a loved one is profound enough without the added stress of navigating complex financial questions. Questions like “What happens to someone’s debt when they die? Do the family members have to pay it? Does it just disappear?” are incredibly common. Understanding these details ahead of time, through careful estate planning, can provide immense peace of mind and significantly ease the burden on those you leave behind. This article aims to clarify these often-confusing aspects, offering a clear, actionable guide to what truly happens to debt when someone dies in the US.

In this comprehensive guide, we’ll break down the complexities of debt after death, providing you with the essential knowledge to protect your loved ones and ensure your financial legacy is handled as you intend. We’ll explore how various types of debt are managed, identify situations where family members might become responsible, and highlight the critical steps you can take today to plan for tomorrow. Let’s shed some light on these important financial realities so you can approach the future with clarity and confidence.

1. **Understanding Debt After Death: The Basics**When someone dies, their debt doesn’t just disappear into thin air. Instead, a specific legal process kicks in to address these financial obligations. The primary entity responsible for a deceased person’s debt is their “estate.” The estate is essentially everything the person owned at the time of their death – this includes bank accounts, cars, homes, property, money, and personal belongings. It’s the sum total of their assets, which will be used to settle their liabilities.

This process of handling a deceased person’s estate and its debts is called probate. During probate, an executor (often a trusted person named in a will) is appointed to manage the estate. Their crucial role involves identifying all assets, notifying creditors, and ensuring that any outstanding debts are paid off using money or property from the estate. Only after these debts are satisfied can any remaining assets be distributed to the heirs – the family or other individuals named in the will. So, the fundamental rule is that the estate pays the debt, not the family, in most circumstances.

It’s a common relief for many to learn that, typically, family members are not personally responsible for paying the deceased person’s debts from their own pockets. This distinction is vital for peace of mind. However, this general rule comes with significant exceptions that we will delve into. The core principle remains: the assets left behind by the deceased are the first line of defense against outstanding obligations, aiming to settle financial affairs before any inheritance is passed on.

2. **When the Estate is Insolvent: More Debt Than Assets**What happens if the deceased person’s debts exceed the value of their assets? This unfortunate situation occurs when an estate is deemed “insolvent.” In such cases, there simply isn’t enough money or property within the estate to cover all the outstanding obligations. It’s a challenging scenario for both creditors and grieving families, but there’s a clear legal hierarchy for how it’s handled, which varies somewhat by state.

When an estate is insolvent, some debts may ultimately go unpaid. Creditors, the individuals or companies owed money, may not receive everything they are due. Importantly, in these situations, heirs usually don’t receive anything from the estate because all available assets must be used to settle debts. But again, unless a family member is legally responsible (like being a co-signer or joint account holder), they don’t have to pay the remaining debt from their own pocket.

The process for prioritizing debt repayment in an insolvent estate typically distinguishes between secured and unsecured debts. Secured debts (such as mortgages and car loans) are backed by specific assets, which are usually sold to pay off the loan or repossessed by the lender. Unsecured debts (credit cards, personal loans, medical bills and student loans) generally go unpaid if there’s no remaining money in the estate to cover it. In these cases, creditors will typically take a loss and write off the amount.

3. **Key Exceptions: When Family Members ARE Responsible**While the general rule is that family members are not personally responsible for a deceased person’s debt, there are several crucial exceptions that you absolutely need to be aware of. These exceptions can significantly alter the financial landscape for surviving loved ones and are often a source of stress and confusion if not understood in advance. Being informed about these scenarios can help you take protective measures or at least know what to expect.

One of the most common exceptions involves co-signed loans. If you co-signed a loan with the person who died, you are still 100% responsible for paying that loan. This applies to car loans, personal loans, and even some student loans. By co-signing, you legally agreed to make the payments if the primary borrower couldn’t, and death is a circumstance where they certainly cannot. The lender will pursue you for the full balance. Similarly, if you shared a credit card or bank account as a joint account holder, you may still owe the balance. Authorized users on a credit card, however, are typically not responsible for the debt, which is a key distinction to remember.

Another significant exception applies to surviving spouses in “community property states.” In these nine states—Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin—spouses are generally considered to share equal ownership of most assets acquired during the marriage, and also equal responsibility for debts taken on during the marriage. This means that if your spouse incurred debt during your marriage, even if only their name was on the account, you as the surviving spouse may be legally responsible for it. This can include private student loans or other obligations. It underscores the importance of understanding your state’s laws and openly discussing financial obligations with your spouse.

4. **Mortgage Debt After Death: What Happens to the Family Home?**For many families, the home is their largest asset and often carries the largest debt: a mortgage. Understanding what happens to mortgage debt when someone dies is critical, especially for surviving spouses or heirs who wish to keep the property. Mortgages are considered “secured debts,” meaning the loan is backed by collateral – in this case, the house itself. This distinction significantly impacts how they are handled compared to unsecured debts.

If the deceased person owned the home and had an outstanding mortgage, their estate becomes responsible for paying back the remaining debt. Because mortgages are secured, the lender has a strong claim. If the house is willed to someone, that heir will typically take over the mortgage payments if they want to keep the home. The lender may allow someone else (like a spouse or child) to take over the mortgage. As long as payments continue, the home can remain with the heir. However, if no one can pay, the house may be sold to pay off the loan.

What about situations involving married couples? If one spouse dies with an outstanding mortgage, the survivor usually takes over the mortgage, especially if they were a joint homeowner. But your spouse may have had the only name on the mortgage. If so, then they need to leave the home to you in their will. Whether you are a joint homeowner — or are set to inherit the home — you will be responsible for your spouse’s mortgage debt after they die. For unmarried individuals, if there’s no specific beneficiary named for the home in the will, your estate will pay out the debt that is left. If there aren’t enough funds in your estate to cover your mortgage debt, your lender is out of luck. They can’t squeeze blood from a turnip.

5. **Car Loans Post-Mortem: Repossession or Inheritance?**Here is another example of a secured debt. The lender can repossess the vehicle if the borrower doesn’t keep up with their monthly bills. If your spouse purchased a new vehicle shortly before passing on, odds are they left behind an auto loan. When a car owner dies with an outstanding auto loan, the situation can unfold in a few different ways, depending on who is involved and where they reside.

The most straightforward scenario is if an heir wishes to keep the car. The car can be returned, sold, or taken by the lender if payments can’t continue. The person’s estate can be used to pay off a car loan. Otherwise, whoever inherits the car in the deceased’s will can choose to either continue making the payments if they want to keep the car or sell it to pay off the loan. It’s crucial for the executor or surviving family members to communicate with the lender early to understand the options available and avoid penalties or repossession.

A significant factor determining responsibility for a deceased spouse’s car loan is whether you live in one of the nine community property states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. In these states, laws mandate that married couples split half of their assets and half of all debts. So, if your spouse financed a $20,000 vehicle during your marriage and dies owing a balance of $18,000, you could be responsible for $9,000 of that debt. Furthermore, regardless of your state, if you co-signed on your deceased spouse’s auto loan, then you are responsible for paying it back in full.

6. **Credit Card Debt: Who Pays the Tab?**Credit card debt is one of the most common types of debt, and its handling after death is a frequent concern. Unlike mortgages or car loans, credit card debt is generally “unsecured.” This means it’s not backed by any specific asset. When an individual who was the only account holder on the card passes away, the debt is theirs alone. Only the estate can be held liable to pay off the remaining balance. Once the estate is closed, credit card debts can’t pass to your heirs.

The estate’s executor has the responsibility to notify all credit card companies of the account holder’s death. This is a critical step because it allows the accounts to be closed, preventing any additional interest charges or potential fraudulent activity. The executor typically needs to send a registered, certified letter in writing, often accompanied by copies of the death certificate. It’s advisable for executors to obtain as many copies of the death certificate as possible for these notifications, as well as for informing the “Big Three” credit bureaus (Equifax, Experian, Transunion) to flag the credit report as “deceased,” which helps prevent identity theft and the opening of new fraudulent accounts.

For the most part, a surviving spouse is not responsible for their deceased spouse’s credit card debt if they were only an authorized user or if the account was solely in the deceased’s name. The debt rests with the estate. However, you could be on the hook in a few situations. One instance where you’re always going to be responsible for paying your spouse’s debt is when you are a joint account holder or cosigner on the credit card. Another is when they have outstanding credit card balances and live in a community property state. In these states, both partners in the marriage take 50/50 ownership of all assets and all debts. So, if your spouse dies, you inherit half of their debts along with half of their assets.

A joint account holder is jointly responsible for the debt. With cosigners, the cosigner accepts as much responsibility as the primary holder. In that sense, the credit card issuer can pursue the cosigner the same way they would the primary. If the primary account holder’s death leaves an active balance, the joint account holder and cosigner are responsible for paying it. The authorized user accepts zero legal obligation to the debt. The authorized user can walk away from the debt if the credit card holder passes while the two share an account. Just ensure you don’t try to make new charges to the account, especially after the executor informs the credit card company that the account holder has passed away. Using a deceased person’s credit card — even if authorized to do so — is considered fraud.

Navigating the complexities of debt after a loved one’s passing can feel overwhelming, but understanding the nuances of how different debts are handled is empowering. We’ll delve into specific, often confusing, types of debt and crucial planning strategies to safeguard your loved ones from potential financial burdens.

7. **Student Loans: Federal vs. Private Obligations**Student loan debt is a significant concern, and its fate after death depends heavily on whether the loans are federal or private. This distinction is crucial as rules for forgiveness and responsibility vary widely. Knowing the loan type provides immense clarity and peace of mind during an already difficult time for grieving families.

Good news often comes with federal student loans: those obtained through FAFSA from the Department of Education are typically discharged upon a borrower’s death. This compassionate policy extends to Parent PLUS Loans, which are also forgiven if either the student or the parent borrower dies. To initiate this process, the loan servicer simply requires documentation, such as a death certificate, allowing the debt to be canceled after a Death Discharge application is verified.

However, private student loans operate under different rules and are generally not forgiven upon death. These loans frequently require a cosigner, with a vast majority having one. If the primary borrower dies, the cosigner may find themselves solely responsible for repayment. It’s critical for cosigners to review the specific lending agreement or contact the lender directly, as policies can vary. Additionally, discharged Parent PLUS loans, though forgiven, might be considered taxable income by the IRS for the surviving parent, potentially leading to a tax burden unless an exemption applies.

8. **Medical Debt: A Lingering Concern for Estates**Medical debt can accumulate rapidly, adding a layer of financial complexity after a person’s death. Like other unsecured debts, medical bills are generally obligations of the deceased’s estate. The estate’s assets are used to pay off these bills before any remaining inheritance is distributed to heirs, but the process isn’t always straightforward.

The landscape of medical debt is often intricate, especially concerning state-specific regulations and programs like Medicaid. If the deceased received Medicaid services from age 55 until their death, the state might seek to recover those payments from the estate. This could involve a lien on the deceased’s house, diverting a portion of sale profits to cover medical costs, a significant surprise for surviving family members.

Given this complexity, especially regarding Medicaid recovery, consulting an attorney is highly advisable for surviving family members or executors. Medical debt laws vary significantly by state, and a legal professional can offer guidance on applicable nuances, helping to clarify what creditors can and cannot claim. This proactive step can prevent misunderstandings and undue financial strain.

9. **The Complications of Filial Responsibility Laws**While families are usually not personally responsible for a loved one’s debts, obscure exceptions like filial responsibility laws exist in almost 30 states. These laws can legally obligate adult children to cover certain long-term care costs for their parents if the parent’s estate cannot afford the bills. This means adult children might be pursued for repayment of nursing home or extensive hospital services after a parent’s passing.

Despite their existence, these laws are rarely enforced, but they do pose a potential risk. Cases exist where healthcare providers, like hospitals and nursing homes, have successfully sued adult children to recoup unpaid medical and care-related debts. Such actions can come as an unexpected shock to grieving families, especially if they were unaware of these statutes in their state of residence.

The enforceability of filial responsibility laws varies significantly based on state legislation, the financial situation of both the deceased parent’s estate and the adult child, and the specific circumstances of the care received. It’s a complex legal area where understanding your state’s laws and discussing potential responsibilities with legal counsel is critical, particularly if a parent is receiving or may soon need long-term care.

10. **Timeshares: An Unexpected Inheritance**For some, a timeshare is a vacation dream, but for heirs, it can unfortunately become a financial burden. When someone dies, their timeshare typically doesn’t just vanish; it becomes part of their estate due to common “perpetuity clauses” in contracts. This means the ownership and its ongoing obligations, such as annual maintenance fees and assessments, continue indefinitely.

These perpetual obligations dictate that the timeshare, along with its associated charges, can pass to heirs named in a will or by intestacy laws. While the immediate instinct might be to refuse such an inheritance, it’s not always simple. Timeshare companies can still make claims because the timeshare is part of the deceased’s estate and subject to the probate process, potentially holding the estate responsible for fees even if a beneficiary disclaims it.

This makes timeshares particularly tricky post-mortem, often creating a burden rather than a benefit for those left behind. Many financial experts advise avoiding timeshares precisely because they can become financial traps extending beyond one’s lifetime. Proactive planning, such as divesting a timeshare or clearly outlining its disposition in an estate plan, can spare loved ones significant hassle and expense.

11. **Protecting Your Legacy: Assets Safe from Creditors**While creditors have a legal right to claim against a deceased person’s estate, not all assets are fair game. Understanding which assets are protected can significantly influence your loved ones’ financial security. Creditors typically have a specific timeframe, usually three to six months, to submit claims against the estate, but certain assets bypass this process.

Certain valuable assets are generally off-limits to creditors because they often bypass the probate process entirely, flowing directly to designated beneficiaries. This is a critical distinction for estate planning. Foremost among these protected assets are life insurance benefits, provided a beneficiary is explicitly named on the policy. These payouts go directly to the named individual, remaining shielded from creditor claims against the estate.

Similarly, most retirement accounts, such as 401(k)s and IRAs, are protected if they have named beneficiaries. These funds are distributed directly to those beneficiaries and are typically not subject to estate creditor claims. Assets placed into a living trust also generally avoid probate and are therefore protected from creditors seeking repayment. The key is to keep all beneficiary designations meticulously up-to-date, as an outdated designation could leave these assets vulnerable to probate and creditors.

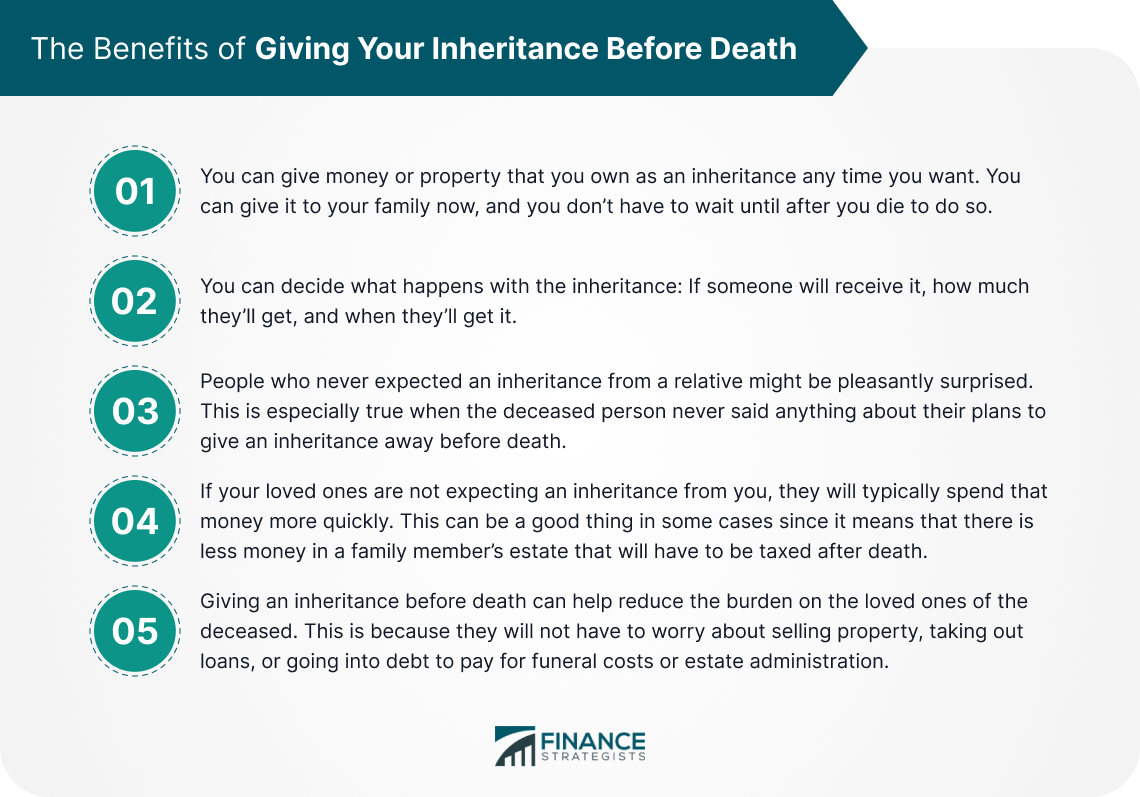

12. **The Power of Proactive Estate Planning**Contemplating mortality and debt isn’t pleasant, but proactive estate planning is the most impactful step to protect your loved ones. It’s a legal plan to manage your money, property, and responsibilities after you pass, ensuring your financial legacy is handled exactly as you intend, alleviating stress and confusion for your family.

A foundational element is a well-drafted will. A will clearly outlines who receives your assets and designates an executor to manage your estate through probate, providing a roadmap for distribution and debt settlement. This ensures your wishes are honored and someone trustworthy manages your affairs.

Beyond a will, establishing a trust can offer greater protection and efficiency, often avoiding probate altogether. Assets within a trust can be distributed to beneficiaries more quickly and privately, bypassing the public and potentially lengthy court proceedings that creditors typically interact with. This streamlines the management of assets and debts.

Life insurance also plays a pivotal role, acting as a crucial financial safety net. A well-chosen policy provides funds to pay off debts, cover funeral expenses, or maintain your family’s standard of living, offering crucial resources to navigate a difficult period with greater security.

Maintaining meticulous records of all debts, accounts, and important documents simplifies the executor’s job and reduces family headaches. Working with experienced professionals, like estate planning attorneys or financial advisors, ensures all critical details are covered, from state-specific laws to asset protection. This guidance is invaluable for clarity and confidence, allowing your loved ones to grieve without the added stress of financial uncertainty.

Read more about: Sydney Sweeney’s Surprising Financial Reality: How Her Off-Screen Ventures Outpace Hollywood Earnings

Understanding debt after death is more than a financial exercise; it’s an act of love and foresight. While daunting, equipping yourself and your family with this knowledge, coupled with thoughtful estate planning, ensures your legacy is one of security and peace, rather than unforeseen financial burdens. Taking proactive steps today truly protects those who matter most.