Qatar’s sovereign wealth fund, the Qatar Investment Authority (QIA), injected $375 million into Elon Musk’s substantial acquisition of Twitter, positioning the Gulf state among a diverse group of investors backing the social media platform’s new direction. This investment became public through a U.S. Securities and Exchange Commission filing, revealing Qatar Holding LLC, the QIA’s main investment subsidiary, as one of nearly 20 entities contributing to the $7.1 billion funding pool for the $44 billion buyout.

The QIA’s chief executive, Mansoor Al Mahmoud, recently affirmed the fund’s support for Elon Musk’s leadership regarding Twitter’s transformation. Speaking at the World Economic Forum in Davos, Al Mahmoud addressed a direct query about whether the QIA had requested Musk to reduce his tweeting frequency over the preceding eight months, a period characterized by considerable volatility on the platform.

“Not really,” Al Mahmoud responded, indicating a hands-off approach to daily operations. He elaborated, “we do not really involved to that extent in term of, again, he has our trust and we are sure that he would manage it very professionally.” This statement underscores the QIA’s stated belief in Musk’s capability to navigate the challenges facing the company.

The QIA’s engagement, Al Mahmoud noted, focuses on the strategic direction rather than granular operational details like the CEO’s social media activity. He stated, “We engage with the management, with Elon in terms of the plan that he has for the company, and we believe in this, and we trust his leadership in terms of turning around the company.” This perspective highlights the fund’s investment as a vote of confidence in Musk’s broader vision for the platform.

Separately, Al Mahmoud reiterated the QIA’s position as part of a consortium of financial investors. He told Insider that the fund places “very much trust in the leadership” of the social media company. This consistent message from the QIA emphasizes its role as a financial backer relying on Musk’s management expertise.

Since finalizing the acquisition in late October, Elon Musk has initiated significant organizational changes. These have included extensive layoffs, which Musk cited as necessary due to the company’s reported $4 million daily loss. He also reinstated the account of former President Donald Trump following a poll on the platform, a move that generated considerable discussion.

Musk’s public commentary has also expanded to include more political issues since the acquisition. This increased visibility and engagement in potentially sensitive areas have added to the controversies surrounding Twitter, with some observers noting spillover effects on Tesla, where Musk also serves as CEO.

The group of high-profile investors providing funding for Musk’s Twitter acquisition includes prominent names alongside the QIA. Regulatory filings indicate that Saudi Arabian Prince Alwaleed bin Talal and the cryptocurrency exchange Binance are also among the backers, forming a diverse group contributing to the deal’s financial structure.

Prince Alwaleed bin Talal, chairman of the board at the Kingdom Holding Company (KHC), initially voiced criticism of Musk’s takeover offer, stating it did not reflect the company’s “intrinsic value.” However, he later announced KHC would roll over its approximately $1.9 billion investment in Twitter.

In a notable public interaction, Prince Alwaleed tweeted to Musk, “Great to connect with you my ‘new’ friend @elonmusk🤝🏻

I believe you will be an excellent leader for @Twitter to propel & maximise its great potential@Kingdom_KHC & I look forward to roll our ~$1.9bn in the “new” @Twitter and join you on this exciting journey.” This interaction publicly solidified his support and participation in the new ownership structure.

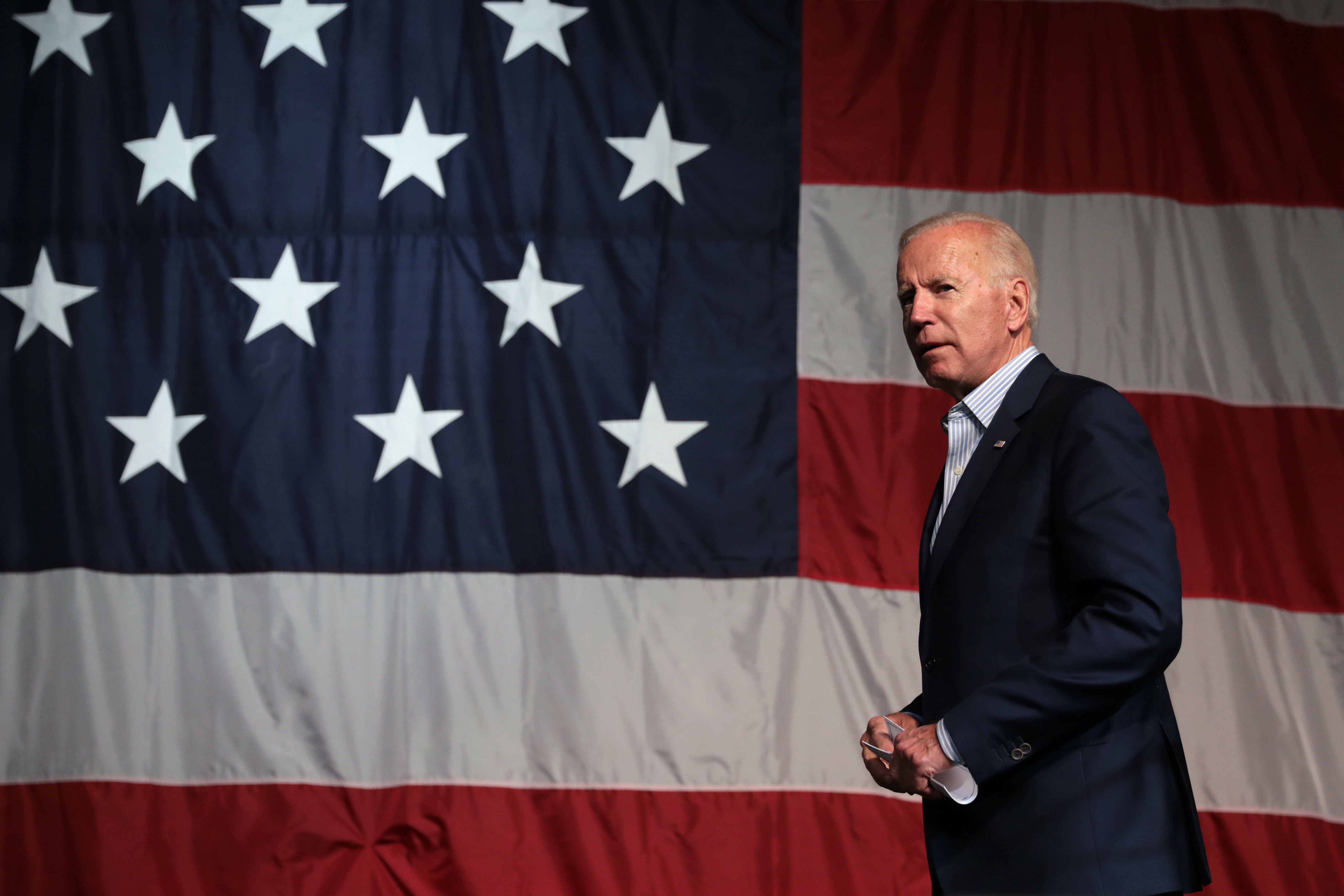

The presence of foreign investors, particularly those linked to governments, in the ownership of a major social media platform has raised questions concerning potential national security risks. President Joe Biden, during a White House press conference in November, indicated that Musk’s business ties with foreign nations were “worthy of being looked at.”

Biden specifically mentioned his belief that “Elon Musk’s cooperation and/or technical relationships with other countries is worthy of being looked at.” While White House officials had previously denied reports of a planned security review of Musk’s deals, including the Twitter purchase, the President’s comments signaled a level of official attention.

Concerns have extended beyond the executive branch. Senator Chris Murphy (D-Conn.) publicly called upon the Committee on Foreign Investment in the United States (CFIUS), a unit of the Treasury Department, to review the investments from Saudi Arabia and Qatar in the social media firm. This call for review highlights the sensitivity surrounding foreign stakes in platforms considered critical infrastructure or repositories of sensitive data.

Senator Murphy pointed to CFIUS’s mandate to review even non-controlling investments in certain sensitive U.S. businesses. He specifically mentioned companies developing critical technologies and those possessing sensitive personal data on U.S. citizens, arguing that Twitter fits these criteria.

The Senator referenced the Department of Justice’s 2019 investigation into two former Twitter employees. These individuals were charged with sharing the private information of Twitter users with the Saudi government, an incident that resulted in one conviction by a federal jury in August, adding a historical context to concerns about data security and foreign access.

While Prince Alwaleed was a pre-existing investor when Twitter was a public company, Qatar’s investment represents a new engagement. This move was described in some reports as “somewhat unusual” for the tiny Gulf State’s sizable $461 billion sovereign wealth fund, suggesting a potential strategic shift or unique interest in this particular asset.

Details of the QIA’s $375 million commitment first surfaced publicly on May 4th via an SEC filing. This investment provided the QIA with just under a 1% stake in the now privately held Twitter, a relatively small percentage but one that nonetheless grants the fund a position within the ownership group.

Despite the QIA’s stake being less than 1%, experts suggest it could still potentially lead to national security risks in the U.S. The concern is not solely about control but also potential influence over platform policies or access to user data, even through minority ownership or relationships fostered through investment.

Sanjay Patnaik, director of the Center on Regulation and Markets at the Brookings Institution, articulated this concern. He stated, “Even though it’s a small investment, that doesn’t preclude CFIUS from looking into it if they believe that either the Qataris might get some influence over Twitter’s policies or might be able to access the data of Americans.” This view emphasizes the potential for indirect influence or data access as a security consideration.

Beyond the foreign investment aspect, Twitter has faced scrutiny over its handling of user data. In May, before the acquisition closed, the Federal Trade Commission and the DOJ imposed a $150 million fine on Twitter for “deceptively” collecting users’ phone numbers and email addresses and subsequently sharing this data with advertisers for targeted advertising purposes.

Related posts:

Qatar’s sovereign wealth fund — which invested $375 million in Elon Musk’s Twitter buyout — says it hasn’t told the new CEO to tweet less

Qatar’s Backing Of Elon Musk’s Twitter Deal Raises Questions Ahead Of The FIFA World Cup

Qatar fund chips in $375m for Elon Musk’s Twitter buyout