Ah, retirement… that magical time when you’ll wake up whenever you darn well feel like it, send your grandkids to college debt-free, buy that classic Corvette you’ve been drooling over, and go skydiving over New Zealand. No matter what your retirement dream looks like, it’s going to take money to turn those dreams into a reality. After all, those classic ’Vettes aren’t getting any cheaper (and don’t even get us started on the gas to drive it!). So the more you know about your options for retirement saving, the better.

Your 401(k) and Roth IRA are two of the most powerful tools you can use to save for retirement. You might be a little familiar with both terms, but what are they exactly? And which one will best help you save for retirement? We understand that navigating the world of retirement savings can feel like deciphering a complex financial puzzle, but it doesn’t have to be.

The truth is, a Roth IRA and a traditional 401(k) are both great ways to build wealth for retirement, but it’s important to know their differences and how they work together. This in-depth guide is designed to break down the pros and cons for both retirement savings options, providing clear, actionable insights so you can confidently determine which one works best for you. (Hint: It could be both!) Let’s start with the basics to lay a solid foundation for your future financial security.

1. **Understanding the Roth IRA: Tax-Free Growth Explained**The Roth IRA (Individual Retirement Account) stands out as a powerful personal retirement savings account that you can open yourself. When you hear the word Roth, your ears should automatically perk up—because a Roth IRA allows your savings to grow completely tax-free. This isn’t just a minor perk; it’s a significant advantage that can dramatically impact your retirement nest egg.

The mechanism behind this tax-free growth is simple yet effective: you contribute to a Roth IRA with after-tax dollars. This means the money you put into the account has already been subject to income taxes. Because you’ve paid taxes upfront, the money will grow entirely tax-free inside the account, and you won’t pay a single dime in taxes when you withdraw your money at retirement, provided you meet the qualified distribution requirements.

This tax treatment means that once you turn 59 1/2, you can withdraw money from your account without owing a penny in taxes. This can be a substantial benefit, especially as a significant portion of your Roth IRA balance in retirement is likely to be growth from your investments. Keeping hundreds of thousands of dollars in your pocket, rather than paying it to Uncle Sam, makes a Roth IRA a truly “sweet” deal for many savers.

2. **Key Advantages of a Roth IRA Beyond Tax Savings**Beyond the undeniable benefit of tax-free growth and withdrawals, Roth IRAs offer several other compelling advantages that make them a standout choice for retirement savings. These features provide flexibility and control that can be particularly appealing depending on your life stage and financial goals. Understanding these broader benefits helps paint a complete picture of why a Roth IRA might be a crucial component of your retirement strategy.

One significant advantage is the wider array of investing options available to Roth IRA holders. Unlike some employer-sponsored plans where investment choices might be limited by a third-party administrator, with a Roth IRA, “you literally have thousands of mutual funds to pick and choose from.” This expansive selection empowers you to tailor your investment portfolio more precisely to your risk tolerance and financial objectives, giving you greater control over how your money grows.

Another major benefit is that a Roth IRA is not tied to your employer. You can open a Roth IRA at any time, regardless of your employment situation, and your job changes won’t affect it. “No need to roll over anything or worry about keeping track of a pile of 401(k)s you left behind from old jobs.” This portability ensures that your retirement savings move with you, providing continuity and stability no matter where your career takes you.

Furthermore, Roth IRAs come with “no required minimum distributions (RMDs)” during the account owner’s lifetime. This means you have the option to keep your money in the account for as long as you’d like, allowing it to continue growing tax-free over an extended period. This flexibility can be invaluable for estate planning or simply for those who wish to defer accessing their retirement savings until later in life, maximizing the compounding effect.

Finally, the Roth IRA offers a unique benefit known as the “Spousal IRA.” If you’re married but only one of you earns money, “you can still open a Roth IRA for the nonworking spouse.” The spouse who earns money can invest in accounts for both spouses, up to the full amount. On the other hand, only the employee of the company offering a 401(k) can contribute to their 401(k), highlighting the Roth IRA’s distinct advantage for certain couples.

Read more about: Your Empowerment Guide: Navigating Simple Estate Planning Without a Lawyer to Secure Your Future

3. **Navigating the Limitations of a Roth IRA**While the Roth IRA offers numerous fantastic benefits, it’s equally important to be aware of its limitations. Understanding these potential drawbacks is crucial for determining if a Roth IRA is the right fit for your specific financial situation and for planning around any restrictions that might apply to you. These limitations often involve contribution amounts and eligibility requirements.

One of the most notable disadvantages is the “Lower Contribution Limits” compared to a 401(k). For example, you can only invest up to $7,000 in a Roth IRA in 2024 (or $8,000 if you’re age 50 or older). This stands in stark contrast to the significantly higher 401(k) contribution limit of $23,000 for 2024. This difference often leads to the conclusion that 401(k)s and Roth IRAs “work better together,” allowing you to maximize your overall retirement savings.

Another significant limitation revolves around “Income Limits.” As amazing as the Roth IRA is, there’s a chance you might not even be eligible to put money into one. For 2023, “If your modified adjusted gross income (MAGI) is higher than $161,000 as a single person or more than $240,000 as a married couple filing jointly, you won’t be able to contribute to a Roth IRA.” These phase-out ranges mean that high earners may have limited or no direct access to this account type.

The income limits for Roth IRA contributions are subject to phase-outs based on your MAGI and filing status. For instance, in 2025, a single filer can make a full contribution if their MAGI is less than $150,000, with reduced contributions allowed until MAGI reaches $165,000, after which no contributions are permitted. Similarly, for married couples filing jointly in 2025, full contributions are allowed below $236,000 MAGI, with phase-outs up to $246,000. If you exceed these thresholds, a traditional IRA might be your fallback, which is “better than nothing.”

Finally, there’s the “Five-Year Rule” to consider, though it typically won’t impact most savers planning for long-term retirement. This rule states “you can’t take money out of your Roth IRA until it’s been at least five years since you first contributed to the account.” Breaking this rule can result in taxes and penalties. Additionally, similar to a 401(k), you’ll generally be penalized for taking money out of a Roth IRA before age 59 1/2, unless certain exceptions apply, emphasizing that these accounts are designed for long-term retirement savings.

Read more about: Burt Reynolds, Enduring Icon of Film and Television, Dies at 82

4. **What Defines a Traditional 401(k)?**A 401(k) is a fundamental retirement savings plan that’s sponsored by an employer, making it a cornerstone of workplace benefits packages for many individuals. Unlike an IRA which you open yourself, a 401(k) is intimately tied to your employment, with contributions often facilitated directly through payroll deductions. This convenient structure makes saving for retirement a seamless part of your regular financial routine.

With a traditional 401(k), employees decide how much of their paychecks to invest automatically in their account. The distinctive feature of a traditional 401(k) lies in its tax treatment: the money you put in is considered “tax-deferred.” This crucial aspect means “you won’t pay income taxes on that money . . . yet,” effectively reducing your current taxable income.

This immediate tax break can be a significant advantage, especially for those looking to lower their annual tax bill during their prime earning years. However, the deferral aspect means that the taxes are not eliminated, merely postponed. Years from now, when you retire and start pulling from your 401(k) savings, “those withdrawals will be taxed at whatever the income tax rate is when you take it out.”

Furthermore, traditional 401(k) accounts are subject to “required minimum distributions (RMDs),” which typically begin at age 73 (or 72 if you were born before July 1, 1949). These RMDs mandate that you start withdrawing a certain amount from your account each year once you reach the specified age, ensuring that the government eventually collects its deferred tax revenue. Understanding this future tax liability is key to comprehensive retirement planning with a traditional 401(k).

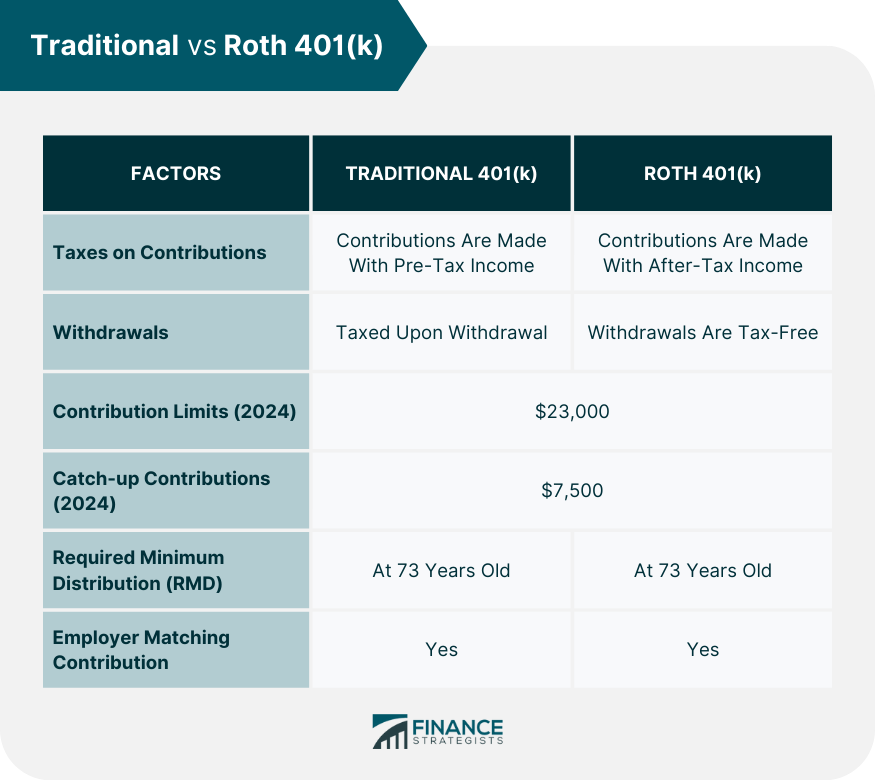

5. **Distinguishing Between Traditional and Roth 401(k) Plans**While the traditional 401(k) is widely recognized, many employers now also offer a Roth 401(k) option, adding another layer of choice to retirement planning. Both pre-tax (traditional) and Roth 401(k) accounts share the benefit of growing tax-deferred, meaning your investments compound over time without annual taxation on gains. However, beyond this shared characteristic, there are several key differences that fundamentally alter their tax implications both today and in retirement.

The primary distinction lies in how contributions are made and how withdrawals are taxed. With a traditional 401(k), “contributions reduce your regular current taxable income” because they are made with pre-tax dollars. This provides an immediate tax deduction. Conversely, Roth 401(k) contributions “are made with after-tax dollars,” meaning you don’t get an upfront tax break, but you also don’t have to worry about income limits for eligibility, unlike a Roth IRA.

The tax implications reverse when it comes to distributions in retirement. For a traditional 401(k), “distributions in retirement are taxable as ordinary income” because you received a tax break on the contributions. In contrast, “withdrawals in retirement from a Roth 401(k) are tax-free (subject to age and holding period requirements).” This makes the Roth 401(k) particularly appealing if you anticipate being in a higher tax bracket in retirement than you are during your working years.

Required Minimum Distributions (RMDs) also differ between the two plan types. Traditional 401(k)s are “Subject to required minimum distributions (RMDs).” Notably, Roth 401(k)s, like Roth IRAs, have “No required minimum distributions during the account owner’s lifetime,” offering greater flexibility to let your money grow longer or to manage your retirement income more strategically.

A critical differentiator, particularly for high-income earners, is the absence of income limits for Roth 401(k) contributions. “Unlike contributions to a Roth IRA, there are no income limits for Roth 401(k)s.” This feature makes the Roth 401(k) an attractive option for individuals whose income levels might preclude them from contributing to a Roth IRA, allowing them to still benefit from tax-free withdrawals in retirement without income restrictions.

Read more about: Unlock Your Financial Superpower: 15 Must-Have Budgeting App Features Millennials Are Using to Win with Money

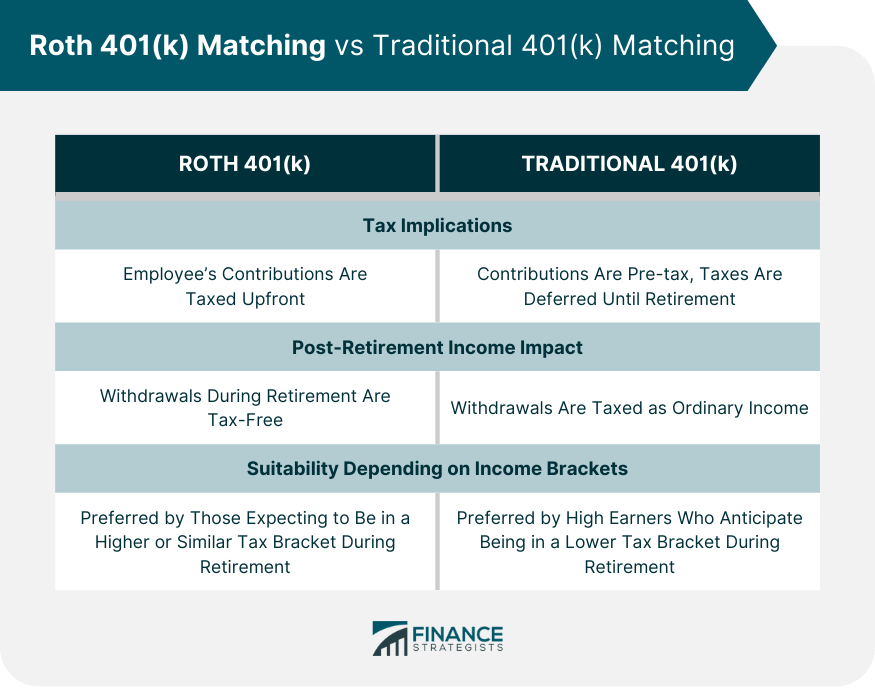

6. **Strategic Considerations for Roth 401(k) vs. Traditional 401(k) Contributions**Deciding whether to make pre-tax (traditional) or after-tax (Roth) 401(k) contributions isn’t always straightforward, as the “answer varies depending on the taxpayer.” While both options offer significant benefits, the optimal choice often hinges on your current financial situation, particularly your income level and your long-term tax expectations. This strategic decision requires careful consideration to maximize your retirement savings’ tax efficiency.

A primary factor to consider is “What Tax Bracket Are You In?” The general rule of thumb suggests that if you’re in a higher tax bracket now than you expect to be in retirement, then making Roth 401(k) contributions over pre-tax options “generally doesn’t make sense.” For example, if your household taxable income is $505,000 in 2025, you’re in the 35% marginal tax bracket. If you were retired with taxable income of $300,000, you’d fall into the 24% marginal tax bracket. In this example, pre-paying tax at 35% wouldn’t make much sense if you could pay tax at a much lower rate down the road. Conversely, if you expect your tax bracket to be higher in retirement, the Roth option becomes more appealing.

It’s also crucial to factor in the dynamic nature of the tax code, as “New Tax Bill Changes The Math (Again).” Tax laws are constantly evolving, which can alter the calculus for pre-tax versus Roth contributions. For instance, the context notes that from 2025 to 2029, the $10,000 deduction cap on SALT (state and local) taxes is increased to $40,000 for taxpayers with income below $500,000, which could indirectly influence the value of pre-tax deductions for high-income taxpayers. Such legislative changes highlight the importance of regularly re-evaluating your contribution strategy.

Another key consideration is “How Much Income Can Your Assets Support In Retirement?” Many workers mistakenly assume they’ll need (or be able to afford) income equal to their salary during their working years, which “is often not the case.” Understanding your projected retirement income needs is vital. If your retirement income is likely to place you in a lower tax bracket, then the traditional pre-tax contribution could be more advantageous, as you’d be paying taxes at a reduced rate on those distributions.

State taxes also play a significant role in this decision. “If you are working in a state with an income tax, and plan to relocate to a state with lower income taxes or no state income taxes, then that might be another reason to consider a traditional 401(k) today.” By taking the deduction now, you might avoid a higher state income tax, and then pay federal taxes (and potentially lower state taxes) on withdrawals in retirement. Consulting a tax advisor for state-specific issues, such as the Massachusetts ‘Millionaire’ Tax, which adds a 4% surtax to taxable income above the threshold, is highly recommended to ensure you’re making the most tax-efficient choice.

Finally, always “do the math first to make sure doing so won’t reduce how much you’re able to save from a cash flow perspective.” Pre-tax contributions immediately reduce your taxable income, potentially leaving more in your paycheck for savings, while after-tax Roth contributions mean less take-home pay initially. If making Roth contributions prevents you from saving the same amount overall, “then it likely isn’t worth it.” The goal is to maximize your total savings, and sometimes taking the immediate tax break with a traditional 401(k) is the more practical path for high-earning workers, given the opportunity cost of pre-paying tax today.

Read more about: Navigating Your Golden Years: A Comprehensive Guide to the Pros and Cons of Early Retirement vs. Working Longer

7. **Deep Dive into the Traditional IRA: Your Pre-Tax Contribution Powerhouse**The Traditional IRA is a key retirement tool, offering an immediate tax break. Contributions are typically pre-tax and can be tax-deductible in the year you make them, directly reducing your current taxable income—a significant advantage during prime earning years.

Money in a Traditional IRA grows tax-deferred; you won’t pay taxes on investment earnings as they accumulate, allowing wealth to compound effectively. Taxes are paid later, upon withdrawal in retirement, at your then-current income tax rate, beneficial if you anticipate a lower tax bracket.

Traditional IRAs are subject to Required Minimum Distributions (RMDs), mandating annual withdrawals once you reach age 73 (or 72 if born before July 1, 1949). A 10% early withdrawal penalty also applies if funds are taken before age 59 ½, emphasizing its long-term purpose.

For 2025, the contribution limit is $7,000, plus a $1,000 “catch-up contribution” for those age 50 or older ($8,000 total). While lower than 401(k) limits, a Traditional IRA offers individual setup without employer sponsorship, ideal for freelancers or the self-employed lacking workplace plans.

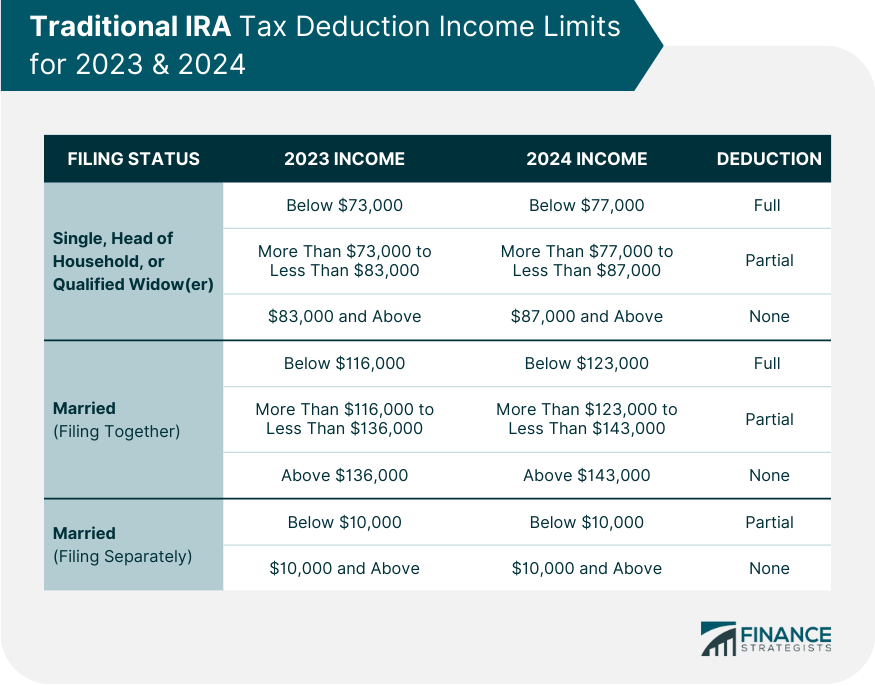

8. **Navigating Traditional IRA Deduction Limits: When Your Income Matters**Traditional IRA contributions can offer a tax deduction, but eligibility is complex if you or your spouse have employer-sponsored plans. Deductibility depends on your Modified Adjusted Gross Income (MAGI) and filing status; understanding these thresholds is crucial for maximizing benefits.

For single filers or heads of household covered by a work plan, a full 2025 deduction is allowed if MAGI is $79,000 or less. The deduction reduces in the $79,000-$89,000 phase-out range. Above $89,000, no deduction is allowed, though contributions are still possible.

For married couples filing jointly with both spouses in a work plan, a full 2025 deduction applies if MAGI is $126,000 or less, phasing out between $126,000-$146,000. If only one spouse has a work plan, the full deduction threshold is $236,000 or less, phasing out up to $246,000. Verify current IRS guidelines.

If neither you nor your spouse can access a workplace retirement plan, your Traditional IRA contribution is fully deductible regardless of income. This highlights its universal benefit for those without employer options. For others, reviewing MAGI thresholds is essential for deductibility.

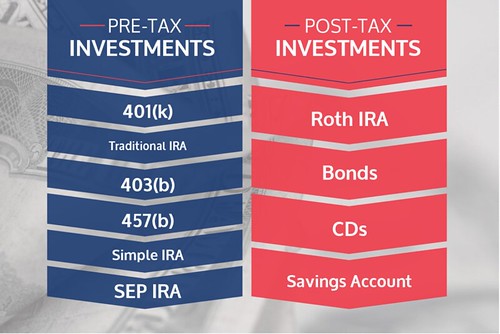

9. **A Comprehensive Look: Traditional IRA vs. Roth IRA vs. 401(k) Side-by-Side**Understanding the core differences between Traditional IRAs, Roth IRAs, and 401(k)s is vital for informed retirement planning. These tools help build wealth, but their unique tax treatments, rules, and accessibility cater to different financial situations.

The fundamental distinction: how contributions and withdrawals are taxed. Traditional IRAs use pre-tax contributions for an immediate tax deduction and tax-deferred growth, with withdrawals taxed in retirement. Traditional 401(k)s operate similarly. Both are subject to RMDs at age 73.

The Roth IRA uses after-tax contributions, so no upfront deduction. Its advantage: money grows entirely tax-free, and qualified withdrawals are 100% tax-free. Ideal if you anticipate a higher tax bracket in retirement. Roth IRAs also have no RMDs during your lifetime.

Traditional IRAs and 401(k)s suit those wanting to lower current taxable income and expecting a lower tax bracket in retirement. The 401(k) offers higher contribution limits and potential employer matching. Roth IRAs, with tax-free withdrawals, are best for those expecting higher income/tax brackets.

Income limits are key. Traditional IRAs have no income limits, but deductibility can be restricted. Roth IRAs have specific income limits. 401(k) plans generally have no income limits, making them accessible to high earners. A diversified approach combining these tools is often most effective.

10. **Maximizing Your Retirement: Strategic Tips for Optimal Plan Selection**Choosing the right retirement plans means considering your financial situation, income, and tax expectations. A strategic approach is vital for maximizing savings and navigating taxes effectively.

Prioritize your 401(k) if your employer offers matching contributions. This “free money” provides an instant, guaranteed return, serving as a crucial first step. Don’t leave this benefit on the table.

Assess your future tax bracket. If you expect a higher tax bracket in retirement, a Roth IRA or Roth 401(k) is smart; paying taxes now locks in tax-free withdrawals later. Conversely, if you foresee a lower retirement tax bracket, a Traditional IRA or 401(k) might offer better upfront tax deductions.

A split strategy often provides the best of both worlds. You can contribute to both a 401(k) and an IRA in the same year, even splitting contributions between Traditional and Roth IRAs. This diversifies your approach, hedging against future tax uncertainties. Always monitor income and contribution limits to avoid penalties. Start early and contribute consistently.

Read more about: Mastering Classic Car Longevity: An Expert Guide to Keeping Your Vintage Beauty Running for Decades

11. **Setting Up Your Savings: Practical Steps for IRAs and 401(k)s**Once you choose your retirement accounts, setting them up and funding your future is the next step. Understanding how IRAs and employer-sponsored 401(k)s differ is essential for a smooth start.

For Traditional and Roth IRAs, open accounts through banks, online brokers, or financial advisors. Some small businesses offer SIMPLE or SEP IRAs. This accessibility makes IRAs excellent for self-employed individuals or those without employer 401(k)s.

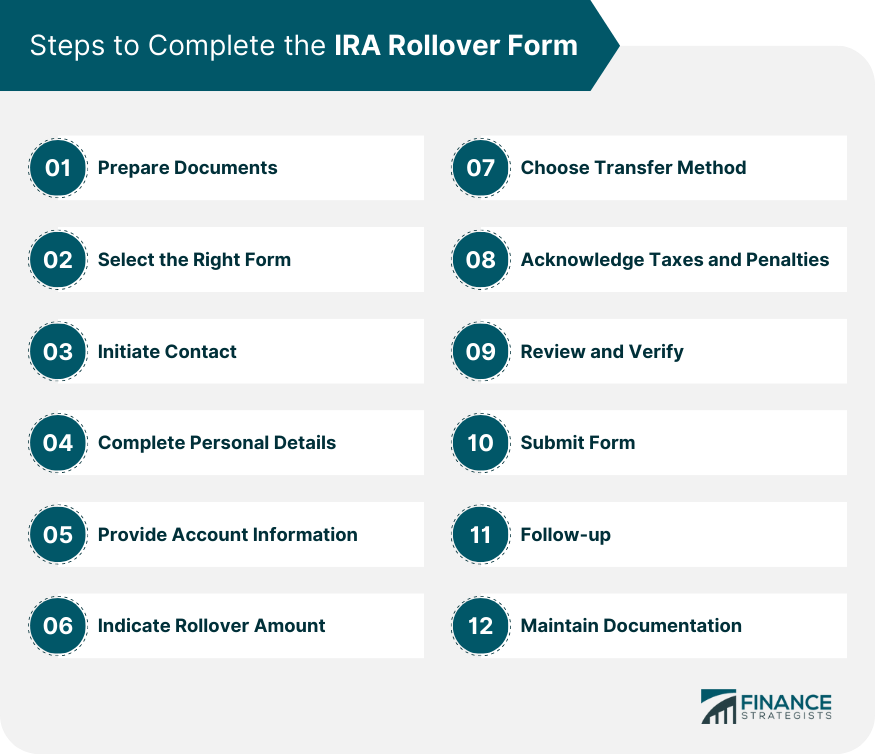

Funding an IRA is straightforward: make direct contributions from your bank account, often with recurring transfers. Rollovers from 401(k)s or other IRAs are also common, consolidating assets while maintaining tax advantages. Converting a traditional IRA to a Roth typically triggers taxes on converted pre-tax amounts.

401(k) plans are employer-sponsored; setup and funding are tied to your job, via payroll deductions. This automated system makes saving convenient. Know what happens if you over-contribute. For IRAs, remove excess amounts before the tax deadline. 401(k) over-contributions are rarer due to automatic payroll stops; if it occurs, contact your plan administrator immediately.

Read more about: Navigating Retirement at 61: Is Your $1.65 Million Nest Egg Enough for Financial Freedom?

12. **Frequently Asked Questions: Clarifying Common Retirement Savings Queries**Retirement savings often spark numerous questions. With various account types, tax rules, and contribution limits, clarity is key. Let’s tackle some frequently asked questions to demystify the process and provide actionable answers.

Can you contribute to both a Traditional and Roth IRA in the same year? Yes, but total contributions across both cannot exceed the annual limit ($7,000 for 2025, or $8,000 if 50+). This allows strategic blending. Understand “tax-deferred” (taxes paid later) vs. “tax-free” (qualified withdrawals never taxed).

What about early withdrawals? Generally, taking money out before age 59 ½ incurs a 10% penalty plus taxes. Exceptions exist for medical expenses, higher education, or buying a first home, potentially allowing penalty-free withdrawals (taxes may still apply). Consult IRS guidelines.

Confusion surrounds Roth 401(k)s vs. Roth IRAs, and if Roth IRA contributions reduce taxable income. Both offer tax-free retirement withdrawals. Roth 401(k)s are workplace-based, may offer employer matches, and have no income limits. Roth IRAs are self-directed with MAGI limits. Roth IRA contributions do *not* reduce current taxable income; they’re after-tax.

Finally, “Which retirement account should I start with?” If your employer offers a 401(k) with a match, start there; it’s free money. After maximizing that, consider a Roth or Traditional IRA, or additional 401(k) contributions. Rollovers are common when changing jobs (e.g., 401(k) to Traditional IRA, or Traditional IRA to Roth IRA conversion, though conversions of pre-tax funds are taxable).

As we’ve explored, the path to a secure and fulfilling retirement is paved with informed choices. Whether you lean towards the immediate tax breaks of a Traditional 401(k) or Traditional IRA, or prefer the long-term tax-free growth of a Roth IRA or Roth 401(k), the most crucial step is to simply begin. Every contribution, no matter how small, sets the stage for a future where your retirement dreams — from that classic Corvette to skydiving over New Zealand — can become a vibrant reality. Understanding these powerful tools empowers you to confidently build the wealth needed to live your best retirement life, one smart financial decision at a time.