When the markets plunge, every second counts. Investors scramble to make quick decisions—buy, sell, hold—and they need their trading platforms to work flawlessly. Yet, this is precisely when many popular investing apps falter, exposing vulnerabilities at the most critical junctures. Users often face frustrating experiences, from frozen screens and agonizingly delayed order executions to critical login errors and even seemingly vanishing portfolios, costing them real money and severely undermining trust in platforms that frequently claim to be ‘built for everyone.’

A market crash isn’t merely a test of economic resilience; it also serves as an unforgiving stress test for the underlying financial technology that powers our digital investment lives. While some apps manage to hold steady, others unfortunately crack under pressure, revealing serious weaknesses in their infrastructure that can have profound implications for investor outcomes. This comprehensive analysis will delve into seven prominent investing applications that have demonstrated a concerning tendency to glitch when market conditions become exceptionally turbulent, leaving users in the lurch.

Whether you are an active day trader reliant on split-second decisions or a long-term investor seeking stability and timely information, understanding which tools might fail you when you need them most is paramount. In the dynamic world of finance, where information is power and execution is everything, staying informed about the operational integrity of your chosen platform is the crucial first step toward protecting your hard-earned capital and navigating market storms with confidence. Let’s explore the platforms that have struggled when the stakes are highest.

1. **Robinhood**Robinhood gained immense popularity through its commission-free trades and user-friendly interface, democratizing market access for many. However, its operational track record during intense market volatility has been notably checkered, raising significant questions about its reliability when investors need it most. A major outage in March 2020, during a historic rally after a sharp market drop, famously left users unable to execute trades at a crucial time.

Since then, Robinhood has experienced multiple hiccups during volatile days, including frustrating delays in order execution and intermittent account access issues. These outages have fueled widespread outrage and even lawsuits, alleging damages from lost trading opportunities during critical market shifts. Such incidents highlight the tangible financial consequences when technological infrastructure falters.

Despite public commitments to bolster its systems, reliability remains a persistent concern when volatility spikes dramatically. The platform’s simplified experience often overshadows inherent risks associated with its performance under pressure. Investors using Robinhood should remain vigilant regarding its capabilities during high-stress market conditions.

Read more about: Beyond the Limelight: 14 A-List Celebrities Forging New Legacies as Tech and Business Investors

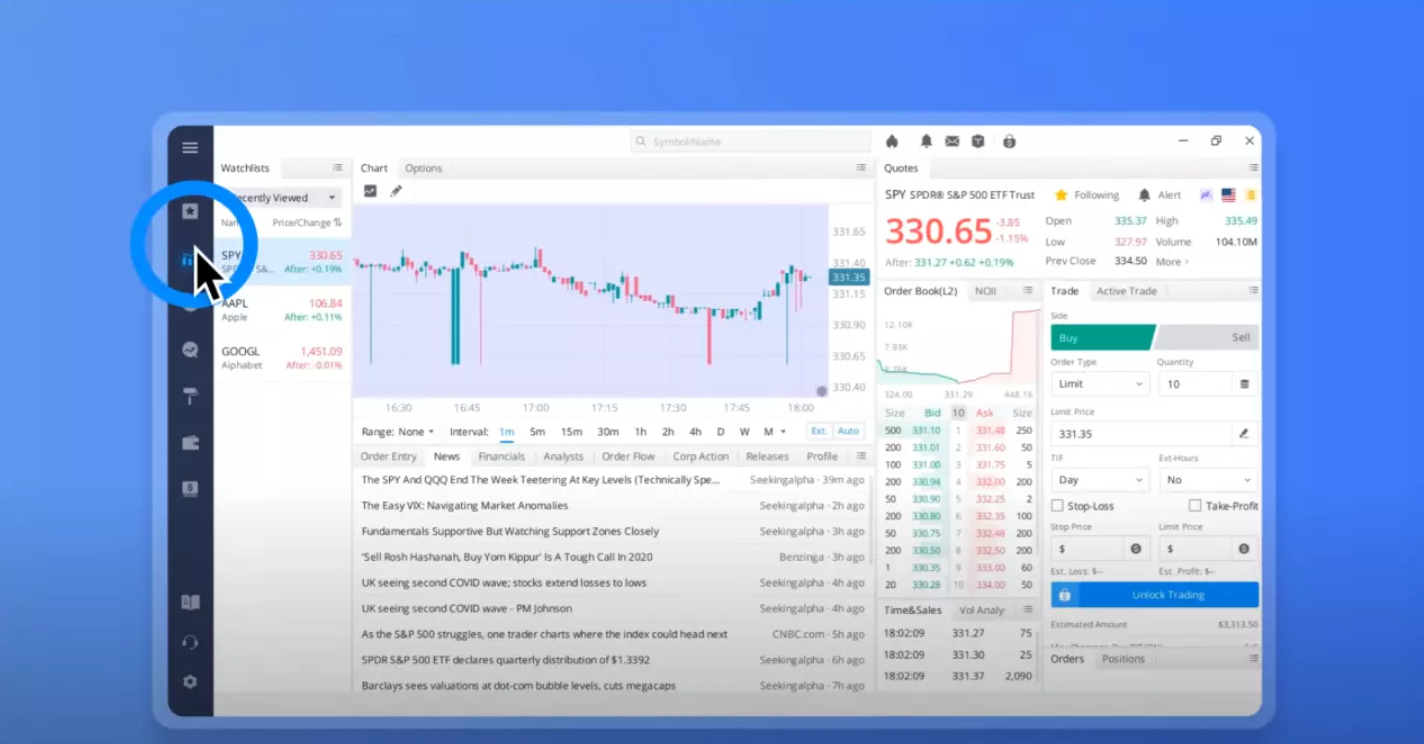

2. **Webull**Often positioned as a more advanced alternative to platforms like Robinhood, Webull appeals to users seeking deeper analytical tools and broader trading options. Yet, even this platform has not been immune to significant technological challenges during high market traffic and rapid price movements. During events like the GameStop frenzy, users reported app crashes, delayed data, and critical execution problems that hindered trading.

Market surges place immense strain on trading platforms, often causing discernible latency issues on Webull that impact real-time decision-making. This lag can be particularly detrimental for options traders, where even a five-second delay can dictate the outcome of a trade, revealing the platform’s struggle to maintain peak performance under stress. The promise of advanced capabilities diminishes when the system cannot keep pace with market dynamics.

While Webull continues to expand, its backend infrastructure appears to lag behind its ambitious growth strategy. This disparity creates bottlenecks during peak periods, exposing a gap between its sophisticated offerings and actual operational resilience. Serious traders require consistent, instantaneous performance, and Webull’s recurrent issues suggest a need for more robust systemic improvements in volatile environments.

3. **E*TRADE**E*TRADE, owned by Morgan Stanley, holds a strong reputation for robust tools and comprehensive investment options, appealing to seasoned traders. Yet, even this heavyweight has stumbled during market chaos. High-volume trading days have been marred by log-in failures, slow dashboards, and delayed order status updates.

These technical impediments particularly frustrate active traders relying on ETRADE Pro for precision. When systems slow or fail to update in real-time, it compromises their ability to react quickly, potentially leading to missed opportunities or exacerbated losses. The expectation of reliability from such an established institution makes these recurring issues especially frustrating for its clientele.

Despite E*TRADE’s claims of continuous backend improvements, glitches persist during critical market turbulence. This pattern suggests that while enhancements are made, the platform’s capacity to handle extreme volatility consistently remains inconsistent. For investors seeking unwavering dependability, E*TRADE’s occasional reliability issues when volatility spikes beyond normal levels present a tangible concern, challenging its image as an unshakeable market leader.

4. **Charles Schwab**Charles Schwab stands as another pillar in the financial industry, respected for its robust backend systems and strong performance under normal market conditions. Its commitment to investor education has cemented its position. Nevertheless, even Schwab has shown signs of buckling under extreme market pressure, revealing vulnerabilities when the financial landscape turns tumultuous.

During abrupt market corrections, Schwab users have encountered various issues disrupting their trading and portfolio management. These include login timeouts, preventing immediate access, and noticeable delays in quote refreshes, hindering real-time data for informed decisions. Such occurrences suggest the platform struggles to keep pace with the sheer volume and velocity of market data when trading volumes spike sharply.

While Schwab may not be as crash-prone as some competitors, these struggles demonstrate that even industry stalwarts possess blind spots in digital capacity and scalability. The challenge of scaling instantly to meet overwhelming demand is complex. These instances remind us that no platform is entirely invulnerable. Discerning investors must understand these limitations for managing expectations and having contingency plans when the market tests even the best.

Read more about: Simplify Your Finances in 2025: 7 Practical Strategies to Reclaim Control and Reduce Stress

5. **TD Ameritrade**TD Ameritrade, now integrated into Charles Schwab, has long been lauded for advanced trading platforms like Thinkorswim, catering to sophisticated active traders. Despite its reputation for institutional-grade tools, TD Ameritrade has been plagued by recurrent issues during high-volatility days, casting doubt on its robustness. The precise demands of its user base require absolute precision and speed, often compromised under stress.

Traders on Thinkorswim have consistently reported a litany of problems during key market moves. These include freezing charts, lagging order books failing to reflect real-time depth, and critically, unfilled orders during crucial price fluctuations. These are not isolated bugs; they often follow predictable patterns during significant market surges, indicating systemic rather than sporadic failures.

The discrepancy between TD Ameritrade’s marketing of institutional-grade tools and its actual reliability during stress tests has drawn considerable criticism. This raises fundamental questions about how well retail traders, who depend on these platforms, are served when every second impacts financial outcomes. The integration with Charles Schwab presents both opportunities and challenges for enhancing reliability in volatile environments.

6. **SoFi Invest**SoFi Invest has carved a niche by pitching a sleek, user-friendly platform designed primarily for beginners, integrating with broader financial services. Its emphasis on ease of use has attracted a growing demographic seeking to simplify their finances. However, this appealing simplicity has, at times, come at the cost of stability, particularly during rocky market performance and heightened investor activity.

The platform has experienced notable instability when markets become turbulent. Technical problems include unresponsive dashboards hindering quick actions, delayed account updates causing confusion, and problematic order errors leading to missed opportunities or incorrect trades. SoFi Invest has yet to conclusively prove its resilience during prolonged extreme volatility or significant market downturns, leaving users uncertain about its capabilities.

While SoFi Invest remains a solid choice during calm conditions, its dependability significantly wanes when the financial environment turns stormy. The trade-off between simplicity and robust performance under pressure is critical. SoFi Invest’s track record suggests users should be aware of these limitations, as a more battle-tested infrastructure might offer greater peace of mind during market upheavals.

Fortifying Your Future: Seven Essential Strategies and Investment Vehicles to Build a Resilient Portfolio and Thrive Amidst Market Volatility

As we’ve seen, relying on a fragile platform during a market downturn can turn a challenge into a catastrophe. But understanding where the weaknesses lie is only half the battle. True financial resilience comes from proactively building a portfolio designed to withstand—and even thrive—amidst market volatility. With increased volatility, rising geopolitical tensions, and soaring inflation, many investors are looking for robust strategies and reliable investment vehicles. Let’s delve into seven essential approaches to help protect your portfolio from severe downturns and navigate the next market storm with greater confidence.

Read more about: The 12 Sneaky Bank Fees Draining Your Account (and How Savvy Savers Avoid Them)

7. **Diversify Your Portfolio Strategically**A cornerstone of resilient investing, strategic diversification is paramount when aiming to protect your portfolio against a market crash. By spreading your money among a variety of asset classes, company sizes, and geographies, you inherently minimize the impact of declining individual assets. This approach helps cushion the blow of market downturns by ensuring that while some segments may fall, others may appreciate or remain stable.

The benefit of diversification lies in its ability to smooth out returns and reduce overall risk. When the market crashes, other assets that are less correlated with the broader equity market, such as bonds or real estate, tend to appreciate or hold their value, compensating for losses elsewhere. This strategic allocation across diverse investments is not just about mitigating losses; it’s about increasing the ownership potential of assets that can still generate value even in turbulent times.

A well-diversified portfolio acts as a safeguard, providing a balanced exposure that can weather different economic climates. It ensures that no single investment or market segment can disproportionately jeopardize your entire financial standing. This foundational strategy offers a robust defense, making your wealth less susceptible to the concentrated risks that can emerge during significant market corrections.

Read more about: From Blockbusters to Billions: 14 Hollywood Stars Who Secretly Mastered Real Estate Beyond the Red Carpet

8. **Regular Portfolio Rebalancing**Even the most thoughtfully diversified portfolio can drift out of alignment over time as market conditions evolve. For instance, if stocks experience several years of strong performance, their proportion within your portfolio might grow larger than originally intended, consequently increasing your overall risk exposure just before a potential market downturn. This imbalance can inadvertently make your portfolio more vulnerable to the very fluctuations you sought to mitigate.

Rebalancing is the systematic process of periodically selling overperforming assets and then reinvesting those proceeds into underweighted ones. The goal is to restore your portfolio to its original, target asset allocation. This disciplined practice helps to control risk by ensuring you are not overly concentrated in any single asset class, while simultaneously locking in gains from those assets that have performed well.

Implementing regular rebalancing is a proactive measure against market corrections, allowing you to systematically reduce exposure to potentially overvalued assets and increase holdings in those that may be undervalued. This methodical approach ensures your portfolio remains aligned with your long-term investment objectives and risk tolerance, preventing market momentum from dictating your exposure and maintaining an optimal risk-adjusted return profile.

Read more about: Navigating the Market with Ease: A Beginner’s Comprehensive Guide to Index Fund Investing

9. **Investing in Essential Sector Stocks and Funds**During economic downturns, certain industries exhibit greater resilience, making their stocks and funds attractive for stability. These are typically companies that provide essential goods and services, often referred to as consumer staples, healthcare, and utilities. Even when the economy falters, consumers continue to prioritize necessities like food, medicine, and electricity, ensuring continued demand for these sectors.

While these industries are not entirely immune to market-wide declines, they generally do not experience the same severe drops as more cyclical sectors. This defensive characteristic helps preserve capital during volatile periods. Many companies in these essential sectors also historically offer generous dividend yields, which can provide a steady income stream that offsets a decline in share price.

For investors seeking to diversify their portfolio with equities that offer some level of protection against market swings, considering ETFs in essential sectors can be a prudent move. Examples include the Health Care Select Sector SPDR Fund (XLV), which tracks healthcare companies within the S&P 500, with top holdings like Johnson & Johnson, UnitedHealth Group, Pfizer, and Thermo Fisher Scientific.

The First Trust Nasdaq Food & Beverage ETF (FTXG) tracks major food and beverage companies, including names like PepsiCo, Coca-Cola, Mondelez, Tyson Foods, Hershey, and General Mills. Additionally, the Vanguard Utilities ETF (VPU) aims to duplicate the performance of a utility stock index, with holdings such as Duke Energy, Exelon, American Water Works, and NextEra Energy. These funds offer diversified exposure to sectors less correlated with the broader market’s extreme fluctuations.

Read more about: Unlocking Your Retirement Potential: A Beginner’s Guide to Maximizing Your 401(k) Match and Beyond

10. **Harnessing the Power of Cash and Equivalents**In times of market correction, the adage “cash is king” holds significant truth. Holding a portion of your portfolio in cash or cash equivalents provides crucial liquidity and stability. Unlike volatile assets, cash does not lose value as the market declines (provided inflation is tame), offering a secure base during periods of uncertainty. This strategic reserve ensures you have purchasing power readily available to capitalize on bargains when distressed assets begin to rebound.

However, it’s vital to recognize that inflation erodes the value of cash over time, meaning you don’t want to keep excessive amounts sitting idle for too long. To maximize returns while maintaining liquidity, consider parking your money in a money market fund or a high-yield savings account. These options provide competitive interest rates compared to traditional savings accounts, helping your money grow modestly even as it remains highly accessible.

Money market funds, in particular, are ultra low-risk mutual funds that invest in securities with short maturity periods, making them among the lowest-risk investments outside of government bonds. While their returns may be microscopic in some environments, their stability and accessibility are invaluable during market turbulence. For investors who need to keep their money relatively safe and liquid within a brokerage account, money market funds serve as an excellent temporary holding vehicle.

Read more about: Demystifying the $44,000 Salary: An In-Depth Look at Its Real-World Value and Financial Implications in the Modern Economy

11. **Securing Stability with Government Bonds**For investors prioritizing safety and consistent returns, U.S. Treasury notes are an exceptionally stable choice, backed by the full faith and credit of the U.S. government. These bonds have historically offered solid returns on low-risk investments, providing a bedrock of stability when other market sectors induce nervousness. The federal government has an impeccable payment record, ensuring investors receive interest payments every six months until maturity, at which point the face value is returned.

Beyond traditional Treasury bonds, other government-backed debt instruments offer compelling benefits, especially during specific economic conditions. Treasury Inflation-Protected Securities (TIPS), for example, offer attractive returns and liquidity, protecting investors against inflation by adjusting their principal value. Series I Savings Bonds are another worthy investment, particularly appealing during periods of high inflation. These options provide a reliable haven for capital, offering a bit more yield than simple cash under a mattress.

You can buy Treasury bonds, I bonds, and TIPS directly from the U.S. Treasury through its website, TreasuryDirect.gov. These investments are key components for padding portfolios with low-risk assets, providing a steady counterbalance to more volatile holdings. They are a crucial element in a well-diversified strategy, offering dependable income and capital preservation during times of market stress.

Read more about: 8 Strategic Reasons Why Municipal Bonds Demand Your Attention Now

12. **Exploring Gold and Precious Metals**Gold has long been recognized as a traditional “store of value,” with investor interest typically surging during periods of economic uncertainty and market volatility. This precious metal often demonstrates an inverse correlation with the broader stock market, meaning its value can increase when the overall market struggles. For example, between 2008 and 2011, gold’s price rose more than 100% as the economy navigated the Great Recession and moved into recovery. Other precious metals like silver and platinum offer similar characteristics and can also be attractive diversifiers.

Investors have several avenues for gaining exposure to precious metals. They can choose to buy and hold physical precious metals, such as gold bullion, though this option necessitates considerations for secure storage and insurance costs. Alternatively, many investors opt for more liquid and convenient investment vehicles like precious metal funds and ETFs. These funds track the prices of precious metals or invest in companies involved in mining and refining, providing diversified exposure without the logistical challenges of physical ownership.

While precious metals can offer stability during turmoil, they may lag typical market returns during bull markets, as investors often shift back to riskier assets. Therefore, it’s generally advisable not to over-allocate to them. For instance, the five-year trailing return of the iShares Gold Trust Fund was 6.50%, compared to the SPDR S&P 500 ETF Trust’s 17.51% over the same period. Nonetheless, a strategic allocation to gold and other precious metals remains a valuable hedge and a component of a resilient portfolio.

Read more about: Robert Kiyosaki’s 10 Blueprint Ideas for a Stronger, Smarter Retirement Future

13. **Real Estate as a Resilient Asset**Real estate offers a tangible asset that can provide positive returns even when the stock market is experiencing a downturn. Its performance may be less correlated to the stock market, making it an effective hedge against crashes. Property owners can generate income through various means, whether by flipping homes for profit or by acquiring properties to hold as rental investments, creating a steady stream of passive income.

For investors who prefer not to manage individual properties directly, real estate investment trusts (REITs) offer a compelling alternative. REITs are companies that own, operate, or finance income-producing real estate across a range of property types. Investing in REITs allows individuals to earn a share of the income produced by commercial real estate without the complexities of direct ownership. They trade on major stock exchanges, providing a degree of liquidity not typically found in physical real estate.

As an added bonus, REITs generally pay higher dividends than many other types of investments, making them attractive for income-focused portfolios. While REITs are not entirely risk-free and are vulnerable to industry-specific ups and downs, their performance tends to experience different volatility than traditional stock investments. This distinct behavior makes them an excellent tool for diversifying a portfolio and enhancing its overall resilience against broader market fluctuations.

**Bottom Line: Building a Future-Proof Portfolio**

Read more about: Future-Proofing Your Career by 2030: 12 Essential Strategies for Professionals in an AI-Driven World

The stock market’s journey is rarely a straight line; it’s marked by inevitable peaks and valleys. While market crashes can be unsettling, they also present opportunities for those who are prepared. The key to successfully navigating these turbulent waters isn’t just about finding platforms that won’t fail; it’s about having a sound financial plan and a portfolio constructed with resilience in mind. By embracing strategic diversification, regular rebalancing, and a considered allocation to robust asset classes like essential sector stocks, cash equivalents, government bonds, precious metals, and real estate, investors can fortify their financial futures. This proactive approach allows you to meet financial goals, regardless of market conditions, and transform potential panic into calculated opportunity. Remember, your money deserves better than to be left vulnerable—it deserves a plan that allows it to thrive, no matter what the market throws your way.