In a recent and notable intervention, Pope Leo XIV, the 70-year-old pontiff and first American-born leader of the Catholic Church, has issued a stark warning regarding the escalating chasm between the world’s wealthiest individuals and the working class. His critique, delivered during his first formal media interview since assuming the papacy, specifically targeted the potential for Tesla CEO Elon Musk to become the world’s first trillionaire, framing it as a symptom of a deeper societal malaise.

Speaking to the Catholic news site Crux, Pope Leo articulated a profound anxiety that if extreme wealth accumulation becomes the sole measure of value in society, humanity risks entering a period of “big trouble.” This assertion underscores a broader concern about executive compensation and the perceived loss of fundamental human, familial, and societal values in an increasingly polarized global landscape. His remarks offer an authoritative lens through which to examine contemporary economic disparities and their far-reaching implications.

The Pontiff’s observations come at a critical juncture, as reports highlight a significant boom in billionaire wealth juxtaposed against persistent struggles faced by everyday workers. This article delves into the core tenets of Pope Leo XIV’s warning, exploring the widening income gap, the specifics of Elon Musk’s proposed compensation, the unprecedented growth of ultrarich fortunes, and the challenges associated with philanthropic pledges, all drawing directly from the Pope’s expressed concerns and related economic data.

1. Pope Leo XIV’s Urgent Warning on Extreme Wealth and Societal Values

Pope Leo XIV has positioned the discussion around extreme wealth, particularly the potential ascension of figures like Elon Musk to trillionaire status, not merely as an economic issue but as a profound moral and societal crisis. His words, “If that is the only thing that has value anymore, then we’re in big trouble,” cut to the heart of a concern that material accumulation is eclipsing more enduring human values. This perspective reflects his understanding of the interconnectedness of economic structures and ethical frameworks.

During his interview, the Pope explicitly linked the proposed pay package for Elon Musk to what he described as “the loss of a higher sense of what human life is about, of the family, of the value of society.” This statement broadens the scope of the debate, suggesting that unchecked financial disparity erodes the very foundations of communal well-being and shared purpose. His critique extends beyond mere financial statistics, venturing into the philosophical underpinnings of modern economic systems.

As the first pontiff originally from Chicago, who spent decades as a missionary in Peru and is known for his progressive political views, Pope Leo XIV’s voice carries significant weight in global discourse. His message, delivered with a more reserved style than his predecessor Pope Francis, yet equally potent, aims to encourage a re-evaluation of societal priorities. He posits that the burgeoning wealth gap is a primary driver of global polarization, urging a collective introspection into the root causes of such divisions.

2. The Escalating Chasm: CEO vs. Worker Compensation Ratios

A central component of Pope Leo XIV’s critique of wealth inequality is the dramatic increase in the disparity between executive and worker compensation over the past several decades. He pointedly recalled a time “60 years ago [when] CEOs might have been making four to six times more than what the workers are receiving.” This historical context serves as a sharp contrast to contemporary figures, illustrating a profound shift in corporate reward structures.

The pontiff then delivered a stark update on the current situation, stating, “the last figure I saw, it’s 600 times more than what average workers are receiving.” This observation is corroborated by independent analysis, with the Institute for Policy Studies reporting an even higher ratio. According to their data, among 100 S&P 500 corporations with the lowest median worker pay, the average CEO compensation hit $17.2 million in 2024, while the average median worker pay stood at a mere $35,570, resulting in a ratio of 632 to 1.

Such figures paint a vivid picture of a deeply imbalanced economic system where executive salaries have not only outpaced but vastly overshadowed the earnings of the average employee. This dramatic escalation in the pay gap raises critical questions about corporate governance, fairness, and the equitable distribution of economic gains within companies and across society. The Pope’s emphasis on this disparity highlights its role in exacerbating social tensions and economic instability.

3. Elon Musk’s Path to Trillionaire Status: Tesla’s Proposed Pay Package

The immediate impetus for Pope Leo XIV’s pointed remarks was the news of Tesla’s board proposing an unprecedented $1 trillion pay package for its CEO, Elon Musk. This compensation plan is not a guaranteed payout but is contingent on Musk’s ability to achieve ambitious growth targets for the electric vehicle company, specifically growing it by eightfold over the next decade. The sheer scale of this potential remuneration has drawn significant global attention and scrutiny.

Details surrounding this proposal indicate a strategy by Tesla’s board to incentivize Musk’s continued leadership and focus on the company’s long-term vision. Just recently, Musk reinforced his commitment to Tesla by purchasing $1 billion worth of its stock, an action seen by some analysts as a clear signal of his intention to remain deeply invested in the company’s future. This move comes as shareholders prepare for a vote on the compensation plan, scheduled for November.

Reports from Informa Connect Academy had already suggested that Musk could reach the $1 trillion net worth threshold by as early as 2027, even before the latest proposed package. This makes the board’s offer not merely a financial transaction but a symbolically charged event that embodies the extreme wealth accumulation Pope Leo XIV is warning against. The proposition itself, with its monumental potential, casts a spotlight on the contemporary limits of executive compensation and corporate accountability.

4. The Global Surge in Billionaire Wealth Amidst Worker Struggles

Beyond the specific case of Elon Musk, Pope Leo XIV’s concerns are situated within a broader context of rapidly expanding wealth among the ultrarich, occurring simultaneously with economic hardships for the majority. Data from Oxfam reveals a stark trend: billionaire wealth increased three times faster in 2024 than it did in 2023, signaling an accelerating concentration of global capital at the very top of the economic ladder.

Over the past decade, this trend has manifested in an astounding figure: the top 1% of the world’s population increased their wealth by nearly $34 trillion. To put this into perspective, this amount is theoretically “enough to eliminate annual poverty 22 times over at the highest poverty line.” Such statistics underscore the immense scale of wealth accumulation by a minuscule segment of the population, raising profound questions about resource allocation and global equity.

This explosion in billionaire wealth starkly contrasts with the reality faced by everyday workers, who continue to grapple with persistent inflation, stagnant wages, and a tightening job market. While the ultrarich see their fortunes soar to unprecedented heights, many individuals and families struggle to maintain their living standards. The recent record-breaking one-day increase of $89 billion in Larry Ellison’s net worth, driven by Oracle’s rapid growth, further exemplifies this phenomenon, highlighting the ease with which fortunes can multiply within the current economic framework.

Read more about: College Student and Meme Stock King Cashed Out $180 Million Before Bed Bath & Beyond’s Collapse

5. The Giving Pledge: An Examination of Billionaire Philanthropy and its Limitations

In response to the growing accumulation of vast private fortunes, initiatives aimed at encouraging philanthropic giving have emerged, most notably The Giving Pledge. Launched in 2010 by prominent figures Warren Buffett, Bill Gates, and Melinda French Gates, this commitment invited the world’s wealthiest individuals to publicly declare their intention to give away at least 50% of their wealth to philanthropy either during their lifetimes or through their wills. The initiative was envisioned as a significant step towards addressing global challenges through private generosity.

The premise of The Giving Pledge was to leverage immense private wealth for public good, inspiring a new generation of philanthropists to commit substantial portions of their fortunes to charitable causes. It aimed to create a moral imperative and a peer-driven movement among billionaires, fostering a culture of giving back to society on an unprecedented scale. The public nature of the pledge was intended to increase accountability and transparency in high-net-worth philanthropy.

At its inception, The Giving Pledge offered a hopeful vision that the concentration of wealth could be mitigated, at least in part, by the voluntary, large-scale charitable contributions of those who possessed it. It sought to channel capital towards areas of need, from health and education to poverty alleviation and scientific research. The commitment represented an optimistic outlook on the potential for private action to complement or even lead public efforts in addressing critical societal issues.

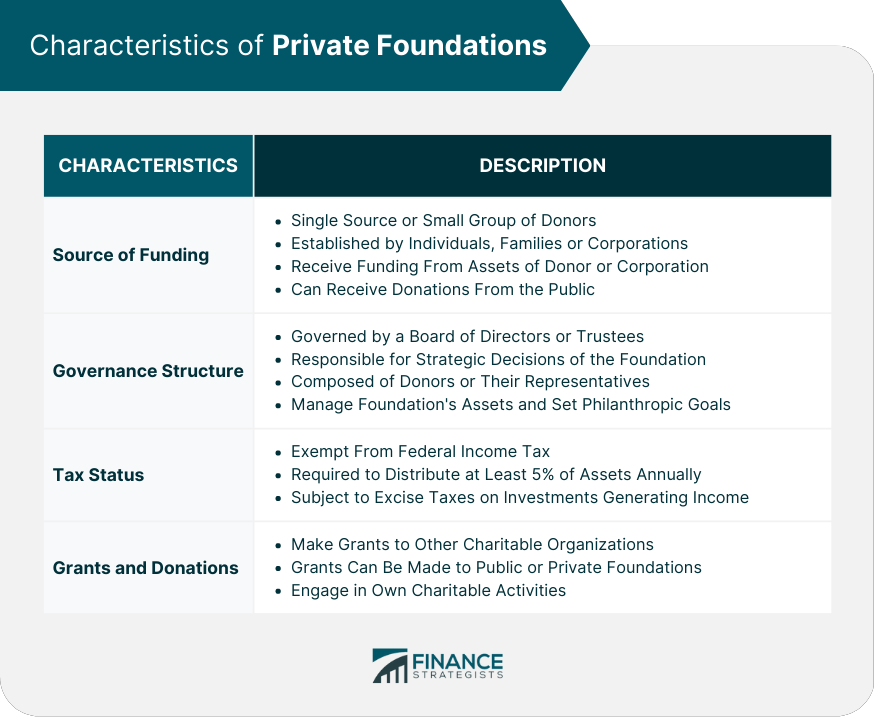

6. The Role of Private Foundations in Billionaire Donations

Despite the noble intentions behind The Giving Pledge, a recent report from the Institute for Policy Studies (IPS) has cast a critical light on its effectiveness and implementation, particularly concerning the destination of donated funds. The report indicated that among the 256 individuals who have signed the pledge, a remarkably small number—just nine—have actually followed through with the pact. This finding raises significant questions about the tangible impact of such commitments.

Further analysis by the IPS revealed that a substantial portion of the estimated $206 billion donated by the original Pledgers in 2010 has not flowed directly to public charities but rather to intermediaries, specifically private foundations. Roughly 80%, or $164 billion, has been directed into these private foundations. This practice has implications for the transparency, accessibility, and immediate societal benefit of these funds, as private foundations offer a degree of control and flexibility that differs from direct charitable giving.

While The Giving Pledge organization, in a statement to Fortune, contended that the IPS report “paints a misleading picture of the impact and intent of Giving Pledge signatories and the spirit and intent of the Giving Pledge,” it concurrently acknowledged that “important questions” remain. These questions, as admitted by the organization itself, aim to “encourage greater giving” and suggest an ongoing internal reflection on how to improve the efficacy and impact of billionaire philanthropy. The debate highlights the complex realities of channeling vast private wealth for public benefit.

Read more about: Beyond the Billionaire Bling: An Insider’s Look at Warren Buffett’s 10 Unexpected Car Choices and Driving Philosophies

7. Practical Failures and Unaddressed Questions of The Giving Pledge

The initial optimism surrounding The Giving Pledge, conceptualized as a significant step towards leveraging private wealth for public good, has been tempered by concrete findings regarding its implementation. A recent report from the Institute for Policy Studies (IPS) critically highlighted that out of 256 individuals who have publicly committed to the pledge, a remarkably low number—only nine—have demonstrably fulfilled their promise. This stark reality casts doubt on the initiative’s broader efficacy and its ability to instigate widespread, direct philanthropic action.

Further scrutiny by the IPS revealed a more intricate layer to these donations: a substantial proportion of the estimated $206 billion contributed by the original Pledgers in 2010 has not reached public charities directly. Instead, approximately 80%, or $164 billion, has been channeled into private foundations. While these foundations can serve legitimate philanthropic purposes, their structure often allows for greater control by the donors and can introduce layers of complexity that may delay the direct application of funds to urgent societal needs, thereby impacting transparency and immediate benefit.

The Giving Pledge organization, in a statement to Fortune, contested the IPS report, asserting it “paints a misleading picture of the impact and intent of Giving Pledge signatories and the spirit and intent of the Giving Pledge.” However, the organization concurrently conceded that “important questions” persist regarding how to “encourage greater giving.” This admission underscores an ongoing internal deliberation within the philanthropic community about the most effective and direct methods for vast private wealth to genuinely address global challenges, echoing Pope Leo XIV’s overarching concerns about the societal implications of unchecked wealth.

8. Pope Leo XIV’s Disillusionment with the United Nations and Multilateral Diplomacy

Beyond the realm of economic disparity, Pope Leo XIV’s inaugural media interview offered profound insights into his perspectives on global governance and international cooperation. The Pontiff expressed a notable disillusionment with the current state of the United Nations, a body traditionally viewed as the primary forum for resolving complex international issues. He stated unequivocally that “The United Nations should be the place where many … issues are dealt with,” but lamented that “Unfortunately, it seems to be generally recognised that the United Nations, at least at this moment in time, has lost its ability to bring people together on multilateral issues.”

This critique from a leader of global moral authority signals a deep concern about the erosion of effective multilateral diplomacy. Pope Leo XIV, despite being relatively new to the diplomatic stage in his pontifical role, identified a systemic challenge within an institution crucial for global peace and stability. His observation implies that the mechanisms intended to foster dialogue and consensus among nations are faltering, contributing to a more fragmented and polarized international landscape.

The Pope, originally from Chicago and having spent decades as a missionary in Peru, admitted to feeling more prepared for the spiritual aspects of his role than for the demands of global diplomacy. He remarked, “The totally new aspect to this job is being thrown onto the level of world leader,” adding, “I’m learning a lot and feeling very challenged, but not overwhelmed. On that one, I had to jump in on the deep end of the pool very quickly.” His candidness highlights the immense pressures and complexities inherent in navigating global affairs, even for a figure of his stature, further emphasizing the gravity of the UN’s perceived shortcomings in facilitating crucial diplomatic efforts for issues like the bloody, three-year conflict between Ukraine and Russia.

9. Elon Musk’s Strategic Imperatives: AI, Robotics, and Voting Control at Tesla

Elon Musk’s vision for Tesla extends far beyond electric vehicles, deeply embedding the company’s future in the burgeoning fields of artificial intelligence and robotics. This ambitious trajectory is fundamentally linked to his demand for a significant increase in his voting control within the company. Musk has articulated his discomfort with growing Tesla into a leader in these transformative technologies “without having ~25% voting control,” clarifying that this level would be “enough to be influential, but not so much that I can’t be overturned.”

His insistence on this enhanced control underscores a strategic imperative, as he explicitly warned, “Unless that is the case, I would prefer to build products outside of Tesla.” This statement highlights the critical role he sees himself playing in spearheading these innovations and suggests that his continued, focused leadership is contingent upon the board granting him the necessary authority. The proposed $1 trillion pay package, therefore, is not merely a financial incentive but a mechanism designed to secure his long-term commitment and strategic direction for Tesla’s evolution into an AI and robotics powerhouse.

Musk has publicly asserted that a substantial portion—as much as 80%—of Tesla’s long-term value could eventually derive from the Optimus humanoid robot project, rather than its core electric vehicle sales, which are facing challenges. This bold projection is supported by the ambitious operational milestones tied to his compensation plan, including the delivery of 20 million Tesla vehicles, the deployment of one million humanoid robots, and the establishment of one million Robotaxis in operation, alongside aggressive market value and EBITDA targets. These goals delineate a future where Tesla’s dominance is redefined by its advancements in autonomous systems and AI-driven robotics.

10. Navigating Headwinds: Tesla’s Market Challenges and Declining Performance

Despite the ambitious future articulated by its CEO, Tesla is simultaneously navigating a complex landscape marked by significant operational and market challenges. The company, celebrated for its pioneering role in electric vehicles, has recently contended with a noticeable downturn in sales and profitability, factors that introduce a measure of uncertainty into its projected growth trajectory and impact its overall financial health.

Recent quarters have revealed concerning performance metrics for the electric car manufacturer. Global EV deliveries are on track to experience a decline for a second consecutive year, with sales reportedly down by 13%. Concurrently, profits have seen a notable reduction of 16%, reflecting a tightening market and increased competitive pressures. These figures collectively paint a picture of a company facing considerable headwinds in its primary market, demanding strategic adjustments and innovative responses.

The erosion of Tesla’s operating margin, which has collapsed to a mere 2.1%, underscores the confluence of adverse factors affecting its financial standing. This decline can be attributed to several key elements: the expiration of crucial US tax credits that previously incentivized electric-car purchases, a reduction in regulatory credit sales that once bolstered revenue, and aggressive price cuts—some as steep as 15% on key models—implemented to stimulate demand in a more competitive environment. These economic shifts highlight the delicate balance Tesla must maintain between market share, profitability, and consumer affordability.

11. The Rise of Competition: BYD and Supply Chain Vulnerabilities

A significant dimension of Tesla’s current challenges stems from the intensification of global competition, particularly from emerging contenders in the electric vehicle sector. The Chinese automaker BYD has rapidly ascended to become a formidable rival, demonstrably altering the competitive landscape that Tesla once largely dominated. This shift underscores the dynamic nature of the EV market and the rapid technological advancements occurring globally.

BYD has not only intensified competition but has also achieved a critical milestone: it has surpassed Tesla in global sales, signaling a profound reordering of market leadership. The Shenzhen-based automaker has effectively carved out substantial market share, particularly in crucial regions like Europe and its home market of China. This aggressive expansion by BYD, coupled with its diverse product offerings and competitive pricing strategies, presents a direct and growing threat to Tesla’s global market position and its aspirations for continued dominance.

Compounding these competitive pressures is Tesla’s inherent supply chain dependence on China. While this dependency has facilitated growth, it also exposes the company to a range of geopolitical and economic risks. The ongoing potential for tariffs, trade disputes, and broader geopolitical tensions between major global powers could significantly disrupt Tesla’s production capabilities and increase its operational costs. This vulnerability adds another layer of complexity to Tesla’s strategic planning, requiring careful navigation of international relations alongside market dynamics.

12. The Political Dimension: Elon Musk’s Activities and Brand Alienation

Beyond market forces and technological ambitions, Tesla’s brand and operational stability are increasingly intertwined with the multifaceted political activities of its CEO, Elon Musk. His deepening involvement in the political sphere has become a notable factor, generating significant public discourse and, in some instances, backlash that directly impacts the company’s public perception and customer base.

Musk’s political leanings and actions have become more pronounced, including his public endorsement of former President Donald Trump in 2024 and his brief tenure as head of the Department of Government Efficiency within Trump’s administration. Furthermore, his speculative discussions about creating his own political party have firmly placed him within the political spotlight. These engagements, while personal, have direct ramifications for a company whose brand identity was initially associated with environmental consciousness and technological progress.

A significant consequence of Musk’s political foray has been the alienation of Tesla’s traditional customer base, which has historically leaned towards more progressive political ideologies. This divergence has translated into tangible negative outcomes, including consumer boycotts, organized protests, and even acts of vandalism targeting Tesla showrooms. Such reactions underscore a growing tension between a company’s perceived values and the personal political stances of its leadership, posing a unique challenge to brand loyalty and market appeal in an increasingly polarized socio-political environment. This phenomenon echoes Pope Leo XIV’s earlier warnings about the divisive consequences of extreme disparities and the loss of broader societal values, suggesting that the impacts of individual actions can ripple through economic and social structures alike.

As Pope Leo XIV thoughtfully cautioned, the current trajectories in wealth accumulation, corporate governance, and international cooperation present a formidable challenge to global stability and societal cohesion. The potential for an individual to amass wealth on an unprecedented scale, exemplified by the discussions around Elon Musk’s trillionaire status, serves as a potent symbol of economic disparities that the Pontiff argues threaten fundamental human values. When juxtaposed with the evolving complexities of global diplomacy, the pragmatic limitations of philanthropic endeavors, and the inherent challenges facing even leading technological enterprises, a clear picture emerges: the modern world is at a critical juncture. Addressing these intertwined economic, social, and political issues demands a collective re-evaluation of priorities, moving beyond mere material metrics to foster a more equitable and values-driven future for all.