The year 2025 is poised to be a period of significant transition and formidable challenge for the United States trucking industry. With a new presidential administration taking shape in Washington, stakeholders across the sector are bracing for a landscape redefined by shifts in federal laws, regulatory frameworks, and economic policies. This environment, characterized by both potential relief from certain burdens and the emergence of new complexities, demands close attention from motor carriers, independent owner-operators, and logistics companies alike.

At the heart of this evolving scenario are a series of critical legal and regulatory issues that directly impact operational costs, business models, and overall industry stability. Insights from legal experts, alongside analyses of impending policy changes, reveal a multifaceted environment where traditional practices are being re-evaluated and new compliance requirements are on the horizon. From the courtroom to the regulatory agencies, the decisions made and policies implemented in the coming months will set the course for how America’s vital transportation network functions.

This in-depth analysis delves into the primary legal and policy considerations that are commanding the industry’s attention. We will explore how these distinct yet interconnected challenges are forcing truckers to rethink their strategies, adapt their operations, and advocate for reforms that could ensure their long-term viability in an increasingly complex economic and political climate. Understanding these shifts is crucial for any entity operating within or alongside the trucking sector to navigate the opportunities and hurdles that lie ahead.

1. **Accident Liability: The ‘Nuclear Verdicts’ Trend**The trucking industry finds itself grappling with a “relentless trend of excessive verdicts in accident liability cases,” as noted by Prasad Sharma, a partner at Scopelitis. This phenomenon, often termed ‘nuclear verdicts,’ has become a significant financial threat to motor carriers, dramatically increasing the stakes in litigation. The sheer scale of some of these judgments far exceeds historical averages, putting immense pressure on companies of all sizes.

Several factors contribute to this concerning trend. Sharma points to “a combination of aggressive plaintiffs’ attorneys’ tactics, impassioned juries and failure to keep out testimony and evidence that is more prejudicial than it is relevant to, or probative of, the cause of an accident.” These elements often work in concert to sway jury sentiment, leading to disproportionately large awards. Furthermore, some attorneys employ “anchoring” tactics, presenting juries with large, often arbitrary, figures for damages that are “divorced from any economic calculation,” thereby influencing perceptions of appropriate compensation.

The consequences of these frequent excessive verdicts are profound. They significantly elevate the risk associated with taking cases to trial, compelling carriers to settle for higher amounts rather than face potentially ruinous judgments. This difficult legal environment has directly “translated to ever-increasing insurance costs” for motor carriers, a substantial burden that impacts profitability and operational sustainability across the industry. The rising cost of liability coverage is becoming an unsustainable expense for many.

However, the industry is not passively accepting this trend. Sharma notes that “the last couple of years have seen the trucking industry make progress in fighting back with civil justice reform measures that seek to bend the curve.” Looking ahead, “2025 promises to be another active year for civil justice reform measures in state legislatures throughout the country,” indicating a concerted effort by trucking stakeholders to address this critical issue through legislative action.

2. **Independent Contractor Classification: Shifting Definitions and State-Level Battles**The independent contractor (IC) business model, a cornerstone for many owner-operators in trucking, has faced intense scrutiny and legal challenges in recent years at both state and federal levels. A primary concern within the industry has been the potential for a Biden-era ruling to effectively compel companies to reclassify their owner-operators as company employees, fundamentally altering established business relationships and operational flexibilities.

Greg Feary, a partner at Scopelitis, anticipates that IC classification will remain a pivotal issue. He believes that under a new administration, “We are likely to see the U.S. Department of Labor return to the more entrepreneur-centric view of owner-operators in trucking as compared to the Biden-era Independent Contractor Test rule under the Fair Labor Standards Act (aka the ‘Biden Rule’).” The most probable route back to the 2020 Trump rule, which offered greater flexibility for IC status, is through one of the five pending court challenges to the Biden Rule, which Feary suggests should encounter less opposition.

Despite potential federal shifts, activity at the state level continues to highlight ongoing tensions. Feary points to “evidence of activity at the state level with California’s multiple portable benefits bills and Iowa’s transportation network company initiative.” While these state-specific efforts may be on the “periphery of the trucking misclassification legal agenda,” they nonetheless “signal that focus remains on the issue in the transportation space.” This indicates that even with federal changes, carriers must remain vigilant about varying state-level requirements.

Maintaining independent contractor status offers significant advantages for both truckers and companies. Independent truckers value the “freedom to work for multiple clients and set their own schedules,” providing crucial autonomy. For trucking companies, utilizing independent contractors reduces costs by avoiding expenses such as payroll taxes, health insurance, retirement contributions, and overtime pay. Easing labor classification rules would also enable independent truckers to retain ownership and control of their vehicles and operations, fostering a competitive environment that offers more opportunities and flexible service options.

3. **Potential FMCSA Regulatory Changes: Safety Systems and Appeals Processes**Changes originating from the U.S. Department of Transportation (DOT) and its constituent agencies, particularly the Federal Motor Carrier Safety Administration (FMCSA), are consistently a top concern for motor carriers. Chris Eckhart, a partner at Scopelitis, emphasizes that “The FMCSA could potentially issue proposed rulemakings or procedures on a number of important issues” in the current year. Among these, previously proposed modifications to the agency’s Safety Measurement System (SMS), a critical tool used to identify carriers for safety interventions, are under consideration.

Beyond the SMS, the FMCSA is actively contemplating changes to its safety fitness determination procedure, a process that evaluates a carrier’s overall safety performance and compliance. Additionally, the agency has already announced planned modifications to its crash preventability determination program, with these adjustments scheduled to commence in 2025. These collective revisions indicate a broader effort by the FMCSA to refine its methods for assessing and addressing safety risks within the industry.

Another significant development on the horizon is the FMCSA’s prior indication that it was considering implementing a formal appeal process for requests for data review, commonly known as Data Qs. Under this proposed system, “eligible Data Qs could be appealed to FMCSA if they ‘pertain to significant matters of legal interpretation or implementation of enforcement policies or regulations.’” This would provide carriers with a structured mechanism to challenge certain adverse safety data, addressing long-standing industry concerns about the accuracy and fairness of recorded incidents.

Eckhart notes the possibility that the FMCSA could finalize this appeals process in 2025, a development that would have substantial implications for how carriers manage their safety records and navigate compliance. Such a process could offer a more robust avenue for recourse against data inaccuracies or disputed interpretations of regulations, potentially mitigating negative impacts on carriers’ safety ratings and, by extension, their insurance premiums and operational opportunities. These changes underscore the need for carriers to stay informed and adapt their safety management practices.

4. **Drug and Alcohol Testing Issues: Navigating State vs. Federal Marijuana Laws**Motor carriers face a complex legal landscape in 2025 concerning drug and alcohol testing, primarily due to the intricate “interplay between state laws that prohibit adverse action against employees for off-duty marijuana use and the DOT Drug and Alcohol Regulations,” as highlighted by Chris Eckhart. This divergence creates significant compliance challenges, as federal regulations maintain a strict prohibition on marijuana use for commercial drivers, while an increasing number of states have legalized or decriminalized its use.

While the DOT Drug and Alcohol Regulations unequivocally prohibit any marijuana use, Eckhart clarifies a critical nuance: they “technically do not require motor carriers to terminate the driver’s employment if the driver completed a substance abuse program and the return-to duty-process.” This distinction means that carriers must carefully consider their policies and actions, as outright termination might not always be mandated by federal law, opening doors for potential legal challenges under state laws protecting off-duty conduct.

Compounding this issue, some carriers extend drug testing to drivers operating mid-size commercial motor vehicles, even if these drivers are not subject to the federal DOT’s specific drug and alcohol regulations. However, under 49 C.F.R. Part 391, such drivers cannot physically qualify to operate if they test positive for marijuana. This situation places carriers in a precarious position, as “Carriers who terminate non-CDL drivers for testing positive for marijuana may face legal challenges under state law,” Eckhart explains.

The situation is further complicated by recent federal policy shifts. “The Department of Justice’s recent decision to reschedule marijuana from Schedule I to Schedule III under the Controlled Substances Act could further impact these issues,” Eckhart states. This rescheduling, while not legalizing marijuana at the federal level, signals a change in its perceived danger and could influence judicial interpretations and future legislative efforts regarding drug testing protocols in the transportation sector. Motor carriers must remain agile and informed to navigate these evolving legal crosscurrents.

5. **Broker Issues: Transparency, Preemption, and Litigation**Many motor carriers diversify their operations by also maintaining property broker functions, a strategic decision that, unfortunately, exposes them to an additional layer of legal risk. Prasad Sharma notes that as plaintiff’s attorneys relentlessly seek “additional sources of money in accident cases,” property brokers are increasingly and “all too frequently named in litigation.” These claims often hinge on theories alleging that the broker negligently hired or retained the carrier involved in the accident, shifting liability beyond the direct parties.

However, there has been some success in defending against such state law claims by asserting preemption under a federal deregulatory statute, 49 U.S.C. 14501(c), commonly known as the FAAAA. Sharma highlights that “The U.S. Courts of Appeals for the Seventh and Eleventh Circuits have found such claims preempted,” providing a critical defense for brokers. Conversely, “the Ninth Circuit found that they are not; such claims fall within a safety regulatory exception to preemption,” creating a significant and unresolved circuit split that introduces considerable uncertainty for interstate operations.

The Supreme Court has, to date, “turned down the opportunity to resolve this difference in opinion, including just this past January,” leaving the industry in a state of watchful anticipation. Sharma indicates, “We will be watching the other Courts of Appeals to see how they decide this important issue and whether the Supreme Court will ultimately decide the issue,” underscoring the ongoing legal ambiguity that impacts broker operations nationwide.

In addition to these liability concerns, the FMCSA has “threatened to dive back into the pool of economic regulation with a proposed rule on broker transparency.” This proposal, for which the comment period closed in late January, aims to address existing practices where the right of shippers and carriers to review transaction records, including amounts paid to and by the broker, is often waived in contracts. The FMCSA has “proposed making it a non-waivable regulatory obligation to disclose such information within 48 hours of a request by a carrier or a shipper.” If finalized, this significant shift would compel brokers to “revisit their agreements to better protect their shipper clients’ confidential information” and fundamentally alter transparency requirements, to the chagrin of many in the brokerage sector.

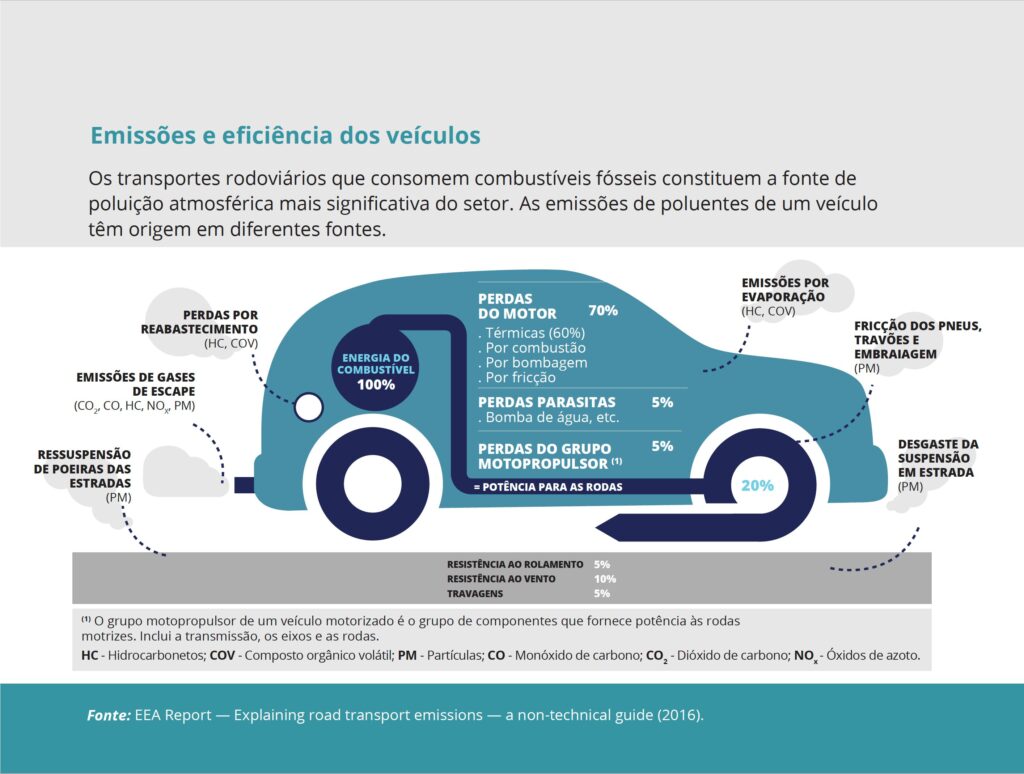

6. **Emissions Rollbacks and Environmental Policies: Costs, Compliance, and Market Shifts**A pivotal area of anticipated change under the new administration involves the rollback of Biden-era emissions standards and environmental policies, which had pushed for a transition to electric or hydrogen-powered trucks by 2027-2032. The new administration plans to reverse these mandates, including potentially revoking California’s authority to enforce its stricter emissions standards, aiming instead for a less stringent, uniform federal standard. This shift could have wide-ranging effects on the trucking industry, impacting everything from operational costs to equipment markets.

One immediate implication is the potential for “Reduced Compliance Costs.” Relaxed emissions standards could alleviate significant financial pressure on trucking companies, particularly smaller operators, by removing the mandate to invest heavily in cleaner, more fuel-efficient vehicles or undertake costly retrofits of existing fleets. This could free up capital for other operational needs, offering a short-term economic benefit to many carriers struggling with high expenses.

However, this policy reversal is also expected to trigger a “Shift in Equipment Markets.” Less stringent regulations may decrease demand for low-emission and electric trucks, potentially delaying the broader adoption of these technologies within the industry. This could influence manufacturing and consumer choices, particularly for cost-conscious operators, and further entrench reliance on traditional diesel-powered trucks. Consequently, “Fuel Consumption and Costs” could see an increase due to greater dependence on fossil fuels, potentially impacting profitability in the long run through volatile fuel prices.

There are also significant “Environmental and Health Impacts” to consider. The rollback could lead to increased air pollution in high-traffic areas, intensifying public health concerns. This, in turn, might prompt individual states or localities to implement their own stricter regulations, creating a “Potential for Regulatory Uncertainty” as interstate trucking companies would then need to navigate a complex, fragmented patchwork of varying compliance requirements across different jurisdictions. This could negate some of the perceived benefits of a federal rollback by introducing new administrative burdens.

Finally, the policy changes could reshape “Competitive Dynamics” and lead to “Global Trade and Export Challenges.” Larger trucking companies, driven by sustainability goals or customer demand, may continue to adopt cleaner technologies, potentially widening the gap between industry leaders and smaller operators less able to manage associated costs or market shifts. Furthermore, countries with stringent environmental standards might impose tariffs or restrictions on goods transported by higher-emission vehicles, potentially diminishing the competitiveness of U.S. goods in international markets and adding unforeseen indirect costs to the trucking industry.

7. **Tariffs and Cross-Border Trucking: Supply Chain Disruptions and Trade Shifts**The proposed push by the new administration to impose higher tariffs on imports, particularly from China, Mexico, and Canada, introduces a significant element of disruption for cross-border trucking operations. These tariffs are designed to encourage domestic production, but their immediate effect could be an increase in costs across supply chains and a fundamental alteration of established trade patterns. This shift is likely to create short-term volatility in freight rates and intensify competition, especially for businesses heavily reliant on imported goods.

Foremost among the impacts are “Disruptions in Supply Chains.” Higher import tariffs directly translate to increased costs for goods, which can ripple through the entire logistics network. These disruptions may also cause delays in shipping as customs processes become more complex and trade routes shift in response to new economic incentives. Trucking companies, therefore, could face significant challenges in meeting delivery deadlines and maintaining predictable schedules, impacting customer satisfaction and efficiency.

Accompanying these supply chain headaches are “Increased Operational Costs” for trucking companies. Tariffs raise the cost of goods and shipping, putting pressure on profit margins if clients are unwilling to absorb higher fees. Furthermore, companies may need to invest in adjusting their operations to mitigate potential delays at border crossings, incurring additional expenses related to staffing, technology, or re-routing. This constant adaptation to shifting trade landscapes adds a layer of financial and logistical complexity.

These tariff policies are also expected to drive “Shifts in Trade Patterns.” The impetus to reshore manufacturing or diversify international suppliers will inevitably alter cross-border trucking volumes. This necessitates that trucking companies remain agile, ready to adjust their routes and adapt to new trade flows that may emerge. Certain regions might see a decrease in international freight, while others experience a surge in domestic or nearshored goods, demanding quick strategic recalibration.

Specifically, the “Impact on Regional Trucking” will be pronounced, particularly for operations along the U.S.-Mexico and U.S.-Canada borders. Nearshoring trends, wherein companies bring production closer to home, combined with increased tariffs, are likely to boost cross-border trucking activity between the U.S. and its immediate neighbors. This will alter demand dynamics and require significant operational adjustments for carriers in these key corridors, presenting both challenges and new opportunities.

Ultimately, the “Long-Term Economic Effects” of sustained or increased tariffs could be broad. They have the potential to slow the recovery of the trucking industry in certain sectors, reduce overall demand for consumer and industrial goods, and contribute to lower economic growth. Such an environment would inevitably decrease the total volume of goods requiring transportation, impacting the financial health and stability of carriers and their extensive networks. The industry will need to strategically adapt to these profound economic reconfigurations.

8. **Freight Rates Are Still Stuck at Rock Bottom**For many in the trucking industry, the economic realities of 2025 are stark, with freight rates remaining stubbornly low and exacerbating an already challenging environment. Just a few years ago, the sector witnessed unprecedented profits as demand surged, leading to all-time high rates. Today, the landscape is dramatically different, characterized by a fierce race to the bottom that threatens the financial viability of countless operators.

This sustained collapse in the spot market means that current rates frequently fail to cover the escalating costs essential for operation, including fuel, insurance, and critical maintenance. The repercussions are particularly severe for those who leveraged high loans during the freight boom of 2021-2022; many now find themselves struggling to meet payment obligations, with the looming specter of vehicle repossession becoming a harsh reality for some.

Freight brokers and shippers are keenly aware of the prevailing market conditions, often offering rates that barely sustain operations. This dynamic forces desperate truckers to accept loads at prices that yield little to no profit, simply to keep their wheels turning and avoid immediate financial collapse. Owner-operator Jack Simmons, who manages his own truck in Texas, encapsulated this dire situation by stating, “We’re being forced to haul loads at a loss. If I shut down for a month, I might lose my truck. But if I keep running at these rates, I lose money anyway.”

The persistence of these rock-bottom freight rates creates an unsustainable paradox for independent truckers and small fleets. It traps them in a cycle where operational continuity comes at the cost of profitability, highlighting a systemic issue that profoundly impacts their long-term solvency and mental well-being, demanding urgent attention from industry stakeholders.

Read more about: Are You a ‘Prepper’? Unveiling 14 Vehicles Built for Surviving the End of the World

9. **The Broader Regulatory Burden: A Crushing Weight for Small Operators**The trucking industry has always operated under a significant regulatory framework, yet 2025 is ushering in an era where the cumulative burden of these rules feels heavier than ever. While specific policy shifts are being addressed, the broader impact of increasing regulations creates a challenging economic landscape, particularly for independent truckers and smaller carriers struggling to absorb escalating compliance costs.

Beyond federal mandates, new rules continue to emerge, further tightening the operational environment. Proposals such as speed limiter mandates, for instance, could reduce efficiency on the road, directly impacting a trucker’s ability to maximize earnings by limiting their travel time and delivery capacity. Each new regulation, regardless of its individual scope, adds another layer of complexity and expense.

California’s AB5 law stands as a stark example of how state-level regulations can profoundly impact business models. By making it exceedingly difficult for owner-operators to maintain their independent contractor status within the state, AB5 has forced many to either leave California or transition into company drivers. This showcases how diverse regulatory pressures, even those originating at the state level, can reshape an operator’s fundamental business structure and geographical reach.

Such an expansive and ever-evolving regulatory landscape disproportionately benefits larger carriers. These mega-fleets possess the financial resources and administrative infrastructure to more readily absorb compliance costs and adapt to new requirements, further solidifying their market position. Conversely, independent truckers find themselves increasingly squeezed, facing a growing competitive disadvantage that threatens their long-term viability and ability to compete effectively.

10. **Industry Consolidation and the Rise of Technological Dominance**The economic pressures faced by individual truckers are simultaneously fueling a significant trend toward industry consolidation and the increasing dominance of large carriers leveraging advanced technology. While many small operators struggle to stay afloat, big trucking companies are not merely surviving; they are actively thriving by deploying substantial financial backing and cutting-edge innovations to expand their control over the transportation sector.

This phenomenon is visible in the strategic acquisitions being made across the industry. Major players like Schneider, Swift, and J.B. Hunt are systematically buying up struggling small carriers, effectively absorbing market share and further concentrating power. This trend leads to a less fragmented industry landscape, where independent voices and small businesses find it harder to compete against corporate behemoths.

Technological advancements are a key driver of this dominance. Mega-carriers are heavily investing in and utilizing AI-powered automated dispatching and sophisticated route optimization systems. These tools drastically cut down on operational costs, allowing large fleets to operate with greater efficiency and precision. This technological edge enables them to consistently outbid independent truckers, who often lack the capital to implement similar scale-driven solutions.

Moreover, the trucking world is witnessing the growing presence of autonomous trucks. While these vehicles are not yet fully replacing human drivers, the substantial corporate investment in AI-driven logistics signals a clear direction for the industry’s future. This ongoing shift towards automation and sophisticated technology is fundamentally reshaping the competitive dynamics, moving power away from small, independent operators and towards corporate-controlled logistics networks.

Read more about: The Streaming Wars Are Over: Unpacking the Bundle Economy, M&A Reshaping Hollywood, and the Future of Digital Entertainment

11. **Proactive Strategies: How Truckers Are Fighting for Survival**Despite the formidable challenges, truckers across the nation are refusing to go down without a fight, actively seeking innovative strategies to survive and thrive in an industry undergoing profound transformation. This period of intense economic and regulatory pressure has spurred a wave of adaptability, as independent drivers and small fleets explore new approaches to maintain their livelihoods.

One significant avenue being pursued is the formation of co-operatives. By banding together, truckers aim to gain collective bargaining power, allowing them to negotiate better rates directly with shippers rather than passively accepting the low offers dictated by brokers. This collective action represents a direct challenge to the market dynamics that have historically disadvantaged individual owner-operators.

Many are also strategically shifting their focus towards specialized freight segments that still offer profitable rates. Transporting hazardous materials, oversized loads, or refrigerated goods often requires specific certifications, equipment, and expertise, creating a niche market where competition is less fierce and margins remain healthier. This move away from general dry van freight allows some truckers to carve out more sustainable business models.

Additionally, cost-cutting has become a paramount concern. This involves rigorous financial scrutiny, downsizing fleets, or even driving less to reduce expenses like fuel and maintenance. Some innovative truckers are diversifying their income streams by exploring alternative revenue sources or developing side businesses, ensuring they are not entirely dependent on the volatile freight market for their economic stability. However, the harsh reality is that while some adapt, others are forced to leave the industry entirely, seeking more stable employment opportunities with fewer financial risks, underscoring the critical need for robust adaptation.

12. **The Emotional Toll on Drivers: Beyond the Financial Strain**While much of the discussion surrounding the trucking industry’s current downturn rightly focuses on financial metrics and regulatory complexities, it is crucial to acknowledge the profound human cost. The persistent financial struggle is only one facet of the problem; the mental and emotional toll on drivers is significant, impacting their well-being and, in many cases, their fundamental sense of purpose.

Many truckers, who have dedicated years to an industry that once rewarded hard work and independence, now report feeling a deep sense of betrayal. The discrepancy between the promise of a lucrative career and the current reality of low pay, escalating costs, and dwindling job security creates a psychological burden that extends far beyond monetary concerns. This emotional strain can lead to burnout, stress, and a diminished quality of life for those who spend long hours on the road.

The constant pressure to find profitable loads, manage ever-increasing expenses, and navigate a complex regulatory maze takes a heavy toll. Drivers often face difficult decisions about their careers and families, weighing the uncertainties of staying in the industry against the prospect of starting over in a new field. This environment of sustained anxiety can erode morale and foster a sense of powerlessness among even the most seasoned professionals.

Ultimately, the emotional well-being of truckers is an often-overlooked yet critical component of the industry’s health. The current climate forces many to make agonizing choices, either staying hopeful and seeking adaptive measures or, sadly, walking away from a profession they once loved, frustrated by the lack of opportunities and the overwhelming feeling of being undervalued and unsupported.

13. **Domestic Oil Production: A Potential Balm for Fuel Costs and Industry Stability**Amidst the myriad challenges, a potential shift in energy policy under a new administration offers a glimmer of relief, specifically regarding one of the trucking industry’s most significant variable costs: fuel. A push to boost domestic oil production aligns with the broader goal of reducing dependence on foreign energy sources, a move that could lead to lower fuel costs by increasing the national supply.

This increased availability would likely stem from policy adjustments aimed at easing drilling restrictions, streamlining permitting processes for energy projects, and actively encouraging greater investment in domestic energy infrastructure. Such measures are designed to enhance the nation’s energy independence, directly impacting the price stability and overall cost of petroleum products crucial for the transportation sector.

The immediate and most tangible benefit for the trucking industry would be substantial cost savings. Lower fuel prices directly reduce operating expenses for motor carriers, freeing up vital resources that can be redirected towards other investments, fleet upgrades, or simply bolstering strained profit margins. For smaller operators, in particular, this reduction in a major overhead cost could be instrumental in remaining competitive and staving off financial distress. Moreover, reduced inflationary pressures from lower fuel prices could stimulate broader consumer demand and freight volumes, as businesses require more goods to be transported to meet market needs, creating a positive ripple effect throughout the supply chain.

However, this policy shift is not without its complexities and potential trade-offs. While economically beneficial, less expensive fossil fuels, especially when combined with relaxed emissions standards, could inadvertently slow efforts within the industry to transition towards greener trucking initiatives. This raises sustainability concerns, creating a tension between immediate economic relief and long-term environmental goals, influencing how the industry balances profitability with its evolving ecological responsibilities.

The trucking industry stands at a pivotal juncture, navigating a confluence of regulatory shifts, economic pressures, and technological advancements that demand profound adaptation. From the relentless pursuit of civil justice reform to the strategic adoption of new business models and the careful consideration of energy policies, every facet of this vital sector is under scrutiny. The road ahead is undoubtedly challenging, yet the inherent resilience of American trucking, its crucial role in the nation’s economy, and its capacity for innovation provide a compelling narrative of perseverance. For those willing to stay informed, adapt strategically, and advocate for their interests, the opportunity to reshape the future of transportation remains firmly within grasp.