The dream of retiring a millionaire might seem like a distant fantasy, especially when you’re starting with what feels like a modest amount – perhaps just $50 a week. However, the path to a seven-figure retirement nest egg isn’t as unattainable as it often appears. With a strategic approach, a clear understanding of financial principles, and the incredible power of index fund investing, that seemingly small weekly contribution can genuinely grow into a substantial fortune. This isn’t about complex stock picking or trying to time the market; it’s about disciplined, long-term investing that leverages proven methods to build wealth.

Many of us hold an overly simplistic view of retirement saving: save continuously from your first job until you retire. But the reality is far more nuanced and, thankfully, more actionable. Financial planning evolves through different phases of life, each presenting unique opportunities and best practices that, when followed, significantly boost your chances of achieving your retirement goals. It’s about making smart, informed choices consistently over time, allowing your money to work harder for you than you might imagine.

In this in-depth guide, we’ll break down the essential steps and strategies you need to implement to transform a $50 weekly investment into a million-dollar retirement portfolio. We’ll explore how to harness the magic of compounding, identify the best investment vehicles, and make critical decisions at every stage of your financial journey. Prepare to be empowered with practical, actionable advice that can lead you to a financially secure and comfortable retirement.

1. **The Unstoppable Power of Compounding Interest**

At the heart of transforming modest weekly savings into a million-dollar fortune lies the unparalleled power of compounding interest. This concept, often called the ‘eighth wonder of the world,’ means that your investments earn returns, and then those returns also start earning returns, creating an accelerating snowball effect over time. It’s not just about what you save, but how long that money has to grow and multiply itself.

Consider this compelling illustration: putting $100 into a retirement account every month starting at age 20 is remarkably more effective than contributing a lump sum of $100,000 at age 65. Even with a relatively conservative 5% rate of return, that consistent $100 per month for 45 years will cost you a total of $54,000 in contributions. Yet, thanks to compounding interest, it could be worth more than $200,000 when you reach 65. The earlier you begin, the more time your money has to compound, and the less you ultimately have to contribute out of your own pocket to reach your goals.

For those starting with $50 a week, which totals $2,600 annually, the principle remains the same. While $78,000 saved over 30 years might not seem like a retirement sum, investing that amount strategically into growth stocks or, more reliably, index funds, can lead to exponential growth. To reach $1 million by investing just $50 each week over 30 years, you would need to generate an annual growth rate of a little over 13% per year. This demonstrates how critical consistent investment and the long-term compounding effect are to achieving such an ambitious goal.

Read more about: Mark Cuban’s Ultimate Playbook: 14 Passive Income Streams Billionaires Use to Build Lasting Wealth

2. **Start Early: Your 20s and 30s Are Golden**

The earliest phase of your career, typically your 20s and 30s, represents the most crucial period for retirement saving. While it might feel daunting to prioritize retirement contributions when student loans, rent, and other immediate expenses loom large, the advantage of time is simply non-negotiable. Most people are not saving nearly enough in their early working years, and the objective is to ensure you don’t fall into that category. These initial years lay the absolute strongest foundation for future wealth.

During this phase, you are setting the stage for decades of compounding. The money you invest now has the longest runway to grow, allowing it to benefit significantly from market cycles and reinvested gains. Missing out on these early years means you’ll have to save substantially more later to catch up, often requiring larger, more burdensome contributions as you approach retirement. It’s far easier to commit a smaller amount consistently over a long period than to try and cram significant savings into a shorter timeframe later in life.

If you begin buying index funds when you are 40 years from retirement, you’ll need to save less than one-fourth as much per month compared to someone who waits until they are 25 years from retirement to achieve the same $1 million goal. This powerful insight underscores why starting early, even with just $50 a week, is arguably the single most impactful decision you can make for your retirement security. Don’t underestimate the profound impact your early financial habits will have on your future self.

3. **Amplify Your Savings with Employer Matching**

One of the most straightforward and effective ways to boost your retirement savings, particularly in your early career, is by taking full advantage of employer matching contributions to your 401(k) or similar workplace retirement plan. This is essentially free money offered by your employer to encourage you to save for retirement, and to turn it down would be a significant missed opportunity for wealth accumulation.

Always contribute at least enough to your employer-sponsored plan to receive the maximum matching contribution. For example, if your employer offers to match 50% of your contributions up to 6% of your salary, you should aim to contribute at least 6% of your salary. This ensures you’re capturing all the “extra” money available to you, which immediately increases your effective rate of return on your contributions. This boost can significantly accelerate your journey toward that million-dollar mark, especially when combined with the power of compounding.

Beyond the initial match, it’s also advisable to increase your contributions whenever your income increases. Any time you get a raise, a promotion, or a new job with a higher salary, you should make it a priority to increase the percentage you’re contributing to your retirement accounts. This ‘pay yourself first’ strategy helps grow your retirement savings even faster without significantly impacting your current lifestyle, as you’re increasing savings with newly acquired income rather than cutting from existing expenses.

Read more about: Unlocking Your Retirement Potential: A Beginner’s Guide to Maximizing Your 401(k) Match and Beyond

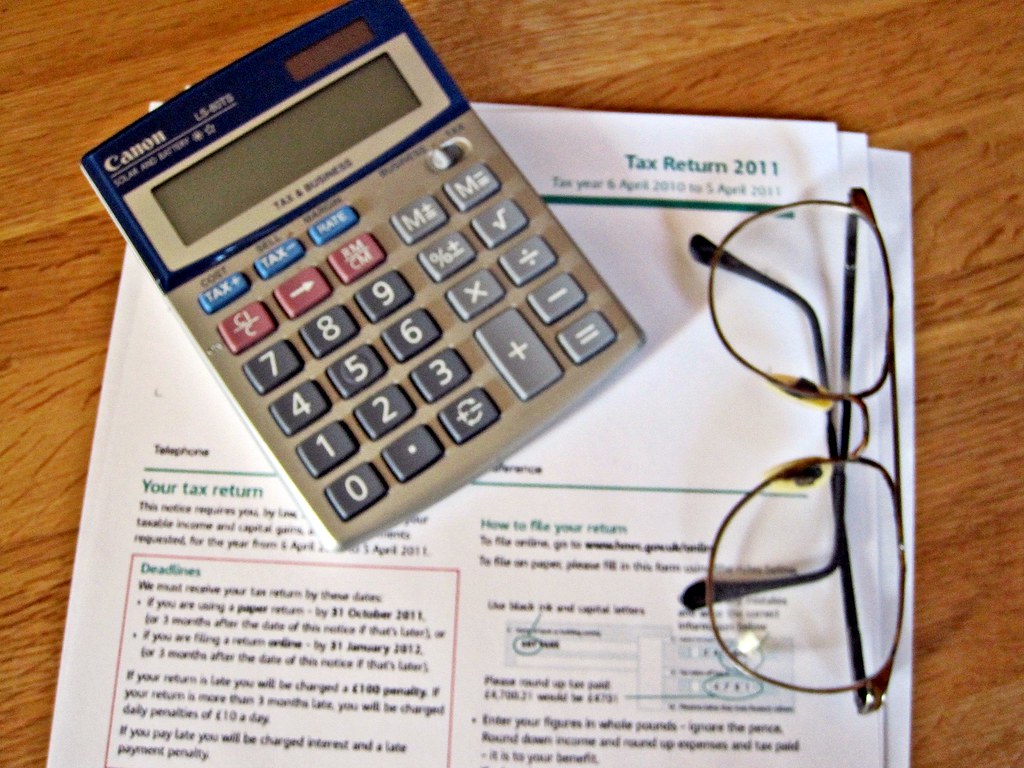

4. **Strategize for Taxes: The Roth Advantage**

When planning for retirement, it’s crucial not to overlook the impact of taxation on your withdrawals. Many traditional retirement accounts like 401(k)s and IRAs offer upfront tax deductions, meaning you don’t pay taxes on contributions now. However, you will pay income and capital gains taxes on that money when you withdraw it in retirement. It’s important to recognize that the tax environment you face in retirement might not be as favorable as it is today.

For many workers, early career years find them in a considerably lower tax bracket than they will be much later in their working lives. It’s likely that your income will be substantially higher in the middle and late stages of your career compared to your entry-level positions. This scenario presents a compelling argument for considering contributions to a Roth retirement account.

With a Roth account, you pay taxes on your contributions now, at your current, presumably lower, tax bracket. The significant advantage is that any increase in value that account experiences will not be subject to capital gains tax, and qualified withdrawals in retirement will be completely tax-free. This can be considerably more tax-efficient to contribute to a Roth now than to attempt to convert a traditional retirement account to a Roth later in your career when you might be in a higher tax bracket, or when tax laws could be less favorable for conversions.

5. **The Core of Your Portfolio: S&P 500 Index Funds**

To achieve strong returns over time without the complexities and risks associated with picking individual stocks, index funds are an excellent solution. You don’t need to be a Wall Street guru to build significant wealth. By simply matching the market’s performance through index fund investing, you might be surprised at the results. For most investors, particularly those starting with $50 a week, a core investment in an S&P 500 index fund is often the best starting point.

An S&P 500 index fund, such as the Vanguard S&P 500 ETF (VOO) mentioned in the context, tracks the performance of the benchmark S&P 500 index. This index represents 500 of the largest publicly traded companies in the United States, providing broad diversification across various industries. Historically, the S&P 500 has averaged annual returns of about 10%. With a rock-bottom expense ratio, like the 0.03% for VOO, you get to keep almost all of the index’s gains, making it an incredibly efficient way to invest.

The simplicity and effectiveness of an S&P 500 index fund make it a foundational component for any long-term retirement portfolio aiming for a million dollars. It allows you to participate in the growth of the overall U.S. stock market with minimal ongoing effort and low costs, making it accessible even for those starting with smaller, weekly contributions through fractional shares. It’s a ‘set it and forget it’ approach that relies on the consistent, long-term upward trend of the market.

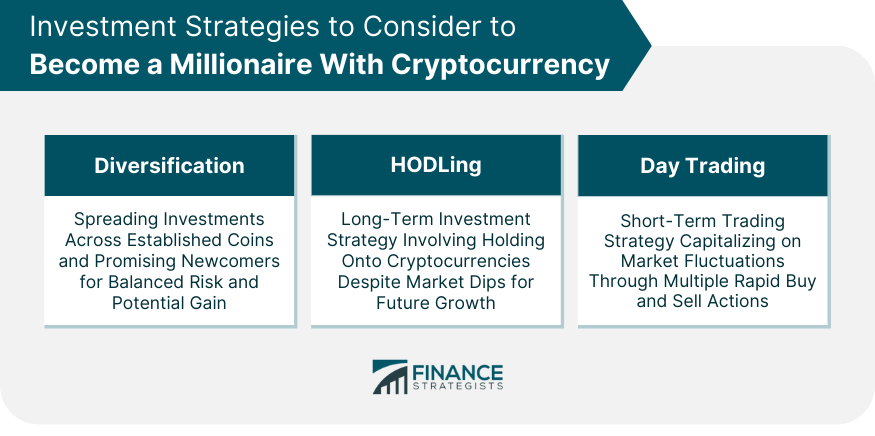

6. **Diversify Your Foundation: Beyond the S&P 500**

While an S&P 500 index fund forms an excellent core, a truly robust and diversified portfolio can benefit from exposure to other asset classes and market segments. Diversification helps spread risk and can potentially enhance returns over the long term. If you were starting a portfolio from scratch and could only choose a handful of index funds, expanding beyond just the S&P 500 would be a smart move, even when investing $50 a week.

Consider the Vanguard Real Estate ETF (VNQ), which invests in Real Estate Investment Trusts (REITs). Many people don’t realize that REITs have historically slightly outpaced the S&P 500 while often doing so with significantly less volatility. For a young investor, adding a small allocation to fixed-income investments is also wise, gradually increasing this as you age. The iShares iBoxx Investment Grade Corporate Bond ETF (LQD) invests in corporate bonds, offering a yield with relatively low downside risk, providing stability to your portfolio.

Further diversification can come from the Vanguard Russell 2000 ETF (VTWO), which invests in a broad basket of small-cap stocks. While small-cap stocks have sometimes underperformed their large-cap counterparts, they tend to produce similar or even better returns over long periods of time. Finally, to gain international exposure, the Vanguard International High Dividend ETF (VYMI) can be a smart choice. International stocks diversify your portfolio geographically, and dividend stocks often represent mature companies with stable cash flows, offering both growth potential and a steady income stream.

7. **Sustaining Growth: Reinvesting Dividends & Fractional Shares**

To maximize the growth potential of your index fund investments, two practical strategies are particularly valuable for those building a portfolio with consistent, smaller contributions: reinvesting dividends and utilizing fractional shares. These tactics ensure that every dollar you invest is put to work immediately, compounding your wealth even faster.

Many growth stocks and index funds pay dividends, which are distributions of a company’s earnings to its shareholders. Instead of taking these dividends as cash, choose to reinvest them automatically back into your investment. This means the dividends buy more shares (or fractional shares) of the same fund, which then earn their own returns and pay their own dividends. This is a classic example of compounding in action, accelerating your portfolio’s growth over time without requiring additional out-of-pocket contributions. The model for reaching $1 million by investing $50 weekly often assumes you reinvest all dividend income.

Since shares of popular index funds or individual growth stocks can trade for hundreds of dollars, it might seem difficult to invest a mere $50 each week. This is where fractional shares become incredibly useful. Many brokerage platforms allow you to buy fractions of a share, meaning your $50 can purchase a portion of a share in an S&P 500 ETF or any other fund you choose. This removes the barrier of high share prices, enabling you to consistently invest your full $50 weekly without waiting to accumulate enough to buy a whole share. This consistent investment, combined with dividend reinvestment, ensures your money is always growing and compounding efficiently. Also, by investing monthly instead of weekly, you might avoid significant commission costs, depending on your broker.

8. **Increasing Contributions and Catch-up in Your 40s and 50s**

As you navigate your 40s and 50s, often referred to as your middle-age years, your financial landscape typically undergoes significant shifts. Many parents find that their children are beginning to move out or have already done so, and the substantial expense of college tuition may be winding down. This period frequently brings with it higher compensation from accumulated career experience, leading to a crucial outcome: more disposable income. This increased financial flexibility presents a golden opportunity to supercharge your retirement savings, making these years pivotal in your journey to becoming a millionaire.

It’s imperative that a meaningful portion of this newfound disposable income is directed straight into your retirement accounts. While it might be tempting to upgrade your lifestyle significantly, prioritizing your long-term financial security now will pay immense dividends down the road. Remember the “pay yourself first” principle – every raise, bonus, or reduction in household expenses should ideally be met with an increase in your retirement contributions. This disciplined approach ensures that your wealth-building momentum continues to accelerate.

For those aged 50 and above, a particularly powerful tool becomes available: catch-up contributions. The IRS allows individuals in this age bracket to contribute additional amounts beyond the standard limits to their 401(k)s and IRAs. This provision is an excellent chance to make up for any periods when your savings might have lagged or to simply push your nest egg closer to that million-dollar mark. Leveraging catch-up contributions is a smart, strategic move that can dramatically impact your retirement readiness, especially if you felt you started later than ideal.

Read more about: Decoding Your Wealth: What the Average 60-Something American Has in Net Worth and How You Compare

9. **Adjusting Your Portfolio Risk as Retirement Approaches**

While your early career years encourage an aggressive, growth-oriented investment strategy, your 40s and 50s signal a natural shift towards a more balanced approach, gradually dialing back risk as retirement looms closer. The closer you get to your desired retirement date, the less time you have to recover from significant market downturns. This isn’t about shying away from growth entirely, but rather ensuring your portfolio has a solid foundation that can withstand volatility without jeopardizing your hard-earned savings.

The lesson from the 2008 downturn, where many near or in retirement faced severe financial setbacks due to overexposure to high-risk assets, remains a stark reminder. These individuals had assumed market returns would always be robust, and when they weren’t, their retirement plans were severely impacted. To avoid a similar fate, it’s prudent to gradually reallocate some of your portfolio from higher-volatility stocks towards more stable assets like bonds. This doesn’t mean you need to “hit home runs” with every investment; a steady stream of “singles and doubles” can be perfectly sufficient to reach and maintain your millionaire status.

As you move into your 60s, this emphasis on risk management becomes even more critical. With little to no time left to recover from substantial losses, preserving your capital takes precedence. This might involve increasing your allocation to fixed-income investments, which offer lower but more predictable returns, or moving towards more conservative balanced funds. Regularly reviewing and adjusting your risk profile to align with your proximity to retirement is a fundamental aspect of securing your comfortable future. A financial advisor can be instrumental in helping you determine the appropriate level of risk for your specific situation.

Read more about: Beyond Gold: Unveiling the Next Generation of Wealth-Building Opportunities in High-Growth Sectors and Alternative Investments

10. **Navigating Social Security Benefits: When to Claim**

Your 60s mark a pivotal time for making crucial decisions about Social Security benefits, a fundamental component of most retirement plans. While you can begin claiming benefits as early as age 62, it’s important to understand the significant implications of this choice. Taking benefits early will result in a permanent reduction in your monthly payment, as you are only entitled to full benefits once you reach your designated full retirement age. For instance, if you were born in 1960 or later, your full retirement age is 67, and a $1,000 estimated monthly benefit at full retirement age would be reduced to $700 if claimed at age 62.

Conversely, delaying your benefits past your full retirement age, up to age 70, can lead to a substantial increase in your monthly checks due to delayed retirement credits. Each year you wait past your full retirement age, your benefit amount will grow, offering a compelling incentive for those who can afford to defer. This decision isn’t just about maximizing individual payments; it also involves considering a spouse’s benefits, as their payout can be impacted by your claiming strategy. The maximum benefit for a spouse is 50% of the worker’s full retirement age benefit, and early claiming for the worker also reduces the spouse’s potential benefit.

Before making this critical choice, it’s essential to weigh the advantages and disadvantages carefully. Collecting benefits for a longer period by starting early offers immediate income, but at a reduced rate. Delaying provides larger payments later but means fewer years of collection. Social Security is designed to supplement your personal savings, not to fund your entire retirement, so its role within your overall financial picture is paramount. Using benefit calculators and consulting with a financial expert can provide personalized insights, ensuring you select the most prudent path for your unique circumstances.

Read more about: Unlock Your HSA’s Full Potential: A Practical 2026 Guide to Maximize Your Health Savings Account

11. **Understanding Medicare Enrollment**

As you approach your 65th birthday, another critical step in your retirement planning involves Medicare enrollment. This federal health insurance program is a vital lifeline for millions of Americans, and understanding its enrollment timelines is crucial to avoid potentially costly penalties. It is strongly advised that you apply for Medicare benefits within three months of your 65th birthday, regardless of whether you plan to retire immediately or continue working.

Delaying your Medicare enrollment beyond this initial window can lead to higher costs for your medical insurance (Part B) and prescription drug coverage (Part D) throughout your retirement. These late enrollment penalties are typically permanent, meaning you could be paying a higher premium for the rest of your life. Medicare’s eligibility at age 65 is a significant factor for many, as it often eliminates the need to work solely for the purpose of maintaining health insurance coverage, thereby making traditional retirement at this age more attractive and financially viable.

It is also important to recognize that Medicare premiums, particularly for Part B and Part D, are based on your income from two years prior. High earners may find themselves assessed a higher monthly premium, known as the Income-Related Monthly Adjustment Amount (IRMAA). This can be a surprising expense for some, and it’s another reason why understanding your financial situation and planning your income streams around retirement is so vital. Consulting a financial advisor can help you anticipate and plan for these costs, ensuring a smooth transition into Medicare coverage.

Read more about: Unlock Your HSA’s Full Potential: A Practical 2026 Guide to Maximize Your Health Savings Account

12. **The Role of Life Insurance in Retirement Planning**

While often considered a tool for younger families, life insurance can continue to play a powerful and strategic role in your retirement planning, particularly if you have dependents or a spouse whose financial well-being you wish to secure. The decision of whether to obtain or continue life insurance coverage in your later years requires careful consideration of your specific circumstances and financial goals. It can act as a safety net, ensuring that your loved ones are taken care of financially should you pass away unexpectedly, providing a lump sum to cover debts, living expenses, or leave an inheritance.

When evaluating life insurance in retirement, two main types typically come into focus: term-life and whole-life insurance. Term-life insurance provides coverage for a specific period, and if you live past the end of that term, the policy will not pay out. While generally less expensive than whole-life, it might not offer the long-term coverage desired in retirement if the term expires. Whole-life insurance, on the other hand, provides coverage for your entire life and often includes a cash value component. However, it is considerably more expensive, especially if you sign up later in life, and may not always be the most cost-effective solution for every retiree.

The decision to maintain life insurance should align with your broader retirement objectives. If your nest egg is substantial enough to provide for your spouse and cover all potential expenses, the need for life insurance may diminish. However, if you have ongoing financial obligations, desire to leave a legacy, or want to protect a surviving spouse from potential financial strain, life insurance can be an invaluable asset. A comprehensive review of your assets, liabilities, and family needs with a financial advisor can help you determine the most prudent approach.

Read more about: The Hidden Engineering of Your Future: Unpacking the Power and Precision of a Last Will and Testament

13. **Embracing Phased Retirement and Encore Careers**

The landscape of retirement is evolving dramatically, moving beyond the traditional notion of simply “checking out” from work entirely. As Marilyn Suey, a certified financial planner, aptly states, “This is not your parents’ or grandparents’ retirement.” More and more individuals are embracing phased retirement or pursuing “encore careers,” opting for a second act that often combines continued engagement with greater flexibility. This modern approach recognizes that retirement doesn’t have to be an all-or-nothing proposition, offering a bridge between full-time work and complete leisure.

Phased retirement can take many forms: transitioning from a full-time role to a consulting or freelance capacity within your existing field, or even launching a completely new business venture. Other popular options include switching to part-time hours or pursuing a passion project that generates some income. This allows individuals to gradually reduce their work commitment while still benefiting from financial inflows, potentially delaying the need to tap into retirement savings, and enjoying the mental and social benefits that work can provide.

Beyond the financial advantages, continuing to work in some capacity can profoundly impact your mental and physical well-being. Work offers structure, routine, and a sense of purpose that can be vital for healthy aging, alongside fostering valuable social connections that combat isolation. While some individuals might unexpectedly retire early due to health issues, for those who have the opportunity, embracing a phased retirement or an encore career can lead to a more fulfilling and financially secure “third act,” enriching your later years with meaningful engagement.

14. **The Invaluable Role of Professional Financial Advice**

Navigating the complexities of retirement planning, especially as you approach and enter your golden years, involves a myriad of intricate decisions that extend far beyond simply accumulating wealth. From optimizing Social Security claims to managing Medicare enrollment, adjusting investment risk, and planning for estate needs, these choices can significantly impact your financial comfort and peace of mind. As your financial journey progresses, these decisions become increasingly nuanced, underscoring the invaluable role of a professional financial advisor.

A seasoned financial advisor can serve as your guide through each phase of retirement planning, helping you to “know your numbers,” as certified financial planner Marilyn Suey emphasizes. They can provide personalized strategies for increasing contributions, fine-tuning your investment portfolio’s risk profile, and making informed choices about Social Security and Medicare. Their expertise is particularly crucial as you near retirement age, offering clarity on complex options and helping you model various scenarios to determine the most prudent path forward.

Ultimately, the goal is to maximize your chances of enjoying your golden years in financial comfort, and attempting to manage all these moving parts alone can be overwhelming. A financial advisor brings an objective perspective, backed by expertise, to help you create a holistic retirement plan that aligns with your individual goals, risk tolerance, and desired lifestyle. Their guidance ensures that every strategic decision, from your investment choices to your benefit claims, is optimized to support your dream of a secure and comfortable millionaire retirement.

Read more about: Beyond the Boardroom: Mark Cuban’s Essential Reading List for Entrepreneurs and Visionaries

The journey to becoming a millionaire in retirement, starting with just $50 a week, is not merely a financial endeavor; it’s a testament to discipline, foresight, and the remarkable power of strategic, long-term planning. By embracing the principles of early and consistent investing, leveraging the magic of compounding and index funds, and making informed decisions at every life stage, you can transform seemingly modest contributions into a substantial legacy. A financially secure future isn’t a pipe dream—it’s an achievable reality, within reach for anyone willing to commit to the journey.