The landscape of financial security is constantly shifting, and unfortunately, older adults are increasingly becoming prime targets for cunning and sophisticated scams. Each year, older adults in this country fall victim to financial abuse, costing seniors an estimated $27 billion. This exploitation can manifest in many forms, from the direct theft of money or property by family members or caregivers to the elaborate schemes orchestrated by professional scammers. The emotional toll of these experiences, as many victims report, can be devastating, leading to feelings of helplessness, embarrassment, and diminished quality of life.

It’s crucial to understand that these aren’t just isolated incidents; financial exploitation is a pervasive problem, with estimated annual losses as high as $28 billion in the U.S. alone. As the fastest-growing and wealthiest segment of the population, currently controlling 65 percent of the U.S.’s total wealth, older adults represent a significant target for fraudsters. Their vulnerability often stems from a combination of factors, including declines in cognition, alterations in life circumstances such as the death of a spouse, and the challenge of keeping pace with the rapidly evolving technological landscape.

However, recognizing these threats is the first vital step toward protection. The good news is that many people are able to detect a scam and walk away, often by maintaining a skeptical mindset and staying well-informed about the diverse tactics used by scammers. This article aims to arm you with that crucial knowledge, breaking down some of the most common and dangerous scams targeting older adults today. By understanding how these schemes work, you can fortify your defenses and protect yourself and your loved ones from becoming the next victim. Let’s delve into these threats and equip ourselves with practical, actionable advice.

1. **AI-Powered Scams**In an era of rapid technological advancement, artificial intelligence has introduced alarming new methods for fraudsters to trick older adults, primarily through replicated or altered voices, videos, photographs, and documents. These sophisticated tools make it easier to deceive individuals into sharing sensitive information or taking fraudulent actions, as the AI-generated messages or calls may appear incredibly convincing and authentic. It’s a problem that has “brought to a boil a problem that has been simmering for several decades,” as the context highlights.

Consider the harrowing experience of Anthony, an older man from California, who was scammed out of $25,000. He received a call he believed was from his son, who claimed to have been in a car accident. Soon after, another person called, claiming to be his son’s lawyer, demanding $9,200 for bail. Shaken, Anthony rushed to the bank, withdrew the money, and gave it to someone who came to his home. The scam escalated with another call, claiming the accident victim had passed away, and more money, $15,800, was needed.

This type of scam preys on emotions and urgency, inciting panic and inducing isolation so that individuals make decisions alone and quickly. Scammers use AI to generate realistic-sounding voices that ask a victim for personal information, making the caller sound exactly like a trusted family member. They analyze patterns from a target’s online presence to develop messages that sound real, crafting highly personalized and believable narratives.

To protect yourself from these advanced threats, it’s imperative to have a system in place. Creating a “secret family password” to verify the identity of a family member in the event of suspicious telephone or online requests for money or personal information is a highly effective preventative measure. Always be suspicious of unexpected calls or messages, even if they sound like someone you know, especially if they demand immediate action or payment. Remember, legitimate requests will allow time for verification.

Read more about: 12 Simple Steps to Shield Your Identity: A Lifehacker’s Guide to Deepfake Protection

2. **Funeral Scams**Grief is a profound and vulnerable state, and unfortunately, scammers exploit this by targeting individuals who have recently lost a loved one. Funeral scams manifest in several cruel ways, preying on grieving families during an already difficult time. This makes them particularly insidious, as victims are less likely to be critical or suspicious when consumed by sorrow.

One common tactic involves fraudsters scanning obituary columns in local newspapers to identify and befriend a widow or widower. As John, then age 67, told us, someone from local funeral homes “reminds women to never put an obituary [in the newspaper] because you are a target, and the minute that that goes in there, some crook is reading that to see if they can make a connection with you.” The scammer might then fabricate a connection to the deceased, like claiming to have served in the Air Force with the late husband, to gain trust and eventually get at their money.

Another variation involves criminals contacting you, insisting that your deceased relative left behind an unpaid debt that needs immediate settlement. They might even attend the funeral to gather information about you before making their move. Alternatively, someone pretending to be from the funeral home itself could call, claiming there are extra charges that haven’t been paid, putting pressure on you to settle quickly.

To avoid falling victim to these heartless schemes, it is crucial to refuse to send money immediately for any unexpected charges or debts related to a funeral. Always ask for written documentation of the expense and verify the claim directly with the official funeral home or a trusted family member before making any payments. Never make hurried decisions, especially when you are emotionally compromised.

Read more about: The Multifaceted Career of Jim Carrey: Exploring His Journey from Comedy Dynamo to Acclaimed Dramatic Actor

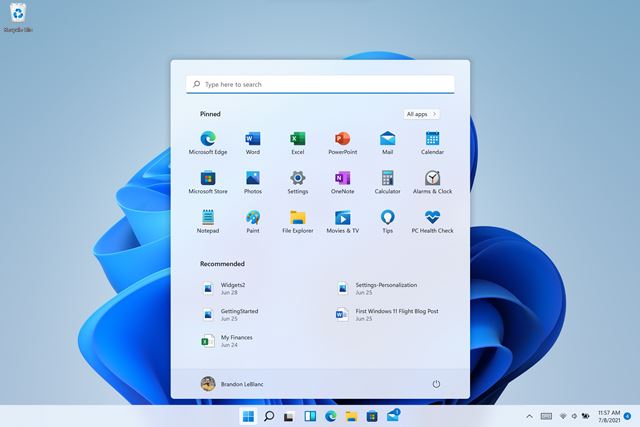

3. **Tech Support Scams**The increasing reliance on technology in daily life also opens new avenues for scammers, leading to the rise of tech support scams. In these schemes, criminals leverage fear and urgency related to your computer’s health to gain access to your personal information or money. They exploit the common anxieties people have about viruses or malware damaging their devices.

Typically, a criminal will initiate contact through a phone call or email, pretending to be a support representative for a well-known tech company like Microsoft or Apple. They might warn you that a severe virus or malware has infected your computer, or that your device is experiencing critical errors. Their goal is to create panic and convince you that immediate action is required to prevent further damage.

Once they have your attention, they will offer to “update” or “fix” your device. This often involves convincing you to grant them remote access to your computer. Once they gain this access, they can install malicious software, steal personal files and information, or even lock your computer and demand a ransom. In 2025, these scams have become even more sophisticated, mimicking two-factor authentication processes to appear even more legitimate.

If you receive an unsolicited call or email claiming to be from tech support, remember that legitimate companies rarely initiate contact in this manner regarding computer issues. Never grant remote access to your computer to someone you don’t know or didn’t independently contact. If you are concerned about your computer’s health, contact the tech company directly using the official number found on their website or your product documentation, never a number provided by the suspicious caller. Keeping your computer up to date with antivirus and security software is also a vital preventative step.

Read more about: 11 Critical Financial Mistakes People Over 55 Must Avoid for a Secure Retirement

4. **Government Imposter Scams**One of the most insidious types of fraud involves scammers impersonating government officials, leveraging the authority and fear associated with agencies like the IRS or Social Security Administration. These scams are designed to intimidate victims into immediate compliance, often under threat of arrest, deportation, or loss of vital benefits. They exploit trust in official institutions while preying on a lack of familiarity with official procedures.

You might receive phone calls from individuals claiming to be from the IRS, demanding immediate payment of unpaid taxes. Or, they might pretend to be from the Social Security Administration, asking for personal information to ensure your Social Security or Medicare benefits continue. These calls often come with dire warnings: failure to send money immediately, individuals are told, will result in their arrest or deportation.

Scammers frequently use a technique called “spoofing,” which manipulates caller ID to make it appear as if the incoming phone number is from a legitimate government agency. This adds a layer of credibility to their deceit. The caller is highly likely to ask for sensitive personal information or insist that you make a payment, often demanding unusual payment methods such as gift cards or wire transfers, which are difficult to trace. As Steve Weisman, a lawyer and author of the scam blog Scamicide, clearly states, “The IRS and the SSA will never initiate contact with people through a phone call, so you can be sure that the person calling you is a scammer.”

To protect yourself, it’s crucial to remember that legitimate government agencies like the IRS or Social Security Administration will never initiate contact by phone to demand immediate payment or sensitive personal information. They will typically communicate through official mail. If you receive such a call, hang up immediately. Do not provide any personal details or make any payments. If you are concerned about your tax status or benefits, contact the agency directly using their official number, which you can find on their official website or in official correspondence.

Read more about: 11 Critical Financial Mistakes People Over 55 Must Avoid for a Secure Retirement

5. **Grandparent Scams**The grandparent scam is a deeply emotional form of financial exploitation that preys on the love and concern older adults have for their grandchildren. This type of fraud, resembling the one experienced by Anthony with the AI voice cloning, exploits a person’s emotions, inciting fear and anxiety by impersonating a grandchild or other family member in distress. It’s a classic scam that continues to evolve, often using information harvested from social media and obituaries.

In this scenario, a person will pretend to be your grandchild, claiming to be in an urgent situation, such as a car accident, arrest, or being lost in a foreign country. The “grandchild” often says they don’t want anyone else to find out, specifically their parents, amplifying the sense of secrecy and pressure. They will then ask for money to be sent quickly to resolve their fabricated emergency, frequently demanding payment through gift cards or wire transfers because these methods are difficult to trace and don’t require identification to collect.

The scammers often harvest the information they need to make the call appear legitimate from public sources. As Weisman notes, they gather details from obituaries and social media to create a convincing story. This allows them to mention specific details about your family, making their impersonation more believable. Sometimes, they have even sent couriers directly to victims’ homes to collect the demanded money, adding another layer of immediacy and danger.

To safeguard against this emotionally manipulative scam, establish a “code word” or “safe word” with your grandchildren and other close family members that can be used in a real emergency. If you receive such a call, no matter how convincing, always try to verify the story by calling the grandchild directly on a known number or contacting another family member to confirm the situation before sending any money. Resist any pressure to act quickly or keep the situation a secret.

Read more about: Navigating the New Golden Age of Travel: 12 Essential Insights for Retirees

6. **Internet Scams**In our increasingly connected world, the internet has become a vast playground for scammers, offering numerous avenues to exploit older adults. These “internet scams” encompass a wide range of fraudulent activities that leverage online platforms, social media, and email to target individuals and extract personal information or funds. The more information you share online, the more vulnerable you become.

If you share information about yourself through social media, scammers could target you online, using your personal details to motivate you to provide funds or share more information. They might pretend to be someone you know, or someone famous, to build a connection. A client of elder law attorney Patrick Simasko, for instance, “got scammed out of a lot of money through Facebook” by someone pretending to be an army officer needing money to return from Afghanistan. This highlights the deep emotional manipulation inherent in these scams.

Beyond direct social media interactions, internet scams also include phishing attempts through email or text messages. You might receive a message asking you to click a link, share details about your identity, or make a payment. These messages often appear to be from legitimate companies or organizations, but they are designed to trick you into revealing sensitive information or downloading malware. Never open an e-mail attachment or click a link in a text message from someone you do not know.

To protect yourself from the myriad of internet scams, exercise extreme caution with the information you share online, especially on social media. Be wary of unsolicited messages or friend requests from strangers, particularly if they quickly express strong emotions or financial needs. Always delete messages asking you to click a link, share personal details, or make an unexpected payment. Regularly update your computer with antivirus and security software, and check your financial accounts for unusual activity to quickly spot and address any breaches.

Read more about: Buyers Beware: 13 Car Mods That Are a Total Waste of Money and Could Land You in Trouble

7. **Investment Scams**Investment scams are a particularly insidious form of financial exploitation, preying on an older adult’s desire for financial security and often promising enticingly high returns. These schemes involve fraudsters impersonating legitimate financial professionals, such as financial advisors, real estate investors, or wealth managers. They will contact you, often out of the blue, with what appears to be an exciting, low-risk, high-reward investment opportunity designed to lure you into sending them funds.

What makes these scams so dangerous is their ability to sound utterly convincing. The scammer might present elaborate business plans, use financial jargon, or even provide fake documentation to create an illusion of credibility. However, their true intention is simply to take your money without providing any legitimate return. Once funds are transferred, the “investment” disappears, along with the scammer, leaving the victim with significant financial losses and often, shattered trust.

In recent years, a particularly alarming variation known as “pig butchering” scams has emerged. These intricate schemes often combine elements of romance scams with fake investment opportunities, particularly in volatile markets like cryptocurrency. The fraudster spends weeks or months building a deep, personal relationship with the victim online, only to eventually introduce a “surefire” investment opportunity. This deep emotional connection makes the victim more susceptible to the scammer’s financial advice, making it incredibly difficult to recognize the deception.

To safeguard your hard-earned savings, it is paramount to consult a trusted, credentialed financial advisor before committing to any new investment, especially those promising unusually high or guaranteed returns. Legitimate investments always carry some degree of risk, and no honest advisor will guarantee fast, risk-free profits. Always take your time, ask probing questions, and avoid making fast decisions under pressure. If an opportunity sounds too good to be true, it almost certainly is.

Read more about: The 13 Riskiest Car Customizations That Can Instantly Void Your Warranty: What Every Enthusiast Needs to Know

8. **Check Fraud**Even in an age of digital transactions, check fraud remains a persistent and evolving threat, with thieves using increasingly sophisticated methods to intercept and manipulate checks. This type of scam can manifest in several ways, all designed to steal your money or misuse your banking information. It’s a stark reminder that vigilance is required across all forms of financial interaction.

One common tactic involves thieves physically stealing checks, either directly from your mailbox or from mail carriers. Once a check is in their possession, they can perform various alterations. They might change the amount of the check to a higher sum or modify the payee’s name, redirecting the funds to themselves or an accomplice. This direct theft and alteration can lead to immediate and unauthorized withdrawals from your account.

Beyond physical alteration, criminals are also leveraging digital technology. They can take a digital picture of a stolen check and then use that image to make multiple unauthorized deposits. Even more alarmingly, they can use the details from the stolen check to develop entirely new fraudulent checks, effectively creating an endless supply of tools to drain your accounts. This digital replication makes the scale of potential fraud much larger and harder to track.

Another significant risk associated with check fraud involves requests from strangers to deposit a check into your account and then send some or all of the money back to them. This is almost always a scam, where the initial check is fake, but by the time your bank discovers it, you’ve already sent your real money to the fraudster. It is crucial to never comply with such requests. Always be suspicious of unsolicited checks or requests to move money in this manner. Protecting your checkbook and sensitive documents in a secure location and shredding any unneeded financial papers are essential preventative measures.

Read more about: Unmasking the ‘Lemon’: A Consumer Reports Guide to Dodging Used-Car Dealer Tricks

9. **Reverse Mortgage Scams**Reverse mortgages, while legitimate financial products for some, have unfortunately become a fertile ground for scammers looking to exploit older homeowners. These fraudsters prey on individuals who own their homes, particularly those with significant equity, by promising access to quick cash or financial relief. The scams often begin with an unsolicited contact, either through calls, mail, or even door-to-door visits.

Criminals involved in reverse mortgage scams will often present themselves as helpful agents or advisors. They might offer to appraise your home for an upfront fee, only to provide an invalid or inflated home value to make their offer seem more attractive. Their ultimate goal is to convince you to sign up for a reverse mortgage using inaccurate or misleading loan documents, often hiding excessive fees, complex terms, or even leading to the outright theft of your home ownership.

These scammers are experts at making their offers sound appealing, especially to those who might be struggling with expenses or looking for ways to supplement their income. They promise quick access to your home equity, often without fully explaining the long-term implications or the hidden charges involved. The deceptive practices are designed to confuse and pressure homeowners into making a decision that is not in their best financial interest, often leading to severe financial distress or even foreclosure.

To protect yourself from these predatory schemes, it is vital to be highly suspicious of any unsolicited requests that ask you to share details about your home or make a payment for a reverse home mortgage. Legitimate mortgage lenders or advisors do not operate by pressuring you with unverified offers. If you are considering a reverse mortgage, the only safe approach is to proactively reach out to a reputable mortgage lender or certified financial advisor in your area. Conduct thorough research, discuss all your options, and always seek independent advice to ensure you understand every aspect of the agreement before signing any documents.

Read more about: Navigating Retirement: Understanding the ‘Worst’ Financial Pitfalls and Products Targeting Seniors Over 70

10. **Caregiver Scams**Tragically, not all financial exploitation comes from strangers; a significant portion originates from individuals in positions of trust, particularly caregivers and even family members. Caregiver scams are especially heartbreaking because they betray the trust placed in those meant to provide support and assistance. These insidious acts of exploitation can be difficult to detect and even harder for victims to report, often due to emotional ties or fear.

Caregivers, whether professional health aides or trusted family members assisting with daily tasks, often have unparalleled access to an older adult’s personal and financial information. While in your home, they may collect sensitive data, including bank account numbers, Social Security numbers, or passwords. This access allows them to take money directly from your accounts without your knowledge, or they might use your information to open new credit cards or make unauthorized purchases.

What makes these situations so complex is the emotional dimension. Nearly 50 percent of all elder financial exploitation cases involve people closest to the older adults, including family members. These cases are severely underreported to law enforcement, as victims often feel embarrassed, ashamed, or are reluctant to incriminate a loved one. The sense of helplessness and betrayal can be profound, impacting an older adult’s mental and physical well-being.

To mitigate the risk of caregiver exploitation, careful research and vetting of any health aides or caregivers before they enter your home are absolutely crucial. Conduct background checks, check references thoroughly, and consider involving another trusted family member in the hiring process. If family members are providing care, establish clear boundaries and consider putting legal protections like powers of attorney in place with extreme caution, ensuring that only trusted individuals with proper oversight have access to sensitive financial information. Regularly monitoring bank statements and credit reports for suspicious activity can also provide an early warning against potential abuse.

Read more about: Navigating the New Golden Age of Travel: 12 Essential Insights for Retirees

11. **Sweepstakes Scams**Sweepstakes scams are a classic form of fraud that continues to ensnare older adults with the allure of immense winnings. The core of this scam is a deceptively simple premise: you’re contacted out of the blue and congratulated for winning a substantial prize in a lottery or sweepstakes that you don’t recall entering. The catch, however, is that to claim your supposed millions, you must first pay a series of “fees” or “taxes.”

Fraudsters behind these schemes often impersonate well-known celebrities, organizations, or government agencies to add a layer of false legitimacy. They might send official-looking letters or even fake checks, which initially appear real. Victims are instructed to deposit these checks, but the funds are typically fictitious and will eventually be rejected by the bank. However, by the time the check bounces, the victim has already sent their own money—sometimes thousands of dollars—to cover the “taxes,” “shipping,” or “processing fees” demanded by the scammer.

Victims are repeatedly contacted, with scammers pressuring them to send more money for new, fabricated fees, despite no prize ever materializing. The emotional toll can be devastating, as people are led on by false hope, only to lose significant portions of their savings. As attorney Jim White noted, such scams even target individuals with cognitive impairments, with fraudsters trying to extract funds by claiming an incompetent person has won a large sum.

The most critical defense against sweepstakes scams is a simple rule: if you didn’t enter, you couldn’t have won. Legitimate lotteries or sweepstakes will never ask you to pay money to receive your winnings. If you receive such a notification, especially if it demands immediate payment or uses gift cards or wire transfers, it is unequivocally a scam. Do not deposit any checks you receive for such purposes, and never send money to cover fees or taxes for a prize. Be wary of any situation where you are told to forward money of any kind to anyone else, as this is a common tactic to make you responsible for losses from a fake check.

Read more about: Your Ultimate Guide to 15 Top Sites for Scoring Free Stuff Online

12. **Romance and Digital Friendship Scams**Romance and digital friendship scams are emotionally manipulative forms of fraud that exploit an older adult’s longing for companionship and connection. These scammers meticulously build deep, long-term trust with their victims online, often over weeks or months, creating a profound emotional bond before introducing any financial requests. They are master manipulators, capable of weaving elaborate false identities and compelling narratives.

These fraudsters typically create fake online profiles, often posing as attractive, successful individuals, frequently from professions like military personnel stationed overseas or engineers working on international projects. They will engage in lengthy conversations, showering their victims with attention and affection, making them feel valued and understood. As Cheryl, then age 66, recounted, a scammer made her feel “like I was an okay person, where I was feeling really badly about myself at the time,” preying on her vulnerability during a divorce.

Once a strong emotional connection is established, the scammer begins to introduce fabricated emergencies or investment opportunities, requesting money. These requests might range from needing funds for a medical emergency, travel expenses to finally meet the victim, or urgent business investments. The victim, now deeply invested emotionally, is often reluctant to question the validity of these pleas, viewing them as helping a loved one in need.

To protect yourself from such profound emotional and financial exploitation, never send money, gift cards, or wire funds to someone you have not met in person, regardless of how strong your online connection feels. Be extremely cautious of individuals who quickly express strong emotions or make financial requests early in a relationship. Verify the person’s identity and story through independent means, and share details about your online relationships with trusted friends or family members who can offer an objective perspective. Remember, genuine relationships should never put you in a position where you feel pressured to send money for emergencies or investments.

**Fortifying Your Defenses: A Holistic Strategy for Ongoing Protection**

The array of scams targeting older adults is diverse and ever-evolving, but by understanding their tactics and consistently applying protective strategies, you can significantly reduce your risk of becoming a victim. The journey to financial security in retirement is an ongoing process of education, vigilance, and proactive defense. It’s about empowering yourself with knowledge and building a robust network of support.

Staying informed is your first and most powerful defense. Reputable government agencies like the Consumer Financial Protection Bureau, Federal Trade Commission, FBI, and U.S. Department of Justice regularly publish updated information on scams. Organizations such as AARP’s Fraud Watch Network also provide invaluable resources, sharing real-life stories and offering guidance. Make it a habit to seek out and absorb this critical information, recognizing that the fraud landscape is constantly shifting.

Beyond knowledge, cultivating a skeptical mindset is paramount. Approaching unsolicited interactions—whether by phone, email, or at your door—with an underlying questioning attitude can empower you to ask questions, slow down, and seek assistance before making any decisions. Never rush a financial decision, especially if your instincts signal that something feels off. Remember the age-old dictum: “if it seems too good to be true, it probably is.” Do not be afraid to say no, hang up the phone, refuse to open your door, or delete suspicious emails.

Building a strong support system is equally critical. Identify and rely on trusted individuals—family members, close friends, or professional advisors—who can provide an objective perspective when you’re faced with a questionable offer. Create a “family pact” to discuss any significant financial moves or suspicious contacts. This prevents isolation, which scammers actively seek to induce. Social connection acts as a powerful deterrent against fraud, as isolation can significantly increase vulnerability.

Practical steps for digital and physical security are also essential. Keep your computer and devices updated with antivirus and security software, use strong, unique passwords, and enable two-factor authentication whenever possible. Regularly check your financial accounts for any unusual activity and protect your personal identifiable information meticulously. Never open email attachments or click links from unknown senders, and if an unexpected call comes from your bank, hang up and call their official number directly.

Should you find yourself targeted by a scam, or even worse, fall victim, remember that you are not alone, and there is no shame in seeking help. Immediately end all communication with the suspected perpetrator, verify any claims through official channels, and most importantly, report your experience. Resources like the National Elder Fraud Hotline (1-833-FRAUD-11), the FBI Internet Crime Complaint Center (ic3.gov), and the FTC (ftc.gov/scams) are available to provide support and help you take action. Your report not only aids in your recovery but also helps protect countless others from falling prey to similar schemes. By standing together and speaking out, we fortify our collective defenses against the relentless tide of financial fraud.