The global economic landscape often feels like a vast, interconnected ocean, prone to powerful currents and sudden, unforeseen storms. For nations and their complex economies, navigating these turbulent waters demands immense skill and profound foresight. Yet, alarmingly, the present confluence of factors suggests many are on a particularly perilous course, teetering precariously on the brink of significant fiscal challenges. While we’ve witnessed cycles of expansion and contraction throughout history, the current convergence of indicators paints an especially unsettling picture, flashing vivid red warnings across multiple critical fronts.

Understanding these crucial warning signs is far from a mere academic exercise. It represents a vital necessity for every individual, business, and community. The stakes involved are high, encompassing everything from our personal living standards and technological innovation to the fundamental resilience of democratic societies. The uncomfortable truth is it’s no longer a question of *if* the tide will irrevocably turn, but rather *when*—and whether we’ll be adequately prepared for the abrupt and potentially devastating shifts. This article aims to pull back the curtain on these complex and urgent realities.

Our journey commences by delving into the first six of these unsettling indicators, offering a crucial and comprehensive look into the foundational fiscal issues and their immediate, far-reaching economic repercussions. Prepare to gain a clearer, more urgent understanding of the powerful forces currently at play.

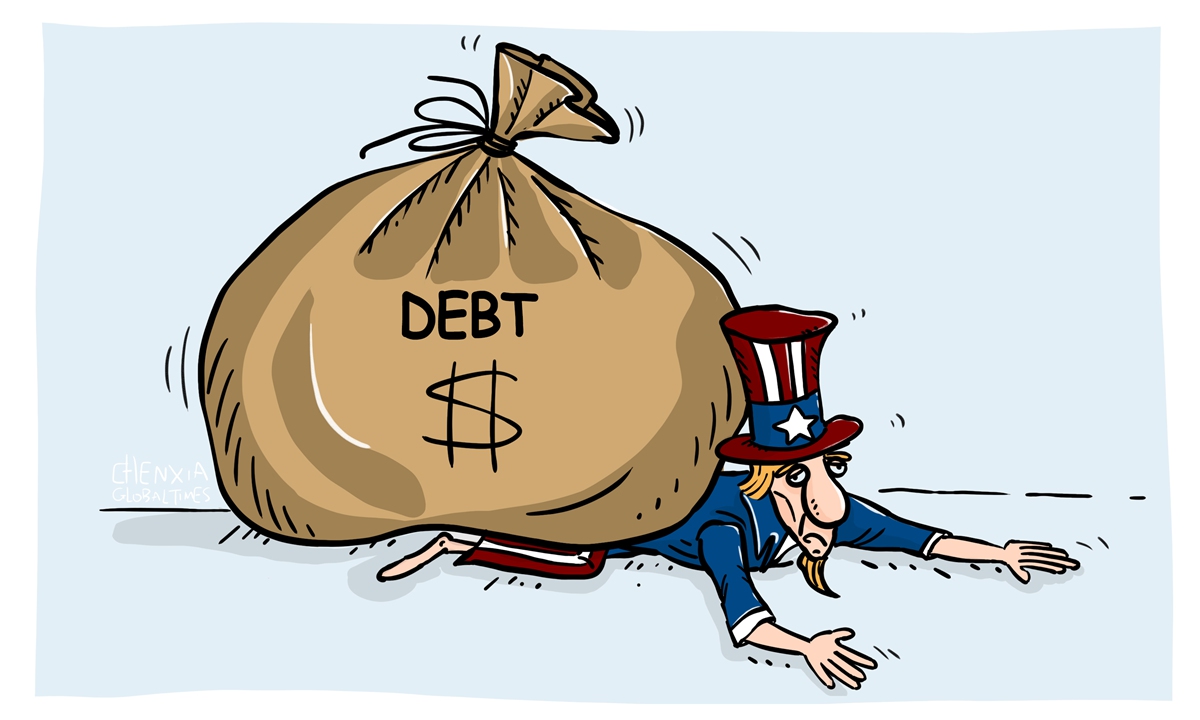

1. **Unprecedented National Debt Escalation: America’s Fiscal Tightrope Walk**The United States, traditionally a pillar of global economic stability, is currently embarked upon a fiscal journey vividly described as a “Titanic-esque voyage.” This implies a relentless progression towards a massive “iceberg of unfunded entitlement obligations.” The nation’s federal budget appears to be on autopilot, racing full steam ahead without a designated captain to seize the helm and alter its perilous course. It is a profoundly sobering prospect that demands immediate attention, spotlighting deep-seated risks to long-term national prosperity.

The precise figures supporting this alarming trajectory are stark and irrefutable, painting a clear picture of impending fiscal strain. Within a mere five years, publicly held debt—the portion borrowed in credit markets and from the Federal Reserve—is projected to surpass 106 percent of gross domestic product (GDP). This grim milestone would signify the highest debt level ever recorded in U.S. history. Yet, this unprecedented peak serves as only a precursor to what grim realities lie further down the path, requiring urgent intervention.

Looking further into the future, the projections become even more disconcerting. Even under generously optimistic assumptions—excluding major wars, recessions, or public health crises—publicly held debt is forecast to swell considerably, reaching between 120 and 140 percent of GDP within a single decade. Should these trends persist, within 30 years, public debt could astonishingly exceed 180 percent of GDP. This relentless and unchecked expansion fundamentally undermines future living standards, significantly hindering technological progress, and eroding the very bedrock upon which liberal democracy is founded.

2. **Mounting Unfunded Entitlement Obligations: A Generational Burden Unaddressed**Beneath the surface of America’s rapidly escalating national debt lies an even more formidable and potentially catastrophic challenge: the colossal “iceberg” of unfunded entitlement obligations. These are not simply abstract financial liabilities; they represent massive, long-term promises made by previous legislative bodies, for which no sufficient or sustainable funding mechanisms have been adequately secured. The lion’s share of this immense burden, a staggering 95 percent, stems overwhelmingly from the critical social safety net programs of Medicare and Social Security. Their sheer scale and the persistent lack of a viable funding plan are inexorably pushing the nation towards an inevitable economic reckoning, demanding serious political will.

To truly grasp the immense magnitude and gravity of this looming fiscal threat, consider this sobering statistic: the combined unfunded obligations for Medicare and Social Security total an astonishing $85 trillion. To put this into a more relatable context, this figure is equivalent to approximately $650,000 for every single U.S. household. Such a massive, unprecedented long-term funding shortfall means that the U.S. federal budget is, without exaggeration, “heading full steam toward an inevitable crash with economic reality.” The sheer scale of this problem necessitates immediate, bold, and decisive action, yet it continues to remain largely unaddressed by the political establishment.

The current Congress, regrettably, exhibits a woeful and persistent lack of the necessary long-term planning required to alter this perilous fiscal course. Compounding this challenge, presidents from both major political parties have actively discouraged members of Congress from even engaging in public discourse about the critical and urgent need for comprehensive entitlement reform. This widespread political reluctance and ingrained procrastination strongly suggest that the ultimate, viable solution to America’s deepening entitlement crisis will most likely need to emerge from outside the traditional legislative process. This underscores the profound depth of the political gridlock preventing these long-overdue reforms.

3. **Soaring Interest Costs on Public Debt: A Budgetary Black Hole Expands**One of the most immediate, tangible, and rapidly expanding consequences of an ever-increasing public debt is the dramatic surge in the cost of servicing that very debt. These escalating interest payments are quickly becoming a substantial and undeniable drain on national budgets, actively diverting crucial funds that could otherwise be allocated to productive investments or essential public services. The Congressional Budget Office (CBO) estimates that net interest costs for the U.S. will total a staggering $640 billion this year alone. This figure is far more than just a line item; it represents a significant 13 percent of all federal revenues, a substantial portion of the nation’s incoming funds being consumed simply to pay for past borrowing.

The projected trajectory for these interest costs is deeply concerning and shows no discernible signs of abating. The CBO anticipates a steep and alarming escalation, with net interest costs projected to reach an eye-watering $1.4 trillion by 2033. At that point, these burgeoning payments would consume a full 20 percent of federal revenues, further highlighting the escalating and untenable strain on the nation’s finances. Perhaps one of the most sobering projections is that, on this current path, interest costs are shockingly set to surpass U.S. defense spending as early as 2028. This means paying interest on accumulated debt will paradoxically cost more than safeguarding the nation, representing an unsustainable shift in national priorities.

The inherent sensitivity of these burgeoning costs to even minor market fluctuations adds yet another perilous layer of vulnerability to the national budget. Were interest rates to rise by just one percentage point higher than the CBO’s current, conservative projections over the next decade, annual interest costs could conceivably balloon to nearly $2 trillion by 2033. This possibility underscores the profoundly precarious position of the federal budget. Even modest increases in borrowing costs can trigger exponentially larger expenditures, exerting immense pressure on all other areas of government spending.

4. **The Drag of High Debt on Economic Growth: A Silent Saboteur at Work**Beyond the conspicuous, widely “seen costs” of ever-increasing interest payments, there exists a far more insidious and frequently “neglected” consequence of excessive public debt: a tangible and significant reduction in overall economic growth. This adverse effect is not speculative; rather, it is rigorously and consistently supported by extensive empirical evidence. A comprehensive review by Jack Salmon, encompassing no less than 40 studies published between 2010 and 2020 on the intricate relationship between public debt levels and economic growth, “unequivocally demonstrates that high debt hurts growth.” This definitive conclusion carries profound implications for a nation’s long-term prosperity and the sustained well-being of its citizens.

Further analytical inquiry into this critical area consistently reveals a distinct and alarming threshold where government debt begins to act as a significant and tangible drag on economic expansion. For industrialized nations, this detrimental effect typically becomes pronounced when public debt levels surpass the crucial mark of 80 percent of Gross Domestic Product (GDP). As governmental borrowing intensifies beyond this point, it invariably “crowds out private investment,” effectively absorbing available capital that would otherwise be channeled towards fueling vital business expansion, fostering groundbreaking innovation, and stimulating robust job creation. Resources are thus, regrettably, reallocated from genuinely productive endeavors—those with the inherent potential to push “out the technological frontier”—towards politically driven spending initiatives. Such initiatives, all too often, yield negative growth outcomes and create market distortions.

The ripple effect of this pervasive crowding out phenomenon extends broadly and deeply across the entire economy, creating a stifling environment for growth. Higher interest rates on federal government borrowing inevitably “spill over into higher interest rates in the private sector.” This makes it considerably more challenging and prohibitively expensive for businesses to launch new ventures or expand existing operations, thereby stifling entrepreneurship and hindering overall job growth. Similarly, ordinary individuals face increased costs when attempting to secure crucial loans for major purchases. The cumulative and distressing result of excessive government spending and debt is therefore a chilling forecast: consistently lower economic growth, a noticeable decline in living standards, and a significantly “enhanced risk of a fiscal crisis.”

5. **The Peril of a Sudden Fiscal Crisis: The “Gradually, Then Suddenly” Tipping Point**While preceding discussions focused on the gradual accumulation of national debt and its costs, a far more alarming and frequently “discounted” risk tragically looms large: the “significant tail risk of a sudden fiscal crisis.” This terrifying scenario vividly embodies the chilling wisdom popularized by Ernest Hemingway’s character, who explained going bankrupt in “Two ways… Gradually and then suddenly.” This profound insight refers to the very real possibility of a sharp, unexpected loss of investor confidence in a nation’s ability or willingness to meet its debt obligations. Such a crisis could send interest rates “skyrocketing” with devastating speed and without any clear advance warning, potentially precipitating economic collapse.

A peculiar and somewhat paradoxical characteristic of the U.S. public debt markets, specifically its “winner-take-all nature,” poses a unique and insidious challenge. During periods of intense global market volatility, U.S. Treasury bonds are universally viewed as the absolute safest asset. This perception compels investors to “flock to U.S. Treasury bonds,” channeling the vast majority of available capital towards them at remarkably cheap prices, even when the source of the volatility originates directly within the United States itself. This phenomenon, while superficially appearing beneficial in the short term, unfortunately “lulls legislators into a false sense of security.” It keeps U.S. government interest rates artificially low, effectively encouraging continued deficit spending without serious concern or effective market discipline.

However, this deceptive calm tragically masks the profound potential for a catastrophic and abrupt turn. When the tide of investor sentiment finally shifts—and history unequivocally shows it eventually does for debt-laden countries—it could do so with astonishing rapidity. This leaves absolutely no opportunity for sensible policy adjustments or a gradual, measured course correction. Instead, such a sudden fiscal crisis could brutally force legislators into making abrupt, steep spending cuts and frantically attempting to rapidly raise more revenue, precisely when the economy is already collapsing under the immense weight of rapidly rising interest rates. This grave scenario is further compounded by “investor herd mentality.”

6. **Monetary Policy’s Inability to Avert Crisis: A Critical Disconnect Between Theory and Reality**

Despite proactive measures and aggressive interventions by central banks, particularly the Federal Reserve’s efforts to stabilize financial markets through interest rate adjustments, historical evidence strongly suggests that monetary policy, when acting in isolation, may be profoundly insufficient to deflect an impending financial storm. The provided context vividly illustrates this crucial and pervasive “disconnect between monetary easing and market realities.” For instance, during the 2001 recession, the Federal Reserve’s aggressive series of rate cuts, explicitly intended to stimulate economic activity, demonstrably failed to prevent a significant and alarming spike in corporate bankruptcies. This period saw the Option-Adjusted Spread (OAS) for high-yield bonds widen dramatically, signaling heightened risk aversion and a substantial increase in default risks for lower-rated companies, irrespective of the newly lowered borrowing costs.

A strikingly similar, deeply concerning pattern re-emerged with stark clarity during the cataclysmic 2008 global financial crisis. For a protracted period, the ICE BoFA US High Yield OAS Spread remained stubbornly above 1000 basis points (bps), an unmistakable and grim signal of “extreme market stress.” This prolonged and elevated period of spreads directly corresponded with a significant surge in Chapter 7 liquidations, as countless companies facing insurmountable refinancing difficulties were compelled by market forces to liquidate their assets rather than attempt any form of restructuring. This direct correlation paints a grim and stark picture of the inherent limitations of monetary policy when confronted with deep-seated financial vulnerabilities.

Furthermore, the Federal Reserve’s interest rate policies have frequently “lagged the Taylor Rule’s recommendations,” a widely recognized guideline for setting rates based on prevailing economic conditions. This cautious, often delayed approach, preferring to wait for “clear evidence of economic trends” before making decisive rate adjustments, can result in critical rate cuts or increases arriving “too late to prevent inflationary pressures or curb an overheating economy,” as conspicuously witnessed in previous recessions. Balancing the Fed’s dual statutory mandate of promoting maximum employment and stable prices with the strict guidelines of the Taylor Rule, while simultaneously considering broader financial market stability, often leads to complex decisions that diverge from optimal timing.