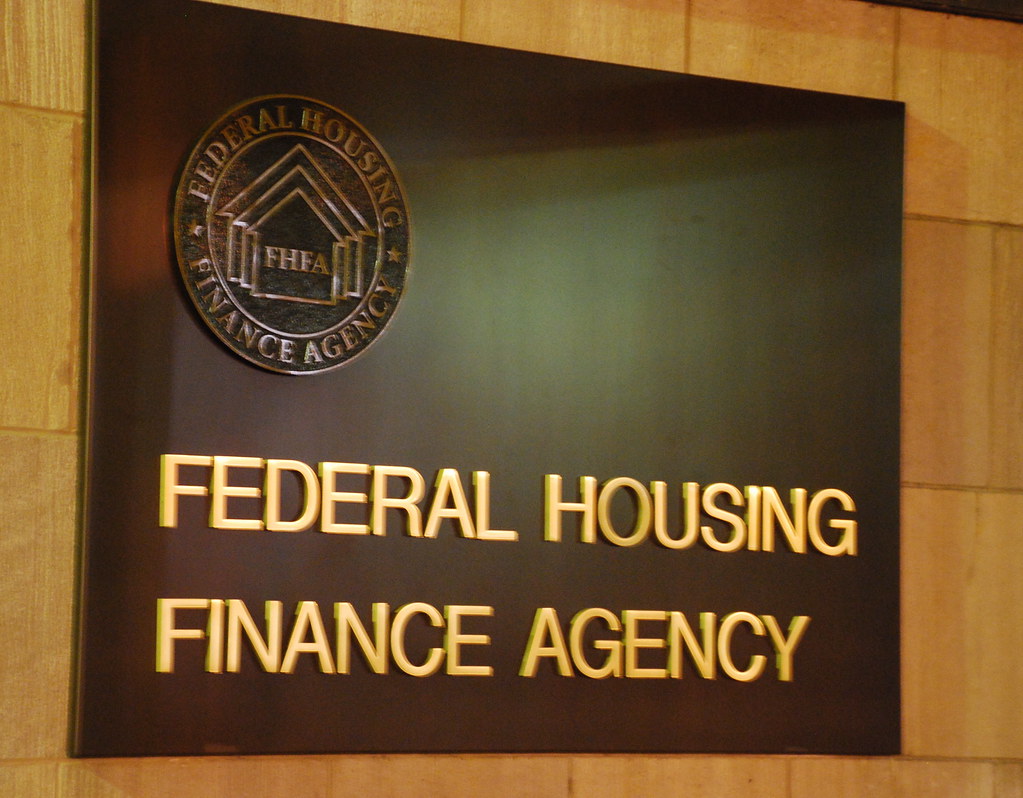

The financial landscape surrounding homeownership in the United States underwent a notable transformation on May 1, 2023, as the Federal Housing Finance Agency (FHFA) enacted significant revisions to the fee structure for conventional mortgages. These changes primarily impact loans guaranteed by government-sponsored enterprises Fannie Mae and Freddie Mac, recalibrating the costs associated with securing a home loan across various borrower profiles. The stated intention behind these adjustments is to foster greater affordability for underserved communities and first-time homebuyers, aligning with a broader government initiative to broaden access to homeownership.

However, the new framework has elicited a mixed reception, drawing considerable scrutiny and debate from financial officials, industry leaders, and potential homebuyers alike. While certain segments of the borrower population stand to benefit from reduced upfront costs, others, particularly middle-income borrowers with strong credit profiles and substantial down payments, may find themselves facing increased expenses. This rebalancing act has sparked concerns about its potential to disadvantage those traditionally considered less risky to lenders, leading to calls for reconsideration and a deeper examination of its long-term implications for the housing market.

The modifications represent an intricate interplay of variables, including credit scores, loan-to-value (LTV) ratios, and the loan’s purpose, fundamentally reshaping how upfront fees, often embedded within interest rates, are calculated. As such, understanding these updated fee matrices is paramount for anyone navigating the current mortgage environment, from prospective purchasers to those considering refinancing. This article will delve into the specifics of these changes, dissecting their structure, rationale, and multifaceted impacts across the spectrum of homebuyers.

1. Implementation Date and Scope of the New Mortgage Fee Structure

The updated mortgage fee structure officially commenced on May 1, 2023, marking a pivotal moment for new conventional mortgage originations across the United States. This significant shift was orchestrated by the Federal Housing Finance Agency (FHFA), the federal body responsible for overseeing Fannie Mae and Freddie Mac, the two dominant government-sponsored enterprises (GSEs) in the secondary mortgage market. The directive mandated that all conventional mortgages delivered to or acquired by these GSEs after this date must incorporate the newly defined credit score and loan-to-value (LTV) matrices into their pricing.

Crucially, these changes specifically target conventional mortgages, which are loans that conform to the guidelines set by Fannie Mae and Freddie Mac. This means that a substantial portion of the U.S. mortgage market, approximately 60% of new mortgages, is directly influenced by these new upfront fee structures. The scope of impact extends to various loan types within the conventional category, including purchase loans, rate-term refinance loans, and cash-out refinance loans, each subject to its own updated base fee grid.

It is important to clarify what types of loans remain unaffected by these particular revisions. Government-backed loans, such as those issued under the Federal Housing Administration (FHA), Department of Veterans Affairs (VA), or U.S. Department of Agriculture (USDA) programs, operate under different regulatory frameworks and are thus exempt from these FHFA-mandated changes. Similarly, jumbo loans and other non-conforming loan products, which do not meet Fannie Mae and Freddie Mac’s size or eligibility requirements, are also outside the purview of this new fee structure. Furthermore, the adjustments apply exclusively to *new* loans, meaning existing mortgages originated prior to May 1, 2023, continue under their original terms and are not subject to these revised upfront fees.

The changes prompted an immediate response within the lending community, requiring lenders to integrate the new pricing framework into their workflows ahead of the official implementation date. This presented compliance challenges for some, but ultimately, the new rules became the standard for conventional loan lending from the specified date forward, reshaping the cost calculations for a vast number of prospective homebuyers and those looking to refinance.

2. Understanding Loan-Level Price Adjustments (LLPAs)

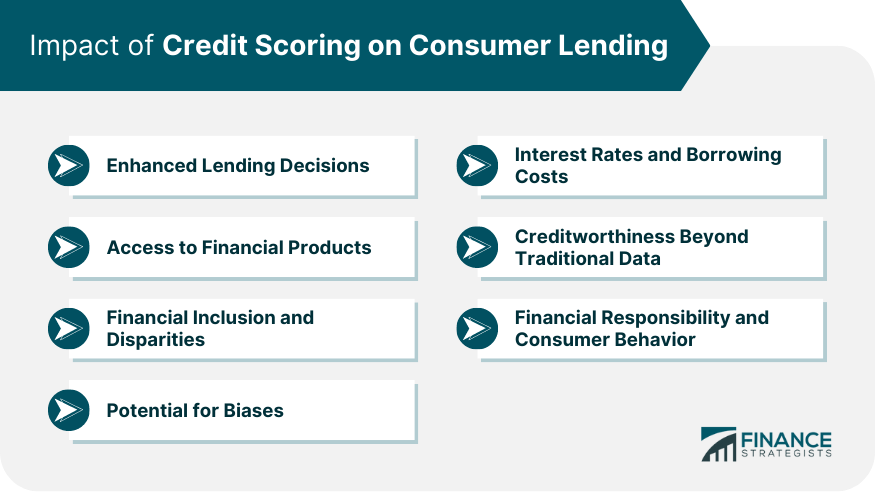

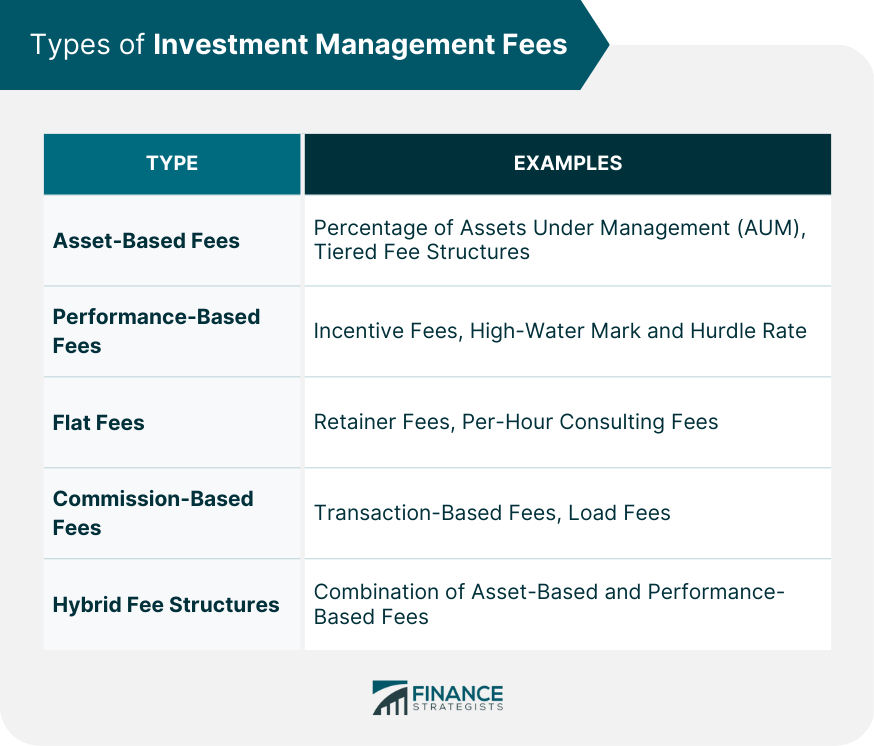

At the heart of the new mortgage fee structure are Loan-Level Price Adjustments, commonly referred to as LLPAs. These are essentially upfront fees that Fannie Mae and Freddie Mac levy on the conventional loans they purchase from mortgage lenders. Since their inception in 2008, LLPAs have served as a critical component of conventional loan lending, primarily designed to ensure the “stability and soundness” of these government-sponsored enterprises. They represent the government’s method of differentiating pricing for loans based on perceived risk.

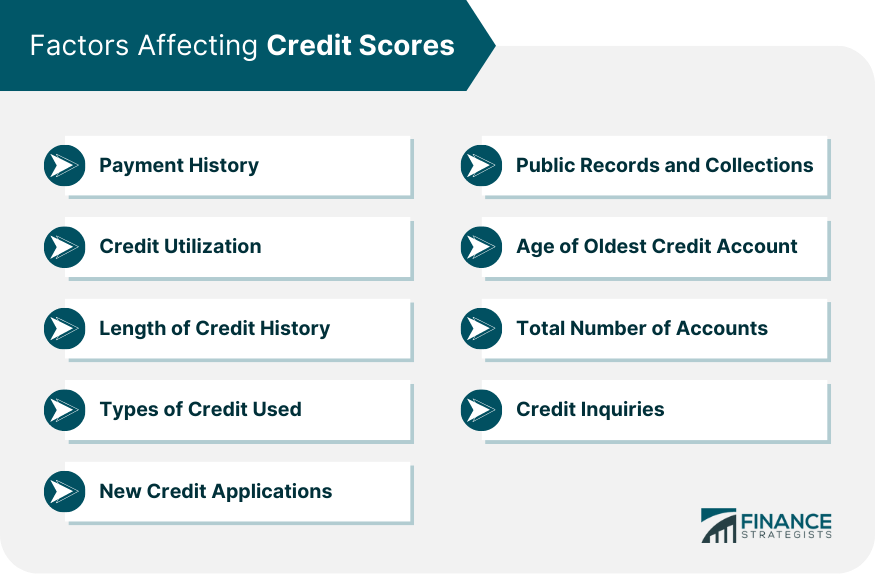

The amount of an LLPA is not static; it varies significantly based on a number of key factors associated with the borrower and the loan itself. The primary determinants include the borrower’s credit score, which serves as an indicator of financial reliability, and the loan-to-value (LTV) ratio, reflecting the size of the borrower’s down payment relative to the property’s value. Beyond these, other loan features, such as the type of product (e.g., purchase, rate-term refinance, cash-out refinance) and the occupancy type (e.g., owner-occupied, investment property, second home), also play a role in determining the specific LLPA applied.

While LLPAs are technically “upfront fees,” their cost is typically not paid as a separate lump sum at closing by the borrower. Instead, the vast majority of borrowers experience these fees in an indirect manner: they are “baked into the interest rates homebuyers pay,” as described in the context. This means that the LLPA effectively increases the overall interest rate on the mortgage, which, in turn, translates into higher monthly mortgage payments spread over the life of the loan. This integration into the interest rate makes the impact of LLPAs a continuous financial consideration for homeowners rather than a one-time charge.

Historically, the principle behind LLPAs has been straightforward: “riskier borrowers paying more than those with high credit scores and large down payments.” This system was intended to offset the increased risk posed by certain loan characteristics. The recent FHFA updates, however, have not eliminated this fundamental premise but have significantly recalibrated the precise magnitudes of these adjustments. The goal, according to FHFA Director Sandra Thompson, was to ensure that the updated fees “will now be better aligned with the expected long-term financial performance of those mortgages relative to their risks,” suggesting an ongoing effort to fine-tune the economic models underpinning mortgage pricing.

3. The FHFA’s Stated Rationale for the Fee Changes

The Federal Housing Finance Agency (FHFA) articulated several objectives underpinning the controversial changes to the mortgage fee structure, positioning them as part of a broader government initiative. A primary goal, as stated, is “to make homeownership more affordable to underserved communities and first-time homebuyers.” This aligns with the Biden administration’s long-standing aim to enhance housing affordability for low- and middle-income Americans, seeking to address what is often termed the “affordability crisis” in the country. The agency aimed to “provide more targeted support for creditworthy borrowers limited by income or wealth,” thereby facilitating equitable and sustainable access to homeownership for these groups.

Beyond the social objective of expanding homeownership access, the FHFA also emphasized the financial stability of the government-sponsored enterprises themselves. The updates were explicitly designed to “improve the financial stability of Fannie Mae and Freddie Mac,” ensuring their “stability and soundness.” FHFA Director Sandra L. Thompson reinforced this point, stating in a 2023 press release that “These changes to upfront fees will strengthen the safety and soundness of the Enterprises by enhancing their ability to improve their capital position over time.” This highlights a dual mandate: supporting borrowers while simultaneously fortifying the financial backbone of the housing market.

Furthermore, the FHFA specified additional aims, including maintaining “access to homeownership over time,” creating “fair competition between large and small mortgage sellers,” and ensuring “returns on capital investments meet market standards.” These objectives collectively paint a picture of a comprehensive strategy intended to refine the operational and financial efficacy of the GSEs, while also attempting to balance market dynamics. The agency also contended that the previous pricing structure was due for an update, as it had been some time since it was thoroughly reviewed.

In response to significant public and industry pushback, FHFA Director Thompson sought to clarify a “misconception” regarding the changes. She asserted that “Higher-credit-score borrowers are not being charged more so that lower-credit-score borrowers can pay less.” Instead, she explained that the updated fees, consistent with prior fees, “generally increase as credit scores decrease for any given level of down payment,” but the *alignment* of pricing with risk profiles was being refined. The agency stated that the new framework aligns pricing more closely with “the financial risks and performance of backed loans,” aiming for a more accurate reflection of risk rather than a direct cross-subsidization in the manner critics suggested.

4. Impact on Borrowers with High Credit Scores

The new mortgage fee structure, implemented by the FHFA, introduced notable changes for borrowers boasting high credit scores, a segment traditionally accustomed to the most favorable lending terms. Under the revised guidelines, many individuals with strong credit profiles now face an increase in their upfront fees, which translates into slightly higher mortgage interest rates and, consequently, elevated monthly payments. This adjustment has been a primary point of contention and criticism since the changes took effect.

To illustrate this impact, consider a borrower with a 740 credit score who makes a 15% down payment on a loan. Under the new structure, this individual would incur 1% in fees. For a $350,000 loan, this amounts to an additional $3,500 tacked onto the loan balance. This represents a significant increase from the previous fee schedule, where the same borrower would have paid a 0.2500 fee, or $875. Another example highlights borrowers with credit scores of 740 or higher, and a loan-to-value (LTV) ratio of 75%, now facing a 0.375% fee, up from the prior 0.25%.

Critics have interpreted this shift as “in essence punished for having good credit” or a “middle-class tax hike,” arguing that it penalizes financially responsible individuals who have diligently maintained strong credit histories. The National Association of Home Builders (NAHB), for instance, “opposes fee increases on borrowers with higher credit quality.” Jerry Howard, CEO of NAHB, voiced concern that while it might “increase homeownership among the targeted group,” it “could decrease homeownership among the middle class,” leading him to speculate, “I’m not sure that we’re not robbing Peter to pay Paul here.”

Despite these concerns, FHFA Director Sandra Thompson clarified that it was a “misconception” that high credit-score borrowers were being charged more simply to subsidize lower-credit borrowers. She emphasized that while the *gap* between high and low credit score fees had narrowed, borrowers with strong credit scores still generally pay less in fees than those with lower scores for any given down payment level. She also pointed out that many borrowers with high credit scores or large down payments would actually see fees decrease in certain specific scenarios, indicating the complexity of the new fee matrices.

Read more about: Navigating the Digital Road: A Consumer Reports Guide to Online Car Buying and Selling

5. Impact on Borrowers with Low Credit Scores

Conversely, a significant objective of the FHFA’s new fee structure was to make homeownership more accessible for borrowers with lower credit scores, particularly those under 680. These individuals, often categorized as “riskier” borrowers under traditional lending models, are now likely to experience a reduction in their upfront fees, which can translate into lower monthly mortgage costs. This targeted support aims to broaden the pathways to homeownership for segments of the population historically underserved by the housing finance market.

A concrete example illustrates this benefit: a borrower with a 659 credit score applying for a $300,000 loan with a 75% loan-to-value (LTV) ratio. Under the previous structure, this borrower would have paid an upfront fee of $8,250, equivalent to 2.75% of the loan amount. With the new changes, their fee has been significantly reduced to $4,500, or 1.5%. This considerable decrease directly addresses the affordability crisis for these borrowers, aligning with the FHFA’s mission to facilitate equitable access to homeownership.

While these borrowers will see reduced fees compared to the old structure, it is crucial to understand that they will still generally pay higher fees than individuals with excellent credit scores. The new framework narrows the disparity but does not eliminate it; the fundamental principle that “fees generally increase as credit scores decrease for any given level of down payment” remains intact, as clarified by FHFA Director Sandra Thompson. The intent is not to equalize fees but to recalibrate the risk-based pricing more favorably for this demographic, without fully negating the correlation between credit risk and pricing.

This strategic adjustment underscores the government’s initiative to support individuals who may be “limited by income or wealth,” thereby fostering greater inclusion in the housing market. By lowering barriers for creditworthy borrowers who might otherwise be priced out, the FHFA seeks to fulfill its mission of maintaining access to homeownership and bolstering the stability of the housing market by widening its participant base. The reductions are a direct effort to ease the financial burden for those with good, but not exceptional, credit, and for first-time buyers navigating an already challenging environment.

Read more about: Navigating the Digital Road: A Consumer Reports Guide to Online Car Buying and Selling

6. The Effect on Large Down Payments

One of the more contentious aspects of the FHFA’s updated mortgage fee structure is its impact on borrowers who opt to make substantial down payments. Counterintuitively for some, the new rules have resulted in increased fees for those who put down larger sums of money toward their home purchase. This particular change has drawn significant criticism, as it appears to penalize financially prudent individuals who have diligently saved to reduce their loan-to-value (LTV) ratios and, in turn, their perceived risk to lenders.

Prior to May 1, 2023, it was generally understood that a larger down payment would almost invariably lead to lower upfront fees due to the reduced risk profile it presented to Fannie Mae and Freddie Mac. However, the revised fee matrices have altered this dynamic. For instance, a borrower with a 740 credit score and a 15% down payment will now pay a 1% fee on their loan, which is significantly higher than the 0.25% fee they would have incurred under the previous schedule. This represents a tangible increase in costs for borrowers who historically would have been rewarded for their financial discipline.

The sentiment among many critics is that this particular adjustment “punishes hardworking Americans for their fiscal prudence” and establishes a “perverse incentive.” It challenges the conventional wisdom that saving a larger down payment is always the optimal strategy for securing the most favorable mortgage terms. While the FHFA maintains that the overall fee structure is designed to align with financial risks, the increase for larger down payments has been particularly perplexing for many middle-income borrowers who are already contending with high-interest rate environments.

It is important to note that the interaction between credit scores and down payment sizes has become more complex. In certain scenarios, borrowers with high credit scores and large down payments might even pay *more* in fees than high-score borrowers making smaller down payments. While those with lower down payments still face the requirement of private mortgage insurance (PMI), which adds to their overall costs, the upfront fee structure itself has shifted against those making larger initial investments, sparking a debate about fairness and economic incentives within the housing market.

Read more about: Mastering Your Premiums: 12 Proven Ways to Slash Car Insurance Costs, Including Top Models and State-Specific Strategies for 2025

7. The Effect on Small Down Payments

In contrast to the increased fees for larger down payments, the new FHFA mortgage fee structure generally provides some relief for borrowers making smaller down payments, particularly those below the traditional 20% threshold. This adjustment is a key component of the government’s strategy to enhance homeownership accessibility for individuals who may face challenges in accumulating substantial savings for a large initial investment. The aim is to lower some of the upfront financial barriers, making it easier for a broader segment of the population to enter the housing market.

Under the revised guidelines, borrowers with smaller down payments will generally find their upfront fees to be lower than they would have been under the previous fee schedule. For example, a borrower with a strong credit score of 780 or higher who puts down just 3% of the home’s value will now pay a fee equivalent to 0.125% of their loan amount. This is a substantial reduction from the previous charge of 0.75% for the same borrower profile. On a $300,000 loan, this translates to a difference between a $375 fee and a $2,250 fee, representing significant savings.

The context highlights a notable shift in the relationship between down payment size and fees: “If you put down less than 20%, your fees gradually get smaller the less you put down.” This creates an incentive structure where the lowest down payments might surprisingly attract lower loan-level price adjustments compared to moderately larger ones. An illustration shows that the fee for a borrower with good credit (720) and a 15% down payment is 0.5% *higher* than the fee for a borrower with good credit and only a 5% down payment. This inversion of the traditional expectation has been a point of discussion.

This recalibration is intended to specifically benefit “low-income borrowers who might have trouble saving for a down payment,” aligning with the FHFA’s broader mission to support underserved communities. While borrowers making smaller down payments will still typically need to pay for private mortgage insurance (PMI) until they reach a certain equity threshold, the reduction in upfront LLPAs provides a direct cost advantage at the point of origination. This policy aims to facilitate entry into homeownership for those whose primary obstacle is the initial capital requirement, even as other associated costs may still apply.

Read more about: Mastering Your Premiums: 12 Proven Ways to Slash Car Insurance Costs, Including Top Models and State-Specific Strategies for 2025

8. Fee Adjustments for First-Time Homebuyers

The FHFA’s updated fee structure specifically targets first-time homebuyers, aiming to make homeownership more accessible for those navigating the market for the first time. The adjustments introduce a nuanced approach where upfront fees for these new entrants largely depend on their credit scores. This is a critical point of focus for the agency, aligning with its mission to broaden access to housing, especially for segments of the population that have historically faced greater barriers.

For first-time buyers with credit scores under 680, the new framework generally brings about lower fees. Consider a scenario highlighted in the FHFA’s examples: a first-time borrower with a 659 credit score securing a $300,000 loan at a 75% loan-to-value (LTV) ratio. Under the previous structure, this individual would have incurred an upfront fee of $8,250 (2.75%); however, the revised guidelines reduce this significantly to $4,500 (1.5%). Such a substantial reduction aims to ease the initial financial burden for those with good, though not exceptional, credit histories.

Conversely, first-time buyers with higher credit scores, particularly those above 740, may experience a slight increase in their upfront fees. For example, a buyer with a credit score of 740 or higher, borrowing 75% of their home’s value, now faces a 0.375% fee, an uptick from the previous 0.25%. This recalibration, while intended to balance overall market risks, means that even first-time buyers with strong financial footing might encounter slightly higher initial costs than before. The changes also help low-income borrowers who might have trouble saving for a down payment by reducing fees based on down payment size.

These targeted adjustments reflect the FHFA’s dual mandate: to support creditworthy borrowers limited by income or wealth while ensuring the financial stability of Fannie Mae and Freddie Mac. For first-time buyers, understanding these specific nuances is crucial, as the immediate upfront costs can significantly influence their ability to enter the housing market, directly impacting affordability based on their credit profile.

Read more about: America’s Housing Conundrum: A Deep Dive into the Systemic Roots of Unaffordability and the Fading Dream of Homeownership

9. Fee Adjustments for Existing Homeowners and Refinancing

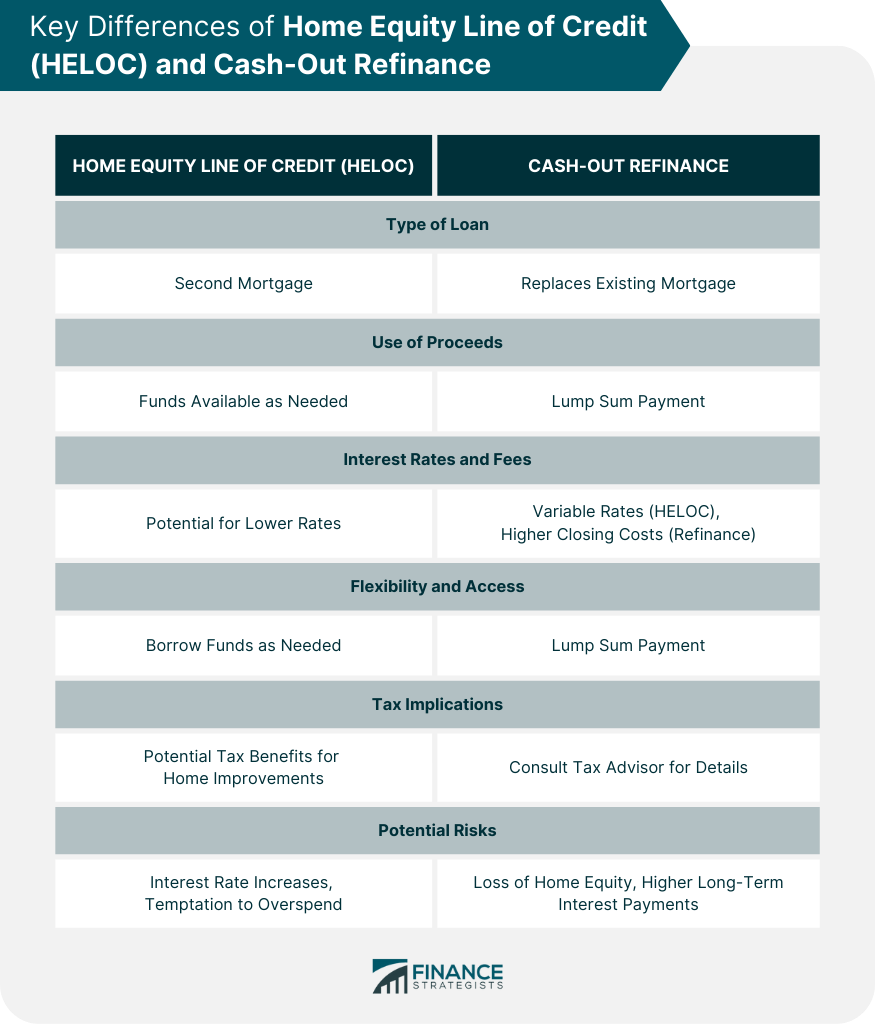

Existing homeowners contemplating refinancing their mortgages are also subject to the FHFA’s updated fee structure, where the costs associated with a rate-term or cash-out refinance are now more intricately linked to their financial profiles. For this segment of borrowers, new fees hinge particularly on their debt-to-income (DTI) ratio and their loan-to-value (LTV) ratio, alongside their credit score. This holistic assessment aims to better align the pricing with the perceived risk of the refinanced loan.

Specifically, homeowners considering refinancing will find that if their DTI exceeds 40% and their LTV is above 60%, they will incur an additional fee. This adjustment is designed to account for situations where borrowers may have a higher debt burden relative to their income or a lower equity stake in their homes, both factors that can increase the risk profile of a loan. These rules directly impact the approximately 60% of new mortgages guaranteed by Fannie Mae and Freddie Mac, including refinance transactions.

While certain high-credit borrowers engaged in refinancing might observe a modest increase in their fees, the changes can provide relief for others. Existing homeowners with lower credit scores, for instance, could potentially see reduced fees when refinancing. This mirrors the broader intent of the fee structure to narrow the gap in pricing between borrowers of varying creditworthiness, extending this benefit to those looking to adjust their existing home loans.

The implications for existing homeowners are clear: prudent financial management, particularly in keeping DTI ratios low and building substantial home equity (thereby lowering LTV), becomes even more critical when planning a refinance. These adjustments underscore the importance of assessing one’s full financial picture before entering the refinancing process, as the combination of DTI, LTV, and credit score will collectively determine the updated upfront fees and, consequently, the new mortgage rate.

Read more about: America’s Housing Conundrum: A Deep Dive into the Systemic Roots of Unaffordability and the Fading Dream of Homeownership

10. Fee Adjustments for Investment Properties

The FHFA’s fee structure updates also extend to loans for investment properties, introducing specific adjustments that acknowledge the inherently different risk profile compared to owner-occupied homes. Borrowers acquiring or refinancing investment properties will find their fees are now governed by the updated fee grids established by Fannie Mae and Freddie Mac. These changes apply across various loan types for investors, whether it’s a rate-term refinance or a cash-out refinance on their non-owner-occupied assets.

Typically, fees for properties that are not owner-occupied are generally higher, reflecting the increased risk associated with investment-grade loans. The new structure continues this trend, with investment property loans being subject to specific LLPAs. Investors with strong credit scores might still notice a slight uptick in their fees, whereas those with lower credit scores could potentially see some reductions, mirroring the broader pattern of narrowing the fee gap across credit tiers. However, the baseline for investment properties remains elevated due to their non-primary residence status.

A significant factor impacting investment property loans, similar to owner-occupied ones, is the borrower’s debt-to-income (DTI) ratio and loan-to-value (LTV). Any borrower, including real estate investors, with a DTI over 40% and borrowing more than 60% of the property’s value, will incur an additional fee. This further underscores the agency’s focus on managing risk across all loan types it guarantees, applying stricter criteria where financial leverage is higher.

For real estate investors, strategically increasing a down payment can be a crucial tactic to help lower the LTV ratio, which in turn can mitigate some of the increased fees. These adjustments mean that thorough financial planning and understanding the specific fee implications for investment properties are more important than ever for those looking to expand or manage their real estate portfolios under the new FHFA guidelines. Additional LLPAs also apply for second homes, alongside investment properties.

Read more about: Conquering the Cold: 15 Top-Tier Camping Gear Essentials Rigorously Tested for Extreme Climates

11. The Rescinded Debt-to-Income (DTI) Fee Change

Amidst the widespread changes to mortgage fee structures, one proposed adjustment garnered significant industry pushback and was ultimately rescinded: an additional upfront fee tied to a borrower’s debt-to-income (DTI) ratio. This particular fee was slated to take effect on August 1, 2023, intending to add extra costs for borrowers whose DTI exceeded 40%, especially if they were borrowing more than 60% of the home’s value. However, the Federal Housing Finance Agency (FHFA) announced its decision to scrap this fee just days after the main fee changes went live, on May 10, 2023.

The swift reversal came after numerous industry leaders voiced strong opposition, urging the FHFA to reconsider. The primary concern revolved around the practical challenges and compliance issues that such a DTI-based fee would introduce. Mortgage industry professionals argued that a borrower’s DTI can fluctuate throughout the extensive mortgage approval process, from initial application to final closing. This variability meant that the pricing or interest rate initially quoted to a borrower could change unexpectedly during the process, leading to considerable uncertainty.

Such mid-process changes would not only create significant compliance hurdles for lenders but also had the potential to cause delays in the critical closing process. Lenders contended that accurately determining a borrower’s precise DTI before rates had to be locked in proved to be an impractical and cumbersome task. The ability to guarantee a consistent rate and fee structure throughout the loan lifecycle is paramount for both lenders and borrowers, and the proposed DTI fee threatened to undermine this stability.

The rescission of the DTI fee demonstrates the FHFA’s responsiveness to industry feedback and its recognition of the operational complexities within the mortgage lending ecosystem. While the agency aimed to further refine risk-based pricing, the practical implementation challenges and the potential for disrupting loan origination processes led to the decision to abandon this specific adjustment, providing a measure of relief and predictability for both lenders and homebuyers.

12. Industry Pushback and FHFA Clarifications

The FHFA’s new mortgage fee structure, particularly the adjustments impacting higher credit score borrowers and those with larger down payments, generated immediate and substantial pushback from various sectors of the financial and housing industries. This widespread concern highlighted the tensions between the agency’s goals of fostering affordability for underserved communities and the potential unintended consequences for other segments of the borrowing population. A group of financial officials representing 27 U.S. states, for instance, promptly sent a letter to President Joe Biden and FHFA Director Sandra Thompson on May 1, 2023, urging them to abandon the new framework entirely.

Critics argued that the changes effectively penalized financially prepared individuals for their fiscal prudence. Bess Freedman, CEO of Brown Harris Stevens, articulated this sentiment, noting that “hearing that one may be in essence punished for having good credit could pose yet another psychological and financial barrier” to homeownership. The National Association of Home Builders (NAHB) specifically voiced its opposition to “fee increases on borrowers with higher credit quality,” with CEO Jerry Howard questioning if the policy was “robbing Peter to pay Paul” by potentially decreasing homeownership among the middle class while increasing it for targeted groups. Former National Economic Council Director Larry Kudlow went further, labeling the changes as a “middle-class tax hike.”

In response to this significant outcry, FHFA Director Sandra Thompson issued clarifications to address what she termed a “misconception.” She firmly stated that “Higher-credit-score borrowers are not being charged more so that lower-credit-score borrowers can pay less.” Instead, Thompson explained that while the *gap* in fees between high and low credit scores had narrowed, the fundamental principle that “fees generally increase as credit scores decrease for any given level of down payment” remained intact. She further clarified that the updated fees were intended to align pricing more closely with “the financial risks and performance of backed loans,” aiming for a more accurate reflection of risk rather than a direct cross-subsidization.

These clarifications also pointed out that, in specific scenarios, many borrowers with high credit scores or large down payments would actually see their fees decrease, underscoring the complexity of the new fee matrices beyond a simplistic ‘good credit pays more’ narrative. The ongoing debate, including a bill introduced in Congress by Republican Representative Stephanie Bice to repeal the changes and public feedback gathered through a May 2023 Request for Input, continues to highlight the delicate balance the FHFA seeks between ensuring financial stability for the GSEs and promoting equitable access to homeownership.

13. Strategies for Borrowers to Navigate the Updated Fee Landscape

For prospective homebuyers and those considering refinancing, the FHFA’s revised mortgage fee structure necessitates a strategic approach to manage potential costs effectively. Navigating this updated landscape involves a multi-pronged strategy that encompasses careful timing, informed loan selection, and leveraging professional guidance. These three key approaches can help borrowers minimize fees and secure the most favorable terms possible under the new rules.

One crucial strategy involves timing the mortgage application. Borrowers with mid-600s credit scores, for instance, saw lower upfront fees effective May 1, 2023, presenting a more opportune moment for them to apply. While the DTI-based fee was rescinded, the interplay of other factors still means that understanding how your profile aligns with the new matrices at a given time can be advantageous. Considering these timing elements and weighing the trade-offs of various product offerings can directly influence the total cost of a loan.

Another vital step is to meticulously evaluate different loan options by focusing intently on annual percentage rates (APRs). It’s not uncommon for a mortgage product with seemingly lower upfront fees to carry a higher interest rate over the life of the loan. Therefore, a comprehensive comparison of APRs across multiple lenders and products is essential to discern the true cost of borrowing and ensure that any initial savings aren’t offset by increased long-term expenses. This diligent comparison helps avoid superficial savings that might prove more costly in the long run.

Finally, working closely with a qualified loan officer is perhaps the most impactful strategy. These experts can provide invaluable clarity on how the complex Loan-Level Price Adjustments specifically impact an individual’s situation. They can explain how personal factors such as credit score, down payment size, and debt-to-income (DTI) ratio translate into actual costs. Loan officers are also equipped to suggest tailored strategies, such as debt consolidation or adjustments to monthly payments, which could make a loan more manageable and potentially reduce overall expenses under the new framework. Aiming for a credit score of 780 or higher and keeping your DTI below 40% are general best practices recommended for securing more favorable rates.

Read more about: Student Loan Relief Unpacked: Navigating Eligibility for Up to $20,000 in Federal Forgiveness, State Programs, and Upcoming Changes

14. Navigating the Future of Homeownership in a Dynamic Market

The May 2023 mortgage fee structure changes initiated by the FHFA have undeniably reshaped the landscape of home financing, presenting both opportunities and challenges for a wide array of borrowers. From first-time buyers striving for affordability to existing homeowners considering refinancing and investors expanding their portfolios, the recalibrated Loan-Level Price Adjustments (LLPAs) demand a deeper understanding and a more strategic approach to securing a home loan. The debate surrounding these adjustments, with its focus on balancing equitable access with financial stability, underscores the continuous evolution of housing policy.

As we look ahead, the core message for anyone entering the mortgage market remains clear: knowledge and preparation are paramount. While the FHFA has clarified its intentions and responded to industry feedback, as evidenced by the rescinded DTI fee, the intricate interplay of credit scores, loan-to-value ratios, and loan purpose will continue to dictate upfront costs. The housing market is inherently dynamic, influenced by economic shifts, legislative actions, and agency directives, making ongoing vigilance crucial for borrowers.

Read more about: Sydney Sweeney’s Surprising Financial Reality: How Her Off-Screen Ventures Outpace Hollywood Earnings

Successfully navigating this environment requires more than just searching for the lowest advertised rate. It demands a proactive commitment to improving one’s financial profile, whether that means boosting credit scores, strategically managing debt-to-income ratios, or carefully planning down payments. Moreover, the value of expert guidance cannot be overstated. Engaging with seasoned mortgage professionals who can dissect the complexities of these fees and offer personalized strategies will be indispensable in making informed decisions and securing the most advantageous path to homeownership or refinancing in this new era of mortgage pricing.