Car insurance premiums have experienced a dramatic escalation recently, transforming into a notable force driving inflation across the United States. At the outset of 2024, the cost of insuring a vehicle in the U.S. had surged by a remarkable 20.6 percent compared to the preceding year, as reported by the Bureau of Labor Statistics consumer price index (CPI). This increase is particularly significant, representing the single greatest price jump witnessed since 1976. For countless drivers, deciphering the myriad factors that contribute to these soaring costs can often feel like navigating an intricate and bewildering financial landscape.

While fundamental aspects like your personal driving record, your age and accumulated driving experience, and even your geographical location undeniably play critical roles in determining your insurance rates, the specific vehicle you choose to operate—its make, model, built-in features, and underlying technological architecture—exerts a profoundly substantial influence on the final premium you are quoted. There’s a clear economic reality at play: cars are becoming progressively more expensive to purchase initially and significantly more costly to repair after an incident. This dual rise in expenses directly translates into higher payouts for insurance companies when accidents inevitably occur, a financial burden that is, in turn, passed on to all policyholders through increased rates.

To truly empower yourself as a consumer and make financially sound decisions, it is absolutely essential to possess a comprehensive understanding of which specific vehicle characteristics are most likely to inflate your car insurance premiums. This knowledge is invaluable, whether you are actively in the market for a brand-new car, considering a pre-owned option, or simply endeavoring to better comprehend the intricacies of your existing insurance policy. In the following sections, we will meticulously examine several distinct car features and various vehicle types that frequently come with a steeper price tag for auto insurance, providing you with clarity on these potential cost drivers and equipping you to choose wisely.

1. **Sedans**Historically, sedans have been a popular and practical choice for many drivers, offering a balance of utility and comfort. However, when it comes to car insurance premiums, sedans often find themselves in a category that incurs higher average annual costs when compared to more robust vehicle types such as minivans, trucks, and SUVs. This reality can be quite counterintuitive for consumers who might perceive sedans as a standard, lower-risk option in the automotive market.

Historically, sedans have been a popular and practical choice for many drivers, offering a balance of utility and comfort. However, when it comes to car insurance premiums, sedans often find themselves in a category that incurs higher average annual costs when compared to more robust vehicle types such as minivans, trucks, and SUVs. This reality can be quite counterintuitive for consumers who might perceive sedans as a standard, lower-risk option in the automotive market.

The precise financial impact is clearly illustrated in the provided context, which indicates that sedans carry an average annual insurance cost of $3,254 for full coverage. This rate is calculated based on comprehensive liability limits (100/300/100), collision and comprehensive coverage, uninsured motorist coverage, and any additional state-mandated insurance. When directly compared to minivans ($2,084), trucks ($2,380), and SUVs ($2,526), the sedan’s premium stands out as significantly higher, highlighting a distinct actuarial assessment by insurers.

Several underlying factors contribute to this pricing differential. Insurers consider repair costs and historical claims data for specific models within the sedan category. Certain sedans, especially those with advanced features or premium branding, can be surprisingly complex and expensive to repair. Additionally, the perception of risk associated with sedan drivers, based on statistical analysis of accident frequency and severity, might also contribute to these elevated premiums, making them a less economical choice for insurance.

Read more about: 14 Unlikely Automotive Heroes: The Cars That Shocked Everyone and Redefined Success

2. **Coupes**For drivers who prioritize sleek aesthetics, sporty handling, and a more dynamic driving experience, coupes often represent an appealing option. However, this preference for style and performance typically translates directly into even higher car insurance premiums than those associated with sedans. This particular body style consistently ranks among the more expensive vehicle types to insure, a reflection of inherent risk factors that auto insurers meticulously evaluate.

The financial implications are starkly clear: coupes register the highest average annual cost among the general car types detailed in the context, demanding an average annual premium of $3,323. This figure is based on the same standard full coverage parameters as other vehicle classifications. The elevated cost is not merely arbitrary; it is rooted in the typical market positioning of coupes and the statistical demographics of the drivers who tend to own them.

Coupes, by their very design and marketing, are often associated with higher speeds, more aggressive driving patterns, and a greater propensity for accidents. Furthermore, many coupes, particularly those equipped with performance-oriented trims and specialized engineering, incorporate more unique and expensive-to-source parts. This translates into substantially increased repair costs following any collision or damage incident. The confluence of perceived higher driving risk and greater repair expenses directly and significantly inflates the insurance premiums for these types of vehicles.

Read more about: 7 Game-Changing Careers AI Will Create by 2030: Your Blueprint for Future-Proofing Your Professional Journey

3. **Convertibles**The irresistible allure of open-air driving, a quintessential experience for many automotive enthusiasts, undeniably carries a notable financial consequence when it comes to securing car insurance. Convertibles, with their distinctive retractable roofs, are routinely classified among the more expensive vehicle types to insure. Their unique design introduces a specific set of vulnerabilities and risks that insurance providers meticulously integrate into their premium calculation methodologies.

Empirical data supports this trend, with the context indicating that convertibles command an average annual insurance cost of $3,023. This figure, derived from full coverage metrics, positions them considerably above more conventional vehicles like minivans, trucks, and SUVs. The heightened premiums for convertibles stem from a multifaceted consideration of both their inherent susceptibility to damage and the elevated costs associated with their repair and replacement.

The specialized mechanisms involved in the soft top or retractable hardtop systems are inherently complex and, consequently, expensive to repair or entirely replace, even in the aftermath of relatively minor incidents. Beyond repair complexities, convertibles are often statistically deemed more vulnerable to theft and vandalism. Their convertible tops, whether fabric or hard-folding, can be more easily compromised compared to the robust, fixed roof structure of a standard vehicle, increasing the likelihood of claims. These combined factors solidify a higher risk profile from an insurer’s viewpoint, resulting in a steeper price for coverage.

Read more about: Remember These Days? 14 Iconic Manual Transmissions That Vanished Or Are Fading From Our Car Options

4. **Luxury and High-End Models**The decision to acquire a luxury or high-end vehicle, irrespective of its specific body configuration, almost inevitably leads to a substantial increase in car insurance premiums. These prestigious vehicles, by their very definition, represent a significantly greater financial exposure and risk for insurance providers. Their sophisticated engineering, employment of cutting-edge technology, and use of premium-grade components drive up potential costs across every facet of an insurance claim.

The profound impact of luxury vehicles on insurance rates is powerfully illustrated within the provided context, which highlights the Audi RQ Quattro Performance. This particular model carries an astonishing average annual premium of $6,656 for full coverage. This extraordinary figure starkly demonstrates the reality that high-end trim levels and luxury models inherently command insurance rates that are often more than double the national average, making them a significant financial commitment beyond the initial purchase price.

The primary catalysts for these escalating insurance costs are manifold. Foremost is the substantially higher purchase price of the vehicle itself, meaning insurers face a larger potential payout if the car is totaled. Secondly, and perhaps even more critically, is the exorbitant cost associated with their repairs. Luxury cars are not merely assembled; they are intricately engineered with specialized parts, advanced materials, and often bespoke components that necessitate highly specialized technicians and equipment for any repair work. Even seemingly minor damage can quickly accumulate into monumental repair bills, costs which insurance companies must proactively anticipate and factor into their elevated premium structures.

Read more about: When Riches Collide with Reality: The 12 Worst Financial Mistakes Celebrities Make with Luxury Assets

5. **Specific High-Performance Electric Vehicles**While the broader adoption of electric vehicles (EVs) is widely lauded for its environmental benefits and technological innovation, a distinct sub-category—specific high-performance EV models—stands out for generating exceptionally high insurance costs. These vehicles represent a confluence of the inherent complexities associated with advanced electric powertrains and the established expense profile of luxury and performance characteristics, presenting a unique and formidable challenge for insurance underwriters.

The available data explicitly underscores this trend by identifying models such as the Tesla Model X and Tesla Model S Plaid among the most expensive cars to insure in the market. These particular vehicles command average annual premiums of $5,568 and $5,522, respectively. These figures are not only considerably higher than the national average but also illustrate that the insurance pricing for electric vehicles is far from uniform, with high-performance variants attracting premium rates due to their specialized attributes.

The fundamental rationale behind these elevated costs is rooted in their advanced technological integration and the sheer, often instantaneous, power delivery they provide. Such high-performance EVs incorporate extraordinarily sophisticated components, including specialized battery packs and complex electronic control units, all of which are exceedingly expensive and specialized to repair or replace in the event of damage. Furthermore, the impressive performance capabilities of these vehicles can lead to a statistical perception of increased risk among insurers, as they may be driven in a manner that statistically increases the likelihood and severity of accidents.

Read more about: 14 Unlikely Automotive Heroes: The Cars That Shocked Everyone and Redefined Success

6. **Electric Vehicles (EVs) in General**Moving beyond the realm of niche, high-performance models, electric vehicles in their more general classification also tend to incur higher insurance premiums when directly compared to their traditional internal combustion engine (ICE) counterparts. This emerging trend, notably, persists despite the often-cited advantage of EVs requiring less routine maintenance. It represents a significant financial consideration that prospective EV owners must carefully evaluate, as the advanced nature of EV technology profoundly influences this cost differential.

The provided context unequivocally supports this assessment, stating that insuring an EV is generally more expensive because these vehicles “tend to have more sophisticated technology, and if there’s an accident, those components are more expensive to repair or replace.” This assertion is further substantiated by LexisNexis, a reputable provider of industry data to insurance companies. LexisNexis explicitly cites “higher labor and parts prices associated with EVs that mean it costs more to fix an electric vehicle versus a traditional internal combustion engine car,” directly linking repair complexities to increased premiums.

Concrete comparative examples provided within the context powerfully illustrate this general cost elevation. For instance, a Chevrolet Bolt EV is noted to cost $78 more per year to insure than a Hyundai Ioniq Blue, which is a hybrid vehicle. More strikingly, a Tesla Model 3 Long Range carries an average annual premium that is $470 higher than that for a gas-powered Audi A4 2.0T Premium. The relative novelty of EV technology, combined with the requirement for specialized expertise and equipment for diagnosis and repair, collectively contributes significantly to these elevated insurance rates, thereby impacting the comprehensive cost of owning an electric vehicle.

Read more about: 14 Unlikely Automotive Heroes: The Cars That Shocked Everyone and Redefined Success

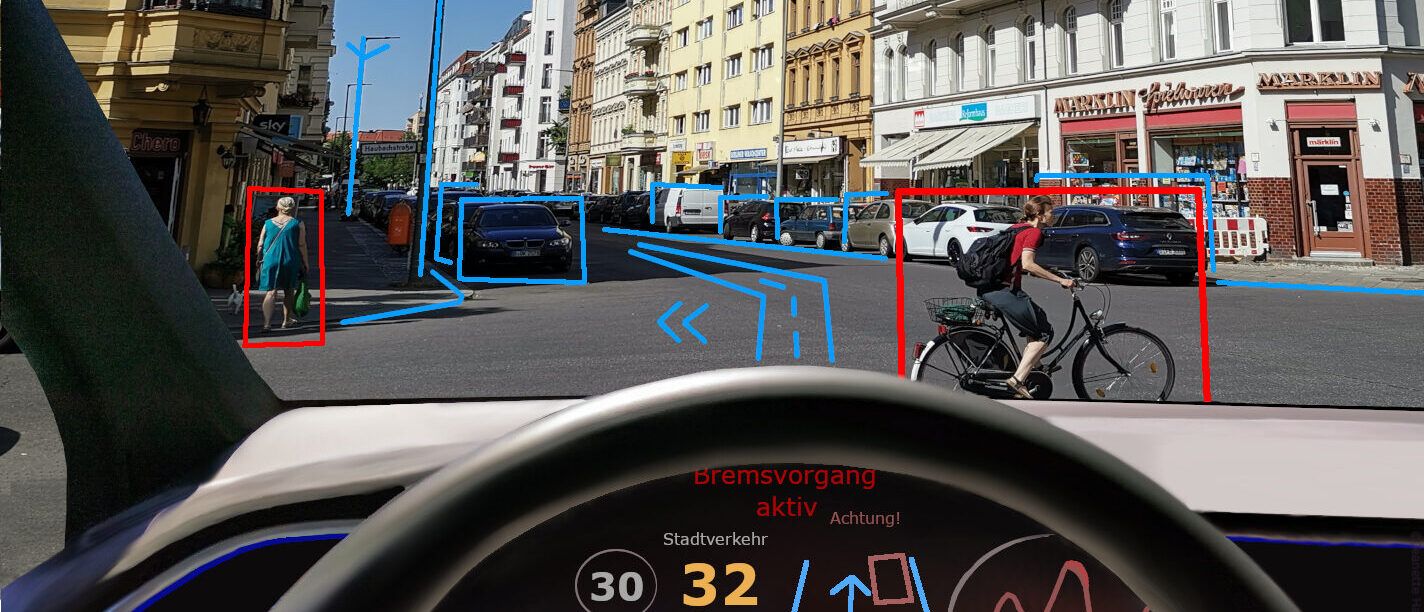

7. **Advanced Driver Assistance Systems (ADAS)**While designed to enhance safety and convenience, advanced driver assistance systems (ADAS) present a paradoxical challenge: they are a notable factor in driving up car insurance premiums. It seems counterintuitive that features intended to prevent accidents could make coverage more expensive, yet their inherent complexity and repair costs make them a significant financial consideration for insurers.

These sophisticated systems rely on an array of high-tech components, including cameras, radar, and lidar sensors, which are exceptionally costly to replace. Beyond the expense of the parts themselves, the intricate nature of ADAS means that any damage necessitates specialized repair procedures and equipment, further inflating the overall cost of a claim.

Indeed, the precision required for ADAS is extraordinary. The context highlights that a sensor misaligned by even a single degree—roughly the thickness of a business card—can lead to an error of 66 inches over a distance of 100 yards. This level of accuracy demands that only a limited number of specialized facilities, equipped with perfectly level floors, ideal lighting, and automaker-specific calibration tools, can perform the necessary repairs. Such equipment can represent an investment of up to $1 million.

This reality directly translates into higher repair bills, a burden insurance companies must account for in their premium structures. Hami Ebrahimi, chief commercial officer at Caliber Collision, succinctly captured the sentiment, stating, “It’s almost becoming too expensive to fix the car.” Furthermore, the context points out that despite studies showing automatic emergency braking systems have reduced claim frequency by 25% in the United Kingdom, the cost of claims soared by 60% over the same five-year period.

Complicating matters further, some drivers opt to simply turn off these advanced systems if they find them annoying or intrusive. This creates a situation where insurance companies may still pay significantly to repair complex features that drivers aren’t even utilizing. This confluence of high repair costs, specialized requirements, and sometimes underutilized benefits solidifies ADAS as a key contributor to rising insurance premiums for newer vehicles.

Read more about: The Raw Truth: 10 Cars That Aced & Failed Crash Tests — Where Engineering Triumph Meets Genuine Disappointment

8. **Complex Technology and Features**Beyond the specific realm of Advanced Driver Assistance Systems, the proliferation of complex technology and advanced features across all aspects of modern vehicles contributes significantly to escalating insurance premiums. Contemporary cars are increasingly integrated with sophisticated electronics, specialized materials, and unique components that elevate their appeal but also their cost to insure.

These advanced features are impressive, but they inherently tend to be more complex and are often made up of expensive-to-replace components. Whether it’s an intricate infotainment system, specialized lighting arrays, or premium interior electronics, the repair or replacement of these elements demands greater expertise and often more expensive parts than traditional vehicle components.

The cost implications are substantial. Even what might appear to be minor damage to a vehicle’s exterior can conceal underlying damage to these integrated technologies, leading to repair bills that quickly accumulate to monumental sums. Insurers, therefore, factor in this elevated risk of high repair costs into their premium calculations.

While some advanced features, especially safety-related ones, undoubtedly offer benefits, consumers are encouraged to consider whether every upgrade justifies the potential increase in their insurance payments. The decision to opt for a car laden with numerous complex technologies means embracing the associated higher costs for coverage, reflecting the inherent expense and specialization required for their maintenance and repair.

Read more about: Unpacking the Colossus: An In-Depth Look at Google’s Genesis, Growth, and Dominance in the Digital Economy

9. **Cars with Lower Safety Ratings**While top-tier safety ratings often translate into lower insurance premiums, the inverse is equally true: vehicles that receive lower safety ratings from authoritative bodies such as the National Highway Traffic Safety Administration (NHTSA) typically incur higher insurance costs. This is a crucial, though sometimes overlooked, factor for consumers evaluating potential vehicle purchases.

Organizations like the NHTSA employ a comprehensive 5-star rating system, where a greater number of stars signifies a safer vehicle. Cars that consistently achieve higher safety ratings are recognized for their superior ability to protect drivers and occupants in the event of a collision, thereby reducing the likelihood of severe injuries and extensive medical claims.

Conversely, vehicles with less favorable safety assessments, meaning fewer stars, are perceived by insurers as posing a higher risk of injury to their occupants during an accident. This increased potential for significant bodily harm translates directly into a higher probability of substantial payouts for medical expenses, personal injury protection (PIP), and liability claims.

Insurers meticulously integrate these safety ratings into their risk assessment models. A car’s inherent structural integrity, its crashworthiness, and the effectiveness of its passive safety features (like airbags and crumple zones) directly influence its safety rating. Therefore, a vehicle identified as having a lower safety rating will invariably be assigned a higher risk profile, leading to steeper insurance premiums to offset the increased financial exposure for the insurance provider.

Read more about: 14 Unlikely Automotive Heroes: The Cars That Shocked Everyone and Redefined Success

10. **Cars with High Theft Rates**Another significant factor that can dramatically inflate car insurance premiums is a vehicle model’s predisposition to theft. Auto insurers vigilantly track theft rates for various makes and models, and if a particular car is statistically more likely to be stolen, it immediately becomes a higher risk to insure.

This heightened risk profile directly impacts the comprehensive portion of a car insurance policy. Comprehensive coverage is designed to protect against non-collision damages, including theft and vandalism. When a vehicle model is frequently targeted by thieves, insurers anticipate a greater likelihood of having to pay out the vehicle’s market value for replacement, which leads to increased premiums for owners of these models.

The context provides an example, noting that convertibles are often statistically deemed more vulnerable to theft and vandalism due to their easily compromised tops. However, the risk extends to any model that, for various reasons—such as popularity among thieves, ease of access, or demand for parts—exhibits a high theft rate in a given area.

Insurance companies diligently look at a model’s “theft rates, past claims, and repair and replacement costs” when determining premiums. Therefore, consumers considering a vehicle that, despite other desirable attributes, has a reputation for high theft vulnerability should be prepared for this to be reflected in their car insurance costs, making such models less economical to insure.

Read more about: Your Ultimate Guide: 14 Critical Car Rental Mistakes Abroad (And How to Dodge Them!)

11. **Dodge Charger**The Dodge Charger stands out as a prime example of a specialized performance car that consistently ranks among the most expensive vehicles to insure. Its potent engine options and muscular design, while appealing to a segment of drivers, undeniably contribute to a significantly elevated insurance premium

Data from the context places the Dodge Charger with an average annual full coverage premium of $4,929. This figure is substantially higher than the national average and significantly above more utilitarian vehicle types. Such an elevated cost signals insurers’ assessment of the inherent risks associated with this particular model.

The primary drivers behind these high premiums are multi-faceted. Performance cars like the Charger are often statistically associated with higher speeds and more aggressive driving patterns, which can increase the likelihood and severity of accidents. Furthermore, these vehicles typically incorporate specialized, high-performance components and engineering that are more expensive to repair or replace after a collision.

Consequently, the combination of a perceived higher driving risk, coupled with the increased cost of parts and labor for repairs, directly and significantly inflates the insurance premiums for the Dodge Charger. For prospective owners, the thrill of its performance comes with a notable financial commitment in insurance costs.

Car Model Information: 2019 Dodge Charger SXT

Name: Dodge Charger

Caption: 1969 Dodge Charger

Manufacturer: Dodge

Production: 1966–1978,1981–1987,2005–present

ModelYears: 1966–1978,1982–1987,2006–present

Categories: 1960s cars, 1970s cars, 1980s cars, 2000s cars, 2010s cars

Summary: The Dodge Charger is a model of automobile marketed by Dodge in various forms over eight generations since 1966.

The first Charger was a show car in 1964. A 1965 Charger II concept car resembled the 1966 production version.

In the United States, the Charger nameplate has been used on mid-size cars, personal luxury coupes, subcompact hatchbacks, and full-size sedans.

Get more information about: Dodge Charger

Buying a high-performing used car >>>

Brand: Dodge Model: Charger

Price: $15,998 Mileage: 105,748 mi.

Read more about: The 14 Indestructible Off-Roaders Engineered to Conquer a Quarter-Century of Trails

12. **Lexus RC F**Following a similar trend to other high-performance vehicles, the Lexus RC F is another model that commands a notably high car insurance premium. This luxury sports coupe, known for its powerful engine and sophisticated engineering, is categorized among the most expensive cars to insure, reflecting its market positioning and specific risk factors.

According to the provided data, the Lexus RC F carries an average annual full coverage premium of $4,584. This substantial figure places it firmly among the top models for high insurance costs, illustrating that its blend of luxury and performance carries significant financial implications beyond the initial purchase price.

Insurers assess such specialized vehicles based on several critical criteria. The RC F’s design, emphasizing dynamic driving and speed, often correlates with a statistical tendency for drivers to engage in higher-risk maneuvers. This perception of increased risk directly influences the calculation of insurance rates.

Moreover, as a luxury performance vehicle, the Lexus RC F is built with advanced materials and intricate, often bespoke, components that require specialized expertise and higher costs for repairs or replacements. Even minor incidents can lead to substantial repair bills. This confluence of higher perceived driving risk and the elevated expense of maintenance and repair translates directly into the steeper insurance premiums faced by RC F owners.

Car Model Information: 2022 Audi Q7 55 Premium Plus

Name: Lexus RC

Caption: Lexus RC F Final Edition (USC10, Japan)

Manufacturer: Toyota

ModelCode: XC10

Production: October 2014 – present

ModelYears: 2015–2025

Assembly: Tahara, Aichi

Designer: Pansoo Kwon (2012)

Class: Sports car

BodyStyle: coupé

Layout: unbulleted list

Platform: Toyota N platform#New N

Related: unbulleted list

Engine: unbulleted list

Motor: unbulleted list

Abbr: on

Powerout: unbulleted list

Transmission: unbulleted list

Wheelbase: 2730 mm

Length: convert

Width: convert

Height: convert

Weight: convert

Predecessor: Lexus IS (XE20)#GSE20 / GSE21 (2008)

Sp: uk

Categories: 2020s cars, All-wheel-drive vehicles, All articles containing potentially dated statements, All articles with dead external links, All articles with unsourced statements

Summary: The Lexus RC is a compact executive two-door sport coupé manufactured by Lexus, Toyota’s luxury division. The RC which according to Lexus stands for “Radical Coupe” is a two-door coupé version of the Lexus IS (XE30). The RC is designated as the XC10 series. The RC borrowed styling from the LF-LC concept and was previewed by the LF-CC concept, being designed as a proposal by Pansoo Kwon from 2010 to early 2012 and approved by supervising designers Yasuo Kajino and Tatsuya Takei.

Get more information about: Lexus RC

Buying a high-performing used car >>>

Brand: Lexus Model: RC F

Price: $38,500 Mileage: 34,532 mi.

Read more about: The Top 14 Vehicles Built to Go the Distance: Your Guide to 350,000+ Mile Reliability

Understanding the nuanced factors that influence car insurance premiums is undeniably a crucial step for every consumer. As we have explored, from the inherent design choices and technological sophistication of a vehicle to its statistical propensity for accidents or theft, numerous characteristics of your chosen car can profoundly impact the cost of your coverage. By arming yourself with this comprehensive knowledge, you are better equipped to make informed decisions, whether you’re in the market for a new ride or simply seeking to optimize your existing policy. Making smart choices about your vehicle means taking control of your financial well-being on the road.