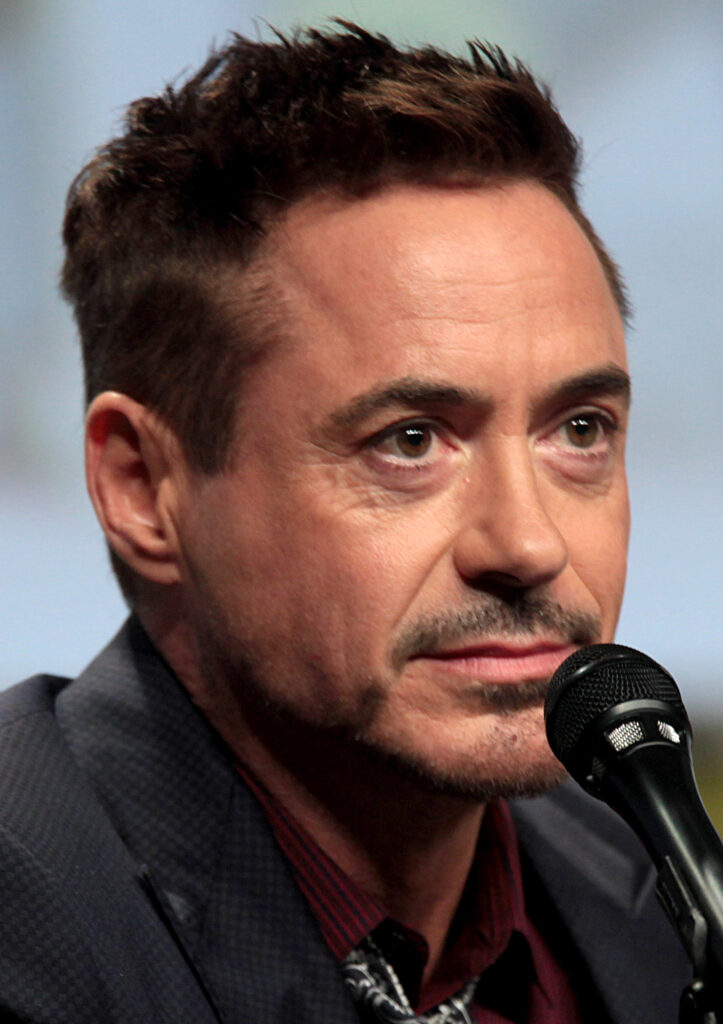

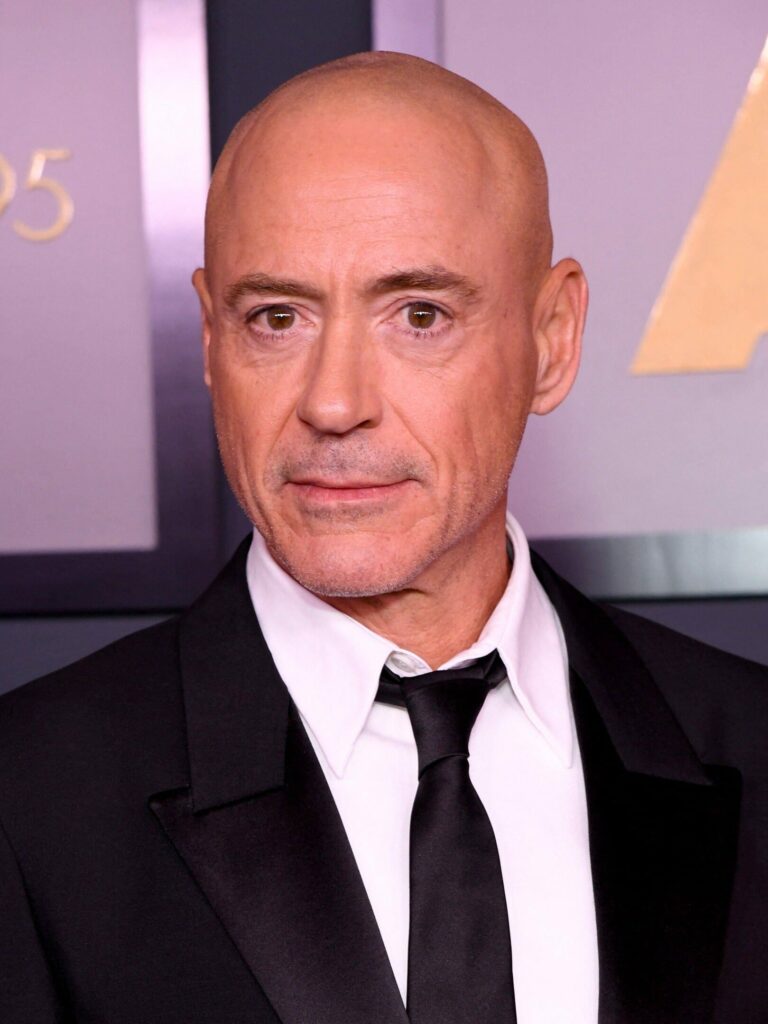

Robert Downey Jr., an actor, producer, and investor globally recognized for his charismatic roles, particularly as Iron Man, has embarked on a profound strategic pivot into sustainable technology investment. Less than two years ago, his commitment to environmental solutions manifested as the FootPrint Coalition, a nascent initiative unveiled at Amazon’s re:MARS conference. Today, this initiative has matured significantly, evolving into a multi-faceted entity that includes five portfolio companies, a dedicated nonprofit arm, and the strategic launch of a rolling venture fund, Footprint Coalition Ventures (FCV), introduced to the global stage at the World Economic Forum’s Digital Davos event. This transition underscores a serious commitment from Downey Jr. to harness his influence and capital in addressing some of the planet’s most urgent environmental challenges.

Footprint Coalition Ventures is meticulously structured to operate at the intersection of two transformative forces currently reshaping the global economic landscape. Firstly, it actively participates in the burgeoning movement towards the democratization of access to capital and diverse investment vehicles, extending opportunities beyond traditional, exclusive financial circles. Secondly, and more critically, FCV is strategically positioned to capitalize on and contribute to the colossal $10 trillion opportunity involved in the decarbonization of global industry. This dual focus ensures the fund is not only financially astute but also deeply aligned with the imperative to foster innovative, scalable solutions for environmental sustainability. FCV represents a distinctive model, aiming to holistically combine storytelling, strategic investing, and nonprofit commitments to effectively combat the world’s pervasive climate crisis.

The fundamental rationale underpinning Downey Jr.’s venture into sustainable technology is rooted in a compelling belief that systemic environmental problems demand a decentralized, broad-based approach to innovation. He articulated this conviction clearly, stating, “This global existential threat is not something that’s going to be solved by a smattering of elite mega-corporations. I think that paradigm must be smashed in favor of innovation by a broad set of new companies.” This perspective highlights FCV’s mission to empower and scale emergent companies that are developing groundbreaking environmental technologies. This article will meticulously explore FCV’s operational framework, its unique investment philosophy, the strategic leadership guiding its efforts, and its concerted strategy to mobilize both capital and public engagement in the urgent global endeavor to mitigate climate change.

1. **The Genesis of FootPrint Coalition and its Vision**Robert Downey Jr.’s foray into climate action and sustainable investment began with a decisive public announcement in 2019, unveiling the FootPrint Coalition as a “coalition of investors, donors, and storytellers committed to scaling technologies to restore our planet.” This declaration marked a dedicated initiative, driven by Downey Jr.’s personal acknowledgment of his environmental impact, calling himself “a one-man carbon footprint nightmare colossus.” His early pronouncements showcased technological optimism, believing that “Between robotics and nanotechnology, we could clean up the planet significantly, if not totally, in 10 years.” This reflected a proactive stance, combining personal conviction with a belief in scalable solutions.

The FootPrint Coalition was comprehensive, co-founded by Downey Jr., his wife Susan Downey, and experienced tech investors. It was designed to bring environmental solutions to scale through a multi-pronged approach: investment, a nonprofit arm supporting early scientific research, and a storytelling component for awareness. This holistic strategy recognizes that individual actions require systemic technological support for global impact.

A critical pillar is the integration of scientific expertise. Rachel Kropa, former head of the CAA Foundation, leads scientific and philanthropic efforts, serving as FCV’s Impact Advisor and liaison to scientific communities. Her role ensures investments are scientifically sound and aligned with critical environmental objectives. Kropa noted, “The idea that the content that we made can be related back to the individual is very powerful,” and that it matters “that the fish that you eat are made using a sustainable feed.” This exemplifies translating complex issues into relatable, actionable insights.

The coalition’s unique content creation strategy further underscores its mission. Producing “edited video segments with Robert doing voice over and overlaying animation,” posted to social media without charge or equity demands, is a distinctive element. This model of “media is additive to activate the group’s audience” leverages Downey Jr.’s 100 million followers to amplify sustainable technologies and environmental messaging. This blends capital, scientific rigor, and pervasive storytelling to drive monumental change.

Read more about: Unveiling the Shadow Warriors: Inside the Secret World of Navy SEALs and Their Unmatched Legacy

2. **FootPrint Coalition Ventures (FCV) as a Rolling Fund**The operational structure of Footprint Coalition Ventures is fundamentally defined by its innovative adoption of the rolling fund model, a distinctive financial mechanism managed in partnership with AngelList. This model contrasts sharply with traditional venture capital funds, which raise fixed capital before deployment. FCV’s rolling fund continually accepts new capital commitments quarterly, investing as funds become available. This “rolling” characteristic offers unique flexibility and dynamism, allowing FCV to adapt fluidly to market demands and advancements in sustainable technology, ensuring a constant flow of resources for promising startups.

The strategic collaboration with AngelList is central to FCV’s mission of democratizing access to venture capital, crucial for mobilizing broader investment in climate solutions. This partnership facilitates significantly lower minimum investment thresholds and shorter commitment periods than traditionally seen in exclusive institutional venture capital. Qualified investors can participate with a commitment of $5,000 per quarter for a minimum of one year. This accessibility intentionally broadens the investor base beyond customary elite circles, inviting a wider spectrum of individuals to engage directly in funding early-stage companies dedicated to environmental restoration.

Robert Downey Jr. champions this accessible approach, characterizing FCV’s model as “a little bit more Slamdance than Sundance” – an analogy conveying its independent, inclusive spirit. This democratized access serves a dual purpose: it opens investment opportunities for “real people,” as Downey Jr. states, and aims to significantly increase the overall capital pool directed towards sustainable technology innovations. This approach is rooted in the belief that widespread participation is key to scaling solutions necessary for global decarbonization.

Jonathan Schulhof, co-founder of FCV, captures the profound implications. He identifies “two powerful trends working together to support the environment: First, engaging content and media distribution enable us to create a passionate community from Robert’s 100 million followers and to use that audience to access great investments. Second, a turnkey technology platform now enables us to manage a broad set of individual investors.” This synergy aims to establish a positive feedback loop, translating public interest and participation into increased capital and accelerated advancements in environmental technologies.

3. **The “Slamdance” Philosophy: Democratizing Sustainable Investment**Robert Downey Jr.’s evocative description of Footprint Coalition Ventures as “a little bit more Slamdance than Sundance” encapsulates a core philosophical tenet: the democratization of sustainable investment. This analogy illustrates FCV’s deliberate strategy to dismantle traditional venture capital barriers, representing a conscious shift from the “ivory tower of the institutional bigwigs” towards an open, inclusive model. It invites a broader audience to participate directly in funding technologies addressing planetary challenges, aligning FCV with the ongoing revolution in finance, where crowdfunding and rolling funds empower everyday investors to finance early-stage companies.

This democratized approach is central to FCV’s mission to transform the paradigm for environmental solutions. Downey Jr. passionately believes that climate change “is not something that’s going to be solved by a smattering of elite mega-corporations. I think that paradigm must be smashed in favor of innovation by a broad set of new companies.” By broadening the investor base, FCV aims to ignite innovation across a diverse ecosystem of startups, providing critical early-stage capital that might otherwise be overlooked by conservative, larger institutional funds. This ensures promising ventures have a pathway to securing funding regardless of their immediate access.

The “Slamdance” ethos is intricately woven into the FootPrint Coalition’s broader objective: to mobilize more people and significantly more capital for sustainable technology. Jonathan Schulhof highlights that “Venture funds traditionally have high minimums that exclude only the wealthiest individuals, or endowments and foundations.” FCV, with its “much lower minimums and shorter investment periods,” purposely extends access to these high-potential companies to a significantly wider group. This inclusivity fosters a passionate community of investors who seek both financial returns and environmental outcomes, cultivating a virtuous cycle where capital and active engagement collectively drive positive planetary impact.

Andrei Cherny, CEO of Aspiration, a FCV portfolio company, powerfully articulated the ethical dimension of this strategy. He remarked, “For years, huge fortunes have been built off of actions that harm our planet. FootPrint Coalition is opening the door to allow real people to invest in the companies that are building businesses around the mission of saving the Earth for generations to come. We are honored to have them and Robert Downey Jr. as investors and partners in this worthwhile battle.” This positions FCV not just as a financial vehicle, but as a platform for collective environmental stewardship.

4. **Strategic Leadership and Expertise at FCV**Beyond Robert Downey Jr.’s public profile and visionary leadership, Footprint Coalition Ventures’ operational effectiveness and strategic direction are significantly bolstered by highly experienced investors and entrepreneurs. The core leadership team, notably Jonathan Schulhof and Steve Levin, brings a wealth of diverse expertise critical for navigating venture capital, technology, and media. These co-founders provide the robust analytical and operational backbone for a fund committed to generating both significant environmental impact and strong financial returns. Their collective experience ensures FCV’s ambitious goals are grounded in sound business principles and effective execution.

Jonathan Schulhof’s professional background is particularly instrumental in shaping FCV’s investment and operational strategies. His entrepreneurial journey includes founding LOOM Media, known for leveraging smart urban infrastructure for advertising, showcasing his acumen in scaling technology solutions in urban environments. He also founded Motivate International, managing bike-sharing services across various U.S. cities, demonstrating practical understanding of sustainable urban initiatives. His tenure as a managing partner for Global Technology Investments provides deep insights into global technology markets and advanced investment methodologies.

Steve Levin’s involvement is equally crucial, bridging media influence, technological innovation, and investment strategy. As a co-founder of Team Downey, Robert Downey Jr.’s media production company, and Downey Ventures, which invests in media and technology firms, Levin possesses invaluable experience in creating ventures that link compelling storytelling with cutting-edge technological development. His expertise is pivotal in leveraging Downey Jr.’s massive social following—100 million across platforms—and the team’s honed storytelling capabilities, refined over decades in the movie business. This synergistic approach allows FCV to amplify the visibility and impact of its portfolio companies beyond traditional venture capital firms.

The combined leadership of Schulhof and Levin ensures FCV is more than an investment fund; it’s a comprehensive platform. Schulhof provides rigorous financial and operational expertise, identifying viable opportunities and ensuring profitability. Levin integrates powerful narrative and media amplification capabilities. This unique blend allows FCV to offer not only capital but also unparalleled marketing and storytelling support, a significant differentiator for early-stage sustainable technology startups. Their collective strategic acumen is vital for building a robust pipeline of investable companies and fostering a passionate community around FCV’s mission, proving the fund is well-equipped to execute its dual mandate of profit and planet.

Read more about: Toyota’s Hypothetical ‘Water Engine’: Unpacking Hydrogen’s Disruptive Potential and the Future of Mobility Beyond EVs

5. **The Dual Investment Strategy: Early and Late-Stage Funds**Footprint Coalition Ventures employs a sophisticated investment strategy through two distinct funds: one tailored for early-stage companies and another for later-stage deals. This bifurcated approach allows FCV to engage sustainable technology startups across their entire developmental spectrum. The early-stage fund focuses on pre-seed and Series A firms, nurturing groundbreaking innovations. The late-stage fund allocates capital to Series B rounds and beyond, providing essential growth capital to companies poised for significant market expansion, having demonstrated product-market fit. This multi-stage engagement enables FCV to construct a diversified portfolio, mitigating risks while capitalizing on proven potential.

The allocation of investment capital reflects this strategic segmentation. FCV plans approximately six investments per year in early-stage companies, acknowledging the higher volume of innovation at this phase. It complements this with four later-stage deals annually, targeting companies needing substantial capital for accelerated growth. This structured deployment ensures a balanced portfolio and prudent risk management. Moreover, the firm initiated investments using founders’ own capital, backing four portfolio companies with initial investments under $1 million. This early commitment underscores confidence and provides a strong foundation for future growth, with anticipation for substantial growth in commitment size as additional capital is raised.

A critical component of FCV’s long-term strategy is maintaining pro-rata investment rights. This ensures that as portfolio companies advance through subsequent funding rounds—often at higher valuations—FCV retains the option to increase its ownership stake. This mechanism is vital for preserving its percentage ownership in successful ventures and maximizing potential financial returns over time. Initial investments were strategically sized with the explicit anticipation of these potential follow-on investments, reflecting a foresighted understanding of startup growth trajectories and valuation escalations. This meticulous approach, coupled with securing future investment rights, powerfully underscores FCV’s objective to generate both profound environmental and sustainability returns, and tangible, robust profits for its investor base.

Jonathan Schulhof articulated this dual objective clearly: “We look at things that are meaningful and impactful [and] I get to be purely capitalist. The question is this a good opportunity is something that has to do with its margins, its scale, its risk profile, the people involved and fundamentally what are the terms … do we think the company will deliver value to investors.” He emphasized, “We’re looking for returns.” This candid statement highlights that FCV views impact and profit as intrinsically linked. By diligently evaluating companies on traditional financial metrics alongside their environmental impact, FCV positions itself to achieve both substantial financial gains and meaningful contributions to global sustainability, aligning capitalist principles with ecological imperatives.

6. **The Broader Landscape of Impact Investing and ESG Growth**The commitment of Footprint Coalition Ventures to both environmental impact and robust financial returns is strategically positioned within a rapidly expanding global investment landscape. This dual objective is not merely aspirational but is deeply rooted in the observable and significant growth of impact investing and Environmental, Social, and Governance (ESG) sectors. This burgeoning market demonstrates a clear convergence of investor interest in both profit generation and positive societal contributions, validating FCV’s integrated approach.

Industry data highlights an enormous opportunity for investors seeking to align their capital with values-driven outcomes. Impact investing funds, which specifically target measurable social and environmental benefits alongside financial returns, have now surpassed $250 billion. This substantial figure reflects a profound shift in capital allocation, moving beyond traditional metrics to embrace a more holistic assessment of corporate and investment performance. The trajectory of sustainability assets further underscores this trend, having doubled in value over the past three years.

This acceleration is part of a broader movement toward “stakeholder capitalism,” where companies are increasingly evaluated not just on shareholder profit but on their wider influence on employees, customers, communities, and the environment. FCV’s model, by design, champions this expanded view of corporate responsibility. It inherently recognizes that long-term financial health is inextricably linked to sustainable practices and robust environmental stewardship, thereby contributing to a more resilient global economy.

Jonathan Schulhof, a co-founder of FCV, has articulated this synthesis of objectives, stating, “We look at things that are meaningful and impactful [and] I get to be purely capitalist. The question is this a good opportunity is something that has to do with its margins, its scale, its risk profile, the people involved and fundamentally what are the terms … do we think the company will deliver value to investors.” This statement underscores that FCV’s pursuit of environmental solutions is not at the expense of financial rigor, but rather a reflection of the inherent value in businesses built on sustainable foundations. The fund’s strategy is to identify companies that are not only purpose-driven but also possess strong fundamentals capable of delivering substantial returns for its investor base.

Read more about: A Financial Advisor’s Blueprint: 15 Essential Investment Strategies for a Secure Retirement in 2025

7. **Leveraging Media Influence and Storytelling for Scale**A distinctive strategic advantage for Footprint Coalition Ventures, beyond its innovative financial structure, lies in its unparalleled ability to leverage media influence and compelling storytelling. This synergistic approach, deeply embedded in the FootPrint Coalition’s broader mission, significantly amplifies the reach and impact of its investment activities. It transforms complex environmental technologies into accessible narratives, captivating a vast global audience and drawing substantial attention to critical solutions.

The coalition actively utilizes sophisticated content creation methodologies, honed through decades in the entertainment industry, to disseminate its message. This involves producing “edited video segments with Robert doing voice over and overlaying animation,” which are then strategically posted across social media platforms. Crucially, this media engagement is considered “additive to activate the group’s audience” and is provided to portfolio companies without charge or equity demands, offering an invaluable marketing and public relations boon that traditional venture funds rarely provide.

Robert Downey Jr.’s formidable social media presence, encompassing over 100 million followers across various platforms, serves as a powerful engine for this amplification. This massive audience, cultivated over a distinguished career, provides an immediate and engaged community for FCV’s message and its portfolio companies. Jonathan Schulhof observed this dynamic, noting that “engaging content and media distribution enable us to create a passionate community from Robert’s 100 million followers and to use that audience to access great investments.” This reach is instrumental in generating public awareness and fostering engagement with sustainable technologies.

Furthermore, the strategic integration of scientific expertise ensures that this storytelling is not only engaging but also factually robust. Rachel Kropa, FCV’s Impact Advisor and liaison to scientific communities, plays a pivotal role in translating intricate scientific concepts into relatable insights. As Kropa remarked, “The idea that the content that we made can be related back to the individual is very powerful,” and that it matters “that the fish that you eat are made using a sustainable feed.” This direct connection to everyday life makes environmental solutions tangible and actionable for a broad viewership, transforming passive observation into active advocacy and investment interest.

Read more about: Totally Tubular! These Epic ’80s Video Consoles Absolutely Owned Your Living Room and Changed Gaming Forever

8. **Targeted Investment Sectors: A Strategic Focus on Global Challenges**Footprint Coalition Ventures strategically channels its investments into six meticulously identified technology categories, each representing a critical frontier in the global effort to combat climate change and advance sustainability. This focused approach ensures that FCV’s capital is deployed where it can yield the most profound environmental impact, targeting innovations that are essential for systemic global decarbonization and resource regeneration. The breadth of these categories reflects a comprehensive understanding of the multifaceted challenges confronting the planet.

The six core investment areas include: sustainability-focused consumer products and services; food and agriculture technology; materials and industrial technology; energy and transportation; education and media; and advanced environmental solutions. This diverse portfolio strategy allows FCV to address a wide spectrum of environmental issues, from sustainable consumption patterns and responsible food production to the development of next-generation energy systems and eco-conscious industrial materials. Each sector is carefully selected for its potential to foster scalable, transformative technologies.

This multi-sector approach is integral to FCV’s mission of empowering a broad ecosystem of innovation, rather than relying on a few dominant players. By investing across these varied fields, FCV aims to catalyze breakthroughs in areas often overlooked by conventional investment paradigms, providing crucial early-stage and growth capital to companies developing groundbreaking solutions. This ensures a robust pipeline of ventures capable of addressing environmental challenges from multiple angles, fostering resilience and diversity within the sustainable technology landscape.

Robert Downey Jr. has consistently articulated this foundational belief, emphasizing that “This global existential threat is not something that’s going to be solved by a smattering of elite mega-corporations. I think that paradigm must be smashed in favor of innovation by a broad set of new companies.” FCV’s strategic focus across these diverse categories is a direct manifestation of this philosophy, actively seeking to identify and accelerate the “new companies” that will ultimately drive the systemic changes required for a sustainable future.

9. **Spotlight on Portfolio Companies: Innovating Across Key Sectors**The strategic vision of Footprint Coalition Ventures is concretized through its growing portfolio of companies, each a testament to the fund’s commitment to supporting impactful sustainable technologies. These initial investments, made using founders’ own capital and now expanding with the rolling fund, exemplify FCV’s diverse sectoral focus and its meticulous selection process, targeting ventures poised for both environmental leadership and significant financial growth. The firms represent crucial advancements across food systems, materials science, and financial services, among other areas.

A prominent example is Ÿnsect, a world leader in producing insect protein from mealworms. This innovative company develops sustainable feed for pets and aquaculture, along with human food applications. Its work directly addresses the environmental footprint of traditional agriculture and animal farming, offering a highly efficient and resource-friendly protein source. Rachel Kropa highlighted the importance of such innovations, noting the impact it has that “the fish that you eat are made using a sustainable feed,” thereby translating a complex industrial process into a relatable consumer benefit.

In the realm of materials science, FCV has backed RWDC Industries, a company at the forefront of developing biovanescent materials. Their work focuses on creating PHA, a bio-based plastic alternative that crucially generates no microplastics, offering a viable solution to the pervasive global plastic pollution crisis. This investment underscores FCV’s commitment to foundational technological shifts that replace harmful conventional materials with genuinely sustainable alternatives, fostering a circular economy model.

Another notable portfolio company is Cloud Paper, which is pioneering sustainable consumer products by producing paper made entirely from bamboo. This initiative directly tackles deforestation and promotes the use of rapidly renewable resources for everyday necessities like toilet paper. It exemplifies how FCV supports innovations that offer direct consumer ties, making sustainable choices accessible and appealing to a broader market and demonstrating a clear path to reducing individual and collective environmental impact.

Furthermore, FCV’s investment in Aspiration, a financial services company with a resolute focus on sustainability, illustrates its expansive view of impact. Aspiration is a neobank that ensures clients’ money goes to sustainable ventures and provides options for customers to offset their carbon footprint. Andrei Cherny, co-founder and CEO of Aspiration, powerfully articulated the ethical dimension: “For years, huge fortunes have been built off of actions that harm our planet. FootPrint Coalition is opening the door to allow real people to invest in the companies that are building businesses around the mission of saving the Earth for generations to come.” This investment highlights the systemic change FCV aims to foster, including within the financial industry itself. The recent $15 million investment in Chunk Foods, an Israeli biotech startup creating vegan steaks, further exemplifies FCV’s commitment to transformative food technology.

10. **The Unfolding Vision: FCV’s Role in a Decentralized Future**Robert Downey Jr.’s venture into sustainable technology investment is underpinned by a profound and consistently articulated vision: to fundamentally reshape the paradigm of environmental problem-solving. He firmly believes that the “global existential threat is not something that’s going to be solved by a smattering of elite mega-corporations.” This conviction drives FCV to empower a diverse and decentralized network of innovators, fostering a future where solutions emerge from a broad array of new companies, rather than being concentrated within established corporate behemoths.

This vision is coupled with an urgent call to action, reflecting Downey Jr.’s personal commitment to active participation over passive observation. “This is no time to be an audience member,” he stated, signifying a readiness to deploy his influence, network, and substantial personal capital – nearly $10 million of his own fortune – to catalyze tangible change. His role extends beyond capital provision, encompassing a tireless advocacy for the ventures he supports, using his platform to accelerate their market presence and public acceptance.

Footprint Coalition Ventures, therefore, is more than an investment fund; it functions as a comprehensive ecosystem designed to mobilize resources on multiple fronts. By integrating strategic investing, a dedicated nonprofit arm supporting early scientific research, and an innovative storytelling component, FCV aims to “mobilise more people and catalyse more capital.” This holistic approach recognizes that solving complex environmental challenges requires not only financial injections but also widespread public engagement and a clear understanding of scientific advancements.

The ultimate objective is to establish a powerful, self-reinforcing dynamic: a positive feedback loop where increased public interest and participation lead to greater capital deployment, which in turn accelerates the development and scaling of environmental technologies. This comprehensive strategy, marrying rigorous financial principles with impactful social and environmental objectives, positions Footprint Coalition Ventures as a pivotal force in the global endeavor to create a sustainable and resilient future, proving that significant returns can indeed go hand-in-hand with profound planetary restoration.

As Robert Downey Jr. continues to champion these groundbreaking initiatives, Footprint Coalition Ventures stands as a compelling model for how influence, capital, and innovation can converge to address humanity’s most pressing challenges. It is a testament to the belief that the future of finance lies not just in profit, but in purposeful investment, inspiring a new generation of entrepreneurs and investors to collectively build a more sustainable world.