In a significant move poised to reshape the landscape of financial regulation, President Donald Trump signed an executive order on Thursday, aimed squarely at addressing the contentious practice known as ‘debanking.’ This order, exclusively obtained by Fox News Digital, seeks to curb instances where banks and financial regulators allegedly shut down accounts or deny services for what are deemed political or religious reasons, a practice the president claims to have experienced firsthand.

The executive order signals a robust push to dismantle what the Trump administration characterizes as political bias embedded within the banking system. At its core, the directive mandates federal banking regulators to expunge concepts like ‘reputational risk’ from their guidance and examination manuals, a broad and often criticized criterion that has historically influenced banks’ decisions to sever ties with clients.

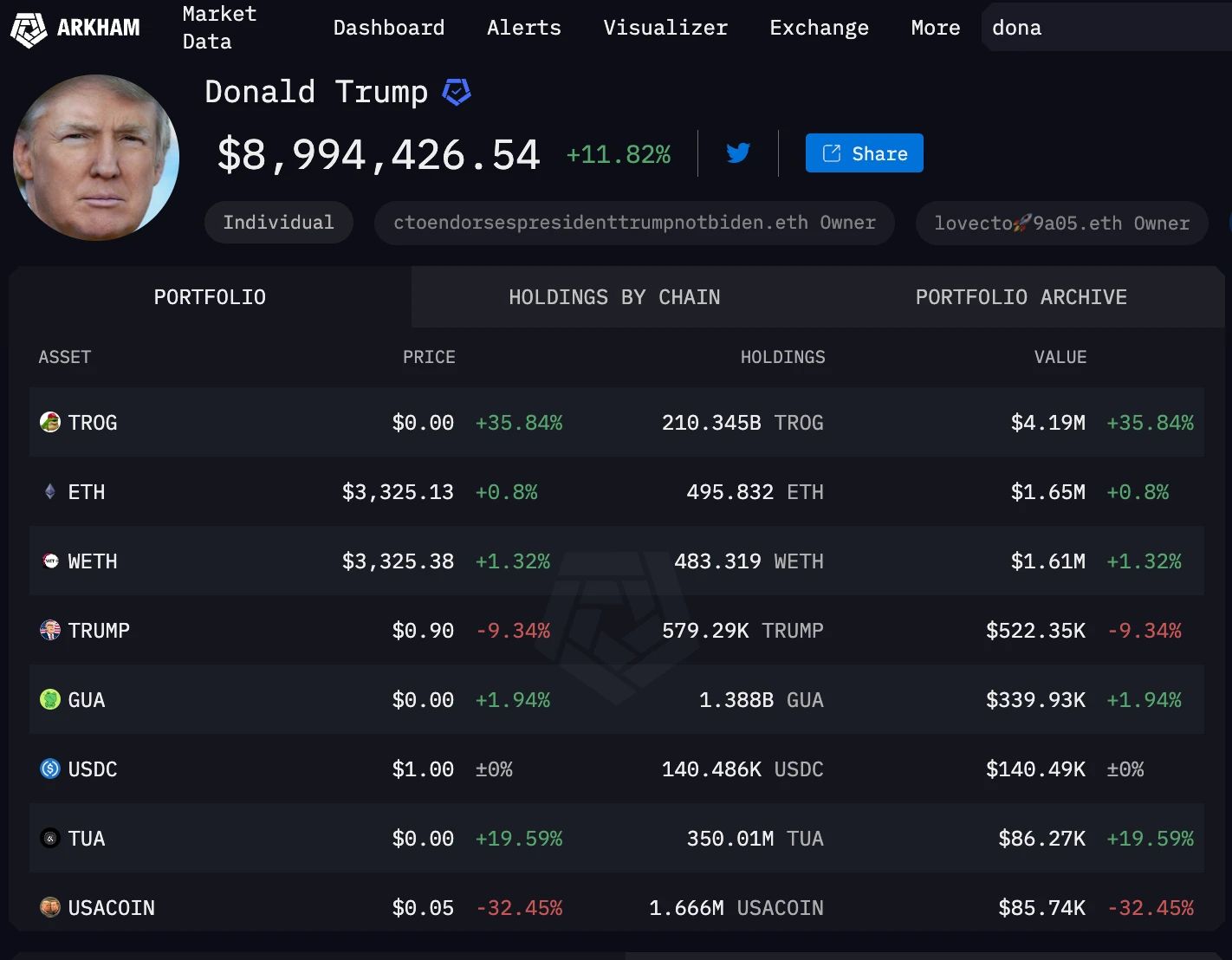

The issue of ‘debanking,’ an umbrella term for a bank rejecting a customer, has increasingly become a flashpoint for conservatives and various business sectors, including the burgeoning cryptocurrency industry. While banks traditionally close accounts for a myriad of reasons, such as suspected fraudulent activity, overdrawn funds, or violations of terms, the recent focus has been on alleged ideological motivations behind such closures.

President Trump has been particularly vocal about his personal encounters with this phenomenon. He recently asserted on CNBC’s “Squawk Box” that “the banks discriminated against me very badly,” elaborating that he believed this discrimination extended to “many conservatives” as well. He further speculated that the Biden administration might have instructed “the Banking Commission, the bankers [and] the banking regulators, to do everything you can to destroy Trump,” a directive he claims they followed.

Recounting a specific instance, Mr. Trump stated that JPMorgan Chase informed him he had “20 days to get out” from accounts holding “hundreds of millions” of dollars. He subsequently claimed that Bank of America refused his business when he attempted to deposit “a billion dollars plus.” These allegations underscore the president’s conviction that powerful regulatory forces exert undue influence over banking institutions.

The new executive order directly confronts these concerns by establishing a multi-pronged approach to prevent and remedy unlawful debanking. It explicitly requires federal banking regulators to review supervisory and complaint data for instances where debanking may have occurred based on religious discrimination, directing that such cases be referred to the office of the attorney general.

Furthermore, the order instructs regulators to scrutinize financial institutions for any past or present formal or informal policies that might have promoted ‘politicized or unlawful debanking.’ Should such policies be identified, the executive order empowers regulators to implement remedial actions, including the imposition of fines and consent decrees, alongside other disciplinary measures.

Beyond immediate enforcement, the directive also casts an eye toward future prevention. It requires the Secretary of the Treasury, in consultation with the Assistant to the President for Economic Policy, to formulate a comprehensive strategy to combat these debanking activities. This strategy is expected to explore potential legislative and regulatory solutions, aiming for a more permanent framework.

A crucial component of the executive order involves the Small Business Association (SBA), which will now require financial institutions under its jurisdiction to make “reasonable efforts to reinstate clients and potential clients previously denied services due to an unlawful debanking policy.” This provision aims to provide a pathway for individuals and businesses to regain access to essential financial services if they were unjustly cut off.

Within the banking industry, there has been a complex reaction to these developments. Major banks on Wall Street, including Bank of America and JPMorgan Chase, have publicly welcomed the Trump administration’s efforts, particularly in seeking “regulatory clarity.” A spokesperson for Bank of America affirmed, “We’ve provided detailed proposals and will continue to work with the administration and Congress to improve the regulatory framework.

Echoing this sentiment, a spokesperson for JPMorgan Chase stated, “We don’t close accounts for political reasons, and we agree with President Trump that regulatory change is desperately needed.” The bank expressed its pleasure that the White House is addressing the issue, an advocacy point for them “for many years,” and expressed eagerness “to work with them to get this right.

Despite these statements, banking insiders, speaking anonymously to outlets like CNN, acknowledged the underlying dynamic. One source indicated, “Banks are not closing accounts for political reasons,” but added, [Trump’s] right that regulators historically have been relentless to get us to close accounts” by using the reputational risk concept. Another insider bluntly stated, “It’s nuts. We don’t say we aren’t going to bank conservatives.”

The concept of “reputational risk” is not new; it traces its roots back to broad debanking regulatory language enacted by former President Barack Obama’s Department of Justice in 2013. This initiative, known as “Operation Chokepoint,” directed regulators to treat “negative public opinion” of account holders as seriously as a direct financial risk. This historical context illuminates the long-standing tension between regulatory guidance and banking practices.

Sources on Wall Street have consistently explained that when a regulator communicates a directive, whether framed as a formal rule, informal guidance, or even a simple conversation, banks perceive little alternative but to comply. President Trump himself articulated this view in June, noting that “the regulators control the banks” and that an administration’s instruction to regulators to “go and make life impossible for big banks and little banks” means regulators “really control it.

The impact of debanking extends beyond political circles. Traditionally, it has posed significant challenges for marginalized groups, including undocumented individuals and poor Americans, who often find themselves resorting to unregulated payday lenders with prohibitively high interest rates to manage their finances. The abrupt closure of an account, typically without a stated reason and with a tight deadline for fund transfer, can be financially devastating.

Melania Trump herself detailed in her memoir that her account was closed after many years with a specific institution, and her son, Barron Trump, was subsequently denied the creation of an account following the events of January 6, 2021. Such anecdotal accounts fuel the conservative narrative that these actions are politically motivated.

The concerns also resonate deeply within the digital assets industry. Crypto firms have long complained about being denied access to banking services, particularly during the Biden administration. Industry figures have alleged that federal agencies like the Federal Reserve, FDIC, and OCC pressured banks to avoid the crypto sector by issuing informal guidance, effectively skirting formal policy processes. This perceived discrimination led crypto venture capitalist Nic Carter to coin the term “Operation Chokepoint 2.0.

Donald Trump Jr. highlighted this evolving dynamic, stating that the Trump family’s foray into crypto was not born of trend-following but out of “necessity,” suggesting that debanking pushed them toward alternative financial systems. This alliance has solidified Trump’s position as the self-professed first “crypto-president,” promising regulatory relief for the sector.

Despite the strong claims of politically motivated debanking, concrete data remains elusive. A February analysis from the U.S. Senate Committee on Banking, Housing and Urban Affairs reported that over 8,000 consumers filed complaints with the Consumer Financial Protection Bureau over three years regarding “improperly closing checking, savings or other deposit accounts.” However, this figure pales in comparison to the 1.3 million complaints about credit reporting in 2023 alone, and does not differentiate based on political affiliation.

Jeremy Siegel, a senior associate at research firm Pleiades Strategy, underscored this data gap, asserting, “There is no actual data or proof that conservatives are being debanked for their beliefs.” He pointed to Florida’s attempt to set up a hotline for this specific issue, which reportedly “got zero complaints,” and a Virginia Credit League Lobbyist’s testimony against a similar bill in Virginia.

Nicholas Anthony, a policy analyst at the libertarian-leaning Cato Institute, described debanking as a “widespread issue” that affects “all different sorts of people.” While acknowledging “anecdotal cases of conservative account holders,” he also noted a “longstanding history of people who are Muslim having their accounts denied, people with Russian last names or Middle Eastern last names for that matter, having their accounts denied.

Banks themselves affirm that account closures are based on risk assessments, not political views. Bank of America CEO Brian Moynihan explained that the bank’s decisions are based on “what’s best for our company, what’s best for our client,” driven by federal regulations and concerns over legal and financial risk. He noted, “People may feel those decisions are made for some other reason, but we always make it on what’s best for our company, what’s best for our client.

Shayna Olesiuk, director of banking policy at Better Markets, reinforced this, stating that banks “must always understand and manage any risk that they are accepting in their business activities and decisions; this could include things like financial risk or unlawful or discriminatory activity.” This perspective highlights the inherent challenges banks face in navigating a complex regulatory environment.

Yet, the allegations persist. The attorney general for Kansas, Kris W. Kobach, sent a letter to Bank of America last year, alleging discrimination against religious groups whose accounts were reportedly closed without explanation, claiming banking policies appeared “to be systematically punishing religious and political views with which it disagrees.

In response to these pervasive concerns, legislative and regulatory efforts have been underway. Senate Banking Committee Chairman Tim Scott has been a vocal critic, alleging that debanking “harms individuals as well as the economy, and violates the principles of fair market access.” He has pointed fingers at regulators for shutting down accounts of Americans they “just don’t like,” describing the situation in Washington D.C. as a “financial swamp.

As the debate continues, the underlying desire for clear, codified law emerges. Azeem Khan, founder of crypto startup Miden, expressed concern that executive orders can be readily rescinded by future administrations. He stressed the need for “new laws that allow us to be sure the pendulum won’t swing based on who is sitting in the chair,” ensuring long-term stability and fairness.

President Trump’s executive order marks a pivotal moment in the ongoing national discourse surrounding financial access and alleged discrimination. It thrusts the spotlight onto the intricate relationship between political influence, regulatory oversight, and the operational decisions of banking institutions, aiming to ensure that the financial system serves all Americans based solely on objective risk, not subjective belief. The path forward involves a delicate balancing act, seeking to protect economic freedom while preserving the integrity and stability of the nation’s banking infrastructure.

As the directives of the executive order begin to take effect, the financial sector and its customers alike will be closely watching. The true measure of its impact will lie in whether it can effectively address the deeply felt grievances of those who believe they have been unjustly excluded, fostering a truly equitable and transparent banking environment for every individual and enterprise across the nation.