The world of autonomous vehicle (AV) investment has been a rollercoaster, moving from an exhilarating boom to a sobering bust in a relatively short period. Once seen as the undisputed future of transportation, the sector has recently experienced what can only be described as a sharp pullback in investor enthusiasm and capital. Understanding the nuances of this decline, and distinguishing between what simply got “worse” and what proved to be “the worst,” offers invaluable lessons for anyone looking to navigate the volatile landscape of emerging technologies.

Much like differentiating “worse” from “worst” in grammar, discerning the degrees of financial misjudgment in AV investing is crucial for making informed decisions. While “worse” signifies a decline or a less favorable comparison between two things – perhaps one investment performing less optimally than another – “worst” denotes the absolute lowest quality, the most negative state, or the most significant blunder among many. As we observe the self-driving vehicle investment craze “crash,” not the car itself, but certainly the venture capital world it enveloped, it becomes clear that many investment strategies fell into the “worse” category, with some spiraling into “the worst” financial outcomes imaginable.

This in-depth analysis will dissect 12 critical financial mistakes that have plagued the autonomous vehicle investment space. Drawing directly from recent market trends and expert observations, we aim to provide actionable insights for investors. By understanding these pitfalls, you can avoid the kinds of decisions that lead to significantly “worse” returns, and more importantly, prevent the “worst-case scenario” outcomes that have impacted so many in this once-hyped sector.

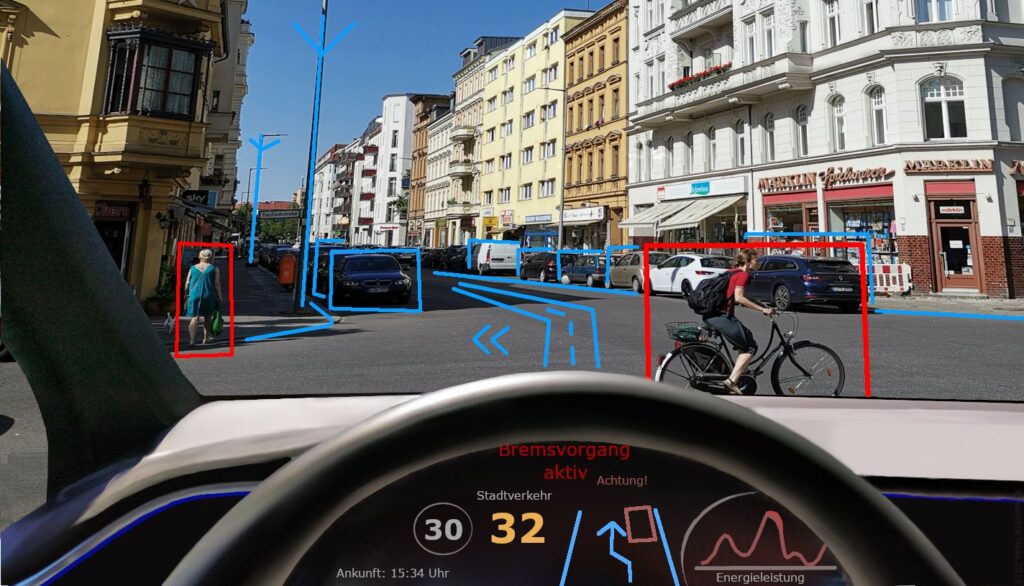

1. **Chasing the Hype: Over-Optimistic Investment in AV Craze**The autonomous vehicle sector, just a few short years ago, was characterized by an “investment craze that enveloped the venture capital world.” In 2021 alone, investors “poured a record $9.7 billion into autonomous vehicle development.” This eager rush to fund AV startups, often without sufficient scrutiny, exemplifies a classic financial mistake: allowing exuberance to overshadow fundamental analysis. Many investors, eager to be part of the next big thing, treated the AV market as a sure bet, rather than a speculative, high-risk frontier.

Such unbridled optimism often leads to inflated valuations and a competitive environment where capital is deployed rapidly, sometimes without adequate due diligence. When an entire industry segment sees “record” levels of investment, it’s a critical moment for investors to pause and assess if the underlying value truly supports the capital influx. Failing to do so can lead to a “worse” situation when the market inevitably corrects, and speculative investments begin to unravel. The pervasive enthusiasm for AVs often obscured the significant technical, regulatory, and commercial hurdles ahead.

Indeed, the trajectory quickly shifted. “Last year however, that dropped by almost 60% to just $4.1 billion.” This dramatic decline illustrates how quickly a market can turn from “good” to “worse,” punishing those who invested primarily based on hype rather than a robust understanding of the sector’s long-term viability and immediate challenges. For many, investing at the peak of this craze, just before the “sharp pullback of investments in 2022,” proved to be a costly misstep, placing their investments in a decidedly “worse” position than those who exercised caution.

This mistake often stems from a fear of missing out, a powerful psychological driver in bull markets. However, the subsequent market correction demonstrated that what seemed like a minor misjudgment could quickly escalate into a “worse” financial reality, impacting portfolio performance significantly. Learning to resist the allure of the latest investment craze is paramount in speculative technology sectors.

2. **Neglecting Due Diligence: Failure to Question Commercialization Paths**A significant mistake identified in the F-Prime Capital report is that “AV [autonomous vehicles] was particularly impacted as investors began to question the path to commercialization for many of these companies.” This indicates that initial investments were made without adequately scrutinizing how these advanced technologies would transition from prototypes and pilots to commercially viable, scalable products generating substantial revenue. The allure of groundbreaking technology often overshadows the pragmatic realities of market adoption, regulatory landscapes, and operational costs.

The “path to commercialization” is rarely straightforward in nascent industries, especially one as complex and safety-critical as autonomous driving. Investors who focused solely on technological breakthroughs, rather than tangible business models and clear roadmaps for revenue generation, found their positions turning “worse” as the market matured. The report’s emphasis on this questioning suggests a fundamental oversight where capital was committed without sufficient proof of concept for market entry and sustained profitability, leading to a precarious investment position.

In the face of these commercialization doubts, many AV companies found themselves in increasingly difficult positions. This mistake is not merely about a minor setback; it speaks to a foundational flaw in investment strategy that can lead to significant capital erosion. Without a clear and defensible route to market and profitability, even the most innovative technology risks remaining an academic exercise rather than a lucrative investment. The market’s belated questioning of these paths served as a harsh wake-up call, turning once promising ventures into less desirable, or “worse,” propositions, severely impacting investor returns.

3. **Misallocating Capital: Overlooking the Rise of Vertical Robotics**While general AV investment saw a “sharp pullback,” the context clearly highlights a contrasting trend: “One of the more exciting trends in the industry has been the growth of Vertical Robotics, with the sector defying the overall VC market by growing again in 2022.” This divergence points to a crucial mistake in capital allocation: a failure to recognize the shift in market preference towards purpose-built, specialized robotic solutions over broad, generalized autonomous vehicle development. Investors heavily concentrated in pure AVs missed a significant growth opportunity.

Vertical robotics, defined as those “purpose-built for specific industries such as warehousing, shipping, health, defense, manufacturing, and construction,” demonstrated resilience and growth even as the broader VC market struggled. This indicates a more immediate and clearer “path to commercialization” for these specialized applications. Investors who continued to pour funds into generic AV solutions while ignoring this emerging, more robust segment were essentially placing their bets on a “worse” performing horse, missing the “better” opportunities that were actively defying market downturns.

The data underscores this misallocation: “vertical robotics investment has jumped from $2.2 billion in 2018 to almost $7 billion last year.” This substantial growth, contrasting sharply with the AV decline, suggests that a significant portion of capital was directed towards a struggling segment while a burgeoning, more promising one was either overlooked or underinvested. This strategic oversight meant not only missing out on substantial returns but also compounding the “worse” performance of undifferentiated AV investments, proving a less optimal use of capital.

Failing to adjust investment strategies to align with these emergent, high-growth sectors can lead to persistently “worse” outcomes, especially when compared to the robust performance of areas like vertical robotics. It highlights the importance of staying agile and responsive to evolving market dynamics, rather than clinging to initial investment theses that may no longer hold true.

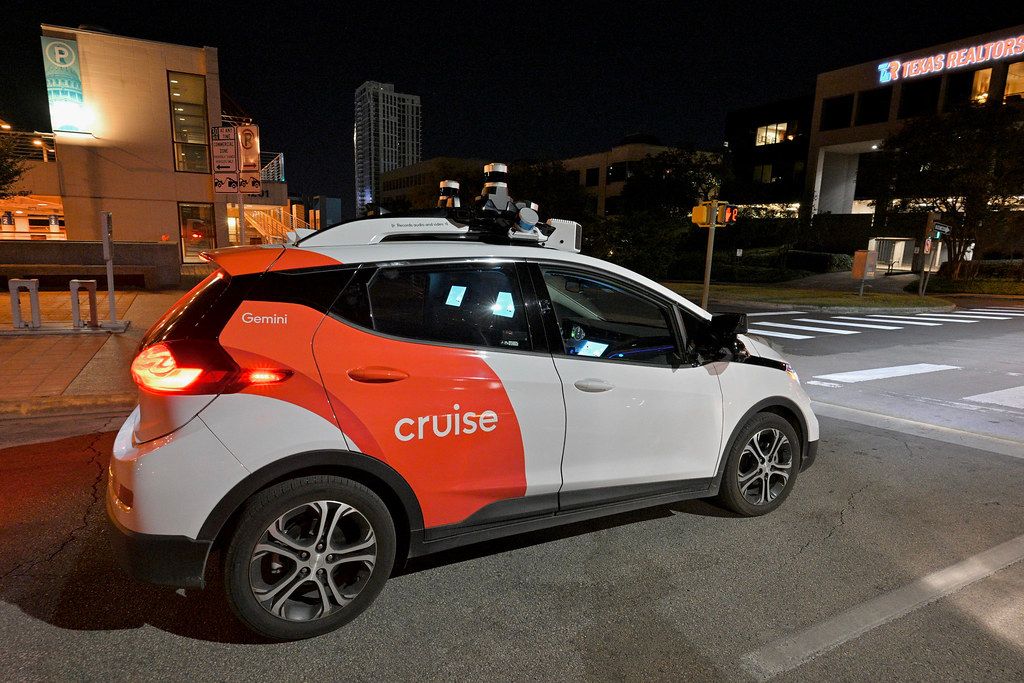

4. **Ignoring Red Flags: Overlooking Consolidation and Layoffs in AV Firms**Astute investors pay close attention to market signals, especially when they point to distress. A key mistake was ignoring the early “red flags” manifesting as “layoffs,” “cash preservation” efforts, and outright “shutting down” of prominent projects. The report explicitly states that “Google’s robotaxi startup Waymo has laid off staff, self-driving tech company Aurora is looking at cash preservation, Ford and VW’s Argo AI is shutting down, and multiple other autonomous vehicle startups and projects are consolidating their positions, partnering to reduce costs and risks, or reducing headcount.” These are not minor adjustments; they are clear indicators of systemic issues.

For an investor, observing a major player like Waymo initiating layoffs should trigger a re-evaluation of the entire sector’s immediate prospects. Similarly, when Aurora, another self-driving tech company, starts focusing on “cash preservation,” it signals a shift from expansion to survival mode. These actions collectively paint a picture of an industry grappling with unsustainable costs and uncertain revenue streams, making the investment climate “worse” for new or continued capital commitments.

Failing to interpret these early warning signs – the layoffs, the need for cash preservation, and the general trend of “reducing headcount” – as severe indicators of market correction is a critical financial error. Investors who continued to maintain or increase exposure to AV stocks without adjusting their strategy based on these clear distress signals likely found their portfolios becoming “worse,” if not directly exposed to “the worst” outcomes experienced by companies forced to shut down. This oversight can quickly turn a bad situation into something far more severe.

Such a mistake exemplifies how a lack of timely responsiveness to market indicators can lead to progressively “worse” financial positions. It’s a lesson in vigilance: the market communicates its health through the actions of its players, and ignoring these communications can lead to avoidable losses and significant underperformance.

5. **Blind Betrayal: Investing in Ventures Facing Shutdowns**Perhaps one of “the worst” mistakes an investor can make is to hold onto, or even worse, invest further into, companies that are on the brink of closure. The explicit mention of “Ford and VW’s Argo AI is shutting down” serves as a stark reminder of this extreme risk. Investing in such ventures, particularly without foresight or a timely exit strategy, results in a complete loss of capital, a definitive “worst-case scenario” for any equity investor.

Argo AI represented a significant joint venture between automotive giants, suggesting robust backing. Yet, even with such formidable partners, the inability to achieve commercial viability led to its demise. This highlights that deep pockets and reputable names do not guarantee success in a challenging new technology sector. Investors who placed their trust, and their capital, in companies like Argo AI without anticipating the potential for a complete strategic pivot or abandonment by their backers, experienced “the worst” possible financial outcome.

The “shutting down” of a well-funded and strategically important project like Argo AI underscores the high-stakes nature of AV investment. This mistake is about more than just poor performance; it’s about a total failure of the investment thesis, leading to the “worst” possible outcome where an investment goes to zero, proving to be the absolute “worst” among all potential failures. The complete loss of principal is a stark reminder of the perils of misjudging long-term viability.

This specific financial mistake serves as a profound warning that even seemingly secure investments in innovative sectors can face “the worst” fate. It emphasizes the need for continuous reassessment of an investment’s fundamental health, even when it appears to have strong corporate backing. Relying solely on brand names or prior successes, rather than ongoing performance and strategic alignment, can lead to devastating losses.

6. **Underestimating Operational Challenges: Dismissing the Need for Cost Reduction and Risk Sharing**

The market’s reality forced many AV companies to confront significant operational challenges, leading them to “consolidating their positions, partnering to reduce costs and risks, or reducing headcount.” A critical mistake for investors was underestimating the sheer capital intensity and complexity involved in bringing autonomous vehicles to market, and consequently, failing to value companies that proactively addressed these challenges. Investing without appreciating the necessity of these survival strategies left portfolios vulnerable.

The move towards “partnering to reduce costs and risks” is a clear signal that individual companies found the burden too heavy to bear alone. This implies that the initial business models or investment expectations for many AV startups were overly optimistic regarding the ease and expense of development and deployment. Investors who ignored the underlying operational struggles, or did not factor in the inevitable need for strategic partnerships and cost-cutting measures, found their investments performing “worse” than anticipated.

This mistake is about a lack of foresight regarding the inherent difficulties of scaling AV technology. The need for aggressive “cost reduction” and collaborative “risk sharing” highlights that the path to profitability was far more arduous than initially envisioned. Investors who dismissed these operational realities as minor hurdles, rather than fundamental challenges requiring significant strategic shifts, were setting themselves up for disappointment and ultimately, “worse” financial outcomes as companies struggled to adapt or survive.

Understanding that companies that proactively engage in “reducing headcount” and “partnering to reduce costs and risks” are often responding to a challenging environment, rather than just optimizing, is crucial. Investors who fail to recognize the gravity of these operational challenges may find their portfolios experiencing a “worse” performance, as the fundamental business models of their investments prove unsustainable without drastic measures.

7. **Overlooking Maturation Signals in Specialized Robotics**While many investors were still fixated on the distant promise of generalized autonomous vehicles, a crucial mistake was the failure to recognize clear maturation signals emanating from the specialized robotics sector. This oversight meant missing out on opportunities that presented a decidedly ‘worse’ risk profile compared to the high-stakes, uncertain world of pure AV plays. The market was providing tangible clues about where more stable and advanced development was occurring, but these were often overlooked in the chase for the next ‘big thing’ in AV.

Indeed, the F-Prime Capital report highlighted that “41% of that investment is in series B and C rounds, indicating lower-risk and more-developed products and go-to-market strategies in the space.” This isn’t just a minor detail; it’s a robust indicator of companies moving past the initial, highly speculative R&D phase into more established business models with clearer pathways to revenue. For investors, this should have signaled a shift in where capital could be deployed with greater confidence and less exposure to the absolute ‘worst’ outcomes.

Those who continued to pour funds into early-stage, undifferentiated AV ventures, while ignoring these clear maturation signals in vertical robotics, found their portfolios in an increasingly ‘worse’ position. The contrast between the nascent, often unproven AV technologies and the steadily de-risking specialized robotics market offered a stark lesson. It underscored the importance of adapting investment strategies based on the evolving maturity of different segments within the broader robotics ecosystem, rather than clinging to a singular, often overhyped, vision.

This mistake underscores that even within innovative sectors, there are distinct stages of development and market readiness. Failing to discern these stages, and where capital is most effectively utilized for ‘lower-risk and more-developed products,’ can turn what seems like a cutting-edge investment into a ‘worse’ performing asset when clearer, more mature opportunities are readily available. Astute investors understand that timing and product maturity are paramount in volatile tech markets.

8. **Failing to Diversify into Proven Vertical Robotics Leaders**Another significant misstep was the failure to actively diversify investment portfolios into the specific, proven leaders emerging within the vertical robotics space. While general AV investments faltered, the context clearly indicates that “one of the more exciting trends in the industry has been the growth of Vertical Robotics,” with the sector actively “defying the overall VC market by growing again in 2022.” This wasn’t merely a niche trend; it represented a robust, growing segment that many AV-centric investors unfortunately neglected.

The report highlighted key companies making significant strides in these specialized areas. For example, “Key companies in the space include Zipline in logistics, CMR Surgical in health/medical, former Oculus founder Palmer Freeman Luckey’s Anduril in defense, Bright Machines in manufacturing, and Built Robotics in construction and mining.” These are not abstract concepts but tangible enterprises delivering purpose-built solutions to specific industries. Investors who remained solely focused on broader AV applications missed the opportunity to participate in the success stories of these sector-specific innovators.

By staying overly concentrated in the increasingly speculative general AV market, investors subjected themselves to ‘worse’ returns compared to those who strategically allocated capital to these diversified vertical robotics leaders. The sheer breadth of applications, from warehousing to defense, offered a compelling case for diversification. Ignoring these concrete examples of success in specialized fields meant missing out on tangible growth and stability, opting instead for a path that frequently led to ‘worse’ financial outcomes.

This mistake serves as a reminder that even within a broad technology theme like robotics, diversification into distinct, commercially viable sub-sectors is critical. Relying on a single, often highly speculative, segment like general AVs, while overlooking established players in specialized fields, can lead to a ‘worse’ overall portfolio performance. Identifying and backing companies that are already demonstrating tangible value in specific industry verticals is a more prudent strategy than chasing generalized, unproven concepts.

9. **Misjudging Broader Robotics Market Cycles**Beyond the specific issues within the autonomous vehicle sector, a broader financial mistake was misjudging the overall venture capital market cycles for robotics. Investors often became too myopic, focusing intensely on AVs without fully appreciating the macroeconomic shifts affecting the entire robotics investment landscape. This led to capital deployment at precisely the ‘worse’ possible time for many.

The F-Prime Capital report provides a crucial data point: “Overall investment in robotics, which have totaled $90 billion globally over the past five years, is also down, hitting $12 billion in total last year versus $18 billion in a much more optimistic 2021.” This dramatic 33% decline in overall robotics investment in a single year should have served as a significant ‘red flag.’ It indicated a broader market pullback, signaling that the era of easy money and sky-high valuations was receding, making any new investment in speculative tech inherently ‘worse’ risk-wise.

For investors who continued to deploy capital in AVs or other robotics ventures without acknowledging this overarching market contraction, their timing proved to be particularly ‘worse.’ They were effectively buying into a declining market, increasing their exposure to potential losses. Ignoring the broader VC market’s health meant that even fundamentally sound investments could struggle in an environment where capital was becoming scarce and investor scrutiny was intensifying. The ‘worst’ outcomes were often reserved for those who rode the market up and failed to exit before the downturn.

Understanding market cycles and the broader venture capital environment is paramount for any investor, especially in high-growth, high-risk sectors. Failing to recognize when the tide is turning, and when overall investment is “down,” can lead to ‘worse’ performance. This mistake emphasizes that even excellent technology can suffer when the broader market sentiment shifts, making careful timing a critical factor in mitigating risk and avoiding the ‘worst-case scenario’ of investing at the peak of exuberance.

10. **Persisting with Early-Stage AVs Amidst Risk Aversion**In a market signaling a clear pivot towards “lower-risk and more-developed products,” a critical mistake was the persistence of investors in funding highly speculative, early-stage autonomous vehicle projects. As the AV sector faced increasing skepticism regarding its “path to commercialization,” the market’s preference for maturity and proven viability became undeniably clear. Ignoring this trend set many investors on a course for increasingly ‘worse’ returns.

The context explicitly states that in vertical robotics, “41% of that investment is in series B and C rounds, indicating lower-risk and more-developed products and go-to-market strategies in the space.” Series B and C rounds typically signify that a company has moved beyond initial proof-of-concept, secured some traction, and is closer to scaling or profitability. This shift was a strong signal that capital was flowing towards ventures with a more established foundation, reducing the likelihood of encountering the absolute ‘worst’ outcomes associated with very early-stage failures.

By contrast, many AV investments remained firmly entrenched in the high-risk, protracted development phase, often without the tangible commercialization roadmaps that investors were beginning to demand. Those who continued to back these early-stage AVs, expecting a quick turnaround or a speculative buyout, often found their capital tied up in projects that increasingly faced difficulties. This unwavering focus on the most speculative end of the AV spectrum, despite market signals of risk aversion, led to significantly ‘worse’ portfolio performance.

This mistake highlights the importance of aligning investment strategy with prevailing market sentiment and maturity preferences. When the market begins to favor “lower-risk and more-developed products,” continuing to invest disproportionately in highly speculative, early-stage ventures can prove to be a costly error, making those investments far ‘worse’ than alternatives. It’s a lesson in responding to subtle shifts in investor appetite and seeking out ventures that offer a more de-risked pathway to success.

11. **Underestimating the Value of Publicly Traded Robotics Companies**Another overlooked opportunity and corresponding mistake was the underestimation, or outright neglect, of established publicly traded robotics companies. In the frantic search for the “next big thing” in private AV startups, many investors bypassed entities with proven market presence and existing revenue streams. This focus on speculative ventures over stable assets put their portfolios in a ‘worse’ comparative position, missing out on more reliable returns.

The F-Prime Capital report noted that “Despite a pullback in 2022, the report says there is now $15 billion of market cap for publicly-traded robotics companies, including AutoStore, Innoviz, and Precept.” These companies represent a segment of the robotics industry that has achieved sufficient scale and commercialization to be listed on public exchanges. Their market capitalization reflects a degree of stability, investor confidence, and often, profitability, which is a stark contrast to the often pre-revenue, highly speculative AV startups.

For investors chasing the elusive promise of a private AV unicorn, ignoring these publicly traded alternatives proved to be a ‘worse’ strategy in terms of risk-adjusted returns. While the allure of massive, rapid gains from a private startup can be strong, the reality for many AV investors was protracted losses or even outright shutdowns. The established market cap of companies like AutoStore, Innoviz, and Precept offered a more grounded, albeit perhaps less sensational, investment opportunity.

This mistake underscores the importance of a balanced portfolio that considers both high-growth, speculative ventures and more established, publicly traded companies within an emerging sector. Dismissing the stability and proven market presence of firms that have already achieved a “market cap for publicly-traded robotics companies” in favor of pure speculation can lead to significantly ‘worse’ long-term outcomes, as the known entities often provide a bedrock of value that early-stage ventures lack.

12. **Failure to Prepare for “Worst-Case Scenario” Outcomes**Perhaps “the worst” financial mistake of all was a pervasive failure among investors to adequately prepare for or even envision the “worst-case scenarios” inherent in autonomous vehicle investments. The venture capital world, enveloped in an “investment craze,” often overlooked the absolute lowest quality, most negative states that could realistically materialize. This lack of robust contingency planning proved devastating for many.

The context defines “worst case” as referring to “a situation that is as bad as possible compared to any other possible situation,” using expressions like “in the worst case” and “worst-case scenario.” For AV investments, these scenarios became terrifyingly real: “Google’s robotaxi startup Waymo has laid off staff, self-driving tech company Aurora is looking at cash preservation, Ford and VW’s Argo AI is shutting down.” These were not minor setbacks but fundamental failures, leading to the complete loss of capital – a definitive “worst” outcome.

Investors who failed to rigorously stress-test their investment theses against such severe possibilities found themselves caught off guard. They had likely hoped for the best-case or even moderate scenarios, but were unprepared for the absolute “worst” (meaning “most bad”) where projects folded and capital vanished. The consequences of such oversight were compounded by the speculative nature of the technology, turning what might have been a minor ‘worse’ outcome in a stable sector into a total ‘worst’ loss in the AV space.

This final, critical mistake serves as a profound warning: in highly speculative and capital-intensive sectors like autonomous vehicles, thorough risk assessment and preparation for “worst-case scenarios” are not optional. As the article defines, ‘worst’ denotes “the absolute lowest quality, the most negative state, or the most significant blunder among many.” Investors must constantly ask not just what could go right, but what could go absolutely, irrevocably wrong, and how to mitigate such ‘worst’ outcomes to protect their capital. Understanding the full spectrum of potential failures is key to navigating the treacherous path of innovation investment.

Read more about: The Worst of the Worst: From Failed Future Forecasts to Tricky Grammar Traps

Navigating the complex and rapidly evolving world of autonomous vehicle investment has indeed been a challenging journey, marked by exhilarating highs and sobering lows. The 12 financial mistakes we’ve dissected in this article offer invaluable, actionable insights. By understanding these pitfalls – from chasing hype and neglecting due diligence to misjudging market cycles and failing to prepare for the absolute ‘worst-case scenario’ – investors can arm themselves with the knowledge to make more informed decisions. The goal is not merely to avoid making investments that perform ‘worse’ than expected, but critically, to steer clear of the ‘worst’ financial outcomes that have unfortunately plagued so many in this once-hyped sector. Ultimately, success lies in foresight, diligence, and a keen appreciation for the nuanced realities of commercializing groundbreaking technology.