Searching for the perfect apartment can often feel like embarking on a daunting quest, especially for those stepping into the rental market for the first time. Whether you’re a young professional launching your career, a student balancing studies, a couple building a life together, or a family seeking stability, the excitement of finding a new home can sometimes overshadow the crucial financial commitments involved. It’s not just about selecting a space that looks good; it’s about ensuring it’s financially sound and truly suited to your lifestyle, free from unexpected financial burdens. Understanding the intricate financial implications embedded in a rental lease agreement is paramount, as this knowledge can be your shield against hidden costs, unforeseen expenses, and long-term regret.

Vigilance is truly key in this journey. From determining if the rent comfortably fits within your budget to recognizing subtle signs of a sketchy landlord, or uncovering those sudden, often camouflaged fees, every detail matters. Many renters, both seasoned and new, often skim through lease agreements, primarily focusing on obvious details like the monthly rent, the lease term, and the security deposit. However, a wealth of potential financial traps can be buried deep within the fine print, legally binding clauses that, once signed, can lead to costly disputes, unexpected expenses, and significant financial strain.

This in-depth guide is designed to empower you by walking you through the most common financial red flags and overlooked clauses in rental agreements. We’ll meticulously unpack the financial dangers that often hide in plain sight, equipping you with the insights needed to make informed decisions. By shedding light on these common pitfalls and offering actionable advice, our goal is to help you secure a place that genuinely feels like home, safeguarding your budget against unnecessary stress and ensuring a smooth, financially responsible rental experience. Let’s dive in and uncover the first seven crucial traps.

1. **Excessive Application, Administrative, and Move-In Fees**

When the thrill of finding a promising new apartment takes over, it’s easy to overlook the initial barrage of fees that can quickly inflate your moving costs. While certain charges are standard in the rental process, a significant financial pitfall lies in the accumulation of excessive or redundant administrative, application, and move-in fees. These fees are often among the first financial hurdles a prospective tenant encounters, and they can catch renters off guard if not scrutinized carefully.

The context explicitly warns, “Administrative, application, and move-in fees can quickly add up.” It highlights that while “some fees are standard,” renters should “be cautious of excessive or redundant charges that may be negotiable.” These upfront costs, which might seem minor individually, have a cumulative effect that can significantly stretch a new renter’s initial budget, creating an unexpected financial burden before you even unpack your first box.

To protect yourself, the key is proactive inquiry and diligent review. Always “request a detailed breakdown” of all fees before committing. Furthermore, it’s crucial to “seek clarification on any fees that seem unjustified.” Understanding which fees are genuinely necessary versus those that might be negotiable or even excessive is an essential step in safeguarding your finances from these common upfront traps. Don’t hesitate to ask questions; clarity upfront can save you from budget surprises down the road.

2. **Unfair Security Deposit Deductions & Management**

The security deposit is a standard requirement in most rental agreements, intended to cover potential damages to the property beyond normal wear and tear. However, this seemingly straightforward financial safeguard can quickly become a significant financial trap if the conditions for its return or deduction are unclear or unfairly applied. The excitement of moving in often overshadows a thorough examination of these critical clauses.

Many landlords, as the context points out, “impose unfair deposit deductions for normal wear and tear, which should not be the case.” The definition of what constitutes “damage” versus “normal use” can be subjective, leaving tenants vulnerable to unwarranted charges. Furthermore, simply understanding that a deposit is required isn’t enough; you also need to know the legal framework surrounding its management. “Before collecting or managing security deposits, it is crucial to understand the relevant laws in your state or jurisdiction,” as these dictate amounts, holding requirements, and return processes.

To prevent financial loss and disputes, meticulous documentation is your best defense. “Check if the lease clearly outlines the conditions under which deductions are permissible.” Beyond that, it’s “wise to document the apartment’s condition at both move-in and move-out to support any disputes,” ideally with photos. This evidence helps protect your deposit and ensures that landlords comply with the rule that “landlords can only use your security deposit for specific reasons, such as unpaid rent, damage beyond normal wear and tear, or cleaning costs.” By being proactive and informed, you can significantly enhance your chances of receiving your full deposit back.

3. **Unclear Tenant Repair & Maintenance Obligations**

One of the most frequently overlooked yet potentially costly clauses in a lease agreement pertains to repair and maintenance responsibilities. It’s easy to assume that major repairs are automatically the landlord’s duty, but the fine print can sometimes subtly shift significant financial burdens onto the tenant, leading to unexpected and substantial expenses.

The context explicitly warns, “Leases often contain clauses concerning maintenance and repairs, potentially leading to unexpected costs.” It advises to “specifically, look for leases that require tenants to cover the cost of repairs that may arise.” This can include responsibilities for things you might typically expect the owner to handle, such as appliance malfunctions or even structural system upkeep like HVAC or plumbing, as noted in the discussion of “Repair & Maintenance Obligations.”

To safeguard your budget, clarity is absolutely essential. Before signing, you must “clarify what maintenance is included in your rent and what you’re responsible for.” The article stresses the importance of specifying “which repairs fall under ‘routine maintenance’ and which are structural” to avoid ambiguity. Don’t settle for vague language; request more detailed terms in writing. This proactive approach prevents unexpected bills from arising when maintenance issues inevitably occur, ensuring you don’t unknowingly agree to significant financial liabilities that should rightly fall on the landlord.

4. **Opaque or Unfair Rent Increase Clauses**

While landlords inherently have the right to adjust rent, the manner and frequency of these increases can become a major financial trap if not carefully outlined and understood in the lease agreement. The presence of rigid or vague rent escalation clauses can severely disrupt a tenant’s budgeting and lead to unexpected financial strain down the line.

“Be wary of rigid rent escalation clauses,” the context advises, noting that “these clauses detail how and when your rent might increase.” A lease with “vague or frequent escalation terms can disrupt your budgeting,” turning what should be a predictable expense into an unpredictable financial challenge. It’s not uncommon for some agreements to include “mandatory rent reviews that could mean regular increases,” catching tenants by surprise if they haven’t thoroughly read the provisions.

Your protection against this trap lies in meticulous review and negotiation. “Make sure any rent increase terms are reasonable and align with local rent control laws, if applicable.” If the lease language surrounding rent increases is “unclear, ask for specifics or request a fixed-rate term” to ensure stability. Understanding when and by how much your rent can go up is critical; it empowers you to plan your finances effectively and avoid “painful surprise hikes later” that can seriously impact your long-term budget.

Read more about: Unpacking the Code: The 15 Most Controversial Hiring Practices Shaking Up Major Tech Companies Today

5. **Draconian Early Termination Penalties**

Life is unpredictable, and sometimes, circumstances necessitate breaking a lease before its stipulated term ends. Whether it’s a job relocation, a family emergency, or simply changing life plans, being forced to move can be stressful enough without the added burden of exorbitant financial penalties. This is where draconian early termination clauses pose a significant financial danger.

Many lease agreements, as the context warns, “include stiff penalties if you break the contract before the term is up.” These penalties can be severe, often requiring you to “pay the remaining balance or a set fee,” which could amount to months of rent or a substantial lump sum. The article notes, “Life changes can force a move, and draconian termination fees are costly,” highlighting the very real financial risk if such clauses are ignored.

To mitigate potential financial damage, it’s crucial to examine these provisions closely. “Look for leases that outline transparent processes and reasonable fees for lease termination.” Even better, “discuss having the option to sublet or find a replacement tenant to mitigate potential financial damage.” If you anticipate that your situation might change, actively “look for leases with flexible exit options or negotiate these terms before signing,” ensuring that you understand “exactly what those penalties are” before committing to the agreement.

6. **Unaccounted Utility Costs**

When budgeting for a new rental, it’s natural to focus on the monthly rent, but savvy renters know that living expenses extend far beyond that single figure. A common financial trap, and one that can significantly inflate your monthly outflow, is found in unaccounted utility costs. These are expenses that are often overlooked until the first set of bills arrives, much to the tenant’s surprise.

The context explicitly advises, “First, consider utility costs. Some leases include utilities like water and gas, but others may not.” This ambiguity can be a major red flag. If the lease doesn’t clearly specify which utilities are covered, you could find yourself responsible for a host of essential services – water, gas, electricity, trash, and sewage – that you hadn’t budgeted for, drastically increasing your actual living expenses month-to-month.

To protect your finances, thorough investigation is crucial. Always “verify what’s covered” in the lease agreement regarding utilities. Beyond that, the article recommends, “ask for estimates of past utility bills” for the unit. This proactive step “can help you assess whether you can sustain the full expense month-to-month.” Gaining this clarity upfront ensures that you have a realistic picture of your total monthly housing costs and can budget accordingly, avoiding a costly and unexpected drain on your finances.

Read more about: Achieving Financial Synergy: The 15 Best Budgeting Apps for Couples to Track Expenses and Build Wealth

7. **Hidden Renovation Charges and Rent Hikes**

An apartment that has just undergone fresh renovations can be incredibly appealing, promising a modern and comfortable living space. However, beneath the gleaming new surfaces, there can be a hidden financial trap: the potential for immediate or future rent hikes tied directly to these upgrades. What seems like an attractive improvement can quietly become a significant expense.

The context warns about “Renovation charges” being a “red flag.” It states, “If the apartment is due for upgrades, you might face a sharp increase in rent.” While landlords might present renovations as a benefit, the financial reality for the tenant can be quite different. “While fresh renovations can be enticing,” the article cautions, “they might come with rent hikes that stretch your budget” far beyond what you initially anticipated.

To avoid this financial surprise, it’s vital to be proactive before signing. “Before signing, confirm the current state of the apartment and any slated improvements.” More importantly, inquire directly about how any past or upcoming renovations will impact your rent. Ensure that the lease agreement clearly spells out the rental rate, and if any future increases are tied to renovations, seek clarification on the specifics. This diligence can prevent you from stepping into a beautifully renovated space only to find your budget severely strained by unexpected and significant rent adjustments.

Beyond the Surface: Uncovering the Remaining Seven Hidden Financial Dangers in Your Rental Agreement

Having navigated the initial gauntlet of upfront fees and immediate cost concerns, our journey into the intricacies of rental lease agreements continues. Many financial traps aren’t immediately obvious; they lie in the long-term commitments and often-overlooked clauses that can surprisingly alter your financial landscape over the duration of your tenancy. These hidden provisions can bind you to unexpected expenses, restrict your flexibility, or even make you personally liable for significant sums.

Understanding these deeper, more subtle dangers is crucial for truly empowering yourself in the rental market. It’s about more than just avoiding a bad deal; it’s about securing a stable, predictable, and financially healthy living situation. Let’s peel back the layers and uncover the next seven critical financial pitfalls that every renter should be aware of before committing to a lease.

Read more about: Unlock Your Home’s Hidden Wealth: Simple, Tax-Free Strategies to Convert Equity into Income

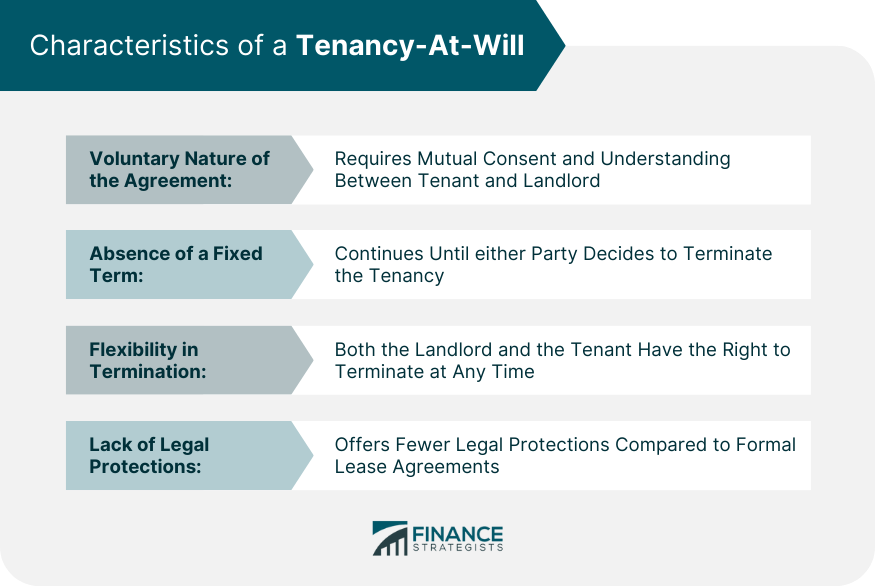

8. **Automatic Renewal Clauses**

One of the most frequently overlooked yet potentially costly clauses in a lease agreement is the automatic renewal provision. This term can quietly lock you into another full lease period if you don’t provide proper notice to your landlord before your current agreement is set to expire. It’s an easy detail to miss amidst the hustle of daily life, but overlooking this deadline, even by a single day, can trigger significant financial repercussions.

According to the context, missing this crucial deadline “may mean you’re responsible for months of extra rent or payments.” Imagine being suddenly bound to another year of rent payments because you missed a notification window, even if your personal circumstances have changed or you planned to move. This unexpected financial burden can severely disrupt your budget and force you into a situation you no longer desire, highlighting how seemingly minor administrative details can have major financial consequences.

To safeguard your finances against this trap, proactive management is absolutely essential. Always “check how much notice you need to give” for lease termination or non-renewal, and make a point to “set reminders well before the deadline.” By understanding these terms upfront and being diligent with your calendar, you can avoid unwanted lease extensions and maintain control over your housing decisions and financial planning.

Read more about: Don’t Get Trapped: The 13 Essential Questions to Ask Before Signing Any Contract

9. **Insurance Requirements**

Many rental agreements include clauses mandating that tenants carry specific types of insurance, most commonly renters’ or liability insurance. While often seen as an additional expense, this requirement is a significant financial consideration. Failing to comply with these terms can put you in breach of your lease agreement, potentially leading to penalties or even eviction, adding another layer of financial risk.

Beyond simply being a requirement, the context points out that landlords sometimes “mandate specific coverage amounts that cost more than a standard policy.” This means you can’t just pick any basic renters’ insurance; you might need to shop around to meet the lease’s exact specifications, which can unexpectedly inflate your monthly housing costs. It’s crucial to remember that while the landlord’s property insurance covers the building, it typically doesn’t protect your personal belongings from theft, damage, or unforeseen events.

To effectively manage this financial mandate, ensure you “understand the requirements and compare rates to find the best deal” that meets both the lease’s terms and your personal needs. It’s wise to “include the cost of insurance in your budgeting from the start,” rather than treating it as an afterthought. Obtaining renters’ insurance is not only a lease obligation but also a smart financial move that provides peace of mind and safeguards your valuable assets from potential loss.

Read more about: Diesel Durability Unveiled: 10 Engines That Redefine Longevity — And Those That Don’t

10. **Restrictive Subleasing & Use Restrictions**

Lease agreements often contain clauses that limit how you can use the property or whether you’re permitted to sublet. These restrictions, while seemingly minor, can become major financial traps if your living or business circumstances change. Violating these terms can lead to severe consequences, including significant fines or even eviction, which can trigger immediate and long-term financial distress.

The context highlights examples such as being “barred from running a business from home or having roommates.” For commercial tenants, “Sublease & Assignment Restrictions” can mean being “stuck paying rent on an unusable space if business slows.” If you sign a lease with strict limitations and your life unexpectedly necessitates a home-based business, a new roommate, or a temporary relocation, you could find yourself in a financially precarious position.

To mitigate these risks, it’s vital to thoroughly review these clauses before signing. If you anticipate that your situation might change, “look for flexible terms or permission to sublease.” The context advises looking for clauses that “give landlords approval rights without being ‘unreasonably withheld,'” allowing for more flexibility. Most importantly, “Always get any agreement in writing” to ensure that any negotiated flexibility is legally binding and protects your financial interests.

11. **Late Payment Fees**

While often clearly stated, the financial impact of late payment fees can be a subtle yet persistent drain on a renter’s budget. These charges, imposed when rent is not paid by the due date, can accumulate quickly and disproportionately impact your finances, turning what should be a straightforward monthly expense into a source of ongoing financial stress.

According to the context, “Creditors often impose late fees, which can range from a few dollars to a substantial amount, depending on the type of debt.” For rental agreements, even if a few days late might incur small fees initially, these “can quickly accumulate over a year,” transforming minor oversights into significant financial penalties. Beyond just the fees, the context also notes that your “interest rate may increase, making it even more expensive to pay back your debt” in other financial contexts, underscoring the broader impact of late payments on your overall financial health.

To avoid this trap, meticulous attention to payment schedules is paramount. Always “outline exactly when rent is due and the penalties for late payments in the lease.” The context advises reviewing your lease “for details on late fees, including the amount and the grace period for late payments.” If you foresee financial hardship, “try to communicate with your landlord and arrange a payment plan to avoid accruing significant late fees.” Being proactive and clear about payment expectations is the best defense against these avoidable financial drains.

Read more about: The Essential 12: Ironclad Contract Clauses Every Influencer and Brand Needs to Know

12. **Ambiguous Language and Legal Jargon**

Rental lease agreements are legal documents, and as such, they are often laden with legal terminology and phrases that can be confusing or ambiguous to the average renter. This isn’t just an inconvenience; “Ambiguous language hides financial dangers that may only become clear after a dispute,” as the context warns. These hidden dangers can result in unforeseen costs or obligations that you unknowingly agreed to.

Many people, in their eagerness to secure a home, tend to “skip reading the fine print or don’t fully understand what they’re signing.” This can lead to a situation where a vaguely worded clause about ‘property upkeep’ might later be interpreted to include costly repairs you assumed were the landlord’s responsibility, or ‘reasonable wear and tear’ could be stretched to justify unfair security deposit deductions. The lack of clarity can be financially devastating when disputes arise, leaving you with unexpected bills and limited recourse.

To protect yourself from the financial dangers lurking in vague language, clarity is your strongest ally. “If you’re unsure about any section, ask for clarification.” Don’t hesitate to engage your landlord or a legal professional if needed. Most critically, “Don’t rely on verbal explanations—get all changes in writing.” Ensuring that all terms are clear, specific, and documented prevents future misunderstandings and safeguards your financial well-being against costly legal interpretations.

Read more about: 12 Telehealth Platform Flaws Seriously Confusing Seniors: Why Age-Friendly Design is Failing

13. **Personal Guarantees and Joint Liability**.

Certain lease agreements, particularly those for commercial properties or when a tenant’s credit history is limited, may require a personal guarantee. This is a significant financial commitment where “you’re personally responsible for the payments, even if your business or roommate defaults.” It means that your personal assets could be at risk if the primary tenant or entity is unable to fulfill the lease obligations.

Compounding this risk are “Joint liability clauses,” which can make you “responsible for the full amount if another tenant skips out.” This is a critical point for roommates or co-tenants to understand. If one person leaves or fails to pay their share, the landlord can legally pursue the remaining tenants for the entire unpaid balance, not just their portion. This can place an immense and unexpected financial strain on individuals who believed they were only responsible for their share.

Before agreeing to such terms, it is absolutely essential to “Understand your obligations.” These clauses “can have long-term financial consequences” that extend far beyond the immediate lease term. If you are entering a lease with roommates or for a business, ensure everyone understands the implications of joint liability and personal guarantees, and consider the financial stability of all parties involved before signing on the dotted line.

Read more about: Electrifying the Family Ride: Are 2025 Electric Minivans Finally Practical and Poised to Reshape Your Travel Experience?

14. **The Relocation Clause**

A less common but incredibly disruptive and potentially costly financial trap is the relocation clause. This provision grants the landlord the right to move a tenant to a different space within the property during the lease term. While it might seem like a simple logistical arrangement, its implications for a tenant, especially a business, can be profound and financially damaging.

As the context explains, for tenants, “Relocation can disrupt operations, drive away customers, and force expensive build-outs in the new space.” Imagine a small café, as in the example given, being moved “to the back of the property” after signing a lease with such a clause. The café “loses foot traffic, revenue plummets, and a dispute erupts.” Such a forced move necessitates unforeseen expenses, lost income, and the significant hassle of relocating, all without the tenant’s initial agreement to such a move.

To protect your financial stability and operational continuity, it is paramount to be aware of this clause and review it with extreme care. The context emphasizes, “Every lease should be reviewed with an eye for detail — because the risks of overlooking certain clauses are costly.” If a relocation clause is present, seek to understand the conditions, potential compensation, and implications. Negotiate its removal or seek specific protections before signing, as this clause can otherwise lead to substantial, unforeseen financial losses and operational setbacks.

Final Thoughts: Your Lease, Your Shield

In the dynamic world of rentals, a lease agreement is far more than just a piece of paper outlining rent and dates; it is a legally binding contract brimming with potential financial opportunities and pitfalls. From the upfront fees that greet you at the outset to the nuanced clauses governing renewals, repairs, and even potential relocation, every detail matters. The journey through these 14 worst financial traps in a rental lease agreement is designed to empower you, transforming you from a passive signatory into an informed, proactive renter.

Read more about: The 12 Essential Prenup Clauses That Even Everyday Couples Can Learn From Celebrity Agreements

By meticulously reading beyond the obvious, understanding ambiguous language, and questioning every fee, you build a robust financial shield against unexpected costs and disputes. Remember, knowledge is your most powerful tool in securing not just an apartment, but a home that genuinely aligns with your budget and lifestyle, free from the stress of unforeseen financial burdens. Taking the time to understand your lease protects your peace of mind and ensures an enjoyable living experience, allowing you to truly thrive in your chosen space. Always prioritize thorough due diligence; it’s an investment that pays dividends in financial security and lasting comfort.