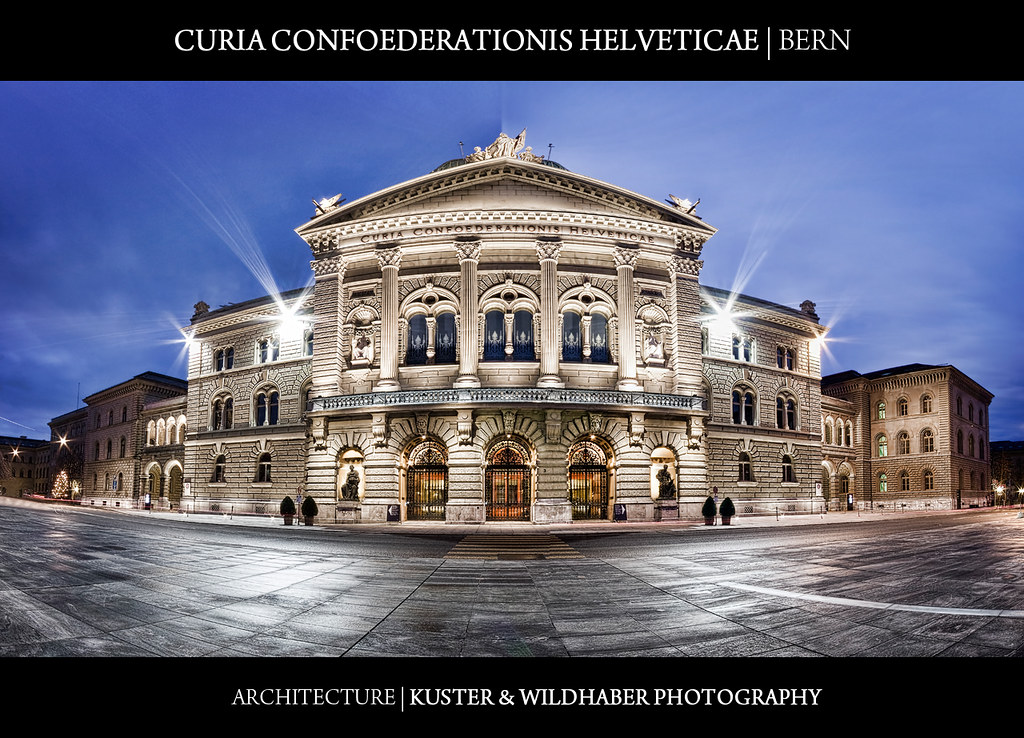

In a sudden and impactful turn of events, Switzerland, a nation long emblematic of stability and prosperity, finds itself at a critical juncture in its trade relations with the United States. An emergency cabinet meeting convened by the Swiss government on Monday heralded a decisive response to President Donald Trump’s imposition of a strikingly high 39 percent tariff on Swiss goods, a levy set to take effect imminently on August 7.

This development has sent ripples of concern through the Alpine state, prompting an immediate commitment to present Washington with a “more attractive offer” aimed at reducing the punitive import tax. The swift action underscores the deep implications for Switzerland’s export-oriented economy, which relies heavily on international trade for its sustained growth and well-being.

The initial shock wave struck Switzerland on Friday when Mr. Trump revealed the 39 percent tariff rate, one of the highest globally, targeting goods from this long-standing European ally. News bulletins across the nation conveyed a palpable sense of surprise and disbelief, as the small but industrially robust country earns every second Swiss franc from foreign trade.

This unprecedented situation unfolded after a 20-minute phone call on Thursday between President Trump and Swiss President Karin Keller-Sutter appeared to have gone off the rails. Swiss Economy Minister Guy Parmelin expressed the government’s astonishment, stating, “We had no indication even in the last hours before the call of the president that it could end in this manner, and above all, no indication that we would be hit with such a punishment.

At the heart of President Trump’s rationale for the elevated tariffs lies the significant trade deficit between the United States and Switzerland. Last year, the U.S. recorded a substantial $38.5 billion trade deficit with Switzerland, a figure that President Trump has squarely focused on as he endeavors to reshape global trade dynamics.

For Mr. Trump, countries exhibiting large trade gaps, where America imports considerably more than it exports, have become targets for increased import taxes. This emphasis on rebalancing the flow of goods has fundamentally altered traditional trade alliances and expectations, leading to the current predicament for Switzerland.

Switzerland, however, presents an unusual case within this broader trade narrative. A substantial two-thirds of its recent exports to the United States consisted of gold bullion and bars, refined in Swiss foundries. The Swiss central bank has consistently argued that gold, which is explicitly exempt from Mr. Trump’s tariffs, should not be factored into the overall trade balance sheet.

Excluding gold, Switzerland’s largest export category is pharmaceuticals, which currently enjoy a temporary exclusion from U.S. import taxes. This exemption, however, remains under review as Mr. Trump considers imposing a sector-specific tariff, adding another layer of uncertainty to the economic outlook.

Swiss negotiators had operated under the belief that they had thoroughly explained these nuances to their American counterparts during prior discussions. Rahul Sahgal, chief executive of the Swiss-American Chamber of Commerce, confirmed that the actions of major Swiss pharmaceutical companies, including Roche and Novartis, were not perceived as a barrier to a tariff agreement during these talks.

Furthermore, agriculture had not been identified as a sticking point, as Switzerland already facilitates the import of certain U.S. farm goods at a low tariffed rate. The Swiss also consistently highlighted their significant investment footprint in the United States, emphasizing that their companies invest more in America per capita than those of any other nation.

Adding to their prior concessions, the Swiss had also finalized a substantial deal in 2021 to procure 36 next-generation F-35 American fighter jets, a significant commitment signaling a strong strategic partnership. Mr. Sahgal, a former Swiss diplomat, articulated the prevailing sentiment, saying, “We thought we had discussed and negotiated something that was fine more or less for both sides.”

The purpose of the phone call between President Keller-Sutter and President Trump was intended to be a “final concluding discussion,” not one that would fundamentally challenge the negotiated framework. This perception clash underscores the communication breakdown that preceded the tariff announcement, leaving Swiss officials puzzled.

The immediate economic fallout from a 39 percent tariff would be substantial, according to leading Swiss industry groups. Yves Bugmann, president of the Federation of the Swiss Watch Industry, warned of severe challenges for watchmakers, stating, “It would be difficult for watch brands, and for U.S. consumers and retailers.”

Mr. Bugmann noted that some smaller watch companies had already placed employees on temporary furlough since Mr. Trump initially imposed a 10 percent tariff in April. The Swiss government is actively making provisions to support companies facing the need for extended employee furloughs, anticipating increased pressure.

Hans Gersbach, a director at the KOF Swiss Economic Institute at ETH Zurich, observed that companies producing precision instruments and machinery, along with parts for Swiss watches, have already seen an increase in short-term furloughs since April. He projected a substantial increase in these figures if the higher tariffs are implemented, indicating a deepening economic strain.

Economic models from the KOF Swiss Economic Institute project a 39 percent tariff rate on goods, excluding pharmaceuticals, could shave 0.3 percent off Swiss economic growth, translating to a cost of approximately 300 Swiss francs ($371) annually for every Swiss citizen. The implications would be even more dire if pharmaceuticals were to be subjected to the same tariff.

If the pharmaceutical sector, a cornerstone of Swiss exports, were included in the tariff hit, the economic impact could more than double, potentially pushing the entire Swiss economy into a recession. This grim forecast underscores the urgency of the ongoing diplomatic efforts to mitigate the situation and protect the nation’s economic stability.

In response to this critical situation, the Swiss Federal Council held an emergency meeting on Monday and unequivocally stated its intention to “continue negotiations with the aim of reaching a trade deal,” even if discussions extend beyond the Thursday deadline. This demonstrates a resolute commitment to finding a resolution.

The official statement from the council confirmed, “Switzerland enters this new phase ready to present a more attractive offer, taking US concerns into account and seeking to ease the current tariff situation.” While specific details of this revised offer remain undisclosed, the Swiss government is actively exploring various options to sweeten the deal.

Potential concessions under consideration include increasing investment pledges by Swiss companies in the United States. Additionally, Switzerland is exploring commitments to purchase more U.S. energy products, such as liquefied natural gas (LNG), mirroring strategies employed by other nations in their own trade negotiations with the U.S.

Business Minister Guy Parmelin openly discussed these possibilities, stating, “Look at the European Union, they promised to buy LNG. Switzerland imports LNG too—maybe that’s one path.” He also highlighted the option of “more investments,” signaling a comprehensive approach to addressing U.S. concerns.

Both Minister Parmelin and President Keller-Sutter have expressed their readiness to travel to Washington if necessary to pursue direct talks, underscoring the high-level commitment to resolving this dispute. This proactive stance reflects Switzerland’s historical reliance on open trade and its determination to preserve a strong economic partnership with the United States.

The broader context of President Trump’s global trade reset highlights the seemingly disproportionate impact on Switzerland. While the U.S. administration cited Switzerland’s perceived “refusal to make meaningful concessions” and labeled the trade relationship “one-sided,” Switzerland points to its own open market policies.

Switzerland unilaterally abolished all tariffs on industrial goods as of January 1, 2024, meaning that over 99% of U.S. goods enter Switzerland entirely tariff-free. This stands in stark contrast to the 39% levy imposed on Swiss products, which applies to nearly 60% of its exports to the U.S., placing Switzerland at a “distinct disadvantage.

Comparatively, other key trading partners like the 27-nation European Union, Japan, and South Korea have successfully negotiated significantly lower tariff rates of 15 percent with Washington. These nations, notably, maintain substantially larger trade surpluses with the U.S. than Switzerland, further highlighting the Alpine country’s unique predicament.

For instance, the EU’s surplus stands at approximately $235 billion, Japan’s at $70 billion, and South Korea’s near $56 billion. This numerical disparity underscores the Swiss argument that their treatment is inconsistent with the broader pattern of U.S. trade policy, despite President Trump’s focus on deficits.

The chocolate industry association, Chocosuisse, articulated the profound impact of the tariffs, describing them as a “tough blow” for a sector already grappling with a 10 percent duty. The association voiced its dismay, stating, “It is particularly shocking that Switzerland finds itself at a distinct disadvantage compared to all other Western industrialised countries.”

Chocosuisse strongly urged the Swiss government to persist in its negotiations, emphasizing the vital importance of resolving this trade impasse for the health of its member companies and the broader economy. This collective call to action reflects the widespread concern across various Swiss industries.

The argument concerning the statistical distortion caused by gold trade remains a key point for Switzerland in these negotiations. Switzerland serves as a significant hub for refineries where imported gold bars, predominantly from Britain, are melted down to meet U.S. standards.

These gold transactions, while economically significant, create an artificial inflation in trade figures, giving the impression that Switzerland exports more to the U.S. than it effectively does in terms of domestically produced goods. Clarifying this distinction is crucial to presenting a more accurate picture of the bilateral trade balance.

Economists have continued to analyze the potential ramifications. Hans Gersbach of ETH Zurich reiterated that a 39% tariff could cut Switzerland’s annual economic growth by between 0.3% and 0.6%, with the figure potentially escalating above 0.7% if the pharmaceutical industry, currently exempt, were included.

Prolonged disruptions stemming from these tariffs could further shrink Swiss GDP by more than 1%, according to Gersbach, cementing the risk of a recession. The Swiss stock market experienced an initial tumble of over 2% when it reopened on Monday, though it later pared losses, ending the day down 0.15%. The Swiss franc also weakened against the dollar, reflecting market anxieties.

Analysts at Swiss investment managers Vontobel expressed a cautious optimism, suggesting “there is some hope for an agreement on US tariffs for Switzerland” that could align them with the 15 percent rate applied to other countries. This sentiment was echoed by Kathleen Brooks, XTB Research Director, who noted the stock market’s recovery as a sign of investor hope for a negotiated lower levy.

The prospect of a 39% tariff remaining in place could substantially impact earnings for critical sectors like watchmakers, as warned by Vontobel analysts. Furthermore, financial institutions like Nomura have speculated that the tariffs could prompt the Swiss National Bank to implement an interest rate cut in September, potentially lowering the rate to -0.25%, to counteract economic contraction and deflationary pressures.

Despite the significant challenges and the tight timeline, Switzerland remains undeterred. The Swiss government’s unwavering resolve to find solutions, coupled with its readiness to revise its offer and engage in high-level discussions, showcases a nation determined to navigate this storm. The focus is firmly on securing fair treatment and ensuring the continued vitality of its economy on the global stage.

As the August 7 deadline approaches, the international community watches closely, anticipating the outcome of these intense negotiations. Switzerland, with its characteristic pragmatism and resilience, is committed to leveraging every diplomatic channel to safeguard its economic future and uphold its standing as a key player in global trade, demonstrating its enduring capacity to weather many storms and find effective solutions.