In an era where vehicle theft statistics are more alarming than ever, protecting your car has become a critical concern for every driver. With a car stolen every 4.8 seconds and thieves causing a staggering $7.4 billion in losses during 2020 alone, the financial and emotional toll of auto theft is undeniable. These grim numbers highlight why proactive measures are not just recommended, but essential for modern car ownership.

Fortunately, smart drivers have a powerful tool at their disposal: anti-theft devices. These innovative solutions do more than just deter criminals; they also unlock significant savings on your car insurance premiums. Insurance companies, facing rising auto theft claims that have seen the average private passenger auto claim cost jump over $10,000—a 16% increase from 2022—are eager to reward policyholders who take steps to reduce risk. This translates into tangible discounts, with some drivers seeing their rates cut by as much as 30% for businesses using vehicle tracking solutions, and up to 25% for GPS tracking systems for individuals.

If you’re looking to safeguard your vehicle and simultaneously lighten your insurance load, understanding the various anti-theft devices and their benefits is your first step. This guide will delve into a comprehensive list of 12 simple yet highly effective devices and systems that not only enhance your car’s security but can also lead to substantial reductions in your annual car insurance costs. Get ready to discover how a one-time investment in security technology can pay dividends year after year, providing both peace of mind and financial relief.

1. **Vehicle Immobilizers**Vehicle immobilizers represent a foundational layer of passive anti-theft protection, operating seamlessly in the background to safeguard your car. These clever systems are designed to prevent your vehicle from starting unless the correct, authorized key is present and properly inserted into the ignition. This means that even if a thief manages to break into your car, they won’t be able to simply hotwire it and drive away, as the engine’s crucial functions are electronically disabled without the proper authentication.

The mechanism behind an immobilizer is elegantly simple yet incredibly effective. It functions by sending a specific electronic signal to the car’s engine control unit. If this signal doesn’t match the one embedded within the legitimate key, the engine will not receive the necessary commands to ignite. This direct communication link between the key and the engine ensures that only authorized access can bring the vehicle to life, acting as a powerful deterrent against opportunistic thieves who rely on quick, straightforward methods of theft.

For insurance companies, the presence of a vehicle immobilizer significantly lowers the risk associated with insuring your car. The context states that thieves “usually go after cars that are easy to steal,” and an immobilizer dramatically increases the difficulty, making your vehicle a less attractive target. By contributing directly to a reduction in potential theft claims, these devices help insurers reduce their payouts, especially as auto theft claims have hit new highs over the last several years, impacting personal auto insurance results badly.

The benefits extend beyond mere deterrence; they translate directly into financial savings for policyholders. While the exact discount percentage can vary by insurer and state, the fact that immobilizers are a passive system—meaning they protect your car automatically without any action from you—makes them a highly valued feature. This automatic protection ensures that your vehicle is consistently guarded, providing continuous peace of mind and a tangible reduction in your insurance bill. Professional installation, often required by insurers to qualify for discounts, further certifies the reliability and effectiveness of the system, cementing its value in the eyes of your provider.

Read more about: Fort Knox on Wheels: The Ultimate Guide to 15 Anti-Theft Devices That Keep Your Classic Car Safe and Sound

2. **Transponder Keys**Transponder keys are a specific type of smart key that integrates advanced microchip technology to enhance vehicle security. These keys contain tiny microchips that communicate wirelessly with your car’s onboard computer. Before the engine can start, the car’s computer must detect and authenticate the unique code emitted by the transponder chip within the key. If the correct code is not received, the vehicle’s ignition system remains disabled, effectively preventing unauthorized starting.

This sophisticated form of authentication has proven to be incredibly effective in combating car theft. The context highlights its success, noting that “Car makers’ transponder keys deserve credit too – they helped cut car thefts by 40% from 1995 to 2008.” This significant reduction demonstrates the power of this technology in deterring thieves who cannot bypass the electronic handshake required between the key and the vehicle. It’s a testament to how well these systems work at cutting risk long-term for both drivers and insurers.

From an insurance perspective, the proven track record of transponder keys in reducing theft rates makes them a highly desirable feature. Insurers actively seek to mitigate risk, and devices with a quantifiable impact on theft reduction directly translate to lower risk assessments for policyholders. The substantial 40% drop in theft attributable to these keys underscores their value, allowing insurance companies to offer better rates on cars equipped with this technology.

Installing or ensuring your vehicle comes equipped with transponder keys can lead to noticeable reductions in your comprehensive coverage premiums. The lower risk of theft associated with these passive systems means insurers can offer big savings for cars with anti-theft tech, with discounts that can range from 5% to 30%. By making your car significantly harder to steal, transponder keys become a valuable asset not just for security, but also for securing a more favorable insurance rate, contributing to overall savings year after year.

Read more about: Unlocking the Secrets of Auto Theft: The 14 Most Common Ways Expensive Sports Cars and High-Value Vehicles Vanish in the U.S.

3. **Smart Keys and Locks**Smart keys and locks represent the evolution of keyless entry systems, offering convenience alongside enhanced security. These modern systems typically involve a key fob that you carry with you, which communicates wirelessly with your vehicle. The car will unlock automatically when you approach it, or with a simple touch of the door handle, because the key fob sends a signal that authenticates your presence. This seamless interaction enhances user experience while maintaining a high level of security against unauthorized access.

Beyond simple unlocking, smart keys often incorporate advanced features that bolster anti-theft capabilities. For instance, many contemporary vehicles equipped with these systems can automatically lock themselves when the key fob is moved more than five feet away from the vehicle. This automatic locking mechanism provides an extra layer of protection, ensuring your car is secured even if you forget to manually lock it. This feature acts as a crucial deterrent, preventing thieves from breaking into your car or stealing belongings from an unsecured vehicle.

While the context notes that “intelligent keys and locks are great anti-theft devices,” it also acknowledges that “they can also be expensive.” However, the investment is often justified by the heightened security they provide, particularly if you reside in a high-crime area. The inherent design of smart keys, which only allows authorized individuals to start the car, directly addresses the insurer’s concern about theft risk, classifying them as passive anti-theft systems that protect automatically.

The enhanced security provided by smart keys and locks translates into potential insurance discounts, as they reduce the likelihood of theft and subsequent claims. Insurance companies are keen to reward drivers who equip their vehicles with features that lower their overall risk profile. By making your vehicle significantly more challenging to unlawfully access and start, smart keys contribute to a safer driving environment and allow insurers to offer more competitive rates on comprehensive coverage, ultimately helping you to reduce your car insurance premiums.

Read more about: Fort Knox on Wheels: The Ultimate Guide to 15 Anti-Theft Devices That Keep Your Classic Car Safe and Sound

4. **Car Alarms**Car alarms are perhaps the most universally recognized anti-theft device, serving as a loud and unmistakable deterrent against potential thieves. These systems are designed to emit an audible sound—a piercing siren, horn honks, or flashing lights—whenever someone attempts to open a car door, window, or trunk without authorization, or if the vehicle is disturbed. The primary goal of a car alarm is to immediately draw attention to the attempted intrusion, startling the thief and alerting nearby individuals to the potential crime in progress.

Despite their long history and common presence, car alarms remain an effective component of a comprehensive vehicle security strategy. The context confirms this, stating, “Car alarms still work well despite being common – they blast loud sounds if someone tries to break in.” This immediate, noisy response is intended to scare away potential thieves, making the act of stealing the vehicle too risky and attracting too much unwanted attention. The psychological impact of a blaring alarm can often be enough to make a criminal abandon their efforts and seek an easier target.

For car insurance companies, the presence of a functioning car alarm signifies a proactive step taken by the policyholder to protect their vehicle. As an active anti-theft device, meaning it requires activation (e.g., locking the car with the alarm armed), it directly contributes to lowering the risk of theft. Insurers like State Farm explicitly “reward vehicles that have alarms or other approved devices,” offering discounts because alarms make cars less susceptible to theft and thus reduce the likelihood of costly claims.

Incorporating a car alarm into your vehicle’s security setup can result in a reduction in your insurance premiums. While the discount amount can vary, it is a recognized measure that helps mitigate risk. By demonstrating a commitment to vehicle security through the installation of an alarm, you signal to your insurer that your car is less likely to be stolen, which in turn allows them to offer you a more favorable rate on your comprehensive coverage. This simple yet effective device continues to be a worthwhile investment for both security and savings.

Read more about: Fort Knox on Wheels: The Ultimate Guide to 15 Anti-Theft Devices That Keep Your Classic Car Safe and Sound

5. **Steering Wheel Lock**The steering wheel lock is a classic, highly visible anti-theft device that offers a strong physical deterrent. This simple yet robust mechanism clamps onto your car’s steering wheel, making it impossible to turn. The bright color and prominent position of most steering wheel locks instantly signal to a potential thief that the vehicle is protected, often causing them to bypass your car in favor of an easier target. It’s a straightforward solution that creates a significant obstacle for anyone attempting to drive away with your vehicle.

The operational principle of a steering wheel lock is direct: once engaged, it prevents the steering wheel from being rotated. This renders the car undrivable, even if a thief manages to gain entry and start the engine. The context explicitly notes, “Steering wheel locks make it very hard to steal your car by stopping the wheel from moving.” This physical barrier is incredibly effective because it targets the fundamental ability to maneuver the vehicle, neutralizing the thief’s primary objective of driving the car away.

Beyond its physical effectiveness, the steering wheel lock serves as an important visual deterrent. Thieves are often looking for the path of least resistance, and a clearly visible lock adds time and effort to their potential illicit activity, increasing their risk of detection. This visual warning is a key factor in its preventative power. Moreover, these locks are typically “very affordable, making them a popular choice” for drivers seeking cost-effective security enhancements.

Because a steering wheel lock significantly impedes a thief’s ability to drive off with your car, insurance companies view it as a valuable risk-reducing measure. As an active anti-theft device that requires manual engagement, it demonstrates a policyholder’s commitment to securing their vehicle. While specific discount percentages for steering wheel locks might vary, their ability to lower an insurer’s risk assessment often translates into discounts on comprehensive coverage. It’s a simple, affordable investment that offers both peace of mind and tangible savings on your car insurance.

Read more about: Unveiling America’s Most Breathtaking Journeys: The Ultimate Guide to 14 Scenic Drives and Captivating Roadside Gems

6. **Brake Pedal Lock**Similar in concept to the steering wheel lock, a brake pedal lock provides another layer of robust physical security by targeting the vehicle’s braking system. This device is designed to secure itself to the brake pedal, effectively immobilizing it. The consequence is severe for any would-be thief: even if they manage to start the car, they won’t be able to depress the brake pedal. This critical obstruction means they cannot shift the car into gear or drive it away, making the vehicle completely inoperable for unauthorized use.

The effectiveness of a brake pedal lock stems from its ability to render the vehicle undrivable, even with the engine running. As the context explains, a thief “won’t be able to put the car into gear since they can’t depress the brake pedal.” This simple mechanical intervention directly frustrates the act of driving, creating a powerful physical barrier that is difficult and time-consuming for criminals to overcome. It turns the car into an immovable object, protecting it from theft.

Like steering wheel locks, brake pedal locks offer a dual benefit of physical security and visual deterrence. Their presence is often visible, sending a clear message to potential thieves that the car is protected. This visibility, combined with their affordability, makes them an attractive option for drivers seeking effective and economical anti-theft solutions. Investing in such a device can be a smart move, especially given the rising costs and frequency of auto theft.

For insurance companies, the installation of a brake pedal lock reduces the risk of vehicle theft, qualifying it for potential insurance discounts. These devices are classified as active anti-theft systems, as they require the driver to manually engage them. By preventing the car from being driven away, even if accessed and started, brake pedal locks lower the insurer’s exposure to theft claims. This commitment to physical security translates into a reduced risk assessment for your vehicle, which can lead to lower premiums on your comprehensive car insurance coverage, making it a valuable addition to your security arsenal.

Having secured your vehicle with fundamental physical and electronic deterrents, it’s time to explore the next frontier in automotive protection and insurance savings. The devices we’ve discussed so far lay a solid groundwork, but modern technology offers even more sophisticated solutions that don’t just deter theft but actively assist in recovery and even reshape how your insurance premiums are calculated. This second section will delve into advanced security measures—from discreet engine disablers to smart tracking and data-driven systems—that provide enhanced protection, greater peace of mind, and the potential for even more substantial discounts on your car insurance. Get ready to discover how cutting-edge innovation can make your car an exceptionally difficult target while simultaneously lightening your financial load.

Read more about: Fort Knox on Wheels: The Ultimate Guide to 15 Anti-Theft Devices That Keep Your Classic Car Safe and Sound

7. **Kill Switches**A kill switch is an active anti-theft device that offers a proactive layer of protection by cutting power to critical engine components. Unlike passive systems that operate automatically, a kill switch requires manual activation. When engaged, it prevents the flow of electricity to essential parts like the fuel pump, ignition, or starter, making it impossible for a thief to start the car, even if they bypass the ignition system.

This simple yet highly effective device essentially renders your vehicle immobile. By interrupting the power supply to vital engine functions, a kill switch acts as a powerful deterrent. It forces any would-be thief to spend additional, valuable time troubleshooting a non-starting vehicle, significantly increasing their risk of detection and making your car a much less appealing target for quick getaways.

Installation of a kill switch is usually straightforward for a professional, and its location is often concealed to prevent a thief from easily finding and disengaging it. This hidden aspect adds another layer of security, as criminals won’t immediately know why the car won’t start. This clever design ensures that the protection remains effective even after an initial break-in, leaving the thief frustrated and empty-handed.

Insurance companies recognize the value of active anti-theft measures like kill switches. Because these devices directly prevent a vehicle from being driven away, they reduce the likelihood of a successful theft and subsequent claim. Installing a kill switch demonstrates a policyholder’s commitment to securing their vehicle, which can lead to favorable adjustments in your car insurance premiums, particularly on comprehensive coverage, as it significantly lowers the insurer’s exposure to theft-related losses.

Read more about: Fort Knox on Wheels: The Ultimate Guide to 15 Anti-Theft Devices That Keep Your Classic Car Safe and Sound

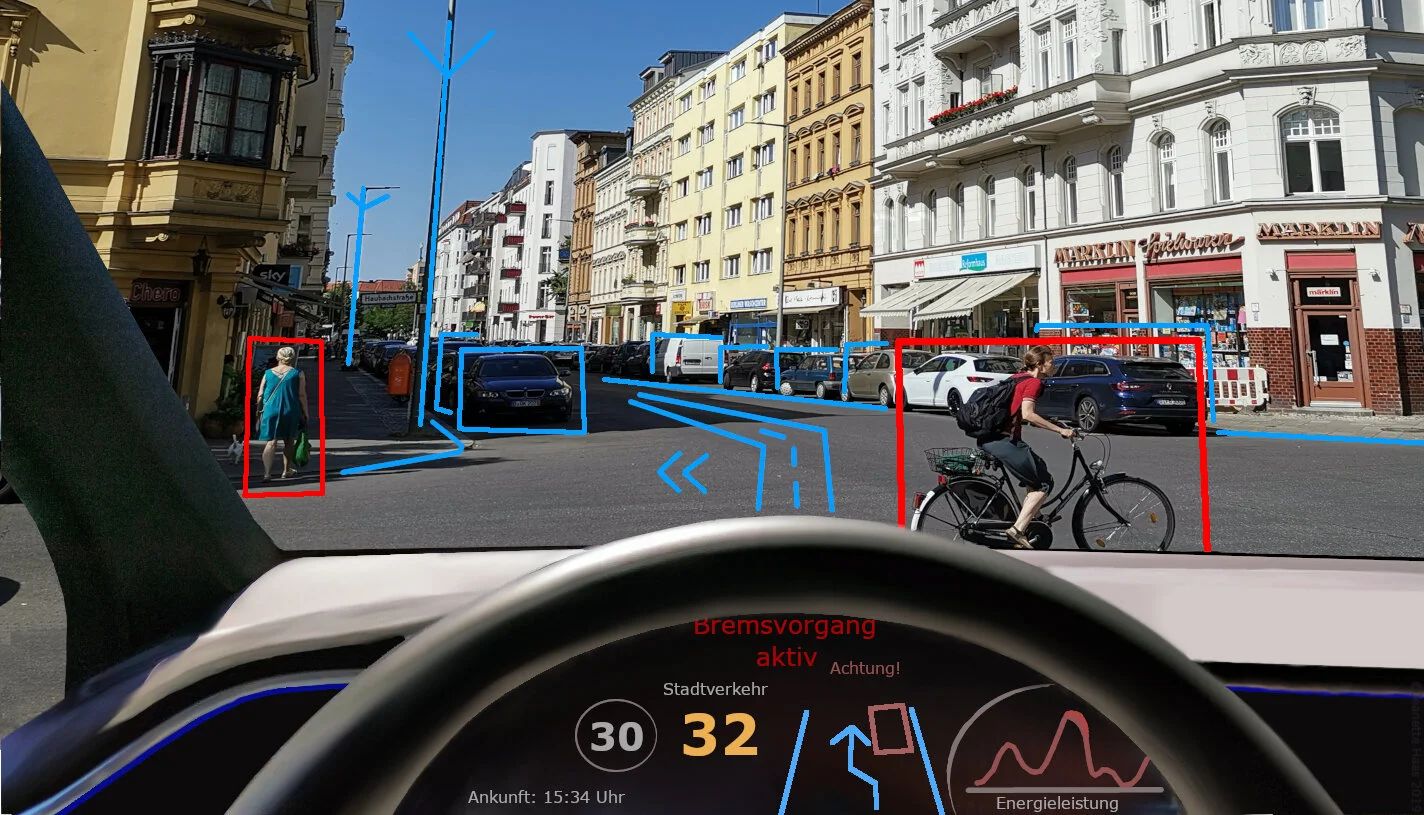

8. **GPS Tracking Systems**GPS tracking systems represent a significant leap forward in vehicle security, offering both theft deterrence and crucial recovery assistance. These innovative systems integrate a small, GPS-enabled device discreetly within your car that constantly monitors its location. Should your vehicle be moved without authorization, the system can instantly send alerts to your smartphone, putting you in control and allowing for immediate action to prevent further loss.

The power of GPS tracking extends beyond just initial alerts; it’s a dynamic tool for real-time recovery. If your car is stolen, the system continuously updates a monitoring center or sends precise location data directly to your phone, enabling you to guide law enforcement. The context highlights that GPS tracking systems are “new tracking systems that help both stop theft and recover stolen cars,” showcasing their dual functionality in prevention and post-theft response.

These systems are remarkably effective at “helping police find stolen cars,” as the continuous location updates drastically cut down search times. This capability not only increases the likelihood of recovering your vehicle intact but also aids in apprehending criminals. The swift response facilitated by GPS data means less time for thieves to strip the car for parts or transport it across borders, preserving your asset.

For insurance providers, the ability to track and recover stolen vehicles so effectively makes GPS systems highly desirable. They substantially lower the risk of total loss from theft, as stolen cars become “easier to find.” This reduced risk translates into tangible savings for policyholders, with GPS tracking systems capable of reducing individual insurance rates by “up to 25 percent.” Furthermore, businesses employing these solutions can see even greater savings, “up to 30 percent,” underscoring the significant financial benefits of this advanced security technology.

Read more about: Fort Knox on Wheels: The Ultimate Guide to 15 Anti-Theft Devices That Keep Your Classic Car Safe and Sound

9. **VIN Etching**VIN etching is a remarkably simple yet highly effective anti-theft measure that permanently marks your vehicle’s identification number (VIN) onto its windows. This process typically involves using a stencil and an etching cream to engrave the VIN onto all the major glass surfaces, making it a visible and undeniable identifier. The permanence and widespread application of this marking are what make it such a powerful deterrent against car theft.

The primary reason VIN etching makes thieves “think twice” is its profound impact on the resale value and marketability of stolen parts. A thief aiming to dismantle a stolen car and sell its components will find their efforts greatly complicated by etched windows. Each piece of glass bearing the VIN immediately identifies the car as stolen, making the parts difficult to offload legally and significantly reducing their value on the black market. This effectively turns your car into a less attractive target, as its components become “hot” and harder to profit from.

Beyond deterring professional chop shop operations, VIN etching also serves as a visible warning to opportunistic thieves. The mere sight of the etched numbers can signal that the vehicle is specifically protected and not an “easy target.” This visual cue adds time and risk to a thief’s plans, increasing the chances they will move on to an unprotected vehicle, bolstering your car’s overall security profile.

Investing in VIN etching is also a highly cost-effective security solution, especially when compared to the potential losses from theft or the expense of other security systems. The context states that “You can spend between $15 and $200 on VIN etching, depending on whether you do it yourself or hire a professional.” This relatively low cost for a permanent security feature provides excellent value, and most insurance companies recognize this by offering discounts, often cutting “5-15% off your comprehensive coverage” if you have VIN etching, making it a smart financial choice.

Read more about: Unveiling America’s Most Breathtaking Journeys: The Ultimate Guide to 14 Scenic Drives and Captivating Roadside Gems

10. **Vehicle Recovery Systems**Vehicle recovery systems are specialized devices explicitly designed with one primary goal: to help law enforcement officials find and retrieve your car if it’s ever stolen. While sharing some technological underpinnings with general GPS trackers, these systems often come with additional components and a focused recovery infrastructure. They operate on the principle that even if a theft isn’t prevented outright, a rapid and successful recovery can still mitigate the severe financial and emotional impact on the owner.

These robust systems typically involve a combination of advanced technologies and dedicated services. The context mentions key components such as a “VIN (vehicle identification number) sticker, a microchip, and a database.” This integration allows for a comprehensive approach to tracking and identification. If your car is stolen, the microchip within the system can be activated, and its connection to a central database helps law enforcement pinpoint the vehicle’s location, often using radio signals for precise tracking in challenging environments.

One of the most compelling reasons for installing a vehicle recovery system is their proven track record. Systems like LoJack, for example, are highly effective, boasting an impressive recovery rate of “90% of stolen vehicles.” This statistic alone highlights the incredible value of such a system. The ability to quickly locate and retrieve a stolen asset not only saves the owner from the financial burden of a total loss but also minimizes the disruption and stress associated with vehicle theft.

For insurance companies, the high success rate of vehicle recovery systems in returning stolen cars translates directly into significantly reduced losses. When a car is recovered, it prevents a costly total loss claim, which can save insurers thousands of dollars. Therefore, insurers “offer better rates on cars with this technology,” actively rewarding policyholders who equip their vehicles with these advanced recovery capabilities, ultimately helping you save money on your premiums by demonstrating a lower risk profile.

Read more about: Beyond the Grind: 15 Proven Tricks Long-Haul Truckers Use to Master Alertness and Focus on the Road

11. **Company Subscription Services**Beyond individual anti-theft devices, many drivers can significantly enhance their vehicle security by enrolling in specialized company subscription services. These comprehensive solutions often integrate advanced tracking technology with professional, round-the-clock monitoring, providing an elevated level of protection that goes beyond what a standalone device can offer. By linking a tracking device in your vehicle to a company’s dedicated monitoring center, you gain constant surveillance and rapid response capabilities.

A key advantage of these services is the immediate professional intervention they offer in the event of theft. If your car is stolen, the monitoring center’s trained staff can actively track its location in real-time and quickly coordinate with local law enforcement, providing them with critical information for a faster recovery. This proactive approach means that response times are often much quicker than if you were relying solely on personal alerts, greatly improving recovery chances.

Furthermore, many of these advanced subscription services provide the invaluable capability to “shut down the vehicle remotely to not be driven,” effectively stopping a thief in their tracks. This remote immobilization feature is a powerful tool against continued theft, making it impossible for criminals to escape or further damage the vehicle. While these services may not always prevent the initial theft, they dramatically improve the chances of recovery and severely limit the thief’s escape options, safeguarding your asset.

Insurance companies view company subscription services very favorably due to their enhanced recovery potential and active professional monitoring. The ability for a service to track, and in some cases, remotely disable a stolen vehicle, significantly reduces the insurer’s risk of a total loss. This commitment to advanced security and recovery can qualify policyholders for considerable discounts, with the context noting that businesses using vehicle tracking solutions save “up to 30 percent” on their insurance costs, reflecting the significant impact these comprehensive services have on risk reduction.

Read more about: Unpacking the AI Revolution: 15 Must-Know Facts About ChatGPT’s Evolution and Impact

12. **Telematics (Usage-Based Insurance)**Telematics technology, often associated with usage-based insurance (UBI) programs, offers a modern and data-driven approach to both vehicle security and insurance savings. While primarily focused on monitoring driving behavior, these systems inherently contribute to overall vehicle protection by providing granular data on how and when your car is used. This valuable data helps insurers create more personalized and equitable premium structures, directly rewarding safer driving habits with lower rates.

These sophisticated systems track various aspects of your driving in real-time. This includes crucial factors such as acceleration patterns, braking habits, cornering speed, and even phone usage while driving. Leading programs like GEICO’s DriveEasy and State Farm’s Drive Safe & Save utilize this collected information to calculate a comprehensive safety score for the driver. The context explicitly states that “Cars with telematics have about 20% fewer accidents,” which powerfully underscores the technology’s effectiveness in encouraging safer behavior and, consequently, reducing overall accident risk.

For insurance companies, telematics is a game-changer, enabling “behavior-based pricing” where premiums are precisely matched to an individual’s actual risk rather than relying on broad demographic factors. This approach makes insurance pricing much fairer, as it directly reflects how safely you operate your vehicle. It offers a tangible benefit for drivers who consistently demonstrate good habits behind the wheel.

The direct result of participating in a telematics program is often significant financial savings. Safe drivers can be rewarded with substantial discounts, with some programs offering “up to 30% on premiums.” By installing a telematics device or actively participating in a UBI program, you provide tangible, data-driven proof of your safe driving, making your vehicle less of a risk for insurers and unlocking considerable savings on your annual policy. It’s a clear win-win for both the driver and the insurance provider.

In a world where vehicle theft is an unfortunate reality, taking proactive steps to protect your car is simply non-negotiable. The arsenal of anti-theft devices available today, from the simple to the sophisticated, offers powerful solutions not just for security, but for your wallet too. By equipping your vehicle with these smart technologies, you’re not merely deterring criminals; you’re actively engaging in smart financial planning, transforming a one-time investment into years of reduced insurance premiums and the invaluable peace of mind that comes with knowing your ride is safeguarded. So go ahead, protect your prized possession, enjoy those savings, and drive confidently into the future!