Paying off debt is often celebrated as a major financial milestone, a moment of triumph where hard work and discipline culminate in a lighter financial load. It’s a goal many strive for, promising financial freedom and a brighter future. However, for many, the immediate aftermath of clearing a significant debt can come with an unexpected and rather perplexing twist: a temporary dip in their credit score. This can feel counterintuitive, almost like being penalized for doing the right thing, and it often leaves individuals scratching their heads, wondering, ‘Why?’

Understanding why your credit score might take a temporary hit after diligently paying down debt is crucial for navigating your financial journey with confidence. Your credit score, after all, is not just a reflection of how much debt you owe, but a complex calculation based on several factors that assess your creditworthiness. While eliminating debt is undeniably a positive step for your overall financial health, the mechanics of credit scoring can sometimes produce an initial, disheartening dip before the long-term benefits materialize. This article will break down the hidden reasons behind this phenomenon, offering clarity and actionable insights in a clear, accessible, and data-backed style, much like a trusted financial advisor.

We’re going to explore seven key reasons why your credit score might temporarily decrease even after you’ve diligently paid off debt. This isn’t about discouraging you from debt repayment; quite the opposite. It’s about empowering you with the knowledge to understand the system, anticipate potential short-term fluctuations, and ultimately, to rebound stronger. By understanding these nuances, you can avoid unnecessary panic and instead focus on reinforcing the positive financial habits that will truly elevate your score over time. Let’s dive into the first four critical areas that often contribute to this surprising credit score movement.

1. **The Credit Utilization Conundrum: How Paying Off Debt Can Inadvertently Raise Your Utilization**

One of the most significant and often misunderstood reasons your credit score might drop after paying off debt relates to your credit utilization ratio. This factor alone accounts for a substantial 30% of your FICO score, making it a powerful influencer of your overall credit health. Credit utilization, also referred to as ‘amounts owed,’ is essentially a measure of how much credit you’re currently using compared to the total amount of credit you have available across all your accounts. Most financial experts generally advise keeping this ratio at 30% or below to demonstrate responsible credit management, signaling to lenders that you aren’t over-reliant on borrowed funds.

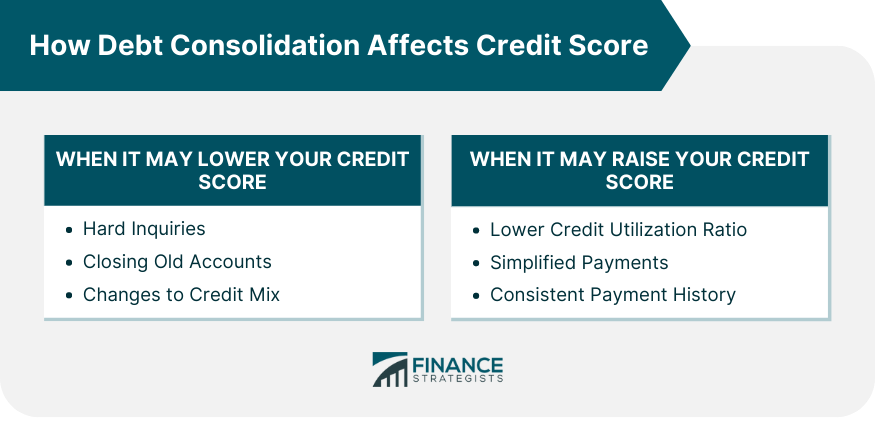

Here’s where the conundrum arises: while paying off a credit card balance to zero is a fantastic achievement, if you subsequently close that credit card account, you could inadvertently increase your overall credit utilization ratio. Let’s consider a practical example provided in the context: imagine you possess two credit cards, each generously offering a $5,000 credit limit. On one card, you carry a $4,000 balance, while the other holds a $1,000 balance. In this scenario, your total available credit stands at $10,000 ($5,000 + $5,000), and your total debt is $5,000 ($4,000 + $1,000), resulting in a credit utilization rate of 50% ($5,000 divided by $10,000). While this is above the recommended threshold, it provides a baseline.

Now, if you successfully pay off that $1,000 debt on the second card but then make the decision to close the account, the dynamics of your credit profile shift dramatically. Your total available credit suddenly shrinks from $10,000 down to just $5,000 (because one card is now closed). However, your remaining debt of $4,000 on the first card persists. This change causes your credit card debt to credit availability ratio to soar to 80% ($4,000 divided by $5,000). Even though you’ve responsibly eliminated some debt, this significant jump in your credit utilization can directly trigger a noticeable drop in your credit score.

The key takeaway here is often to resist the urge to immediately close revolving accounts, especially credit cards, once they are paid off. The context explicitly suggests that one way to avoid this specific issue would be to pay off the $1,000 debt and simply keep the account open. This action would leave you with a $0 balance on that card and maintain the $5,000 limit, effectively lowering your credit utilization ratio to a more favorable 40% across both accounts ($4,000 divided by the maintained $10,000 total available credit, not considering the closed card, or $4,000 divided by $10,000 total available credit, which is 40%). By retaining the unused credit, you present a healthier utilization picture, which can lead to a potential improvement in your credit score rather than a decline.

This phenomenon highlights the intricate nature of credit scoring: it’s not merely about the absolute amount of debt, but also about the proportion of available credit you’re actively using. A high utilization ratio signals a higher risk to lenders, even if it’s the result of reducing your overall credit capacity rather than increasing your borrowing. Therefore, a strategic approach often involves paying down balances without necessarily eliminating the credit lines themselves, allowing those healthy $0 balance accounts to contribute positively to your credit utilization and overall score.

2. **The Age of Accounts Dilemma: The Impact of Closing Old Accounts on Your Credit History Length**

Your credit history isn’t just a record of your financial actions; it’s a testament to your longevity and consistency as a borrower, and it contributes a significant 15% to your overall credit score. Lenders view a longer credit history as a sign of stability and experience in managing financial responsibilities. The average length of your credit accounts is precisely what this factor considers, rewarding those who have maintained active credit relationships over an extended period. This is why the act of paying off and subsequently closing one of your oldest credit accounts can unexpectedly lead to a decrease in your score.

When an old account, especially one with a long history of on-time payments, is closed, it effectively removes that history from the ‘active’ calculation of your average account age. Even if the account’s positive payment history might remain on your credit report for a period—Experian notes that a closed account in good standing can still affect your credit report for 10 years—its immediate closure can still bring down the *average* age of your *active* credit accounts. This is particularly impactful if you have a relatively short credit history overall, as the loss of one long-standing account will have a more pronounced effect on your average.

The advice from most experts, echoing the context, is a simple yet powerful one: keep accounts open whenever you can, even after you’ve paid them off and they carry a $0 balance. This strategy ensures that the established history of those accounts continues to contribute positively to your average credit account age. For instance, maintaining your oldest credit card, especially if it doesn’t come with an annual fee, is a straightforward way to protect this valuable component of your credit score. You might not have the luxury of choice with certain types of installment loans, such as student loans, which automatically close upon full repayment, but for revolving credit like credit cards, you do have control.

However, it’s also important not to panic if circumstances necessitate closing an account. While the immediate average age might dip, the long-term impact is often temporary, especially if you have other established accounts. The key is to be mindful of this factor when making decisions about closing accounts. If you have multiple old accounts, closing one might have less of an impact than if it’s your absolute oldest and only long-standing account. The overarching goal is to maintain a healthy and lengthy credit profile, demonstrating sustained responsible financial behavior over time.

3. The Credit Mix Shift: Why Reducing Account Types Can Negatively Affect Your Score

Your credit score isn’t just about how much credit you use or how long you’ve had it; it also considers the variety of credit accounts you manage. This factor, known as ‘credit mix,’ makes up 10% of your FICO score and is a testament to your ability to handle different types of financial obligations responsibly. Both FICO and VantageScore models award more favorable scores to individuals who demonstrate proficiency in managing a healthy blend of credit accounts, signaling versatility and financial maturity to potential lenders.

What constitutes a good credit mix? It typically involves a combination of ‘revolving accounts’ and ‘installment accounts.’ Revolving accounts are those where you can borrow and repay funds repeatedly up to a certain limit, such as credit cards, retail store cards, or Home Equity Lines of Credit (HELOCs). Installment accounts, on the other hand, involve a fixed loan amount repaid over a set period with regular payments, like student loans, auto loans, or mortgages. While you don’t need every single type of account, showing that you can handle both categories effectively can boost your score.

Here’s how paying off debt can sometimes trigger a score drop through this factor: if you pay off an account that significantly changes your credit mix, particularly if it reduces your diversity, your score could be negatively impacted. For instance, consider a scenario where your credit profile primarily consists of several credit cards (revolving accounts) and just one personal loan (an installment account). If you meticulously pay off that personal loan, you’ve certainly eliminated debt, but you’ve also effectively reduced your credit mix to a single type of credit – revolving accounts. This shift can be perceived by credit scoring models as a less diverse and therefore potentially less robust credit profile, leading to a temporary dip in your score.

This isn’t to suggest you should keep a personal loan open just for the sake of diversity, as the primary goal is always to eliminate high-interest debt. Rather, it’s about understanding the nuances of how these actions are interpreted by scoring models. If you find your credit mix becoming less diverse after a major debt payoff, it might be a subtle signal to consider (responsibly) adding a different type of credit down the line, once you’re financially stable and ready for such a commitment. The aim is to demonstrate a broad capability in managing various forms of credit, which credit bureaus view favorably.

4. The Credit Reporting Lag: Understanding the Delay Between Payoff and Score Update

One of the most straightforward yet frustrating reasons behind a temporary credit score drop after paying off debt is simply the timing of reporting. The financial world doesn’t operate in real-time when it comes to updating your credit file, and this delay can create a period of confusion and seemingly contradictory information. Credit card issuers and other lenders typically don’t report your account activity to the major credit bureaus – Experian, Equifax, and TransUnion – instantaneously. Instead, they usually do so only once each billing cycle.

This means that if you’ve recently paid off a substantial debt, there will inevitably be a lag between the moment you make that final payment and when the credit bureaus actually receive and process the updated information. While it might feel like an eternity when you’re eagerly awaiting a score increase, the reality is that the major credit bureaus update credit reports on a cycle that typically spans every 30 to 45 days. This can easily mean that by the time you check your credit score shortly after your debt payoff, the positive change may not yet be reflected in your official credit report or, consequently, in your score.

Imagine the scenario: you make that triumphant final payment on your credit card on the 10th of the month. The credit card issuer’s billing cycle, however, might close on the 25th, and they might then report to the bureaus a few days after that. If you check your credit score on the 15th, your report might still show the old, higher balance, leading to a score that hasn’t improved, or perhaps even dropped if other factors (like utilization changes on other cards) have already been reported. This temporary discrepancy can be disheartening, but it’s a systemic quirk rather than a reflection of poor financial management on your part.

The important practical and actionable advice here is patience and vigilant monitoring. Recognize that a short-term dip or lack of immediate improvement is often just a matter of timing. The best course of action is to give the system time to catch up. Continuously monitor your credit reports during this period, which you can do for free weekly at AnnualCreditReport.com. This allows you to confirm when your zero balance has been accurately reported and ensures that your credit score has the correct, updated information to reflect your hard-earned debt payoff. The positive impact of clearing debt will almost certainly manifest, but it requires a little patience for the reporting cycle to complete.

Navigating your financial journey confidently means anticipating these nuances, especially when you’re doing everything right. While the first four reasons we explored highlighted direct impacts related to how paid-off debts interact with credit factors, the next set of reasons often involve separate, albeit sometimes coincidental, factors that can influence your score during the same period. These ‘hidden reasons’ further underscore the complexity of credit scoring, reminding us that a temporary dip isn’t always directly linked to the debt you just cleared.

5. Unrelated Payment History Issues

It’s an often bewildering experience: you’ve just triumphantly paid off a significant chunk of debt, only to log in and discover your credit score has taken an unexpected dip. While your focus might be on that recently cleared account, the culprit could lie elsewhere entirely – a late payment on a different, perhaps less prominent, financial obligation. Payment history stands as the single most impactful factor in your FICO score, contributing a formidable 35%. Lenders consistently prioritize a record of timely payments as the clearest indicator of responsible financial stewardship, making any deviation a significant red flag in your credit profile.

This means even a solitary missed payment can trigger a disproportionately negative effect, eclipsing the positive momentum of your debt payoff. Imagine diligently paying down a large personal loan, only for an overlooked due date on a utility bill or a minor retail credit card to result in a 30-day late mark on your report. Such an event, despite your recent financial success, can swiftly overshadow your progress because credit scoring models are highly sensitive to new negative marks, especially concerning payment punctuality.

These “unrelated” issues often arise in common, unsuspecting scenarios. Perhaps the intense focus required to tackle a large, high-interest debt caused a smaller, less frequent bill, or even an annual subscription service, to inadvertently slip your mind. Automatic payments might unfortunately fail due to an expired credit card on file, or a new billing cycle might catch you off guard, leading to an unintentional lapse. Each of these seemingly minor slip-ups, once reported, can contribute to that puzzling credit score reduction precisely when you’re expecting an improvement.

The repercussions of late payments extend beyond an immediate score dip; they can have a lingering impact. A payment reported as 30 days or more overdue can remain a visible negative mark on your credit report for up to seven years. While the severity of its influence naturally diminishes over time, its initial appearance can cause a substantial decrease, underscoring the critical importance of preventing such incidents rather than trying to mitigate their effects later.

Therefore, proactive prevention and diligent monitoring are not just advisable, but essential. To safeguard against such mishaps, cultivate a meticulous system for tracking all your payment due dates. Utilizing calendar alerts, setting up reliable automatic payments for recurring bills, or even consolidating due dates where possible, can be highly effective. Regularly reviewing all your active account statements also helps you catch any potential issues or reporting errors before they ever reach the credit bureaus, thus protecting the integrity of your hard-earned credit progress.

Read more about: From Riches to Ruin: The Shocking Stories of 10 Celebrities Who Lost It All and Couldn’t Recover

6. New Credit Inquiries

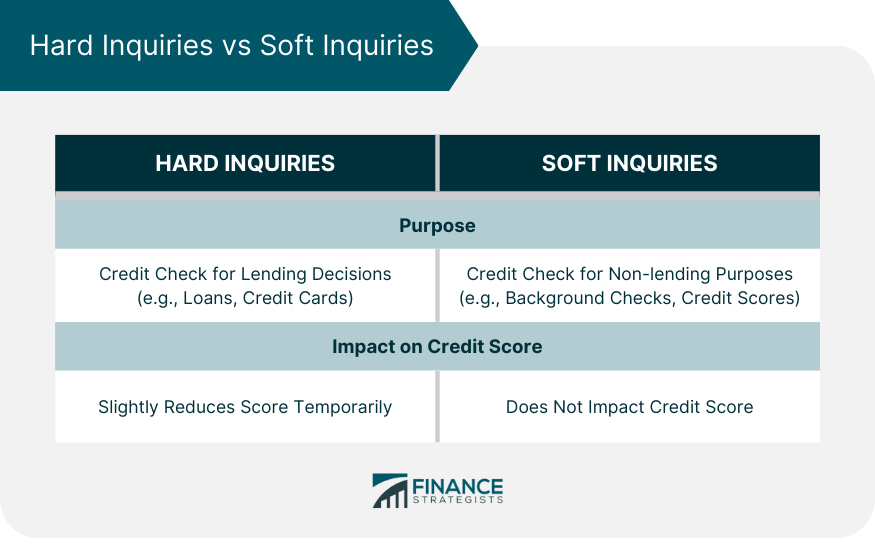

Another frequently overlooked factor that can contribute to a temporary dip in your credit score after paying off debt relates to new credit inquiries. It may seem counterintuitive that seeking out more credit after clearing old obligations could be detrimental, but the “new credit” component accounts for a noticeable 10% of your FICO score. This factor primarily assesses both the number of recently opened credit accounts and, more directly, the volume of ‘hard inquiries’ appearing on your credit report.

Understanding the distinction between ‘hard’ and ‘soft’ inquiries is crucial here. A ‘hard inquiry’ is initiated by a lender when you actively apply for a new line of credit, such as a mortgage, an auto loan, or even a new credit card. Each instance of a hard inquiry signals to potential lenders that you might be expanding your overall debt exposure. This perceived increase in financial risk can result in a small, temporary reduction in your credit score, indicating a slight shift in your credit profile.

The cumulative effect of multiple inquiries within a short timeframe can be particularly impactful. While a single hard inquiry might only cause a minor, often negligible, decrease, a cluster of applications over a few months can be more concerning. Credit scoring models tend to interpret numerous simultaneous credit applications as a sign of potential financial instability or an urgent need to take on substantial new debt, which can amplify the negative effect on your score. This heightened perception of risk can lead to a more noticeable and frustrating dip.

It’s important to remember that the influence of a hard inquiry is generally fleeting. Hard inquiries typically remain on your credit report for two years, though their actual impact on your credit score usually begins to diminish significantly after just a few months. For certain types of credit shopping, like comparing mortgage rates or auto loans, scoring models often consolidate multiple inquiries made within a short ‘shopping’ period (ranging from 14 to 45 days, depending on the model) into a single inquiry to prevent excessive score reductions, a thoughtful provision by the bureaus.

To manage this factor strategically, if you anticipate needing new financing – perhaps for a significant purchase like a home or vehicle – it’s often wise to ensure your major debt payoffs are complete and your credit score has had ample time to stabilize before applying. Strategically spacing out your credit applications, rather than submitting several in rapid succession, helps minimize the negative repercussions of hard inquiries. This approach allows your credit profile to more accurately reflect your improved financial standing and recent responsible debt management.

Read more about: 13 Essential Life Hacks for US Online Casino Players in 2025: Maximize Your Wins & Experience

7. Undetected Errors on Your Credit Report

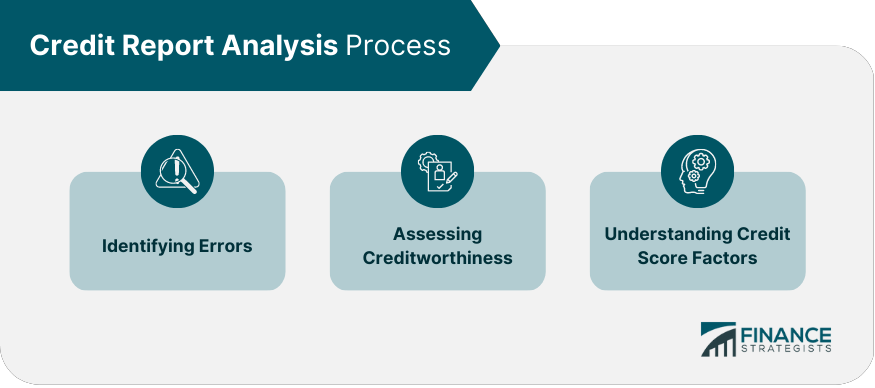

Perhaps the most insidious, yet surprisingly common, reason for an unexpected drop in your credit score, particularly after a diligent debt payoff, is the presence of undetected errors on your credit report. Even the most meticulous financial planning and flawless payment history cannot protect you if inaccuracies are introduced into your credit file. These reporting mistakes, whether from creditors or credit bureaus, can wrongly portray you as a higher credit risk, leading to an unwarranted and frustrating reduction in your score.

It’s essential to be aware of the specific types of credit report errors that can cause significant damage to your score. Common inaccuracies include misreported payment statuses, where an account with a perfect record is incorrectly marked with a late payment, instantly harming your payment history. Another frequent issue is incorrect account balances; a loan or credit card that you’ve fully paid off might still appear with an outstanding high balance, directly and negatively impacting your crucial credit utilization ratio.

Beyond simple data errors, more severe issues like identity theft can profoundly impact your financial health. Fraudulent accounts opened in your name or unauthorized transactions appearing on your report can cause complex and long-lasting damage. Additionally, accounts you have successfully closed or fully paid off might mistakenly remain listed as open with an outstanding balance, continuously draining your available credit and misrepresenting your overall credit picture.

Your right and responsibility to meticulously monitor your credit reports cannot be overstated. Federal law ensures that the three primary credit bureaus—Experian, Equifax, and TransUnion—provide you with free weekly access to your credit reports via AnnualCreditReport.com. This vital resource acts as your personal financial watchdog, enabling you to detect any discrepancies promptly and prevent them from festering into deeper, more detrimental problems that could affect future borrowing opportunities.

Should you uncover any inaccuracies, swift and decisive action is paramount. It is crucial to immediately dispute the incorrect information directly with both the credit bureau that reported it and the creditor responsible for the original entry. Providing comprehensive supporting documentation, such as bank statements, payment confirmations, or formal letters from lenders, is vital. This evidence will substantiate your claim, expedite the correction process, and ultimately ensure your credit score accurately reflects your true financial responsibility and diligent efforts.

Read more about: The Unexpected Urban Conundrum: Why Owning a Car in the City Can Become a Significant Liability

While it might undeniably feel disheartening, and perhaps even unfair, to witness a temporary dip in your credit score precisely after achieving the monumental feat of debt payoff, it is crucial to remember that this is almost always a short-term anomaly within a much larger, overwhelmingly positive financial trajectory. The fundamental act of reducing your debt load is, without question, an unequivocally positive step towards greater financial freedom and long-term stability, promising benefits that far outweigh any momentary fluctuations. By understanding these often-hidden reasons—from the intricate mechanics of credit utilization and the nuances of average account age, to the potential delays in reporting, the influence of new inquiries, or even the lurking presence of undetected errors—you are now empowered with the comprehensive knowledge needed to proactively navigate your financial journey with confidence. Continue to practice diligent financial habits, remain vigilant in monitoring your credit reports, and confidently expect your score to rebound, ultimately reflecting the true strength of your commitment to a healthier, debt-free financial future. Your dedication to financial well-being is a powerful and valuable asset, and the profound rewards, both in personal financial independence and a robust credit standing, are undeniably on their way.